1.Introduction

The global electric vehicle (EV) market is witnessing an unprecedented transformation, driven by the confluence of technological advancements, environmental concerns, and changing consumer behaviors. As the world pivots towards sustainable transportation, EV manufacturers are at the forefront of this shift, employing diverse strategies to capture market share and influence consumer preferences [1]. This paper embarks on a comparative analysis of product positioning strategies among leading brands like Tesla and emerging market players such as Build Your Dream (BYD) and Tata Motors, offering a panoramic view of how innovation, market penetration, pricing, and sustainability shape the competitive landscape.

Central to the discourse on EV adoption is the role of technology innovation. Leading brands have leveraged advancements in battery technology, drive systems, and autonomous driving capabilities to set new industry standards and differentiate themselves in a crowded marketplace. For instance, Tesla's introduction of the 4680 battery cell and its proprietary electric motors highlights the company's commitment to enhancing efficiency and performance [2]. Similarly, BYD's Blade Battery technology and e-Platform demonstrate how emerging market players are also pushing the envelope in technological innovation to carve out significant market share [3].

However, technological prowess alone does not guarantee market dominance. The analysis extends to market penetration strategies and pricing models, which are equally pivotal in navigating the economic and competitive dynamics of the global EV market [4]. Brands adopt various approaches, from Tesla's premium positioning and direct sales model to BYD's cost-effective strategy, targeting different consumer segments and leveraging government incentives to foster adoption. These strategies underscore the importance of understanding and adapting to the unique economic and societal contexts of target markets.

Moreover, sustainability and environmental policies have emerged as critical components of product positioning strategies in the EV market. As consumers become increasingly environmentally conscious, automakers' commitment to sustainability, through initiatives like battery recycling and renewable energy use in manufacturing processes, not only reflects corporate responsibility but also enhances brand image and competitiveness [4]. The comparative analysis of these policies among Tesla, BYD, and other players reveals a spectrum of approaches to aligning business operations with environmental sustainability goals.

This paper, therefore, seeks to unravel the complex interplay between technology innovation, market penetration strategies, pricing models, and sustainability efforts in shaping the product positioning strategies of EV manufacturers. Through accurate data and analysis, the study offers insights into how leading brands and emerging market players navigate the challenges and opportunities of the global EV market, providing valuable lessons for stakeholders across the automotive industry.

2.Technology Innovation and Product Features

In the rapidly evolving Electric Vehicle (EV) market, technological innovation serves as a pivotal differentiator among brands, significantly influencing consumer preferences and market dynamics. The ability of a brand to innovate, particularly in battery technology, drive systems, and autonomous driving capabilities, not only establishes its position in the market but also sets the pace for industry standards [1]. This section explores how leading brands like “Tesla” and emerging market players such as “Build Your Dream (BYD)” from China and “Tata Motors” from India, leverage technological advancements to carve their niches within the global EV landscape.

2.1.Comparative Analysis of Battery Technology and Range

The demand for automotive lithium-ion (Li-ion) batteries surged by approximately 65% to 550 GWh in 2022, driven by a 55% increase in electric passenger car sales [1]. This significant growth, particularly pronounced in China and the United States, underscores the increasing consumer shift towards electric mobility and highlights the importance of battery technology in driving EV adoption. This demand is a direct result of the substantial innovations in battery technologies and the strategic implementation of these advancements by leading EV manufacturers.

Tesla introduced the 4680 battery cell, which has significantly enhanced its battery power by six times and increased the driving range by 16%. This innovation aims to extend the vehicle's range and lifespan, thereby revolutionizing battery technology [2]. On the other hand, BYD has made remarkable progress with its Blade Battery technology, successfully applied in its Han EV model. This technology has enabled the vehicle to achieve a driving range of 605 miles and an acceleration time from 0 to 100 km/h in just 3.9 seconds. By broadly utilizing lithium ferrous phosphate (LFP) technology, BYD's approach emphasizes the company's commitment to innovation without compromising safety or performance, improving battery utilization efficiency by over 50% [3]. Besides, Tata Motors, committed to making electric vehicle technology ubiquitous, has made extensive use of lithium-ion batteries, which are declining in cost, to provide practical range at a more affordable price [4]. While Tata Motors is not leading the way in terms of maximum range, it has optimized for cost-effectiveness and safety.

2.2.Comparative Analysis of Drive Systems and Performance

Electric drive systems are at the heart of an EV's performance, dictating acceleration, top speed, efficiency, and overall driving experience. As the EV market grows, manufacturers are pushing the envelope in developing more advanced, efficient, and compact drive systems that can deliver not only higher power and torque but also greater range and reliability, all while maintaining or reducing costs and environmental impact.

Accurate data and benchmarks play a pivotal role in understanding the advancements in this area. For instance, Tesla's introduction of its proprietary electric motors, which utilize a permanent magnet design in the Model 3 and Model Y, demonstrates a significant leap in efficiency and performance. According to Tesla's official disclosure, the drive systems of the Model 3 and Model Y are about 89 percent efficient, while the electric motors average about 77.64 percent efficiency, showcasing how innovations in drive systems can enhance vehicle range and performance [2,5]. Similarly, BYD's development of its e-Platform, which integrates highly efficient motors and power electronics, exemplifies how emerging market players are also at the forefront of drive system innovation. This platform enables the BYD Han EV to accelerate from 0 to 100 km/h in just 3.9 seconds, rivaling luxury performance sedans while maintaining impressive energy efficiency. Furthermore, BYD has introduced the fourth evolution of its DM technology: the DM-i hybrid technology, which combines efficiency and performance with a balance between electric and hybrid drive systems, based on the main focus on fuel efficiency [3]. This approach ensures good performance while maintaining efficiency and reducing emissions.

2.3.Comparative Analysis of Autonomous Driving and Smart Features

With the rapid advancement of technology, autonomous driving, and smart features have become a key trend in the contemporary electric vehicle (EV) market. Not only do these technologies have the potential to revolutionize the way people drive, but they also have a significant impact on the market positioning and product strategies of automotive brands.

Tesla leads in autonomous driving technology with its Autopilot and Full Self-Driving (FSD) capabilities, integrating advanced sensors, and AI to provide near-autonomous driving experiences. Continuous updates have improved functionality and safety over time, for example, according to official data published in 2024, only one accident occurs every 518 miles to 618 miles when using the Autopilot system, compared to an average of one accident every 670,000 miles in the United States in 2022 [2]. BYD offers smart features in its vehicles, including adaptive cruise control and lane-keeping assist, but has not yet reached the level of autonomy provided by Tesla. However, BYD focuses on integrating smart connectivity and safety features to enhance the driving experience [3]. Tata Motors, focusing on affordability, provides smart features such as connected car technology and driver assistance systems in its EVs [4]. While not as advanced in autonomy as Tesla, Tata's approach makes smart EV technology accessible to a broader audience.

The examples of Tesla, BYD, and Tata Motors illustrate the strategic importance of technological innovation in the electric vehicle market, demonstrate how technological leadership is driving market differentiation and consumer preference, and highlight the megatrend of rapid technological advancement in the electric vehicle industry. The global electric vehicle industry is bound to see more innovation as companies continue to push the boundaries and shape the future of mobility, sustainability, and energy efficiency.

However, despite their technological crossover, each of these companies has adopted unique market positioning and differentiation strategies. Tesla, with its leadership in battery technology, drive systems, and autonomous driving, has successfully created a premium, innovative brand image and consolidated its leadership in the premium market. At the same time, BYD has successfully captured the mid-range market through its comprehensive low-carbon strategy and cost-effective products that cater to a wide range of consumers with high requirements for range, safety, and value for money. Tata Motors is focused on meeting the needs of price-sensitive consumers in emerging markets by providing practical and reliable electric vehicle solutions [4].

The strategies of these three companies not only demonstrate their competitive advantages in the global EV market but also reflect their deep understanding of the needs of different markets.

3.Market Penetration Strategies and Pricing Models

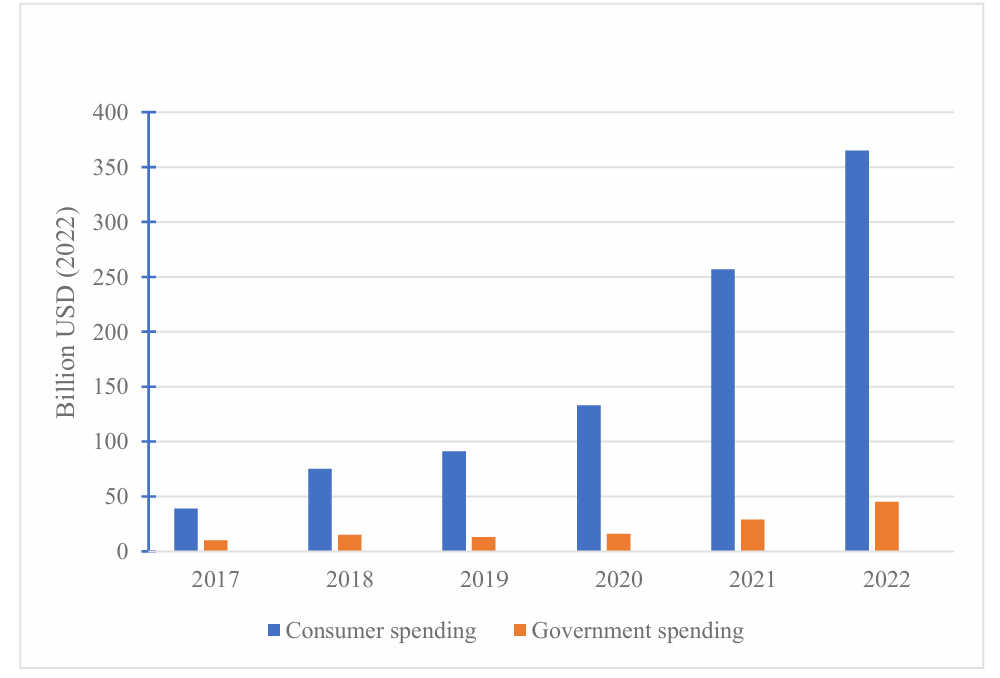

The electric vehicle (EV) industry has witnessed substantial growth from 2017 to 2022, with consumer adoption increasing exponentially. Figure 1 illustrates this surge in demand, highlighting the compounded annual growth rate (CAGR) of EV sales worldwide. Despite the fluctuating and modest government spending on EV infrastructure and incentives, there is an observable uptick in investment, signaling a supportive albeit cautious stance towards electrification. The upsurge is a clear indicator of the market's readiness for innovative transportation solutions, and the imperative for EV manufacturers to devise effective market entry and pricing strategies. This section aims to dissect the approaches taken by pivotal players in the EV landscape, to navigate the economic landscapes and consumer predilections within their respective target demographics.

Figure 1: Global spending on electric cars, 2017-2022 (Picture credit: Original).

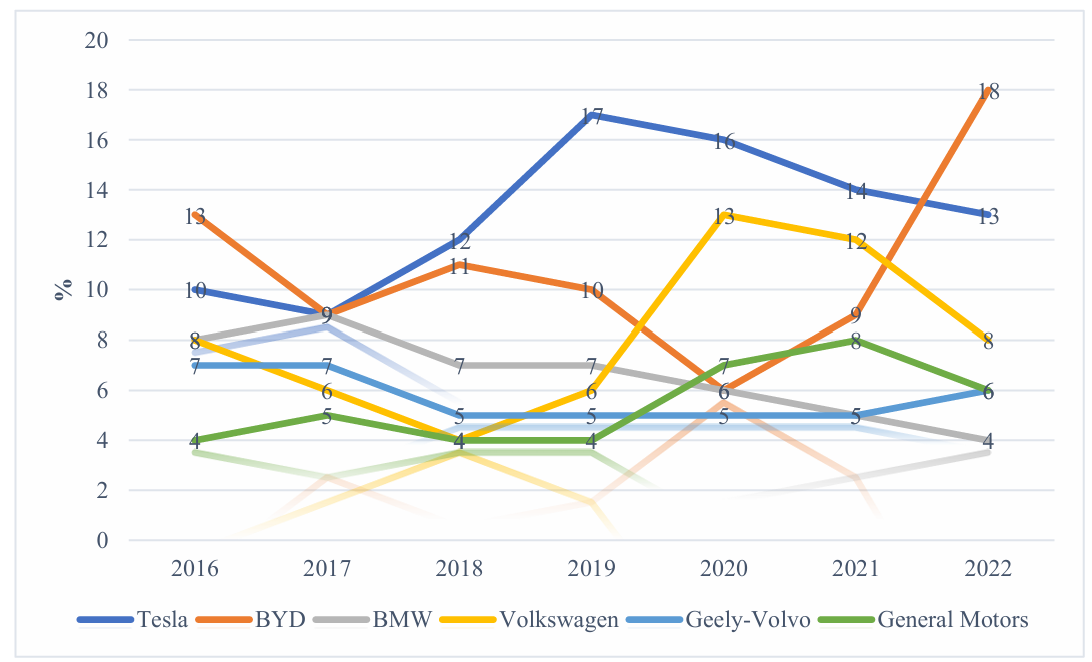

3.1.Comparative Analysis

Firstly, in terms of market positioning, Tesla, as a pioneer in the electric vehicle industry, adopts a direct sales model that distinguishes it from traditional car brands, coupled with its innovation in electric vehicle technology, i.e., by offering high-performance, high-tech electric vehicles (as all the models are shown in Table 1). Tesla has succeeded in attracting a large number of consumers who are in pursuit of new technology, high-end quality control and sustainable lifestyles, which has laid the foundation for its positioning in the premium market [6]. On the other hand, in terms of pricing, the Tesla Model S starts at around USD 94,990 at the end of 2023, while the Model 3, a relatively more popular option, also has a base price of around USD 42,990 [2]. Additionally, Tesla employs a dynamic pricing strategy that constantly adjusts prices based on production costs and and market demand from quarter to quarter [6]. As a result, as Figure 2 demonstrates, Tesla's share of the global EV market is far greater than that of other brands, especially during the 2018-2021 period. Meanwhile, the very impressive sales forecasts in Table 1 illustrate that Tesla's high-end market positioning strategy has helped Tesla to maintain high-profit margins and customer loyalty in an increasingly competitive market, and to establish a sustained market leadership position, highlighting the effectiveness of the strategy.

In contrast, BYD is adopting a cost-effective strategy. Firstly, the approximate pricing of BYD's various series is as follows: the most common car models such as the Seagull EV will start at $11,400 in 2023, and the Yuan Pro will go on sale for $13,400; while the Tang series, one of the most powerful series, will remain in a price range of between $34,300 and $41,100 in 2023 [7]. Simultaneously, the government has also provided substantial subsidies. From Table 2, it is clear to see that BYD's various vehicle series are focusing on affordable and cost-effective electric vehicles to cater to a wider consumer base by focusing on the key Chinese market without sacrificing quality through mass production and optimizing supply chain costs [8]. This strategy is critical in regions with different economic backgrounds and is essential for BYD to expand its global footprint. In addition, by innovating battery technologies and optimizing production processes, BYD has also emphasized that high-volume, cost-effective EV production can meet the growing consumer base's demand for sustainable and affordable transport options, maintaining an edge in a highly competitive market.

Table 1: Tesla Sales Forecast (10,000 units)

|

2021 (10000 units) |

2022 (10000 units) |

2023 (10000 units) |

2024 (10000 units) |

2025 (10000 units) |

2030 (10000 units) |

||

|

region |

China |

47 |

44 |

72 |

85 |

95 |

150 |

|

United States |

30 |

52 |

90 |

135 |

175 |

300 |

|

|

Europe |

17 |

23 |

30 |

38 |

45 |

70 |

|

|

vehicle model |

Model 3 |

40 |

48 |

60 |

80 |

90 |

230 |

|

Model Y |

51 |

75 |

100 |

130 |

150 |

300 |

|

|

Model X/S |

3 |

7 |

10 |

15 |

20 |

30 |

|

|

Cyberyruck |

20 |

30 |

50 |

120 |

|||

|

Semi |

2 |

3 |

5 |

10 |

|||

|

Total |

94 |

131 |

192 |

258 |

315 |

520 |

|

|

YOY |

39.36% |

46.56% |

34.38% |

22.09% |

Table 2: BYD Sales Forecast (10,000 units)

|

2021 (10000 units) |

2022 (10000 units) |

2023 (10000 units) |

2024 (10000 units) |

2025 (10000 units) |

2030 (10000 units) |

||

|

Domestic sales |

59 |

180 |

340 |

420 |

460 |

600 |

|

|

Export |

- |

6 |

20 |

35 |

50 |

100 |

|

|

vehicle model |

YUAN |

4 |

20 |

50 |

65 |

72 |

127 |

|

QIN |

17 |

32 |

50 |

65 |

73 |

80 |

|

|

SONG |

11 |

42 |

70 |

80 |

88 |

120 |

|

|

HAN |

12 |

25 |

42 |

50 |

58 |

70 |

|

|

TANG |

5 |

14 |

21 |

30 |

33 |

50 |

|

|

DOLPHIN |

3 |

20 |

40 |

50 |

58 |

60 |

|

|

SEAL |

- |

5 |

20 |

30 |

35 |

40 |

|

|

Total |

59 |

186 |

360 |

455 |

510 |

700 |

|

|

YOY |

215.25% |

93.55% |

26.39% |

12.09% |

Figure 2: Share of global EV markets by selected carmakers, 2016-2022 (Picture credit: Original).

It is worth noting that in recent years, emerging markets and brands have emerged, such as India, Thailand, and Indonesia. According to the Global Electric Vehicle Outlook 2023, combined EV sales in these countries more than tripled in 2022 from 2021 to 80,000 units, despite the relatively small base of the EV market in these regions [1].

In emerging markets, EV adoption is influenced by a range of factors, including economic constraints, infrastructure readiness, and government policies. Brands operating in these regions are increasingly adopting flexible pricing strategies and partnering with local governments to offer incentives to promote EV adoption there. A case in point is the $3.2 billion incentive program launched by the Indian government, which should be used primarily for the development of the manufacturing side of electric vehicles and their components, which has attracted $8.3 billion in investment [1]. These efforts are aimed at overcoming barriers to entry and making electric vehicles more accessible to the general public. Strategically deploying pricing models based on the economic realities and social needs of these markets will be critical to accelerating the transition to electric vehicles [9].

In summary, the comparative analysis reveals that while Tesla's high-end positioning targets a niche market segment willing to invest in premium EVs, BYD's cost-efficient approach seeks to democratize EV ownership by making it more accessible. In emerging markets, the adoption strategies pivot on pricing models that address specific economic and societal contexts, underscoring the importance of flexibility and localization in global market penetration efforts.

4.Sustainability and Environmental Policies

In the current global marketplace, automakers' sustainability and environmental policies are not only a commitment to environmental responsibility but have also become a central component of brand and product positioning strategies. For electric vehicle (EV) manufacturers, these policies not only reflect their stance on combating climate change but also have a direct impact on consumer perceptions of the brand and its competitiveness in the marketplace.

4.1.Comparative Analysis of Corporate Responsibility

In terms of corporate responsibility, electric vehicle manufacturers demonstrate their commitment to the environment by adopting different sustainability and environmental protection measures.

In the Western market, Tesla's sustainability strategy is noteworthy for its leadership in sustainability not only in its products (i.e. electric vehicles) but also in its operations and supply chain management. A key example is Tesla's Gigafactory, a large battery factory dedicated to using renewable energy and reducing its carbon footprint, of which there are currently six worldwide. Many of the Gigafactories reportedly have solar panels on their roofs, designed to maximize thermal energy recovery and achieve zero-carbon emissions [2]. At the same time, Tesla is also emphasizing environmental responsibility with its innovative battery recycling program and solar product line. Through these measures, Tesla has not only reduced its dependence on fossil fuels but also enhanced its brand image and attracted consumers with a high concern for sustainability [6].

In comparison, among Asian markets, China's BYD has adopted a more integrated sustainability strategy. Firstly, BYD has highlighted its efforts to promote sustainable transport solutions by adopting its self-developed iron battery technology and promoting electric buses globally. In addition to producing electric transport, BYD is also involved in solar power generation and energy storage to form an environmentally friendly ecosystem. Besides, BYD has taken proactive measures in battery recycling and material sustainability [3]. These measures not only reduce carbon emissions, reflecting its overall commitment to sustainability but also increase its competitiveness in the international market, demonstrating its ambition to be a global sustainable brand.

The comparison shows that despite the differences in the specific measures taken by Tesla and BYD, they have both strengthened their brand image through their sustainability strategies and have gained a favorable competitive position in the global electric vehicle market.

4.2.Comparative Analysis of Government Regulatory Frameworks

Government regulatory frameworks also have important implications for the sustainability and environmental policies of electric vehicle manufacturers.

Subsidies and tax incentives are the main tools for promoting the sale of electric vehicles. For instance, the European Union (EU) has encouraged the production and adoption of electric vehicles by imposing stringent carbon emission standards and providing subsidies for the purchase of electric vehicles; while the Norwegian government offers consumers an exemption from the 10% purchase tax and 25% value-added tax (VAT) on the price of cars, making electric vehicles competitive with conventional fuel vehicles on overall cost [1]. These policies not only promote the development of EV technology but also provide a favorable market environment for EV manufacturers. By contrast, the U.S. has a federal tax credit of up to $7,500, but this benefit is regressive, and the subsidy begins to taper off once a given manufacturer sells more than 200,000 EVs [10]. This regional disparity presents both a challenge and an opportunity for global EV makers, as they will need to adapt their respective strategies to accommodate regulations in different markets.

On the other hand, stringent emission standards in regions such as the EU, China, and California have prompted automakers to accelerate the development and launch of electric vehicles into the market. EU emissions regulations require carmakers to reduce the average CO2 emissions of new vehicles, forcing brands to shift to cleaner EV technologies [1]. The Chinese government has implemented a new energy vehicle points policy that requires manufacturers to produce a certain percentage of EVs to meet overall sales volume requirements. In 2023, China added a new energy vehicle points pool to manage the new energy vehicle points, updated the points calculation methodology, and continued to form a market-based mechanism for the coordinated development of energy efficiency and EVs [11]. These policies are not only driving the development of EV technology but also prompting brands to adopt more aggressive marketing strategies in these crucial markets.

Overall, the sustainability and national environmental policies of electric vehicle manufacturers are key components of their brand and product positioning strategies. Through corporate responsibility and adapting to different government regulatory frameworks, these manufacturers cannot only demonstrate their commitment to the environment but also differentiate themselves in the global marketplace. The importance of these strategies will only increase further as consumers and governments continue to pay more attention to environmental issues. Therefore, for electric vehicle manufacturers, a deeper understanding and an effective response to these challenges will be key to achieving long-term success.

5.Conclusion

The comparative analysis of product positioning strategies in the global electric vehicle (EV) market underscores the multifaceted nature of achieving success in this rapidly evolving sector. Leading brands like Tesla and emerging players such as BYD and Tata Motors have showcased a range of strategies that exemplify the critical role of technological innovation, market penetration tactics, effective pricing models, and a commitment to sustainability and environmental policies in carving out a competitive edge.

Technological innovation emerges as a cornerstone, with advancements in battery technology, drive systems, and autonomous features serving as key differentiators that influence consumer preferences and market dynamics. However, the analysis reveals that innovation extends beyond product features, encompassing market penetration strategies and pricing models that reflect a deep understanding of the diverse global marketplace. The strategic positioning of Tesla at the premium end of the market contrasts with BYD's focus on affordability, highlighting the importance of aligning product offerings with target consumer segments and economic realities.

Furthermore, sustainability and environmental policies have become integral to brand and product positioning, resonating with the growing consumer demand for environmentally responsible products. The initiatives undertaken by the companies analyzed in this study not only contribute to environmental sustainability but also enhance brand loyalty and market competitiveness by aligning corporate values with consumer expectations.

In conclusion, the global EV market presents a complex landscape where success is predicated on a multifaceted strategy that balances technological innovation with strategic market penetration, adaptive pricing, and a commitment to sustainability. The insights garnered from this comparative analysis offer valuable lessons for existing and aspiring EV manufacturers. As the market continues to evolve, the ability to innovate, adapt, and align with broader societal values will remain pivotal in shaping the future of sustainable transportation. For stakeholders across the automotive industry, understanding and implementing these multifaceted product positioning strategies will be crucial in navigating the challenges and seizing the opportunities of the electric vehicle revolution.

References

[1]. International Energy Agency (IEA). (2023) Global EV Outlook 2023. Retrieved from https://www.iea.org/reports/global-ev-outlook-2023.

[2]. Tesla. (2023) Electric Cars, Solar Panels & Clean Energy Storage | Tesla. Retrieved from https://www.tesla.com/en_gb

[3]. Huang, H. (2022) Investment Analysis of BYD: A New Energy Vehicle Enterprise. In 2022 2nd International Conference on Economic Development and Business Culture, Atlantis Press, 71-76).

[4]. Adnan, Z. H., Chakraborty, K., Bag, S., Wu, J. S. (2023) Pricing and green investment strategies for electric vehicle supply chain in a competitive market under different channel leadership. Annals of Operations Research, 1-36.

[5]. Montoya-Torres, J., Akizu-Gardoki, O., Iturrondobeitia, M. (2023) Optimal replacement scenarios for an average petrol passenger car using life-cycle assessment. Journal of Cleaner Production, 423, 138661.

[6]. Qin, K. (2022) Analysis of Tesla’s innovation strategy and influence of leadership. In Advances in economics, business and management research, 228–238.

[7]. BYD. (2023) About Us | BYD USA. Retrieved from https://www.byd.com/us/about-byd

[8]. Lai, Y., Li, D., Luo, Y., Wu, G. (2023) Analysis of Enterprise Valuation and Future Development Trends of BYD Company. Highlights in Business, Economics and Management, 19, 440-449.

[9]. Liu, C. (2023) Comparison of Corporate Strategies Adopted by Tesla and BYD. Comparison of Corporate Strategies Adopted by Tesla and BYD, 25(1), 170–175.

[10]. Slowik, P., Searle, S., Basma, H., Miller, J., Zhou, Y., Rodríguez, F., Baldwin, S. (2023) Analyzing the impact of the Inflation Reduction Act on electric vehicle uptake in the United States. Energy Innovation and International Council on Clean Transportation. 99, 1-1.

[11]. Lin, J., Shimada, K. (2023) An Empirical Study on the Policies Affecting the Market Penetration of New Energy Vehicles in China. The Ritsumeikan Economic Review, 71(4), 3-20.

Cite this article

Wang,Z. (2024). A Comparative Analysis of Product Positioning Strategies in the Global Electric Vehicle Market: Insights from Leading Brands and Emerging Markets. Advances in Economics, Management and Political Sciences,84,288-296.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. International Energy Agency (IEA). (2023) Global EV Outlook 2023. Retrieved from https://www.iea.org/reports/global-ev-outlook-2023.

[2]. Tesla. (2023) Electric Cars, Solar Panels & Clean Energy Storage | Tesla. Retrieved from https://www.tesla.com/en_gb

[3]. Huang, H. (2022) Investment Analysis of BYD: A New Energy Vehicle Enterprise. In 2022 2nd International Conference on Economic Development and Business Culture, Atlantis Press, 71-76).

[4]. Adnan, Z. H., Chakraborty, K., Bag, S., Wu, J. S. (2023) Pricing and green investment strategies for electric vehicle supply chain in a competitive market under different channel leadership. Annals of Operations Research, 1-36.

[5]. Montoya-Torres, J., Akizu-Gardoki, O., Iturrondobeitia, M. (2023) Optimal replacement scenarios for an average petrol passenger car using life-cycle assessment. Journal of Cleaner Production, 423, 138661.

[6]. Qin, K. (2022) Analysis of Tesla’s innovation strategy and influence of leadership. In Advances in economics, business and management research, 228–238.

[7]. BYD. (2023) About Us | BYD USA. Retrieved from https://www.byd.com/us/about-byd

[8]. Lai, Y., Li, D., Luo, Y., Wu, G. (2023) Analysis of Enterprise Valuation and Future Development Trends of BYD Company. Highlights in Business, Economics and Management, 19, 440-449.

[9]. Liu, C. (2023) Comparison of Corporate Strategies Adopted by Tesla and BYD. Comparison of Corporate Strategies Adopted by Tesla and BYD, 25(1), 170–175.

[10]. Slowik, P., Searle, S., Basma, H., Miller, J., Zhou, Y., Rodríguez, F., Baldwin, S. (2023) Analyzing the impact of the Inflation Reduction Act on electric vehicle uptake in the United States. Energy Innovation and International Council on Clean Transportation. 99, 1-1.

[11]. Lin, J., Shimada, K. (2023) An Empirical Study on the Policies Affecting the Market Penetration of New Energy Vehicles in China. The Ritsumeikan Economic Review, 71(4), 3-20.