1. Introduction

Financial derivatives are financial contracts based on underlying assets such as stocks, bonds, currencies, and commodities. They include forwards, futures, swaps, and options, as well as hybrid financial instruments incorporating characteristics of these contracts. The primary purpose of these instruments is to improve market efficiency by dispersing and transferring risk. With the rise of globalization and rapid advancements in digital technologies, the financial derivatives market is facing unprecedented opportunities and challenges.

The development of financial derivatives is rooted in underlying financial instruments, which in turn depend on the strength of the real economy. A mature real economy ensures sufficient consumption, financing, government purchasing, and import-export activities, all of which contribute to the activity level of financial instruments in the market. Consequently, the development of the financial derivatives market is heavily influenced by various real economy factors such as urbanization, economic development stage, policy or economic shocks, technological innovation, and the vibrancy of consumption, investment, and trade activities.

Thus, this study aims to explore the extent and mechanisms through which the real economy influences financial derivatives development within China. To this end, we conduct an empirical analysis based on macroeconomic data from 1993 to 2023, employing a linear regression model supplemented with robustness checks and heterogeneity analyses.

2. Literature review

The literature most closely related to this study also examines the relationship between financial derivatives and the real economy. Zheng Liting [1] pointed out that derivatives contribute to the development of the real economy, primarily by increasing the value of non-financial enterprises and enhancing bank lending to them. Wang Huanzhou et al [2]. noted that in 2017, some enterprises defaulted in the bond market, leading to a gradual rise in interest rate and credit risks for market participants, while issuers faced declining financing efficiency and rising financing costs. Li Qiuxia [3] emphasized that under a market economy, financial markets and the real economy are closely interconnected in a mutually reinforcing and symbiotic relationship.

On another front, studies that focus solely on the development of financial derivatives are also relevant to this research. Shi Guang [4] pointed out that compared to developed countries, China's derivatives market is characterized by faster development of futures compared to options and a stronger presence of exchange-traded derivatives relative to over-the-counter derivatives. Fang Suyuan and Fang Xiongying [5] argued that strengthening legal and regulatory frameworks, improving market oversight, increasing transaction transparency, enhancing risk management capabilities, and advancing internationalization are essential pathways for the reform and development of China’s derivatives market. Yao Yaxin et al [6]. identified several issues facing China’s derivatives market, including limited product diversity, inadequate market infrastructure, and the misuse of derivatives by investors. Liang Xiaojuan [7] found that the development of the financial derivatives market can guide and regulate the basic financial markets and plays a positive role in the efficient allocation of resources across society.

Additionally, literature focusing specifically on the real economy is also relevant. Hu Hao [8] discussed the concept of hedging, its practical applications, motivations for implementing hedging strategies, and the challenges companies face when applying them, offering suggestions for risk control related to hedging. Zheng Mingxuan [9] demonstrated that the deep integration of the digital economy with the real economy is not only a driving force for high-quality economic development but also a cornerstone for building a modern industrial system and a solid foundation for accelerating the modernization of socialism. Zhang Ying [10] discussed the features of how digital finance empowers the high-quality development of the real economy and analyzed the main challenges involved.

Based on the above literature, this study potentially makes four contributions: First, in terms of topic selection, the research subject is highly timely and enriches the academic understanding of factors influencing the development of financial derivatives in China. Second, in terms of methodology, it employs statistical tools for empirical testing, incorporates robustness checks of the baseline regression, and conducts in-depth heterogeneity analyses across different time periods and industries in China. Third, the study uses comprehensive and novel datasets with a long time span. Fourth, against the backdrop of China's rapidly developing financial system, this analysis of China’s financial derivatives market—particularly its futures market—holds significant theoretical and practical value and may offer valuable lessons for other developing countries while expanding the boundaries of financial theory.

3. Development characteristics and stylized facts of China’s financial derivatives market

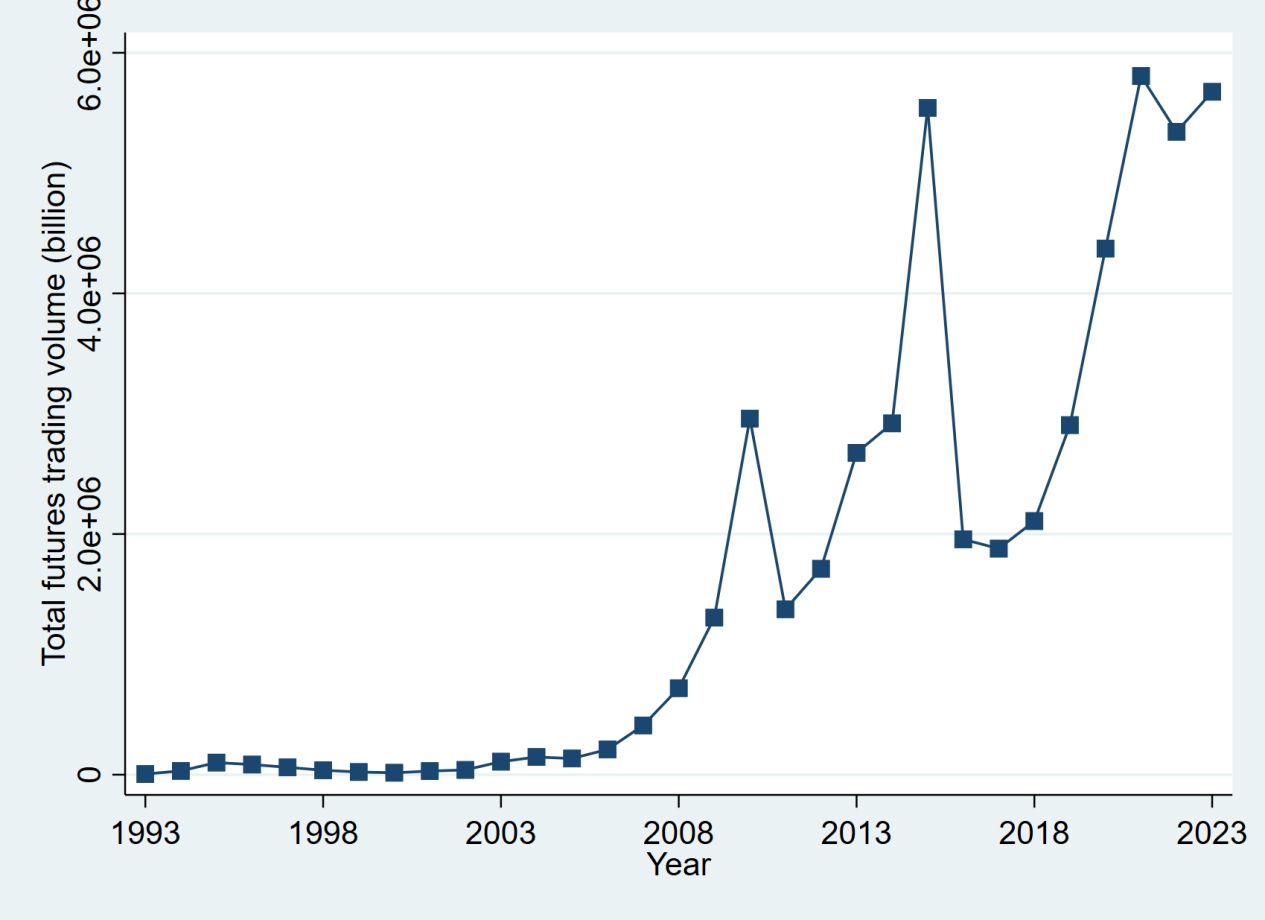

Figure 1 illustrates the development trend of China's financial derivatives market from 1993 to 2023, using the total value of futures transactions as the indicator. As shown in the figure, from the perspective of development trends, the market has exhibited a general upward trajectory with increasing fluctuations, peaking at nearly 60 trillion yuan. This indicates that since the introduction of futures trading in 1993, the market has gained growing attention.

From the perspective of growth rate, the market experienced relatively flat growth before the 21st century, with almost zero increase. However, after 2000, the market began expanding rapidly. In particular, two periods—2011 to 2015 and 2017 to 2021—witnessed especially high growth rates. This highlights the fast pace of development and the increasing prominence of the financial derivatives market in China.

It is worth noting that the market experienced a decline around 2010 and again around 2015. The underlying causes include the 2008 U.S. subprime mortgage crisis and China’s shift to a “new normal” phase of economic development around 2015.

4. Research design

4.1. Variable selection

The dependent variable in this study is the development of financial derivatives, proxied by the total value of futures transactions. The core explanatory variable is the real economy, represented by the combined value added of the primary and secondary industries. For robustness checks, the total futures trading volume is used as an alternative proxy for the dependent variable. Additionally, the study conducts sectoral heterogeneity analyses using value-added data for the primary and secondary industries separately.

4.2. Data source

This empirical study focuses on China and uses annual data from 1993 to 2023. All data are sourced from the National Bureau of Statistics of China. Descriptive statistics are presented in Table 1.

|

Variable |

Obs |

Mean |

Std.Dev. |

Min |

Max |

|

Real Economy (100 million yuan) |

31 |

224728 |

175867 |

23360 |

565105 |

|

Total Futures Value (100 million yuan) |

31 |

1.635e+06 |

1.945e+06 |

5522 |

5.807e+06 |

|

Total Futures Volume (10,000 contracts) |

30 |

207656 |

227388 |

5461 |

737871 |

|

Primary Industry Value Added (100 million yuan) |

31 |

38827 |

26009 |

6888 |

89169 |

|

Secondary Industry Value Added (100 million yuan) |

31 |

185901 |

149912 |

16473 |

475936 |

4.3. Model specification

The study adopts a simple linear regression model as follows:

Where:

5. Empirical analysis

5.1. Correlation analysis

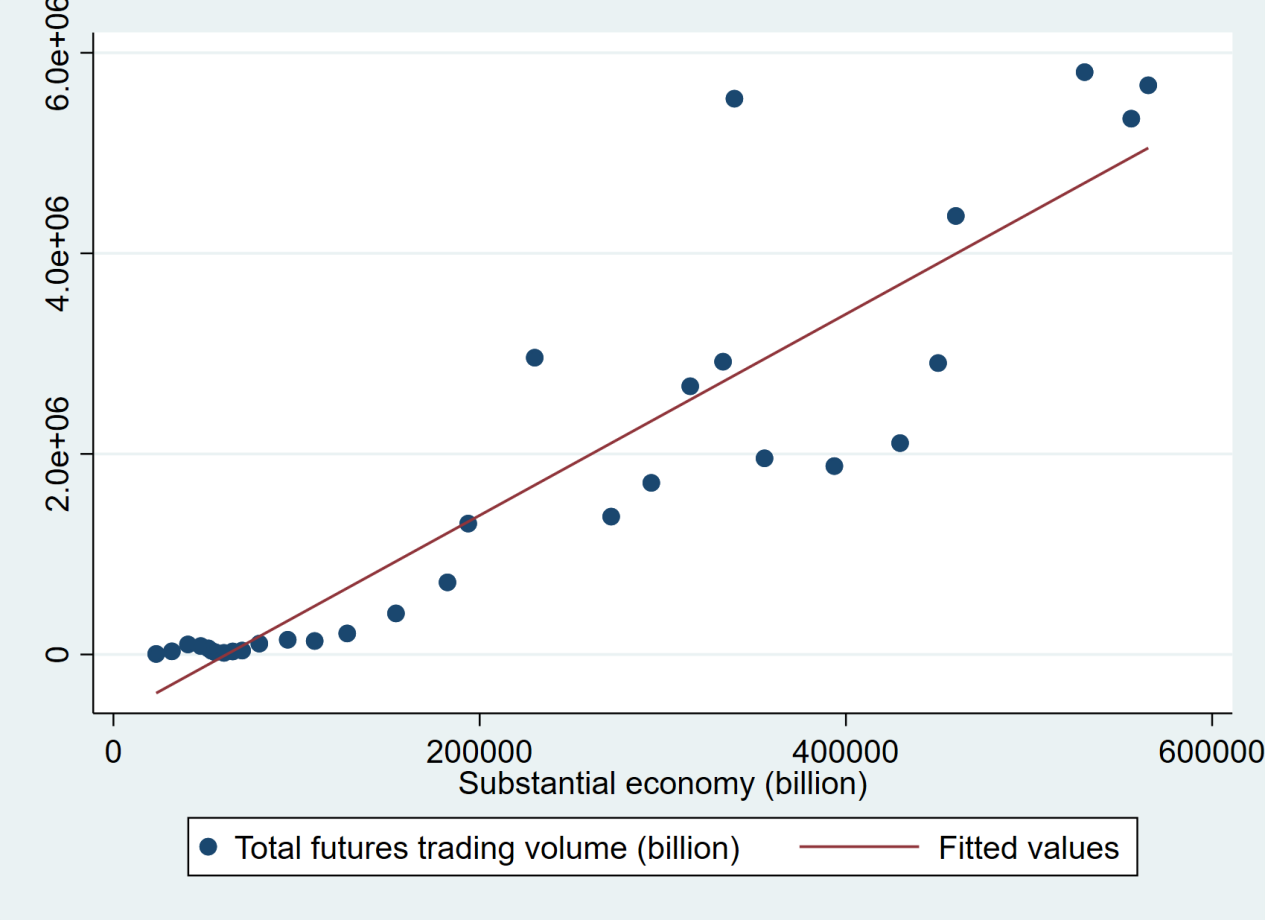

Figure 2 depicts the relationship between the real economy and financial derivatives. At a preliminary visual inspection, the development of financial derivatives appears to increase in tandem with the growth of the real economy. However, during the early stages of real economic development, there is no evident correlation between the two. Therefore, regression analysis is needed to further confirm the nature of the relationship between the real economy and financial derivatives.

5.2. Baseline regression

Models (1) and (2) in Table 2 report the regression results assessing the impact of the real economy on the development of financial derivatives. In Model (2), the data used in Model (1) is log-transformed. Specifically, the estimated coefficients of the core explanatory variable are 10.0339 and 2.1060, respectively, both of which are significantly positive at the 1% level. These initial regression results suggest that the real economy exerts an overall positive influence on the development of financial derivatives, indicating a clear supportive effect.

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

|

y |

y |

y |

y |

y |

y |

y |

|

|

x |

10.0339*** |

2.1060*** |

1.4708*** |

1.7095*** |

1.3467*** |

2.7350*** |

1.9761*** |

|

(11.6315) |

(18.3980) |

(11.7679) |

(4.6286) |

(4.6396) |

(18.7669) |

(17.9552) |

|

|

_cons |

-6.20e+05** |

-12.2033*** |

-6.1057*** |

-7.9326* |

-2.4090 |

-15.2890*** |

-10.1979*** |

|

(-2.5327) |

(-8.9038) |

(-4.0953) |

(-1.9412) |

(-0.6501) |

(-10.1413) |

(-7.8868) |

|

|

N |

31 |

31 |

30 |

15 |

16 |

31 |

31 |

|

R2 |

0.8235 |

0.9211 |

0.8318 |

0.6224 |

0.6059 |

0.9239 |

0.9175 |

Note: *** p < 0.01; ** p < 0.05; * p < 0.10. t-values are in parentheses. Same applies below.

5.3. Robustness check

To verify the stability and reliability of the baseline regression estimates, this study replaces the dependent variable—total futures transaction value—with total futures trading volume. The result, shown in Model (3) of Table 2, continues to exhibit a significantly positive effect of the real economy on the development of financial derivatives. This confirms the robustness of the baseline model's conclusion.

5.4. Heterogeneity analysis

5.4.1. Temporal heterogeneity analysis

In light of the 2008 U.S. subprime mortgage crisis, 2008 is used as a temporal cutoff to divide the sample into two periods for comparative analysis. Models (4) and (5) in Table 2 report the regression results for the periods 1993–2008 and 2008–2023, respectively. The estimated coefficients of the real economy are 1.7095 and 1.3467, both significantly positive at the 1% level. These results suggest that the real economy played a stronger role in promoting the development of financial derivatives during the earlier period (1993–2008). In contrast, its supportive effect diminished in the post-crisis period (2008–2023), indicating that the shock of the financial crisis weakened the real economy’s influence on the development of financial derivatives.

5.4.2. Sectoral heterogeneity analysis

This study further distinguishes between agriculture and industry to analyze the heterogeneity of the real economy's impact. Model (6) in Table 2 reports the regression results for the agricultural sector, while Model (7) focuses on the industrial sector. The estimated coefficients are 2.7350 and 1.9761, respectively, both statistically significant at the 1% level. These findings indicate that agriculture contributes more strongly to the development of financial derivatives than industry does, meaning that the supportive effect of agriculture surpasses that of industry.

6. Conclusion

Based on the empirical findings above, this study concludes that there is a positive relationship between the real economy and the development of financial derivatives—demonstrating that the real economy provides a supportive effect. When segmented by time, the supportive effect of the real economy was more pronounced prior to the 2008 global financial crisis. From an industry perspective, the agricultural sector exhibits a stronger supportive effect on the development of financial derivatives compared to the industrial sector.

References

[1]. Zheng, L. (2018). The use of derivatives by listed companies and its impact on the development of the real economy: A study based on quarterly financial statement data. China Securities and Futures, (01), 57–67.

[2]. Wang, H. , Hong, J. , Yan, H. , & Gao, G. (2018). Supporting the real economy with financial derivatives: Risk management through interest rate and credit derivatives. Financial Market Research, (02), 21–27.

[3]. Li, Q. (2017). The role of financial derivatives in promoting economic restructuring. Popular Investment Guide, (09), 6.

[4]. Shi, G. (2020). Building financial and commodity derivatives markets that meet the requirements of a modern economic system. Journal of Chongqing University of Technology (Social Science Edition), 34(03), 1–8.

[5]. Fang, S. , & Fang, X. (2025). Current status, existing problems, and suggestions for the development of China’s financial derivatives market. Hainan Finance, (01), 51–60.

[6]. Yao, Y. , Wang, T. , Jiang, S. , & Huang, Y. (2023). A review of research on the development of China’s financial derivatives. Business Observer, 9(35), 102–107+116.

[7]. Hu, H. (2022). Analysis of hedging strategies using derivative financial instruments. Modern Business, (20), 102–104.

[8]. Liang, X. (2021). Research on the functions and development pathways of the financial derivatives market. Journal of Henan Radio and TV University, 34(02), 14–19.

[9]. Zheng, M. (2025). Deep integration of digital economy and real economy: Logic, challenges, and practical solutions. Journal of Suihua University, 45(03), 21–23.

[10]. Zhang, Y. (2025). A brief discussion on how digital finance empowers high-quality development of the real economy. Modern Business, (04), 87–90.

Cite this article

Ye,X. (2025). The Supportive Effect of the Real Economy on Financial Derivatives: An Empirical Analysis Based on Chinese Futures Market Data. Advances in Economics, Management and Political Sciences,205,36-41.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: The 4th International Conference on Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zheng, L. (2018). The use of derivatives by listed companies and its impact on the development of the real economy: A study based on quarterly financial statement data. China Securities and Futures, (01), 57–67.

[2]. Wang, H. , Hong, J. , Yan, H. , & Gao, G. (2018). Supporting the real economy with financial derivatives: Risk management through interest rate and credit derivatives. Financial Market Research, (02), 21–27.

[3]. Li, Q. (2017). The role of financial derivatives in promoting economic restructuring. Popular Investment Guide, (09), 6.

[4]. Shi, G. (2020). Building financial and commodity derivatives markets that meet the requirements of a modern economic system. Journal of Chongqing University of Technology (Social Science Edition), 34(03), 1–8.

[5]. Fang, S. , & Fang, X. (2025). Current status, existing problems, and suggestions for the development of China’s financial derivatives market. Hainan Finance, (01), 51–60.

[6]. Yao, Y. , Wang, T. , Jiang, S. , & Huang, Y. (2023). A review of research on the development of China’s financial derivatives. Business Observer, 9(35), 102–107+116.

[7]. Hu, H. (2022). Analysis of hedging strategies using derivative financial instruments. Modern Business, (20), 102–104.

[8]. Liang, X. (2021). Research on the functions and development pathways of the financial derivatives market. Journal of Henan Radio and TV University, 34(02), 14–19.

[9]. Zheng, M. (2025). Deep integration of digital economy and real economy: Logic, challenges, and practical solutions. Journal of Suihua University, 45(03), 21–23.

[10]. Zhang, Y. (2025). A brief discussion on how digital finance empowers high-quality development of the real economy. Modern Business, (04), 87–90.