Volume 205

Published on July 2025Volume title: Proceedings of ICEMGD 2025 Symposium: The 4th International Conference on Applied Economics and Policy Studies

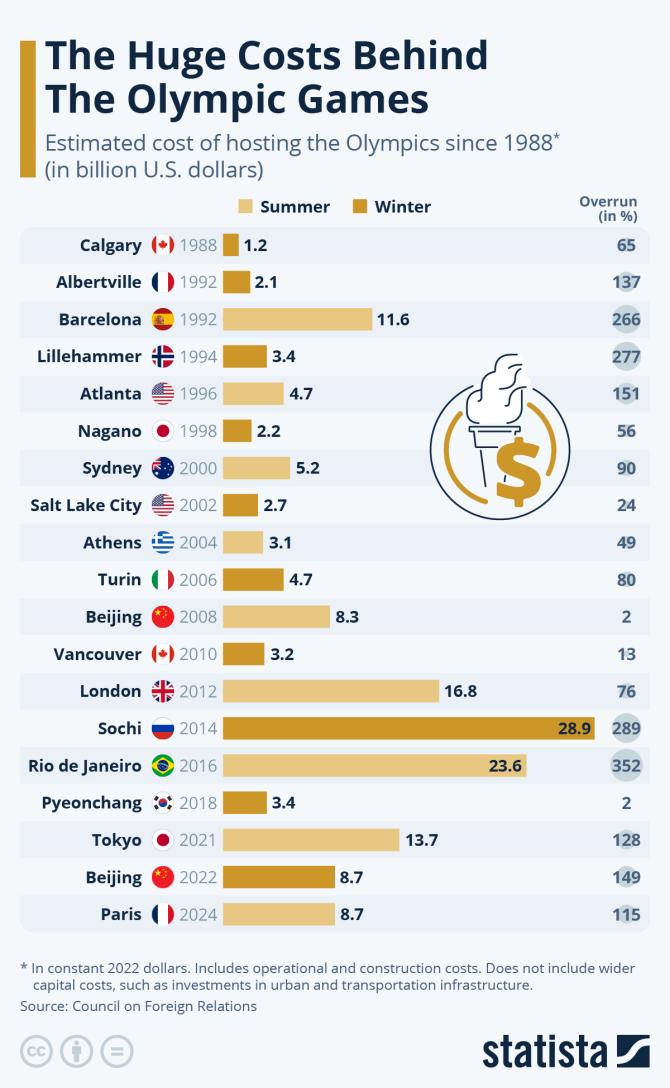

In the context of accelerating globalization, large-scale sporting events such as the Olympic Games have become crucial platforms for host nations to demonstrate economic power and strengthen their global influence. While these events bring immediate economic benefits via infrastructure investment, tourism, and international exposure, their long-term financial sustainability remains a matter of concern. Historical data reveals significant cost overruns and post-event infrastructure underutilization, with the 2004 Athens and 2016 Rio Olympics serving as typical examples. This paper employs a SWOT analysis framework to evaluate the multidimensional economic impacts of hosting the Olympics. The results show that while the Olympics enhance global visibility and promote cultural diplomacy, they also impose substantial fiscal risks and environmental burdens. In addition, it further examines strategies such as enhancing budget management, repurposing infrastructure after the event, and exploring multi-country hosting options to enhance the economic impact and long-term viability of the Games. In conclusion, host nations should prioritize cost-benefit analysis and long-term sustainability in their decision-making processes to minimize economic risks and promote lasting development.

View pdf

View pdf

Artificial intelligence (AI) is revolutionizing accounting, shifting from human-centric to algorithmic information processing, challenging traditional double-entry bookkeeping and triggering institutional restructuring. This study examines AI’s impact on accounting, analyzing intelligent financial systems’ technological drivers like data analytics, pattern recognition, and autonomous decision-making. It explores institutional conflicts, such as blockchain’s impact on audit trails and deep learning’s tension with accounting standards’ interpretability. The research highlights technical dilemmas in unstructured data mining, including multi-modal data fusion and algorithmic black-box issues. This study adopts a literature research method, combining perspectives from the philosophy of technology, the theory of institutional change, and cognitive science to analyze the impact of artificial intelligence on accounting. It uses case analysis to explore the technological architecture and process reengineering of intelligent financial systems. It can be concluded that AI presents opportunities and challenges. Future development requires a dynamic, hybrid intelligent architecture, a robust governance framework, and ethical mechanisms to balance technology and professional judgment, fostering an intelligent accounting ecosystem and driving a paradigm shift in the discipline.

View pdf

View pdf

This paper investigates the relationship between subjective well-being, household financial asset accumulation, and investment risk tolerance. Based on empirical analysis using data from the China Household Finance Survey (CHFS), the results show that after controlling for factors such as year, region, and occupation, household financial asset accumulation has a significantly positive effect on individual well-being. Endogeneity is tested using total household income as an instrumental variable. Further analysis reveals that low investment risk tolerance negatively moderates the relationship between household financial assets and well-being, while high investment risk tolerance positively moderates the relationship between stock investment and well-being. This suggests that households with low risk tolerance experience greater increases in well-being as their financial situation improves, whereas households with high risk tolerance are more likely to enhance well-being through stock investment.

View pdf

View pdf

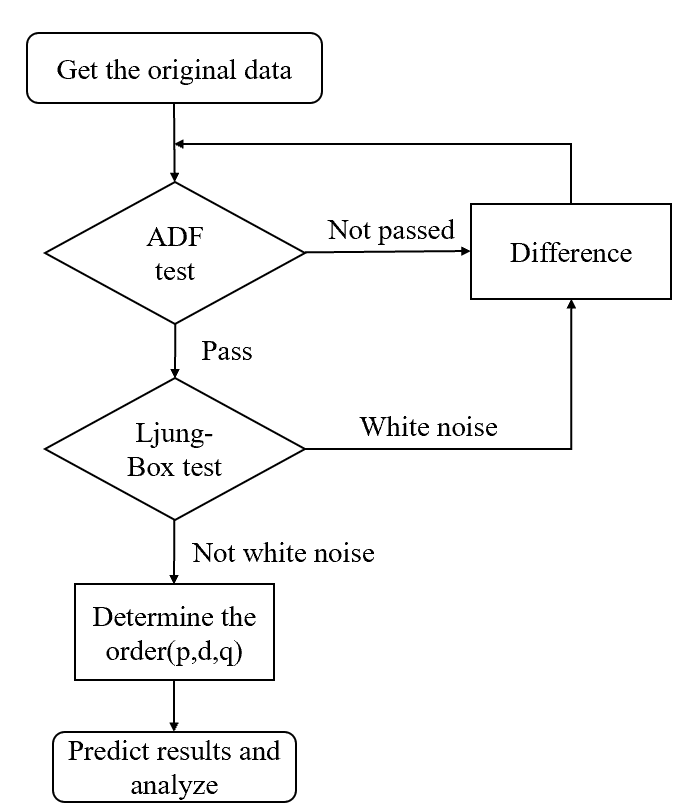

The stock market has grown to be an essential component of China's economic market as the country's economy has developed. And stock prices are closely watched by investors and managers. This paper uses Python to crawl the monthly stock prices of Ping An of China from January 2016 to December 2024 and decides to estimate its closing price using the ARIMA, GM, and LSTM models. Furthermore, this paper mixes the ARIMA model with the GM model to build a hybrid model. The empirical results show that the ARIMA model’s mean square errors is 35.79, while the GM model’s is 125.63. The MSE loss function of the LSTM model is 14.186, and the MSE of the ARIMA-GM hybrid model is 7.575. The results of this paper show that the hybrid model’s prediction accuracy surpasses not only that of a single model but also that of the LSTM model in machine learning, providing a scientific and effective guide for investor and manager behavior.

View pdf

View pdf

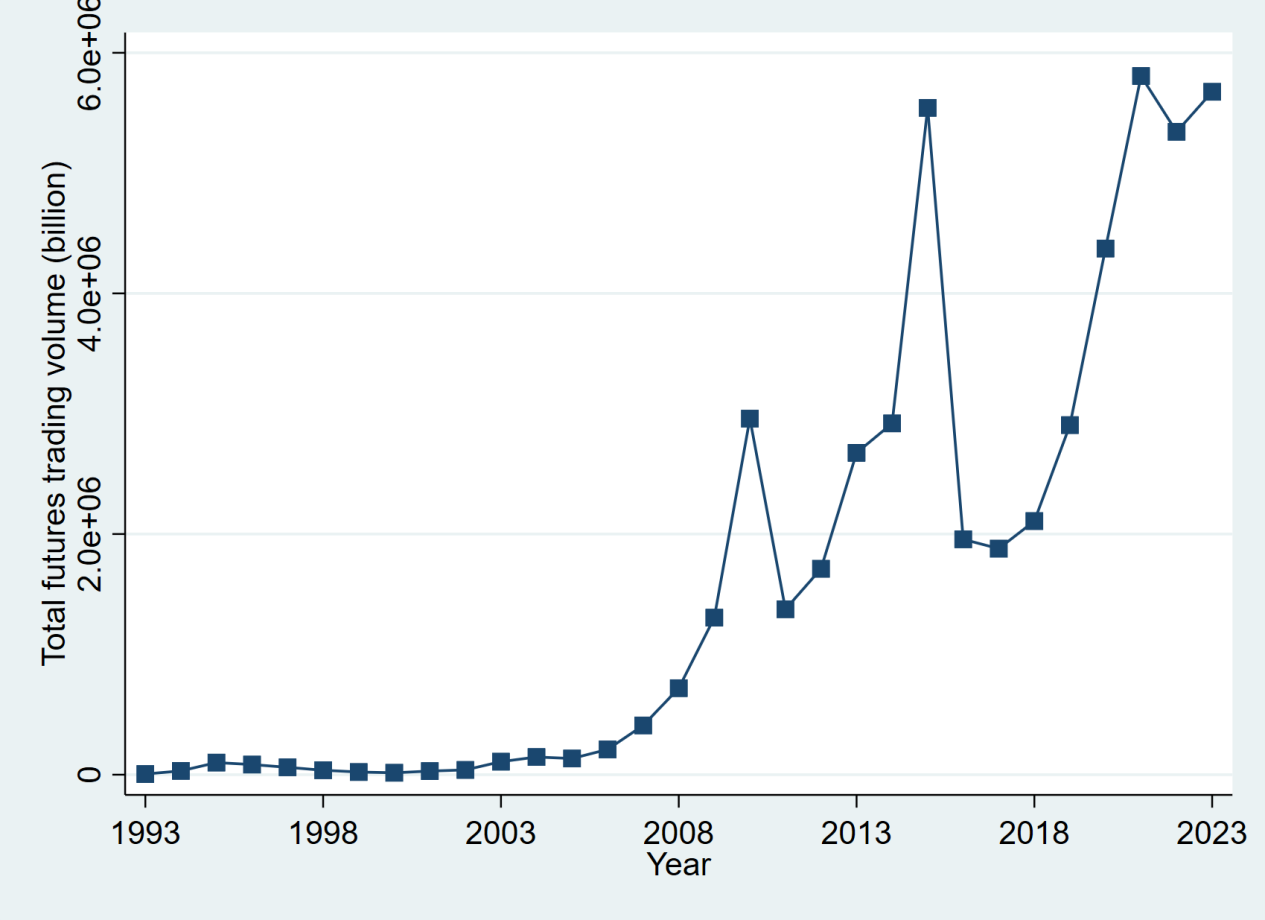

As an essential component of modern financial markets, financial derivatives often rely on a mature real economy for their development. Therefore, assessing the influence of the real economy on financial derivatives is crucial. This study employs a linear regression model combined with robustness checks to examine the impact of the real economy on the development of financial derivatives in China, using data from 1993 to 2023. Additionally, it incorporates a heterogeneity analysis from temporal and sectoral perspectives.The findings reveal that: (1) The real economy exerts a positive and supportive effect on the development of financial derivatives. (2) The supportive effect was more pronounced before the global financial crisis. (3) The agricultural sector plays a more significant role in promoting the development of financial derivatives compared to the industrial sector.

View pdf

View pdf

Based on panel data from the China Household Tracking Survey spanning 2010 to 2022, this study investigates the impact and mechanism of minimum wage standards on income polarization at the county level. The findings indicate that increases in the minimum wage significantly exacerbate income polarization. This effect is realized through industrial structure upgrading and moderated by productivity and labor supply, with a more pronounced impact in low-income regions. Accordingly, policy recommendations are proposed to optimize income distribution, provide targeted assistance to farmers, and promote coordinated regional development.

View pdf

View pdf

With the development of economy and popularization of culture, the art market in China is also booming. However, even though the art market generates a lot of economic benefits, it also reveals some shortcomings as well as limitations. Therefore, this study aims to find out the factors which may impact the consumption of the Chinese art market through an in-depth study of the art market. This will help the art market to develop better, and also help art enterprises to better understand the consumers, so as to formulate marketing strategies in a targeted manner. In this study, a questionnaire survey was used to collect data, and the data were transformed into quantitative form for easy analysis. In addition, linear regression model was constructed to investigate the relationship between the influencing factors and the amount of artwork consumption. The final results of the research show that age (AG), knowledge of artwork (KA) and attitude towards expensive artwork (EX) could significantly affect the amount of artwork consumption, while gender (GE) education background (EB) and income (IN) do not significantly affect the amount of artwork consumption.

View pdf

View pdf

With the globalization and the increasing complexity of supply chain management, the financial risks faced by enterprises show the characteristics of diversification and multi-level. Supply chain transparency is considered to be one of the important factors affecting the financial health of enterprises. Through regression analysis, this paper discusses the impact of supply chain transparency on enterprise financial risk. The results show that there is a significant negative correlation between supply chain transparency and enterprise financial risk. Every unit of supply chain transparency increases, the financial risk of the enterprise (measured by the financial leverage ratio) will be reduced by 0.280 units. The analysis shows that the stability of enterprise scale and capital structure also has a significant impact on financial risk. Larger enterprises usually face lower financial risk, while the instability of capital structure will aggravate financial risk. This finding provides important practical enlightenment for enterprises and policy makers, and shows that improving supply chain transparency and optimizing capital structure are effective ways to reduce financial risk.

View pdf

View pdf