1.Introduction

1.1.Research Background

An occurrence or circumstance that causes an investor to lose assets or income might be covered financially by investment insurance. Policyholders can invest their premiums in stocks, funds, and other assets, among other investment possibilities, through various fund options offered by insurance plans. With this flexibility, consumers may select a fund that aligns with investing objectives, risk tolerance, and investment time horizon. It might result in better returns than with standard life insurance plans. Investing insurance is a fantastic technique to shield money from unforeseen circumstances. Risk management requires a well-diversified investment portfolio since it lessens exposure to any one asset class, industry, or geographic area. A financial cushion known as investment insurance helps shield investments against risks related to market volatility, unplanned occurrences like natural catastrophes, and premature death, among other things. A particular financial instrument known as investment insurance combines the advantages of investment vehicles with life insurance. With this combination, consumers may increase wealth via investments and benefit from the security provided by life insurance. The knowledge that investments are safe and secure is a comfort investment insurance offer [1]. AIA Group Limited is the largest insurance company in Hong Kong, serving more than 3.5 million clients. The company cooperates with well-known banks and funds to provide customers with more insurance options. AIA has more than 120 products ranging from personal, accident, health, pension insurance, investment, and other aspects [2]. The research on the optimal portfolio strategy of AIA’s investment insurance products based on the Markowitz and Index model can help investors hunt for the most suitable portfolio with the highest return and help AIA develop new portfolio products.

1.2.Literature Review

Haugen, Kroncke, and Zemon’s findings suggest that non-life underwriters may find some predictive value in the Markowitz portfolio model. By applying portfolio theory methodologies, they were able to develop financing and investing strategies that outperformed a regularly produced estimate of actual firm performance for twelve years after the portfolio study [3]. Cai, Ding, Du, Hou, Zhang, and Zhao find that MM, the cornerstone of IM, may be used to control the risk of a limited number of assets precisely, making it more appropriate for situations. On the other hand, as an enhancement of MM, IM excels in analyzing a sizable securities portfolio, and it is extensively employed in productive markets around the globe [4]. Lee, Cheng, and Chong find that systematic risk is un-diversifiable, and unsystematic risk is diversifiable with more stocks in a portfolio. For this reason, it may be more prudent for an optimistic investor with a low tolerance for risk to place money in fixed deposits in order to obtain a risk-free rate and spare the trouble of being concerned about the volatility of stocks, which might yield a loss [5]. Sun finds that investors may use the two models to create almost exact graphs showing the portfolio frontier of minimal variance, often represented by stocks and an SPX index. Putting this into practice means that an investor may invest using either approach, which fully supports the hypothesis that the two ways of analysis are comparable. In conclusion, a single index model is more appropriate for average investors like us than for expert investment scientists. The ease of covariance computation lessens the requirement for estimators in exponential models [6].

Most scholars have mainly studied some common stock data. In contrast, only some articles focus on stocks in a specific industry or a company’s portfolio of investment products. Hence, most of these articles are only instructive regarding data analysis of MM and IM, not business or social significance.

1.3.Research Framework

Therefore, after careful selection, this paper selects the investment insurance of AIA Group Limited as the research object, collects the historical price and dividend data of the product in the past, and then analyzes the product through the Markowitz model and Index model, finally obtains the optimal investment portfolio, and puts forward suggestions on the actual operation of the company.

2.Method

2.1.Markowitz Model

A portfolio is created by allocating capital to assets that provide investors with the best possible returns at a manageable risk. With a particular risk threshold, The Markowitz model seeks to provide the highest possible return on an efficient portfolio. Furthermore, the Markowitz model offers an optimization procedure extensively employed in insurance portfolio management to create the most efficient target portfolio. The Markowitz model reduces the risk that investors take when choosing stocks.

A hyperbola that represents portfolios with all possible asset pairings that produce efficient portfolios is the Markowitz Model's efficient frontier [7]. The efficient frontier is the collection of portfolios which have the potential to provide the greatest return on investment at a particular degree of risk. The portfolio is regarded as efficient if no additional portfolio offers a higher return at a corresponding or smaller amount of risk. The threat sensitivity of the investor influences where the portfolio falls on the efficient frontier [8].

The formula of Markowitz model:

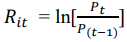

1. Calculate level of return

(1)

(1)

With,

𝑅𝑖𝑡: Return of stock i in period t

𝑃𝑡: Closing price of stock in period t

𝑃𝑡−1: Closing price of the previous stock in period t-1

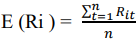

2. Calculate expected return rate

(2)

(2)

With,

E (Ri): Expected return from stock i

n: Number of stocks

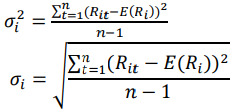

3. Calculate risk

(3)

(3)

With,

𝜎𝑖2: Variance of stock i’s return

𝜎𝑖: Standard deviation of stock i’s return

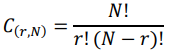

4. Calculate combination of stocks

(4)

(4)

With,

𝐶(𝑟, 𝑁): Combination of portfolio level from N

N!: Factorial number of stocks

r!: Factorial portfolio level

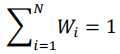

(5)

(5)

With,

𝑊𝑖: Weight of the stock i portfolio

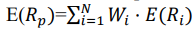

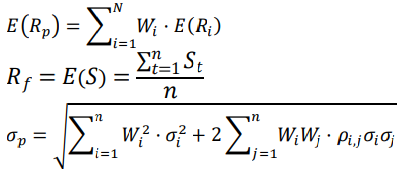

(6)

(6)

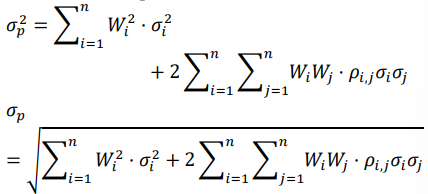

Calculate variances and standard deviations

(7)

(7)

With,

𝜎𝑝2: Variance of portfolio

𝜎𝑝: Standard deviation of portfolio

𝜎𝑖2: Variance of stock i’s return

𝜎𝑖: Standard deviation of stock i’s return

𝜎𝑗: Standard deviation of stock j’s return

𝜌𝑖, 𝑗: Correlation coefficient between stock i and j

𝑊𝑖: Weight of the funds invested in stock i

𝑊𝑗: Weight of the funds invested in stock j

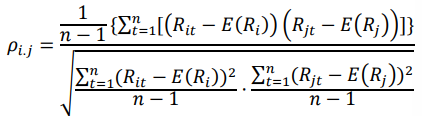

Correlation coefficient between stocks:

(8)

(8)

With,

𝑅𝑖𝑡: Return of stock i in period t

𝑅𝑗𝑡: Return of stock j in period t

2.2.Index Model

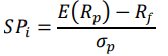

According to the index concept, one common effect, or index, accounts for the connected movement of equities. It is evident by observing stock prices that most of them correlate with the stock market. The shared reaction to market fluctuations may be one of the causes of the potential connection between securities returns. Stock returns may be linked to returns to generate a helpful index representing this association. The following is the formula used by the Index Model to determine the portfolio:

(9)

(9)

With,

𝑆𝑃𝑖: Sharpe portfolio index

𝐸(𝑅𝑝): Expected return of portfolio

𝑅𝑓= 𝐸(𝑆): Average risk-free investment interest rate return

𝐸(𝑅𝑖): Expected return of stock i

3.Result

3.1.The Description of Product Data

Table 1 shows some of AIA Group Limited’s investment insurance products’ revenue data from 2018 to 2023 [8]. They are all from the same investment plan, which means they can form a portfolio. Moreover, the assets of these funds are all in China or Hong Kong, which is beneficial for the research due to the similar background and convenience. Models can be built after calculations on these data.

Table 1: Some of AIA’s Investment Insurance Products’ Revenue Data from 2018 to 2023

|

Fund Name |

2018 |

2019 |

2020 |

2021 |

2022 |

YTD (as at 11/30/2023) |

|

JPMorgan China Income Fund (acc) - USD |

-11.34% |

16.43% |

14.00% |

-1.61% |

-16.26% |

-5.76% |

|

JPMorgan China Income Fund (mth) - USD class (Dis) |

-11.35% |

16.40% |

13.99% |

-1.60% |

-16.23% |

-5.79% |

|

Ninety One Global Strategy Fund - All China Bond Fund A Acc Share Class USD |

-2.09% |

4.77% |

11.32% |

2.50% |

-13.91% |

-7.74% |

|

Ninety One Global Strategy Fund - All China Bond Fund A Inc-3 Share Class (Dis) |

-2.02% |

4.79% |

11.23% |

2.52% |

-13.92% |

-7.71% |

|

abrdn SICAV I - All China Sustainable Equity Fund “A2” |

-12.29% |

23.86% |

36.39% |

-15.19% |

-25.98% |

-20.13% |

|

Allianz Global Investors Fund - Allianz China A-Shares Accumulation Shares (Class AT) (USD) |

-25.85% |

58.47% |

72.73% |

-0.73% |

-35.75% |

-21.15% |

|

Fidelity Funds - China Consumer Fund “A-ACC” |

-20.92% |

23.83% |

34.60% |

-25.01% |

-20.87% |

-13.12% |

|

First Sentier Investors Global Umbrella Fund plc - FSSA China Growth Fund (Class I) |

-17.59% |

30.55% |

32.00% |

-6.00% |

-19.74% |

-16.45% |

|

HSBC Global Investment Funds - Chinese Equity “AD” |

-20.63% |

23.02% |

39.16% |

-20.77% |

-24.36% |

-11.04% |

|

Value Partners Chinese Mainland Focus Fund |

-28.32% |

36.58% |

73.59% |

-13.23% |

-31.51% |

-10.20% |

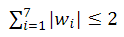

3.2.Illustration of constraints

Since consumers have different demands and AIA is consistently committed to offering excellent product solutions to satisfy high-net-worth clients' financial demands, there should be four different constraints on investment weights [9].

(1) The combination of investment weights of 10 products has to be smaller or equal to 2.

(10)

(10)

(2) For any product, the investment weight has to be smaller than 1

(11)

(11)

(3) No constraints. Look for the most ideal case, and the client has adequate funds. For any products, put investment in each one of them. Consumers may not have fund constraints, but they do not want too much risk, so the company wants diversification with all options.

(12)

(12)

(4) No investment in certain products sees the effects. For example, the client does not have fund constraints but is willing to take higher risk, which means the company would not spend money on low-risk assets.

(13)

(13)

3.3.Markowitz Model

It is possible to deduce from Figure 1, given the identical risk conditions, that other constraints’ return are greater than constraint 4’s return (no constraint). Additionally, the minimal variance portfolio, which means the lowest risk, of the model is represented by the orange point, and the maximal sharp ratio is the gray one of the efficient risky portfolio [7].

Figure 1: Analysis using Markowitz Model

(Photo credit: Origin)

3.4.Index Model

Based on Figure 2, it can be inferred that under a given risk condition, the return under other Constraints are greater than the return under Constraint 3, indicating no restriction. Additionally, There is no doubt about the association between a market index's return and an individual product's return [7].

Figure 2: Analysis using Index Model

(Photo credit: Origin)

4.Discussion: Comparison between MM and IM

When compared to MM, IM made the risk simpler. Macroeconomic risk and firm-specific risk make up the risk in investment management. It disregards the risk unique to the industry. Compared to the Markowitz approach, the index model requires far less computation. Hence, it was recommended that investors use the index model to build their portfolios [10]. Conversely, the risk estimated by MM needs to be more accurate but more detailed. MM requires more input data than IM, and since each piece of input data is a point estimate, MM accumulates a more significant error than IM. Expect the two variances to differ from one another. The following might be the cause of the discrepancy. Instead of being a straightforward linear superposition, some hazards may counteract one another [4].

5.Conclusion

It is evident from the comparison of the Markowitz and Index models’ analyses that the Markowitz model’s ideal portfolio outperforms the Index model’s optimal portfolio. The Index model makes the estimate of the matrix issue of covariance easier. The model also breaks down the risk into firm-specific and systematic parts, suggesting the Markowitz Model’s optimal risky portfolio is inferior to the Index Model under identical risk conditions. Nevertheless, since the Index Model’s advancements are also related to a wide range of marketing considerations, there may be much uncertainty in the outcomes of the model’s ideal risky portfolio.

This paper uses MM and IM to find the optimal insurance investment product strategy, which can promote the product allocation of AIA companies and inspire general investors. However, the research object of this paper is too single, and the scope of data selection needs to be narrower. Future research can focus on other insurance investment products or more representative products.

References

[1]. How Investment Insurance Protects Your Assets, InLife. (n.d.). How investment insurance protects your assets: InLife. Retrieved from: https://www.insularlife.com.ph/articles/how-investment-insurance-protects-your-assets-00000313

[2]. About Us | Asia’s Leading Insurance Company, AIA Hong Kong. (n.d.). We lead the industry with our forward-looking vision and superior protection and Financial Solutions. Retrieved from: https://www.aia.com.hk/en/about-aia/about-us

[3]. Haugen, R. A., Kroncke, C. O., & Zemon, R. B. (1977). The Predictive Power of the Markowitz Portfolio Model in the Insurance Industry. The Journal of Insurance Issues and Practices, 1(4), 90–102.

[4]. Cai, Z. Q. & Ding, Y. T. & Du, W. N. & Hou, Y. L. & Zhang, Y. L. & Zhao, Y. F. (2022). Portfolio Investment Strategy Based on Markowitz Model and Single Index Model. BCP Business & Management. 26. 981-994.

[5]. Lee, H. S., Cheng, F. F., Chong, S. Y. (2015). Markowitz Portfolio Theory and Capital Asset Pricing Model for Kuala Lumpur Stock Exchange: A Case Revisited. International Journal of Economics and Financial Issues, 2016, 6(S3) 59-65.

[6]. Sun, J. Y. (2022). The Application of Markowitz Model and Index Model on Portfolio Optimization. Advances in Economics, Business and Management Research, volume 215.

[7]. Zhang, Z. D. (2022). The Optical Portfolio of the Markowitz Model and the Index Model -Under Ten Stocks from S&P 500. Advances in Economics, Business and Management Research, volume 211.

[8]. Individuals Help & Support - Investment Information - AIA Hong Kong. (n.d.). Investment options information. Retrieved from: https://www.aia.com.hk/en/help-and-support/individuals/investment-information/investment-options-prices.html

[9]. Home Insurance. (n.d.). AIA Hong Kong to Launch Market-First Critical Illness Product “AIA Assemble” Singer/ Songwriter Terence Lam Stars in a New Ad to Share His Personal Experience about the Importance of Having Freedom to Make Choices. Retrieved from: https://www.aia.com.hk/en/about-aia/about-us/media-centre/press-releases/2023/aia-press-release-20230518

[10]. Ni, H. C. (2022). Application and Comparison of Markowitz Model and Index Model in Hong Kong Stock Market. Advances in Economics, Business and Management Research, volume 215.

Cite this article

Ye,Z. (2024). The Optimal Portfolio of AIA Group Limited’s Investment Insurance Products Based on Markowitz Model and Index Model. Advances in Economics, Management and Political Sciences,79,99-105.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. How Investment Insurance Protects Your Assets, InLife. (n.d.). How investment insurance protects your assets: InLife. Retrieved from: https://www.insularlife.com.ph/articles/how-investment-insurance-protects-your-assets-00000313

[2]. About Us | Asia’s Leading Insurance Company, AIA Hong Kong. (n.d.). We lead the industry with our forward-looking vision and superior protection and Financial Solutions. Retrieved from: https://www.aia.com.hk/en/about-aia/about-us

[3]. Haugen, R. A., Kroncke, C. O., & Zemon, R. B. (1977). The Predictive Power of the Markowitz Portfolio Model in the Insurance Industry. The Journal of Insurance Issues and Practices, 1(4), 90–102.

[4]. Cai, Z. Q. & Ding, Y. T. & Du, W. N. & Hou, Y. L. & Zhang, Y. L. & Zhao, Y. F. (2022). Portfolio Investment Strategy Based on Markowitz Model and Single Index Model. BCP Business & Management. 26. 981-994.

[5]. Lee, H. S., Cheng, F. F., Chong, S. Y. (2015). Markowitz Portfolio Theory and Capital Asset Pricing Model for Kuala Lumpur Stock Exchange: A Case Revisited. International Journal of Economics and Financial Issues, 2016, 6(S3) 59-65.

[6]. Sun, J. Y. (2022). The Application of Markowitz Model and Index Model on Portfolio Optimization. Advances in Economics, Business and Management Research, volume 215.

[7]. Zhang, Z. D. (2022). The Optical Portfolio of the Markowitz Model and the Index Model -Under Ten Stocks from S&P 500. Advances in Economics, Business and Management Research, volume 211.

[8]. Individuals Help & Support - Investment Information - AIA Hong Kong. (n.d.). Investment options information. Retrieved from: https://www.aia.com.hk/en/help-and-support/individuals/investment-information/investment-options-prices.html

[9]. Home Insurance. (n.d.). AIA Hong Kong to Launch Market-First Critical Illness Product “AIA Assemble” Singer/ Songwriter Terence Lam Stars in a New Ad to Share His Personal Experience about the Importance of Having Freedom to Make Choices. Retrieved from: https://www.aia.com.hk/en/about-aia/about-us/media-centre/press-releases/2023/aia-press-release-20230518

[10]. Ni, H. C. (2022). Application and Comparison of Markowitz Model and Index Model in Hong Kong Stock Market. Advances in Economics, Business and Management Research, volume 215.