Volume 190

Published on July 2025Volume title: Proceedings of ICEMGD 2025 Symposium: Digital Transformation in Global Human Resource Management

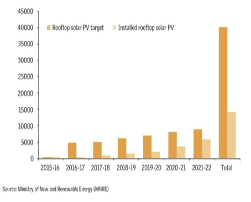

This paper examines the challenges hindering rooftop solar (RTS) deployment in India and explores how a U.S.-India partnership can unlock its full potential. RTS, a decentralized and scalable renewable energy solution, is critical to India’s renewable energy goals, including its target of 40 GW of RTS capacity under the National Solar Mission by 20...

View pdf

View pdf  Export citation

Export citationIn today's rapidly developing digital era, social media has deeply integrated into the financial market and has multidimensional impacts on information asymmetry. This article delves into the role of social media in the dissemination of information in financial markets and explores its positive and negative effects on information asymmetry. Social ...

View pdf

View pdf  Export citation

Export citationIn contemporary China, a significant number of university graduates pursue careers that diverge from their original fields of study, reflecting a broader trend of academic and occupational mismatch. This review examines the principal factors influencing such career decision-making processes, with particular attention to the role of self-efficacy, a...

View pdf

View pdf  Export citation

Export citation

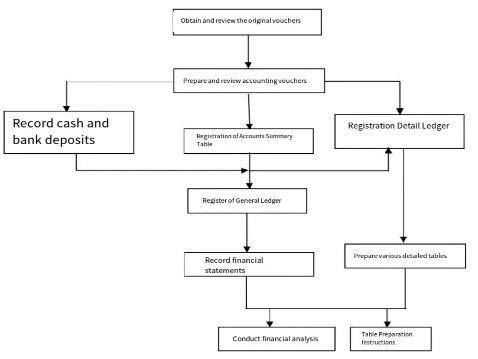

Under the wave of digital transformation, traditional accounting processes face challenges in audit risk control. Blockchain technology, with its unique advantages, offers a new approach to addressing this issue. Through case studies, this paper conducts an in-depth exploration of the application value of blockchain in accounting processes from the...

View pdf

View pdf  Export citation

Export citationIn the era of rapid digital transformation, artificial intelligence (AI) has emerged as a transformative force with broad applications across industries. However, its impact on corporate governance—particularly in Chinese enterprises—remains under-researched. This study addresses this gap by empirically examining how AI adoption influences corporat...

View pdf

View pdf  Export citation

Export citation

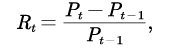

The dynamic nature of the stock market, shaped by a complex interplay of economic and non-economic variables, presents both opportunities and challenges for investors seeking to optimize their returns. Prudent participation necessitates careful consideration of risk mitigation strategies, often involving the construction of diversified investment p...

View pdf

View pdf  Export citation

Export citation

This paper focuses on the acquisition between Microsoft and LinkedIn, offering an in depth and comprehensive analysis of its financial performance. Through methods like case study, event study with Cumulative Abnormal Return Rate (CAR) calculation, and comparative analysis, it closely examines the short-term market responses around the acquisition ...

View pdf

View pdf  Export citation

Export citationThis paper investigates the impact of financial market volatility on supply chain management decisions, focusing on two major global retailers: Walmart and Amazon. As global markets become increasingly interconnected, financial fluctuations—driven by factors such as economic recessions, geopolitical conflicts, and speculative behaviors—pose signifi...

View pdf

View pdf  Export citation

Export citation

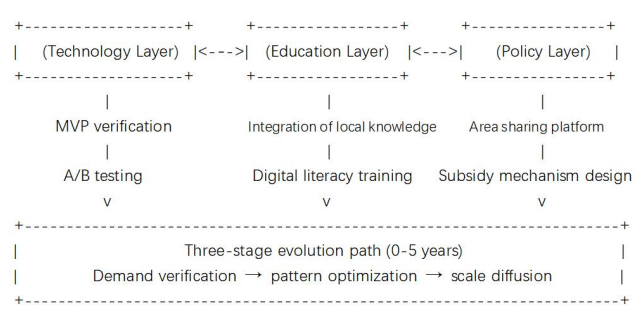

Technology-driven social entrepreneurship, as an emerging paradigm that integrates technological innovation with social missions, offers innovative solutions to address the plight of the 700 million extremely poor people worldwide and the uneven distribution of educational opportunities. This paper reviews the literature in both Chinese and English...

View pdf

View pdf  Export citation

Export citationCentralized accounting has been a prevalent paradigm for financial data management in contemporary organizations. This study examines the development, implementation, and effects of centralized accounting systems on financial transparency and operating efficiency. A detailed review of literature is augmented by empirical study using a mixed-methodo...

View pdf

View pdf  Export citation

Export citation- 1

- 2

- 3

- 4