1. Introduction

1.1. Service robots in financial advisory services

As stated in the article "Implementing artificial intelligence empowered financial advisory services.Artificial Intelligence (AI)-empowered financial advisory services (i. e.: robo-advisors) have been investigated and discussed by researchers from different aspects and disciplines, constituting a wide range of knowledge regarding their emergence, evolvement, implementation, design, and application. [1]However, existing knowledge regarding robo- advisors is fragmented, calling for a structured and integrative frame- work for researchers and service providers.

Due to the formidable computational capabilities of AI, customer service providers employ AI for the analysis and assimilation of user data, yielding diverse benefits within frontline customer services. In contrast to other digital technologies, AI possesses the ability to tailor services to individual customers and make predictions through intricate algorithms without human inter- vention. Furthermore, AI’s interface can communicate, interact, and provide customer service, all while operating autonomously. [2]This interactive, adaptive, and autonomous interface, is referred to as a ser- vice robot .

1.2. development situation

At present, the pace of the combination of artificial intelligence and finance is getting faster and faster. For example, the first generation of securities investment artificial intelligence system (SIAI) developed by Beijing Zipeiyi Investment Consulting Company, which is the first in China to use artificial intelligence for investment management, can independently analyze investments every day, and produce a number of investment strategies, and then enter the market for trading. [3]During the investment period, SIAI system can adjust positions and buy and sell according to market signals in real time. The "Smart Investment" tool launched by Jingdong Finance intelligently works out a portfolio investment plan for investors by answering a few simple questions on the page; JD.COM's "Fund Optimization" tool ranks the fund products in Jingdong Finance from six dimensions, providing a reference for users to select fund products. [4]Baidu Finance is rapidly promoting the "Baidu Brain" plan and innovating the financial service model with Baidu characteristics. Alibaba's Ant Financial Team uses population intelligence technology to allocate assets in the business scenario of Ant Financial.Taking the innovation in the field of monitoring technology as an example, it shows that the combination of artificial intelligence and finance has bright prospects. For example, on the one hand, artificial intelligence financial consultants can improve the efficiency, accuracy and personalization of services and meet the diversified needs of users; On the other hand, data security, the stability and reliability of algorithm models and the constraints of laws and regulations also need to be paid attention to. In order to meet these challenges, artificial intelligence financial consultants need to constantly improve their professional ability, strengthen technology research and development and data security protection, and ensure business compliance.

1.3. Research gaps and aims

1.3.1. Gaps and limitations

The reliability of this matter is impacted by the decision of the AI system based on its built-in algorithm and model. However, although these models and algorithms will be more accurate and more convenient to operate than manual work in most cases, even AI algorithms may have defects or loopholes, which may lead to the AI system making wrong decisions. In addition, the over-fitting of the model may also lead to its poor performance in the new market environment.

At the same time, financial data often involves personal privacy and asset security. However, the AI system may face the risk of security threats and privacy leakage when processing these data. Hackers or malware may use system vulnerabilities to attack the AI system, resulting in investors' financial losses or personal information disclosure. [5]

In addition, artificial intelligence still has many defects in financial management. In order to give full play to the potential of AI in the financial field, it is necessary to constantly improve relevant technologies, regulations and policies to improve the accuracy, security and adaptability of AI systems. At the same time, it is also necessary to pay attention to user needs and privacy protection to improve the convenience and comfort of human-computer interaction.

As a study by the Division of Real Estate Business and Financial Systems, KTH Royal Institute of Technology, Sweden shows:Numerous articles regarding robo-advisory services have been pub- lished across various journals and conference proceedings in recent years. Amidst this literature, three distinct gaps come to light. Firstly, these studies are scattered across research disciplines each with its own focal points. [6]This necessitates an interdisciplinary analysis and the development of an integrative framework to reorganize and synthesize existing evidence into new knowledge.

1.3.2. Overall Aim:

With the continuous development of economy and the continuous growth of residents' wealth, the importance of personal financial advisory services has become increasingly prominent. In the current complex and changeable financial environment, individual investors are faced with many investment options and financial products, which makes them urgently need to seek professional financial consultants to provide tailor-made financial planning solutions for themselves. As the cornerstone of artificial intelligence, machine learning improves the accuracy of prediction and decision-making through continuous learning and improvement. In the field of personal finance, the application of machine learning technology has significantly improved the personalication and refinement of financial planning. By analyzing users' financial situation, investment preferences and risk tolerance, machine learning model can tailor personalized financial advice and product recommendations for users. This personalized service not only meets the diverse needs of users, but also improves the work efficiency and professionalism of financial consultants.

1.3.3. Specific objectives

The importance of this study is that artificial intelligence is used as a personal financial consultant, which improves the safety, efficiency and convenience of investors in the financial management process in terms of algorithms. In detail, this combination not only greatly improves the efficiency and accuracy of financial management, but also enables investors to better grasp the market dynamics and realize the preservation and appreciation of assets. The following is a detailed analysis:

I.Accurate financial analysis Artificial intelligence technology can accurately analyze the financial situation of investors through big data analysis, machine learning and other methods. By collecting data such as investors' income, expenditure and assets, artificial intelligence can provide them with a clear and comprehensive financial portrait, help investors understand their financial situation more accurately and provide strong support for subsequent investment decisions.

II. Personalized investment planning Everyone's financial situation, risk tolerance and investment objectives are different. Artificial intelligence technology can recommend the most suitable investment portfolio for investors through multi-dimensional data analysis of market, industry and products according to their personal situation, so as to achieve the best investment effect.

III.Intelligent Risk Assessment Investment is always accompanied by risks. Artificial intelligence technology can evaluate the risks of various investment projects and help investors understand the potential investment risks more comprehensively. At the same time, artificial intelligence can also adjust the risk assessment results in real time according to market changes, provide real-time risk warnings for investors and ensure their investment safety.

IV.Market Trend Forecast Artificial intelligence technology can predict market trends through deep learning, neural networks and other methods. Through the study and analysis of historical data, artificial intelligence can discover the law of market operation, provide valuable investment advice for investors and help them seize market opportunities.

V.Automated asset allocation In traditional financial management, investors need to allocate assets manually. The application of artificial intelligence technology can realize automatic asset allocation and greatly improve the efficiency of financial management. Through real-time analysis of market, industry and other information, artificial intelligence can automatically adjust the proportion of investors' asset allocation to achieve the best return and risk control.

2. Theoretical Contribution

2.1. Brief Introduction of Artificial Intelligence Since its appearance

Artificial intelligence has been continuously improved in technology and function, which makes its function stronger and stronger and it can play an important role in various fields and promote the development of the information age. One of the goals of artificial intelligence research is to make robots complete the work that human intelligence can do, but this kind of work has different definitions in different times, but artificial intelligence is never human intelligence and will not exceed human intelligence. As far as the definition of artificial intelligence is concerned, it can be subdivided into two aspects: artificial and intelligent, in which artificial is to replace human work, and the definition of this aspect is relatively unified. [7]However, there are many controversies about the definition of intelligence, which involves the definition of consciousness, self, thinking and many other aspects. It is an accepted view that the intelligence that people know is only their own intelligence, and their understanding of their own intelligence is limited, and there are also limitations in understanding the necessary elements of human intelligence. Based on this, understanding the artificial intelligence will face greater limitations.

2.2. Financial management cylinder

Financial management refers to the management of finance, and its purpose is to preserve or increase the value of finance through the purchase of financial products or other investment activities. Financial management can be subdivided into three categories: corporate financial management, personal financial management and family financial management. At present, financial management activities have been integrated into people's daily lives, and financial products are more popular. Financial management often coexists with investment and financial management. The reason is that financial management includes investment, and investment also includes financial management. From this point of view, financial management behavior is not simply a financial outward investment, and the party receiving the investment can also be a financial management behavior. [8]The connotation of financial management includes three aspects: (1) financial management is to manage the financial resources acquired in a person's life, not simply to solve the problem of short-term capital demand. (2) Financial management belongs to cash flow management. Therefore, financial management is needed regardless of whether there is money or not. (3) All financial projects have hidden risks, so financial management is also an uncertain behavior.

2.3. Analysis of the present situation of financial risk monitoring technology from the perspective of patent

The data in this paper comes from "A Patent Retrieval and Analysis Database". The database contains 170 million pieces of patent information worldwide, and provides a functional interface to automatically generate a retrieval form according to the filling of retrieval fields, including keywords, date/number, related persons, classification number and other patent information, and the retrieval scope includes text files such as patent titles, abstracts and specifications. [9]

This paper searches and analyzes the patent status of financial risk monitoring technology. The retrieval requirement is the patent information with the theme of "Financial risk" or "financial risk" as of December 18th, 2023, and the retrieval formula is [SS = (financial risk) ORSS=(Financial risk)AND publication date = (December 1st, 2023. 8)J。 Search results: There are 14,713 patents related to "financial risks" at home and abroad, including invention patents, utility model patents and design patents, among which the most common type is invention patents; There are 10,335 patents in application status, accounting for 70.24%, and 3,858 patents have been authorized, accounting for 26.22%; 110 utility model patents, accounting for 0.75%; 7 design patents, accounting for 0.05%; There are 403 other types of patents, accounting for 2.74%.

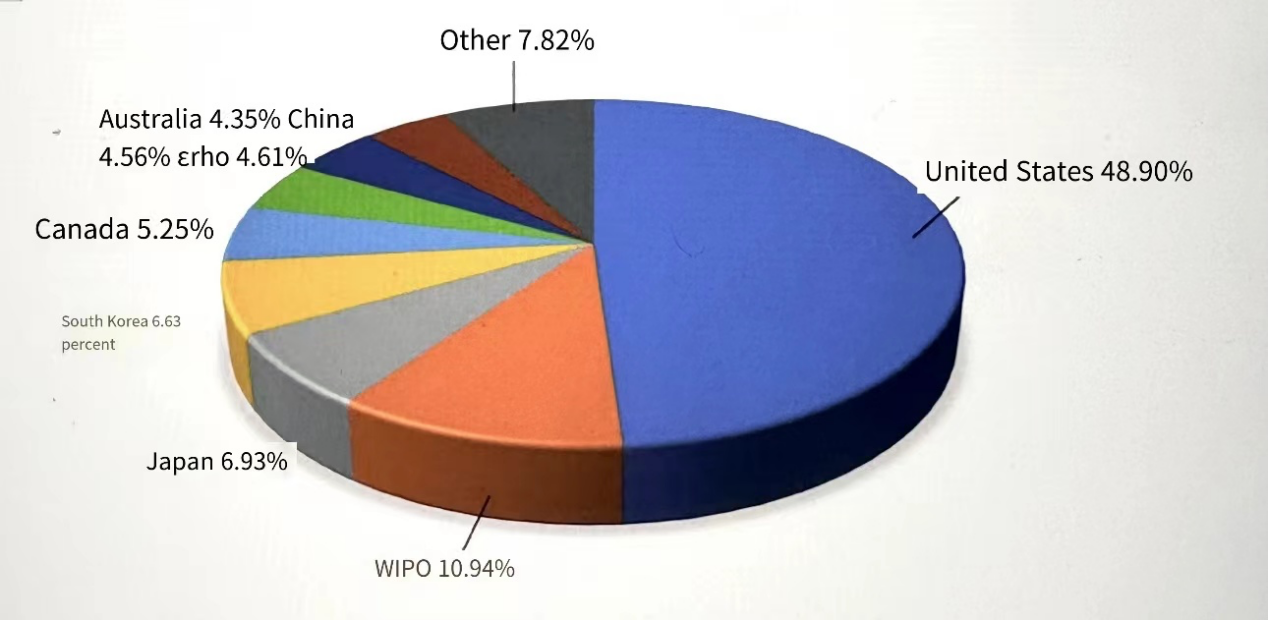

According to the published data, all patents are classified and counted, and it is found that the countries or organizations with the largest number of patents (including those in application and those authorized) in the field of financial risk monitoring technology and their patent numbers are: 7194 in the United States, 1610 in the World Intellectual Property Organization (WIPO), 1019 in Japan and South Korea. 975, 774 Canadian, 678 European patents (EPO) and 671 China. [10]

Figure 1: degree of technological innovation in the field of financial risk monitoring technology in various countries

From the statistical data in Figure 1 above, key findings emerge the degree of technological innovation in the field of financial risk monitoring technology in various countries, especially those related to artificial intelligence. The United States has the largest number of patents in this field, so the accumulation of technological innovation is more advanced; WIPO and EPO, as international and regional patent application organizations, their high number of patents reflects the importance attached to financial risk monitoring technology worldwide. On the whole, the number of patents in this field shows a diversified trend, that is, all economies are actively participating in the innovation of financial risk monitoring technology.

3. Method

3.1. case analysis

Let's look at actual cases to understand how artificial intelligence becomes a personal financial advisor.

Firstly, according to the recent Citibank research report, from 2012 to the end of 2015, the assets managed by smart investment consultants will increase from 0 to 29 billion US dollars, and the assets managed by smart investment consultants will increase geometrically in the next decade. It is estimated that the total scale will reach 5 trillion US dollars. [11]At present, there are a large number of Internet companies that can provide asset management services in developed countries, among which Wealth Front and Better are the two largest companies in the industry, with assets of more than $2.6 billion each.

Secondly, taking JIMI in JD.COM as an example, this paper explores the progress in the application of artificial intelligence in financial management:

in the early stage of financial investment guidance application From the perspective of financial management, people are concerned about choosing the right financial management method. With the rapid development of artificial intelligence, the application scope of intelligent customer service has been continuously expanded, and people can obtain the financial information they need in time through intelligent customer service. In financial activities, the pre-financing service is similar to the website recommendation service, specifically, it is to analyze users' needs and recommend related products for users on this basis. Compared with traditional manual recommendation, this intelligent service is more accurate. Taking JD.COM JIMI as an example, this case shows that AI can provide investment guidance services for users in the early stage of financial management. Through the extraction and analysis of chat records, AI financial advisors can understand the degree of financial knowledge of users, and classify investment types suitable for users and present them to users. By understanding users' needs and investment ability at this time,intelligence system can recommend financial products for them or answer their questions. Financial management is a complicated activity, especially in the market where the variety of financial products is increasing. It is difficult for users to make the right choice. Some users have more funds themselves, and they will put all their eggs in one basket when buying stocks. [12]However, this behavior often leads to all their assets being directly locked up. Under the guidance of JIMI, users can adjust this thinking mode and invest more rationally.

Application in Financial Advisor The foundation of financial management is optimization, and all users who participate in financial management want to get the highest profit with the lowest capital. In the artificial intelligence environment, there is actually a huge knowledge base. [13] Artificial intelligence financial advisors give correct guidance to investment and financial management users by mobilizing the knowledge base. During the campaign, they mostly comprehensively analyze and evaluate the assets and investment direction of financial management personnel, and take the final analysis results as the basis to provide users with suitable investment plans. In the rapid development environment of big data and cloud computing, artificial intelligence services are also developing in the direction of accuracy and convenience. [14]JD.COM JMI can make a comprehensive evaluation based on users' assets, investment intentions and risk preferences, and at the same time optimize the best financial portfolio according to the existing types of financial products with the help of cloud computing and big data analysis.

Application in financial management business After making clear the direction of financial management, financial users will have a deeper understanding of financial management methods and related information. In some large-scale banking services, artificial intelligence has replaced manual services, and users who participate in financial management can get a deeper understanding of the business process and required procedures through contact with intelligent customer service. [15]The application of artificial intelligence service in financial management, on the one hand, improves the efficiency of financial management business, on the other hand, it also helps to improve users' satisfaction with financial management services, thus improving their enthusiasm for participating in financial management.[16]

Application in information security of wealth management users. After the financial management related business is completed, it is necessary to improve the user's personal information, with the aim of ensuring the security of user information. The application of computer's own visual recognition technology and personal physical feature recognition technology in financial institutions has prompted the intelligent service robot to identify the identity of financial users. In addition, in order to further improve the investment environment security of financial institutions, financial enterprises apply artificial intelligence detection systems and install them in more important areas to identify users. [17]In the process of information consultation from users to JIMI, JIMI can obtain user information through relevant channels. If users have problems in JD.COM, JIMI robot will automatically record them.

4. Conclusion

This paper conclude that based on its powerful functions, artificial intelligence can be applied in many fields, including smart homes and intelligent robots, and the application of artificial intelligence in financial management is also one of the main directions. Artificial intelligence is widely used in financial management, from pre-financial consultation, financial management business selection and development, user information analysis and security maintenance. From the analysis results of the application of JIMI in all aspects of financial management, artificial intelligence can greatly improve the efficiency of financial management business, and at the same time, it can automatically identify users, which is helpful to improve the information security of users and control various risks faced by financial management institutions. In addition, with the help of the application of artificial intelligence, users can consult financial management-related questions at any time, and artificial intelligence robots will answer them in a short time, which greatly improves users' satisfaction with financial management services, thus indicating that artificial intelligence can become personalized financial consultants.

References

[1]. Chai Hongfeng, Li Zhixin and Hou Peng (2024) Development trend of financial risk monitoring technology based on artificial intelligence.

[2]. Al-Gasawneh, J. A., AL-Hawamleh, A. M., Alorfi, A., & Al-Rawashdeh, G. (2022). Moderating the role of the perceived security and endorsement on the relationship between per-ceived risk and intention to use the artificial intelligence in financial services.

[3]. Hui Zhu *, Olli Vigren , Inga-Lill So ̈derberg (2024) Implementing artificial intelligence empowered financial advisory services: A literature review and critical research agenda

[4]. Zso ́fia To ́th *, Markus Blut Ethical compass: The need for Corporate Digital Responsibility in the use of Artificial Intelligence in financial services.

[5]. Wenbin Yang(2017) Application Analysis of Artificial Intelligence in Financial Field

[6]. Weiwei Liu 、Qianyong Yuan (2018) Big Data Thinking Approach to Artificial Intelligence Problem

[7]. Qi Yang(2015) Innovative Advantages and Development of Internet Financial Products

[8]. Rui Wang (2016) Analysis of Influencing Factors of Internet Financial Products Purchase Decision-making

[9]. Xinyu Hou(2018) Application Analysis of Artificial Intelligence in Financial Field

[10]. Wujun and Chen Liang (2016) Application of Foreign Artificial Intelligence in Financial Investment Consulting and Its Enlightenment to China.

[11]. Lou Boyang (2023) How does artificial intelligence realize personal finance?

[12]. Baulkaran, V., & Jain, P. (2023). Who uses robo-advising and how?

[13]. Filiz, I., Judek, J. R., Lorenz, M., & Spiwoks, M. (2022). Algorithm Aversion as an Obstacle in the Establishment of Robo Advisors. J

[14]. Chang, Y., & Wang, R. (2023). Conservatives endorse Fintech? Individual regulatory focus attenuates the algorithm aversion effects in automated wealth management.

[15]. Liu, C., Yang, M., & Wen, M. (2023). Judge me on my losers: Do robo-advisors outperform human investors during the COVID-19 financial market crash?

[16]. Chia, H. X. (2019). In Machines We Trust: Are Robo-Advisers More Trustworthy Than Human Financial Advisers?

[17]. Hohenberger, C., Lee, C., & Coughlin, J. F. (2019). Acceptance of robo-advisors: Effects of financial experience, affective reactions, and self-enhancement motives.

Cite this article

Liu,Z. (2024). Artificial Intelligence as Personal Financial Advisor in the Future? - A Case Study Based on Algorithmic Innovation Strategies. Advances in Economics, Management and Political Sciences,87,272-278.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chai Hongfeng, Li Zhixin and Hou Peng (2024) Development trend of financial risk monitoring technology based on artificial intelligence.

[2]. Al-Gasawneh, J. A., AL-Hawamleh, A. M., Alorfi, A., & Al-Rawashdeh, G. (2022). Moderating the role of the perceived security and endorsement on the relationship between per-ceived risk and intention to use the artificial intelligence in financial services.

[3]. Hui Zhu *, Olli Vigren , Inga-Lill So ̈derberg (2024) Implementing artificial intelligence empowered financial advisory services: A literature review and critical research agenda

[4]. Zso ́fia To ́th *, Markus Blut Ethical compass: The need for Corporate Digital Responsibility in the use of Artificial Intelligence in financial services.

[5]. Wenbin Yang(2017) Application Analysis of Artificial Intelligence in Financial Field

[6]. Weiwei Liu 、Qianyong Yuan (2018) Big Data Thinking Approach to Artificial Intelligence Problem

[7]. Qi Yang(2015) Innovative Advantages and Development of Internet Financial Products

[8]. Rui Wang (2016) Analysis of Influencing Factors of Internet Financial Products Purchase Decision-making

[9]. Xinyu Hou(2018) Application Analysis of Artificial Intelligence in Financial Field

[10]. Wujun and Chen Liang (2016) Application of Foreign Artificial Intelligence in Financial Investment Consulting and Its Enlightenment to China.

[11]. Lou Boyang (2023) How does artificial intelligence realize personal finance?

[12]. Baulkaran, V., & Jain, P. (2023). Who uses robo-advising and how?

[13]. Filiz, I., Judek, J. R., Lorenz, M., & Spiwoks, M. (2022). Algorithm Aversion as an Obstacle in the Establishment of Robo Advisors. J

[14]. Chang, Y., & Wang, R. (2023). Conservatives endorse Fintech? Individual regulatory focus attenuates the algorithm aversion effects in automated wealth management.

[15]. Liu, C., Yang, M., & Wen, M. (2023). Judge me on my losers: Do robo-advisors outperform human investors during the COVID-19 financial market crash?

[16]. Chia, H. X. (2019). In Machines We Trust: Are Robo-Advisers More Trustworthy Than Human Financial Advisers?

[17]. Hohenberger, C., Lee, C., & Coughlin, J. F. (2019). Acceptance of robo-advisors: Effects of financial experience, affective reactions, and self-enhancement motives.