1.Introduction

1.1.Research Background

China's economy is entering a new phase of development, transitioning from an extensive growth model with limited environmental constraints to a sustainable development model. Domestic enterprises are experiencing rapid growth, achieving record-breaking financial indicators annually. However, they also face numerous challenges. In 2023 alone, China's ecological and environmental departments handled 79,600 cases of administrative penalties amounting to a total fine and forfeiture of 6.27 billion yuan. The integration of enterprise operations and development with environmental protection has become the focal point across various sectors. Simultaneously, as the concepts of environmental protection and social responsibility deepen, the public and investors have increasingly raised their expectations for non-financial information disclosure by enterprises [1]. Consequently, the concept of ESG (Environmental, Social, and Governance) has gradually gained prominence among the general public.

In the 1990s, the international community began incorporating ESG concepts into investment decisions. ESG factors encompass environmental, social, and governance aspects, providing a framework for external stakeholders such as governments, the public, and investors to address information asymmetry. This not only enables investors to gain a comprehensive understanding of enterprises' sustainable development but also facilitates timely detection and warning of non-financial risks for governments and the public. Government agencies have established an authoritative ESG evaluation system. Since the 21st century, China has enacted 62 relevant policies and regulations, with 48 still in effect. Starting from June 2015, China has introduced standard systems such as "Social Responsibility Guidelines" and "Social Responsibility Performance Classification Guidelines", marking a new phase in social responsibility practices. Recently, the State-owned Assets Supervision and Administration Commission of the State Council formulated and issued a "Work Plan to Improve the Quality of Listed Companies Held by Central Enterprises," which sets higher requirements for ESG management and disclosure while emphasizing implementation of the new development concept along with exploration towards establishing an improved ESG system.

The photovoltaic industry has experienced rapid growth due to its green products' high economic value; moreover, their low usage costs have made them indispensable in driving forward the new energy revolution. In China alone, by 2023 photovoltaic power generation is projected to cost merely ¥0.3 per kilowatt-hour (kWh), representing a significant decrease from ¥0.7/kWh recorded in 2015 – approximately a remarkable reduction rate of about 57% within eight years – thus positioning photovoltaic as one of renewable energy's most affordable sources. Against this backdrop, major countries have introduced policies to promote the rapid development of new energy: General Secretary Xi Jinping has proposed a target of 25% non-fossil energy consumption by 2030; on March 8, 2022, the European Commission released the REPowerEU proposal to further accelerate the green transition and reduce the dependence on Russian gas on the basis of the Green New Deal target (Fitfor55) put forward on July 14, 2021; at the end of February 2023, Germany also put forward new draft legislation for new energy development to achieve 100% renewable energy power generation 15 years ahead of the target to be completed by 2035.

The photovoltaic industry, despite being in an emerging market with less competition, it still faces both crises and opportunities. There are uncertainties regarding policy changes externally, as well as risks of low-price competition and technological backwardness internally. When an enterprise increases its investment in ESG (environmental, social, and governance) resources, it may reduce the resources allocated to direct production and operational activities. These resources do not directly generate cash returns and could potentially impact the performance of the enterprise. However, such investments can still yield positive effects such as investor and consumer recognition, tax reductions, and policy subsidies from government agencies. Companies can obtain more government subsidies by improving their ESG performance. Mechanism analysis shows that corporate transparency plays a positive mediating role in the process of ESG influencing government subsidies [2]. High-rated ESG companies have lower cost of capital, which can be interpreted as investors' preference for more sustainable assets, thus contributing to corporate financing and market value management [3].While there have been numerous studies on the relationship between ESG and enterprise performance, most fail to clearly describe their impact on performance. Improving ESG performance requires significant financial investment and resource allocation; Also, the better the ESG performance, the greater the inhibition on the level of inefficient investment [4]. What’s more, though ESG investment is significant compared to market index investment, its significance is limited due to the convergence of ESG investment performance and market portfolio performance [5]. Therefore, whether it is necessary to pursue remains a question that the author aims to explore.

1.2.Importance and Relevance of the Research

This study possesses not only theoretical significance but also practical significance. ESG encompasses a broad spectrum of fields, encompassing ESG practice and ESG investment. Existing research in China primarily focuses on the construction of ESG rating and indicator systems, with an excessive emphasis on index disclosure, particularly within the realm of ESG investment. The limited studies conducted on the relationship between ESG and enterprise performance are predominantly empirical in nature, lacking integration with specific management and operational scenarios of enterprises while disregarding their combination with management and operation practices. Therefore, directing attention towards the impact of ESG practice on enterprise performance and exploring the pathway from ESG practice to enterprise performance partially enriches research in this area while providing valuable insights for subsequent studies.

The findings of this study also offer valuable insights for regulators. Currently, China does not impose mandatory requirements for corporate ESG information disclosure, indicating a relative lack of emphasis on ESG compared to foreign countries which already focus on importance of data sources and quality, selection of ESG indicators, weighting and aggregation methodologies, and the necessary validation and benchmarking procedures [6]. Standardization of ESG reporting and evaluation frameworks would reduce efforts to adopt ESG information and could build a strong foundation for facilitating ESG information integration so it is vital to formalise ESG [7]. But Many domestic enterprises rely on their own understanding when it comes to ESG practices and information disclosure, resulting in insufficient standardization. Therefore, this study serves as a useful resource for regulators to effectively guide enterprises towards targeted ESG practices and facilitate the sustainable development of society.

2.Methodologies and Content of the Research

As it comes to the methodologies and content, firstly, the author points out that ESG practices can potentially enhance overall enterprise performance by influencing financial and market performance. Secondly, the author outlines the impact pathway of ESG practices on enterprise performance. It examines case enterprises such as LONGi Green Energy (mainly), Jinko Solar, etc., highlighting their specific situations and demonstrating the necessity of adopting ESG practices. Through vertical analysis of market performance and financial indicators, along with case analysis and comparative study methods employed in this research, the author explores how ESG practices influence enterprise performance. Furthermore, through horizontal analysis of photovoltaic enterprise performance data, the author investigates how ESG factors affect the entire photovoltaic industry's operational outcomes while also introducing non-economic factors' impact on enterprise performance. Additionally, questionnaire surveys and interviews are conducted to further supplement information collection.

3.Analysis and Discussion

3.1.Case

LONGi Green Energy has been listed since 2012, boasting absolute advantages in the single crystal silicon segment and experiencing rapid growth in the module sector, thereby setting a new market value record for photovoltaic enterprises and establishing itself as an undisputed leader in the industry. The company's core operations encompass research and development, production, and sales of single crystal silicon rods, silicon wafers, batteries, and components. It stands as the world's largest manufacturer of single crystal photovoltaic products that seamlessly integrates research and development, production, sales, and service. Based on available data for H1 this year, LONGi achieved an operating revenue of CNY 64.652 billion—an impressive Y to Y increase of 28.36%.—significantly surpassing previous figures, becoming The forefront of the photovoltaic industry. As a top-tier enterprise committed to excellence across environmental (E), social (S), and governance (G) practices—commonly referred to as ESG—it consistently upholds these principles while actively engaging in effective ESG initiatives. Notably from 2021 to 2023 period onwards its ESG rating is expected to remain above A.

3.2.Analysis

3.2.1.LONGi’s Practice in ESG

3.2.1.1.In the Environment Aspect

LONGi is dedicated to pursuing environmentally-friendly practices and is committed to achieving scientifically-based carbon reduction targets in accordance with the requirements of SBTi and the Paris Agreement. It has pledged to reduce greenhouse gas emissions by 60% and decrease raw material carbon intensity by 20% by 2023. In terms of environmental compliance and resource consumption reduction, LONGi strictly adheres to environmental laws, regulations, and requirements. The company has implemented a robust Environmental Impact Assessment (EIA) system and internal management system, obtaining ISO14001 certification as well. Notably, the group has achieved a 5.389% decrease in electricity consumption per unit and a 10.739% decrease in water consumption. Regarding waste discharge management, LONGi meticulously oversees waste disposal processes through the formulation of corresponding management systems while entrusting third-party entities for handling hazardous waste disposal; this approach maximizes material value through recycling.

3.2.1.2.In the Social Aspect

In terms of social responsibility, LONGi excels in product creation and maintains a leading position in the photovoltaic industry through independent innovation and high investment in research and development (according to the the principle that the impact of enterprise green technology innovation on enterprise ESG performance has marginal increasing effect [8]. And ESG performance promotes corporate innovation by reducing agency problems, enhancing information disclosure, and improving internal corporate governance [9]). The company has established a multi-level R&D system that attracts top technical experts to join its team. LONGi Green Energy has broken world records for battery conversion efficiency dozens of times, while also improving its quality management system to ensure product excellence. It prioritizes customer satisfaction by providing standardized services throughout the entire life cycle, including establishing comprehensive customer service archives and three major support platforms, utilizing digital technology to encode products, and offering personalized customer service tailored to meet individual needs. Mechanism tests reveal that digital finance influences ESG performance by promoting firm green innovation, improving firm goodwill and reducing agency costs [8]. Additionally, it strengthens supply chain management by adhering to sustainable development principles that reduce environmental and social risks through access standards and thresholds while fostering collaborative innovation with suppliers. Finally, LONGi protects employee rights by promoting fair labor policies that eliminate child labor and forced labor practices as well as gender inequality issues; it also invests heavily in employee training programs designed to improve overall quality while establishing clear career development paths.

3.2.1.3.In the Governance Aspect

In terms of governance, LONGi Green Energy has optimized its corporate governance system to enhance the level of governance. The company places great importance on the independence and diversity of its board of directors and actively engages in information disclosure and investor communication to achieve a healthy and sustainable development. In 2021, Longji Green Energy established the Compliance Department within the Legal Center to strengthen compliance management. This department is responsible for establishing a legal compliance risk prevention and control management system to support the global operational needs of the group. Furthermore, LONGi Green Energy strategically laid out its entire industry chain. During a period of performance decline, it seized the opportunity presented by the domestic distributed market and promptly expanded into middle and lower segments of the industrial chain for single crystal silicon product applications. By integrating production links and constructing downstream power stations, it successfully opened up all aspects of the photovoltaic industry's value chain, promoting comprehensive development throughout. LONGi also implemented an effective appeal procedure to ensure fairness and justice while adhering to principles of honesty, trustworthiness, anti-corruption measures, as well as respecting basic human rights for employees. The company established an audit and supervision center along with an anti-bribery management system that includes relevant institutional documents and regulations. Since becoming certified as the first enterprise in the global photovoltaic industry with IS037001 anti-bribery management system certification, annual audits have been conducted continuously until 2023.

3.2.2.ESG Practice in Photovoltaic Industry

Although Vertically-integrated-development enterprises-LONGi Green Energy, Jinko Solar, and Tongwei’s primary business focuses differ (As LONGi specializes in midstream single crystal technology, operating within the entire industry chain of "monocrystalline silicon wafer - solar cells and modules - distributed photovoltaic." Tongwei concentrates on upstream high-purity silicon production with its main product being polycrystalline wafers. Lastly, Jinko primarily emphasizes downstream expansion by focusing mainly on monocrystalline cells and modules). However, it is worth noting that all three companies actively prioritize ESG practices.

Jinko Solar and Tongwei advocate environmentally friendly operations in terms of environmental protection, actively responding to climate change by continuously optimizing the environmental management system, improving energy management, standardizing waste disposal and resource utilization, and enhancing the governance system for air pollutants. The two companies also actively promote environmental protection through the construction of green parks and implementation of public welfare activities, integrating it into their corporate operations.

In terms of social responsibility, similar to LONGi, both companies strive for innovation in research and development while strictly controlling product quality to safeguard customer rights and interests through various means. They also actively build a sustainable supply chain by standardizing supplier behavior through supplier management, assessment, and capacity improvement. Additionally, attention is given to talent team building while actively participating in public welfare activities to fulfill their social responsibility.

In terms of corporate governance, like LONGi, both companies continue to optimize their corporate governance structure while deepening risk compliance management. They adhere to a transparent business philosophy and maintain continuous relations with investors.

The adoption of ESG practices has become a prevailing trend in the photovoltaic industry, as observed from the practices of the three leading enterprises.

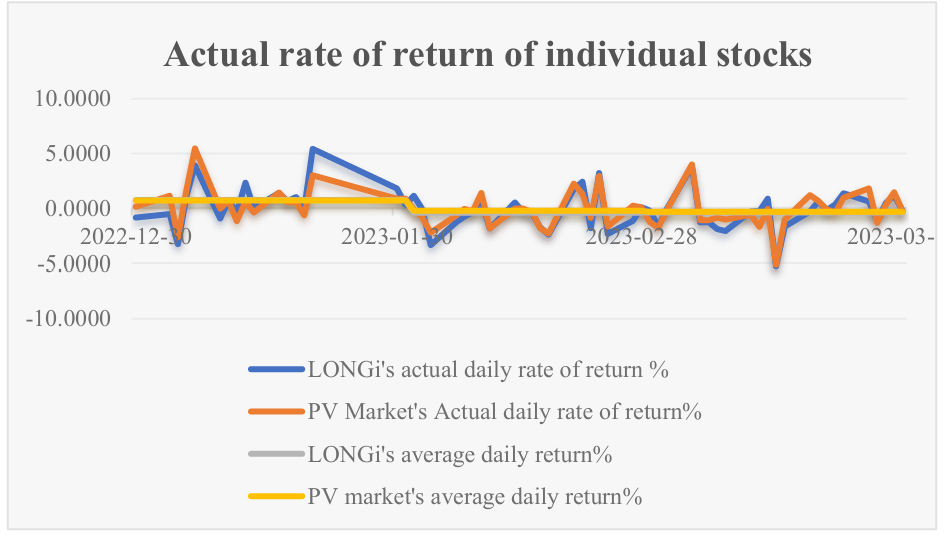

3.2.3.The Analysis of Market Performance

Conducting a case study on the short-term market impact, this paper employs the event study method to assess the immediate effects of LONGi Green Energy in the capital market. Specifically, it focuses on the first quarter of 2023 when LONGi Green Energy ESG was selected as Forbes' annual ESG inspiration case benchmark date, spanning from January 1st to March 31st. The author meticulously selects and analyzes both performance condition and daily stock prices of LONGi Green Energy and the photovoltaic market during this event window period using a choice financial terminal. Furthermore, by considering the closing price of LONGi Green Energy Shanghai Composite Index throughout the estimated window period, various metrics such as daily rate of return, average rate of return, and monthly rate of return are calculated for both individual stocks and market index. The formulas are stated as follows:

\( Daily real return=Daily closing price-Daily opening price/Daily opening price \)(1)

\( Average return =Sum of daily real returns in a month/Number of trading days in a month \)(2)

The final data is made into a line chart as Fig.1:

Figure 1: Comparison of LONGi and PV industry about their actual rate of return on individual stocks

Then the author use the following formula to further analysis the data in Fig 1:

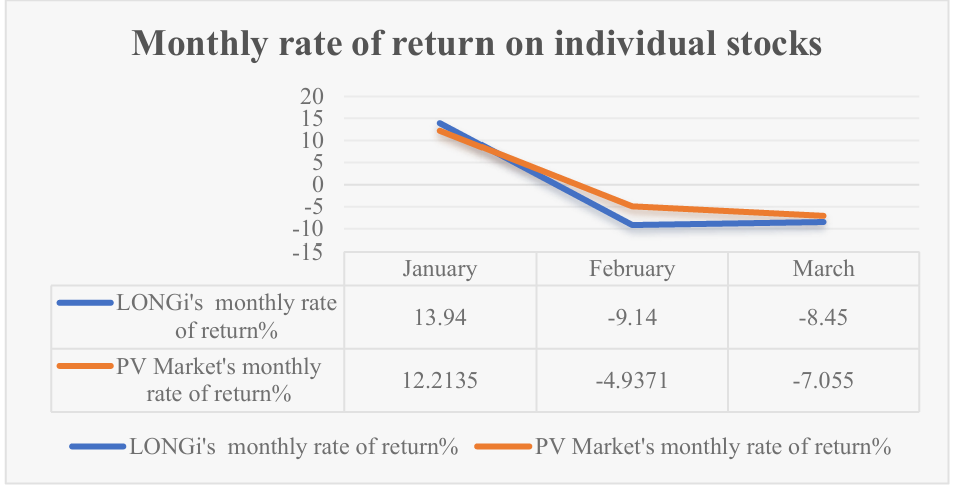

Monthly real return = Monthly closing price - Monthly opening price / Monthly opening price.

Ultimately the author make the data into Fig.2:

Figure 2: Comparison of LONGi and PV industry about their monthly rate of return on individual stocks

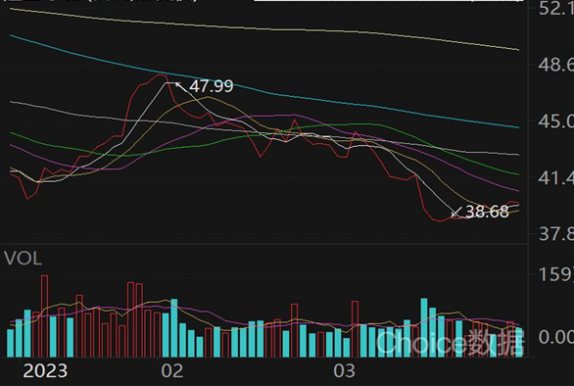

The author therefore utilized the choice financial terminal database to generate a chart based on the available data:

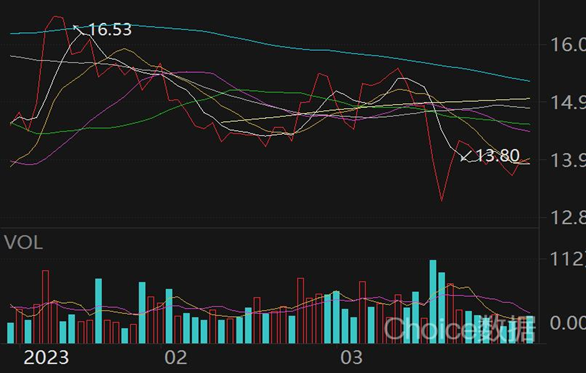

Figure 3: LONGi’s Closing Price Chart

Figure 4: PV Market’s Closing Price Chart

It can be observed that while ESG practices are being implemented gradually, LONGi Green Energy has also demonstrated commendable performance in this reporting period. According to statistical data, the total revenue at the end of this report stands at 28.319 billion yuan, reflecting a significant increase of 52.29% compared to the corresponding period last year. The net profit attributable to the parent company amounts to 3.637 billion yuan, exhibiting a notable growth rate of 36.52% when compared with the same period last year. These figures indicate a substantial improvement in both sales and profitability for the company during this reporting cycle, surpassing a growth rate of over 50%. Furthermore, as of the end of this report, total assets have reached 143.875 billion yuan, marking an impressive rise of 25.69% from the previous year's equivalent period; meanwhile, total liabilities amount to 77.922 billion yuan which represents an increase of 22.35% compared with the same period last year; consequently resulting in a reduced debt ratio standing at 54.18%, down from its previous value of 55.66%. The aforementioned statement suggests that the company underwent a modest expansion of its assets during the reporting period, while effectively managing its debt. Longji Green Energy's return on equity (ROE) at the end of the reporting period stood at 5.69%, reflecting an increase of 4.98% compared to the corresponding period last year. Similarly, return on assets (ROA) reached 2.56%, indicating a growth of 2.33% in comparison to the same period last year. However, there was a decline in gross margin by 19.25%, resulting in it standing at 10.28% for this reporting period as opposed to last year's figure. Furthermore, the debt ratio remained relatively stable at 54.18%, showing no significant change from the previous year's level. These data collectively suggest an improvement in profitability for the company; however, they also indicate a decrease in profit quality.

The analysis of the correlation with actual events reveals that Longji experienced rapid growth in January, as shown in Fig.1.and Fig.2., emerging as a prominent leader in the photovoltaic market compared to its competitors. This achievement can be primarily attributed to LONGi's efficient productivity and its sincere collaboration with NIO in jointly establishing a robust presence in the new energy automobile charging sector. Such strategic positioning not only yields economic benefits but also serves as an effective implementation of ESG principles, aiming to reduce reliance on fossil fuels for automotive electricity consumption and consequently mitigating environmental pollution caused by vehicle exhaust emissions. This aligns perfectly with China's development strategy for the new energy automobile industry, facilitating its transformation and upgrading.

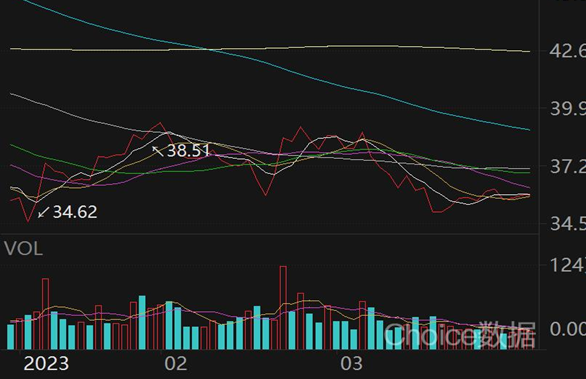

In the later stages of investment, particularly in February, a noticeable decline in yields can be observed, the rate of return suddenly decreased from 0.73% to -0.40% in Fig.2.,the stock price is declining, too, as shown in Fig.3. and Fig.4.. This phenomenon is not exclusive to a single company but rather exhibits industry-wide characteristics like what Fig.4.shows. Taking JinkoSolar and Tongwei as examples, both operating within the new energy sector, they have also encountered similar declines in yields (refer to the charts Fig.5. and Fig.6.below). Jinko’s stock price declined by 17% while Tongwei’s declined by 9%.

Figure 5: JinkoSolar’s Green Energy’s Closing Price

Figure 6: Tongwei’s Closing Price

This phenomenon is primarily attributed to the combined influence of the following factors: Firstly, the decrease in silicon material prices leads to a decline in profitability for silicon chips. Silicon material serves as a crucial raw material in silicon chip production. The reduction in its price lowers the production cost of silicon chips and compresses profit margins. Secondly, the overall downturn in the new energy industry results in a significant drop in operating revenue and profit growth, further impacting company profitability. As industry development slows down, both revenue and profit growth rates for the company decelerate, directly causing stock price declines. Additionally, volatility and instability within international markets exacerbate investment risks. Despite LONGi Green Energy's plans to go public in Switzerland, there are uncertainties associated with investment environments in Malaysia, Vietnam, and other locations that pose potential risks for the company. Lastly, the accelerated reduction of positions by public equity firms has also increased pressure on the market. As public equity firms reduced their positions, the number of outstanding shares in the market increased, leading to a decline in the share price and further affecting the company's yield. To summarize, the decline in yield is the result of a combination of factors, and previously in the LONGi Green Energy ESG from B to A and stabilization period (2017-2021), the three companies' year-on-year growth rate of operating income have maintained a positive year-on-year growth rate, which is higher than that of the other two companies, reaching more than 60% in 2020; in the vulnerable Tongwei's year-on-year revenue growth rate is also around 26%, the cost-effectiveness of good ESG practices has brought greater profit growth for the enterprise, moreover, enterprises with better ESG performance are more likely to obtain equity financing through the stock market, so we can't give up the practice of ESG just because the industry is in a momentary adversity [10].

4.Conclusion

Based on the above analysis, the author concludes that ESG has a positive impact on the overall development of companies, including corporate performance. Firstly, as an investment concept, ESG emphasizes the three aspects of environment, society and governance, guiding the investment direction of companies to promote sustainable development, and thus helping enterprises to obtain long-term benefits. Secondly, ESG standards highlight enterprises' concerns about the environment, strong sense of social responsibility and effective governance, to highlight their positive development attitude. In terms of environmental protection, enterprises should pay attention to resource conservation and environment-friendliness, actively respond to climate change, and promote green production and consumption; in terms of social responsibility, enterprises should pay attention to employee rights and interests, product quality, customer service and other issues, and actively fulfill their social responsibilities; in terms of corporate governance, enterprises should improve the governance structure, strengthen internal control, improve corporate transparency, and prevent conflicts of interest. Since these reflect enterprises' efforts and effectiveness in their own comprehensive development, they have become important indicators to attract investment. With the increasing attention of investors to ESG issues, the lower cost of capital of highly rated ESG companies can be explained both by investors' preference for more sustainable assets, thus benefiting corporate financing and market capitalization management. Moreover, enterprises can obtain more government subsidies by improving ESG performance. All of these are conducive to corporate financing and market value management. In conclusion, ESG has a positive impact on the overall development of the company, and enterprises should respond positively by incorporating it into strategic planning and daily operations to achieve sustainable development.

This study to some extent bridges the gaps between ESG and corporate performance, conducting more targeted research on domestic ESG policies. This not only facilitates other scholars in further advancing the development of ESG with Chinese characteristics but also aids policy makers in revising and enhancing the ESG system. Moreover, it serves as a catalyst for enterprises to fulfill their ESG responsibilities and contribute to the sustainable development of society.

However, the current state of research in data analysis remains relatively superficial, limited to stock data analysis and broad conclusions that cannot fully and accurately confirm the positive impact of ESG. Therefore, future research should focus on more detailed market analyses to obtain more precise data and derive more accurate answers.

References

[1]. Li C. (2023) Empirical study on the economic effect of ESG practice in Chinese listed companies. University of science and technology of China.

[2]. Liu Y., Osterrieder J., Hadji Misheva B., Koenigstein N., Baals L. (2023) Navigating the Environmental, Social, and Governance (ESG) landscape: constructing a robust and reliable scoring engine - insights into Data Source Selection, Indicator Determination, Weighting and Aggregation Techniques, and Validation Processes for Comprehensive ESG Scoring Systems, 3, 119.

[3]. Park SR, Oh KS. (2022) Integration of ESG Information Into Individual Investors' Corporate Investment Decisions: Utilizing the UTAUT Framework. Front Psychol, 13.

[4]. Jiang X.Y. (2023) ESG performance, Debt Financing and enterprise inefficient investment. China's fiscal science research institute.

[5]. Kanamura T. (2022) Clean energy and (E)SG investing from energy and environmental linkages. Environ Dev Sustain, 3, 1-41.

[6]. Li W., Pang W. (2023) The impact of digital inclusive finance on corporate ESG performance: based on the perspective of corporate green technology innovation. Environ Sci Pollut Res Int, 30, 65314-65327.

[7]. Xue L., Dong J., Zha Y. (2023) How does digital finance affect firm environmental, social and governance (ESG) performance? - Evidence from Chinese listed firms. Heliyon, 9.

[8]. Zhang X., Zhang J., Feng Y. (2023) Can companies get more government subsidies through improving their ESG performance? Empirical evidence from China. PLoS One, 18.

[9]. Wang Y., Wang X. (2024) From ratings to action: The impact of ESG performance on corporate innovation. Heliyon, 10.

[10]. Zahid RMA, Saleem A., Maqsood US. (2023) ESG performance, capital financing decisions, and audit quality: empirical evidence from Chinese state-owned enterprises. Environ Sci Pollut Res Int, 30, 44086-44099.

Cite this article

Wang,X. (2024). Examine the Influence of Non-Economic Factors on Enterprise Performance in Photovoltaic Enterprises by Implementing ESG Practices. Advances in Economics, Management and Political Sciences,85,229-238.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li C. (2023) Empirical study on the economic effect of ESG practice in Chinese listed companies. University of science and technology of China.

[2]. Liu Y., Osterrieder J., Hadji Misheva B., Koenigstein N., Baals L. (2023) Navigating the Environmental, Social, and Governance (ESG) landscape: constructing a robust and reliable scoring engine - insights into Data Source Selection, Indicator Determination, Weighting and Aggregation Techniques, and Validation Processes for Comprehensive ESG Scoring Systems, 3, 119.

[3]. Park SR, Oh KS. (2022) Integration of ESG Information Into Individual Investors' Corporate Investment Decisions: Utilizing the UTAUT Framework. Front Psychol, 13.

[4]. Jiang X.Y. (2023) ESG performance, Debt Financing and enterprise inefficient investment. China's fiscal science research institute.

[5]. Kanamura T. (2022) Clean energy and (E)SG investing from energy and environmental linkages. Environ Dev Sustain, 3, 1-41.

[6]. Li W., Pang W. (2023) The impact of digital inclusive finance on corporate ESG performance: based on the perspective of corporate green technology innovation. Environ Sci Pollut Res Int, 30, 65314-65327.

[7]. Xue L., Dong J., Zha Y. (2023) How does digital finance affect firm environmental, social and governance (ESG) performance? - Evidence from Chinese listed firms. Heliyon, 9.

[8]. Zhang X., Zhang J., Feng Y. (2023) Can companies get more government subsidies through improving their ESG performance? Empirical evidence from China. PLoS One, 18.

[9]. Wang Y., Wang X. (2024) From ratings to action: The impact of ESG performance on corporate innovation. Heliyon, 10.

[10]. Zahid RMA, Saleem A., Maqsood US. (2023) ESG performance, capital financing decisions, and audit quality: empirical evidence from Chinese state-owned enterprises. Environ Sci Pollut Res Int, 30, 44086-44099.