1. Introduction

Currently, China’s Internet industry is in a booming stage of development and is gradually penetrating various industries and fields. The construction of new infrastructure has achieved remarkable results, while the integration of information technology applications has accelerated, prompting China’s Internet to develop in a healthy and sustainable direction. The growth in significance of the Internet in life is reflected in the fact that social networking software has become an indispensable part of daily lives.

Tencent Holdings Limited is one of China’s leading Internet technology companies, as well as one of the country’s largest game developers and social media providers. QQ and WeChat, developed and operated by Tencent, are currently the two most widely used social instant messaging software programs in China, released in 2000 and 2011, respectively. However, in recent years, WeChat’s user activity has greatly outpaced that of QQ, with 1,313.2 million monthly active users in 2022, compared to 572.1 million for QQ, according to Tencent’s 2022 annual report [1]. In this comparison, WeChat is gradually becoming an essential product item for Tencent to increase its profitability and development space. However, Tencent still retains QQ as one of its main lines of business and continuously optimizes and upgrades it.

This study compares the two social instant messaging software programs, WeChat and QQ, by means of theoretical analyses, and then analyzes Tencent’s internal strategic development and suggests the opportunities and threats that Tencent may face in its operations.

2. Reasons of retaining QQ

2.1. The different functions of QQ and WeChat

QQ was the first instant messaging software in China in 1999, which Tencent imitated and developed based on ICQ. WeChat is a new instant messaging software that Tencent developed in 2011 [2]. Although both products are social software, the division of tasks and product positioning are distinctive, as WeChat is an office-based social tool for building social relationships and transmitting text messages, while QQ offers significant advantages in processing office documents, such as larger file transfers. Based on the long-term development of QQ, Tencent is committed to establishing a comprehensive network ecosystem, which is part of Tencent’s development strategy. The network ecosystem permits users to experience other Tencent Internet services, such as Tencent mailboxes and Tencent games, for free by registering an account for one of Tencent’s popular products. Thus, the QQ social software account represents one of Tencent’s most valuable products, enabling links to products developed by Tencent itself [3]. For example, the registration and login of one of the popular games developed by Tencent Games, Honor of Kings, is realized through QQ and WeChat accounts [3]. The data for users logging in with the QQ account and the data for users logging in with the WeChat account are not related to each other. If a user who logs in with the QQ number no longer uses QQ, the corresponding game account will also stop being used. Therefore, once the QQ service is canceled at Tencent, a large number of Tencent users will lose the right to use Tencent’s Internet products, which also means that Tencent will eventually lose a part of its users.

2.2. Different target groups

QQ is an early product of Tencent during the era of computer development, so QQ is more like a personal computer (PC)-based product. Through the PC, QQ social software features numerous young people’s favorite functions, including QQ Games and QQ Show. Among them, QQ games provide users with a variety of game experiences, such as casual games, strategy games, board games, simulation games, which basically enriches users’ spare time and satisfies their entertainment needs. And QQ Shows is a QQ virtual image design, including virtual costumes, virtual scenes, and virtual character images. Users can buy different virtual costumes to dress up their virtual character images displayed in QQ. These features take into account the needs of young people, who are the main user group, and are therefore very popular among users. QQ game rankings enhance the competitive mentality of young people. The QQ Show, which can be displayed in the chat window, strengthens the possibility for users to interact with the avatars of the people they are chatting with. In addition, QQ’s membership system capitalizes on young people’s curiosity and show-off mentality by changing the status of their account avatars to make them more distinctive [4].

On the other hand, WeChat is a mobile-based chat software that was developed based on mobile phones as the smartphone market expanded. It is more popular among adult users as the interface design is more convenient and easier to understand. WeChat’s page design concept is simple and clear, without a series of complicated functions and divisions, such as QQ’s grouping, couple space, or anonymous updates. For working adults, a simple page allows for more effective communication. Moreover, WeChat is more private and trustworthy than QQ. WeChat’s unique circle of friends and related comments are only shown to friends, which is a kind of niche communication based on the network of acquaintances, whereas Qzone’s dynamics are open to everyone. For WeChat, whose user profile is mainly adult, users can avoid unnecessary trouble by posting in their own familiar community circles. Furthermore, WeChat offers a change packet function, and the user’s bank card binding function allows users to consume online by scanning QR code, which accelerates the implementation of cashless life as well as facilitates people’s lives.

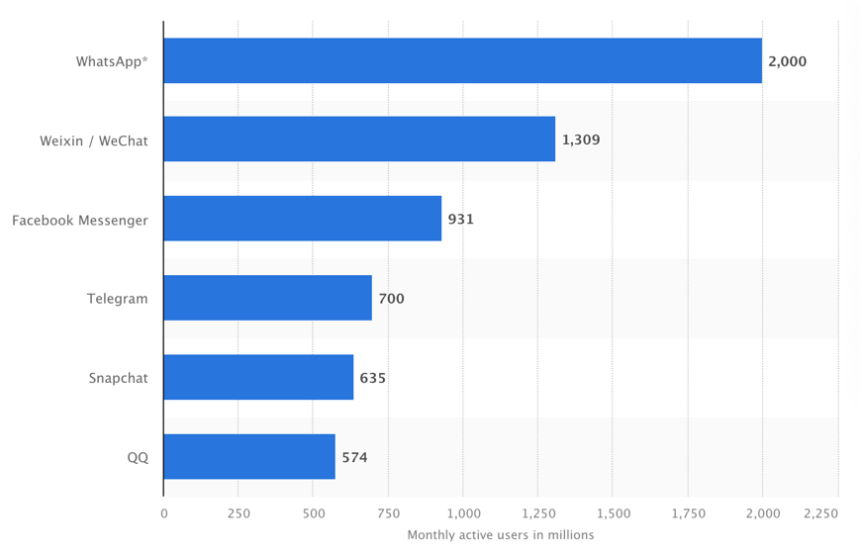

2.3. Maintaining a good competitive relationship

Competitiveness is one of the most essential factors for enterprises to maintain stable development in the market competition, and competition is also one of the driving forces for the development of the market. In China, the most used and popular social software are WeChat and QQ, respectively. As can be seen in Figure 1, WeChat and QQ are at the top of the list in the global instant messaging market, this also indicates that WeChat and QQ have almost monopolised the instant messaging market in China. Since both products are Tencent products, it can be understood that Tencent has almost monopolized the instant messaging market in China. In order to ensure a favorable competitive environment, Tencent needs to retain its QQ product and keep QQ in operation.

Figure 1: Most popular global mobile messenger apps as of January 2023, based on number of monthly active users [5]

Intense competitive relationships can stimulate the potential of companies and employees, thus promoting technological progress and product quality. The competition between WeChat and QQ allows Tencent Group to compare the two products and make deeper improvements. At the same time, WeChat’s success also suggests improved optimization directions for QQ’s development to attract more users through product updates. This kind of healthy competition, which complements and promotes each other, also allows Tencent to maintain an upward trend and more stable development.

3. QQ can still generate profits

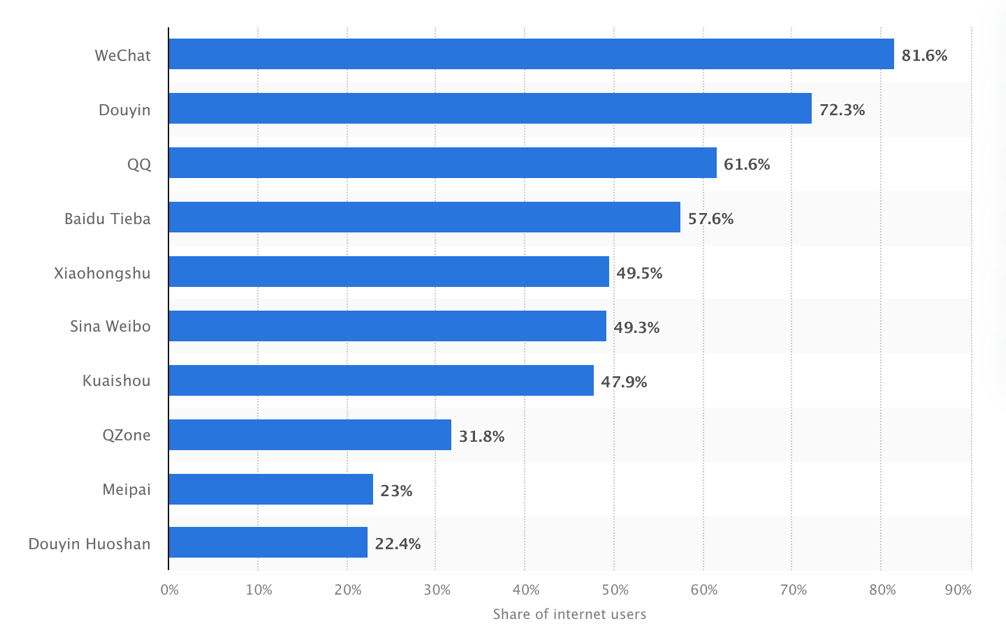

According to Figure 2, which illustrates the percentage of users using social media in China in the third quarter of 2022, QQ ranked third in terms of usage rate, after WeChat and Douyin. However, according to Tencent’s 2022 annual financial report, QQ’s monthly active base in 2021 was 552.1 million, compared to 572.1 million in 2022, an increase of 3.6% [1]. This also demonstrates that QQ’s user activity is still on a slight upward trend in recent years, suggesting that it can still generate revenue for Tencent. Although QQ has fewer monthly active accounts than WeChat, it still has a large user base. As many users are still using QQ or retaining QQ accounts, QQ still has a certain influence on Tencent’s strategic development and has brought Tencent a certain amount of revenue.

Figure 2: Share of internet users of the leading social media in China as of 3rd quarter 2022 [6]

4. Tencent Strategy

Tencent chose to retain QQ has a certain correlation with the strategy of the company, which can be reflected in the two aspects which are product management and innovation.

4.1. Product Management

The founders of Tencent identified seven principles that need to be fulfilled for product creation: agility, openness, user first, speed, resilience, evolution, and innovation [7].

Product development needs to have the ability to anticipate and respond to market changes.

Tencent adopts a youthful approach in employee management, prioritizing the involvement of young people who are more aware of the changing needs of social users as the main project leaders in product development. In addition, facing market demand requires the manager to have the ability to react and implement [7]. In other words, when the market demand changes or when the product needs to be adjusted, the employees are required to accurately and timely capture the changes in demand, and, at the same time, take corresponding measures to accomplish and implement the optimization of the product within a short period of time. In addition, Tencent adopts the principle of open management to encourage employees to actively participate in product development, providing the freedom of space for product design and development, and maximizing the conversion of market demand and the company’s product planning into products [7].

The most important point of product development is the customer first, only to make the customer satisfied can be called a successful product. And every product will be updated, it cannot be perfect at the beginning, so, like QQ and WeChat, although they have reached a certain degree to meet the needs of many customers, but still should not be improved, to become better. Next, no matter internal or external, the pressure of competition is inevitable, as the internal competition between WeChat and QQ. QQ should not be given up easily because the current development trend of QQ is not as good as that of WeChat, rather, it is necessary to learn from the failures. Then there is evolution, QQ is irreplaceable in the computer era, however, after entering the mobile era, Tencent has evolved it to the mobile mode as well, even though many other functions can only be used on the PC, QQ can still be used for simple socialising on the mobile. Finally, there is innovation, and a product cannot be isolated from innovation.

4.2. Innovation

4.2.1. Imitative Strategy

As mentioned above, QQ is Tencent’s copycat based on ICQ, but products such as offline messaging, QQ Groups, Magic Emoji, Mobile QQ, and Dazzling Bells are Tencent’s innovations [8]. One of Tencent’s development strategies is: follow the "imitation, follow, catch more, monopoly" [9]. On the basis of imitation, Tencent innovated to make their products better, thus attracting more customers. This is why QQ has laid a strong customer base for Tencent, paving a solid path for the creation of WeChat more than a decade later, allowing WeChat to have a total of more than 300 million registered accounts in 2013 [10], both at domestic and international level.

4.2.2. Collaborative Innovation

Through cooperation with major universities, such as Tsinghua University, Peking University, and Singapore’s Nanyang Technological University, Tencent has achieved a lot of innovations and developed a lot of new functions while cultivating talents and specialised cooperation. For example, the real-time route recommendation system developed for Tencent Maps and the query and subscription system based on spatial location awareness [11].

4.2.3. Independent innovation

WeChat is a highly innovative software that can connect many other different programmes through WeChat mini programs. Users do not need to download a separate software or programme but can use it directly through QR code scanning or mini programme search [10], which is convenient and fast.

4.2.4. Diversification

Since Tencent’s founding, it has gone from a simple instant messaging service to online media, wireless internet value-added services, interactive entertainment service, internet value-added service, e-commerce and online advertising service. This has made Tencent a leader and strong competitor in the Chinese Internet market [11].

5. Opportunity and threats

Tencent’s biggest advantage at the moment is the instant messaging market, where Tencent holds 66.94% of the overall market share and has a certain amount of customer base [8]. Together with the current development of China’s Internet, Tencent has a good chance of continuing to grow in this market. However, Tencent’s strategic goal is to create three major product lines: home, school, and work [12], however, Tencent has not made a good development in the school and work segments. At work, people are more inclined to use Flying Book, which belongs to Byte Jump (a new type of major social media), while at learning, Dingding is a strong competitor of Tencent.

6. Conclusion

Overall, this paper analyses the reasons why Tencent chose to keep QQ, and on its basis, it examines Tencent’s seven principles on product management and four innovation strategies, as well as briefly introduces the problems Tencent will face in the future. However, this paper still has shortcomings. Firstly, the article lacks market research, and all the information comes from existing surveys. Furthermore, the market scope is relatively small, as this essay mainly analyses Tencent’s Chinese market without involving the foreign market. Therefore, this essay can strengthen deeper analysis and research on the Internet industry to ensure better research results.

References

[1]. Tencent. (2022). 2022 financial report (p. 4). https://www.tencent.com/en-us/investors/quarter-result.html

[2]. Napitupulu, B. E. P. (2020). What Makes tencent becomes a successful business? A case study analysis of Tencent Doctoral dissertation, STIE Perbanas Surabaya.

[3]. Wu, J. P., & Frantz, T. L. (2012). Largest IM platform in China Tecents QQ. Journal of Business Case Studies (JBCS), 8(1), 95-102.

[4]. Shang, Y. (2022). Tencent’s Business Model and Business Strategy. Frontiers in Business, Economics and Management, 4(2), 29-33.

[5]. Statista. (2019). Most popular messaging apps 2019 | Statista. https://www.statista.com/statistics/258749/most-popular-global-mobile-messenger-apps/.

[6]. Statista. (2022). China: most popular social media platforms 2018, Statista. https://www.statista.com/statistics/250546/leading-social-network-sites-in-china/

[7]. BIRKINSHAW, J., DE DIEGO, E., & LIANGHONG KE, D. (2018). Seven lessons from Tencent’s Pony Ma. London Business School Review, 29(2), 50–53. https://doi.org/10.1111/2057-1615.12239

[8]. Liu, S (2021). Financial Analysis of Light Asset Company Based on Harvard Analysis Framework—Taking Tencent as an Example. Advances in Social Sciences, 10, 1640, DOI: 10.12677/ASS.2021.107227.

[9]. Dai, J., Shen, L., & Zheng, W. (2011). Business-model dynamics: A case study of Tencent. 2011 IEEE 18th International Conference on Industrial Engineering and Engineering Management. https://doi.org/10.1109/icieem.2011.6035164

[10]. Tencent. (2013). 2013 financial report (p. 7). https://www.tencent.com/en-us/investors/quarter-result.html

[11]. Greeven, M. J., & Yip, G. S. (2021). Six paths to Chinese company innovation. Asia Pacific Journal of Management, 38, 17-33.

[12]. Negro, G., Balbi, G., & Bory, P. (2020). The path to WeChat: How Tencent’s culture shaped the most popular Chinese app, 1998–2011. Global Media and Communication, 16(2), 208-226.

Cite this article

Sun,Q. (2024). The Analysis of Tencent's Mainstream Social Products - Take WeChat and QQ as Examples. Advances in Economics, Management and Political Sciences,87,84-89.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tencent. (2022). 2022 financial report (p. 4). https://www.tencent.com/en-us/investors/quarter-result.html

[2]. Napitupulu, B. E. P. (2020). What Makes tencent becomes a successful business? A case study analysis of Tencent Doctoral dissertation, STIE Perbanas Surabaya.

[3]. Wu, J. P., & Frantz, T. L. (2012). Largest IM platform in China Tecents QQ. Journal of Business Case Studies (JBCS), 8(1), 95-102.

[4]. Shang, Y. (2022). Tencent’s Business Model and Business Strategy. Frontiers in Business, Economics and Management, 4(2), 29-33.

[5]. Statista. (2019). Most popular messaging apps 2019 | Statista. https://www.statista.com/statistics/258749/most-popular-global-mobile-messenger-apps/.

[6]. Statista. (2022). China: most popular social media platforms 2018, Statista. https://www.statista.com/statistics/250546/leading-social-network-sites-in-china/

[7]. BIRKINSHAW, J., DE DIEGO, E., & LIANGHONG KE, D. (2018). Seven lessons from Tencent’s Pony Ma. London Business School Review, 29(2), 50–53. https://doi.org/10.1111/2057-1615.12239

[8]. Liu, S (2021). Financial Analysis of Light Asset Company Based on Harvard Analysis Framework—Taking Tencent as an Example. Advances in Social Sciences, 10, 1640, DOI: 10.12677/ASS.2021.107227.

[9]. Dai, J., Shen, L., & Zheng, W. (2011). Business-model dynamics: A case study of Tencent. 2011 IEEE 18th International Conference on Industrial Engineering and Engineering Management. https://doi.org/10.1109/icieem.2011.6035164

[10]. Tencent. (2013). 2013 financial report (p. 7). https://www.tencent.com/en-us/investors/quarter-result.html

[11]. Greeven, M. J., & Yip, G. S. (2021). Six paths to Chinese company innovation. Asia Pacific Journal of Management, 38, 17-33.

[12]. Negro, G., Balbi, G., & Bory, P. (2020). The path to WeChat: How Tencent’s culture shaped the most popular Chinese app, 1998–2011. Global Media and Communication, 16(2), 208-226.