1. Introduction

In this article, the author will deeply explore the key role played by the Federal Reserve and monetary policy in regulating the market during several major economic crises from the early 20th century to the present. How do these policies affect the market, and how do they help the U.S. economy prosper? As times change, what has the Fed learned from experience and history, what changes have been made in policy formulation, and how this affects the process of this interest rate hike. The author will explore this aspect from the history of past economic crises, why the market crashed, how the Federal Reserve regulates the market through monetary policy, and their subsequent impact on the financial market and ordinary people's lives.

The first was the Great Depression of 1929, one of the worst recessions in modern economic history. This article will analyze how it affects the US economy, the banking industry, and ordinary people's lives, as well as the role of the Federal Reserve in responding to the crisis. The article next turns to the stagflation period from the 1970s to the 1980s. During this period, stagnant economic growth and high inflation coexisted. This article will combine the history of the year, inflation rate, and unemployment rate to explore the dangers of spiral inflation and how the Federal Reserve responds to this challenge. Then there's the 2008 financial crisis, the worst economic downturn since the Great Depression, and how the Fed's actions helped the financial markets, the housing market, and the lives of ordinary people during that crisis.

The final article will examine the recent COVID-19 crisis and the subsequent rise in inflation. Evaluate the Fed's policies during the COVID-19 crisis and efforts to suppress inflation. At the same time, this article will also predict the impact of this crisis on the future US economy, policy, and technological development. Through a comprehensive analysis of these historical events, we can better understand the damage that economic crises have done to the entire financial system and the challenges and strategies of policymakers in dealing with these crises. This will not only provide an understanding of history but will also provide valuable experience in predicting and responding to future economic challenges.

2. 1929 Great Depression

The Great Depression of 1929 was one of the most severe economic recessions of the 20th century to date. It caused the longest and most severe damage to the economy, banking industry, and people's daily lives.

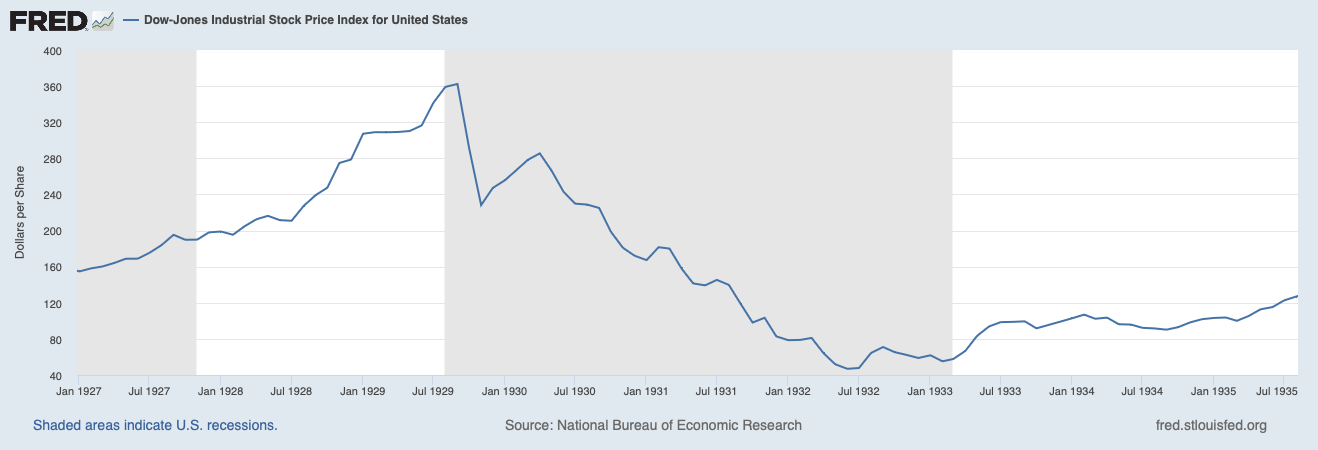

The Great Depression resulted in widespread declines in industrial production and rising unemployment. As consumer demand dwindled, business closures and layoffs became the norm, further exacerbating the economic contraction. From 1929 to 1932, the Dow Jones Industrial Index fell by nearly 90%, accompanied by massive unemployment and industrial shutdowns (see Figure 1). In 1932, the unemployment rate soared to 25%, and U.S. industrial output was only half of what it was before the crisis [1].

Figure 1: Dow-Jones Industrial Stock Price Index during 1927-1935 [2].

The banking industry was also hit hard, with over 9,000 banks failing. Many banks failed due to loan defaults and run on depositors. Bank collapses exacerbated financial market instability and stoked public distrust of the financial system. For example, the United States experienced a banking crisis in early 1933 that resulted in the closure of thousands of banks. The failure of these banks directly affected the savings of ordinary people and the capital chain of enterprises [1]. The Great Depression had a profound impact on ordinary people's lives. Many families have lost their source of income, and their living standards have plummeted. Unemployment, poverty, and hunger became commonplace. People's consumption behavior has changed, moving more towards thrift and self-sufficiency. Social unrest increases, such as popular protests and strikes becoming more frequent.

In the early days of the Great Depression, the Federal Reserve did not take immediate action to lower interest rates but left it to the market to adjust itself. Although there were some interest rate cuts at the end of 1929 and early 1930, these measures were far from enough to resolve the crisis. The result is that the entire economic system falls into a death spiral. Bank failures cause Americans to withdraw their money early, leading to more bank runs and bankruptcies. The Fed's laissez-faire economic strategy needs to be revised to deal with serious systemic damage, largely exacerbating the economic downturn's depth and duration. Then, in the mid-1930s, the Federal Reserve realized the seriousness of the situation and began to take more active measures, such as continuing to lower interest rates and purchasing government bonds to increase liquidity in the banking system. This helps ease tensions in financial markets. From 6% in 1929 to 1935, the interest rate was only 0.8% [3]. President Roosevelt signed the Gold Reserve Act on January 30, 1934, ending the gold standard to relieve financial pressure.

The Great Depression exposed the Federal Reserve's deficiencies in crisis response. The essence of a financial crisis is a liquidity crisis. In the following years, the Federal Reserve focused on building public confidence and credibility, prompting subsequent financial supervision and policy adjustments, including establishing the 1933 FDIC and the 1935 reorganization of the Federal Reserve System. This is very helpful in quickly responding to emergencies and giving people quick support and confidence. The economic recovery and improvement of people's lives after the Great Depression was a slow upward process, and its effects lasted for decades. With the gradual recovery of the economy, people's living standards have also begun to improve. The unemployment rate has gradually declined, wages have increased, and consumer confidence has recovered. The Fed's inadequate response in the early days of the Great Recession is widely considered one of the factors that contributed to the deepening and lengthening of the recession. As time went on, however, the Fed began to take more aggressive measures to stabilize the financial system and economy. Numerous regulatory policies and emergency response measures have been developed, which will have a profound impact on future crisis response.

3. 1970-1980 Stagflation

The stagflation period from the 1970s to the 1980s was a critical period in modern economic history. It was a distorted economy with a unique phenomenon of slow economic growth, high inflation, and high unemployment. Federal Reserve Chairman Paul Walker's understanding of economic conditions and policy formulation during this period provided a benchmark for dealing with stagflation for future generations.

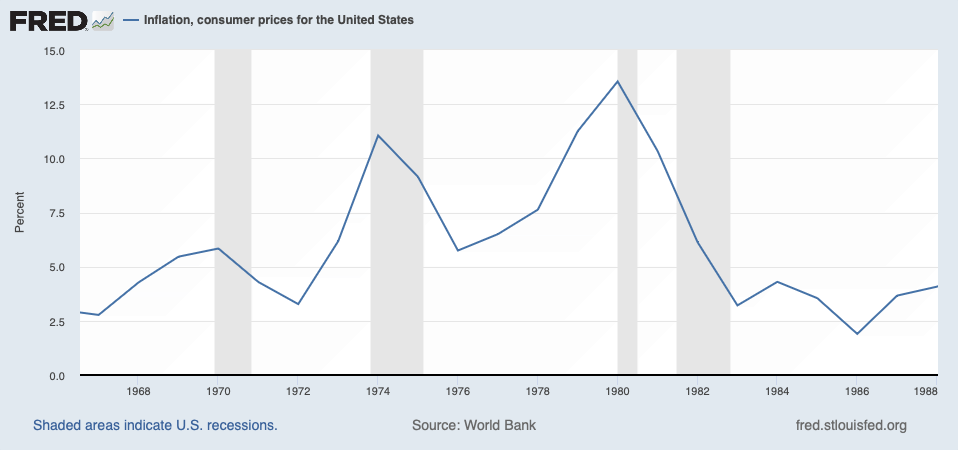

The most worrying thing during this period was the high inflation rate. In the early 1970s, due to various factors, especially the two oil crises in 1973 and 1979 that caused sharp fluctuations in energy prices and rising food prices, inflation rates rose sharply around the world. In the United States, annual inflation briefly exceeded 10% in the mid-1970s, the highest level of inflation since World War II.

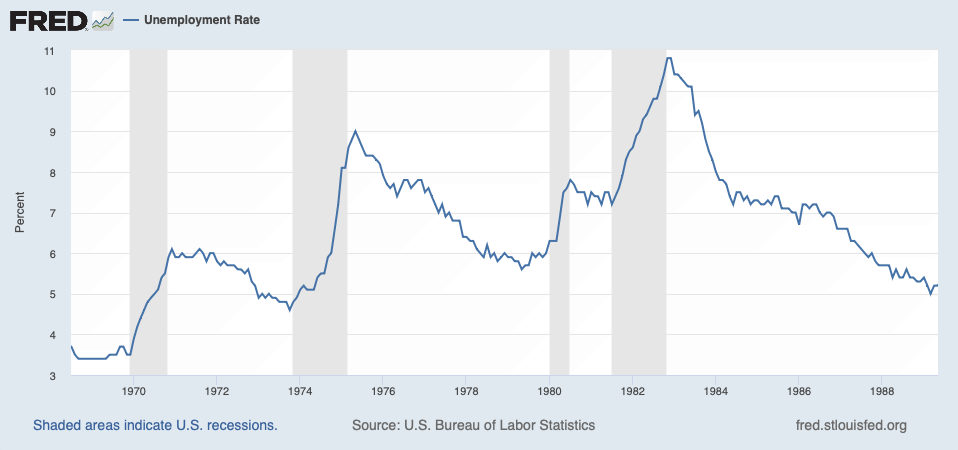

From 1973 to 1980, inflation remained above 5% for a long time (see Figure 2). High inflation has yet to be accompanied by economic growth and job creation. Instead, economic growth slowed or even stagnated, causing unemployment to rise. In the late 1970s, the unemployment rate in the United States reached levels close to 10% (see Figure 3). This coexistence of economic stagnation and high unemployment breaks the traditional Phillips curve theory: the negative relationship between inflation and unemployment.

Figure 2: Inflation Rate during 1968-1988 [2].

Figure 3: Unemployment Rate [2].

The reason for the formation of spiral inflation comes from the policy environment from the late 1960s to the 1970s, including expansionary fiscal and monetary policies, which increased overall demand and further pushed up prices. When government spending increases, and taxes are not enough to cover it, this fiscal policy can lead to overheating of demand and rising prices. Another key factor is the wage-price spiral. In this case, inflation expectations lead workers to demand higher wages to maintain their purchasing power. At the same time, employers pass on the increased costs to the prices of products and services to maintain profits. This cycle of rising wages and rising prices further fuel inflation. When people begin to expect that inflation will continue to rise, they take actions in advance, such as demanding higher wages and buying goods in advance, to avoid future price increases. This expectation itself becomes a factor pushing up inflation [4]. Spiral inflation has completely disrupted the economic system. It not only continues to weaken the purchasing power of currency but also creates chaos in ordinary people's consumption concepts and wages, which greatly affects basic investment and consumption.

Price changes were also a notable feature of this period. With inflation rising rapidly, wage incomes need to catch up with sharp increases in the costs of daily living, including price increases in food, energy, and housing costs. This has placed significant pressure on household budgets, particularly for low-income households, eroding consumers’ purchasing power and living standards. High unemployment during this period meant more people faced financial hardship and uncertainty. The combination of these factors has led to public dissatisfaction and distrust of the government's economic policies and prompted the Federal Reserve's radical changes in economic policies.

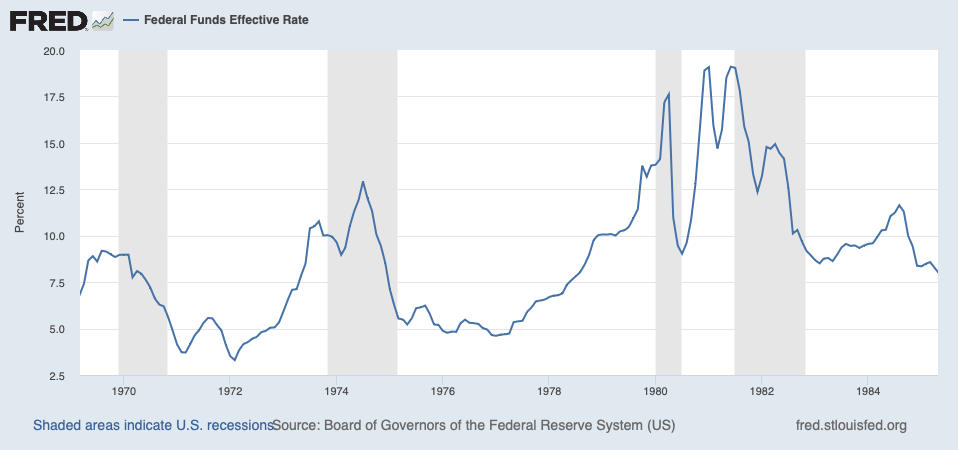

Economic conditions during the stagflation of the 1970s and 1980s prompted economists and policymakers to rethink macroeconomic policy. In dealing with high inflation and unemployment, monetary policy, especially interest rate policy, has become a key tool. The Federal Reserve adopted severe tightening monetary policies under the leadership of Paul Volcker. To break the spiral of high inflation, after Volcker became chairman of the Federal Reserve in 1979, he took unprecedented radical measures, significantly raising the federal funds rate, which was once close to 20% (see Figure 4).

Figure 4: Federal Rate during 1970-1984 [2].

This approach aims to curb inflation by creating a liquidity crisis in the economy by reducing currency liquidity and raising borrowing costs. At the same time, the Federal Reserve gave up its previous attempt to regulate the money supply by controlling interest rates. It instead directly affected interest rates by adjusting the money supply. This has led to extreme swings in interest rates, especially short-term rates. Such extreme tightening ultimately changed market participants' expectations of future inflation. As the inflation rate declines, people are less concerned about continued inflation, which helps stabilize the economy and promote long-term economic growth [5]. Extremely tight monetary policy, while ultimately successful in reducing inflation, triggered a severe recession in the short term. In the early 1980s, the United States experienced a severe economic recession; the unemployment rate rose rapidly to more than 10%, and many small and medium-sized enterprises faced difficulties.

The Fed's actions during this period had a positive impact on its credibility and the future direction of monetary policy. Volcker's radical policies were seen as the key to breaking the inflation spiral. This also established the Fed's reputation for fighting inflation because people also believed in the Fed more. In subsequent crises, the Fed's words could immediately and efficiently influence people's opinions, and psychological expectations.

To sum up, the Federal Reserve adopted tough tightening monetary policies during the stagflation period of the 1970s and 1980s. These policies exacerbated economic difficulties in the short term, but ultimately succeeded in reducing the inflation rate and had an impact on future economic policy formulation. profound influence. Tight monetary policy has effectively controlled inflation and made the economic environment more stable. A low-inflation environment is conducive to long-term economic growth, which has a significant impact on people's lives. After experiencing a brief recession in the early 1980s, the U.S. economy gradually recovered and entered a period of long-term growth. In the ten years from 1982 to 1992, the S&P 500 Index rose from a low of 102 to around 400 [6]. With the economic recovery, the job market has gradually improved, and the unemployment rate has gradually declined from its high point in the early 1980s. More start-up companies have been born because of the stable financial environment, and many job opportunities have been created. These economic growths have driven Increased personal income and improved living standards.

4. 2008 Financial Crisis

The 2008 financial crisis was the most serious global economic crisis since the Great Depression in 1929. Its damage to the financial system had a great impact on the financial market, the real estate industry, and the lives of ordinary people.

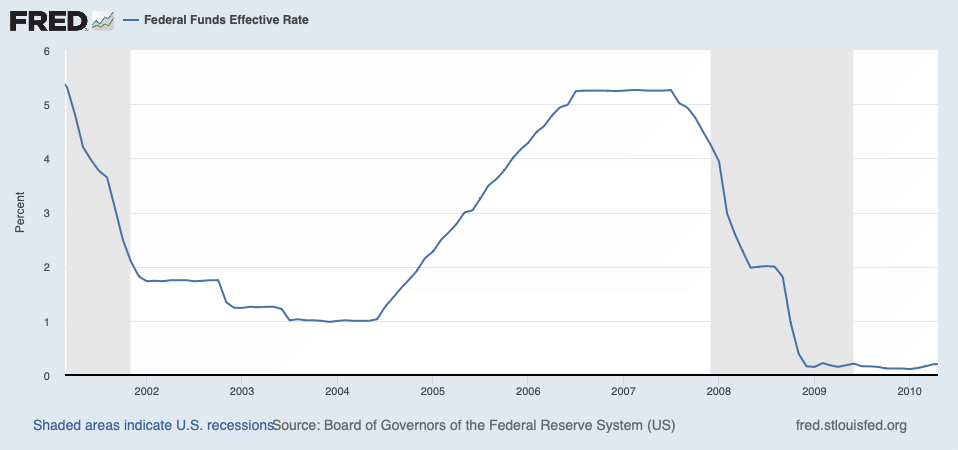

The origins of the crisis can be traced to the low-interest environment of 2002 to 2004, which led to a bubble in the U.S. housing market and the associated widespread distribution of risky loans (subprime mortgages). These high-risk loans are packaged into complex financial products, such as mortgage-backed securities (MBS) and covered debt obligations (CDOs), and then sold to financial institutions worldwide. Because federal interest rates increased from 2005 to 2007, the over-leveraged real estate market began to collapse in a low-interest environment (see Figure 5). Because the large number of sellers left far insufficient buyer demand in the market, the value of these assets fell sharply in a short period of time, resulting in Entire financial markets being hit hard. The U.S. stock market plummeted as a result, with the S&P falling nearly 60%. Investment banks such as Lehman Brothers filed for bankruptcy, and many other financial institutions also fell into crisis one after another due to the knock-on effect. The credit market has experienced a severe tightening in the short term, and banks and investors have become more cautious about credit.

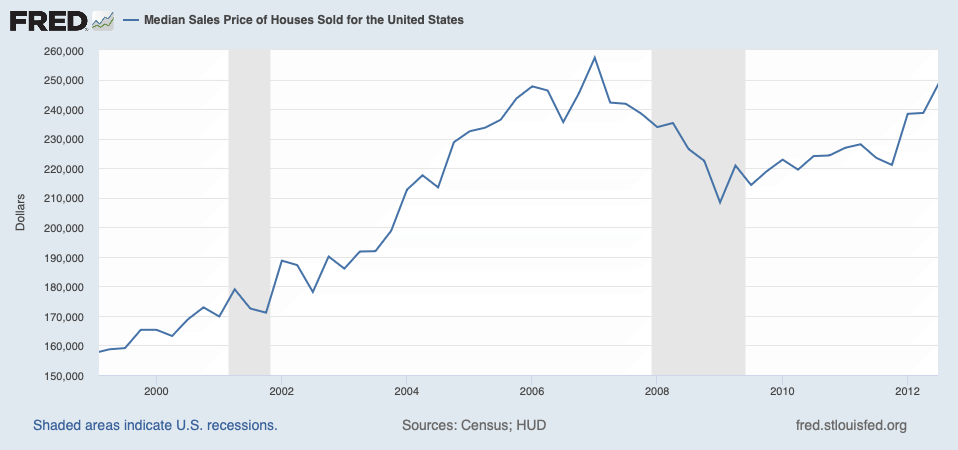

The real estate market has also been hit hard (see Figure 6). House prices fell sharply, and many families found their homes were worth less than the balance on their mortgages, known as "negative equity." A surge in home auctions and delinquencies has further depressed home prices, sending the housing market into a prolonged downturn. The devastation of the financial system has a particularly profound impact on ordinary people. Unemployment soared, with many people losing their jobs as companies went bankrupt or downsized. Household wealth has also shrunk significantly due to panic declines in the stock and real estate markets. Many families face financial difficulties or even lose their homes.

Figure 5: Federal Rate during 2002-2010 [2].

Figure 6: Median Sales Price of Houses during 2000-2012 [2].

In response to the financial crisis, the Federal Reserve adopted a series of unprecedented large-scale rescue plans to stabilize financial markets and support the economy. This includes providing emergency liquidity to banks and insurance companies, significant interest rate cuts, and quantitative easing to increase market liquidity to repair the stalled financial system, boost the sluggish economy, and prevent the crisis from worsening. The Fed's actions can be divided into several key areas: Lowering interest rates. The Fed quickly and significantly lowered the federal funds rate to lower borrowing costs and encourage investment and consumption. By the end of 2008, interest rates dropped from the original 5.25% to almost zero. This extremely low-cost lending environment greatly helped market liquidity. Then came quantitative easing. As traditional interest rate policy tools reached their limits (i.e., interest rates were close to zero), the Federal Reserve implemented trillions of dollars in quantitative easing (QE) to inject liquidity to the greatest extent. This includes large-scale purchases of government bonds and mortgage-backed securities to increase liquidity in the financial system and support credit markets. Immediately afterwards, the Federal Reserve took direct measures to rescue distressed financial institutions. This includes emergency loans and capital infusions to key banks and other financial institutions, such as the bailout of American International Group (AIG). The Federal Reserve injects liquidity into the banking system through various procedures, such as expanding its discount window operations, to ensure that banks have sufficient funds to meet customer needs, thereby preventing the credit market from freezing [7]. During the crisis, the Fed worked to increase communication and transparency about its policies to bolster market confidence. Chairman Ben Bernanke uses public speeches, press conferences, etc. to explain the Fed's actions and policy intentions.

The Fed's actions during the 2008 financial crisis are widely considered key to averting a more severe recession. Although these excessive injections of liquidity have been controversial and criticized, these measures have significantly stabilized financial markets and laid the foundation for a rapid economic recovery. These actions have also changed the traditional monetary policy framework and provided new experiences and methods for future policy formulation. After experiencing financial turmoil in 2008, the global economy gradually began to recover, the unemployment rate gradually declined, and the stock and real estate markets also compensated for the decline during the panic and gradually rose. The financial crisis also exposed multiple weaknesses in the financial system. It promoted the upgrading and reform of regulatory frameworks, such as the Dodd–Frank Wall Street Reform and Consumer Protection Act passed in the United States and the international central bank’s Basel IV. These reforms aimed at reducing the risk of future crises and prompted adjustments to the global economic structure [8].

5. COVID-19 Crisis

The COVID-19 crisis, which began in late 2019 and quickly spread across the world in 2020, has left people unable to interact with each other, and many people have been infected with the virus and quarantined at home. This has greatly changed people's lives and caused a panic decline in the entire U.S. economy and financial markets. The crisis not only led to a sharp economic recession but also triggered a subsequent supply chain crisis that led to a wave of inflation.

In the early stages of the epidemic, many countries implemented lockdown measures to curb the spread of the virus, resulting in a significant decline in economic activity. Many factories have closed, and tourism has stalled, which has hit the retail and service industries hard. The global economy fell into a severe recession. The impact on financial markets has been equally dramatic. In March 2020, the U.S. stock market experienced violent fluctuations. The stock index fell sharply in a short period of time. The Dow Jones Industrial Average triggered three circuit breakers in just two weeks. However, as the Federal Reserve and central banks implemented large-scale fiscal and monetary stimulus measures, the market gradually stabilized and began to recover [8].

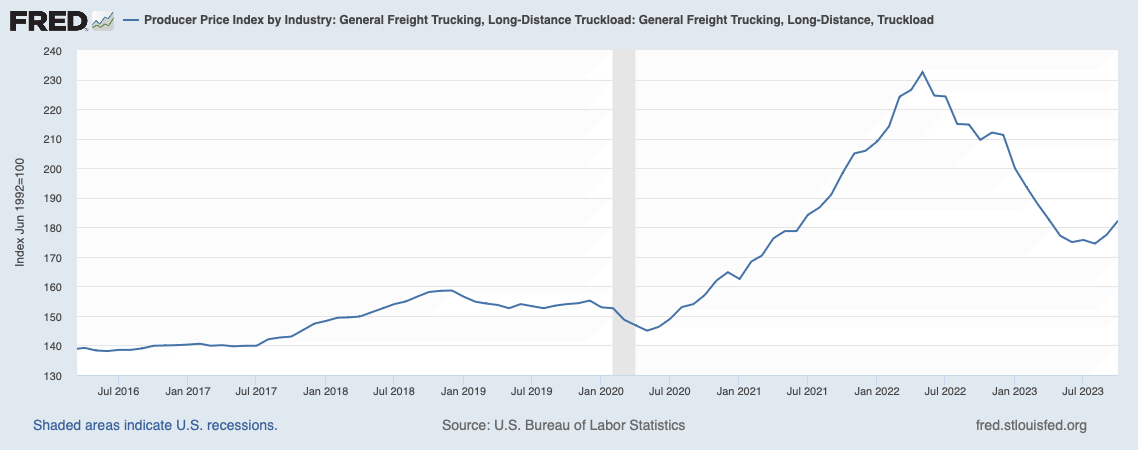

As excess liquidity accompanies the reopening of the economy, inflation is starting to become a major concern. On the one hand, the epidemic has caused disruptions in global supply chains, resulting in significant increases in raw material and transportation costs. The producer price index rose all the way from 130 to 160 before the epidemic to a high of 232.53 (see Figure 7).

On the other hand, large-scale fiscal and monetary stimulus excessively increased market liquidity and increased consumer demand. Together, these factors have driven up prices, leading to sharp increases in inflation in several countries. Rising inflation has increased the cost of living, especially with rising food and energy prices, and people's lives have been severely affected. The COVID-19 crisis and the inflation it has caused have shaken the global economy and financial markets. This crisis not only changed the economic structure and growth model but also had long-term effects on people's way of life. Governments and central banks face the challenge of balancing economic recovery and controlling inflation, which will shape the direction of the global economy in the coming years.

Figure 7: Producer Price Index during the COVID-19 period [2].

During the COVID-19 crisis, the Federal Reserve responded to the recession and market turmoil with measures to ease markets and calm panic. Following the experience of previous financial crises, the Fed quickly lowered the federal funds rate to near zero. This measure aims to reduce borrowing costs, stimulate consumption and investment, and enable companies and ordinary people to borrow easily to cope with sudden crises [9]. The Federal Reserve restarted its quantitative easing (QE) program to increase liquidity in the financial system and support credit markets by purchasing large amounts of government bonds and mortgage-backed securities (MBS). To ensure market liquidity and the availability of credit, the Federal Reserve has established multiple emergency lending facilities, including the Commercial Paper Financing Facility (CPFF), the Primary Dealer Credit Facility (PDCF), and the Money Market Mutual Fund Liquidity Facility (MMLF). The Fed also launched a series of new programs, such as the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF), as well as the Municipal Liquidity Facility (MLF), to directly support the financing needs of businesses and local governments [10]. At the same time, to support small and medium-sized companies from going bankrupt, the Federal Reserve began to directly purchase corporate debt for the first time to support the corporate credit market. At the same time, by establishing currency swap lines, the Federal Reserve provides U.S. dollar liquidity to central banks in other countries to ease tensions in global capital markets. Federal Reserve Chairman Powell has conducted many public speeches, press conferences, and policy statements to calm panic in the market, enhance financial confidence, and provide guidance. These measures reflect the Fed's learning from past financial crises on how to quickly stabilize the market and provide rapid support and response, demonstrating its determination to maintain financial stability and support the economy in extraordinary times. While these policies have succeeded to some extent in stabilizing markets and supporting the economy, excess liquidity has also raised concerns about future inflation, debt levels and asset bubbles.

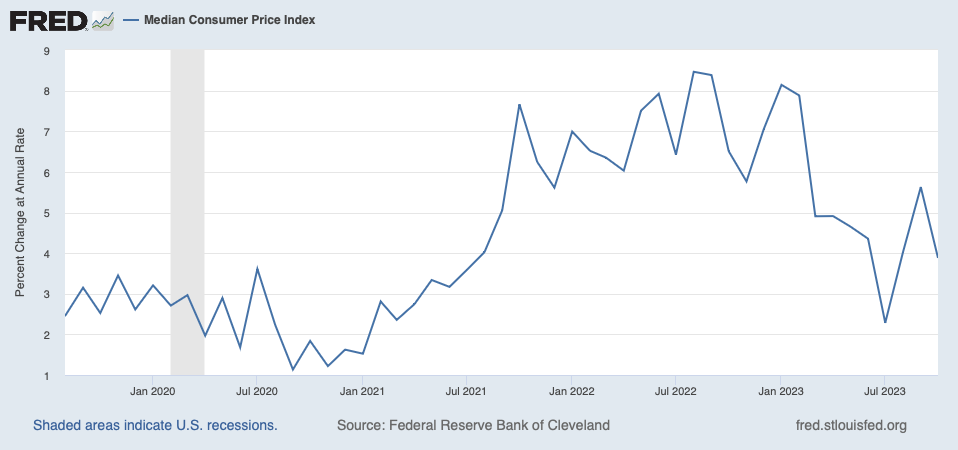

Figure 8: Median Consumer Price Index during 2020-2023 [2].

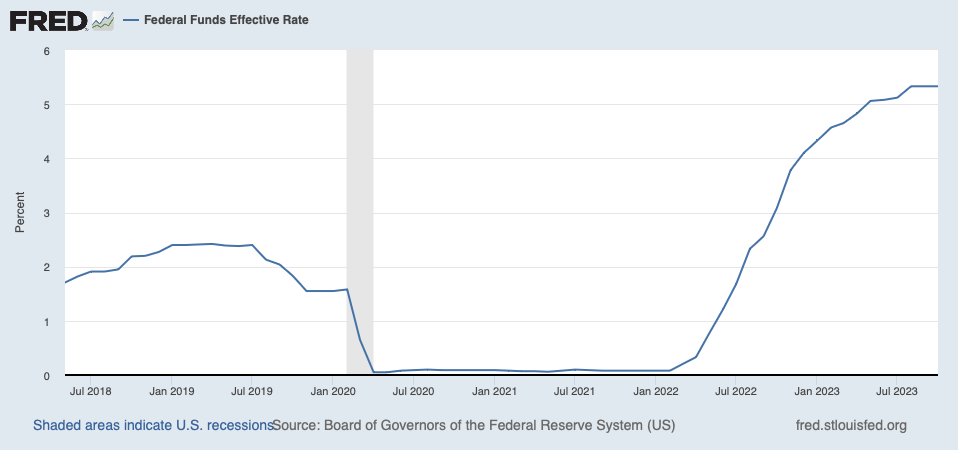

Inflation first started due to the disruption of global supply chains caused by the epidemic and the increase in raw material and transportation costs (see Figure 8). The Federal Reserve did not pay attention to this inflation initially, believing that it was temporary inflation and that inflation would fall to a balanced range as the supply chain improved. However, when inflation continued to rise without any sign of slowing down, the Federal Reserve stopped buying long-term U.S. debt in March 2022 and began raising interest rates. The Federal Reserve raised the federal interest rate by nearly 460 basis points in just one year and remained at 100 basis points as of the deadline (see Figure 9). 5.25% to 5.5%, which made the entire economic environment extremely tight quickly.

Figure 9: Federal Funds Effective Rate during 2018-2023 [2].

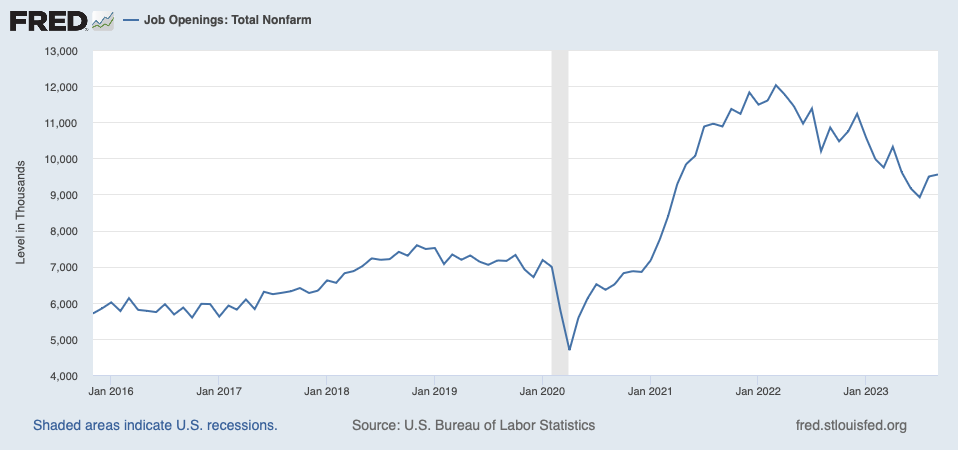

Rising inflation has increased labor costs, and the Federal Reserve had the painful experience of spiral inflation in the 1970s. This has caused the Federal Reserve to break the 50 basis points expected by the market to raise interest rates in 2022 and instead raise interest rates by 460 basis points. Such a radical interest rate hike will help change people's psychological expectations and bring down inflation. As of today, the labor market is approaching pre-pandemic levels (see Figure 10).

Figure 10: Job Openings during 2016-2023 [2].

Whether the inflation rate can decline steadily is the main concern of the Fed. The Fed needs to balance controlling the inflation rate and avoiding entering a severe recession. It may see continued high interest rates and tight monetary policy until inflation gradually returns to 2%. Then, the Federal Reserve gradually began to cut interest rates to try to avoid a recession. Controlling a soft economy is an extremely difficult task. Historically, only Federal Reserve Chairman Alan Greenspan has succeeded in doing so. However, the former started to raise interest rates before inflation occurred, but now there is still time to raise interest rates and steep interest rates. This makes it difficult for the current Fed to make a soft landing if it uses lagging data without forecasting. The Fed has already made a wrong forecast once in 2022, and now the Fed cannot afford the risk of another forecast error causing inflation to relapse. The Fed is not afraid of over-raising interest rates and triggering a recession, because the Fed can stimulate the market through interest rate cuts and QE. However, if the economy becomes stagflation, the Fed is most worried about it.

The authors predict that the U.S. will likely enter a mild to severe recession depending on how long interest rates remain high. But inflation will be brought under control soon, and the economy will go down in the short term, but in the long term the economy will rise better. The U.S. economy will gradually emerge from a possible recession. The U.S. economy is expected to continue growing in the coming years. However, this growth may be affected by the economy's disintegration from the global economic system, supply chain issues, and geopolitical tensions.

In terms of future development, because the epidemic has accelerated the pace of digital transformation, technology, and innovation are expected to continue to drive economic growth. Areas such as remote working, e-commerce, artificial intelligence, and clean energy technology will be key drivers of future growth [11]. With the government’s massive debt issuance during the epidemic and the high interest rates on government bonds, future fiscal policies may focus more on sustainability and debt management.

Overall, the future economic outlook is complex and volatile, affected by numerous factors. Despite the uncertainties, technological innovation, policy adjustments, and increased global cooperation are expected to promote stronger and sustainable economic growth.

6. Conclusion

From the Great Depression of 1929 to the COVID-19 crisis and its subsequent economic fallout, each period has revealed the complexity and interdependence of the global economy. In the Great Depression of 1929, the decline in industrial production, the collapse of the banking industry, and the hardship of ordinary people's lives promoted the Federal Reserve's concept of intervening in the economy. The stagflation period of the 1970s and 1980s followed, an era of high inflation and unemployment that forced the Federal Reserve to adopt tightening monetary policy and triggered a major shift in economic policy and theory. The 2008 financial crisis further exposed the fragility of the global financial system, leading to the collapse of the stock market, the decline of the real estate market, and a global economic recession. The Federal Reserve provided important support for economic recovery through interest rate cuts and quantitative easing. The COVID-19 crisis has once again tested the resilience of the global economy. Under the influence of the epidemic, the global economy has suffered a severe recession and financial markets have experienced panic decline. The Fed took emergency measures again, including public speeches to reassure markets, lowering interest rates, implementing quantitative easing, and setting up emergency lending facilities to support the economy. However, the epidemic has also brought new challenges, such as supply chain disruptions and rising inflation. Thanks to the efforts of central banks, inflation no longer seems to be a problem. The biggest challenge now is preventing inflation from recurring and achieving a soft landing for the economy.

Historically, every economic crisis prompts policymakers and economists to rethink and adjust strategies. Whether it was the New Deal during the Great Recession, monetary policy adjustments during stagflation, or regulatory reforms after the 2008 financial crisis, these periods marked major shifts in policy and theory. Likewise, the COVID-19 crisis is enabling new ways of economic management and global cooperation. These periods demonstrate that economic challenges prompt policy changes that profoundly affect the global economy and people's lives. From the Great Recession to the COVID-19 crisis, every economic turmoil is a major test for the global economic system while also providing valuable experiences and lessons for future policy formulation.

References

[1]. Bernstein, M. A. (1989). The Great Depression: Delayed Recovery and Economic Change in America, 1929-1939. Southern Economic Journal, 55(4), 1058.

[2]. Federal Reserve Economic Data (2023). St. Louis Fed. https://fred.stlouisfed.org/

[3]. Wheelock, D. C. (1992). Monetary policy in the Great Depression: What the Fed did, and why. Review, 74(2), 3-28.

[4]. Bluedorn, J., Hansen, N., Álvarez, J. S., Pugacheva, E., Sollaci, A., & Huang, Y. (2022). Wage-Price Spirals: What is the Historical Evidence? IMF Working Paper, 2022(221), 1.

[5]. Blinder, A. S. (1979). Economic policy and the Great stagflation. In Elsevier eBooks.

[6]. Silber, W. L. (2013). Volcker: the triumph of persistence. Choice Reviews Online, 50(06), 50–3384.

[7]. Christiano, L. J., & Kehoe, P. J. (2008). Facts and Myths about the Financial Crisis of 2008. Federal Reserve Bank of Minneapolis Working Paper 666 (2008).

[8]. Mrkaić, M., Nabar, M., & Chen, W. (2019). The global economic recovery 10 years after the 2008 financial crisis. IMF Working Paper, 2019(083), 1.

[9]. Armantier, O., Koşar, G., Pomerantz, R., Skandalis, D., Smith, K., Topa, G., & Van Der Klaauw, W. (2021). How economic crises affect inflation beliefs: Evidence from the Covid-19 pandemic. Journal of Economic Behavior and Organization, 189, 443–469.

[10]. Rosana, G., Abraham, H. & Vetotama, G. (2022). The Effect of The Fed’s Interest Rate Hike as The Implementation of Tight Money Policy in The Capital Market. University of Indonesia.

[11]. Further thoughts on sea change. (2023). https://www.oaktreecapital.com/insights/memo/further-thoughts-on-sea-change.

Cite this article

Wang,C. (2024). The Role of Monetary Policy in Global Financial Crisis. Advances in Economics, Management and Political Sciences,75,119-130.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bernstein, M. A. (1989). The Great Depression: Delayed Recovery and Economic Change in America, 1929-1939. Southern Economic Journal, 55(4), 1058.

[2]. Federal Reserve Economic Data (2023). St. Louis Fed. https://fred.stlouisfed.org/

[3]. Wheelock, D. C. (1992). Monetary policy in the Great Depression: What the Fed did, and why. Review, 74(2), 3-28.

[4]. Bluedorn, J., Hansen, N., Álvarez, J. S., Pugacheva, E., Sollaci, A., & Huang, Y. (2022). Wage-Price Spirals: What is the Historical Evidence? IMF Working Paper, 2022(221), 1.

[5]. Blinder, A. S. (1979). Economic policy and the Great stagflation. In Elsevier eBooks.

[6]. Silber, W. L. (2013). Volcker: the triumph of persistence. Choice Reviews Online, 50(06), 50–3384.

[7]. Christiano, L. J., & Kehoe, P. J. (2008). Facts and Myths about the Financial Crisis of 2008. Federal Reserve Bank of Minneapolis Working Paper 666 (2008).

[8]. Mrkaić, M., Nabar, M., & Chen, W. (2019). The global economic recovery 10 years after the 2008 financial crisis. IMF Working Paper, 2019(083), 1.

[9]. Armantier, O., Koşar, G., Pomerantz, R., Skandalis, D., Smith, K., Topa, G., & Van Der Klaauw, W. (2021). How economic crises affect inflation beliefs: Evidence from the Covid-19 pandemic. Journal of Economic Behavior and Organization, 189, 443–469.

[10]. Rosana, G., Abraham, H. & Vetotama, G. (2022). The Effect of The Fed’s Interest Rate Hike as The Implementation of Tight Money Policy in The Capital Market. University of Indonesia.

[11]. Further thoughts on sea change. (2023). https://www.oaktreecapital.com/insights/memo/further-thoughts-on-sea-change.