1. Introduction

Currently, the BOJ faces significant challenges at a critical juncture, with its strategies against inflationary pressures gaining global interest [1].

Japan's "Lost Decades" signify the economic stagnation from the early 1990s to the 2020s following a burst economic bubble. During this period, the Bank of Japan (BOJ) focused on stabilizing prices and aimed for a 2% inflation rate. Despite these efforts, deflationary expectations curbed consumption and investment, limiting the effectiveness of monetary policies and contributing to sluggish economic growth [2-3]. The COVID-19 pandemic brought about long-anticipated inflation to Japan. However, not only was the inflation rate low internationally, but the expected economic prosperity following inflation also failed to materialize as expected.

Existing research encompasses empirical studies on the impact of BOJ’s monetary policies over past decades, alongside theoretical discussions on mechanisms of policies [4-5]. This study adds to the existing literature by identifying social structural issues for the disparity between anticipated and actual effects and offering insights into the present complexity and future possibilities by examining historical precedents. The following sections contain a succinct introduction to the evolution of BOJ’s monetary policies and the theoretical underpinnings of the shifts over decades, an analysis of post-COVID inflation dynamics and BOJ’s corresponding responses, and a discussion on the underlying reasons for the disparity observed, alongside future foresight.

2. A Brief Introduction of the Evolution of BOJ’s Monetary Policies

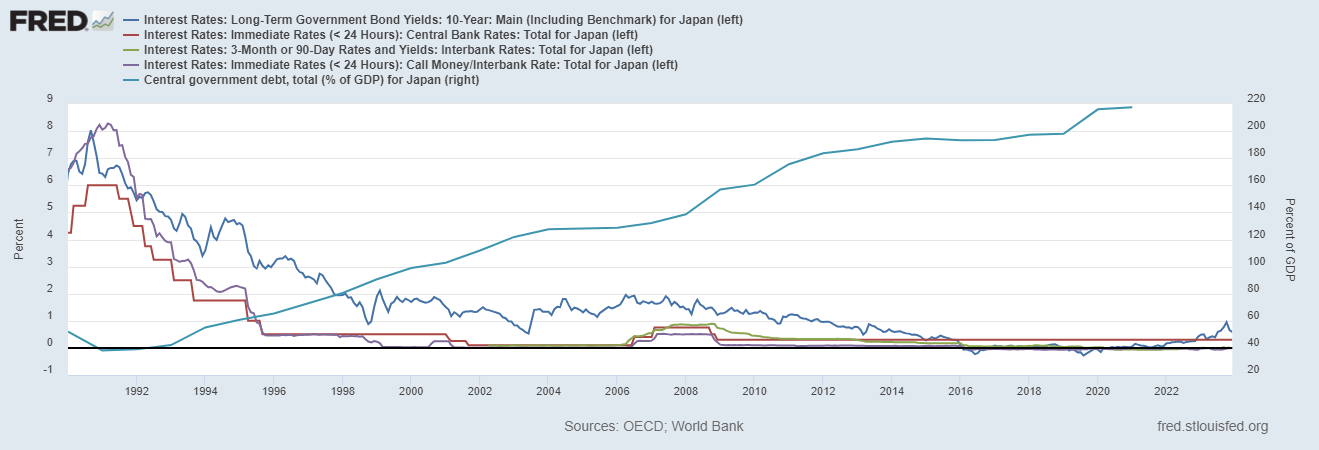

Figure 1: Central Government Debt and interest rates in different terms(OECD, World Bank)

Curves in Figure 1 showcase the change of central government debt and interest rates over the past decades. Based on these trends, scholars delineated BOJ’s monetary policies into three phases [6]:

Phase 1 (1991-1998): low growth, low inflation, low debt. Characterized by low growth, low inflation, and a low ratio of national debt to GDP, Japan implemented low-interest-rate and expansionary fiscal policies aimed at reducing short-term interest rates to stimulate spending.

b. Phase 2 (1999-2012): low growth, low inflation, moderate debt. During this period, the economy continued to exhibit low growth and low inflation, but with a moderate national debt-to-GDP ratio. Japan adopted a zero-interest-rate policy, quantitative easing, and loose fiscal policies, targeting both short-term and long-term interest rates to encourage investment and consumption.

c. Phase 3 (2013-2022): low growth, low inflation, high debt. Marked by low growth, low inflation, and a high national debt-to-GDP ratio, Japan employed zero interest rates, qualitative and quantitative easing (QQE), and Yield Curve Control (YCC) policies. These measures aimed not only to reduce both short-term and long-term interest rates to boost investment and consumption but also to lower the cost of national debt financing to maintain fiscal sustainability.

3. Theoretical Foundations of the Shift in BOJ’s Monetary Policies

Given that Japan was one of the initial adopters of Unconventional Monetary Policies (UMPs), probing into the theoretical underpinnings of various policies could elucidate the underlying motivations and consequential impacts of these policies, thereby enriching our comprehension of the mechanisms through which they affect the economy and the scope of influence contemporarily.

3.1. Basic Theoretical Models

In April 2023, during Kazuo Ueda’s initial address as the governor of the BOJ, he articulated the dual transmission mechanisms of monetary policy, specifically how changes in interest rates and prices affect economic activity, relatively underpinned by theoretical frameworks of the IS Curve and the Phillips Curve [7].

The Fisher Equation, expressed as i=r+Π, reveals an important relationship between nominal interest rates (i), real interest rates (r), and inflation (Π). This equation influences the IS Curve, modified to Y=C(Y−T)+I(i−Π)+G. The Phillips Curve depicts the interplay between inflation rates and the output gap, serving as the fundamental framework for conventional monetary policies in which an inflation target is determined with a set of contingent policies implemented accordingly. Inflation expectations and supply shocks are two major driving forces behind the shift of Phillips curve. The AS-AD Model combines the real and nominal aspects of the economy, showing how aggregate demand and supply determine price levels and output, incorporating the effects of monetary and fiscal policies. Here is the mathematical representation [8]:

AD Curve: Y=C(Y−T)+I(i−Π)+G+NX(Y)(1)

AS Curve: P=Pe(1+g(Y−Yn))(2)

This setup explains how price levels (P) and national income (Y) adjust in response to changes in economic policies and external shocks. Essential insights could be drawn via integrating basic models with the context of Japan’s economic situation, which has been characterized by prolonged deflation (Π<0) and sticky price expectations (Pe), traditional monetary policies face significant limitations, particularly due to the zero lower bound (ZLB) on nominal interest rates. Hence, Unconventional Monetary Policies (UMPs) including negative interest rates, forward guidance, and quantitative easing (QE) were designed to break the economic trap.

3.2. Unconventional Monetary Policies (UMPs)

Crucial in addressing economic downturns and financial instability, UMPs have been adopted by BOJ and other central banks worldwide, especially in response to the financial crisis of 2008 [9].

Negative Interest Rates: The BOJ uses negative rates to penalize banks for holding excess reserves, encouraging them to boost lending, which reduces real interest rates and stimulates economic activity.

Forward Guidance: This involves the BOJ signaling future monetary policies, such as maintaining zero interest rates to counter deflation expectations, thereby lowering long-term interest rates and stimulating the economy.

Quantitative Easing & Yield Curve Control: Central banks buy securities to increase money supply and promote lending. While QE has influenced financial conditions, its impact on overall economic output and inflation remains uncertain [9]. Operating through a demand–supply channel, the Fed's QE Program purchased longer-term bonds to impact financial conditions directly, pushing up bond prices and lowering yields. Similarly, the BOJ sets targets for long-term government bond yields to manage interest rates across different maturities. However, YCC can lead to market distortions and impact central bank independence and financial stability. Its effectiveness varies with the credibility of the central bank, market conditions, and economic context.

4. Post-COVID Inflation Dynamics

The COVID-19 pandemic had a profound global impact beginning in early 2020, leading to widespread supply chain disruptions and prompting many countries to implement expansive fiscal policies to stimulate economic recovery. While major economies such as the United States experienced a sudden and sharp rise in inflation rates, Japan initially saw a gradual increase and a transition from deflation to inflation in 2020, with this trend intensifying in 2021 and culminating in a steep increase towards its peak, a seven-year high in May 2022, as illustrated in Figure 2.

Figure 2: Inflation rate in major economies around the world(World Economic Outlook, 2023)

The time inconsistency of inflation rate rises resulted in a significantly weakened yen against the dollar, as depicted in Figure 3. In addition to a global surge in energy prices, the post-COVID period brought about an unusual inflationary shock to Japan, although remaining relatively low by international standards

Figure 3: US Dollar to Japanese Yen, 2021-2023

The escalation of the inflation rate and the depreciation of the yen have fueled international investors' speculation that Japan might retreat from its ultra-loose monetary policy and relinquish its commitment to maintaining low-interest rates on Japanese government bonds. Moreover, unprecedented fluctuations in exchange rates have further incentivized the selling and shorting of these bonds, significantly complicating the BOJ’s Yield Curve Control (YCC). This situation poses substantial challenges for the BOJ as it strives to stabilize long-term interest rates amidst these market dynamics.

5. Examining BOJ’s Responses to Post-COVID Inflation: Explaining Disparity with Structural Issues from the 'Lost Decades'

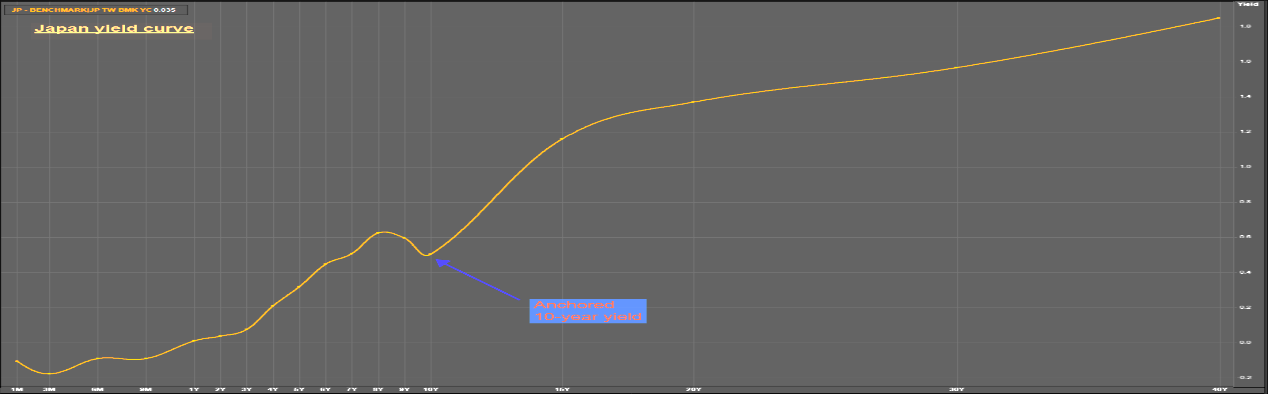

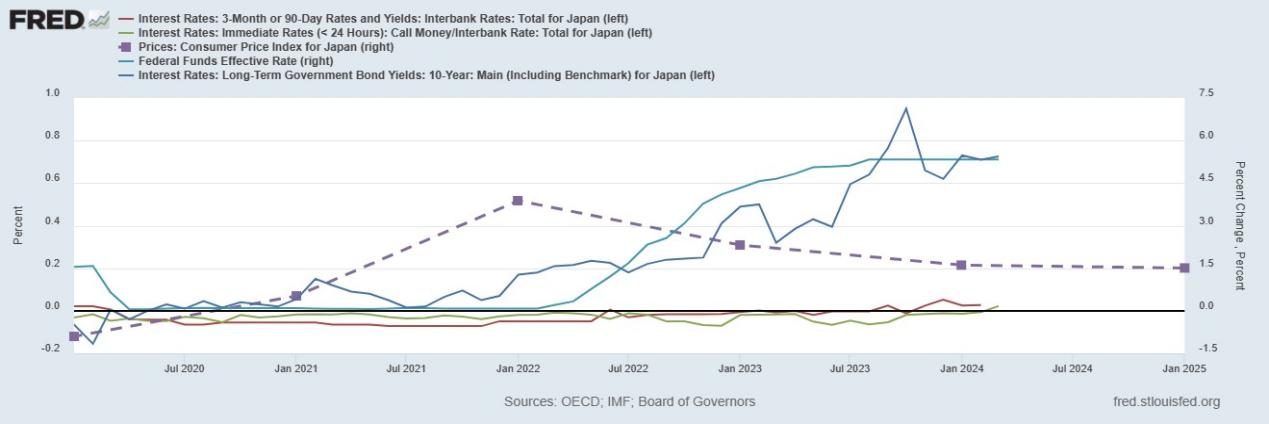

The BOJ’s responses to Post-COVID Inflation were cautious and vacillating. Despite selling and shorting by investors, the BOJ persisted with QQE policies, leading to the 10-year government bond yield hovering around 0.25% and causing a distortion in the yield curve, as depicted in Figure 4 and 5. Under mounting pressure from the market, in December 2022, without effective communication, the BOJ doubled the upper limit target of the 10-year government bond yield, perceived as a signal of a shift in Japan's ultra-loose monetary policy.

Figure 4: Interest rates: Long-term government bond yields(10-year) [10]

Figure 5: Yield Curve in Japan prior to upper bound adjustment [11]

In theory, raising the upper limit target of the 10-year government bond yield can gradually lead to an increase in interest rates of different terms, thereby dampening overall demand in the economy and help alleviate inflationary pressures. It may also attract foreign capital inflows seeking higher returns on domestic assets, leading to appreciation of yen and lowering the cost of imported goods and services. However, empirical observations reveal disparities between theory and reality, as short-term interest rates remain low and the yen continues to weaken against the USD (Figure 6).

Figure 6: Inflation rate, Interest rate of different terms for Japan and the US(OECD, IMF, Board of governors)

The inconsistency stems from the cautiousness and conservatism of policy implementations. In his inaugural address as the governor of the BOJ in April 2023, Kazuo Ueda declared the intention to maintain loose monetary policies until the inflation rate stabilizes at 2%, citing the uncertainty surrounding cost-push inflation, which is a prevailing concern in the Japanese economy [7].

But what leads to such caution? Through the lens of history, three critical structural issues that have accumulated during Japan's 'Lost Decades' insightfully explain the conservative stance on monetary policy:

a. Age Structure: Japan faces a rapidly aging population with a low birth rate and increasing life expectancy. This demographic trend leads to a shrinking workforce and a consequent decline in demand for goods and services, since older people tend to spend less. As a result, deflationary pressures persist, complicating economic recovery. The strain on pension systems and healthcare services further exacerbates the fiscal burden, leading to a cautious approach to monetary policy.

b. Debt Structure: Japan's government debt-to-GDP ratio exceeds 260%, among the highest in the world. This immense debt load consumes a significant portion of government revenue for servicing, leaving fewer resources for public investment and social programs. The high debt burden limits the BOJ's flexibility, as raising interest rates can increase borrowing costs, potentially leading to a sovereign debt crisis or economic instability.

c. Risk Structure: Arising from the economic environment following Japan's asset bubble burst in the early 1990s, the economy now contains a significant number of "zombie" companies—firms that persist despite low profitability due to supportive lending practices from banks. These companies often struggle to repay their debts and lack the capacity for innovation, leading to resource misallocation and stagnation in productivity. Any tightening of monetary policies, such as raising interest rates, could worsen their financial position, affecting bank profitability and potentially compromising financial stability. This situation compels the BOJ to adopt a conservative approach to monetary policy, balancing the risks of tightening with the goal of achieving sustainable economic growth.

These interconnected structural issues underscore the conservative mindset in Japan's monetary policy and explain the disparity between theory and practice, along with BOJ's cautious approach when navigating the post-COVID inflationary environment. Addressing these deep-seated challenges requires a holistic strategy that balances short-term monetary adjustments with long-term structural reforms.

6. Conclusion

From the ‘Lost Decades’ to Post-COVID era, the Bank of Japan's (BOJ) journey through various monetary policy landscapes, particularly its adoption of unconventional measures, underscores a pivotal era in central banking history. These policies, while initially designed as responses to unique economic challenges, have evolved into critical tools for managing the Japanese economy's complex interplay of inflation, deflation, and growth.

Despite the best efforts, the inconsistency between theoretical solutions and practical policy implementations, as well as the divergence between theoretical mechanisms and actual empirical outcomes, is unavoidable. By revisiting the past and closely examining the present, we can understand the root causes of these gaps, offering insights that can enrich both monetary theory and central banking practices. Importantly, these disparities underscore the need to focus on the real economy rather than solely on monetary policy designs.

As Japan hits its 2% inflation target, and the BOJ raises its target interest rate, the era of ultra-loose monetary policies appears to be concluding. However, considering the entrenched structural issues discussed earlier, the new phase in Japan's economy will likely be marked by “creative destructions” — significant disruptions that create both challenges and opportunities for economic growth. This signals the need for more detailed econometric and causal analyses to understand the interplay between monetary policies and real economic dynamics.

References

[1]. Masterson, V. "Why Is Inflation in Japan One of the Lowest in the World." World Economic Forum, 6 Oct. 2022, https://www.weforum.org/agenda/2022/10/why-japan-low-inflation/#:~:text=URL%3A%20https%3A%2F%2Fwww.weforum.org%2Fagenda%2F2022%2F10%2Fwhy.

[2]. Baig, T. “Understanding the Costs of Deflation in the Japanese Context.” (2003).

[3]. Cargill, Thomas F. et al. “Financial Policy and Central Banking in Japan.” (2001).

[4]. Shibamoto, Masahiko, et al. "Japan’s Monetary Policy: A Literature Review and Empirical Assessment." Journal of Computational Social Science, vol. 6, no. 1, 2023, pp. 1215–1254, doi:10.1007/s42001-021-00113-z.

[5]. Xiao, Xiaolin. "Review of the Evolution of Monetary Policy in Developed Economies: 2008–2022." Quarterly Journal of Economics and Management, Guanghua School of Management, Beijing University, Year, vol. X, no. Y, pp. xx-xx.

[6]. Zhang, Chun. "How Far Can Japan's Loose Monetary Policy Go?" Columns 2024, no. 02, pp. 55-57.

[7]. Ueda, Kazuo. "The Basic Idea of Japan's Monetary Policy." Translated from a speech given on May 19, 2023, at the Committee for Researching Internal and External Circumstances.

[8]. Romer, David. Advanced Macroeconomics. McGraw-Hill Education, 2018.

[9]. Borio, C., & Disyatat, P. "Unconventional Monetary Policies: An Appraisal." The Manchester School, vol. 78, 2010, pp. 53–89.

[10]. Trading Economics. “Japan Government Bond Yield.” Trading Economics, https://tradingeconomics.com/japan/government-bond-yield.

[11]. Reuters. “What Is Happening in Japan's Bond Market?” Reuters, 16 Jan. 2023, https://www.reuters.com/markets/rates-bonds/what-is-happening-japans-bond-market-2023-01-16/.

Cite this article

Chen,S. (2024). Monetary Policies in Japan: Structural Challenges and Evolutions from ‘The Lost Decades’ to Post-COVID Dynamics. Advances in Economics, Management and Political Sciences,88,158-164.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Masterson, V. "Why Is Inflation in Japan One of the Lowest in the World." World Economic Forum, 6 Oct. 2022, https://www.weforum.org/agenda/2022/10/why-japan-low-inflation/#:~:text=URL%3A%20https%3A%2F%2Fwww.weforum.org%2Fagenda%2F2022%2F10%2Fwhy.

[2]. Baig, T. “Understanding the Costs of Deflation in the Japanese Context.” (2003).

[3]. Cargill, Thomas F. et al. “Financial Policy and Central Banking in Japan.” (2001).

[4]. Shibamoto, Masahiko, et al. "Japan’s Monetary Policy: A Literature Review and Empirical Assessment." Journal of Computational Social Science, vol. 6, no. 1, 2023, pp. 1215–1254, doi:10.1007/s42001-021-00113-z.

[5]. Xiao, Xiaolin. "Review of the Evolution of Monetary Policy in Developed Economies: 2008–2022." Quarterly Journal of Economics and Management, Guanghua School of Management, Beijing University, Year, vol. X, no. Y, pp. xx-xx.

[6]. Zhang, Chun. "How Far Can Japan's Loose Monetary Policy Go?" Columns 2024, no. 02, pp. 55-57.

[7]. Ueda, Kazuo. "The Basic Idea of Japan's Monetary Policy." Translated from a speech given on May 19, 2023, at the Committee for Researching Internal and External Circumstances.

[8]. Romer, David. Advanced Macroeconomics. McGraw-Hill Education, 2018.

[9]. Borio, C., & Disyatat, P. "Unconventional Monetary Policies: An Appraisal." The Manchester School, vol. 78, 2010, pp. 53–89.

[10]. Trading Economics. “Japan Government Bond Yield.” Trading Economics, https://tradingeconomics.com/japan/government-bond-yield.

[11]. Reuters. “What Is Happening in Japan's Bond Market?” Reuters, 16 Jan. 2023, https://www.reuters.com/markets/rates-bonds/what-is-happening-japans-bond-market-2023-01-16/.