1. Introduction

Under the circumstances where the process of digital transformation is advancing rapidly, traditional accounting is confronted with numerous risks. These risks increase the risk of misstatement in financial statements and undermine the reliability and authenticity of financial information. With the introduction of blockchain technology, distributed ledgers, encryption algorithms and smart contracts provide unique solutions to the problems faced by traditional accounting and auditing. The application of blockchain significantly enhances security, while smart contracts automate business processes, reduce the possibility of tampering, decrease the need for manual intervention, and minimize the risk of human error. The research significance of this paper is to help people better understand how blockchain technology can reduce accounting and auditing risks. Through case analysis, this paper conducts an in-depth exploration of the application value of blockchain in accounting processes from the perspective of audit risk assessment. By understanding the definitions, relationships, and differences between accounting and auditing, and by examining the traditional accounting process, it is found that there are audit risks in terms of information accuracy and completeness.

2. Blockchain

2.1. Definition

In a narrow sense, blockchain is a kind of chain-like data structure that combines data blocks in sequence and in order to form a chain, and it is a distributed ledger that ensures the non-modifiable and non-forgeability of data through cryptography. In a broad sense, blockchain technology is a new distributed infrastructure and computing paradigm that uses a blockchain-like data structure to verify and store data, uses a distributed node consensus algorithm to generate and update data, uses cryptography to ensure the security of data transmission and access, and uses smart contracts composed of automated script codes to program and operate data. Blockchain is a new application mode of computer technologies such as distributed data storage, peer-to-peer transmission, consensus mechanisms, and encryption algorithms. A consensus mechanism is a mathematical algorithm in the blockchain system that realizes the establishment of trust and the acquisition of rights among different nodes and ensures the trust between them [1]. With the advent of the digital era, the economic statistics and auditing fields are undergoing unprecedented changes. Among many technologies, blockchain is regarded as one of the technologies that may completely change these two fields. As a decentralized, transparent and non-modifiable distributed ledger, blockchain brings new standards for the authenticity, integrity and security of data. Its automatic verification and smart contract functions also provide the possibility for automated auditing processes. However, how to combine this technology with traditional economic statistics and auditing practices remains a problem to be solved [2].

2.2. How to apply blockchain

In accounting and financial reporting, blockchain is mainly applied in data collection and recording, ledger registration and management, and financial statement preparation. The distributed ledger of blockchain is one of the core features of blockchain technology. It is a database that is shared, replicated and synchronized among multiple nodes. It has no centralized control institution. The data in the ledger is jointly maintained and verified by multiple participants in the network.

2.2.1. Data acquisition and recording

Blockchain is a decentralized distributed ledger technology, which is composed of multiple blocks linked in chronological order. Each block contains certain transaction data and the hash value of the previous block. Through cryptographic techniques and consensus mechanisms, it ensures the authenticity and integrity of the data. Therefore, when acquiring and recording data, the distributed ledger technology of blockchain can be utilized. When a transaction occurs, relevant data will be simultaneously recorded by multiple nodes, and once recorded, it is difficult to tamper with, ensuring the authenticity and reliability of the accounting data sources, which helps to reduce the workload and error rate of manual input.

2.2.2. Distributed ledger sharing

The distributed ledger on the blockchain can be accessed and shared by authorized accountants and relevant departments simultaneously, ensuring the consistency and real-time nature of the ledger information. Accounting data from different departments or branches can be synchronized in real time, facilitating unified accounting and management by the enterprise.

2.2.3. Financial statement preparation

Data is automatically summarized. Smart contracts can automatically extract relevant data from the blockchain ledger based on preset financial statement preparation rules, and then summarize and calculate it to generate the draft of the financial statement.

Real-time update of statements. Since the transaction data on the blockchain is updated in real time, financial statements can also reflect the latest financial status of the enterprise in real time. Management can obtain the latest statement information at any time and provide timely and accurate data support for decision-making.

3. Distinctions and connections between audit and accounting

3.1. Definition of accounting

Accounting is an economic management activity that uses currency as the main unit of measurement and adopts specific methods and procedures to conduct complete, continuous, and systematic accounting and supervision of the economic activities of enterprises, administrative and public institutions. Its main purpose is to provide economic information and reflect the fulfillment of entrusted responsibilities.

Accounting calculation is the basic function of the financial work of public institutions and plays an important role. With the continuous reform of China's fiscal and taxation system in recent years and the increasingly improved accounting system for public institutions, the implementation of the new government accounting system in 2019 has set higher standards for the accounting calculation work of public institutions. During the execution of accounting calculations, units must strictly follow the requirements of the system to standardize the accounting process [3].

3.2. Definition of audit

Audit refers to an independent economic supervision activity carried out by an established authority in accordance with the law to review major projects and financial revenues and expenditures of governments at all levels, financial institutions, enterprises, and public institutions before and after their occurrence. The purpose of an audit is to determine whether the financial statements of the audited entity truly and fairly reflect its financial position and operating results, as well as whether its economic activities are legal and compliant, in order to enhance the credibility of financial information and protect the interests of investors and other stakeholders. The meeting further clarified the new positioning of national auditing in the new era: an important force for promoting the modernization of the national governance system and governance capacity. It endowed the national auditing in the new era with a new mission: a unique role in promoting the self-revolution of the Party. It put forward new requirements for national auditing in the new era: a general requirement, three "as" specific requirements, and five work requirements. We should deeply study and understand, and fully implement the first meeting of the 20th Central Audit Commission of the Party Central Committee's spirit. We should accurately grasp the new positioning, new mission and new requirements of national auditing in the new era, and provide high-quality audit supervision to serve and guarantee the high-quality development of the economy and society [4].

The essence of auditing is an important issue in the basic theory of auditing. Auditor-General Jiayi Liu pointed out at the 7th Member Congress and the First Meeting of the 7th Council of the China Audit Society, "We should focus on the system's origin and strengthen the research on the essence and laws of national auditing. The understanding of the essence of auditing is the main thread, and only when the main thread is held high can the branches be unfolded." Therefore, deepening the research on the essence of auditing is an important topic in current auditing theoretical research [5].

3.3. Distinctions and connections

Accounting mainly involves the confirmation, measurement, recording and reporting of economic transactions; auditing, on the other hand, is the examination of accounting materials. The relationship between auditing and accounting is very close. Accounting serves as the foundation, while auditing can be regarded as an upgraded version. From a theoretical perspective, accounting reflects and outputs information on business operations or economic activities of enterprises, while auditing examines such information to verify and confirm its authenticity. Both share the same basic accounting principles. Auditing cannot be carried out without accounting materials, which are the main source of evidence for auditing. Both take the economic activities of enterprises as their working objects, and their ultimate goal is to enhance the economic benefits of enterprises and maintain the order of the market economy.

4. Accounting calculation

4.1. Flowchart of accounting calculation process

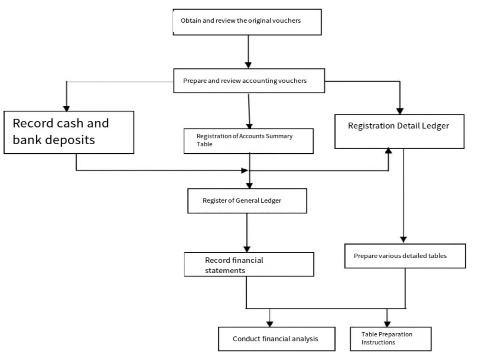

Based on Figure 1, a detailed analysis of the accounting calculation process can be conducted:

(1) Obtain and review original vouchers, prepare and review accounting vouchers.

(2) Record in the cash and bank deposit accounts, subsidiary ledgers, and trial balance. Then, record in the general ledger according to the trial balance.

(3) Prepare financial statements and detailed statements based on the general ledger.

(4) Conduct financial analysis and write explanations for the statements.

Figure 1: Accounting and calculation flow chart

4.2. Deficiencies in accounting calculation process

Under the circumstances of rapid development of the digital economy, traditional accounting is confronted with numerous risks. These risks increase the risk of misstatement in financial statements and weaken the reliability and authenticity of financial information.

4.2.1. Professional competence of accountants

Accountants may lack professional knowledge or be unfamiliar with new accounting standards and regulations. During the entry of original data, accountants may be negligent, leading to accounting processing errors and affecting subsequent accounting results. Some accountants may deliberately tamper with accounting data and provide false financial information for personal interests or under external pressure.

4.2.2. Internal control and supervision

Inadequate supervision mechanisms and insufficient internal supervision may result in uncorrected and undetected violations in accounting calculations, thereby increasing financial risks. For instance, incompatible positions may not be effectively separated. For example, the accountant and the cashier may be held by the same person, which may lead to fraudulent behavior.

5. Applications of blockchain in accounting calculation

The application of blockchain in accounting calculation can to some extent solve the problems of traditional accounting calculation. With the rapid development of technology, blockchain technology is also constantly maturing. Blockchain not only promotes the transformation of enterprise production and operation models, but also drives the integration and innovation across different fields and industries. The core features of blockchain technology, such as decentralization, distributed bookkeeping, and smart contracts, have a natural connection with the accounting field. It is almost a brand-new accounting system and seamlessly integrates with accounting professionals. Based on the connotation and essential characteristics of blockchain, analyze the correlation between the movement of funds in accounting activities and blockchain, construct a "four-in-one" accounting model based on blockchain technology, and explore its application value to improve the accuracy and efficiency of financial accounting, provide decision support for management accounting, and force the transformation and upgrading of enterprise accounting models into an irreversible trend, further promoting the creation of enterprise value and the enhancement of vitality [6]. Distributed ledger records can be conducted, thereby enhancing the authenticity and reliability of data.

6. Application value of blockchain

As an emerging technology, blockchain has broad application prospects. It not only plays an important role in promoting the update of new technologies and industrial innovation, but also deeply integrates with the economy and society, giving rise to new economic forms or new business models. The popularization and application of blockchain technology is only a matter of time and will bring disruptive impacts to the accounting and auditing industries. Accountants and auditors must update their professional knowledge systems as soon as possible, comprehensively study and master new technologies such as blockchain, and expand their knowledge and skills [7]. The application of blockchain technology can effectively reduce operating costs and improve process efficiency; at the same time, it can enhance trust value and promote multi-party collaboration. Blockchain technology plays a positive role in promoting the integration of accounting and finance in the accounting industry. It can not only improve the internal information system of enterprises but also effectively connect the integrated process of accounting and finance, helping enterprises achieve strategic development. The development and progress of blockchain technology and the integration of accounting and finance can significantly optimize the financial accounting model, promote the virtuous cycle of enterprises, and drive the innovation of industries [8]. Blockchain technology has become increasingly mature and has been widely applied in various industries. For the accounting industry, most enterprises still use the double-entry bookkeeping method. It can assign different businesses to professional personnel for operation. The application of blockchain technology can not only collect data but also transmit it through blockchain and finally program it. It saves time while improving the quality of accounting information [9]. Applying blockchain to accounting can better ensure the authenticity and integrity of accounting data, effectively prevent data from being tampered with by humans, and ensure that accounting data truly reflects the economic activities of the enterprise.

7. Conclusion

With the in-depth development of the digital era, traditional accounting and auditing processes are facing numerous challenges, and the assessment of auditing risks has also become more difficult. Traditional accounting and auditing processes have many drawbacks, such as data information asymmetry; being easy to be tampered with by others; low confidentiality. These problems have led to an increase in the difficulty of auditing risk assessment. Blockchain technology has unique advantages and can solve some problems of traditional accounting and auditing to a certain extent. The main research focus is on the distributed ledger technology of blockchain. Introducing blockchain technology into the accounting and auditing processes significantly improves the quality of accounting and auditing information, reduces the risk of major auditing errors, optimizes the auditing process, improves auditing efficiency, reduces inspection risks, reshapes the trust mechanism, enhances the transparency of accounting information, reduces information asymmetry, and lowers the uncertainty of auditing risks. Due to its technical characteristics, blockchain technology is of great significance for optimizing accounting and auditing processes and improving the level of auditing risk control in the digital era. It provides important theoretical references and practical guidance for enterprises to achieve the coordinated development of financial management and auditing supervision in the digital era and has broad application prospects.

Although blockchain has significant advantages in the accounting and auditing processes, there are still many difficulties that need to be addressed. For example, technical standards have not yet been unified; laws and regulations are still not complete. Therefore, to address these challenges, it is necessary for the government, industry organizations, and enterprises to collaborate in multiple ways. Only in this way can blockchain be expected to become an important force promoting the high-quality development of accounting and auditing industries.

References

[1]. Chunxiao Xing, Guigang Zhang. (2017) Definition of Blockchain. China Blockchain Technology and Industry Development Report, pp. 2-3.

[2]. Wendong Liu. (2024) The Application Prospect of Blockchain Technology in Economic Statistics and Audit. China's Collective Economy, (19): 169-172.

[3]. Mi Ke. (2024) Analysis of Accounting and Calculation Strategies in Public Institutions. Guide to Township Enterprises, (8): 54-56.

[4]. Jun Liu, Huijin Wang, Zhuo Chen. (2023) New Positioning, New Mission and New Requirements of China's Audit in the New Era—Learning Experience of the Spirit of the First Meeting of the 20th Central Audit Commission. Friends of Accounting, (23): 12-16.

[5]. Dasheng Dong. (2015) The Essence of Audit: The Definition and Positioning of Audit. China Audit, (4): 6-9.

[6]. Kehong Li. (2020) Research on the Accounting Mode and Application Based on Blockchain Technology. Finance and Accounting Monthly, (16): 76-81.

[7]. Zhijun Lin. (2023) Research on the Influence of Blockchain Technology on Accounting and Audit. Friends of Accounting, (20): 2-6.

[8]. Qu Chen, Zhenxing Lu. (2023) Research on the Application of the Integration of Accounting, Business and Finance Based on Blockchain Technology. Accounting of China's Township Enterprises, (6): 141-143.

[9]. Xinzhu Zhang. (2024) Research on the Application of Blockchain Technology in the Accounting Industry. China Storage & Transport, (1): 142.

Cite this article

Zhang,Z. (2025). The Application Value of Blockchain in Accounting Process from the Perspective of Audit Risk Assessment. Advances in Economics, Management and Political Sciences,190,24-29.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Digital Transformation in Global Human Resource Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chunxiao Xing, Guigang Zhang. (2017) Definition of Blockchain. China Blockchain Technology and Industry Development Report, pp. 2-3.

[2]. Wendong Liu. (2024) The Application Prospect of Blockchain Technology in Economic Statistics and Audit. China's Collective Economy, (19): 169-172.

[3]. Mi Ke. (2024) Analysis of Accounting and Calculation Strategies in Public Institutions. Guide to Township Enterprises, (8): 54-56.

[4]. Jun Liu, Huijin Wang, Zhuo Chen. (2023) New Positioning, New Mission and New Requirements of China's Audit in the New Era—Learning Experience of the Spirit of the First Meeting of the 20th Central Audit Commission. Friends of Accounting, (23): 12-16.

[5]. Dasheng Dong. (2015) The Essence of Audit: The Definition and Positioning of Audit. China Audit, (4): 6-9.

[6]. Kehong Li. (2020) Research on the Accounting Mode and Application Based on Blockchain Technology. Finance and Accounting Monthly, (16): 76-81.

[7]. Zhijun Lin. (2023) Research on the Influence of Blockchain Technology on Accounting and Audit. Friends of Accounting, (20): 2-6.

[8]. Qu Chen, Zhenxing Lu. (2023) Research on the Application of the Integration of Accounting, Business and Finance Based on Blockchain Technology. Accounting of China's Township Enterprises, (6): 141-143.

[9]. Xinzhu Zhang. (2024) Research on the Application of Blockchain Technology in the Accounting Industry. China Storage & Transport, (1): 142.