1. Introduction

With the emergence of the term " FinTech " over the recent years, the financial industry landscape has been fundamentally transformed. It encompasses a range of digital innovations and technological advances that have dramatically revamped traditional financial services. Innovations such as mobile money, online payments, peer-to-peer lending, AI-driven robo-advisors, and blockchain technology have reframed the way that monetary transactions are carried out, rendering them more convenient, more efficient, more accurate, and at the same time, more accessible to a broader range of people [1]. The FinTech industry is exhibiting unparalleled growth, as evidenced by the "FinTech Market Size and Share Analysis - Growth Trends and Forecasts (2023 - 2028)" published by Mordor Intelligence. The prediction of the Fintech market is to be $355.57 billion by 2028 and is also anticipated to witness a CAGR from 2023-2028 of 11.72% [2]. In addition, investments in fintech are also on a significant uptrend in many areas. Although the extensive COVID-19 in 2020 led to a dramatic decrease in fintech investment, they are increasing again in 2021, with a total of $226.5 billion [2]. However, as the popularity and enhancement of fintech offerings and services continue apace, so does the number of participants and providers in the marketplace, and the imperative to examine their risks and regulatory implications is also increasing.

Realizing the importance of risk management in FinTech, financial regulators have been actively monitoring and evaluating the influence of FinTech on the worldwide economic structure. The commitment of the Financial Stability Board (FSB) is to keep the global financial sector stable. It actively monitors and assesses market developments and gauges the risks and opportunities of fintech innovations. It is also a key player in elaborating regulatory frameworks and policies to enhance the stability of global finance [3].

With the dynamic nature of the sector, which emphasizes the importance of risk management in FinTech, the FinTech market continues to see an increase in collaborations and M&A transactions to facilitate its growth and market. Case studies of partnerships and collaborations in the FinTech sector further focus on the need for a robust risk management infrastructure. In May 2022, MasterCard declared a strategic partnership with Synctera, a renowned FinTech banking services company [4]. MasterCard delivers fintech developers the information and insights they need to lower risk, fraud, and account verification solutions for Synctera-powered FinTechs [4]. Besides, it enhances the user experience by increasing the number of clients, streamlining the service delivery process, and offering a more comprehensive range of payment options. This exemplifies the ethos of collaboration within the fintech ecosystem and demonstrates the need for a safe and reliable financial infrastructure. In March 2022, Envestnet entered into a partnership with Productfy, a developer of business-to-business fintech platforms, whereby fintech creators use the Productfy platform to gain immediate visibility into Envestnet, thereby simplifying the financial service and its operations [2]. These collaborations accelerate the pace of innovation and create new risks that must be effectively managed.

This essay will focus on the risks of blockchain, robo advice, online payments, and peer-to-peer lending in the FinTech world. It will explore and analyze the risks, regulatory frameworks, and risk management practices specific to these innovations. With the identification and understanding of the perceived risks of these technologies, supervisors are better equipped to develop productive strategies to alleviate these risks and foster a safe and sustainable fintech ecosystem.

2. Blockchain

Blockchain is a transparent, safe database that allows users to exchange data and helps them to access updated information. Cryptocurrencies have developed because of blockchain technology. And Bitcoin is one of the most well-known cryptocurrencies.

As the first and most prominent digital currency, Bitcoin is changing the way of conducting transactions and data management in the world of finance. With its security and transparency features, it has been accepted by some online retailers as a payment method [5]. Moreover, Bitcoin's decentralization traits and ability to facilitate cross-border transactions have reduced its reliance on financial intermediaries such as banks and exchanges [5]. It is a sign that pushes the dominance of fiat currencies and accentuates its potential to drastically replace traditional payment methods, such as public fiat currencies. Regarding its store of value, there is a limited supply and increasing demand for Bitcoin, making it an investment asset with the potential for storing value [5].

The recent most severe pandemic, COVID-19, has significantly impacted the value of virtual currency, accelerating its use and value. For the duration of the outbreak, the value of Litecoin, Bitcoin, Ethereum, and Bitcoin Cash dramatically increased, ranging from 1.34% to 3.84% [6]. Moreover, the financial markets attributed it to investors seeking substitute assets in the face of economic uncertainty and low market interest rates, which boosted the demand for virtual currencies [6]. This is particularly true of Bitcoin, which experienced a staggering 300% growth in 2020, made possible by investors who considered it a potential hedge against the inflation caused by the global pandemic [6]. While central bank money printings will lead to inflation or a decrease in the value of the money for some time, there is a constant supply of cryptocurrencies, such as Bitcoin [6]. On top of that, the restricted supply could help avoid the arbitrary inflationary pressures that arise from an infinite ability to print money. The capacity of Bitcoin's constant pool is believed to be able to fight inflation and stabilize a country's economy [6]. As described by Harvard Business Review, the impact of Bitcoin can be tied to the perspective of disruptive innovation [7]. As was already noted, the decentralized network of computers known as "nodes" that underpins Bitcoin eliminates the need for middlemen like banks to process transactions. As a result, peer-to-peer transactions can be conducted directly without a centralized organization. Furthermore, users are not required to have faith in a centralized organization. The transactions are kept on a public ledger that is safe and transparent (blockchain). Then, anybody with an internet connection may use Bitcoin to offer financial services to those who could not use the existing banking system because of things like residency restrictions or a lack of documents [8]. Because of this, Bitcoin transactions are geographically unrestricted, allowing anyone to send and receive money internationally without relying on established financial infrastructure. It is expected to be especially advantageous for foreign trade and remittances. The decentralized and country-free nature of Bitcoin has had a profound impact on the financial world by overturning the traditional financial architecture and bringing in new concepts of money that can challenge the mainstream status of traditional currencies. Furthermore, since cryptocurrencies showed a rebound effect during the market downturn, investors should diversify their holdings to prevent selling all of their cryptocurrencies during a market price plunge [6]. Doing so will increase their dividends when an encouraging market signal prompts a rebound effect.

Although the potential of Bitcoin is undeniably tremendous, it is exposed to several risks that impede its widespread utilization. The first one mentioned is the volatility of its price. Bitcoin is notorious for its extreme and intense price volatility, and its value is liable to swing drastically quickly. The price of Bitcoin fell from about $48,000 to lows of approximately $16,000 in 2022, which would certainly be a tremendous loss for investors [9]. It is evident that the volatility exposes investors to the risk of either substantial returns or immense losses. Therefore, developing an effective risk management strategy, such as diversification, as mentioned in the previous section, is paramount in reducing the investment risk.

Secondly, there are also regulatory risks. The global regulations for cryptocurrencies are still developing and improving. In contrast, the changes in the regulatory environment and the implementation of cryptocurrency regulations in different countries may have an impact on the use of Bitcoin, which can result in risks for both users and investors [9]. For instance, in the United States, Bitcoin is considered a commodity by the Commodity Futures Trading Commission (CFTC). At the same time, China, the second-biggest economy in the world, essentially outlawed its people's ability to create or possess any cryptocurrency in 2021, according to Rodriguez [9].

Not to be overlooked, security threats. Given that cryptocurrency is digital money and is susceptible to hackers, human mistakes, and technological issues, it is imperative that you take precautions to protect your Bitcoin holdings [9]. A rising danger to cryptocurrencies is cybercrime, as instances of fraud, fraud, and hacking have been reported in the sector. From the FTC reports, bitcoin fraud occurred between October 1, 2020, and March 31, 2021, causing more than 7,000 people to lose approximately $1900 individually [9]. This emphasizes the necessity of having a strong commitment to sufficient protection. Both individuals and companies may use crypto wallets to safeguard their Bitcoin holdings.

Bitcoins can be used for any transaction, increasing the likelihood of criminals using them. As a result, regulation of Bitcoin to reduce illegal activities is necessary. Though different regulators have different opinions in the USA, most see Bitcoin as lawful. The U.S. Securities and Exchange Commission (SEC) views a number of cryptocurrencies to be securities. While the U.S. Commodity Futures Trading Commission (CFTC) categorizes Bitcoin as a commodity and supervises its derivatives, and FinCEN supervises the usage of Bitcoin as a Money Services Business (MSB). Regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates implemented by the Financial Crimes Enforcement Network (FinCEN) contribute to the complicated regulatory environment. State-level rules also exist; several states have more specialized legislation regarding cryptocurrencies [10]. In the European Union (EU), it is mandatory for bitcoin exchanges and wallet suppliers to register and comply with AML and KYC regulations with the fulfillment of the Fifth Anti-Money Laundering Directive (5AMLD) in 2020 [11]. The disparate legal frameworks in each EU member state complicate the regulatory environment. In addition, the European Union (EU) introduced the world's first complete cryptocurrency issuance and trading rule in June 2023, leading to the creation of a comprehensive legal framework for the crypto business. The Market for Crypto Assets (MiCA) law, which sets up a unified legal structure for crypto assets in the EU, is a part of the framework. Numerous topics are covered by the MiCA legislation, including market misuse, asset categorization, consumer protection, and licensing requirements [12]. Nevertheless, in China, stringent restrictions forbid financial institutions from providing services linked to cryptocurrencies, and the country does not view cryptocurrencies as legitimate money [11]. On the other hand, China's central bank has been developing an official digital currency for years. It finished testing its e-CNY digital money in multiple cities in September 2021 [11].

To sum up, with the constant development of the financial field, it is essential to actively and effectively manage and formulate the regulation of blockchain technology.

3. Robo-Advice

A robo-advisor is a computerized financial advisor requiring little human involvement. As one of the main drivers of the Fourth Industrial Revolution, artificial intelligence (AI) has recently garnered much attention. It is anticipated to influence society and the global economy significantly. Robo-advisors, with over 30% of financial services companies, are prominent in the financial services sector. By 2020, around 60 percent of financial services companies will have successfully incorporated one or more AI technologies into their primary operations. It is good evidence that robo-advisors are likely to change the investment landscape of the financial industry in the future.

Financial choices have a significant impact on investing and wealth management techniques. Financial experts or analysts often make these judgments based on their professional judgment and knowledge. However, the rise of AI-powered robo-advisors has upended this market by offering automated and algorithmic investment management and financial guidance. A robo-advisor uses AI and machine learning algorithms to extract meaningful insights from large amounts of data, enabling more effective and data-driven decision-making [13]. AI improves financial decision-making in several ways. Machine learning algorithms may analyze massive data sets, which can then spot patterns, trends, and significance that human analysts would miss [14]. Robo-advisors with these features can create a personalized portfolio for each investor based on their investing objectives, risk tolerance, and time horizon. To guarantee that portfolios align with investors' objectives, AI-driven algorithms also offer automatic portfolio rebalancing and ongoing monitoring [14].

While AI-powered robo-advisors offer effective, data-driven solutions, human involvement in financial decision-making is still essential. This is because people can combine qualitative elements, form opinions, and consider reasoning that looks forward from a limited amount of past facts. Shortly, computers and people will continue to play various roles, and the best way to enhance financial decision-making may be through a hybrid strategy that combines AI's advantages with human knowledge [13].

In addition to the financial industry, robo-advisors are predicted to be utilized in all industries due to their increasing sophistication. Because robo-advisers provide lower or no minimum investment requirements and charge cheaper fees than traditional wealth management services, they remove entry barriers, making the democratization of investment management one of the significant trends [15]. More investors may get diverse portfolios and personalized counsel thanks to this ease. Second, by automating inventory monitoring, tracking supplier performance, and optimizing purchase choices, robo-advisors can expedite operations in supply chain management [15]. With the help of the application, managers will have quick access to current market data and trends, enabling them to come up with well-informed decisions about production and inventories. This will significantly increase organizational efficiency while cutting expenses. Furthermore, robo-advisors are helpful for risk management since they provide instantaneous risk evaluations and guarantee adherence to regulatory and industry-specific standards. The workflow for risk management will be enhanced by using AI to increase the responsiveness and accuracy of risk identification and mitigation [15].

While there are numerous benefits to AI robo-advice, there are also many risks and challenges that need to be taken into account. Because robo-advisors are automated, there is a risk that they may violate the regulatory framework and face legal repercussions. To safeguard investor protection, authorities need to closely monitor the significant problem of non-compliance with federal consumer financial protection legislation [16]. Furthermore, a problem posed by the increasing dependence on automated solutions is the deterioration in trust and customer service [16]. When working with robo-advisors, customers may feel they need more individuality and connection, positively impacting their whole experience. This illustrates the importance of establishing and maintaining trust for AI-driven financial advising services to succeed. Additionally, chatbots might hurt customers by giving false information about financial goods and services [16]. This puts customers in danger of financial loss and undermines their confidence in robo-advisors.

That is why a robust monitoring procedure is so important. Industry players and regulators must collaborate to build a solid basis to lower the risks associated with AI-robot guidance. Transparency, data protection, cybersecurity, and adherence to all relevant laws and regulations should be prioritized. Finding and fixing such breaches can be facilitated by routinely auditing and monitoring robo-advice platforms [15]. Furthermore, to guarantee the precision and dependability of the financial investment advice given by robo-advisors, ongoing algorithm research, improvement, and monitoring are essential [15].

4. Online Payments

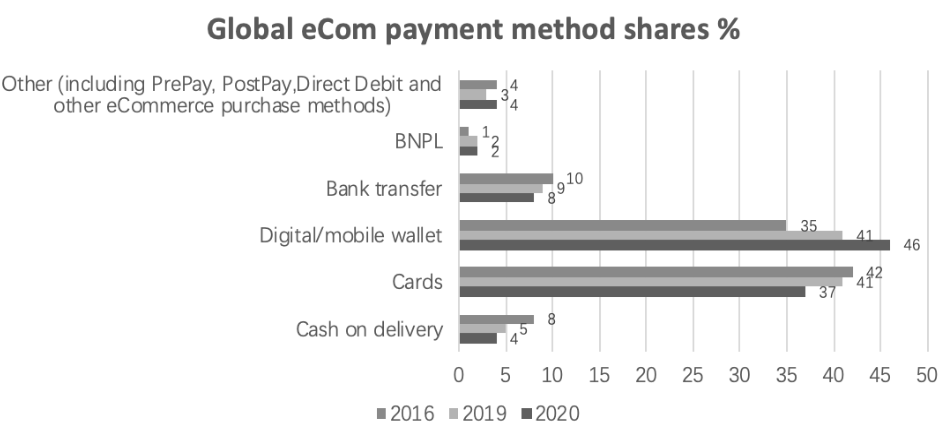

A notable change in how financial transactions are carried out has been the massive rise in the popularity of online payment services, particularly the electronic transfer of money. These services' accessibility and convenience are to blame for this increase. As noted in the Future of Payments study by FIS Global, mobile wallets are now the most widely utilized online payment method worldwide [17]. The digitalization of payments has also had a significant impact on customer behavior. Figure 1 below illustrates the progressive decline in the percentage of cash payments worldwide, suggesting a growing trend among customers to choose digital payment options [17].

Figure 1: Global eCom Payment Method (Picture credit: Original).

A few well-known FinTech payment systems have completely changed how transactions are conducted. The leading and essential participants in this market are PayPal, Apple Pay, Alipay, and WeChat Pay. These platforms take advantage of their numerous functions and distinctive characteristics to give users a safe and easy way to make payments. For instance, by combining many credit and debit cards, customers may take advantage of Apple Pay's smooth integration with the ecosystem (which includes the iPhone, Apple Watch, and Mac) to have a quick and safe payment experience [18]. With features that go beyond basic transactions (digital wallets, QR code payments), such as social and lifestyle integrations (wealth management, credit services, and insurance), Alipay and WeChat Pay have contributed significantly to the growth of mobile payments in China [18]. In addition, they have expanded their services globally, enabling users to make payments in various currencies and being accepted by many foreign merchants. PayPal is a global leader in e-commerce payments and international transactions. It allows peer-to-peer payments and sending money to friends and family locally and abroad. Users don't need to reenter their login information to make purchases thanks to the "one-click" option [18].

Compared to conventional payment methods, fintech mobile payment services provide several advantages. Users can benefit from the simplicity, compatibility, portability, and increased security of their various payment uses [18]. With mobile wallets, consumers can quickly and conveniently make payments using their cellphones instead of carrying cash or bank cards. They also support a large variety of platforms and devices, which makes it easier for consumers to perform transactions and improves user experience. Users may make payments whenever and wherever they want because of the mobile factor, which offers unmatched ease. Additionally, security is a top priority for the FinTech mobile payment service, which protects customer information with robust authentication and encryption technologies [18].

FinTech payment systems are not impervious to security and privacy issues, even though they provide improved security safeguards [18]. Cyberattacks and data breaches are very dangerous since they may lead to identity theft, revealing sensitive financial information about users, and other problems. To protect user data, FinTech companies must continue to invest in cybersecurity measures, implement strict agreements, and use authentication. One example is that neither a payment card company nor a service provider must know the user's previous purchases of services when they make payments using mobile FinTech Payments; this will effectively protect the customer's privacy [18]. Furthermore, policymakers must adopt legislation to handle and mitigate these hazards effectively [19].

Some nations and areas have put data protection laws into place to guarantee the preservation of consumer payment information. For example, all personal data within the EU is subject to privacy and security regulations outlined in the General Data Protection Regulation (GDPR) of the European Union. It addresses exporting personal data outside the EU [19]. These rules must be followed for fintech businesses to continue operating legally and earning customers' trust. Furthermore, central banks have effectively carried out pilot projects to investigate the possibilities of central bank digital currencies (CBDCs) for cross-border and cross-currency payments, including the Bank of Canada and the Monetary Authority of Singapore (MAS) [19]. The effectiveness and openness of digital transactions can be enhanced by CBDCs.

5. Peer-to-Peer Lending

Peer-to-peer lending networks use an Internet platform to facilitate direct communication between lenders and borrowers. By removing the necessity of conventional finance intermediaries such as banks, P2P lending platforms give borrowers and lenders a more efficient and healthy reception experience. It has also developed into a different funding source.

The way individuals exchange resources and information has altered due to peer-to-peer lending. P2P lending lowers the expenses related to traditional lending, such as overhead, because the money comes directly from individual lenders without the use of any financial middlemen. Second, P2P lending solutions expedite the process and enable lenders to obtain cash more quickly than traditional retail banks by utilizing robust algorithms and machine learning to expedite credit evaluation and decision-making [20]. Furthermore, by distributing funds among several loans, lenders can spread the risk involved in lending operations and benefit from peer-to-peer lending's novel approach to portfolio diversification [20].

P2P lending has the potential to yield higher returns than traditional techniques, but since it operates in the digital realm, it presents particular security issues. Tighter regulation is essential to issues including loan defaults and inadequately regulated platforms. The Financial Conduct Authority (FCA) is an essential regulatory body for the United Kingdom's peer-to-peer (P2P) online lending systems. Its regulatory structure is intended to protect the financial system's stability, foster effective competition, and guarantee equitable treatment of clients. As part of its oversight, the FCA regularly evaluates platform performance, establishes prudential guidelines, mandates loan information openness, and enforces policies safeguarding investor money [21]. Due to this strict regulatory framework, the UK P2P online lending sector has seen an increase in confidence and trust.

Severe central and local regulatory issues with China's P2P lending platforms contribute to many fraud cases and platform failures. On the one hand, the central government took decisive action to manage risks after the market crisis broke out. However, it could not respond favorably to the growth of P2P lending with regulation [22]. However, Huang and Wang claim that local regulators failed to achieve a balance between safeguarding investors and fostering economic progress [22]. It ultimately resulted in the defeat of P2P lending services in China.

In conclusion, to secure the long-term viability of these platforms, regulators must find a balance between encouraging innovation and safeguarding stakeholders' interests as the P2P lending sector develops.

6. Conclusion

In conclusion, the rapid expansion of the FinTech sector is reshaping the financial services realm, offering unprecedented opportunities for individuals and businesses. The transformative potential of FinTech in providing innovative products and services to meet evolving consumer demands is clear, yet not without inherent risks. Effective regulation becomes a linchpin in managing these risks, safeguarding the stability and equilibrium of the FinTech ecosystem against significant threats. As the FinTech landscape evolves, regulators face the delicate task of balancing efficiency and stability. Crafting and implementing a nimble regulatory framework demand careful consideration of trade-offs between promoting innovation and preserving financial system resilience. Authorities must stay vigilant, continuously assessing the dynamic FinTech landscape and adapting regulations to address emerging challenges. This proactive approach ensures an environment where FinTech can securely flourish, promoting the seamless integration of cutting-edge financial solutions while fortifying the sector against potential disruptions. In navigating this regulatory landscape, policymakers and industry leaders must collaborate to strike a harmonious balance, fostering a transparent and adaptive regulatory environment that propels the FinTech sector towards sustainable growth and ensures a resilient ecosystem benefiting both providers and consumers. Through strategic regulation, the financial industry can fully harness the potential of FinTech, driving positive change and innovation while maintaining the integrity of the broader financial system.

References

[1]. Goyal, D., Varma, R., Rada, F., Pande, A., Jauregui, J., Corelli, P., Tripathi, S., Sénant, Y., Dab, S., Erande, Y., Choi, J., Koserski, J., Carrubba, J., Morris, N., Rotman, F., Risley, M., & Suri, S. (2023). Global Fintech 2023: Reimagining the Future of Finance. BCG Global. https://www.bcg.com/publications/ 2023/future-of- fintech-and-banking

[2]. Mordor Intelligence. (2023). Fintech Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028). https://www.mordorintelligence.com/industry-reports/global-fintech-market

[3]. Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., & Saal, M. (2021). Fintech and the digital transformation of financial services: implications for market structure and public policy. https://www.bis. org/publ/bppdf/bispap117.htm

[4]. Synctera. (2022). Synctera expands partnership with Mastercard. https://www.synctera.com/news/synctera-expands-partnership-with-mastercard

[5]. Seetharaman, A., Saravanan, A. S., Patwa, N., & Mehta, J. (2017). Impact of Bitcoin as a World Currency. Accounting and Finance Research, 6(2), 230.

[6]. Sarkodie, S. A., Ahmed, M. Y., & Owusu, P. A. (2021). COVID-19 pandemic improves market signals of cryptocurrencies–evidence from Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Finance Research Letters, 44, 102049.

[7]. Christensen, C. M., Raynor, M. E., & McDonald, R. (2015). What Is Disruptive Innovation? Harvard Business Review. https://hbr.org/2015/12/what-is-disruptive-innovation

[8]. Anthony, N. (2023). Money Across Borders: How Cryptocurrency has Opened Global Exchange. Cato.org. https://www.cato.org/publications/money-across-borders-how-cryptocurrency-has-opened-global- exchange

[9]. Hicks, C. (2023). Is Bitcoin Safe? – Forbes Advisor. Www.forbes.com. https://www.forbes.com/advisor /investing/ cryptocurrency/is-bitcoin-safe/

[10]. PwC. (2022). PwC Global Crypto Regulation Report 2023. https://www.pwc.com/gx/en/new-ventures/ cryptocurrency- assets/pwc-global-crypto-regulation-report-2023.pdf

[11]. Comply Advantage. (2020). Cryptocurrency Regulations Around the World. https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/

[12]. European Parliament. (2023). Crypto-assets: green light to new rules for tracing transfers in the EU. https://www.europarl.europa.eu/news/en/press-room/ 20230414IPR80133/crypto-assets-green-light-to-new-rules-for-tracing-transfers-in-the-eu

[13]. Huang, A., & You, H. (2022). Artificial Intelligence in Financial Decision Making. SSRN.

[14]. Hayes, A. (2023). Robo-Advisor vs. Financial Advisor. Investopedia. https://www.investopedia. com/robo-advisor-vs-financial-advisor-4775377

[15]. Finance Magnates. (2023). Robo-Advisors in 2023: Revolutionizing the Investment Landscape. https://www.financemagnates.com/fintech/data/ robo- advisors-in-2023-revolutionizing-the-investment-landscape/

[16]. Ozair, M. (2023). FinanceGPT: The Next Generation of AI-Powered Robo Advisors and Chatbots. NASDAQ. https://www.nasdaq.com/articles/financegpt-the-next-generation-of-ai-powered-robo-advisors -and- chatbots

[17]. Johnson, J. (2021). The Future of Payments in Five Charts. FIS. https://www.fisglobal.com/en/fintech2030/economies/future-of-payments.

[18]. Kang, J. (2018). Mobile payment in Fintech environment: trends, security challenges, and services. Human-Centric Computing and Information Sciences, 8(1). https://doi.org/10.1186/s13673-018-0155-4

[19]. PwC. (2020). Payments regulations: Understanding the global state of play Click to launch. https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/point-of-view/pov-downloads/payments-regulations-understanding-the-global-state-of-play.pdf

[20]. Finance Magnates. (2023). The Emergence of P2P Lending Platforms: Disrupting Traditional Lending Institutions. Financial and Business News. https://www.financemagnates.com/ fintech/p2p/the-emergence-of-p2p-lending-platforms-disrupting-traditional-lending-institutions/

[21]. Bavoso, V. (2019). The promise and perils of alternative market-based finance: the case of P2P lending in the UK. Journal of Banking Regulation, 21(4), 395–409.

[22]. Huang, R. H., & Wang, C. M. L. (2021). The Fall of Online P2P Lending in China: A Critique of the Central-Local Co-regulatory Regime. SSRN.

Cite this article

Qiang,X. (2024). Digital Transformation in the Financial Sector Through Fintech. Advances in Economics, Management and Political Sciences,76,226-234.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Goyal, D., Varma, R., Rada, F., Pande, A., Jauregui, J., Corelli, P., Tripathi, S., Sénant, Y., Dab, S., Erande, Y., Choi, J., Koserski, J., Carrubba, J., Morris, N., Rotman, F., Risley, M., & Suri, S. (2023). Global Fintech 2023: Reimagining the Future of Finance. BCG Global. https://www.bcg.com/publications/ 2023/future-of- fintech-and-banking

[2]. Mordor Intelligence. (2023). Fintech Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028). https://www.mordorintelligence.com/industry-reports/global-fintech-market

[3]. Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., & Saal, M. (2021). Fintech and the digital transformation of financial services: implications for market structure and public policy. https://www.bis. org/publ/bppdf/bispap117.htm

[4]. Synctera. (2022). Synctera expands partnership with Mastercard. https://www.synctera.com/news/synctera-expands-partnership-with-mastercard

[5]. Seetharaman, A., Saravanan, A. S., Patwa, N., & Mehta, J. (2017). Impact of Bitcoin as a World Currency. Accounting and Finance Research, 6(2), 230.

[6]. Sarkodie, S. A., Ahmed, M. Y., & Owusu, P. A. (2021). COVID-19 pandemic improves market signals of cryptocurrencies–evidence from Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Finance Research Letters, 44, 102049.

[7]. Christensen, C. M., Raynor, M. E., & McDonald, R. (2015). What Is Disruptive Innovation? Harvard Business Review. https://hbr.org/2015/12/what-is-disruptive-innovation

[8]. Anthony, N. (2023). Money Across Borders: How Cryptocurrency has Opened Global Exchange. Cato.org. https://www.cato.org/publications/money-across-borders-how-cryptocurrency-has-opened-global- exchange

[9]. Hicks, C. (2023). Is Bitcoin Safe? – Forbes Advisor. Www.forbes.com. https://www.forbes.com/advisor /investing/ cryptocurrency/is-bitcoin-safe/

[10]. PwC. (2022). PwC Global Crypto Regulation Report 2023. https://www.pwc.com/gx/en/new-ventures/ cryptocurrency- assets/pwc-global-crypto-regulation-report-2023.pdf

[11]. Comply Advantage. (2020). Cryptocurrency Regulations Around the World. https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/

[12]. European Parliament. (2023). Crypto-assets: green light to new rules for tracing transfers in the EU. https://www.europarl.europa.eu/news/en/press-room/ 20230414IPR80133/crypto-assets-green-light-to-new-rules-for-tracing-transfers-in-the-eu

[13]. Huang, A., & You, H. (2022). Artificial Intelligence in Financial Decision Making. SSRN.

[14]. Hayes, A. (2023). Robo-Advisor vs. Financial Advisor. Investopedia. https://www.investopedia. com/robo-advisor-vs-financial-advisor-4775377

[15]. Finance Magnates. (2023). Robo-Advisors in 2023: Revolutionizing the Investment Landscape. https://www.financemagnates.com/fintech/data/ robo- advisors-in-2023-revolutionizing-the-investment-landscape/

[16]. Ozair, M. (2023). FinanceGPT: The Next Generation of AI-Powered Robo Advisors and Chatbots. NASDAQ. https://www.nasdaq.com/articles/financegpt-the-next-generation-of-ai-powered-robo-advisors -and- chatbots

[17]. Johnson, J. (2021). The Future of Payments in Five Charts. FIS. https://www.fisglobal.com/en/fintech2030/economies/future-of-payments.

[18]. Kang, J. (2018). Mobile payment in Fintech environment: trends, security challenges, and services. Human-Centric Computing and Information Sciences, 8(1). https://doi.org/10.1186/s13673-018-0155-4

[19]. PwC. (2020). Payments regulations: Understanding the global state of play Click to launch. https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/point-of-view/pov-downloads/payments-regulations-understanding-the-global-state-of-play.pdf

[20]. Finance Magnates. (2023). The Emergence of P2P Lending Platforms: Disrupting Traditional Lending Institutions. Financial and Business News. https://www.financemagnates.com/ fintech/p2p/the-emergence-of-p2p-lending-platforms-disrupting-traditional-lending-institutions/

[21]. Bavoso, V. (2019). The promise and perils of alternative market-based finance: the case of P2P lending in the UK. Journal of Banking Regulation, 21(4), 395–409.

[22]. Huang, R. H., & Wang, C. M. L. (2021). The Fall of Online P2P Lending in China: A Critique of the Central-Local Co-regulatory Regime. SSRN.