Volume 176

Published on April 2025Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

This study investigates the effectiveness and innovative approaches of currency risk hedging strategies for multinational corporations through the case of The Walt Disney Company's response to Japanese yen depreciation risks. Research findings reveal significant limitations of traditional foreign exchange derivatives (forwards, futures, options) in managing long-term risks. Disney's adoption of the ECU Eurobond swap strategy emerged as a superior solution through its 10-year maturity matching, cost optimization (saving ¥105 billion in financing costs), and diversified risk dispersion. This strategy innovatively utilized composite currency instruments to hedge yen-denominated revenues against a basket of European currencies, not only locking in long-term exchange rate risks but also reducing the effective financing cost to 6.8% through U.S. tax deductions. The study demonstrates that multinational corporations should adopt a portfolio strategy combining short-term derivatives (futures, options) with long-term structural tools (currency swaps) to balance flexibility and stability. Priority should be given to maturity-matched financial instruments, and proactive exploration of composite currency product innovations is recommended. Policy suggestions include developing dynamic exchange rate forecasting models, strengthening macroeconomic monitoring, and leveraging policy windows to optimize financing structures. This research provides a structured solution for enterprises to address long-term foreign exchange risks and validates the critical role of financial instrument innovation in global operations.

View pdf

View pdf

With the development of international trade, multinational corporations plays a vital role in commercial activities. However, the multinational corporation’s profit-based mentality makes the forced labor problem really severe, which violates the workers’ basic human rights. Based on the principle of personal responsibility, corporate social responsibility and the balance of interests, multinational corporations have a necessary and irreplaceable responsibility to prevent forced labor issues and protect labor rights. Therefore, this article explores the causes of human rights violations by multinational corporations in international commercial transactions. Specifically, the complicated supply chains of multinational corporations make it difficult to supervise human rights violations. Meanwhile, they often evade their responsibilities by using independent legal personality irrational and failing to conduct their due diligence. Based on the analysis of these reasons, the article proposes to set up a well-developed system for piercing the veil of legal entities, improving supply chain’s transparency, and adopting uniform human rights assessment standards to avoid forced labor issues. In short, giving labor protection suggestions for multinational corporations,this article can help multinational corporations better fulfill their human rights protection obligations.

View pdf

View pdf

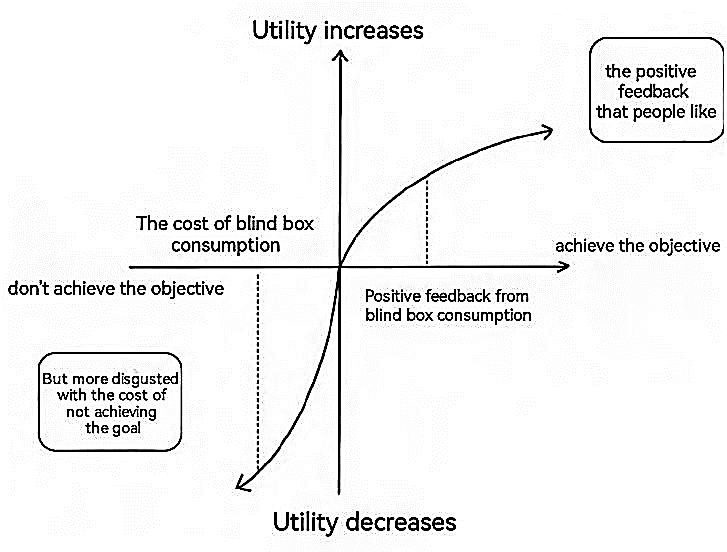

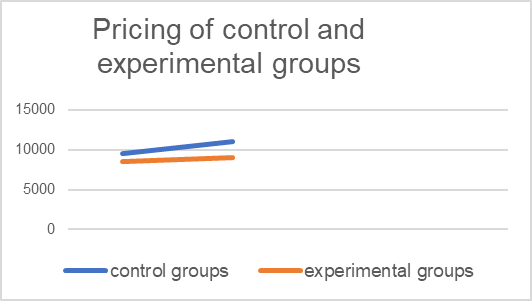

In recent years, with the rise of tide play culture, the blind box economy has developed rapidly, from a personal entertainment consumer product to a new marketing method. Meanwhile, the blind box economy has injected vitality into the consumer market and the investment market. This paper basing on behavioral economics theory, through the perspective of mental account, summarizes and analyzes the research on blind box consumption behavior as investment goods and personal entertainment, and discovers mental account is not only one of the main factors of blind box economy’s prosperity, but also a vital reason that results in different consumers under two behavioral decisions making similar irrational behaviors. Besides, in view of the limitations of the blind box market, this paper puts forward relevant suggestions. The research results of this paper deepen the exploration of mental account in blind box economy, and play a guiding role in the application of mental account theory in blind box economy in the future.

View pdf

View pdf

The global electric vehicle (EV) market is undergoing transformative growth, with 2023 sales surpassing 14 million units. This study investigates innovative EV marketing strategies through the lens of the 4Ps framework (Product, Price, Place, Promotion). By analyzing survey responses and social media comments, the study examines how brand positioning shapes consumer perceptions, evaluate the globalization-localization balance in marketing strategies, and assess cross-cultural variations in EV acceptance. Theoretical analysis serves as the primary research method. Findings reveal that localized customization enhances market penetration in emerging economies, while technological differentiation drives premium positioning in mature markets. The research provides actionable insights for automakers to align marketing strategies with evolving consumer needs and regulatory landscapes, ultimately advancing sustainable mobility adoption.

View pdf

View pdf

In the context of accelerating technological disruption and global energy transition, Elon Musk’s enterprises, including Tesla and SpaceX, have emerged as pivotal forces reshaping industries and macroeconomic dynamics. This paper investigates the impact of Musk’s business empire on the global macroeconomy, focusing on its role in driving structural changes in the energy, transportation, and aerospace sectors. The study aims to elucidate how Musk’s innovations reconfigure industrial landscapes, alter geopolitical economic power, and generate new growth drivers. The research employs a mixed-methods approach: case studies of Tesla and SpaceX are analyzed to assess their industry-level disruptions and uses some data for analysis. Primary data sources include corporate financial reports, industry datasets (e.g., International Energy Agency), and government publications (e.g., U.S. Bureau of Labor Statistics). Comparative analysis is utilized to contrast Musk’s vertically integrated model with traditional industries. The findings reveal four key outcomes: First, Musk’s industries reshape traditional industries. Second, geopolitical economic power shifts, raising resource-rich countries' status. Third, they have a huge impact on employment. Last but not least, Tech giants' vertical integration brings problems, urging an international governance framework.

View pdf

View pdf

The volatility of market conditions, environmental regulations, and technological advancement increases the challenges faced by the global steel industry, thus innovative strategies are needed to achieve sustainable growth. Baosteel's investment strategies, including technological innovations, financial risk management, and legal related issues, and that are subjected to China’s industrial policies and global trade relations, are discussed in this paper. A case study was conducted to analyze the adoption of automation alongside carbon emission reduction initiatives, and supply chain processes restructuring for sustainability and efficiency enhancing purposes. The research found that Baosteel minimizes exposure to financial risks such as volatility in the foreign exchange and stock markets through strategic investments and risk hedging. In addition, the company addresses trade and legal policy disputes and ambiguities through strengthened compliance and contract management. Baosteel’s business strategies serve as an example of how robust resilience and adaptability enable businesses to offset environmental and economic competitiveness while maintaining their supremacy. Using Baosteel as a case study adds to the discussions around corporate social responsibility and industry regulation by illustrating how big steel firms balance fiscal responsibility with technology development. Observations recommend improving R&D in green technologies, restructuring global trade negotiations, and diversifying investment approaches to maintain competitiveness over time. These findings will help those responsible for driving and managing change, as well as investment within the steel industry.

View pdf

View pdf

The open source strategy publicly discloses core code and technology, reducing the threshold for accessing resources and promoting fair development in exploring cutting-edge technology fields such as AI, thus bridging the intelligence divide. It means there is a strong link between it and the knowledge gap hypothesis. The open source strategy of AI companies is both a technology sharing behaviour and a marketing method, and changes in the company's marketing strategy reflect the transformative commercialisation trend in the field of AI. This paper explores DeepSeek's open source strategy from the perspective of the Knowledge Gap Hypothesis, and summarizes the impacts on different subjects and provides an outlook on the possibilities of future development. It is found that open source strategy markedly narrows the gap within those using DeepSeek. Additionally, both advantages and potential challenges exist for the company and even the whole society, and the shifts will in turn affect the company's future development strategies.

View pdf

View pdf

The global derivatives market is experiencing significant growth, and precise pricing of derivatives is essential for optimizing their financial utilization. However, conventional derivative pricing methodologies, such as the Black-Scholes option pricing model, are predicated on strict assumptions, rendering them challenging to apply accurately in practice. In light of advancements in financial technology, the application of machine learning techniques for derivative pricing has emerged as a prominent area of scholarly inquiry. This article seeks to conduct a comprehensive literature review of machine learning-based derivative pricing methods, aiming to assess the current state of academic research in this domain and to elucidate how existing literature employs machine learning approaches for derivative pricing. The paper will initially concentrate on the methodologies associated with machine learning in derivative pricing, utilizing specific studies as illustrative examples of practical applications. Subsequently, it will compile instances where machine learning techniques have been employed for hedging and risk management in relation to derivatives. Finally, the paper will provide a synthesis of findings and offer insights into the future trajectory of machine learning applications in derivative pricing. The machine learning pricing methodology, which eschews reliance on traditional models in favor of extensive historical data analysis, holds the potential for more accurate pricing of derivative products and represents a promising direction for future development.

View pdf

View pdf

Against the backdrop of global warming, green technological innovation has become the key to enterprises' green transition and sustainable development. Green finance supports this process by optimizing resource allocation and providing financial backing for green technological innovation. This study reviews the theoretical foundations of green finance and corporate green technological innovation, analyzes both the direct and synergistic effects of green finance and social capital, and further explores the mechanisms underlying their synergy. The findings offer theoretical insights and practical guidance for optimizing green finance policy design and improving the coordination mechanism between green finance and social capital.

View pdf

View pdf

The endowment effect is common in behavioral economics and consumer psychology, which has a wide range of applications in the consumer and trading market. At the same time, the endowment effect has different positive and negative impacts on various occasions. In life, as consumers, people are often affected by the endowment effect, thus carrying out some irrational consumption. In the market transaction, merchants will also be affected by the endowment effect, thus affecting the market. This paper mainly studies the different effects of endowment effect in other economic behaviors through two examples, it analyzes the case of experiments and the “Double Eleven shopping festivals” and conclude that the endowment effect has an impact on the trading market. Therefore, understanding the endowment effect and its mechanism of action can help people to identify life. At the same time, by analyzing the impact of the endowment effect, it is conducive to a more targeted response strategy, which is beneficial to both businesses and consumers.

View pdf

View pdf