1. Introduction

The early 2000s was the beginning of the Era of E-commerce in China. Driven by technological advancements and so-called “Second Internet Boom” in 2000s to early 2010s, Chinese domestic tech companies such as Alibaba's Taobao and JD.com emerged and quickly gained significant shares in this emerging market. They provide a convenient way for businesses and individual consumers to engage in online transactions and trades. In 2010 (less than a decade after JD.com was founded) it sold CNY513.1 billion of goods online, about 3.3 percent of all retail sales in China in 2010 [1]. As the e-commerce industry flourished, Chinese e-commerce companies joined the ITFIN (internet finance) industry and began to offer credit services as a strategic move to enhance their business ecosystem, including operating “P2P” lending platforms or licensed subsidiary microloan companies. The urgent need of accessing to capital and diversification of risk has made asset-backed securities (ABS) enter the picture.

Asset-backed securities are financial instruments that allow companies to convert their underlying assets, such as receivables or future cash flows, into tradable securities, and, therefore, can be sold to investors in order to provide companies with upfront capital. This act optimizes the capital structure! of companies by transferring the credit risk associated with the assets to investors

The Chinese asset-backed security market's evolution can be traced back to the late 1990s. The Chinese government recognized the potential of ABS soon after the financial market development in China was initiated. The very first attempt at asset securitization occurred in the early 2000s. Over the past decade, the government has actively promoted the development of asset-backed security markets to provide diversified financing channels for companies and support economic growth. China’s ABS market has witnessed significant growth since 2017.

The issuance volume of China’s asset-backed security from 2017 to 2022 has reached an average annual issuance of roughly USD355 billion/CNY2.5 trillion. The outstanding balance of securities was about USD 670 billion/CNY4.7 trillion at the end of 2022 [2]. However, due to the immaturity of the Chinese financial market/industry, risks are present that can potentially impact the performance and stability of ABS in the Chinese e-commerce market, and the goal of our research is to identify and analyze those risks

This paper will focus on JD.com, one of China's largest e-commerce companies. We examine the ABS initiatives undertaken by JD.com and the associated risks of it. This gives us an insight into broader challenges to and opportunities of the Chinese e-commerce ABS market.

2. Basic Information about JD, JD Finance, and Jingdong Baitiao

JD was established in 1998 to market household appliances, health food, etc. It sells wholesale and retail food, health food wholesale, sporting goods, general merchandise, textiles, clothing, daily necessities, etc. In 2004, the company entered the e-commerce industry. It rapidly occupied the consumer market with extremely fast logistics speed and personal after-sales service, and continued to expand, at a rate of 200% per year for the next six years; JD became a giant in e-commerce, ranking 88th in the world's top 500 in 2016. On the whole, JD has a large market share and a high market position in the current rapidly developing B2C market [3]. In recent years, the company has continued to expand its business scope, so it launched JD Finance. Then, we will introduce the relevant information about JD Finance and the launch of "Jingdong Baitiao" ABS from the perspective of the company's financial ability.

JD Finance is a personal financial business brand of Jingdong Digital Technology Group, which has become the personal financial decision-making platform chosen by many users. JD Finance began to operate independently in October 2013 and has established ten business segments - corporate finance, consumer finance, wealth management, payment, crowdfunding, insurance, securities, rural finance, fintech, and overseas business, realizing the dual layout of corporate finance and consumer finance, and realizing internationalization. At the same time, JD Finance is actually a service for JD, providing financial support and help for the development of JD. "Jingdong Baitiao" is the first domestic Internet consumer financial product issued by JD Finance in 2014, allowing users to enjoy the consumption experience of "consumption first, payment later, real-time approval, and installment at will." Take consumer demand as the center, accompanying the life growth of young consumers. This way stimulates consumer consumption and stimulates the company's sales, which is self-evident for the company's growth, but "Jingdong Baitiao" is actually accounts receivable, which has some risks, such as not paying accounts, etc. What’s more, JD is an asset-heavy company, and it needs to have enough funds in hand[4]. JD Finance proposed "Jingdong Baitiao" ABS, a flexible, fast, and low-cost financing method [5], so that these receivables can be quickly recovered for the further operation and development of the enterprise. From the ratio analysis, we can briefly know why JD implemented the “Jingdong Baitiao” ABS (Ratio analysis in the appendix). In the following paper, we will discuss “Jingdong Baitiao” ABS in detail.

3. Introduction of Jingdong Baitiao Asset Securitization Project

Compared with traditional asset securitization, the biggest characteristic of Internet consumer finance asset securitization is the difference between sponsors and asset pools. The securitization of Internet financial assets can be understood as taking the consumer financial assets generated in the Internet platform as the basic assets, securitizing them, selling securities in the financial market, and issuing them. Therefore, in the asset securitization of Jingdong Baitiao, the characteristic is the Internet environment of JD, and the core is the consumer finance generated by Jingdong Baitiao as the basic asset. For JD, the financing cost is lower than that of bank loans, which can develop financing channels. At the same time, due to the small amount, scattered, and large number of consumer finance loans, which can generate future cash flow income, the basic assert of JD is also suitable for the homogeneous basic asset of asset securitization. Due to its characteristics, the asset securitization of Internet consumer finance assets is developing rapidly.

3.1. Overview of Special Plans

Jingdong Baitiao ABS products were launched on September 12, 2015 and were listed on the Shenzhen Stock Exchange after its launch. The underlying assets of Jingdong Baitiao ABS products are derived from the receivables generated by consumers when consumed in JD through installment payment. As the issuance structure of each issue of Jingdong Baitiao ABS is roughly the same, almost all continuing the characteristics of the first phase, the duration of the first phase of Jingdong Baitiao asset securitization expires in 2017, and the allocation of all principal and interest has been completed, and the relevant data are relatively complete. Therefore, this paper selects the special plan of the first phase of Jingdong Baitiao, namely the issuance plan of Jingdong Baitiao 2015-1, and the issuance amount of this period is 800 million RMB.

3.2. Transaction Structure

The establishment of accounts receivable securitization products requires multi-party participation. The product mainly involves the participation of multiple parties, such as the original rights holders, custodians, plan managers, asset service agencies, and registered custodians [6]. The participants of JD Group's major accounts receivable securitization projects are in Table 1.

Table 1: Participants of Jingdong Baitiao 2015-Phase 1 project

Organization Name | Organization Description |

Beijing Jingdong Century Trade Co., LTD | it is the parent company of Jingdong Finance, whose main business is wholesale and retail |

Huatai Securities Asset Management Co. LTD | The business scope includes securities asset management business and public offering securities investment fund management business |

Industrial Bank Co. LTD | Joint-stock commercial bank |

China Securities Depository Clearing Co., LTD. Shenzhen branch | The main business is to provide safe and efficient securities registration and settlement services |

United Credit Ratings Limited | Engaged in securities market credit rating business |

Source: Jingdong Baitiao asset securitization raising book

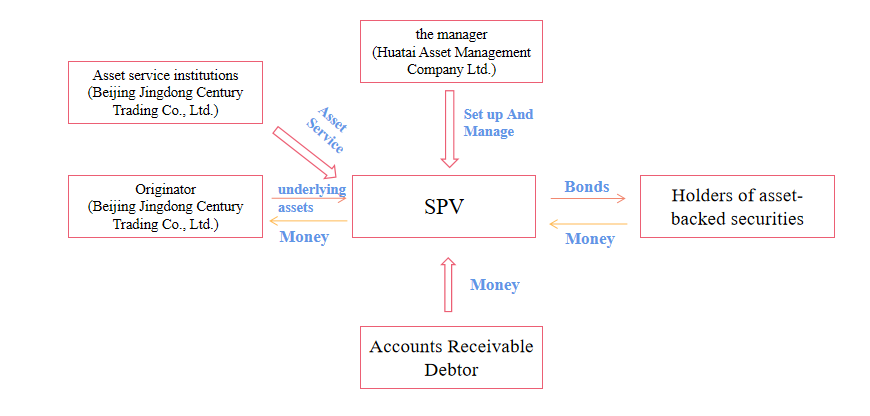

As shown in Figure 1, the original rights holder will form the qualified consumer credit assets in Jingdong Baitiao into the underlying asset pool. Second, entrusted by the original owner, the plan manager will initiate these products on the Shenzhen Stock Exchange and be responsible for the management of securitization. After the issuance of securitization products, the original equity owner and the plan manager sign a contract agreement. At this time JD Economic and Trade from the "original equity owner" into the "asset service agency", responsible for the custody of the underlying asset information. Finally, the proceeds will be distributed to the holders of the asset-backed securities under the special program as agreed in the contract [7].

Figure 1: Structure of Jingdong Baitiao asset securitization transaction

Source: Jingdong Baitiao asset securitization raising book

3.3. Circular Purchase Structure of Underlying Assets

In general, the underlying asset of asset securitization is the asset owned by the original equity holder and can generate foreseeable cash flow in the future. In this case, as the underlying asset is the consumer credit of the e-commerce platform JD.

In the asset pool of this asset securitization project, the amount of accounts individual receivables is generally between 5,000-15,000 yuan, and due to the large number of consumers, the number of accounts receivable is also large, among which there are 670 million deals in the pool, and the corresponding principal of Baitiao accounts receivable is 800 million yuan. As shown in Table 2, according to the term, the underlying assets are divided into four categories, and the corresponding principal of Baitiao accounts for 21.04%, 9.43%, 40.78% and 28.76%, respectively [8].

Therefore, these accounts receivables have a high degree of dispersion, and the maturity period is different. Meanwhile, the duration of the special plan is fixed. Finally, it will lead to the “maturity mismatch” problem. But the circular purchase structure can solve this problem very well.

Table 2: Distribution and proportion of basic assets of JD IUS in Phase 2015-1

Basic asset category | Principal (million) | proportion (%) |

3 months | 168.32 | 21.04 |

6 months | 75.44 | 9.43 |

12 Months | 326.24 | 40.78 |

24 Months | 230.00 | 28.75 |

800.00 | 100 |

Source: Jingdong Baitiao asset securitization raising book

The main difference between static and dynamic asset pools is whether the assets in the underlying asset pool change across the plan duration [9]. The traditional static asset pool is closed during its existence. During the existence, the assets in the asset pool will not go out, and the external assets also cannot enter the pool. For asset securitization projects with a circular structure, part of the underlying assets will expire during the planning period. The money recovered due to the maturity will not be directly distributed to the securities holders, but be used to buy new underlying assets, so that the underlying assets that meet the standards (these standards are in the appendix) will continuously enter the asset pool. This means that while some of the assets of the underlying asset pool will expire during the duration, the overall asset size will not change much.

The cycle purchase structure of the Jingdong Baitiao special plan is divided into cycle period and a purchase period [10]. The first 12 months is a dynamic cycle period. During this period, the corresponding receivables should be screened to join the asset pool according to the regulations. The screening rules include no more than 3 times overdue, and the overdue days should not exceed 25 days, etc. After 12 months, there is the distribution period, where new basic assets will not be purchased into the pool, and the principal and interest of the priority and sub-optimal investors will be distributed every month according to the contract. After the completion of the principal of the investors is paid off, the remaining income will be distributed to the secondary investors, namely JD itself.

3.4. Internal Credit Enhancement Method

In this project, there is no external credit enhancement measures, which mainly include joint debtors, guarantee guarantees, balance replenishment commitments, and liquidity support commitments. The default risk is only shared by internal asset classification. Internal credit enhancement often enhances the credit level of bonds through the hierarchical design of asset securitization products. Jingdong Baitiao asset securitization project mainly adopts the structure classification of securities products and the internal credit enhancement mode of credit trigger mode.

(1) Securitized product of securitization products

Jingdong Baitiao has set the priority 01, priority 02, and secondary levels in the structure of asset-backed securities projects from 2016-1 to 2017-16. Among them, JD Group holds all the subordinated bonds [11]. When the principal and income of the bond are distributed, the priority to repay the 01 bond and then the principal and interest of the 02 bond, and finally, hold the remaining income by themselves. The proportion of stratification is shown in Table 3.

Table 3: Securities Classification of Jingdong Baitiao in Phase 1,2015-1

Interest rate | Amount raised | Duration | Principal and interest repayment methods | Rate | |

Jingdong Priority 01 | 5.10% | 600m | 2 | Interest is paid quarterly in the revolving period, and interest is paid through the distribution period | AAA |

Jingdong Priority 02 | 7.30% | 104m | 2 | Interest is paid quarterly in the revolving period, and interest is paid through the distribution period | AA- |

Jingdong secondary | 96m | 2 | All remaining income will be obtained after the repayment of priority principal and interest in the distribution period |

Source: Jingdong Baitiao asset securitization raising book

(2) Credit trigger mechanism arrangement

The credit trigger mechanism refers to the determination of relevant accelerated liquidation events. In 2015-1, the average annualized return rate of the portfolio for three consecutive months was lower than 2.9%, and the non-performing asset rate exceeded 6% for five consecutive working days during the trust period. When the accelerated repayment event occurs, the underlying asset pool in the cycle period no longer buys the assets that meet the pooling standards but is transferred to the special plan account to prepare for the relevant repayment behavior. After paying the relevant taxes, the funds in the account will repay the principal and interest to the investors according to the priority level of the bond.

4. Risks

4.1. Credit Risk of Underlying Assets

Debtor default risk refers to the risk that the debtor is unable or unwilling to repay the debt, resulting in default. In terms of impact, the credit risk of the debtor is the main factor affecting the quality of Asset-Backed Securities [12]. It is the primary risk of the underlying assets of the Jingdong Baitiao accounts receivable asset-backed special plan. This is because, from the operation mechanism of Jingdong Baitiao ABS products, it can be seen that when debtors choose to default, it directly affects the cash flow of the underlying assets, thereby impacting the interests of investors.

Based on historical data provided by JD Century Trade, as the balance of Baitiao accounts receivable increases, the amount of overdue payments and non-performing assets also increases. Still, the proportion of overdue and non-performing assets in the total Baitiao accounts receivable balance tends to stabilize. As shown in Table 4, as of June 30, 2021, the balance of Jingdong Baitiao's accounts receivable was 70 billion RMB, an increase of 19% from the end of 2020. The non-performing loan ratio was 0.43%, and the overdue rate was 1.15%. In terms of overdue recovery, the recovery rate for overdue payments within 30 days is higher, but the recovery rate decreases as the number of overdue days increases.

Table 4: Jingdong Baitiao accounts receivable balance, Non-performing loan ratio and Overdue rate from 2018 to 2021.6

Year | Balance of Jingdong Baitiao Accounts Receivable (RMB) | Non-performing Loan Ratio (%) | Overdue Rate (%) |

2018 | 35 billion | 0.48% | 1.56% |

2019 | 44 billion | 0.47% | 1.93% |

2020 | 59 billion | 0.51% | 1.24% |

2021.6 | 70 billion | 0.43% | 1.15% |

Data: Jingdong Baitiao Asset-backed Commercial Paper Offering Circular

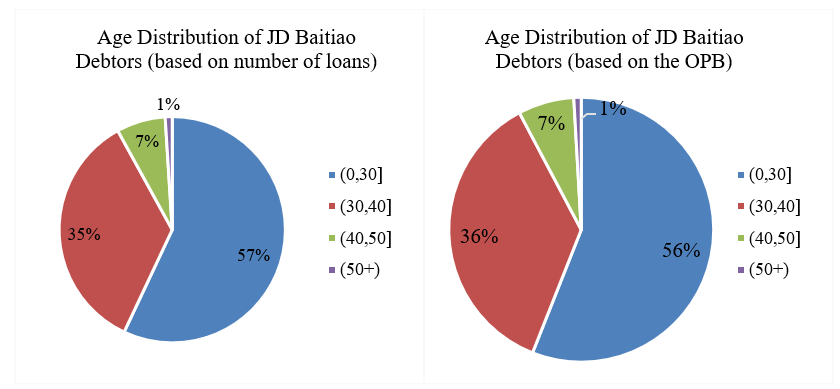

Unlike traditional financial institutions, the target customers of Jingdong Baitiao (a credit service provided by JD.com are mainly concentrated in the low to middle-income group According to the prospectus (see Figure 2), in Jingdong Baitiao installment business, 92% of the debtors are under the age of 40. The weighted average age of the debtors is 31 years. In terms of the number of loans and the opening balance, debtors under the age of 30 (including 30 years old) account for more than half, making them the main target audience of Jingdong Baitiao.

Figure 2: Age Distribution of JD Baitiao Debtors

Data: JD BaiTiao Asset-backed Commercial Paper Offering Circular

In order to establish a dominant position in the highly competitive internet consumer finance industry, Jingdong Baitiao has lowered the customer qualification threshold. The income level of the niche customer group is unstable, and their consumption needs and abilities may not be consistent. If the loan amount exceeds their ability to repay, it may lead to default risk.

4.2. Prepayment Risk of Debtors

Early repayment means that the debtor pays the debt before the debt is due because early repayment will be transmitted to the security end, which has a variety of effects on the return and risk of the security. The debtor's early repayment will affect the future cash flow plan of ABS products, further affect the pricing of ABS, and affect the coupon period. If the transaction structure and security payment plan are not properly designed, early repayment can lead to cash flow disruption and thus, credit risk. In the case of a large spread between the asset side and the security side, early repayment will reduce the excess spread formed, thus reducing the credit support of the asset pool for the senior securities, and will also have an adverse impact on the excess return of the secondary securities.

According to the statistics of China Asset Securitization Analysis Network, the Jingdong hundred ABS products analyzed in this paper belong to the category of personal consumption loans in enterprise asset securitization products. According to the statistics in table 5, the early repayment rate of personal consumption loans is 11.6%, which is the highest early repayment rate among asset securitization products. Jingdong Baitiao users can enjoy a delayed payment period of up to 30 days or a maximum of 24 installments, and can also repay in advance. If there is a 30-day late payment period, no interest will be charged for early repayment. If repayment is made in installments, interest is calculated based on the rate of the installment type and the number of installments remaining.

Table 5. Annualized early repayment rate of asset securitization in China in 2019

Loan Categories | Early repayment rate (%) |

Personal Auto Loans | 2.7% |

Housing Mortgage Loans | 8.1% |

Small Loans | 5.7% |

Personal Consumer Loans | 11.6% |

Factoring financing | 2.2% |

Data: CNABS

When Jingdong Baitiao users make early repayments of interest or principal on their debts, these funds are deposited into a special account[6]. The plan manager then utilizes these funds for the revolving purchase operation by acquiring consumer loan assets from the original equity holder, which is JD.com, and adding them as new assets to the pool. However, due to the possibility of relaxed quality standards for these new pool assets, there is a risk of default associated with the revolving purchase process.

4.3. Risk of Misleading Information Disclosure

Compared to asset securitization in other industries, the securitization of Internet consumer finance assets differs significantly in terms of transaction structure and operating mechanisms. In Jingdong Baitiao ABS products, the involved participating institutions include Huatai Securities, Zhengdong Financial Holding, and the joint credit rating agency, among others. Although these entities are interconnected, they are not mutually exchangeable. Therefore, there may be risks of misleading information disclosure by each party [13].

In addition, for the sake of their own interests, various participating institutions may deliberately conceal or misreport information. For example, JD Century Trading Company, as the original equity holder, intentionally conceals unfavorable information to improve financing efficiency. The result of this behavior can only magnify the credit risk associated with the product.

4.4. Risks Arising from Insufficient Independence of SPV

The risk isolation mechanism is a crucial design in the securitization of receivables, and it relies on a Special Purpose Vehicle (SPV). The SPV is an entity specifically established for this purpose. Due to the unique nature of asset securitization, the original equity holder sells the underlying assets to the SPV, which then converts them into securities and sells them. The proceeds from the sale are then transferred to the original equity holder to compensate for the cost of acquiring the underlying assets. Through risk transfer, even if the original equity holder faces bankruptcy, the issued securitized products remain unaffected. The risk isolation mechanism greatly ensures the security of securitized products and not only reduces the cost of securitization and resolves financing difficulties but also fundamentally maintains the independence and security of the assets [14].

However, in the securitization of receivables in Jingdong Baitiao, the risk isolation mechanism has some differences. Specifically, the SPV is not an independent third-party institution but a special asset management plan established by the plan manager. Therefore, there are certain risks because this special asset management plan is not a trust entity in legal terms and cannot truly obtain ownership of the underlying assets. Furthermore, JD Century Trading not only acts as the original equity holder but also as the asset servicing entity. By playing these two roles in the securitization process, the independence is greatly reduced. Although JD Century Trading transfers the underlying assets to the SPV, the lack of independence in the SPV prevents the complete isolation of risks.

5. Ways to Improve the Implement of ABS

5.1. Control Credit Risk

Credit risk is the biggest problem facing such ABS products. Controlling credit risk is very beneficial to both investors and Internet financial platforms. With the continuous development of digital information technology in recent years, it has become possible to use big data to comprehensively control credit risks. As one of the largest online shopping platforms in China, JD's upstream and downstream user groups can provide a large amount of data. The construction of the big data platform can better help JD.com make a preliminary judgment on the user's credit before the consumer credit is issued. Round-the-clock supervision of users during the loan term, assessing their intention to repay. After the loan is completed, doing a good job in the recovery of principal interest can greatly reduce the possibility of risks in JD's financial business [15]. In addition, this also shows the importance of big data to the risk control of Internet consumer finance, laying the foundation for the quality of basic assets for subsequent financing. What we want to see is that JD's use of big data information is within a reasonable range, which is worth learning and adopting by other Internet consumer finance platforms. By building a full-process big data system, building a database built around the upstream and downstream of the platform, and using a scientific evaluation model to reasonably analyze the user's credit level to minimize the risk of credit asset default [6].

5.2. Improve Information Disclosure Mechanisms

A good information disclosure mechanism can greatly improve transaction efficiency, reduce transaction risks, and promote the further development of the trading market. The fundamental reason is that if exists asymmetric information, moral hazard (such as the insurance market) and adverse selection (such as the lemon market) will come up frequently [16]. This problem will weaken investor confidence and reduce transaction efficiency. Internet consumer finance platforms should classify the risks of their financial products, disclose the quality information of underlying assets or portfolio assets to investors, and regularly disclose relevant dynamic information to investors. These measures can effectively enable investors to make reasonable expectations based on the above information. As a result, we can reduce the problem of information asymmetry. And promote the benign development of the investment market.

5.3. Protect Personal Privacy

While improving the above two points, we should also pay attention to the protection of consumers' personal privacy. In the early days of online shopping, Chinese consumers did not pay attention to protecting their privacy, and China's relevant laws on consumer privacy protection still have a lot of room for improvement.[17] However, in recent years, with the gradual awakening of privacy protection awareness and the continuous improvement of China's rule of law system, laws related to personal privacy protection have also been introduced, and laws related to privacy protection have become increasingly standardized. Therefore, collecting information should follow the principle of moderation, and avoid excessive use of customer information. When collecting users' personal information, internet financial platforms should focus on collecting information that can reflect customers' credit levels and must obtain users' consent. The information collected is also used under clear rules. We can see that soon, the use of user information by Internet consumer finance platforms and other data platforms will face stricter supervision.

The regulator's attitude towards using user information has also undergone a major change, such as the gradual increase in restrictions on text information. And this will directly affect the user evaluation system of Internet consumer finance platforms. To protect consumer privacy while capturing data, the importance of non-text information data, such as images, audio, and video, is highlighted. However, JD and other platforms are slightly weak in their ability to process data in this area. From the perspective of the essence of transactions, the credit risk of Internet consumer finance is essentially information asymmetry. The collection of non-text data can enrich the connotation of data based on the original data collection, and can also greatly reduce the credit risk caused by information asymmetry.

6. Conclusion

The young but promising financial industry and market of China have never stopped exploring and learning from mistakes and deficiencies, and that’s exactly the purpose of this paper. The paper has discussed the risks presented in JD.com's Asset-Backed Securities (ABS) business within the context of the Chinese e-commerce market and possible improvements. By focusing on Jingdong Baitiao as a representative example, several key risks have been identified. Firstly, risks associated with the quality of pooled underlying assets, such as credit risk or stability of assets should not be ignored. Those factors play a direct and fundamental role in determining the overall performance of ABS. Secondly, there are risks from each participant in the ABS trade, especially prepayment risk from investors, which might disrupt the cash flow under circumstances when the interest rate becomes unstable. And finally, the lack of independence of the Special Purpose Vehicle might damage the integrity and credibility of the ABS structure.

To address these risks and enhance the stability and effectiveness of JD.com's ABS business, this paper considers the following several possible improvements:

1. Monitoring and managing credit risk through big data tool is crucial to establish a stringent underwriting standard that carefully evaluates the creditworthiness of borrowers, that ensures a low probability of default, and also remains the ABS product competitive in the market. Not only does credit risk evaluation helps assess the likelihood of default and the potential impact on the cash flow, it is also one of the key factors determining the pricing and yield of ABS product.

2. Improving information disclosure mechanisms is essential to enhance transparency and ensure investors have maximum information accessed for decision-making, in order to avoid situations like moral hazard and adverse selection.

3. Be prepared for unexpected scenarios, for example, when the interest rate becomes unstable. Conducting scenario analysis and stress testing can help JD.com simulate different scenarios and assess the possible impact on the ABS business. Therefore, be prepared for risks such as prepayment risk.

4. When establishing SPV and cooperating with underwriters (bank or financial institution, which is common in e-commerce cases), ensure they act objectively and impartially to serve the best interest of investors and securitization itself. To achieve this, independent management and information barriers will play an essential role.

Appendix

Appendix 1: Standard

JD has strict standards for selecting the underlying assets to form an asset pool for asset securitization.

The underlying assets in the asset pool must be accounts receivable assets generated by consumers using Jingdong Baitiao's credit purchase service to purchase goods or services on the JD platform. In addition, the qualified underlying assets require that the consumer has actively used the corresponding Jingdong Baitiao service for two or more days. During this period, the user has not canceled the purchase order, returned the goods, reduced the amount payable for other reasons, or terminated the transaction. At the same time, the qualified underlying assets must meet the requirements that the total amount owed by the user under the special program does not exceed 50,000 yuan. The maximum overdue days of the user in the process of using Jingdong Baitiao’s service must not exceed 30 days, and the user's internal credit score of JD must be 1-4 points. In addition, the latest repayment date of the accounts receivable of the underlying assets entered the pool shall not be later than 12 months from the date of the establishment of the special plan.

Appendix 2: Ratio Analysis

When conducting financial analysis for the company, we selected three relevant financial ratios: current ratio = current assets/current liability, accounts receivable turnover times = sales/accounts receivables, and ROE = net income/total equity to analyze the company's financial ability and the reason for the issuance of "Jingdong Baitiao" ABS.

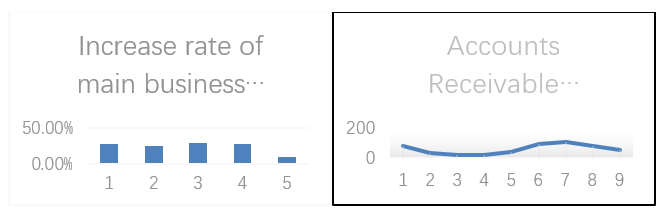

First, let's look at the company's current ratio:

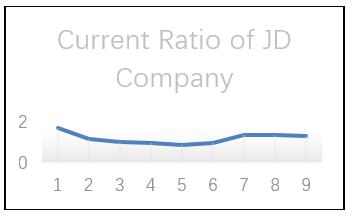

The current ratio is the ratio of current assets to current liabilities, used to measure the ability of a company's current assets to be turned into cash to repay its liabilities before the short-term debt matures. In general, the higher the ratio, the more liquid assets the company has and the higher its solvency. According to the JD company’s annual financial report [18], we can get the current ratio from 2014 to 2022 calculated by the following formula:

Current ratio = current assets/current liability

Source: JD Annual Financial Report[18]

We can see that from 2014 to 2018, the company's current ratio has been showing a downward trend. Although the current ratio has increased after 2018, the overall level is not high. So we can know that the assets of JD company are lack of liquidity.

Then we look at the accounts receivable turnover times:

Accounts receivable turnover times is the ratio of net credit sales revenue to average accounts receivable balance in a certain period. It measures enterprise accounts receivable turnover speed and management efficiency index. The higher the ratio, the faster the company's accounts receivable recovery. According to the JD company’s annual financial report [18], we can get the current ratio from 2014 to 2022 calculated by the following formula:

Accounts receivable turnover times = sales/accounts receivables

Source: JD Annual Financial Report [18]

From the graph, we can see that from 2014 to 2016, accounts receivable turnover times were declining. After 2016(After implementing ABS), the ratio began to rise, However, the ratio declined after 2020, which is mainly due to the impact of the COVID-19 pandemic, and the growth rate of JD's turnover is much smaller than that of accounts receivable, resulting in a decline in the ratio.

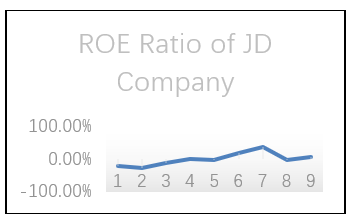

Then we look at the ROE:

ROE is a measure of financial performance calculated by dividing net income by shareholders' equity. ROE is considered a gauge of a corporation's profitability and efficiency in generating profits. The higher the ROE, the more efficient a company's management is at generating income and growth from its equity financing. According to the JD company’s annual financial report [18], we can get the current ratio from 2014 to 2022 calculated by the following formula:

ROE = net income/total equity

ROE = profit margin × equity multiplier × total assets turnover (DuPont Analysis)

Source: JD Annual Financial Report [18]

From the figure, we can see that from 2014 to 2020(After implementing ABS), the ROE of JD increased rapidly, and the company's profitability continued to improve. After 2020, the ROE of JD showed a trend of ups and downs, but overall, the company's profitability has made great progress in these years.

Acknowledgement

Zuming Zhang, Yayuan Wen, Yonghao Li, Yunhong Wang, Yi Shen and Xin Yuan contributed equally to this work and should be considered co-first authors.

References

[1]. Tuo Yannan (2012). E-commerce to make even bigger gains, China Daily.

[2]. Fitch Rating special report (2023). China Securitization Market Overview. Fitch Rating.

[3]. Yu, Y. (2014, April). Application of Securitization of Internet Consumer Financial Assets - Taking Jingdong Baitiao as an Example]. Accounting Monthly, 2017(4), 94-100.

[4]. Gao, S. H. (2018, June). The Financial Risk of JD Group Under Heavy Asset Operation Mode and its Countermeasures [Master's thesis, Jingxi University of Finance and Economics].

[5]. Fu, M. (2006). A Summary of the Discussion on My Country's Asset Securitization. Economic Theory and Economic Management, 2006(4), 75-79.

[6]. Wong, L. W. (2022). Credit Risk Factors of Internet Consumer Financial Securitization. Master's thesis, Zhongnan University of Economics and Law.

[7]. Ji, W. J. Y. (2018). Internet consumer finance asset securitization model and risk: A case study of Jingdong Baitiao asset-backed securitization Program. Gansu Finance, 2018(5), 32-36.

[8]. Shi, X. Y. (2022). Research on the path and effect of Internet consumer financial assets securitization. Master’s thesis, Xinan University of Economics and Law.

[9]. Sun, X. M., & Teng, D (2020). Case study of Internet consumer finance asset Securitization. Rule of law and economy, 2020(11), 87-88.

[10]. Min, W. Y. (2020). Research on securitization of Internet consumer financial assets. [Master’s thesis, Nanchang University].

[11]. Guo, Y. H. (2018). Structure and risk of securitization of Internet consumer financial assets. Modern Business, 2018(36), 87-88.

[12]. Zhang, X. (2019). Research on the risk and prevention of Internet consumer finance in China. Modernization of shopping malls, 2019(16), 142-143.

[13]. Wang, Y. F. (2018). Risk research of Internet consumer financial assets securitization. Financial economy, 2018(16), 131-132.

[14]. Bu, Z. X. (2018). Current situation, problems and countermeasures of Internet financial asset securitization. New Finance, 2018(10), 61-64.

[15]. Xiong, J. H. (2023). Study on the risk of securitization of supply chain financial assets. Master’s thesis, Jingxi University of Finance and Economics.

[16]. Yue, F. C., Zhang, X. M., & Kong, S. Z. (2023). Analysis of the development of Internet consumer financial assets securitization - based on Jingdong Baitiao and Ali Huabei. Theory of Chinese commerce, 2023(4), 109-111.

[17]. Yin, Y. R. (2023). Study on risk factors of Internet financial asset securitization. Master’s thesis, Lanzhou University of Finance and Economics.

[18]. JD.com.Inc (2023) Annual report. https://ir.jd.com/static-files/e5d705b1-3089-4247-8b12-a4fb69fc025a.

Cite this article

Zhang,Z.;Wen,Y.;Li,Y.;Wang,Y.;Shen,Y.;Yuan,X. (2024). Risks and Countermeasures of Internet Consumer Financial Asset Securitization: A Case Study of Jingdong Baitiao. Advances in Economics, Management and Political Sciences,82,110-122.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tuo Yannan (2012). E-commerce to make even bigger gains, China Daily.

[2]. Fitch Rating special report (2023). China Securitization Market Overview. Fitch Rating.

[3]. Yu, Y. (2014, April). Application of Securitization of Internet Consumer Financial Assets - Taking Jingdong Baitiao as an Example]. Accounting Monthly, 2017(4), 94-100.

[4]. Gao, S. H. (2018, June). The Financial Risk of JD Group Under Heavy Asset Operation Mode and its Countermeasures [Master's thesis, Jingxi University of Finance and Economics].

[5]. Fu, M. (2006). A Summary of the Discussion on My Country's Asset Securitization. Economic Theory and Economic Management, 2006(4), 75-79.

[6]. Wong, L. W. (2022). Credit Risk Factors of Internet Consumer Financial Securitization. Master's thesis, Zhongnan University of Economics and Law.

[7]. Ji, W. J. Y. (2018). Internet consumer finance asset securitization model and risk: A case study of Jingdong Baitiao asset-backed securitization Program. Gansu Finance, 2018(5), 32-36.

[8]. Shi, X. Y. (2022). Research on the path and effect of Internet consumer financial assets securitization. Master’s thesis, Xinan University of Economics and Law.

[9]. Sun, X. M., & Teng, D (2020). Case study of Internet consumer finance asset Securitization. Rule of law and economy, 2020(11), 87-88.

[10]. Min, W. Y. (2020). Research on securitization of Internet consumer financial assets. [Master’s thesis, Nanchang University].

[11]. Guo, Y. H. (2018). Structure and risk of securitization of Internet consumer financial assets. Modern Business, 2018(36), 87-88.

[12]. Zhang, X. (2019). Research on the risk and prevention of Internet consumer finance in China. Modernization of shopping malls, 2019(16), 142-143.

[13]. Wang, Y. F. (2018). Risk research of Internet consumer financial assets securitization. Financial economy, 2018(16), 131-132.

[14]. Bu, Z. X. (2018). Current situation, problems and countermeasures of Internet financial asset securitization. New Finance, 2018(10), 61-64.

[15]. Xiong, J. H. (2023). Study on the risk of securitization of supply chain financial assets. Master’s thesis, Jingxi University of Finance and Economics.

[16]. Yue, F. C., Zhang, X. M., & Kong, S. Z. (2023). Analysis of the development of Internet consumer financial assets securitization - based on Jingdong Baitiao and Ali Huabei. Theory of Chinese commerce, 2023(4), 109-111.

[17]. Yin, Y. R. (2023). Study on risk factors of Internet financial asset securitization. Master’s thesis, Lanzhou University of Finance and Economics.

[18]. JD.com.Inc (2023) Annual report. https://ir.jd.com/static-files/e5d705b1-3089-4247-8b12-a4fb69fc025a.