1. Introduction

It is undeniable that Adam Smith is the pioneer, and often called “the founding father”, of political economy, whose book The Wealth of Nations marked the birth of modern capitalism. In that book he put forward several theories, which underlies the Neoclassical Economics, including the famous metaphor of an invisible hand representing individual’s behavior of bettering their own conditions can carry on the whole society to wealth and prosperity [1]. In such expression, Adam not only focused on the market participants’ tendency of maximizing their wealth as well as the consequence of such rational behavior, but also pointed out that such behavior was driven by the unseen instincts to stive for order and opulence [2]. The mechanism of the latter was more detailed discussed in his first book The Theory of Moral Sentiments, which was treasured as one of the roots of Behavioral Economics.

Based on Adam’s work along with the efforts of other great minds, Neoclassical Economics developed a whole framework of analyzing the economical world using mathematical approaches, however one of the underlying theory which Neoclassical Economics was built on, the hypothesis of rational man, was frequently criticized [3]. The Subjective Expected Utility Theory (henceforth, SEUT) and Prospect Theory [4] are two millstones brought up respectively to solve the St. Petersburg Paradox [5] and Allais Paradox [6], which were two great challenge to such hypothesis. The two theory hare the similarity in attempting to explain the decision-making process of individuals under risk or uncertainty, however they have divergent views on the hypothesis mentioned above [7].

2. From the St. Petersburg Paradox to Von Neumann-Morgenstern Utility Function

The pre-SEUT economists generally agree that factors determine choices under risk and uncertainty is the expected value of different state of nature, which is computed by summing all possible gains respectively multiplied to the probability of their occurrence, and a rational man should choose the offer with higher expected value as expected by Bernoulli. As is shown in the equation below the E[X] stands for the expected value, xi and pi stand respectively for the value and possibility of ith circumstance.

E[X] = ∑(xi*pi) = x1*p1 + x2*p2+ … + xk*pk (1)

However, such theory of simply comparing the expected value is confronted with a great challenge call St. Petersburg paradox. This is a coin-tossing game between A and B, and B commits to pay A 1 ducat if it is head at the first throw, 2 ducats if it is head at the second throw, and 2n-1 ducats if it is head at the nth throw. And A needs to decide the amount of money he is willing to buy the ticket to start the game. Since it is a game with an infinite sum, as is shown in the 2nd equation, the expected value illustrates that the rational choice of A is to willingly pay B any amount of money, which is strongly contradict to the reality.

E[X] = 1/2 * 1 + 1/4 * 2 + … + … = ∞ (2)

Therefore, Bernoulli attributes people’s choice under risk and uncertainty to the moral values yield by the monetary gains rather than the gains itself and supposed the satisfaction to be the square root of its mathematical quantity, concluding that the price A would like to pay is converging to a finite number, as is shown in the 3rd equation:

E[√X] = 1/2 * √1 + 1/4 * √2 + … + … = 1/(2-√2) (3)

The very method was enhanced by Von Neumann and Morgenstern [8] and summarized to be the equation bellow, where U(X) is the utility function of the monetary gain X.

E[U(X)] = ∑pi *U(xi) = U(x1) *p1 + U(x2) *p2+ … + U(xk) *pk (4)

Moreover, the expected utility function mention above is subject to several axiomatic constraints, which define a rational decision maker and guarantee their choice under uncertainty is in accordance with the prediction of Von Neumann-Morgenstern (henceforth VNM) utility function, including the Completeness, Transitivity, Independence of Irrelevant Alternatives and Continuity [8].

• Completeness assumes an individual has a clear preference between two alternatives.

• Transitivity assumes the decision made according to the 1st axiom is also consistent.

• Independence of Irrelevant Alternatives assumes the decision between two alternatives do not depend on other alternatives.

• Continuity assumes if an individual prefers A to B and B to C, he should be indifferent between B and the linear combination of A and C.

3. Subjective utility and Subjective Expected Utility Theory

Beside the Bernoulli-VNM tradition of decision theory, SEUT has another root from the tradition of subjective probability which was treated as both a mathematical and psychological problem [9].

What is treated as default by the pre-SEUT economists is that the probability of the occurrence of different alternatives is an objective feature of the physical world which does not depend on human beliefs, just like the probability of tossing a fair coin [10]. Such objective probability should be known to all [11] and people’s belief is described by Bayes’ Law [12]. Just like what Keynes [13] believed that probability is not subjective but the logical relation between pairs of propositions and in some sense perceived. However, this was questioned by Ramsey [14] who argued that probability is the degree of belief of a particular individual, so different people may have different subjective probability towards the same event, and this could be measured by the lowest odds the individual would accept in a proposed bet.

Savage’s [15] Subjective Expected Utility Theory, bridged the two traditions by adopting VNM utility function in a subjective probability framework, arguing individuals’ choice is according to the expectation of their utility values, where the probability and the utility function vary among different people.

4. Allais Paradox and Prospect Theory

Many years after Savage’s work, Machina [16] pointed out that SEUT might lead to several anomalies, including Allais paradox which was investigated by Kahneman and Tversky in their Prospect Theory.

The Allais paradox describes a situation as in the following table, where participants are asked with 2 questions, each containing 2 prospects.

Table 1:The Allais Paradox

Question 1 | |||

Prospect A | Prospect B | ||

Value | Probability | Value | Probability |

1 Million | 100% | 1 Million | 89% |

0 | 1% | ||

5 Million | 10% | ||

Question 2 | |||

Prospect A | Prospect B | ||

Value | Probability | Value | Probability |

0 | 89% | 0 | 90% |

1 Million | 11% | 5 Million | 10% |

And Allais found that the majority answers chose prospect A in the first question while prospect B in the second one, which violates SEUT because there is no function U could satisfy both:

U(100)>0.1*U(500)+0.89*U(100)+0.01*U(0) (5)

which equals to (0 value generates 0 unit of utility)

0.11*U(100)>0.1*U(500) (6)

and

0.11*U(100)+0.89**U(0)<0.1*U(500)+0.9*U(0) (7)

which equals to

0.11*U(100)<0.1*U(500) (8)

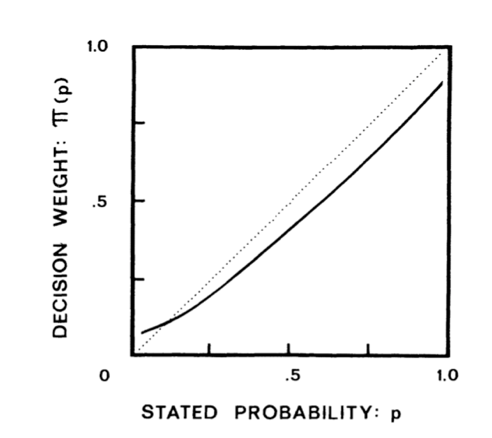

Just like the St. Petersburg paradox, Allais paradox also revealed that SEUT was not adequate enough to verify the rationality of individual’s decision under risk, and Kahneman and Tversky solved such anomaly by replacing the probability in SEUT with a hypothetical decision weighting function towards different probability which is nonlinear and discontinuous around 0% and 100%. As is illustrated in the following figure, people are believed to have a preference for certainty, namely having a tendency to overweight outcomes that could be gained for sure compared with those are merely probable.

Figure 1: A hypothetical weighting function

Furthermore, Prospect Theory defines utility function separately over gains and losses, which are respectively assumed to be concave and convex. Such nonlinearity and asymmetry arising from people’s heuristic of certainty preference, could better describe the different risk attitude towards different probability.

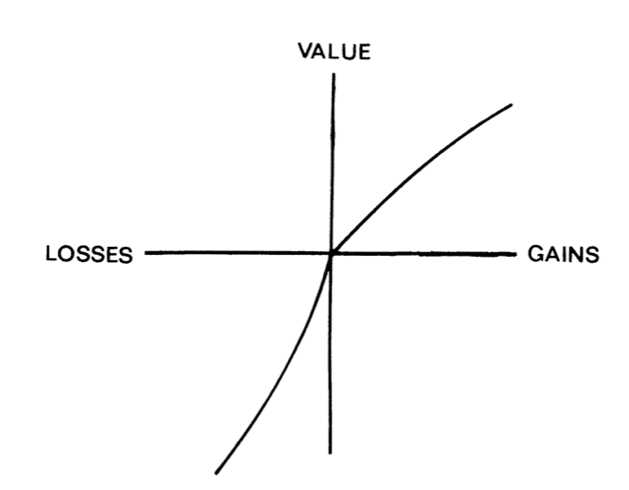

There are other essential features of the Prospect Theory: (i) the losses and gains are not necessarily the absolute value an individual is losing are winning, but rather a relative loss or gain compared to the Reference Point which is the expectation in their minds; (ii) the nonlinear and asymmetric utility function implies that losses loom larger than gains; (iii) such effect is attributed to the human heuristic of loss aversion. And the following figure could give us an more direct impression:

Figure 2: A hypothetical value function

5. Examining SEUT and Prospect Theory with Real-life Cases

The Prospect Theory argues that loss aversion would lead to human behavior deviating from what SEUT predicts, causing excessive risk aversion, Endowment effect, Disposition effect, Framing effect and etc., which we will discuss in the following studies.

One of most distinct examples illustrating the divergence between SEUT and Prospect Theory is the excessive risk aversion, stemming from loss aversion, which drives people to reject a lottery of winning $11 with 50% probability and losing $10 with 50%, however a rational individual should accept such lottery since it’s subjective expected utility is positive. Benartzi and Thaler [17] investigated the so-called equity premium puzzle referring to the fact that the historical difference between the average return of equities and risk-free assets are believed to be too large. And such a high return, which means high potential subjective utility, should attract more investors building portfolios to arbitrage and hence reducing itself. They believed such phenomenon is also attributed to the excessive risk aversion generating from people’s loss aversion. Similarly, the phenomenon of high saving ratio and low level of wealth diversification in China is also deemed to be caused by people’s loss aversion [18].

Besides, the experimental test of the Endowment effect [19] also serves as a great example of loss aversion, where the measure of willingness to accept greatly exceed the measure of willingness to pay, because even if different people may have different preference, the same consumption objects (e.g. coffee mugs) should generate similar utility for two groups of randomly selected people in general. A similar effect, Disposition Effect, also reveals that people’s behavior in real market is not as what SEUT predict. Genesove and Mayer [20] pointed out that condominium sellers in Boston avoid realizing nominal losses which is consistent with the result of Odean’s [21] finding in the stock market.

Additionally, Camerer et al. [22] studied the labor supply of New York City cabdrivers and found out there is not a significant positive relationship between hours supplied and transitory changes in wages, which should be the result if individuals rationally maximizing their utility, namely working more during high-wage period and having more leisure in contrary situation. They argued that it was because they set a loose daily income target, which is the reference point to compare their losses or gains with, and once achieving such goal they will have leisure instead. Moreover, Hossain and List [23] examine such heuristic from another angle with a natural field experiment in a Chinese manufacturing facility – Malata. By merely change the expression of how the workers’ bonuses will be, which is also known as the Framing Effect, they witness a 1% more productivity from the group whose bonus is posed as loss.

6. Conclusion

The SEUT and Prospect Theory both trying to explain people’s decision-making process under risk and uncertainty, however, they are based on different assumptions of individual’s rationality. They both adopt the VNM utility function and take the influence of individuals’ preference into consideration, however, the former one needs more axioms to protect itself which makes SEUT not adequate enough in real-life cases. Still, we can regard SEUT as a salient and primitive model which is a first order approximation of the reality. Similarly, Prospect theory can be treated as a higher order amendment to SEUT, because on one hand, its focus on the asymmetric changes around the reference point can better explain the irrationality behind people’s choice and on the other hand, it is still stemmed from the linear VNM utility function.

Furthermore, both theories are appealingly simple compared to the latest development, for example the subjectively weighted utility (SWU) [24], took people’s information processing performance into consideration, and as for the original version of Prospect Theory, later research enhanced it with the study of people’s overconfidence [25], probability misjudgment [26], self-control problem [27], social preference [28], and etc.,

Lastly, comparing the two theories may not be like a horse race, picking the theory which could explain the majority of the data and discard the other, because there might be several latent decision-making process jointly generate the choice we make and human might not be rational enough to inspect every prospect before making a decision.

References

[1]. Smith, A. (1776). The Wealth of Nations: An inquiry into the nature and causes of the Wealth of Nations. Volume One. London: printed for W. Strahan; and T. Cadell

[2]. Wight, J. B. (2007). The treatment of Smith's invisible hand. The Journal of Economic Education, 38(3), pp. 341-358.

[3]. Colander, D. (2000). The Death of Neoclassical Economics. Journal of the History of Economic Thought, 22(2), pp. 127-143.

[4]. Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), pp. 363-391.

[5]. Bernoulli, D. (1738). Exposition of a new theory on the measurement of risk. In The Kelly capital growth investment criterion: Theory and practice pp. 11-24.

[6]. Allais, M. (1979). The foundations of a positive theory of choice involving risk and a criticism of the postulates and axioms of the American School (1952). In Expected utility hypotheses and the Allais paradox, pp. 27-145, Springer, Dordrecht.

[7]. Harrison, G. W., & Rutström, E. E. (2009). Expected utility theory and prospect theory: One wedding and a decent funeral. Experimental economics, 12(2), pp. 133-158.

[8]. Von Neumann, J., & Morgenstern, O. (1944). Theory of games and economic behavior. Princeton university press

[9]. Mongin, P. (1998). Expected utility theory. The handbook of economic methodology, pp. 173

[10]. Gillies, D., (2003), Probability and uncertainty in Keynes's The General. In The Philosophy of Keynes's Economics: Probability, Uncertainty and Convention (Vol. 23, p. 111), Psychology Press.

[11]. Katona, G. (1953). Rational behavior and economic behavior. Psychological review, 60(5), pp. 307

[12]. Thaler, R. H. (1993). Advances in behavioral finance (Vol. 2). R. H. Thaler (Ed.). New York: Russell Sage Foundation.

[13]. Keynes, J. M. (1921). A Treatise on Probability. Macmillan and Company, limited.

[14]. Ramsey, F.P. (1926). Truth and Probability. In Ramsey, 1931, 156-98. Reprinted in H.E.

[15]. Savage, L. J. (1954). The Foundations of Statistics. John Wiley & Sons, Inc.

[16]. Machina, M. J. (1983). Generalized expected utility analysis and the nature of observed violations of the independence axiom. In Foundations of utility and risk theory with applications (pp. 263-293). Springer, Dordrecht.

[17]. Benartzi, S., & Thaler, R. H. (1995). Myopic loss aversion and the equity premium puzzle. The quarterly journal of Economics, 110(1), pp. 73-92.

[18]. Liu, H., Sui, X. Y., Huang, Y. N., Lin, R. P., & Xx, M. X. (2019). The nudging role of behavioral economics in retirement savings decisions: Current situation and future prospects. Advances in Psychological Science, 27(3), pp. 418.

[19]. Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of political Economy, 98(6), pp. 1325-1348.

[20]. Genesove, D., & Mayer, C. (2001). Loss aversion and seller behavior: Evidence from the housing market. The quarterly journal of economics, 116(4), pp. 1233-1260.

[21]. Odean, T. (1998). Volume, volatility, price, and profit when all traders are above average. The journal of finance, 53(6), pp. 1887-1934.

[22]. Camerer, C., Babcock, L., Loewenstein, G., & Thaler, R. (1997). Labor supply of New York City cabdrivers: One day at a time. The Quarterly Journal of Economics, 112(2), pp. 407-441.

[23]. Hossain, T., & List, J. A. (2012). The behavioralist visits the factory: Increasing productivity using simple framing manipulations. Management Science, 58(12), pp. 2151-2167.

[24]. Karmarkar, U. S. (1978). Subjectively weighted utility: A descriptive extension of the expected utility model. Organizational behavior and human performance, 21(1), pp. 61-72.

[25]. Svenson, O. (1981). Are we all less risky and more skillful than our fellow drivers?. Acta psychologica, 47(2), pp. 143-148.

[26]. Barberis, N., Shleifer, A., & Vishny, R. W. (2005). A model of investor sentiment. Princeton University Press. pp. 423-459

[27]. DellaVigna, S., & Malmendier, U. (2006). Paying not to go to the gym. american economic Review, 96(3), pp. 694-719.

[28]. Andreoni, J., & Bernheim, B. D. (2009). Social image and the 50–50 norm: A theoretical and experimental analysis of audience effects. Econometrica, 77(5), pp. 1607-1636.

Cite this article

Fan,H. (2024). A Critical Comparison of SEUT and Prospect Theory. Advances in Economics, Management and Political Sciences,72,105-111.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Smith, A. (1776). The Wealth of Nations: An inquiry into the nature and causes of the Wealth of Nations. Volume One. London: printed for W. Strahan; and T. Cadell

[2]. Wight, J. B. (2007). The treatment of Smith's invisible hand. The Journal of Economic Education, 38(3), pp. 341-358.

[3]. Colander, D. (2000). The Death of Neoclassical Economics. Journal of the History of Economic Thought, 22(2), pp. 127-143.

[4]. Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), pp. 363-391.

[5]. Bernoulli, D. (1738). Exposition of a new theory on the measurement of risk. In The Kelly capital growth investment criterion: Theory and practice pp. 11-24.

[6]. Allais, M. (1979). The foundations of a positive theory of choice involving risk and a criticism of the postulates and axioms of the American School (1952). In Expected utility hypotheses and the Allais paradox, pp. 27-145, Springer, Dordrecht.

[7]. Harrison, G. W., & Rutström, E. E. (2009). Expected utility theory and prospect theory: One wedding and a decent funeral. Experimental economics, 12(2), pp. 133-158.

[8]. Von Neumann, J., & Morgenstern, O. (1944). Theory of games and economic behavior. Princeton university press

[9]. Mongin, P. (1998). Expected utility theory. The handbook of economic methodology, pp. 173

[10]. Gillies, D., (2003), Probability and uncertainty in Keynes's The General. In The Philosophy of Keynes's Economics: Probability, Uncertainty and Convention (Vol. 23, p. 111), Psychology Press.

[11]. Katona, G. (1953). Rational behavior and economic behavior. Psychological review, 60(5), pp. 307

[12]. Thaler, R. H. (1993). Advances in behavioral finance (Vol. 2). R. H. Thaler (Ed.). New York: Russell Sage Foundation.

[13]. Keynes, J. M. (1921). A Treatise on Probability. Macmillan and Company, limited.

[14]. Ramsey, F.P. (1926). Truth and Probability. In Ramsey, 1931, 156-98. Reprinted in H.E.

[15]. Savage, L. J. (1954). The Foundations of Statistics. John Wiley & Sons, Inc.

[16]. Machina, M. J. (1983). Generalized expected utility analysis and the nature of observed violations of the independence axiom. In Foundations of utility and risk theory with applications (pp. 263-293). Springer, Dordrecht.

[17]. Benartzi, S., & Thaler, R. H. (1995). Myopic loss aversion and the equity premium puzzle. The quarterly journal of Economics, 110(1), pp. 73-92.

[18]. Liu, H., Sui, X. Y., Huang, Y. N., Lin, R. P., & Xx, M. X. (2019). The nudging role of behavioral economics in retirement savings decisions: Current situation and future prospects. Advances in Psychological Science, 27(3), pp. 418.

[19]. Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of political Economy, 98(6), pp. 1325-1348.

[20]. Genesove, D., & Mayer, C. (2001). Loss aversion and seller behavior: Evidence from the housing market. The quarterly journal of economics, 116(4), pp. 1233-1260.

[21]. Odean, T. (1998). Volume, volatility, price, and profit when all traders are above average. The journal of finance, 53(6), pp. 1887-1934.

[22]. Camerer, C., Babcock, L., Loewenstein, G., & Thaler, R. (1997). Labor supply of New York City cabdrivers: One day at a time. The Quarterly Journal of Economics, 112(2), pp. 407-441.

[23]. Hossain, T., & List, J. A. (2012). The behavioralist visits the factory: Increasing productivity using simple framing manipulations. Management Science, 58(12), pp. 2151-2167.

[24]. Karmarkar, U. S. (1978). Subjectively weighted utility: A descriptive extension of the expected utility model. Organizational behavior and human performance, 21(1), pp. 61-72.

[25]. Svenson, O. (1981). Are we all less risky and more skillful than our fellow drivers?. Acta psychologica, 47(2), pp. 143-148.

[26]. Barberis, N., Shleifer, A., & Vishny, R. W. (2005). A model of investor sentiment. Princeton University Press. pp. 423-459

[27]. DellaVigna, S., & Malmendier, U. (2006). Paying not to go to the gym. american economic Review, 96(3), pp. 694-719.

[28]. Andreoni, J., & Bernheim, B. D. (2009). Social image and the 50–50 norm: A theoretical and experimental analysis of audience effects. Econometrica, 77(5), pp. 1607-1636.