1. Introduction

Blind box, a toy box originating from Japanese egg twisting, has currently witnessed rapid development among young adults in China, the US, Japan, and some other countries. The blind box refers to a special sales form of a fashionable toy containing uncertain goods inside the box sold. One theme of the blind box contains several normal version products and one hidden version product. Because the style of the good is not labeled on the package directly, consumers cannot check which style they have picked until the blind box is opened. Nowadays, the blind box market in China has seen a prosperous boom. By 2024, the size of the blind-box market is estimated to enlarge by twice, around 30 billion RMB [1]. Furthermore, with the formation and improvement of electronic commerce, the application of the blind box in China has extended to other industries, for example, beauty, food, stationery, and agriculture.

However, from the perspective of the expected utility theory and risk preference theory, consumers’ addiction to the blind box seems to violate rational decision-making. People are keen on spending a lot of money to purchase this kind of uncertain box or even overspending for a hidden version which may only have 1/100 probability to appear. The enormous profit that blind box products have brought to the whole economic market is undeniable. Meanwhile, there are still some problems like such as quality unevenness of blind box products and false advertising that may lead to concerns in society [2]. This paper first reviews some causes of blind-box prevalence from the perspective of behavioral economics applying the Prospect Theory, risk preference, availability heuristic, Gambler’s Fallacy, Endowment Effect, and Herd Effect. Then, based on the current market situation, potential problems and suggestions for consumers and regulators are explored. Finally, the paper puts forward some advice for future studies on the blind-box economy. Based on prior research results, this paper critically reviews the current status of China’s blind-box economy in order to provide a systematical overview of consumer purchasing motivation and market problems, thus offering suggestions for this rising market to obtain a long-run and sustainable development in the future.

2. Behavioral Economics Explanations of Consumers’ Decision-making Process in the Blind-box Market

2.1. Prospect Theory and Risk Preference

Kahneman and Tversky [3] put forward the Prospect Theory which combines psychology and economics together to explain individuals’ decision-making process under risks. Decision-making under uncertainty can be viewed as a choice between prospects or lotteries [3]. This theory points out some violations of the Expected Utility Theory based on observations and experiments on people’s irrational behaviors. According to Kahneman and Tversky [4], the main elements of the Prospect Theory containing a value function, certainty effect, reflection effect, and some other effects provide a systematical insight of the risk and uncertainty.

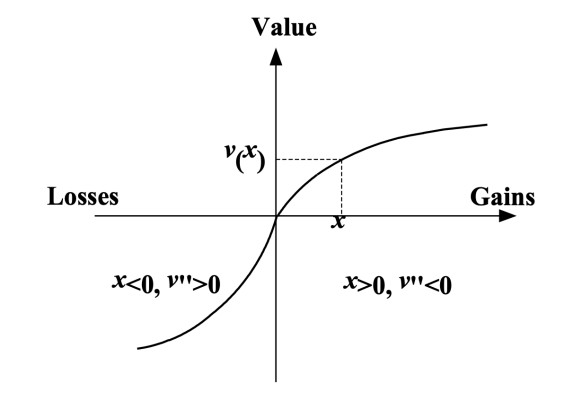

Figure 1: The value function [3].

Figure 1 depicts the value function curve in the Prospect Theory. This value function presents convexity in the gains domain and concavity in the losses domain. This value function specifically illustrates that individuals tend to show risk aversion when faced with gains while appearing to be risk-seeking when facing losses. The certainty effect states a phenomenon that subjects prefer to choose a lower return with certainty instead of choosing a gamble with a higher return. The reflection effect, however, explains people’s risk-seeking behavior when coming across losses. Compared with losing money for sure, individuals tend to select a gamble with the expectation of being lucky enough to avoid losing their fortune.

The risk-seeking behavior and reflection effect in the Prospect Theory can be applied to explain the consumption behavior and psychology in the blind box market [5]. First of all, the blind box in the market is precisely priced like other normal commodities, which means that when buyers decide to purchase a blind box, they are going to face a certain loss. However, since the good contained in the blind box is uncertain, it is possible for consumers to be lucky enough to draw the hidden version that can give them higher utility, or they may be unfortunate to pick a normal version that provides little value. Consequently, as the utility the blind-box content can provide is uncertain, the money consumers payout then becomes uncertain to some extent. According to the Prospect Theory, when faced with losses, people are prone to be risk-seeking. Because of loss aversion, consumers in the blind-box market are easier to become risk lovers hoping to pick a style they are fond of in order for compensating their expenditure in contrast with the common retail goods market.

2.2. Availability Heuristic

Availability heuristic explains a phenomenon that due to limited information and rationality, subjects are inclined to evaluate the probability of an event based on prior memories and examples that can easily come into mind [6].

Mi [5] states that this heuristic can also be applied to the consumer decision-making process in the blind-box market. With the rapid development of social media, it is possible for people to encounter blind-box lovers sharing pictures of precious hidden versions they own on the internet. In this case, the availability heuristic may cause survivorship bias, which would lead people to overestimate the occurrence probability of the rare hidden versions. This overestimation can result in an aggravation of consumers’ cognitive bias, leading them to engender an illusion that obtaining a precious hidden or limited edition version is not as difficult as they imagine. Therefore, consumers with this thought will become overconfident and more willing to stream into the blind-box market.

2.3. Representativeness Heuristic and Gambler’s Fallacy

The representativeness heuristic is another mental shortcut that individuals would apply when facing decision-making under uncertainty. This heuristic extends that in order to infer the probability of currently occurring events, people are inclined to seek previous events or representations with similarity. This heuristic can cause the Gambler’s Fallacy. Gambler’s Fallacy reveals an error that individuals may assume the probability of an independent future random sequence depends on the probability of short-term outcomes [7]. For instance, a gambler may become more confident of winning in a gamble after consecutive losses.

This fallacy also plays an important role in consumers’ purchasing intention in the blind-box market. Buyers who fall into the trap of gambler’s fallacy have the tendency to consider the probability of getting the style out of their expectations to become lower after they have already drawn several styles they dislike. Furthermore, the consumers may also mistake the hidden version to be more likely to appear after their previous insistent purchasing experience. However, in reality, the occurrence probability of either a normal version or a hidden version in the blind box is an independent event that does not have relevance to customers’ past shopping behavior. For example, as one of the most popular blind-box brands in China, a twelve-style series of POPMART sets the probability of normal style as 1/12 and hidden version as 1/144. This probability-setting mechanism only depends on the producers rather than consumers’ accumulated purchasing quantity. As a result of Gambler’s Fallacy, buyers would be easily obsessed with blind boxes and willing to keep spending money on pursuing the version they dream of obtaining.

2.4. Endowment Effect

Chu and Shu [8] summarize that the endowment effect clarifies a tendency for individuals to demand more for selling an object they possess than the price people give up for the preliminary purchase of this object. Mi [5] points out that because of the loss aversion psychology, people have the inclination to put a premium when selling their possessions.

This effect also has application in the blind-box market. Due to the existence of the endowment effect, consumers are likely to overestimate the value of the blind box in their possession ignoring the losses that have already happened [5]. Hence, people may psychologically highly evaluate the blind box they own and neglect the costs. This misunderstanding of valuation would possibly excite buyers’ future purchasing intentions. Additionally, Liu et al. [1] indicate that nearly 300,000 blind-box lovers are trading blind boxes in a Chinese flea-market smartphone APP, Idle Fish. On this online second-hand trading platform, users can sell their possessions by setting an appropriate price. The blind box is one of the most popular goods. It is common to find that sellers who own the hidden version or the limited-edition version tend to ask for a high price in this market and the blind-box enthusiasts are usually willing to purchase. This kind of outbidding behavior may have certain relation with the endowment effect.

2.5. Herd Effect

Herd effect is a common phenomenon in modern society that reveals a psychological process that normal irrational people tend to make judgments or decisions following the behaviors of the vast majority of people [9]. Because of limited rationality and scarce information, people who have to interact with others in society are prone to generate a conformist mentality during their decision-making process.

This effect can also be used to explain some of the irrational purchasing behaviors in the blind-box market. Liu et al. [1] young people born after 1995 are the main force of the consumer group, accounting for approximately 40 percent of the blind-box consumer population. This proportion indicates that young consumers are the main targets and participants of the blind-box market. Yu [10] argues that in comparison with previous generations of adults, young adults are more likely to be misguided by the herd effect. With intenser self-identification and a sense of social belonging, young consumers tend to be influenced by their surroundings. With the concern of being unable to integrate with contemporaries, youngsters are incline to generate conformity after seeing almost everyone around them participating in the blind-box market. Therefore, the young are susceptible to the herd effect and conformist mentality leading to some irrational purchasing behaviors in the blind-box market.

3. Current Blind-box Market Situation, Problems, and Possible Suggestions

3.1. Current Market Situation

Nowadays, with the further development of the blind-box market, numerous merchants and producers not only focus on toys but also enlarge the content range to objects like books, vegetables, beauty products, and even airplane tickets in order to catch the market demand [2]. According to the statistics summarized by Zhu [2], it can be found that the blind-box market scale has already reached 10.1 billion RMB in 2020, and the number will keep boosting in the coming five years. By 2024, the scale of this newly spring-up market is estimated to reach 30 billion RMB. The profit that the blind box economy brought to the Chinese domestic market economy and the stock market is undeniable. In addition, electronic commerce also makes a considerable contribution to the prevalence of blind box products. Taking some online shops for example, the sellers prefer to utilize the live-stream or celebrity endorsement to attract potential consumers with the aim of increasing the brand exposure and promoting the fan’s consumption.

3.2. Potential Problems in the Blind-box Market

Regardless of the benefits that the blind-box market brings to domestic economic development, there still exists some problems waiting to be discussed and resolved in this semi-mature market. Firstly, consumers’ blind purchasing caused by manufacturers’ excess hunger marketing is urgent to be regulated. In addition to the normal version in the blind box, the majority of themes include a so-called hidden version or limited-edition version whose probability of appearing is much lower than the normal ones. Producers with the purpose of absorbing buyers sometimes skillfully utilize the hunger marketing strategy to shape the hidden or limited-edition style into an extremely precious good. Consumers who are addicted to these rare versions then have the inclination to expend ten thousand RMB or even more just to pursue the hidden version. Meanwhile, the uneven quality of the blind-box content is another grave issue that needs to be solved. News reports that some unscrupulous retailers who sell pet blind boxes via the Internet have caused some pets to lose their lives in transit. Moreover, due to the particularity of the blind box, the quality of the products contained in the box is hardly guaranteed. These unqualified goods are mixed in blind boxes that have the same packages and can disrupt regular market orders.

3.3. Possible Suggestions

To cope with the existing issues that may cause disorders in the blind-box economy market, both consumers and regulators can take measures to avoid potential problems. For consumers, it is suggested that they think twice before paying for blind boxes to avoid making some irrational fallacies that may cause losses. From the perspective of supervisors, relevant policies should be established to standardize producer behavior in the blind-box market, thus preventing some over-marketing behaviors. In addition, the department concerned is responsible for strictly inspecting the quality of blind-box products and inhibiting unreasonable prices.

4. Conclusion

To sum up, the blind box economy plays a vital role in China’s domestic fashion toy market nowadays. From the review of previous studies on the blind-box market mentioned above, it can be argued that most of the consumers’ behavior in the blind-box economic market can be explained by applying theories from behavioral economics, for instance, the Prospect Theory, Availability Heuristic, Gambler’s Fallacy, Endowment Effect, and Herd Effect. As a result, in spite of being affected by the domestic overall economic environment, the development of the blind-box economy also depends on consumers’ psychology. The growing trend of the blind-box economy is now accelerating. Groups of researchers have carried out a series of relevant analyses both qualitatively and quantitatively to study the blind-box economy market. The limitation of currently existing research papers is that the number of quantitative analyses is less than the qualitative ones. Most researchers mainly focus on arguing consumer behavior or market problems theoretically neglecting to conduct experiments and collect powerful data to support the results. In the future research process, it is recommended that mathematical methodologies and models should be combined with theoretical analysis to further clarify and explain different phenomena in the blind-box economy market.

References

[1]. Liu, S.-W. et al. (2023). Ternary economic analysis of blind-box marketing. Economic Research-Ekonomska Istrazivanja, 36(3). doi:10.1080/1331677X.2023.2183517.

[2]. Zhu, B. (2021). Exploration on Standardization of Blind Box Economy. China Standardization, (19), 126–129. doi:10.3969/j.issn.1002-5944.2021.19.014.

[3]. Kahneman, D. and Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk, Econometrica, 47(2), 263–291. doi:10.2307/1914185.

[4]. Tversky, A. and Kahneman, D. (2016). Advances in Prospect Theory: Cumulative Representation of Uncertainty. Cham: Springer International Publishing (Springer Graduate Texts in Philosophy. 1). doi:10.1007/978-3-319-20451-2_24.

[5]. Mi, L. (2022). Theoretical Perspective of Behavioral Economics: The Research on the Internal Mechanism and Consumer Behavior of Blind-Box Economy. Dordrecht: Atlantis Press International BV (Advances in Economics, Business and Management Research. 226). doi:10.2991/978-94-6463-052-7_171.

[6]. Kübilay, B. (2022). Economic news and availability heuristic in investor decisions. Ardahan University Journal of the Faculty of Economics & Administrative Sciences / Ardahan Üniversitesi Iktisadi ve Idari Bilimler Fakültesi Dergisi, 4(1), 68–74.

[7]. Mohn, E. (2023). Gambler’s fallacy. Salem Press Encyclopedia of Science [Preprint]. Available at: https://search-ebscohost-com-s.elink.xjtlu.edu.cn:443/login.aspx?direct=true&db=ers&AN=146566029&site=eds-live&scope=site (Accessed: 19 March 2024).

[8]. Chu, C. K. and Shu, S. B. (2023). Mementos and the endowment effect. Journal of Behavioral Decision Making, 36(1), 1–10. doi:10.1002/bdm.2295.

[9]. Liu, H., Wang, Y. and Zhang, L. (2022). The Herd Effect and Cross-Border Mergers and Acquisitions by Chinese Firms. Emerging Markets Finance & Trade, 58(6), 1537–1549. doi:10.1080/1540496X.2021.1903866.

[10]. Yu, X. (2022). The Study on the Consumer Behavior Decision of Blind Boxes Based on Behavioral Economics. China Business & Trade, (20), 58–60. doi:10.19699/j.cnki.issn2096-0298.2022.20.058.

Cite this article

Liu,Y. (2024). A Comprehensive Review of the Blind Box Economy. Advances in Economics, Management and Political Sciences,86,116-121.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, S.-W. et al. (2023). Ternary economic analysis of blind-box marketing. Economic Research-Ekonomska Istrazivanja, 36(3). doi:10.1080/1331677X.2023.2183517.

[2]. Zhu, B. (2021). Exploration on Standardization of Blind Box Economy. China Standardization, (19), 126–129. doi:10.3969/j.issn.1002-5944.2021.19.014.

[3]. Kahneman, D. and Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk, Econometrica, 47(2), 263–291. doi:10.2307/1914185.

[4]. Tversky, A. and Kahneman, D. (2016). Advances in Prospect Theory: Cumulative Representation of Uncertainty. Cham: Springer International Publishing (Springer Graduate Texts in Philosophy. 1). doi:10.1007/978-3-319-20451-2_24.

[5]. Mi, L. (2022). Theoretical Perspective of Behavioral Economics: The Research on the Internal Mechanism and Consumer Behavior of Blind-Box Economy. Dordrecht: Atlantis Press International BV (Advances in Economics, Business and Management Research. 226). doi:10.2991/978-94-6463-052-7_171.

[6]. Kübilay, B. (2022). Economic news and availability heuristic in investor decisions. Ardahan University Journal of the Faculty of Economics & Administrative Sciences / Ardahan Üniversitesi Iktisadi ve Idari Bilimler Fakültesi Dergisi, 4(1), 68–74.

[7]. Mohn, E. (2023). Gambler’s fallacy. Salem Press Encyclopedia of Science [Preprint]. Available at: https://search-ebscohost-com-s.elink.xjtlu.edu.cn:443/login.aspx?direct=true&db=ers&AN=146566029&site=eds-live&scope=site (Accessed: 19 March 2024).

[8]. Chu, C. K. and Shu, S. B. (2023). Mementos and the endowment effect. Journal of Behavioral Decision Making, 36(1), 1–10. doi:10.1002/bdm.2295.

[9]. Liu, H., Wang, Y. and Zhang, L. (2022). The Herd Effect and Cross-Border Mergers and Acquisitions by Chinese Firms. Emerging Markets Finance & Trade, 58(6), 1537–1549. doi:10.1080/1540496X.2021.1903866.

[10]. Yu, X. (2022). The Study on the Consumer Behavior Decision of Blind Boxes Based on Behavioral Economics. China Business & Trade, (20), 58–60. doi:10.19699/j.cnki.issn2096-0298.2022.20.058.