1. Introduction

Blind box refers to a "toy" that is sold in series, in a box as a unit and does not know the specific style before opening but identifies the overall type, which cannot ensure that consumers get the products they want [1]. Blind box also captures the curiosity of consumers because of its “unknown” characteristic, and countless players have “entered the pit”. Meanwhile, investors see business opportunities, so the blind box gradually extends from the characters of animation or film and television works to other fields such as cosmetics, clothing, entertainment and so on, and has become a new marketing method [2]. According to the report on the current situation and future development trend of blind box industry in 2024-2029 issued by Zhongyan Puhua Industrial Research Institute, China's blind box market has grown rapidly from billions of yuan in 2019 to tens of billions of yuan in 2021, and maintained rapid growth. It is expected that by 2024, the scale of China's blind box market will be further expanded, which is expected to break through the 30-billion-yuan mark. At the same time, the causes of the hot blind box economy have attracted the attention and research of many scholars.

Mental account is that people unconsciously classify wealth into different accounts for management, and different mental accounts have different accounting methods and psychological calculation rules [3]. Mental account influences people’s decision-making. As for the popularity of blind box economy, many scholars used mental account theory to explore the causes and limitations of this phenomenon, and analyzed the consumption psychology of blind box consumers: For example, Han Xinyue explained the reasons for the hot blind box economy from the aspects of behavioral economics, experience economy, mental account and anchoring effect, available inspiration and cost doubling effect [4]. However, due to the unknowingness’ and uniqueness of blind boxes, blind box consumers can be divided into “investors” and “entertainers” according to their purchase motives. Therefore, blind box purchase decisions can also be divided into “investment behavior decisions” and “entertainment behavior decisions”. The existing literature primarily analyzes from the perspective of ordinary consumer psychology, or involves two types of behavioral decisions simultaneously, but fails to clearly distinguish and explore the different consumption motives behind blind boxes. As a result, the research findings are mixed, necessitating further collation and supplementation. Therefore, this paper classifies and summarizes the similarities and differences in the role of mental account in different behavioral decision-making in the relevant literature.

The results of this paper are conducive to further expanding the mental account theory to the field of blind box economy, and have reference significance for consumers and investors to understand the blind box, government departments to deepen the supervision of the blind box market, and to promote the sustainable and good development of the blind box economy.

2. The Development of Mental Account

At first, Adam Smith put forward the “economic man” hypothesis, that is, in economic activities, people's behavior is rational and the goal is to maximize their own interests. To achieve that goal, “economic man” will maximize profits at the smallest cost possible. But with the development of economics, some scholars have found that many of people's economic activities in reality cannot be well explained by traditional economics. After a long period of development, behavioral psychology gradually emerged and eventually developed into behavioral economics in the 1970s.Behavioral economics uses the theoretical results of psychology to prove the limitations of the “economic man” hypothesis: there are many cognitive biases or distortions, that is, people are irrational [3].

Mental account theory is one of the important components of behavioral economics. The concept of mental accounting was first introduced in 1980 by Chad Thaler, a psychology professor at the University of Chicago. He posited that the “mental accounting system” present in individuals’ subconscious is a potential explanation for why people are influenced by “sunk costs” in their consumption behavior. In 1985, Thaler formally introduced the theory of mental accounting, positing that individuals, families, and even large enterprise groups all possess explicit or implicit mental accounting systems. When making economic decisions, these systems often adhere to an underlying mental accounting rule that contradicts the principles of economics. The way these systems keep mental accounts differs from the mathematical and economic accounting methods, often influencing decisions in unanticipated ways, leading individuals to violate the simplest of rational economic principles.

3. The Impact of Mental Account on Blind Box Consumption

3.1. The Impact of Mental Accounts on the Blind Box as an Investment

Blind box investors may be individual buyers, through various means of blind box marketing, they carry out secondary sales on e-commerce platforms such as salted fish and Taobao. At this time, the price of blind boxes often far exceeds their actual value in a short period of time, so that these investors can make huge profits from them. What’s more, these individual investors often buy a small amount, so there are some similarities with the psychology of ordinary consumers. Because of the wonderful pricing theory of blind boxes, for example, the price of a blind box is equivalent to the price of a cup of milk tea, so, Blind box consumption is classified into a mental account acceptable to consumers, which leads consumers to misjudge the rationality of the price of blind boxes. Driven by the investment psychology that hidden money can be resold to obtain multiple income, the psychological purchase cost of blind boxes is further reduced, and the mental account cannot operate reasonably, so it often leads to the purchase behavior exceeding the psychological initial budget [5].

The main investor of the other kind of blind box is the blind box manufacturer. Such investors are not only influenced by mental accounts in their investment decisions, but also need to fully consider the impact of mental accounts on ordinary consumers during the production of blind boxes. Therefore, the influence they experience is twofold. The impact of blind box manufacturers' own mental accounts is not much different from the role of mental accounts in general investment decisions. That is, investors treat each investment as an independent mental account, but often overlook the interconnection between these investment decisions, which often leads to negative consequences in their investment decisions [6]. Regarding another impact, since different consumers have varying judgments on the value of money within different mental accounts, there exist significant differences in consumption decisions based on these accounts. Therefore, investors will strive to expand the range of blind box products, devise more innovative features, and ensure that these products can be categorized into one or multiple pre-existing mental accounts with substantial amounts [7].

3.2. The Impact of Mental Accounts on Blind Boxes as Entertainment

The impact of mental accounts on blind box ordinary consumers is multiple. To a large extent, it is the diverse influences that have contributed to the emergence of the “boom” in blind boxes.

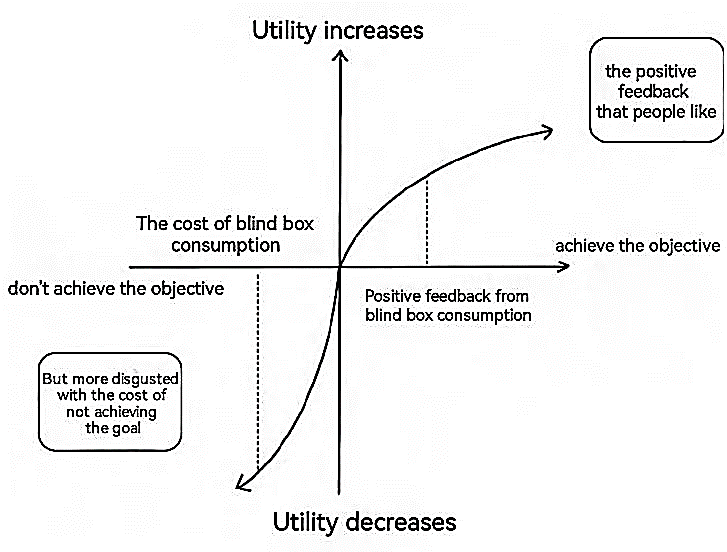

First of all, for blind box ordinary consumers, mental account theory and value curve function can explain the source of sufficient purchase desire of their consumption behavior. As shown in figure 1, consumers are more disgusted with not achieving the purpose of purchase than achieving the purpose of purchase [5]. This is in line with the behavior that consumers are obsessed with getting their favorite blind box and are willing to constantly increase the budget in the mental account. Besides, Because the mental account division of blind boxes is relatively vague, there is no separate mental account division, and there is no preset budget, blind boxes are often purchased excessively. In short, the basic characteristics of non-substitutability of mental accounts lead to some irrational decisions [5].

Figure 1: Blind box consumer risk utility function [1].

Secondly, the irreplaceable nature of mental accounts is not entirely rational. Under the blind box consumption mode of hedonism, the mental account will change when consumers are hesitant to buy transactions, so that consumers can blur the concept of hedonic consumption and find reasons for their own consumption, thus producing irrational consumption [8].

Thirdly, consumers put different goods into different mental accounts, and each account has different “prices”, when the “price” is determined by the utility of the commodity rather than the judgment of risk and choice, consumers will tend to choose their favorite account subjects for consumption. Blind boxes are often incorporated into consumer favorite accounts, so even if the risk is higher, the current effect of blind boxes is more prominent, which leads to excessive purchases of blind boxes by consumers [1].

Fourthly, in the era of experience economy, consumers pay more attention to the improvement of quality of life and emotional satisfaction, and the motivation to buy goods partly comes from the additional benefits brought by goods. According to the mental account theory, consumers do not always rationally calculate the actual value maximization of commodities when making decisions, while the multiple emotional experiences brought about by blind box consumption meet the psychological tendency of consumers to maximize pleasure as the trading goal, so consumers are more likely to have consumption impulses to blind boxes [7]. Taking the popularity of bubble Mart as an example, blind boxes transform consumers' consumption needs from material needs to spiritual needs through a series of marketing activities that evoke consumers' herd mentality and show off mentality, thus contributing to irrational consumption behavior [9]. Generally speaking, the hedonism and curiosity brought about by the blind box itself and the miscalculation of mental accounts are the two causes of irrational consumption behavior.

4. Limitations and Suggestions of Blind Box Market

Although the blind box economy is booming at present, there are inevitably some problems to be solved urgently.

First of all, the quality of products in the market is uneven. Due to the unique purchase mechanism of blind boxes, that is, they cannot view internal products before payment, some illegal businesses often cut corners in the production of blind boxes, resulting in “less weight” of blind box products, or fool consumers by detaining products in warehouses.

Secondly, excessive marketing. Marketing can be said to be an important promoter of the hot blind box economy. Through short video platforms such as Xiaohongshu and Douyin, businesses can easily trigger the curiosity hunting and herd psychology of consumers, especially young people. The price of blind boxes can often reach an incredible level under the influence of marketing, such as bubble mart's Pan God Christmas hidden money, which originally cost 59 yuan, but now the free fish has sold to a high price of 2350 yuan, up 39 times crazily [10].

Thirdly, consumer rights and interests are difficult to safeguard. The production cost of the blind box is not high, and the process is not difficult, so there will be many bad businesses piracy infringement, and consumers cannot ensure that the blind box is authentic and qualified before purchasing, and once the box is opened, businesses can refuse to replace or return the goods on the grounds of "blind box damage", which makes it difficult for consumers to safeguard their legitimate consumer rights and interests.

To solve these chaotic phenomena, the society cannot rely solely on the market for self-regulation, but on the joint efforts of the state, the market and consumers. The legislature actively promulgated relevant laws and regulations, law enforcement departments strengthened market supervision, cracked down on illegal phenomena and strictly enforced law; strengthen social science popularization, urge enterprises to take the initiative to assume social responsibility, and safeguard corporate image and corporate credit; Consumers should strengthen their awareness of reasonable consumption, not blindly follow the trend to buy blind box products beyond their ability, reasonably set up mental accounts, but also actively safeguard their legitimate rights and interests, and become the “third line of defense” of market supervision.

5. Conclusion

Based on the different consumption motives of blind box consumption, this paper analyzes the role of mental account in the consumption behavior of blind box investors and ordinary consumers: For blind box investors, the role of mental accounts is twofold. On the one hand, investors will be affected by their own mental accounts. Although mental accounts are set up separately, it is often easy to ignore the links between different blind box investments. On the other hand, the preference of consumer mental accounts affects investors' decisions on blind box production, which makes them tend to invest in the production of multi-functional blind boxes. For blind box ordinary consumers, the impact of mental accounts is more diversified, which can be roughly reflected in four aspects: consumption motivation, consumption choice, consumption tendency and consumption value. In addition, this paper also lists the existing limitations of the blind box market, and puts forward suggestions for path optimization.

The research of this paper is mainly based on theoretical analysis, but it lacks the support of specific micro data. In the future, with available data, researchers can conduct quantitative research on the amount of mental accounts set up by consumers through further data surveys, establish a model, and obtain more accurate research results on the impact of mental accounts on the consumption behavior of blind box consumers.

References

[1]. Zhang Wenjie. (2023). Analysis and path optimization of “blind box boom” from the perspective of behavioral economics. Industrial Innovation Research, (05),88-90.

[2]. Wang Yiwen. (2022). Consumer psychology exploration and market problem analysis under blind box economy. Time honored brand marketing, (13),33-35.

[3]. Jiang Tao. (2024). Behavioral economics development research. Economist, (03),31-32.

[4]. Han Xinyue. (2019). The mystery of blind box economy from the perspective of behavioral economics. Shangxun, (27),117-118.

[5]. Zhang Geng & Hu Shaolong. (2010). A review of mental account theory. Shandong Textile Economy, (02),43-46.

[6]. Guo Hongman. (2017). Research on investment decision-making behavior based on mental account theory. Modern marketing, (01),109.

[7]. Ming Hui Sun. (2022). Behavioral economics analysis and optimal development path of Book Blind box marketing. Publishing and distribution research, (08),20-26

[8]. Yu Xueni. (2022). Research on blind box consumption behavior decision-making based on Behavioral Economics. China mercantile, (20),58-60.

[9]. Shi Yi. (2022). Bubble mart, which runs a “mental account”. Managers, (04),56-58.

[10]. Hu Xiaoyuan. (2019). Up to 39 times, “investment blind box” is emptying many people’s wallets. modern commercial bank, (22),89-91.

Cite this article

Shen,S. (2025). Comparative Analysis of Blind Box Consumption Behavior Decision-Making from the Perspective of Mental Account. Advances in Economics, Management and Political Sciences,176,16-20.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang Wenjie. (2023). Analysis and path optimization of “blind box boom” from the perspective of behavioral economics. Industrial Innovation Research, (05),88-90.

[2]. Wang Yiwen. (2022). Consumer psychology exploration and market problem analysis under blind box economy. Time honored brand marketing, (13),33-35.

[3]. Jiang Tao. (2024). Behavioral economics development research. Economist, (03),31-32.

[4]. Han Xinyue. (2019). The mystery of blind box economy from the perspective of behavioral economics. Shangxun, (27),117-118.

[5]. Zhang Geng & Hu Shaolong. (2010). A review of mental account theory. Shandong Textile Economy, (02),43-46.

[6]. Guo Hongman. (2017). Research on investment decision-making behavior based on mental account theory. Modern marketing, (01),109.

[7]. Ming Hui Sun. (2022). Behavioral economics analysis and optimal development path of Book Blind box marketing. Publishing and distribution research, (08),20-26

[8]. Yu Xueni. (2022). Research on blind box consumption behavior decision-making based on Behavioral Economics. China mercantile, (20),58-60.

[9]. Shi Yi. (2022). Bubble mart, which runs a “mental account”. Managers, (04),56-58.

[10]. Hu Xiaoyuan. (2019). Up to 39 times, “investment blind box” is emptying many people’s wallets. modern commercial bank, (22),89-91.