Volume 220

Published on September 2025Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

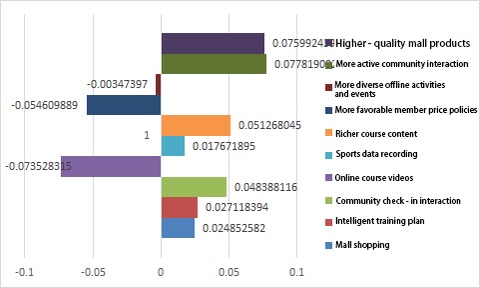

With the continuous improvement of global health and fitness awareness, online fitness platforms have rapidly become an important part of the fitness industry. By leveraging digital technology and integrating O2O (Online-to-Offline), such platforms are reshaping user experience and service models. However, due to the partial homogenization of online fitness products, user stickiness will further become the commercial marketing focus of Internet fitness platforms. This study takes Keep, a leading online fitness platform in China, as a case. Based on its annual financial report, operational data and user questionnaire survey, and combined with SPSS for statistical analysis, it explores its business model innovation and operational effectiveness. The research results show that Keep has maximized the high stickiness of users through its "trinity" innovative mechanism. However, considering the cost control in the technological innovation mechanism, the article suggests that a balance between user activity and profitability can be achieved by optimizing the revenue structure, enhancing high-margin businesses, and introducing intelligent training programs. This study aims to provide practical references and theoretical inspirations for the digital transformation and sustainable development of global online fitness platforms.

View pdf

View pdf

The internet and e-commerce have been in existence for several decades, while machine learning (ML), a subfield of artificial intelligence, is a relatively recent yet highly influential development. Moreover, it is widely used to offer highly relevant products and services, optimize prices, uncover fraudulent activities, and improve customer trust. It contributes to evidence-based decision-making, operational productivity, and enhanced end-user satisfaction. This paper investigates the key applications of ML in e-commerce, focusing on recommendation systems, predictive analytics, dynamic pricing, and customer service automation. From reviewing the current literature and analyzing the industry’s real-life use scenarios, the main benefits of ML are summarized, including scalability, competitive advantage, and continuous improvement over time. Issues such as data quality, algorithmic bias, privacy, and governance are also discussed in depth. The results suggest that ML can significantly change digital commerce strategies, guide informed business decisions, and maximize customer satisfaction in a global e-commerce setting.

View pdf

View pdf

The research value of Disney, as a global entertainment conglomerate, is rooted in the dual challenges of industry transformation and intensifying global competition. This paper presents an economic analysis of The Walt Disney Company. To provide a holistic view of Disney’s market position and future prospects, the analysis combines SWOT analysis and Porter’s Five Forces framework. Through SWOT analysis, the study identifies Disney’s core internal strengths—including robust brand equity, diversified business segments, and an extensive intellectual property portfolio—while also examining external opportunities such as digital streaming expansion and emerging market growth. Conversely, potential risks and competitive threats are also highlighted. Porter’s Five Forces analysis further reveals Disney’s favorable industry dynamics, including strong bargaining power with suppliers and buyers, minimal threat from new entrants and substitutes due to its unique value proposition, and manageable competitive rivalry through continuous innovation.

View pdf

View pdf

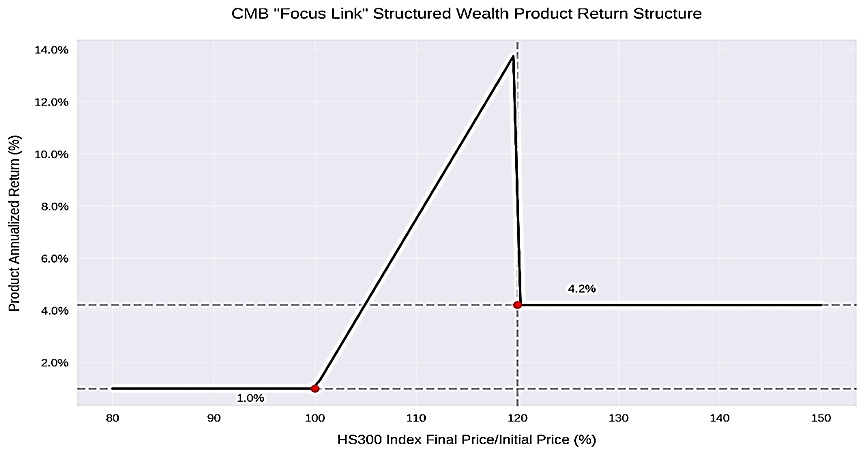

This study conducts an in-depth analysis of the pricing mechanism of China Merchants Bank's "Focus Link Series" equity-index-linked structured wealth management products, using the CSI 300 Index as the underlying asset. It systematically examines the pricing challenges of long-term structured products containing path-dependent clauses and volatility clustering characteristics. By constructing a hybrid pricing framework that employs discounted cash flow methods for fixed-income valuation and GARCH-calibrated Monte Carlo simulation for option pricing, the research reveals significant issuance premium in this 10-year product. Empirical results show an annualized volatility of 16.38% for the product. Greek analysis indicates negative Delta and positive Gamma values, demonstrating the product's unique sensitivity to underlying asset price movements. The study innovatively combines path-dependent Monte Carlo simulation with GARCH volatility modeling, expanding the theoretical framework for pricing structured products in China. Findings suggest that issuers should optimize long-term product pricing mechanisms and establish dynamic risk monitoring systems, while investors should fully understand the return distribution characteristics of structured products. Through rigorous quantitative analysis, this research provides new theoretical perspectives and empirical evidence for understanding the pricing logic of complex financial products in China's financial markets.

View pdf

View pdf

As a major global offshore financial hub, the Hong Kong stock market exhibits volatility anomalies that are significantly different from mature markets due to its dual pricing mechanism and the interweaving of international capital flows. This divergence is no accident; its core root lies first in the "dual pricing mechanism" unique to the Hong Kong stock market. Under this mechanism, locally listed securities denominated in Hong Kong dollars and cross-border trading securities affected by fluctuations in foreign exchange rates have formed parallel yet interacting pricing logics. This paper aims to examine the volatility anomalies exhibited by the Hong Kong stock market in recent years, analyze the underlying drivers, and explore their impact on market participants. Through an in-depth analysis of the Hang Seng Index, trading volume, investor behavior, global economic conditions, monetary policies, mainland economic policies, and industry characteristics, this paper reveals the multiple causes of volatility in the Hong Kong stock market and puts forward targeted investment strategies and recommendations.

View pdf

View pdf