1. Introduction

1.1. Background

1.1.1. Technology-driven innovation

In today's era, emerging technologies such as "Smart Mobility Cloud and IoT Zone" are booming, and in the era of digital economy, data has become a new factor of production.In this regard, China proposes to promote the "cloud and data empowerment" action to further promote the digital transformation of enterprises to cultivate the development of the new economy;In February 2022, the State-owned Assets Supervision and Administration Commission (SASAC) issued the "Guiding Opinions on Accelerating the Construction of a World-class Financial Management System for Central Enterprises", which proposed that qualified enterprises should explore the establishment of digital and intelligent finance based on an independent and controllable system.

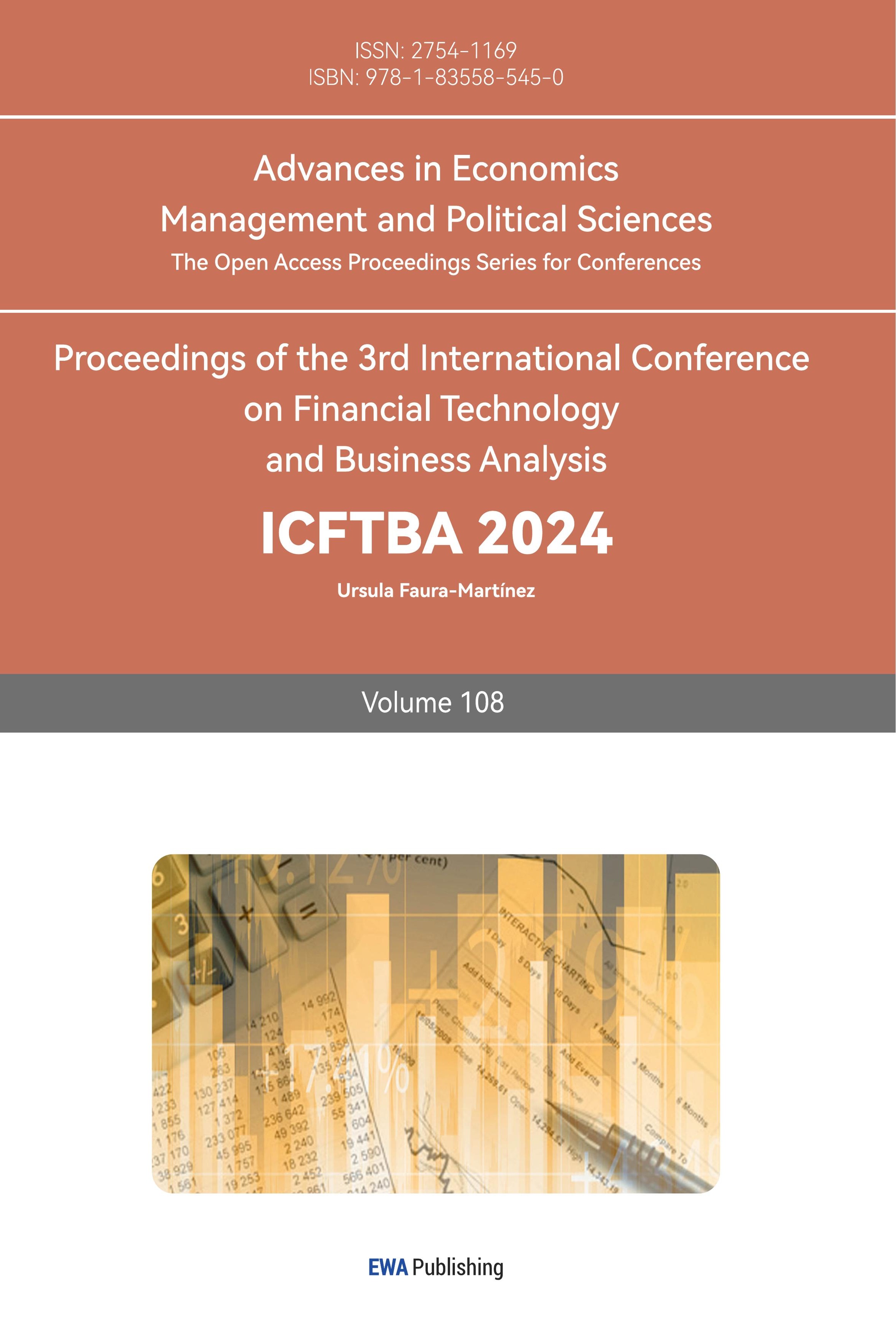

Figure 1: Development stage and performance state of intelligence finance

At the same time, according to the top ten strategic technology development trends released by Gartner for two consecutive years (2023-2024), the development of industry cloud platforms has become the future trend of enterprise development.

The three layers of IaaS, PaaS, and SaaS are further deconstructed, according to Kong Weiwei and Li Jiayi based on CiteSpace Since 2012, the core Chinese literature related to intelligent finance has shown an upward trend, and in 2020, it even reached more than 160 results. It is expected that this research field will remain hot in the next five years and reach a stable peak.

Figure 2: Number of core journals of enterprise intelligent finance published on CNKI

Under the background of digital and intelligent development, the innovation of enterprise financial management is also driven by technology. Information technology runs through the whole process of operation and management of enterprises and institutions, accounting personnel use a variety of information technology to apply to many scenarios of accounting work, such as accounting, financial reporting, expense reimbursement, management accounting, etc., and the innovation and iteration of information technology has accelerated the trend change of accounting application scenarios, bringing a lot of convenience and new thinking to accounting personnel, and the career transformation of accounting personnel has become a directional consensus.

Enterprises begin to explore the application of intelligent technology in the field of financial management to improve management efficiency, reduce costs and optimize decision-making. The application trend of enterprise intelligent finance has become a hot spot in theoretical research and enterprise development, and has received widespread social attention.

1.1.2. Imbalance of talent supply and demand

From 2014 to 2023, the number of undergraduates and master's students in economic management in China has experienced rapid growth, especially in finance and accounting positions, which are in great demand in the market. However, with the large-scale expansion of finance and economics majors in China, the number of students in the field of finance and accounting has also increased rapidly, resulting in the market cannot fully absorb these new job seekers. This imbalance between supply and demand makes the price competition in the finance and accounting training market increasingly fierce, and the unit price shows a rapid decline trend.

1.2. Degree of application

From the perspective of academic research, since the reform and opening up,with the continuous development of accounting informatization in China, intelligent finance has become a new research content in the field of financial management in recent years[1].There are two main definitions of intelligent finance in China today: one is that Liu Meiling et al. will apply new technologies such as artificial intelligence to financial work, such as " Smart Mobility Cloud and IoT Zone " represented by artificial intelligence, to simulate, extend and expand traditional financial work, so as to improve the quality of accounting information, improve accounting work efficiency, reduce accounting work costs, enhance accounting compliance capabilities and value creation capabilities, promote the role of enterprise finance in management control and decision support, and promote the digital transformation process of enterprises through the digital transformation of finance[2] The other is the intelligent finance proposed by Liu Qin and others, which is the financial work with the support of various management information systems of enterprises and new technologies such as big data, artificial intelligence, cloud computing, Internet of Things, and blockchain[3]Through the human-machine collaboration mode of human experts and intelligent machines to complete financial management, it can actively meet the needs of enterprise production, operation and management, and continuously create value for enterprise[4].

The author believes that both perspectives show the connotation of intelligent finance, pointing out that the application of technology can promote the financial transformation of enterprises, but the former emphasizes the digital transformation of accounting, while the latter focuses on the improvement of benefits under the human-machine collaboration under the development of technology, and emphasizes the important needs of enterprises as the demand side.

Based on this, scholars have conducted in-depth research on macro issues such as intelligent financial construction factors, application effects, construction models, and logical elements, and further conducted further research on them OCR, RPA, financial sharing center construction, artificial intelligence and other intelligent technology discussion,[5][6][7][8] Explore its technical challenges and application value.

1.3. Research Gaps

Although scholars have conducted in-depth research on the related issues of intelligent finance construction, the research is mainly based on case studies, and the research methods for intelligent finance are not perfect, and there is a relative lack of effective theories and models to guide the research, and there is a relative lack of overall research on the practical application of intelligent finance. As a product of the era of digital economy, intelligent finance has good application value for studying its trend development.

1.4. Objectives

Therefore, based on the connotation and characteristics of intelligent finance, this paper adopts the method of literature review to comprehensively sort out the views of domestic and foreign scholars on the construction of intelligent finance, and discusses the application and development trend of intelligent financial enterprises.

This paper mainly studies two questions: First, what is intelligent finance, what are its special features. Second, what are the views of scholars on the application trend of intelligent finance enterprises, what research methods are obtained, and what suggestions are there for the future construction of enterprises?

1.5. Implications

The research contribution and significance of this paper are mainly reflected in the fact that the construction of intelligent finance has always received a high degree of attention, especially in the practical work of enterprise finance, the definition, characteristics and application trends of intelligent financial construction are summarized and analyzed, which can clarify the development status of intelligent finance today, provide reference for the subsequent development of enterprise intelligent finance, save the cost of enterprise exploration, obtain a good competitive advantage, and promote the digital transformation of enterprises.

2. Trends in intelligent finance applications

According to the current research status at home and abroad and the characteristics of intelligent finance, the current trend of intelligent financial application can be roughly divided into four aspects: intelligent application, financial sharing development, data transformation and processing, and integrated collaborative application.

2.1. Intelligent applications

Under the development trend of " Smart Mobility Cloud and IoT Zone” intelligent finance is transforming from weak intelligence to strong intelligence [9], that is, from the simple use of people's perception capabilities, such as: digital signatures, RPA, OCR, etc. To the more complex application of human cognitive abilities, such as: chat-GPT uses the prediction of future market trends and investment risks, that is, from dealing with a large number of repetitive and rule-based operational services to using cognitive intelligence to achieve autonomous optimization of operational services to realize the intellectualization of the management accounting platform.[10] Intelligent corporate governance management [11].

According to Yang Yin et al.'s collection of financial intelligence information on Chinese enterprises on the basis of a questionnaire survey, the current information is obtained The financial information system is less intelligent still in the stage of weak intelligence, and the development of strong intelligence is a historical necessity.

At the same time, under this trend, intelligent applications will evolve from single-line development to in-depth development [9] [12] Three-dimensional coverage of the whole enterprise to achieve automated, intelligent and visualized business processes [13] Full coverage, save unnecessary intermediate costs, and maximize benefits. It can be seen that the development of intelligent applications requires enterprises to broaden the dimension of intelligent finance and promote intelligent transformation with data [2] Deepen the cultivation of analytical capabilities such as artificial intelligence cognitive prediction in multi-level and wide fields, and release the momentum of enterprise development.

2.2. Financial sharing development

With the development of emerging intelligent technologies, the traditional financial shared service center has a new direction of transformation. In 2016, Deloitte and others promoted the integration of artificial intelligence technology and the accounting field, which in turn promoted China to enter the era of intelligent accounting[1]. The intelligent financial sharing center has become the transformation direction of the enterprise financial sharing center, from financial accounting sharing to management accounting sharing to enter the big sharing stage [2]. Through the continuous adjustment of the organizational structure, the use of digital tools, the transformation from a physical organization to a virtual organization, information sharing to promote the concentration of personnel in digital form, weaken the constraints of time and space and make the enterprise financial system integrated, lightweight, modular and standardized [14]. Strengthen accounting, management and strategy Multi-platform linkage.

At the same time, shared services organizations are transforming into global shared services (GBS). The future trend will be to develop the shared field with technical resources as the core, which can bring higher value service capabilities and more reasonable resource allocation efficiency to enterprises.[15]

2.3. Data-based transformation and processing

In the era of digital economy, the construction of intelligent finance of enterprises needs to reflect the dual value of data-driven and technological innovation.[16] The development of the "Smart Mobility Cloud and IoT Zone" requires the expansion and deepening of intelligent finance, and the importance of data as a basic element is self-evident. Due to the huge amount of data, its transformation trend can be divided into three aspects, namely quality, efficiency, and green.

2.3.1. Quality

Traditional accounting has comprehensively controlled the accuracy of accounting information through white and black records, full-process stamping and auditing, and strict policy supervision;[17] Its places new demands on data quality and privacy [18] Data security cannot be ignored [18].

Therefore, at present, the development of data has carried out more accurate, reliable, real and safe regulatory system requirements.[19] For example, as early as 2015, the General Office of the State Council issued several opinions on the use of big data to strengthen the service and supervision of market entities [20], the European Union's Data Act of 2022. It can be seen that in the future, the development of data will be more legitimate, authentic and secure, so that business data can have a more complete guarantee system, and then achieve data operation within the standardized system, that is, data standardization.[21]

2.3.2. Efficiency

The trend of data processing automation is obvious, and intelligent finance will be used in an all-round way, including the gradual mastery and application of repetitive bookkeeping work by RPA, as well as the financial analysis and trend of a large number of calculations by the human brain Research and judgment, investment and financing, risk assessment and other market analysis.

At the same time, the development of big data has prompted the large-scale application of intelligent decision support systems in finance, through AI data processing, and the use of RPA technology guidance.[22]For example, in 2020, China Merchants Bank's CBS-RPA collects and analyzes financial data, realizes financial automation, reduces the investment of human accounting resources, and accelerates the development of accounting talents to optimize the efficiency of digital resource allocation. [23]

It can be seen that the development of intelligent finance will greatly improve the efficiency of financial accounting, and the demand for accounting will also tend to high-tech and high-quality digital talents.

2.3.3. Resources

Digital transformation means moving from paper to electronic data. From the perspective of data preservation, electronic data can maximize the utilization of data resources with the advantages of more convenient and much fast search and analysis, and at the same time save the labor cost of paper database maintenance and search.

However, greater requirements are put forward for data storage space and security maintenance, and the confidentiality level of internal data of enterprises relies on higher technical guarantees, more comprehensive policy support, and more sufficient capital reserves. It can be seen that the increasing requirements for data virtual resources and storage guarantee have stimulated the domestic demand for enterprise technology and the direction of future digital transformation.

2.4. Human-machine synergy

The perspective of human-machine collaboration emphasizes the interconnected and collaborative working relationship between man and machine, and helps enterprises integrate resources and improve their production efficiency and decision-making ability through artificial intelligence and other technologies [24][25]. With the widespread use of intelligent finance, related technologies are integrated into the construction of organizational networks [26], which has led to significant changes in the organizational structure of the enterprise [27] to form a new financial organization form and promote the change of financial work efficiency and quality. At the same time, under the mutual supervision of humans and machines, the maximum potential of both can be realized [28] The underlying logic and tacit knowledge of talent understanding are given to the machine, and the time cost of the machine's high-speed processing of basic work is empowered to the enterprise, so that the financial change management is more accurate and effective [29] to promote the maximization of benefits and effectiveness through training and communication.

At present, due to the dilemma of technical level, the trust level between humans and machines is still difficult to apply on a large scale, but some enterprises have achieved simple integrated development through OCR, RPA and other technologies. It can be seen that human-machine collaboration is not a simple one-plus-one effect, but an exponential growth that gives full play to the greatest advantages, and the improvement of enterprise efficiency in the future inevitably requires coordinated development.

2.5. Review

According to the analysis and collation of the trend analysis of the four aspects of intelligent application, financial sharing development, data transformation and processing, and integrated collaborative application, the author believes that experts and scholars have put forward a variety of views from different angles, but in essence, they are still on the same path, and in the future, enterprises will take high-tech as the core, expand the application space of financial intelligence in intelligent applications, deepen cognitive computing technology, empower financial accounting and financial management with science and technology, and build a global sharing network of financial information With the support of huge information data and strict data management, improve the accuracy and automation level of data use, improve the efficiency of resource utilization, and help financial personnel transform into high-tech, high-quality and high-efficiency compound talents; vigorously promote the coordinated development of human-computer interaction, strengthen the mutual auxiliary role of man and machine, liberate human resources with technology, and strengthen the ability of resource integration.

These views comprehensively show the current development trend of enterprise intelligent finance, but they still do not constitute a complete and mature system for the specific trend situation in the future, because due to the limitation of the case-based method, the trend direction is more applicable to typical enterprises and lacks universal value.

3. Conclusions & Recommendations

To sum up, under the development of the "Smart Mobility Cloud and IoT Zone", intelligent finance, as an element of enterprise internal management, has increasingly become an essential technology for enterprises, and has also attracted the attention and research of many scholars. This paper discusses the definition and development trend of intelligent finance, with the aim of finding out the future trend of enterprise application of intelligent finance and providing reference for enterprises. The content of the literature cited in this article is of great help to this paper by analyzing and discussing the relevant theories of scholars. Of course, there are inevitably unsatisfactory places, such as the lack of intelligent financial management information for small enterprises. To summarize the above points, enterprises should choose appropriate technologies and directions based on their own actual conditions, develop them with scientific strategies, and carry out digital transformation in order to improve resource utilization efficiency and achieve good competitive advantages.

References

[1]. Liu Qin, Yang Yin, China's Accounting Informatization in the 40 Years of Reform and Opening-up: Review and Prospect[J]. Accounting Research,2019(2)

[2]. Liu Meiling, Huang Hu, Tong Chengsheng, et al. Research on the basic framework and construction ideas of intelligent finance [J]. Accounting Research, 2020, (03): 179-192.

[3]. Lanzolla G, Lorenz A, Miron-Spektor E et al. (2022) Digital transformation: what is new if anything? Emerging patterns and management research. Acad Manag Discov 6(3):341–350

[4]. Yang Yin,Liu Qin,Huang Hu.Research on the Intelligent Transformation of Enterprise Finance: System Architecture and Path Process[J].Friends of Accounting,2020(20)

[5]. XU Hanyou,YUE Rufei,ZHAO Jing. Research on the impact of financial sharing intelligence on enterprise performance [J]. Friends of Accounting, 2022, (07): 141-147.

[6]. YANG Yin,ZHAO Jian,LV Xiaolei. Analysis on the Status Quo and Development Trend of Intelligent Financial Application in Chinese Enterprises: An Example Based on Questionnaire Data [J]. Finance and Accounting Bulletin, 2021, (11): 1002-8072.2021.11.027.

[7]. Papagiannidis E, Enholm IM, Dremel C, Mikalef P, Krogstie J (2023) Toward AI governance: identifying best practices and potential barriers and outcomes. Inf Syst Front 25:123–141

[8]. Shared service centers:from cost savings to new ways of value creation and business administration [J].Advanced Series in Management,2014,13 (3):112-128.

[9]. LIU Meiling,HU Jiayu,WANG Jiping. The logic, elements and development trend of enterprise intelligent financial construction [J]. Finance and Accounting, 2020, (21): 18-21.

[10]. ZHANG Qinglong. Application Scenario Analysis of Intelligent Finance [J]. Finance and Accounting Monthly, 2021, (05): 19-26. DOI:10.19641/j.cnki.42-1290/f.2021.05.003.

[11]. ZHANG Xiaotao,TIAN Gaoliang. Development Ideas of Intelligent Finance in the Era of Digital Economy [J]. Finance and Accounting Bulletin, 2023, (06): 3-8. DOI:10.16144/j.cnki.issn1002-8072.2023.06.001.

[12]. LIU Meiling,HU Jiayu,WANG Jiping. The logic, elements and development trend of enterprise intelligent financial construction [J]. Finance and Accounting, 2020, (21): 18-21.

[13]. ZHANG Min. Ten Hot Issues in Intelligent Finance [J]. Finance and Accounting Monthly, 2021, (02): 25-30. DOI:10.19641/j.cnki.42-1290/f.2021.02.004.

[14]. ZHAO Lijin,HU Xiaoming. Digital Transformation of Enterprise Finance: Essence, Trends and Strategies [J]. Finance and Accounting Bulletin, 2021, (20): 1002-8072.2021.20.003.

[15]. LI Wenyi,YU Wenjie,LI Juhua.Choice, Realization Elements and Path of Intelligent Financial Sharing[J].Friends of Accounting,2019(8): 115-121.

[16]. YANG Yin,LIU Qin,LV Xiaolei. Research on the Factors, Applications and Effects of Enterprise Intelligent Finance Construction [J]. Friends of Accounting, 2023, (24): 138-144.

[17]. MA Bin. Advantages, Disadvantages and Development of Network Accounting [J]. Accounting for Township Enterprises in China, 2005, (10): 42-44.

[18]. Errida A, Lotfi B (2021) The determinants of organizational change management,success: literature review and case study. Int J Eng Bus Manag,13:18479790211016273

[19]. Truby J (2020) Governing artificial intelligence to benefit the UN sustainable development goals. Sustain Dev 28(4):946–959

[20]. Several Opinions of the General Office of the State Council on Using Big Data to Strengthen Services and Supervision of Market Entities Guo Ban Fa [2015] No. 51

[21]. Tian Gaoliang,Zhang Xiaotao. On the Value Creation of Intelligent Finance Empowerment in the Era of Digital Economy [J]. Finance and Accounting Monthly, 2022, 42-1290/f.2022.18.003.

[22]. Pramod D (2021) Robotic process automation for industry: adoption status, benefits, challenges and research agenda. Benchmarking 29(5):1562–1586

[23]. Polak P, Nelischer C, Guo H, Robertson D (2020) "Intelligent" finance and treasury management: what we can expect. AI Soc 35:715–726

[24]. MAKR IDAKIS S.The forthcoming Artificial Intelligence (AI)revolution:its impact on society and firms[J]. Futures,2017,90(6):46- 60. [6]

[25]. HE Dan. The impact of artificial intelligence on labor and employment[J].Journal of Shanghai Jiao Tong University(Philosophy and Social Science),2020,28(4):23- 26.)

[26]. MURR AY A,R HYMER J,SIRMON D G.Humans and technology:forms of conjoined agency in organizations[J].Academy of Management R eview,2021,46 (3):552- 571.

[27]. LI Yi,YU Liangru,QIU Dong.A Review of Human-Artificial Intelligence Collaboration Models[J]. Journal of Intelligence,2020,39(10):137-143

[28]. LI Wenyi,TANG Huachuan. Research on Human-Machine Collaboration Based on the Perspective of Financial Sharing [J]. Friends of Accounting, 2022, (23): 22-27.

[29]. Erol S, Schumacher A, Sihn W (2016) Strategic guidance towards Industry 4.0—a three-stage process model. Int Conf Compet Manuf 9(1):495–501

Cite this article

Zhang,Y. (2024). Trend Analysis of Enterprise Intelligent Financial Applications. Advances in Economics, Management and Political Sciences,108,52-60.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu Qin, Yang Yin, China's Accounting Informatization in the 40 Years of Reform and Opening-up: Review and Prospect[J]. Accounting Research,2019(2)

[2]. Liu Meiling, Huang Hu, Tong Chengsheng, et al. Research on the basic framework and construction ideas of intelligent finance [J]. Accounting Research, 2020, (03): 179-192.

[3]. Lanzolla G, Lorenz A, Miron-Spektor E et al. (2022) Digital transformation: what is new if anything? Emerging patterns and management research. Acad Manag Discov 6(3):341–350

[4]. Yang Yin,Liu Qin,Huang Hu.Research on the Intelligent Transformation of Enterprise Finance: System Architecture and Path Process[J].Friends of Accounting,2020(20)

[5]. XU Hanyou,YUE Rufei,ZHAO Jing. Research on the impact of financial sharing intelligence on enterprise performance [J]. Friends of Accounting, 2022, (07): 141-147.

[6]. YANG Yin,ZHAO Jian,LV Xiaolei. Analysis on the Status Quo and Development Trend of Intelligent Financial Application in Chinese Enterprises: An Example Based on Questionnaire Data [J]. Finance and Accounting Bulletin, 2021, (11): 1002-8072.2021.11.027.

[7]. Papagiannidis E, Enholm IM, Dremel C, Mikalef P, Krogstie J (2023) Toward AI governance: identifying best practices and potential barriers and outcomes. Inf Syst Front 25:123–141

[8]. Shared service centers:from cost savings to new ways of value creation and business administration [J].Advanced Series in Management,2014,13 (3):112-128.

[9]. LIU Meiling,HU Jiayu,WANG Jiping. The logic, elements and development trend of enterprise intelligent financial construction [J]. Finance and Accounting, 2020, (21): 18-21.

[10]. ZHANG Qinglong. Application Scenario Analysis of Intelligent Finance [J]. Finance and Accounting Monthly, 2021, (05): 19-26. DOI:10.19641/j.cnki.42-1290/f.2021.05.003.

[11]. ZHANG Xiaotao,TIAN Gaoliang. Development Ideas of Intelligent Finance in the Era of Digital Economy [J]. Finance and Accounting Bulletin, 2023, (06): 3-8. DOI:10.16144/j.cnki.issn1002-8072.2023.06.001.

[12]. LIU Meiling,HU Jiayu,WANG Jiping. The logic, elements and development trend of enterprise intelligent financial construction [J]. Finance and Accounting, 2020, (21): 18-21.

[13]. ZHANG Min. Ten Hot Issues in Intelligent Finance [J]. Finance and Accounting Monthly, 2021, (02): 25-30. DOI:10.19641/j.cnki.42-1290/f.2021.02.004.

[14]. ZHAO Lijin,HU Xiaoming. Digital Transformation of Enterprise Finance: Essence, Trends and Strategies [J]. Finance and Accounting Bulletin, 2021, (20): 1002-8072.2021.20.003.

[15]. LI Wenyi,YU Wenjie,LI Juhua.Choice, Realization Elements and Path of Intelligent Financial Sharing[J].Friends of Accounting,2019(8): 115-121.

[16]. YANG Yin,LIU Qin,LV Xiaolei. Research on the Factors, Applications and Effects of Enterprise Intelligent Finance Construction [J]. Friends of Accounting, 2023, (24): 138-144.

[17]. MA Bin. Advantages, Disadvantages and Development of Network Accounting [J]. Accounting for Township Enterprises in China, 2005, (10): 42-44.

[18]. Errida A, Lotfi B (2021) The determinants of organizational change management,success: literature review and case study. Int J Eng Bus Manag,13:18479790211016273

[19]. Truby J (2020) Governing artificial intelligence to benefit the UN sustainable development goals. Sustain Dev 28(4):946–959

[20]. Several Opinions of the General Office of the State Council on Using Big Data to Strengthen Services and Supervision of Market Entities Guo Ban Fa [2015] No. 51

[21]. Tian Gaoliang,Zhang Xiaotao. On the Value Creation of Intelligent Finance Empowerment in the Era of Digital Economy [J]. Finance and Accounting Monthly, 2022, 42-1290/f.2022.18.003.

[22]. Pramod D (2021) Robotic process automation for industry: adoption status, benefits, challenges and research agenda. Benchmarking 29(5):1562–1586

[23]. Polak P, Nelischer C, Guo H, Robertson D (2020) "Intelligent" finance and treasury management: what we can expect. AI Soc 35:715–726

[24]. MAKR IDAKIS S.The forthcoming Artificial Intelligence (AI)revolution:its impact on society and firms[J]. Futures,2017,90(6):46- 60. [6]

[25]. HE Dan. The impact of artificial intelligence on labor and employment[J].Journal of Shanghai Jiao Tong University(Philosophy and Social Science),2020,28(4):23- 26.)

[26]. MURR AY A,R HYMER J,SIRMON D G.Humans and technology:forms of conjoined agency in organizations[J].Academy of Management R eview,2021,46 (3):552- 571.

[27]. LI Yi,YU Liangru,QIU Dong.A Review of Human-Artificial Intelligence Collaboration Models[J]. Journal of Intelligence,2020,39(10):137-143

[28]. LI Wenyi,TANG Huachuan. Research on Human-Machine Collaboration Based on the Perspective of Financial Sharing [J]. Friends of Accounting, 2022, (23): 22-27.

[29]. Erol S, Schumacher A, Sihn W (2016) Strategic guidance towards Industry 4.0—a three-stage process model. Int Conf Compet Manuf 9(1):495–501