Volume 175

Published on April 2025Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

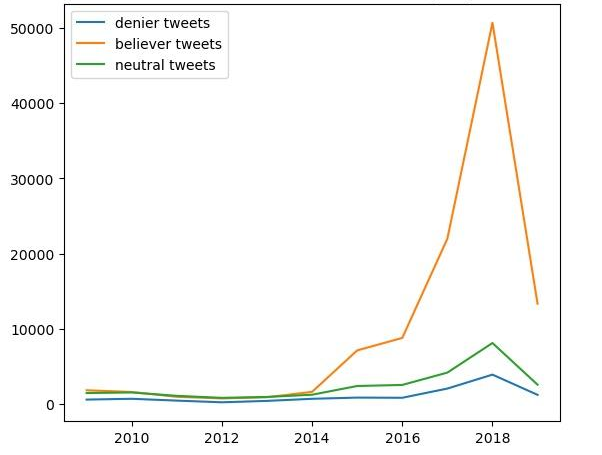

This study explores the factors that may influence public perceptions of climate change by linking various datasets from the United States. It aims to identify patterns among climate change deniers within social media data. The outcome variable in this project is the percentage of climate change denial (people denying that climate change is man-made) in each state on Twitter. Explanatory variables include GDP per capita, gender, and local temperature. The study utilises Python and R programming languages for descriptive analyses and statistical modelling based on large-scale digital trace data. Additionally, the analysis involves constructing both an ordinary least squares regression model and one-way and two-way fixed-effects models. Secondary datasets are collected to measure the variables, and these datasets are merged at the state level. The findings suggest that states with higher GDP per capita tend to have more people acknowledging on social media that climate change is influenced by human activity. However, the effect of GDP per capita on climate change denial is extremely small, and it does not correlate with the unmeasured fixed effects that influence the proportion of denial-related tweets. Moreover, gender shows no statistically significant correlation with climate change perceptions based on our data-driven research. On the other hand, higher local median temperatures in a state are associated with a greater likelihood of citizens forming personal beliefs that humans contribute significantly to climate change. This research can facilitate social media platform moderation and assist the government in identifying the geographic distribution of climate change denial, thereby fostering a more united community to combat climate change.

View pdf

View pdf

Long-standing gender stereotypes and structural injustices still restrict women's chances, development, and career goals. These prejudices, which have their roots in historical, social, and cultural standards, reinforce the exclusion of women from leadership positions in male-dominated industries. This scoping review integrates findings from 9 research studies to investigate how stereotypes impact women's job development across life stages and circumstances. Three main areas are examined in this analysis: the ideas and behaviors of gender stereotypes, their particular effects on professional paths, and the profound systemic factors that underlie these biases. Female stereotypes shape expectations of women's responsibilities, frequently preventing them from high-status professions and relegating them to caregivers. These misconceptions have a big influence on self-efficacy, professional progression, and wages. Their persistence is a result of a combination of intersectional variables like race and class, early childhood impacts, cultural traditions, workplace arrangements, and the economic undervaluation of women's contributions. This review also explores practical approaches, such as gender-sensitive educational reforms, open workplace practices, and cultural changes brought about by media and legislative actions. Reducing these obstacles not only enables women to realize their full potential but also pushes social and economic advancement by encouraging variety and creativity. This review highlights the necessity of consistent efforts to challenge stereotypes and provide environments that support the achievements of women.

View pdf

View pdf

Against the backdrop of an increasingly complex global economy and accelerating digital transformation, traditional accounting standards have revealed many limitations in adapting to emerging business models and market demands. This essay focuses on three core issues: the evaluation of intangible assets, the balance between fair value and historical cost accounting, and lease accounting reform. The current standards are more stringent in recognizing intangible assets, which makes it difficult to reflect the innovative investments of enterprises in financial statements truly. Although fair value accounting can enhance the relevance of financial information, its high volatility may lead to unstable financial conditions, while the lagging nature of historical cost accounting may lead to the undervaluation of assets. In terms of lease accounting, the rise of the sharing economy and the on-demand leasing model has challenged the applicability of traditional lease accounting methods, especially in terms of the accuracy of the valuation recognition of leased assets. In the future, accounting standards should find a proper balance between transparency and stability to meet the needs of globalization and the development of the digital economy, enhance the reliability and relevance of financial information, provide investors with a more accurate basis for decision-making, and promote the modernization of the accounting system.

View pdf

View pdf

This paper analyzes the financial performance and strategic positioning of NVIDIA, a leading player in the semiconductor industry. NVIDIA's market value has surged in recent years, largely driven by advancements in artificial intelligence (AI) and the increasing demand for high-performance computing. The company’s data center division has experienced substantial revenue growth year-on-year, fueled by the widespread adoption of AI-driven applications, cloud computing, and machine learning technologies. However, NVIDIA faces several challenges, including intense competition from industry rivals such as AMD and Intel, geopolitical risks—particularly concerning trade tensions with China—and regulatory scrutiny over its attempted acquisition of ARM. To assess NVIDIA’s competitive landscape, this paper employs both SWOT and PESTLE analyses. The SWOT analysis highlights the company’s strong brand reputation, technological leadership, and innovation capabilities while also identifying weaknesses such as its heavy reliance on GPU sales and supply chain vulnerabilities. The PESTLE analysis further examines external factors shaping NVIDIA’s operations, including regulatory developments, economic shifts, and environmental considerations. This comprehensive evaluation provides insight into NVIDIA’s market positioning and future growth potential in a rapidly evolving industry.

View pdf

View pdf

The rapid development of artificial intelligence (AI) technology has revolutionized creative production and challenged the traditional copyright protection framework in particular. This paper examines the legal implications of AI's ability to accurately mimic creative styles, focusing on the limitations of the creativity-expression dichotomy in addressing this emerging issue. By analyzing the current copyright law framework and its application to AI-generated works, this study reveals significant gaps in the protection of creative style in the age of AI. The study identifies two major challenges: the increasingly blurred line between creativity and expression, and the difficulty of applying the substantial similarity standard in style parody cases. To address these challenges, this paper suggests redefining creative style as a special form of expression worthy of copyright protection and experimenting with total concept and feel test approach in practice. These findings contribute to the theoretical development of copyright law and provide practical guidance for handling AI-related copyright disputes, while promoting balanced protection of creators' rights in the AI era.

View pdf

View pdf

Green and sustainable development has emerged as the central concern of economic transformation in nations all over the world due to the acceleration of global climate change and the growing importance of environmental degradation. Governments and businesses throughout the world have progressively come to recognize green finance as a crucial financial instrument for fostering sustainable development and green economic transformation. The purpose of this essay is to investigate the various ways that green financial policies affect agriculture's green development. This paper explains the meaning and framework of green financial policies, examines how to provide funds and financing channels for the green development of agriculture, encourages technological innovation and the transformation of production models, and enhances resource allocation and industrial chain construction through a variety of methods, including case analysis and literature research. According to the study, green financial policies—such as providing financial support, encouraging technological innovation, and encouraging the transformation of production models—play a significant role in advancing the sustainable development of agriculture. However, more work needs to be done in the future to ensure both high-quality and green sustainable development of agriculture.

View pdf

View pdf

Gender discrimination continues to persist in the workplace today, as evidenced by the 2021 median weekly earning of U.S. women amounting to 83.14% of men’s wages. This paper proposes and analyzes three strategies to address the gender bias and mitigate the wage gap in sexes: pay transparency, unconscious bias training, and fair salary determinants. Pay transparency can effectively highlight wage disparities and indirectly avoid wage gaps, but it does not directly offer a solution. Unconscious bias trainings are capable of raising awareness, though it may unintentionally reinforce certain stereotypes or provoke defensiveness. While pay transparency and unconscious bias trainings can establish short-term benefits, their limitations undermine their efficacy in the long term. Initializing fair salary determinants, the most sustainable solution, will be able to mitigate biases by evaluate employees based on objective criteria, including skill, effort, and responsibility, as suggested in the Equal Pay Act. By emphasizing the objectiveness in the workplace, impartial evaluations and transparent policies will form a fair work environment, especially for female workers to gain equal opportunities and fair compensation. Hence, this paper advocates for a most effective and plausible approach in establishing fair compensation and reduces workplace disparities.

View pdf

View pdf

This paper undertakes an in-depth and comprehensive exploration of Amazon's business model, its current development status and future trends. In the contemporary business research field, although numerous studies have been conducted on e-commerce and technology companies, there is a lack of a detailed and integrated analysis of how Amazon effectively combines its multiple business segments, such as e-commerce, cloud computing, digital media, and logistics to maintain a strong competitive edge. Through a combination of data analysis, case studies, and comparative research methods, this study reveals that Amazon's customer-centric approach, extensive resource network, and strategic partnerships are the keys to its success. This research provides valuable insights for other enterprises in formulating business strategies and helps predict the future development of the e-commerce and related industries, filling a significant gap in existing research.

View pdf

View pdf

As a barometer of the global economy, the price of gold reflects not only monetary policy and market risks but also the function of hedging and value preservation in the face of inflation and geopolitical turmoil. The driving mechanism and long-term value of the gold price are explored by qualitatively analyzing macroeconomic factors, supply and demand, and future trends based on existing literature and data. The main content of this essay is 1. Factors that affected the price change of gold. In detail, this research will explain how Federal Reserve policy, inflation and geopolitical factors can affect gold prices. 2. Supply and demand dynamics. This essay will examine the structure of gold supply (mining, recycling) and demand (jewelry, investment, central banks) and its impact on price. 3. Prediction of future—short-term rise and fall, long-term rise—trends of gold price according to the economic environment. The result shows that in the long term, gold is expected to maintain an upward trend in price due to its anti-inflationary and safe-haven attributes, especially against the backdrop of the current global economic and political instability.

View pdf

View pdf

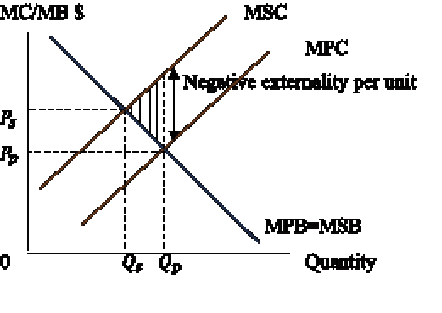

This paper examines the economic and game-theoretic approaches to transboundary pollution, focusing on the dynamics of international cooperation to address shared environmental challenges. Transboundary pollution, often framed within game theory as a "Prisoner's Dilemma," presents nations with a choice between cooperation for mutual environmental benefit or defection, risking greater harm. By analyzing public goods models, the study highlights the complexities of collective action, including the free-rider problem, where some nations may benefit from others' efforts without contributing. Through dynamic game-theoretic strategies, such as tit-for-tat and compliance mechanisms, countries can maintain long-term cooperation by aligning national and global incentives. Case studies of international treaties and regional agreements, such as the ASEAN Agreement on Transboundary Haze Pollution and the Danube River Basin Management Plan, demonstrate the practical application of these economic frameworks, showing how strategic incentives and shared responsibilities enhance collective environmental management. This paper underscores the need for economic tools and cooperative strategies to foster sustained global efforts in pollution control, benefiting both national and global environmental health.

View pdf

View pdf