1. Introduction

The growing effects of climate change have highlighted the pressing need for a global shift toward sustainable energy, with renewable energy playing a pivotal role. Among renewable solutions, rooftop solar (RTS) energy has emerged as a decentralized and scalable option for addressing energy demand while reducing greenhouse gas emissions. India, as the world's third-largest energy consumer, has recognized the potential of RTS in its ambitious solar energy agenda, particularly under the National Solar Mission, which aims to achieve 40 GW of rooftop solar capacity by 2022 [1]. However, as of 2023, RTS deployment in India lags far behind its targets, with only around 10.9 GW installed [2]. This paper seeks to explore the possibilities of a US-India collaboration to address the challenges hindering India's RTS sector, answering the central research question: How can a US-India partnership effectively address the challenges hindering RTS deployment in India and unlock its full potential?

The primary objectives of this paper are to identify the key barriers to RTS adoption in India, evaluate the limitations of current policies, and propose actionable solutions leveraging US expertise, financing, and technology [2]. A successful partnership can not only accelerate India's renewable energy transition but also contribute to global efforts to combat climate change.

1.1. Background

India's energy transition is critical for both national and global climate goals. The country ranks third in terms of global carbon emissions, with its coal sector contributing over 55% of energy demand and releasing enormous emissions [3]. Rooftop solar offers an opportunity to decarbonize electricity generation while addressing India's growing energy demand, which is expected to double by 2040. Moreover, RTS systems can provide energy access to underserved regions, reduce transmission losses, and empower urban and rural households to become energy self-sufficient.

Despite its numerous advantages, India's rooftop solar (RTS) sector continues to encounter significant obstacles, including policy inconsistencies, financing constraints, and limited consumer awareness. In contrast, the United States has successfully implemented effective frameworks for RTS deployment, such as federal investment tax credits, net metering policies, and innovative financing mechanisms [3]. By fostering collaboration, India can leverage these proven strategies and tailor them to its distinct socio-economic and regulatory landscape, thereby maximizing the growth and impact of its RTS market.

This paper employs a multidisciplinary approach to address the research question. First, it provides an overview of India's RTS industry, analyzing current policies and identifying major barriers to deployment. Next, it diagnoses the key limitations of existing frameworks, categorizing them into financial, regulatory, and technical challenges. Finally, it proposes a roadmap for US-India collaboration, focusing on knowledge sharing, financial support, and policy innovation. This approach emphasizes actionable recommendations that can drive growth in India’s RTS sector.

Preliminary research highlights that a US-India partnership has the potential to address critical bottlenecks in India's RTS deployment. For example, US expertise in financing mechanisms, such as power purchase agreements (PPAs) and green bonds, could unlock affordable capital for Indian consumers and developers [3]. Similarly, lessons from US net metering policies could guide the standardization of India's fragmented RTS regulations. These collaborative efforts could not only help India achieve its solar energy targets but also strengthen bilateral ties and set a precedent for international partnerships in the renewable energy domain. By addressing these issues, this paper aims to contribute to the literature on international energy cooperation and provide policymakers with actionable insights for fostering sustainable development.

India, as one of the largest energy consumers in the world, has been making significant strides toward transitioning from fossil fuels to renewable energy sources. The country has set an ambitious target of achieving 500 GW of non-fossil fuel-based energy capacity by 2030, which includes substantial contributions from solar power. To facilitate this transition, the government has outlined measures to integrate approximately 181.5 GW of renewable energy from zones in states such as Andhra Pradesh, Gujarat, Karnataka, Telangana, and Rajasthan. RTS is poised to play a critical role in achieving this goal by reducing dependence on large-scale infrastructure and promoting localized energy generation [4].

1.2. Rooftop solar photovoltaic (RTS PV) systems

Rooftop solar photovoltaic (RTS PV) systems, which involve installing solar panels on rooftops to generate electricity for direct consumption or grid export, are recognized globally for their potential to promote clean energy transitions. India’s unique energy challenges, including its rapidly growing electricity demand and reliance on coal, make RTS an essential component of its energy strategy. Unlike large-scale solar farms, RTS systems offer the advantage of being implemented directly in urban and semi-urban areas where energy demand is concentrated. They also reduce transmission losses by generating power close to the point of consumption. The International Renewable Energy Agency (IRENA) has highlighted that the falling costs of solar installations—reducing by 46% to 85% since 2010 to 2020—even the prices are varied in different regions, it has made RTS an increasingly viable option for households and businesses alike [5].

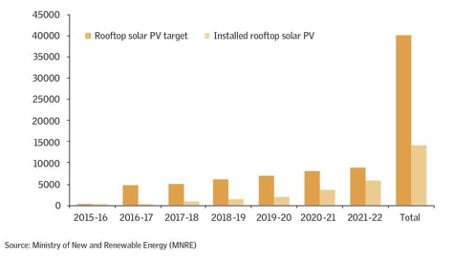

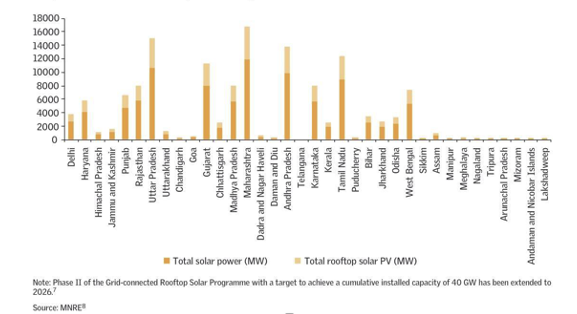

Despite its potential, the Indian RTS sector has been unable to meet its ambitious targets under the National Solar Mission, which aimed for 40 GW of rooftop solar capacity by 2022. As of July 2023, India’s installed RTS capacity stood at 10.9 GW, just over a quarter of the original goal [6]. This shortfall underscores the need to address systemic barriers, including financing challenges [7], regulatory inconsistencies, and limited consumer awareness. Additionally, the lack of uniformity in state-level policies and technical standards has hindered the scalability of RTS projects as shown in Figure 1 and Figure 2.

Figure 1: YoY target for installation of rooftop solar Py (in MW) [5]

Figure 2: State-wise rooftop solar PV goals (in MW) [5]

Several states have emerged as leaders in RTS adoption, demonstrating the potential for replicating successful models across the country. Gujarat, for instance, has achieved 89.2% of its RTS target, contributing nearly 26% of India’s total installed rooftop capacity. The state’s success can be attributed to its SURYA Gujarat scheme, which provides financial subsidies and simplifies installation processes through utility-driven demand aggregation. Other states, such as Maharashtra, Karnataka, and Rajasthan, have also made significant progress, collectively accounting for more than half of India’s RTS capacity [7]. These states’ proactive policies, financial incentives, and robust implementation frameworks highlight the critical role of local governance in driving RTS adoption.

2. Challenges and opportunities in India’s rooftop solar sector

The role of government initiatives such as the Green Energy Corridor and Phase II of the Grid-Connected Rooftop Solar Programme further underscores the importance of RTS in India’s renewable energy landscape. The Green Energy Corridor focuses on integrating renewable energy into the national grid, while Phase II prioritizes residential rooftop installations through Central Financial Assistance (CFA). Under this program, residential users are eligible for subsidies of up to 40% for systems up to 3 kW and 20% for systems between 3 kW and 10 kW, significantly reducing upfront costs for consumers [8]. In addition, the Production-Linked Incentive (PLI) scheme has allocated ₹19,500 crore to support domestic manufacturing of high-efficiency solar PV modules, ensuring a robust supply chain for RTS projects.

However, the sector faces persistent challenges that must be addressed to unlock its full potential. Financing remains a significant barrier, particularly for small-scale residential installations, where many consumers lack access to affordable credit. Policy fragmentation across states has also created confusion for developers and consumers alike. For example, while Gujarat and Karnataka allow net metering for RTS systems up to 1 MW, several other states impose stricter limits that restrict scalability [9]. Moreover, delays in grid interconnection processes and capacity constraints in distribution transformers have further discouraged potential adopters [8].

Another critical challenge lies in the limited awareness among consumers regarding the benefits of RTS systems and available subsidies. Many prospective users remain unaware of the long-term financial savings and environmental benefits that rooftop solar offers. Even if the subsidies could be realized by consumers, a key barrier to RTS adoption in India is the high upfront cost of installations, particularly for residential and small commercial users. While government subsidies under the Phase II Grid-Connected Rooftop Solar Programme reduce costs significantly (e.g., 40% for installations up to 3 kW), many potential adopters still find the remaining expenses prohibitive [9]. For instance, the average cost of a 3 kW RTS system in India is approximately ₹1,80,000 [9]. Even after subsidies, residential consumers must pay around ₹1,08,000, which remains unaffordable for a large segment of the population.

Compounding this issue, financial institutions in India have been hesitant to extend loans for RTS projects, perceiving them as higher risk compared to large-scale utility solar farms. This is primarily due to their smaller size, limited collateral, and uncertainties around repayment. A 2021 report by IEEFA highlighted that many banks charge higher interest rates for RTS loans, citing concerns such as default risks and a lack of technical expertise to assess solar investments. This financing gap has disproportionately impacted small and medium-sized enterprises (SMEs) and rural households, who face relatively higher interest rates compared to C&I segment, despite representing an untapped yet critical market for RTS growth.

The absence of innovative financing mechanisms, such as green bonds or third-party ownership models, further limits consumer options. In the U.S., third-party ownership models like power purchase agreements (PPAs) have driven widespread adoption by allowing consumers to install solar panels with little to no upfront cost. Adapting such models to India’s financial ecosystem could alleviate affordability barriers, especially for low-income households.

India's federal structure has resulted in significant disparities in RTS regulations across states, creating confusion for consumers and developers. For example, while Gujarat and Karnataka allow net metering for systems up to 1 MW, several states, such as Tamil Nadu and Haryana, impose stricter limits of 500 kW or less [9]. Additionally, some states cap installations at 50% of transformer capacity, further constraining grid-connected RTS deployment. These inconsistencies discourage developers from scaling operations and limit consumer confidence in RTS investments.

Resistance from DISCOMs poses another critical obstacle. RTS adoption reduces grid electricity demand, particularly among high-paying C&I users, eroding DISCOM revenues. Consequently, many DISCOMs have delayed grid connectivity approvals, limited net metering access, or imposed additional charges on RTS consumers. A report of IEEFA in 2020 emphasized that Discoms’ reluctance to support rooftop solar is among the leading causes of slow adoption. This conflict of interest underscores the need for regulatory reforms that align DISCOM incentives with renewable energy goals, such as performance-based subsidies or mandates for RTS integration.

Design flaws in RTS systems also contribute to suboptimal performance. Developers often size systems based on sanctioned load or available roof space rather than analyzing daytime electricity demand patterns. This mismatch can lead to underutilization of solar generation capacity, particularly for commercial users with variable loads throughout the day [9]. Additionally, the islanding requirement—which disables RTS systems during grid outages unless paired with storage—has created negative perceptions in rural areas where power outages are frequent. Consumers in such areas often rely on diesel generators during outages, offsetting the environmental benefits of solar and discouraging adoption.

India’s DISCOMs and other institutions lack the technical expertise and infrastructure needed to support the integration of rooftop solar at scale. For instance, the Centre for Science and Environment report highlights that DISCOM officials often receive insufficient training on rooftop solar policies, net metering processes, and system interconnection. This lack of capacity has led to inefficient implementation of government programs, discouraging both consumers and developers from participating in RTS initiatives [10].

Additionally, the RTS market in India is constrained by long-term power purchase agreements (PPAs) signed for conventional energy sources. These agreements, often spanning 25 years, lock DISCOMs into purchasing electricity from fossil fuel-based plants, reducing their flexibility to integrate decentralized solar systems. The U.S., which has successfully transitioned to shorter, more flexible contracts in states like California, could provide guidance on restructuring India’s energy procurement framework to prioritize renewables [11].

3. The proposal strengthening

The challenges in India’s RTS sector present opportunities for collaboration with the United States, particularly in areas such as innovative financing, policy standardization, and technological advancements. U.S.-India partnerships under initiatives like the U.S.-India Clean Energy Partnership can focus on introducing financial mechanisms, such as green bonds or solar investment tax credits, to bridge the affordability gap. Additionally, technical assistance in developing energy storage solutions and grid modernization programs can address infrastructure challenges, while knowledge-sharing initiatives can help build institutional capacity within DISCOMs. By leveraging U.S. expertise and resources, India can accelerate its rooftop solar deployment and strengthen its renewable energy transition [6].

The high upfront cost of rooftop solar installations remains a critical barrier for consumers in India, particularly for residential and small commercial users. Even with the financial support of the government’s Phase II Grid-Connected Rooftop Solar Programme, which offers subsidies of up to 40% for systems under 3 kW, the cost of a 3-kW system after subsidies still amounts to approximately ₹1,08,000 ($1,300). For many middle- and low-income households, this remains a significant financial burden. Additionally, SMEs, which account for 30% of India’s GDP, often lack access to affordable credit for rooftop solar adoption, further slowing market growth. USAID, in that case, has played a crucial role in supporting India’s RTS sector by addressing financing challenges, particularly for MSMEs, which are often underserved by traditional financial institutions. Through the USAID-DFC Loan Guarantee Program, a $41 million loan portfolio guarantee was introduced to reduce the risks financial institutions face when lending to MSMEs for rooftop solar projects. This program provides first-loss guarantees, enabling lenders to offer loans with reduced collateral requirements and lower interest rates. USAID partnered with organizations like Encourage Capital, cKers Financial, and Electronica Finance Limited (EFL) to implement this initiative, with EFL alone financing over 75 rooftop solar projects under the program. Encourage Capital also invested $15 million in EFL to stimulate financing for rooftop solar in the MSME sector. The USAID-DFC guarantee provides coverage for 40-60% of first-loss risks, encouraging financial institutions to lend to smaller businesses that would otherwise struggle to secure credit. This initiative has significantly improved access to rooftop solar, allowing MSMEs to reduce their energy expenses, enhance their competitiveness, and contribute to India's clean energy transition [9].

The United States has extensive experience in deploying innovative financing models that make rooftop solar affordable and accessible. One notable example is the $500 million rooftop solar loan facility launched in 2022 by the U.S. International Development Finance Corporation (DFC) in partnership with HDFC Bank. This program specifically targets India’s SME sector, providing low-interest loans to businesses that otherwise struggle with high borrowing costs. The initiative has already enabled thousands of SMEs to reduce their dependence on grid electricity. Saving on average 20–25% in monthly energy costs. this model to include residential consumers, particularly in rural and semi-urban areas, could significantly accelerate RTS adoption [6].

Another area for collaboration is the development of green bonds for distributed solar projects. While India raised $7.8 billion in green bonds in 2022, most of this capital was directed toward utility-scale projects. In contrast, the U.S. raised $48 billion in green bonds during the same year, demonstrating the potential of this financing mechanism to support smaller, distributed systems. By leveraging its expertise, the U.S. can help Indian financial institutions issue bonds dedicated to RTS projects, with a particular focus on underserved markets. These bonds could serve as a critical source of affordable capital, especially for households and SMEs looking to adopt rooftop solar systems.

Lastly, the U.S. could help India expand access to community solar models, where multiple consumers share the benefits of a single solar installation. This approach has been highly successful in the U.S., particularly in states like Minnesota and New York, where community solar programs have enabled renters and low-income households to access solar energy without owning rooftops. Adapting this model to India could provide an inclusive solution for low-income communities and tenants, who are often left out of the RTS market [6].

DISCOMs are critical stakeholders in the RTS ecosystem but often act as barriers to adoption due to financial and operational challenges. DISCOMs rely heavily on revenue from high-paying C&I consumers, many of whom are increasingly adopting rooftop solar to lower their electricity bills. This shift has created revenue gaps for DISCOMs, making them resistant to widespread RTS adoption. For example, in Tamil Nadu, DISCOMs have pushed for gross metering policies that offer lower economic returns to consumers, discouraging adoption [5]. Additionally, many DISCOMs in India still lack the technical expertise to integrate distributed energy resources like rooftop solar into their grids, further slowing deployment.

The U.S. has significant experience in managing distributed energy resources and aligning utility incentives with renewable energy goals. Initiatives like the USAID PACE-D 2.0 Renewable Energy program laid a robust foundation by supporting DISCOMs in India with innovative models, such as the SUPER RESCO model, which aggregated demand and streamlined rooftop solar deployment. This program also facilitated the development of frameworks like the Vendor Rating System for ensuring quality in solar installations and trained numerous DISCOM officials on rooftop solar integration, demand aggregation, and innovative business models. Building on this progress, subsequent efforts under USAID programs, such as those highlighted in the South Asia Energy Series, have focused on advanced topics like net metering policies, interconnection standards, and leveraging DPV-plus-storage systems. These initiatives continue to provide technical assistance to DISCOMs, helping them adopt performance-based incentives and accelerate solar adoption in South Asia [6].

The U.S. could further support DISCOMs by introducing performance-based incentive models. To address the challenges faced by Indian DISCOMs in integrating renewable energy and optimizing power procurement, PACE-D 2.0 RE program developed the DISCOM Renewable Energy Procurement Optimization and Smart Estimation (REPOSE) software. This advanced tool enables DISCOMs to forecast demand, optimize resource planning, and integrate higher shares of renewable energy into their grids while reducing overall generation costs. By utilizing scientific forecasting methods such as ARIMA, artificial neural networks, and econometric models, DISCOM REPOSE provides granular, long-term demand projections and generation adequacy assessments over a 15-year horizon. The tool also allows DISCOMs to create scenario-based resource maps, optimize procurement plans for cost or emission reductions, and address uncertainties related to renewable energy variability, electric vehicles, and distributed energy resources. With customizable inputs and interactive dashboards, DISCOM REPOSE equips utilities with actionable insights to minimize power procurement costs, reduce emissions, and meet renewable purchase obligations. Tested in states like Assam and Jharkhand with an accuracy level within 5%, the software demonstrates how U.S.-India collaboration can deliver innovative solutions to accelerate India's clean energy transition and strengthen Discoms’ capacity to manage decentralized, renewable-rich energy systems [7].

The U.S. International Development Finance Corporation (DFC) has made significant investments to support India’s solar energy ambitions and diversify global energy supply chains, including a $425 million loan to TP Solar Limited and a $500 million loan to First Solar. These investments aim to address India’s reliance on imported solar modules by financing the establishment of large-scale solar manufacturing facilities in Tamil Nadu. TP Solar’s facility will add 4GW of solar cell and 4GW of solar module manufacturing capacity, while First Solar’s facility will enhance domestic solar panel production with a focus on responsibly sourced materials and reducing dependence on a highly concentrated global solar supply chain. Together, these projects will help India meet its renewable energy targets, including its goal of generating over 50% of electricity from clean energy by 2030, while addressing a current gap where only 4GW of solar cell capacity exists compared to an annual need for 35GW. The two facilities are also expected to create significant local employment, with TP Solar generating 2,300 full-time jobs (over 60% held by women) and First Solar creating over 2,000 construction jobs and 1,100 high-skilled operational jobs, with 40% held by women. These investments highlight the U.S.’s commitment to leveraging American technology and innovation to support India’s clean energy transition, with DFC CEO Scott Nathan emphasizing the importance of strengthening the U.S.-India partnership to achieve lasting climate action. By boosting India’s solar manufacturing capabilities, these facilities will ensure a more reliable and cost-effective supply of solar panels for projects like rooftop solar, reduce reliance on imports, and position India as a leader in the global clean energy transition.

4. Recommendation

To accelerate rooftop solar (RTS) deployment in India through U.S.-India collaboration, key efforts should focus on strengthening financial mechanisms, enhancing policy frameworks, expanding community solar initiatives, investing in technological advancements, and improving capacity building. Expanding loan guarantees, green bonds, and solar investment tax credits can lower financing barriers, while policy standardization across states and performance-based incentives for DISCOMs can streamline adoption. Leveraging U.S. expertise in community solar models can enhance access for low-income households and renters, while investments in grid modernization and high-efficiency solar technologies can improve infrastructure readiness. Additionally, knowledge-sharing platforms, training programs for DISCOMs, and consumer awareness campaigns are crucial for increasing adoption. By implementing these strategies, the U.S. and India can drive sustainable RTS growth, strengthen India’s renewable energy transition, and set a global precedent for international cooperation in clean energy.

5. Conclusion

The findings of this paper highlight that the U.S.-India collaboration can effectively address the systemic challenges hindering rooftop solar (RTS) deployment in India. The U.S.’s expertise in innovative financing models, such as power purchase agreements (PPAs), green bonds, and loan guarantees, can address key financial barriers in India, particularly for residential and SME sectors, which remain underserved by traditional financing institutions. Similarly, U.S. experience with net metering policies, community solar models, and grid modernization programs offers valuable insights for overcoming India's regulatory and technical challenges. However, successful implementation requires adapting these solutions to India’s unique socio-economic and federal policy framework.

The resistance from DISCOMs remains a critical obstacle, as RTS adoption directly affects their revenue streams. U.S.-India partnerships must focus on aligning DISCOM incentives with renewable energy goals, introducing performance-based subsidies, and enhancing the technical capacity of DISCOMs to manage distributed energy resources. Furthermore, addressing consumer awareness gaps and high upfront costs through targeted subsidy programs and innovative ownership models is essential for expanding RTS adoption across diverse demographics, including low-income households and rural communities. By fostering knowledge sharing, capacity building, and financial innovation, this partnership could accelerate RTS adoption and set a global precedent for international cooperation in renewable energy.

A U.S.-India collaboration holds immense potential to transform India's rooftop solar sector, enabling the country to achieve its renewable energy targets and contribute to global climate goals. By leveraging U.S. expertise in financing, policy innovation, and technology, India can address its financial, regulatory, and technical barriers to RTS deployment. Initiatives such as USAID-backed loan guarantees, green bonds, and DISCOM capacity-building programs offer actionable solutions for overcoming systemic obstacles. Additionally, the adoption of community solar models and performance-based incentives can enhance inclusivity and scalability in the RTS sector.

To ensure success, both nations must commit to sustained cooperation through platforms like the U.S.-India Clean Energy Partnership, focusing on long-term investments, knowledge sharing, and policy standardization. By addressing the challenges of affordability, awareness, and infrastructure, this collaboration can unlock the full potential of rooftop solar in India, strengthening its renewable energy transition while fostering bilateral ties. Ultimately, a successful U.S.-India partnership in the RTS sector could serve as a model for international energy cooperation, advancing sustainable development and combating climate change on a global scale.

References

[1]. Mukherjee, Mohua. “The Role of Discoms in India’s Rooftop Solar Sector.” India’s Ongoing Rooftop Solar Journey 2017–2022, Oxford Institute for Energy Studies, 2022, pp. 8–15. JSTOR, http://www.jstor.org/stable/resrep45373.7. Accessed 6 Jan. 2025.

[2]. Institute for Energy Economics and Financial Analysis. (2020, June). The Rooftop Solar Commercial & Industrial Market in India.

[3]. Centre for Science and Environment. “ROOFTOP SOLAR PV.” ROOFTOP SOLAR PV IN INDIA: Scaling up by Discom-Driven Demand Aggregation, Centre for Science and Environment, 2023, pp. 15–41. JSTOR, http://www.jstor.org/stable/resrep55443.10.

[4]. Government of India, Ministry of Power. (2023, December). Impact of Energy Efficiency Measures. https://udit.beeindia.gov.in/wp-content/uploads/2024/03/Impact-of-Energy-Efficiency-Measures-for-FY-2022-23_-FINAL-Report-1.pdf

[5]. U.S. Agency of International Development. (2019, February). PARTNERSHIP TO ADVANCE CLEAN ENERGY DEPLOYMENT (PACE-D 2.0) TECHNICAL ASSISTANCE PROGRAM https://sarepenergy.net/wp-content/uploads/2022/04/PACE-D-2.0-RE-Brochure.pdf

[6]. Institute for Energy Economics and Financial Analysis. (2021, September). Financing Trends in the Commercial and Industrial (C&1) Rooftop Solar Market in India. https://ieefa.org/wp-content/uploads/2021/10/Financing-Trends-in-the-Rooftop-Solar-Commercial-and-Industrial-Segment-in-India_September-2021.pdf

[7]. Institute for Energy Economics and Financial Analysis. (2020, August). The Curious Case of India’s Discoms. https://ieefa.org/sites/default/files/resources/The-Curious-Case-of-Indias-Discoms_August-2020.pdf

[8]. U.S. Agency of International Development. (2019, June). PARTNERSHIP TO ADVANCE CLEAN ENERGY - DEPLOYMENT 2.0 (PACE-D 2.0) PROGRAM.https://sarepenergy.net/wp-content/uploads/2022/04/USAID_PACE-D_20190218-3.pdf

[9]. Government of India, Ministry of Power. (2022, September 28). Amendment to the Scheme for Flexibility in Generation and Scheduling of Thermal/ Hydro Power Stations through bundling with Renewable Energy and Storage Power dated 12th April 2022 - Deletion of Paras 9.2 and 9.4.3 -reg.

[10]. U.S. International Development Finance Corporation. (2023, August 24). DFC CEO marks $500 million loan for strategic supply chain diversification. DFC.

[11]. Government of India, Ministry of Coal. (2021, July 22). Coal-Indian Energy Choice https://coal.nic.in/en/major-statistics/coal-indian-energy-choice https://pdf.usaid.gov/pdf_docs/PA00XGN3.pdf

Cite this article

Chen,T. (2025). How Can the US and India Collaborate to Promote the Development and Deployment of Rooftop Solar Power in India. Advances in Economics, Management and Political Sciences,190,1-9.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Digital Transformation in Global Human Resource Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Mukherjee, Mohua. “The Role of Discoms in India’s Rooftop Solar Sector.” India’s Ongoing Rooftop Solar Journey 2017–2022, Oxford Institute for Energy Studies, 2022, pp. 8–15. JSTOR, http://www.jstor.org/stable/resrep45373.7. Accessed 6 Jan. 2025.

[2]. Institute for Energy Economics and Financial Analysis. (2020, June). The Rooftop Solar Commercial & Industrial Market in India.

[3]. Centre for Science and Environment. “ROOFTOP SOLAR PV.” ROOFTOP SOLAR PV IN INDIA: Scaling up by Discom-Driven Demand Aggregation, Centre for Science and Environment, 2023, pp. 15–41. JSTOR, http://www.jstor.org/stable/resrep55443.10.

[4]. Government of India, Ministry of Power. (2023, December). Impact of Energy Efficiency Measures. https://udit.beeindia.gov.in/wp-content/uploads/2024/03/Impact-of-Energy-Efficiency-Measures-for-FY-2022-23_-FINAL-Report-1.pdf

[5]. U.S. Agency of International Development. (2019, February). PARTNERSHIP TO ADVANCE CLEAN ENERGY DEPLOYMENT (PACE-D 2.0) TECHNICAL ASSISTANCE PROGRAM https://sarepenergy.net/wp-content/uploads/2022/04/PACE-D-2.0-RE-Brochure.pdf

[6]. Institute for Energy Economics and Financial Analysis. (2021, September). Financing Trends in the Commercial and Industrial (C&1) Rooftop Solar Market in India. https://ieefa.org/wp-content/uploads/2021/10/Financing-Trends-in-the-Rooftop-Solar-Commercial-and-Industrial-Segment-in-India_September-2021.pdf

[7]. Institute for Energy Economics and Financial Analysis. (2020, August). The Curious Case of India’s Discoms. https://ieefa.org/sites/default/files/resources/The-Curious-Case-of-Indias-Discoms_August-2020.pdf

[8]. U.S. Agency of International Development. (2019, June). PARTNERSHIP TO ADVANCE CLEAN ENERGY - DEPLOYMENT 2.0 (PACE-D 2.0) PROGRAM.https://sarepenergy.net/wp-content/uploads/2022/04/USAID_PACE-D_20190218-3.pdf

[9]. Government of India, Ministry of Power. (2022, September 28). Amendment to the Scheme for Flexibility in Generation and Scheduling of Thermal/ Hydro Power Stations through bundling with Renewable Energy and Storage Power dated 12th April 2022 - Deletion of Paras 9.2 and 9.4.3 -reg.

[10]. U.S. International Development Finance Corporation. (2023, August 24). DFC CEO marks $500 million loan for strategic supply chain diversification. DFC.

[11]. Government of India, Ministry of Coal. (2021, July 22). Coal-Indian Energy Choice https://coal.nic.in/en/major-statistics/coal-indian-energy-choice https://pdf.usaid.gov/pdf_docs/PA00XGN3.pdf