1.Introduction

Build Your Dream (BYD) is a Chinese multinational company and one of the world's leading manufacturers of electric vehicles. Its electric vehicles include pure electric vehicles, hybrid vehicles, and plug-in hybrid vehicles. BYD has a very perfect product matrix, and the models on sale include various market segments, which has become the car enterprise with the most layout of new energy models [1]. BYD Auto is committed to technological innovation and has made important breakthroughs in battery technology, electric drive technology, and intelligent driving technology, improving the performance and driving range of vehicles. As a new energy vehicle manufacturer, BYD Auto's products focus on environmental protection and energy saving, reducing dependence on traditional fuel resources, helping to reduce emissions, and reducing air pollution. At the same time, BYD's electric vehicle sales in many countries and regions around the world, the company is also constantly promoting the innovation and development of electric vehicle technology. BYD Auto to "build the world level of good cars" as the product goal, to "build the national world-class automobile brand" as the industrial goal, determined to revitalize the national automobile industry [2].

Tesla is an American electric vehicle and clean energy company, and is also one of the world's leading electric vehicle manufacturers, designing, producing, and selling pure electric vehicles, energy storage systems, and solar products. Tesla Motors' product line includes various models of electric vehicles such as Model S, Model X, Model 3, and Model Y, as well as truck models Tesla Semi and all-electric pickup trucks designed to revolutionize the automotive industry. Tesla is committed to innovation in the field of electric vehicle technology, including battery technology, autonomous driving technology, and onboard software updates, to continuously improve vehicle performance, range, and user experience. Tesla cars are sold worldwide, and production plants and sales networks have been established in the United States, Europe, Asia, and other places to meet the market demand in different regions.

There are some differences in the development models of the two companies. Tesla's development model is to launch high-end models first, and then gradually expand to the middle and low-end market. BYD chose to launch low-end models first, and then gradually expand to the high-end market. Next, I will compare the two companies in terms of price, sales, sales channels, sales positioning, marketing strategy, import and export, etc.

2.Model and Price

Tesla currently sells Model S, Model 3, Model X, Model Y, and Cybertruck on the market. BYD mainly sells two series, including the Dynasty and Ocean series. From the model point of view, Tesla is all pure electric vehicles while BYD has pure electric vehicles (EV) and hybrid vehicles (DM-i DM-p).

2.1.Tesla’s Model and Price

The Tesla Model S and Model 3 are sedans, the Model X and Model Y are SUVs, and the Cybertruck is the newly released pure electric pickup truck. Because of the price, Model 3 and Model Y are more common in China.Table 1 is a summary of the prices of various Tesla models on sale [3].The Model 3 and Model Y, the best-selling car, has a simple, modern design with smooth curves and clear lines, conveying a commitment to innovation and advanced technology, and establishing a positive brand image. The interior features a large-screen central control system that enhances user interface friendliness, enhances the pleasure of the driving experience, and the driving performance is also praised by users [4].

Table 1: A roundup of the prices of each Tesla model on sale [3]

|

Vehicle Model |

Price |

|

Model Y |

$32,890 |

|

Model 3 |

$35,990 |

|

Cybertruck |

$57,390 |

|

Model X |

$68,590 |

|

Model S |

$71,090 |

2.2.BYD’s Model and Price

And BYD has introduced more models. BYD focuses on product research and development and technological innovation and has launched many competitive new energy vehicle products, and the fuel consumption advantage of 3.8L 100 km makes it a top current model sought after by the market. Among them, the Dynasty series, mainly positioned as traditional, business, stable, atmospheric appearance style, and luxury interior style, is BYD's sales pillar. Ocean series is younger, sports, intelligent, relatively environmentally friendly, and simple interior, unique aesthetic design. The ocean series is also divided into the pure electric Marine biology series equipped with e-platform 3.0 technology and the warship series equipped with DM-i super hybrid technology. In addition, BYD also cooperated with Germany's Daimler Group to jointly develop the first new energy vehicle - BYD Denza, further enhancing the brand's competitiveness in the market. Table 2 is a collation of the prices of BYD's various models on sale.

Table 2: A roundup of the prices of each BYD model on sale

|

Series |

Vehicle Model |

Price |

|

Dynasty |

Han DM-i |

¥189,800 - 249,800 |

|

Han DM-p |

¥289,800 |

|

|

Han EV |

¥209,800 - 299,800 |

|

|

Tang DM-i |

¥209,800 - 249,800 |

|

|

Tang DM-p |

¥269,800 - 309,800 |

|

|

Tang EV |

¥249,800 - 299,800 |

|

|

Qin DM-i |

¥99,800 - 145,800 |

|

|

Qin EV |

¥129,800 - 176,800 |

|

|

Song L |

¥189,800-249,800 |

|

|

Song Pro DM-i |

¥129,800 - 159,800 |

|

|

Song MAX DM-i |

¥147,800 - 174,800 |

|

|

Yuan PLUS |

¥135,800-163,800 |

|

|

Ocean |

Seagull |

¥73,800 - 89,800 |

|

Escort 07 |

¥202,800 - 289,800 |

|

|

Seal DM-i |

¥166,800 - 236,800 |

|

|

Seal |

¥189,800 - 279,800 |

|

|

Destroyer 05 |

¥101,800 - 148,800 |

|

|

Dolphin |

¥116,800 - 139,800 |

|

|

Song PLUS DM-i |

¥159,800 - 189,800 |

|

|

Song PLUS EV |

¥169,800 - 209,800 |

|

|

2023 e2 |

¥102,800 - 109,800 |

2.3.Second Section BYD and Tesla Price Comparative Analysis

From the price point of view, Tesla's pricing is higher than BYD's overall. From the perspective of brand positioning, Tesla has always focused on the high-end market, and its product line mainly includes high-performance, long-range, luxury configurations of electric vehicles. This premium brand positioning affects the pricing of products, as consumers are willing to pay more for the brand's reputation and premium image. BYD positioning is the low-end market, most models are below 200,000, and cost-effective is BYD's label. In terms of technology and performance, Tesla has been committed to promoting the development of electric vehicle technology, and its models usually have advanced battery technology, autonomous driving functions, and high performance. In terms of batteries, BYD has its own research and development center, and the self-sufficient approach is better than Tesla's mass procurement of Panasonic's ternary lithium batteries. BYD uses a self-developed high-power lithium iron phosphate battery combination, the biggest advantage of this battery is high safety performance, and the price is relatively favorable, but the power is relatively small, with poor endurance. Tesla uses a ternary lithium battery, which has the advantage of strong endurance and relatively high power, but the disadvantage is that it is more expensive and the probability of spontaneous combustion accidents is high. This is also the reason why Tesla models have higher endurance than BYD and are more expensive than BYD. BYD uses a self-developed permanent magnet motor, although this motor consumes rare earth, this motor has the advantage of high power and high efficiency. Tesla uses Taiwan Futian production of a three-phase asynchronous motor, Tesla uses the advantage of this motor is to save independent research and development funds, but the car space occupied by the relatively large volume, power, and efficiency is not as high as the permanent magnet motor. In short, BYD's motors and batteries are slightly higher than Tesla's, but in terms of electric control, Tesla's technology is currently unmatched by BYD. From the perspective of supply chain and production costs, Tesla has made significant investments in battery technology, production processes, and so on, which may achieve economies of scale. In contrast, BYD may have smaller production scales in some areas, leading to higher costs, which may affect the pricing of products.

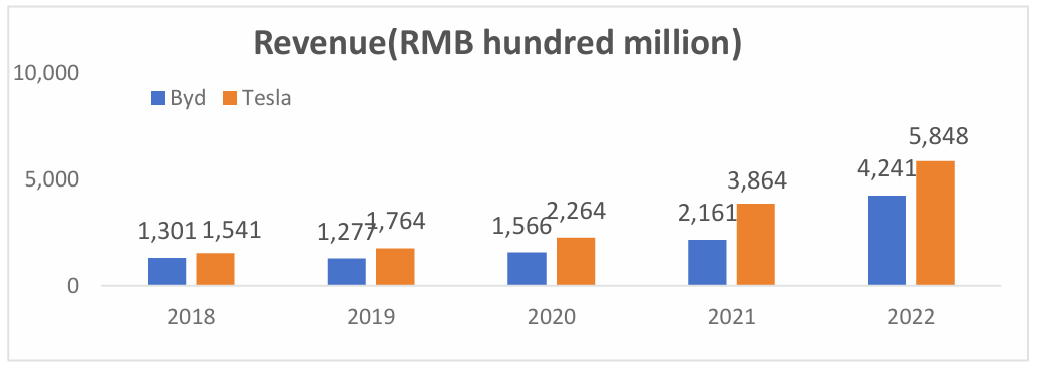

3.Sales Volume

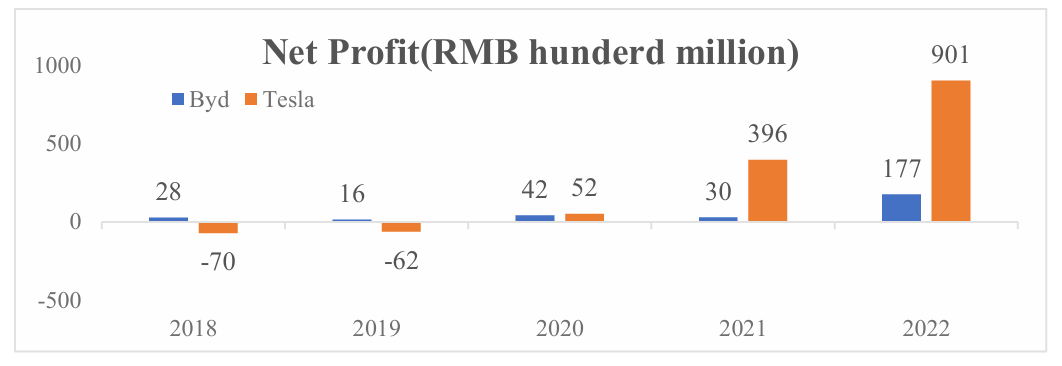

BYD's 2022 sales were 424.1 billion yuan, up 96.2%. With the growth of sales, the level of net profit is also rising, and the net profit in 2022 is 17.7 billion yuan, up 346.5% year-on-year, as shown in Figure 1 [5]. As a manufacturing enterprise, product costs account for the majority of revenue, resulting in a low gross profit margin; Among several key expenses, research and development expenses account for the highest proportion, basically reaching more than 4% of revenue, and it is more concerned about long-term development than current profits. The sales volume of new energy vehicles in 2022 was 1.788 million, an increase of 217% year-on-year. BYD has a total of 19 models, fully covering the price band of 100,000 to 300,000 yuan.

Tesla's 2022 sales were $81.5 billion, an increase of 51%, of which automotive sales accounted for 83%; In 2022, net profit of $12.6 billion, up 17% year-on-year, gross margin of 26%, far ahead of peers, as shown in Figure 2 [5]. In 2022, Tesla sold 1.37 million vehicles, an increase of 47.2%, of which 94.8% was Model 3/Y and 7.6% was Model S/X. The United States was Tesla's largest market at $40.6 billion, accounting for 49.8 percent of revenue, while China accounted for 22.3 percent.

In general, in the global new energy passenger car market share, in 2022 BYD first in the world, accounting for 18.31%, and Tesla second, accounting for 13.02%. In China's new energy vehicle market share, BYD is nearly three times that of Tesla. In the market share of new energy vehicle companies in the United States, Tesla's market share reached 56.5%. BYD's revenue in 2022 is about 75% of Tesla's, although BYD's sales in 2022 have far exceeded Tesla's, Tesla's product pricing is high, supporting revenue and profit margins, and BYD's main model pricing is between 100,000 and 250,000 yuan. In terms of profit, Tesla's profit is 5.4 times that of BYD, mainly because of Tesla's high pricing and low advertising and marketing expenses.

Figure 1: 2018-2022 Revenue of Tesla and BYD (Picture credit : Original) [5].

Figure 2: 2018-2022 Net Profit of Tesla and BYD (Picture credit : Original) [5].

4.Sales Volume

BYD has expanded its brand's market share by setting up specialty stores, 4S stores, and dealer networks. Second, BYD has also cooperated with major e-commerce platforms to expand sales channels and improve brand awareness and market share. In addition, BYD also carries out offline experience activities, test drive activities, and other ways to let consumers better understand the quality and performance of products. In particular, there will be super stores and experience Spaces outside BYD Ocean 4S stores. BYD currently sells its models in a network of sub-channels. For example, if you want to see the car dolphin in the ocean network, then you must go to the 4S shop of the ocean network in your city; If you want to see this Han car, you have to go to the 4S shop of Dynasty net.

Tesla has several sales stores and service centers around the world, including the United States, Europe, Asia, and other places. In China, Tesla has established more than 100 sales stores and service centers, covering major cities across the country. If you want to buy various models of Tesla online, you can also go through the official website, Tmall, Jingdong, and other e-commerce platforms. Different from the sales model of 4S dealers of traditional car companies, Tesla directly uses the form of "offline experience + online order" to directly increase the experience process with consumers and reduce the cost of sales channels and management costs through direct interaction and communication. Tesla's marketing is also synchronized with the product positioning strategy, which can first determine the target consumer groups of Tesla products in entrepreneurs, socialites and elite groups, etc., and then through the publicity of these elites, you can create the popularity of scientific and technological luxury electric vehicles without spending advertising costs. At the same time, with the rich product line, Tesla cars fully seize the market [6].

5.Marketing Strategy

In terms of marketing, BYD Auto pays attention to brand building and product promotion. BYD is well-known at home and abroad, its brand image is distinct and has a strong credibility and reputation. BYD's advertising slogan "Make the world a better place" is loved by consumers, which conveys BYD's concept of green, environmental protection, and sustainable development. BYD allows consumers to obtain a "sense of dignity" and shape brand identity through private domain operations. Han EV will be placed on the dedicated booth to convey the product positioning. Set up an exclusive VIP car owner service group to give users a sense of importance; Through the holding of the pattern car delivery ceremony, small salon afternoon tea, the implementation of the point system, consumer gifts and rights and interests, to help the proportion of old and new to increase to 15%. More than 80% of BYD's auto parts are produced by itself, so it has an inherent advantage in vehicle cost control, so the low-price strategy is an important competitive advantage. BYD e series products focus on the range below 180,000 or 200,000 Yuan, while in BYD Dynasty series products, Qin and Song focus on 100,000-200,000 yuan price belt, Tang and Han focus on 200,000-300,000 yuan, 100,000 yuan products are handed over to Yuan and e series. The distributor distributes the car uniformly to the manufacturer after entering the car. Compared with the direct operation model, this approach can spread out the entire offline distribution channel more efficiently.

Tesla's brand mission is to "accelerate the world's transition to sustainable energy." Tesla started at the high end of the market and then cut prices to drive sales growth. Its chief executive, Elon Musk, has a continuing influence on social media. Tesla's management is full of innovative technological thinking and continuous high R&D investment to ensure technological leadership. Adopt the direct business model and accelerate the sales and card increase through the expansion of offline stores. With a perfect service system and regular access to vehicle data, the mobile service team actively contacts maintenance. Create the ultimate customer experience, turn customers into fans, conduct promotions, motivate customers to share relevant experiences, and recommend usage. Crossover marketing with SpaceX to send a Tesla into space. Build your giga factory, share costs, and ensure upstream procurement. Has independent manufacturing capabilities: body manufacturing technology and power battery system integration technology leading. Battery recycling business mature is expected to continue to drive gross margin improvement.

The similarities between BYD and Tesla in brand marketing strategies are mainly reflected in innovation and research and development, customer relationship management, social media marketing, public relations activities, and sustainable development. Both brands are committed to the research and development and application of electric vehicles and sustainable energy technologies and have independent technological innovation and research and development capabilities. In terms of customer relationship management, both brands maintain the relationship with consumers through customer service, after-sales service, customer loyalty, and other ways. In terms of social media marketing, both brands conduct activities, interactions, influence, and other marketing activities on social media. In terms of public relations activities, both brands maintain their brand image through public relations strategies, event marketing, crisis public relations, and other ways. In terms of sustainable development, both brands have shown performance in environmental protection, social responsibility, and sustainable development.

6.Import and Export

In 2023, Tesla exported 1.808 million vehicles a year. According to S&P Global's registration data for January-November last year, Tesla had 56 percent of the EV segment in the 11-month period with 578,564 new registrations and a 37 percent increase over the year-earlier period [7].It can be seen that the most popular car in each country is the Model Y, followed by the Model 3. The United States is its largest exporter, followed by China, and it is also popular in Europe and Canada, ranking first or second in every European country,as shown in Table 3.

BYD exports 240,000 new energy vehicles in 2023. Sales were highest in Thailand and Israel, where the ATTO 3(Yuan PLUS) was the best-selling model. In 2023, 29,000 units were sold in Thailand, of which the ATTO 3 sold the most with 18,000 units. With 15,000 units sold in Israel, the ATTO 3 topped the list with 14,000 units sold. In Australia, 12,400 units were sold, while the ATTO 3 sold 11,000 units. In Europe, it was in its infancy, with sales of 13,700 units. France sold 4,139 units and Sweden 3,473 units.

According to the data, Tesla's main markets are in North America, Europe, and China, BYD's overseas market contribution from the Southeast Asian market, in the outside world: "Europe as an incremental market for electric vehicles, BYD needs to actively expand the target" [8]. The best-selling models are also dominated by the lowest end of the brand.

Table 3: Tesla Deliver in 2023

|

USA |

Canada |

Europe |

China |

ROW |

Total |

|||

|

Q1 |

Model S/X |

7,728 |

500 |

2,083 |

254 |

130 |

10,695 |

10,695 |

|

Cybertruck |

0 |

0 |

||||||

|

Model 3 |

52,200 |

3,500 |

18,777 |

42,782 |

10,925 |

128,184 |

412,180 |

|

|

Model Y |

98,169 |

3,500 |

73,382 |

94,647 |

14,298 |

283,996 |

||

|

Total |

158,097 |

7,500 |

94,242 |

137,683 |

25,353 |

422,875 |

||

|

Q2 |

Model S/X |

9,900 |

700 |

3,502 |

2,804 |

2,319 |

19,225 |

19,225 |

|

Cybertruck |

0 |

0 |

||||||

|

Model 3 |

56,600 |

4,000 |

23,182 |

47,391 |

8,111 |

139,284 |

446,915 |

|

|

Model Y |

104,237 |

5,400 |

65,512 |

109,285 |

23,197 |

307,631 |

||

|

Total |

170,737 |

10,100 |

92,196 |

159,480 |

33,627 |

466,140 |

||

|

Q3 |

Model S/X |

10,191 |

950 |

1,554 |

1,592 |

1,698 |

15,985 |

15,985 |

|

Cybertruck |

0 |

0 |

||||||

|

Model 3 |

54,800 |

4,500 |

21,628 |

23,447 |

5,394 |

109,769 |

419,074 |

|

|

Model Y |

89,478 |

9,000 |

62,399 |

116,177 |

32,251 |

309,305 |

||

|

Total |

154,469 |

14,450 |

85,581 |

141,216 |

39,343 |

435,059 |

||

|

Q4 |

Model S/X |

16,763 |

900 |

1,915 |

2,154 |

1,051 |

22,783 |

22,969 |

|

Cybertruck |

186 |

186 |

||||||

|

Model 3 |

49,900 |

4,879 |

37,345 |

33,650 |

6,884 |

132,658 |

461,538 |

|

|

Model Y |

103,769 |

12,375 |

53,892 |

136,285 |

22,559 |

328,880 |

||

|

Total |

170,618 |

18,154 |

93,152 |

172,089 |

30,494 |

484,507 |

||

|

2023 |

Model S/X |

44,582 |

3,050 |

9,054 |

6,804 |

5,198 |

68,688 |

68,874 |

|

Cybertruck |

186 |

0 |

0 |

0 |

0 |

186 |

||

|

Model 3 |

213,500 |

16,879 |

100,932 |

147,270 |

31,314 |

509,895 |

1,739,707 |

|

|

Model Y |

395,653 |

30,275 |

255,185 |

456,394 |

92,305 |

1,229,812 |

||

|

Total |

653,921 |

50,204 |

365,171 |

610,468 |

128,817 |

1,808,581 |

7.Conclusion

With the continuous development and increasingly fierce competition in the new energy vehicle market, Tesla and BYD are two representative enterprises in this field. Through the research on their product positioning, it can be found that they have some differences and common points in terms of market positioning, product characteristics, and target audiences.

First of all, in terms of market positioning, Tesla positioned its products in the high-end market, mainly for middle and high-income groups, with high performance, high-tech, and high quality as a selling point, aiming to create an excellent electric vehicle brand image. BYD is focusing more on the mass market, with affordable prices, stable performance, and reliable quality, trying to popularize electric vehicles to a wider range of consumer groups. Secondly, in terms of product features, Tesla emphasizes technological innovation and technological content. Its products have advanced features such as a high driving range, fast charging, and intelligent driving, and is committed to providing a high-end driving experience. BYD, on the other hand, pays more attention to practicality and economy, and its products are relatively balanced in performance and configuration to meet the basic needs of daily travel. Finally, in terms of target audience, Tesla's target customers are mainly mid-to-high-end consumer groups who pursue a sense of science and technology and high brand recognition and pay attention to the improvement of vehicle performance and technological content. BYD is more concerned about the majority of ordinary consumers, especially price-sensitive, paying attention to cost-effective consumer groups.

To sum up, Tesla and BYD have different focuses on the positioning of new energy vehicle products, but they all reflect the grasp of market demand and the strategic deployment of product differentiation competition to varying degrees. In the future, with the further development of the new energy vehicle market and changes in the competitive landscape, the two companies will continue to adjust their product positioning to adapt to changes in market demand and achieve long-term competitive advantages.

References

[1]. Xie, H.X. (2024) Strategic Analysis of BYD's transformation from traditional vehicles to new energy vehicles. Industrial Innovation Research, (01),65-67.

[2]. Hui, M.M. (2022) Growth Analysis of New energy Automobile industry -- Taking BYD as an example. Modern marketing (under the ten-day), (09), 50-52.

[3]. Tesla. (2023) “Electric Cars, Solar Panels & Clean Energy Storage | Tesla.” Retrieved from www.tesla.com/.

[4]. Chen, Z.M. (2024) User Experience analysis of Tesla Model 3 from the perspective of design psychology. Footwear Technology and Design, (01),181-183.

[5]. Tesla. (2023) Tesla Investor Relations. Retrieved from https://ir.tesla.com/#quarterly-disclosure

[6]. Ma, X.G. (2021) Countermeasures and Suggestions for automobile companies to cope with the positioning of new energy transformation. Modern, (09), 99-101.

[7]. Laurence, I. (2024) Small EV makers outpaced Tesla, other big players. Automotive News, 7127.

[8]. Liu, Y., Liu, X.M. (2024) Tesla beat itself and lost to BYD. Commercial daily, 3.

Cite this article

Duan,A. (2024). Research on Product Positioning of New Energy Vehicles - Taking Tesla and Build Your Dream as Examples. Advances in Economics, Management and Political Sciences,84,280-287.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xie, H.X. (2024) Strategic Analysis of BYD's transformation from traditional vehicles to new energy vehicles. Industrial Innovation Research, (01),65-67.

[2]. Hui, M.M. (2022) Growth Analysis of New energy Automobile industry -- Taking BYD as an example. Modern marketing (under the ten-day), (09), 50-52.

[3]. Tesla. (2023) “Electric Cars, Solar Panels & Clean Energy Storage | Tesla.” Retrieved from www.tesla.com/.

[4]. Chen, Z.M. (2024) User Experience analysis of Tesla Model 3 from the perspective of design psychology. Footwear Technology and Design, (01),181-183.

[5]. Tesla. (2023) Tesla Investor Relations. Retrieved from https://ir.tesla.com/#quarterly-disclosure

[6]. Ma, X.G. (2021) Countermeasures and Suggestions for automobile companies to cope with the positioning of new energy transformation. Modern, (09), 99-101.

[7]. Laurence, I. (2024) Small EV makers outpaced Tesla, other big players. Automotive News, 7127.

[8]. Liu, Y., Liu, X.M. (2024) Tesla beat itself and lost to BYD. Commercial daily, 3.