1. Introduction

In recent years, the latest emerging technology generates many new economic forms. People build internet platforms, and it creates Platform Economy. Relying on online platforms, people are more closely connected, which, therefore, allows the temporary exchange of assets. As this convenience of exchanging idle assets become more and more prevalent in society, the concept of sharing economy becomes popular as well. Coyle and Conner [1] define sharing economy as the intersection of digital matching platforms and the rental of assets.The core characteristics of sharing economy include value creation, trust communities, untapped/underutilized capital assets, access over ownership, and low friction & scaling. In other words, sharing economy allows people to utilize their idle assets to generate more income, improve working efficiency, and benefit the whole society. Sharing economy has significant advantages in reducing cost and providing convenience; as the owners lease out their assets, which can be in various forms like space, time, transportation, things, knowledge, experiences, and capital, the lessees can access some high-price items with a relatively low cost of renting fee. Also, Tetřevová and Kolmašová [2] state that sharing leads to positive impacts on the environment, as sharing economy save resources, reduces emission volumes, ensures a harmonious work-life balance, and offers employee benefits. On the other hand, leaseholders can find more customers from the sharing economy platform as well, making their assets generate currency flow during spare time. Currently, there are many developed Sharing Economic businesses, including shared transportation, shared houses, and shared workplaces; companies like Uber, Didi, WeWork, and Airbnb are all major players who established successful business modes in these fields. However, as society needs to expand the forms of sharing economy and make more business in the sharing mode, some negative impacts were caused by sharing economy companies in the society too. For example, the untrust relationship between customers and individual drivers was built from a few cases that the drivers murdered passengers, who called those cabs on the DiDi platform. In May and August 2018, there were two security incidents on Didi. Didi has also made changes, improved drivers' personal information and investing human and safety resources in its customer service team. These made the DiDi platform also lose reliability in the public’s mind. To solve this problem and rebuild the reliable figure in people’s minds, DiDi had to spend millions of Yuans to advertise and upgrade their safety systems. DiDi combines special attributes, such as one-time shared rides on short notice between private individuals, the usage of a mobile application, transparency of GPS location, and interactions with strangers.

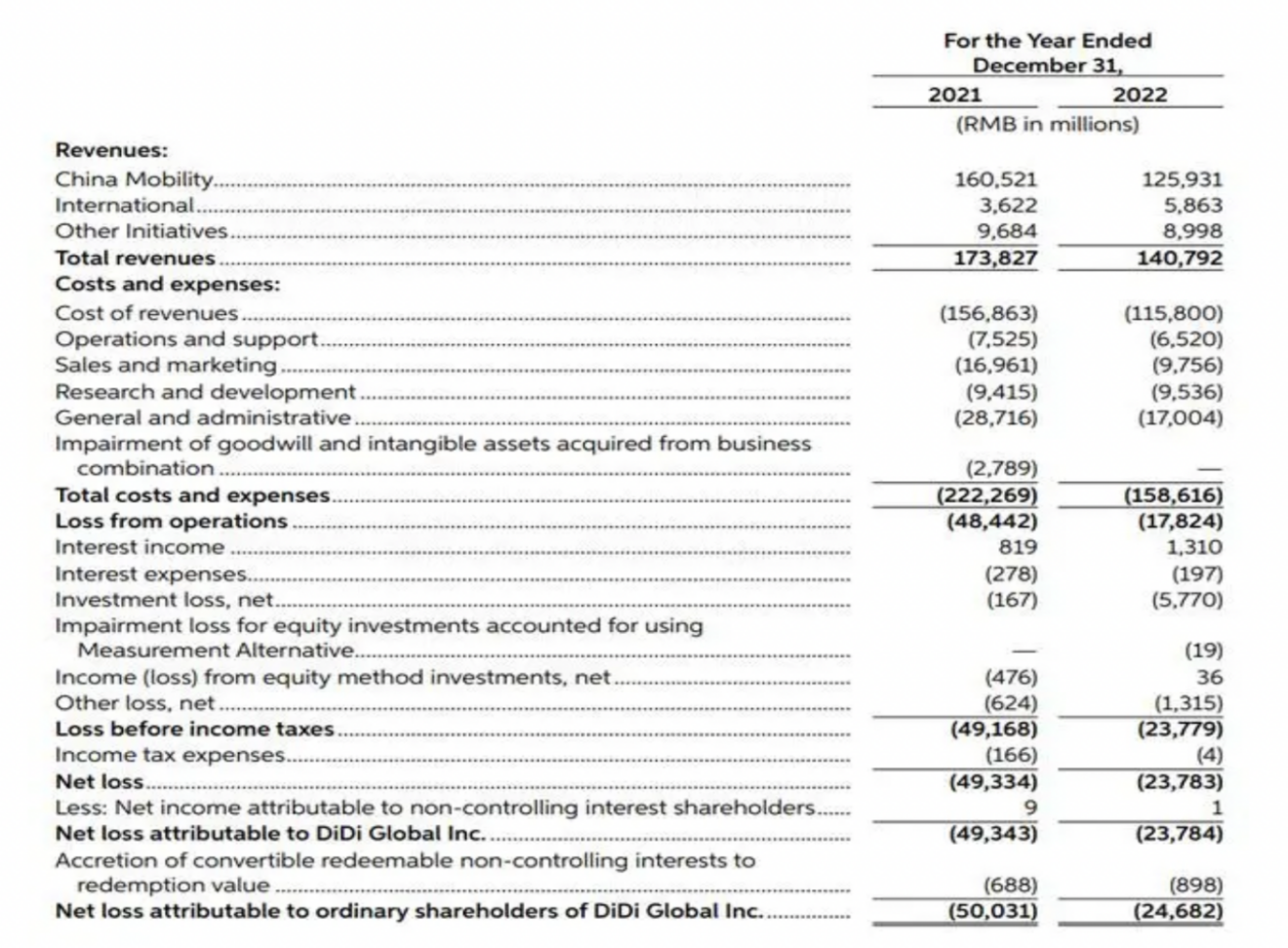

Figure 1: 2021 and 2022 Didi company’s annual account statement.

For another example, the notorious long-term rental apartment-sharing platform, Danke, also resulted in many people’s tremendous loss in money and other aspects such as its bankruptcy. From all these failures of the existing sharing economy business, we found out that many of the problems that occurred were because of the middleman there, which is the sharing economy platforms themselves. In the traditional sharing economy, the participants usually need an intermediary agent, which can be a platform or an institution, or other things, to gain information, create transactions, or allow the intermediary agent to manage their assets. However, this form of centralized sharing economy usually heavily relies on the capability and trustability of the intermediary agent itself, and once the intermediary agent has a trust crisis or management problems, the whole sharing business might collapse, just like what happened to the Danke. Even though some of the sharing economy platforms and businesses already tried to reduce the trading friction of the middleman system by keeping the intermediary fees very low or encouraging P2P trading, the centralized sharing economy still cannot solve the problems mentioned above. As a result, a decentralized form of sharing economy is needed. A decentralized type of sharing economy may have advantages over a centralized sharing business in many ways. Compared to the more conventional sharing economies, the Ethereum platform, one of the most successful decentralized sharing economy businesses and communities, especially has advantages over aspects like building up trust, using a more fair and agreeable system of assets management and profits distribution, and P2P transactions’ frictions reduction. This essay will thoroughly analyze the disadvantages of social harms the conventional forms of sharing economy business can have, compare these problems to the correspondent mechanism of the Ethereum network, and discuss the possibility that the new era of decentralized sharing economy example, the Ethereum platform, can fix these problems and create more social values.

2. Literature Review

In recent years, the latest emerging technology generates many new economic forms. People build internet platforms, and it creates Platform Economy. Relying on online platforms, people are more closely connected, which, therefore, allows the temporary exchange of assets. As this convenience of exchanging idle assets becomes more and more prevalent in society, sharing economy becomes popular as well. Coyle and Conner [1] define sharing economy as the intersection of digital matching platforms and the rental of assets. Steven Kane Curtis and Matthias Lehner [3] redefined sharing economy as a rising pattern in consumption behavior, experiencing immense growth that is surpassing any other markets in outlook and market growth. Since the promotion of sharing economy platforms, plenty of online platforms obtain benefited from it. Gollapudi, Sreenivas, Kostas Kollias, and Debmalya Panigrahi find that Nash [4] equilibrium always exists in sharing economy, but it is often the worst situation, which can be solved by the Sharpley method. Earlier in 2015, Kim, Jeonghye, Youngseog Yoon, and Hangjung Zo [5] investigate how several factors are connected to sharing economy. They discover that Trust, participation intention and reputation are positively related. While trust and risk, risk and participation intention are negatively related. Grondys and Katarzyna [6] examine B2B sharing by analyzing how businesses share resources and the reasons for sharing. A recent study done by Tetřevová, Liběna, and Pavla Kolmašová [2] also provides similar insight. Chuah, Stephanie Hui-Wen [7], et al. use different methods to study businesses and sharing economy. They all find that businesses participate in sharing for financial benefits, sustainability, and social reasons. Coyle and Conner [1] go through sharing economy from multiple perspectives, like location, funding, and technology. Zhen Cao discusses the influence of government policies, regulations, and systems to guarantee platform reward and punishment mechanisms on users' trust in shared travel platforms. Driving safety issues would lead to greater perceived risk, which is negatively correlated with users' trust in the platform. The core characteristics of the sharing economy include value creation, trust communities, untapped/underutilized capital assets, access over ownership, and low friction & scaling.

This essay uses DiDi and Danke to do case studies, which examine the benefits and shortcomings in the current sharing economic mode. In Lei Wang’s [8] research, relying on providing high-quality services to the customers and its business expansion, DiDi’s platform enhances and broadens market value. On the other hand, the rapid and large-scale information dissemination brought by the Internet has also caused some negative impacts on society and the market: “Group renting” endangers urban governance and the lack of identity trust mechanism when all kinds of roles in the online rental market communicate weakly, investigate by Jie Zou [9], which challenges the trust of the online transaction. ZHOU Wenhui DENG Wei CHENLingzi states that the DiDi platform enterprises can effectively promote value co-creation digital empowerment and dynamic evolution. As the DiDi platform provides graded services to drivers and passengers and realizes the development and innovation of the platform's economic resources through an information-sharing process. Mei Yan, and Wang Si Yang [10] find that The Didi platform relies on the Internet platform for resource sharing, and multi-party cooperation will increase transaction costs WeChat, third-party payment platforms, and other platforms participate in the formation of a multilateral market platform. Xiao Feng and RenYe discuss that in May and August 2018, there were two security incidents in Didi. Didi has also made changes, improved drivers' personal information and investing human and safety resources in its customer service team. Liang et al. find that DiDi combines special attributes, such as one-time shared rides on short notice between private individuals, the usage of a mobile application, transparency of GPS location, and interactions with strangers. Huang Hui and Mu Zhi Juan discuss that DanKe Apartment is an asset-heavy enterprise with large initial investment, since its establishment, it has been in a state of high debt and high investment.

Airbnb is a concrete manifestation of sharing economy. Its emergence represents that sharing economy is truly beginning to benefit people. Erose Sthapita,⁎, Peter Björkb focuses on Airbnb customers' negative reviews posted in English on Trustpilot's website. The search for posts was employed with the keyword ‘trust’ to find online narratives from customers who had negative experiences of trust with Airbnb. Of the 2733 online reviews screened, the study concentrated on 216 negative reviews. The data analysis followed the grounded theory approach, which resulted in two themes that reflect the sources of distrust: Airbnb's poor customer service and the hosts' unpleasant behavior. They also found that guests may be faced with the risk of un- reliable hosts or even personal security. In most cases, the host rents rooms to strangers, and the quality of the accommodation service is highly dependent upon the host's competence in hospitality.

This essay provides insight into how Ethereum could improve the sharing economy through the perspective of trust, risk, and transaction friction. To ensure the trust of online transactions, Ethereum, as a platform, uses FSPVM-E to verify security and reliability and Coq to prove the correctness, through the research by Zheng Yang, Hang Lei, and Weizhong Qian [11]. According to Ardit Dika and Mariusz Nowostawski’s [12] investigation, they use four different security tools to assess the quality of contemporary security analysis tools specific to Ethereum for 21 clean and 24 vulnerable contracts. Based on the survey results, they provide some opinions on the security of Ethereum, which is that Ethereum should improve within the user interfaces, interpretation of results, and, most importantly, an enhanced list for vulnerability checks. Bc. Michal Galan claims that trust in authority is a part of centralized systems such as banking, e-commerce, web search engines, and social platforms. Transactions, authentication mechanisms, blockchain, and distributed consensus. Security implications of majority attack as well as generalized brute force attack. Francis Lagueu Fogang mentions that Blockchain technology would be used to implement the decentralized architecture of the application by building Smart Contracts to handle the transaction and management of the application on the Blockchain network. JORGE JESÚS SORIA RUIZ-OGARRIO examining various incentive structures behind mining in proof-of-work blockchain protocols. Pools are a core part of the cryptocurrency market, and they hold most of the processing power (hash rate) in the top blockchain protocols. This generates considerable concerns because it is an indication of high centralization even though proof-of-work protocols were designed to work as decentralized peer-to-peer networks. Rahul Reddy Annareddy explains the incentives that drive the adoption of blockchain technology, two successful blockchain projects, CryptoKitties, are analyzed as case studies. These case studies first examine how these projects leveraged blockchain technology from a technical standpoint, followed by a discussion of the incentives that were built into the projects, which allowed millions of users to participate in these networks and create value. Alexander Menne provides insights into the characteristics of blockchain technology and the success factors of sharing economy businesses. Based on that information, a general model for decentralized sharing economy organizations (DSEO) is given, discussing the design choices that are crucial to be made. Elie F. Kfoury and David J. Khoury [13] present that blockchain is an emergent peer-to-peer technology.vData immutability by relying on consensus algorithms and protocols among peers to solve trust concerns. It ensures the authenticity of the retrieved public key. Don.D.H.Shin [14] introduces a key heuristic used to assess trust in blockchain with trust in individual relationships. The results establish users’ cognitive role in embedding privacy and security in blockchain. School of Engineering and Applied Science, University of Pennsylvania, Philadelphia, USA proposes several risks in the blockchain. Lennart Antea and Aman Saggu [15] state that dynamic causal interplay between transaction fees and economic subsystems leveraging the network. Nevertheless, Ethereum can address these risks by updating and evolving. Becker, Moritz, and Balázs Bodó [16]. discuss blockchain technology can be viewed as exemplifying a change from interpersonal trust mediated by human-based intermediaries to technological intermediaries. The technological environment has played an increasingly important role in setting the conditions of trust relationships. Robinson, Peter [17] finds a web of Trust offers a way to bind identities with the corresponding public keys. Each user could play the role of certificate signer and the privacy of users is protected. Yusoff [18] et al. find that performance and efficiency are crucial to the blockchain. The right consensus algorithm will significantly improve the efficiency of a blockchain application.

3. Analysis

The conventional Sharing Economic mode mentioned above all rely on a platform to operate, which is often an app. The company builds up the app and servers to store users' and providers’ information and let them deal with each other. The platforms get profit through the process by charging from providers or advertising. However, from the cases-analysis, we can see many shortcomings of those existing sharing economy business modes. The middleman in these sharing economic activities may create unnecessary risks and costs for the platform users, and it needs to pay a tremendous amount of money and use many strategies to build up its trustable character in the public’s mind.

Creating a trustable nature, at least seems reliable, is always important for all platforms. As Kim [5] et al. point out that trust is positively related to participation intention. The sharing economy middleman needs to gain trust not only from financial institutions to get loans but also need to get credit from individual participants or other businesses as well. Chuah [7] et al. study the factors influencing the adoption of B2B sharing in China, which shows that lack of trust toward the platform and service provider is the major humble of sharing in the B2B sector. Similar situations are also revealed in P2P sharing. Middlemen usually use strategies like advertisements to tell others how professional and reliable they are, but this process usually needs to cost a lot. The CEO of Didi plans to spend 2 billion yuan on security. For example, the distrust among drivers, users, and platforms make DiDi improve the supervision system of the platform, which mainly includes ensuring the effectiveness of access terms, establishing a passenger access mechanism, exerting the social attributes of the platform, reducing the information asymmetry between drivers and passengers, establishing a reputation mechanism and a signal transmission mechanism, and improving the after-sales service system. Since 2019, there have been 123 civil cases involving Didi drivers who have not obtained the qualification to operate online car services, and 113 cases resulting in casualties. Many cities in China have repeatedly told Didi in legal documents that it is illegal to conduct ride-hailing business without obtaining a platform license and asked Didi immediately to stop ride-hailing services in the region. Didi has been hit hard by legal challenges and user distrust, and it struggled to regain good trust with customers.

In addition, centralized asset management and profit distribution can cost risks to consumers and producers. For instance, the case of Danke long-term rental apartments illustrates how risky it is to handle one’s effort in a centralized institution. Huang Hui and Mu Zhi Juan discuss that DanKe Apartment is an asset-heavy enterprise with large initial investment, since its establishment, it has been in a state of high debt and high investment. in the balance sheet structure of Danke Apartment, of which the current liabilities in 2019 reached 7.923-billion-yuan, accounting for 91.85% of the total liabilities, while the company's current assets were only 2.935 billion yuan, far from enough to meet the ability to pay off current liabilities.

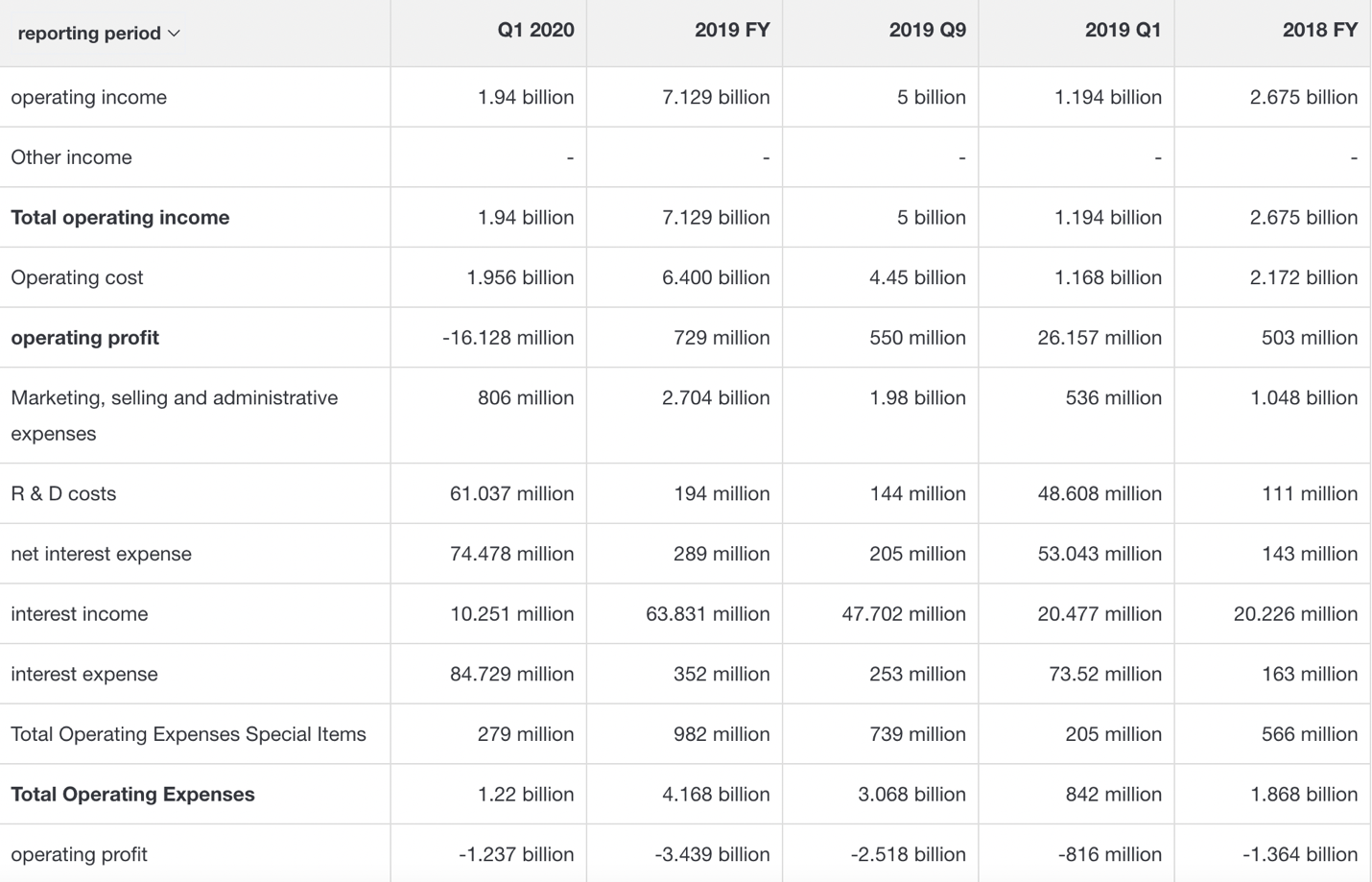

Figure 2: The case of the income and expense of Danke.

Danke is a platform for long-term rental apartments. Danke initially cooperated with WeChat Bank on a "rental loan" business. After the customer confirms that they will rent a house, they will take a loan from WeChat Bank for a whole year's rent and repay at the corresponding monthly price. Such a model benefits all three parties; as the market competes, many rental agencies such as “Wo Ai Wo Jia” compete with Danke for listings. To grab better houses, Danke bought those good houses at a price higher than the market price and then sold them on the platform at a price lower than the purchase price, which resulted in the funds provided by Danke’s customers are not enough for Danke to pay the landlord; In Figure 2, it can be seen from the operating income from 2018 to 2020 that Danke did generate relatively large income. However, it can be seen from the operating expenses that they spent more money on their operations than profits. Combining these two points and the operating profit from 2018 to 2020 in Figure 2 are all very exaggerated negative data, which shows that even though Danke has a lot of trading orders, it has been losing money overall. Danke requires customers, that is, tenants, to pay a year’s rent if they decide to rent a house. This fund will be used by Danke to acquire new houses to attract more customers, forming a cycle. Danke used the above methods to attract customers and achieve a huge amount of transaction data, which was very impressive at the time; from the perspective of corporate financing and loans, many investors would speculate on the company’s future development and prospects based on the company’s data. To choose whether to invest or not, Danke’s large amount of transaction data provides these investors with a basis for speculation, helping Danke’s financing. Under such an operation model, Danke loses money for every order, but Danke can continue to circulate funds in the form of financing and customers paying one-year rental fees each time. This is a similar pattern to one person taking out a loan to repay another loan. When the capital chain is broken, such an operation model will make the company bankrupt, which is the root cause of the collapse of the Danke company.

The failure of Danke shows the damage a middleman can cause. The problem encountered by many Danke tenants is that they give half a year's rent Danke at one time, but the landlord has not been able to collect the rent for a long time, which leads to the landlord wanting to drive out the tenants, and the tenants refuse to leave. Both tenants and landlords are victims of these incidents. The problem lies in the middleman platform Danke, which puts aside the rent that should be transferred to maintain the flow of funds, which also reduces the social credit of Danke. Furthermore, a middleman may make consumers and service providers pay extra money since as an information provider, the platform needs to gain profits as well. This kind of broker’s fee can be in currency form, or it can be compulsive advertisement watching or personal information leakage. Mei Yan and Wang Si Yang [10] find that The Didi platform relies on the Internet platform for resource sharing, and multi-party cooperation will increase transaction costs WeChat, third-party payment platforms, and other platforms participate in the formation of a multilateral market platform. However, this information sharing still is necessary to the consumers and producers since the platforms indeed bring more deals to them. Therefore, a paradox occurred.

As is well known, P2P trading is a direct transaction mode between individuals, where buyers and sellers engage in transactions directly without the involvement of traditional intermediaries. We believe that the advantages of peer-to-peer (P2P) transactions play an important role in the sharing economy. First of all, peer-to-peer (P2P) transactions eliminate traditional intermediaries, such as retailers, hotels, and taxi companies. This reduction in intermediaries results in lower additional fees and handling charges, making transactions more direct and efficient.

It can also reduce costs since, without the profit and operating costs of intermediaries, buyers and sellers can negotiate prices more directly, thereby reducing the cost of products and services. Moreover, peer-to-peer (P2P) transactions allow buyers and sellers to freely choose products, services, and trading methods, thereby enhancing the flexibility and personalization of transactions. P2P transactions encourage the sharing of resources among individuals, such as shared accommodation (like Airbnb) and shared workspaces, in order to effectively utilize resources and minimize waste.

In addition, peer-to-peer transactions play a crucial role in promoting the growth of the sharing economy. Based on the peer-to-peer (P2P) transaction model, the sharing economy has disrupted the monopoly held by certain traditional industries. This has allowed a larger number of individuals to participate in economic activities, thereby promoting market competition and stimulating innovation. P2P also increases economic opportunities. Through peer-to-peer (P2P) transactions, the sharing economy has created numerous economic opportunities, allowing individuals to generate income by sharing their own resources, skills, or time. The sharing economy is beneficial for several reasons. It promotes efficient resource utilization, reduces waste, and supports sustainable development and environmental protection through peer-to-peer transactions. P2P transactions improve resource utilization. In general, the advantages of peer-to-peer (P2P) transactions have enabled the sharing economy to flourish, bringing greater convenience, economic opportunities, and social benefits to society.

However, the centralized sharing economy platform will have many shortcomings and cause social harm in peer-to-peer transactions. The Danke apartment is a perfect example. It failed to leverage the sharing economy, which ultimately led to its bankruptcy. In recent years, Danke Apartments has utilized the "rent loan" model and has rapidly expanded, serving a total of over 1 million users. At the same time, losses are also continuously increasing. According to financial report data, Danke Apartments incurred a cumulative loss of 6.313 billion yuan from 2017 to the first quarter of 2020. As of the first quarter of 2020, the asset-liability ratio of Danke Apartments has increased to 97.06%.

In the capital market, the stock price of Danke Apartments has continued to decline since its listing. The latest stock price of Danke Apartments is $2.37 per share, which is 82.44% lower than the issuance price of $13.5 per share. According to the issuance price a year ago, the market value of Danke Apartments can reach up to $2.74 billion. Today, the market value has decreased to only $233 million, which is less than 20% compared to the previous value. Centralized sharing economies require platforms to invest significant amounts of money and time in establishing a trustworthy reputation in the public eye. The business model of Danke Apartment is to rent a house and then sublet it to tenants, utilizing the assets of others to maximize leverage. Danke Apartments will sign long-term lease contracts with landlords and then subdivide these properties to sublet them to tenants, thereby generating rental income. Through this business model, Danke Apartments do not need to directly own the properties, but instead acquire the right to use them through leasing. They then subdivide these properties into multiple units, which allows them to generate more rental income in the short term. This approach can yield higher returns, but it also increases the company's debt risk, particularly during housing market fluctuations or unstable rental returns.

However, due to the fluctuating real estate market and uncertain rental returns, maintaining high rental income for Danke apartments can be challenging. This can result in CUSUM and capital chain rupture, leading to operational difficulties and ultimately bankruptcy. Intermediary institutions may have dishonest employees or managers who could exploit their positions for personal gain. This may involve misappropriating funds, forging transaction records, or providing false performance reports. In addition, when asset owners entrust their assets to intermediate institutions for management, they may face the risk of information asymmetry. Asset owners may have a limited understanding of the internal operations and decisions of intermediary institutions, making it difficult for them to accurately assess the risks and performance of such institutions. Moreover, intermediary institutions may be affected by market fluctuations and uncertainties while managing assets. For example, investment institutions may experience losses in their investments due to market changes, while credit institutions may face the risk of borrowers defaulting. The operation of intermediary institutions can be influenced by various internal and external factors, including inadequate management, technical malfunctions, natural disasters, and more. These factors can result in asset losses or service disruptions. On certain platforms, there can be a disparity of information between buyers and sellers, resulting in a lack of transparency during the transaction process. Buyers find it difficult to accurately assess the reputation and product quality of sellers, while sellers also struggle to gauge the buyer's payment capability and true intentions. Some platforms may impose restrictions on transactions, such as limiting transaction amounts, restricting transaction locations, or charging high transaction fees, which can lead to dissatisfaction among both parties. Moreover, in peer-to-peer (P2P) transactions, buyers and sellers may have concerns about payment security, the leakage of personal information, or transaction disputes, which can lead to a lack of trust in the platform. When transaction disputes arise, certain platforms may fail to address them promptly or impartially, resulting in dissatisfaction and tension between the parties involved in the transaction. Finally, some platforms may lack effective regulatory and compliance measures, leading to unstable trading environments that are prone to problems.

4. Discussion

Though we addressed several problems in the existing sharing economy, sharing economy is undoubtedly a beneficial business mode. In addition, these addressed problems could be solved. According to Grondys [6], “Modern IT solutions induce cost reduction and revenue growth, resulting in a real competitive advantage for the whole chain.”

To solve the “distrust” problem of sharing economy in Didi, Ethereum is a good solution to solve this problem. First of all, blockchain is an emergent peer-to-peer technology. Blockchain technology can be viewed as exemplifying a change from interpersonal trust mediated by human-based intermediaries to technological intermediaries. The technological environment has played an increasingly important role in setting the conditions of trust relationships. Data immutability by relying on consensus algorithms and protocols among peers to solve trust concerns. It ensures the authenticity of the retrieved public key. Through Ethereum, the Didi platform can mediate and help passengers with any problems encountered on the trip without manual customer service, and passengers can directly communicate with the driver through this blockchain technology and speak out their feedback. It can completely avoid the distrust of passengers caused by the inability of online customer service to do anything about passengers' problems, and it is very efficient for allowing the driver to get feedback and address the passengers’ issues directly. Thus, passengers will be very satisfied with the ride experience. Secondly, Ethereum offers a way to bind identities with the corresponding public keys. Each user could play the role of certificate signer and the privacy of users is protected. [19] In real-life applications, passengers are not afraid of their personal information will be leaked on the Didi platform because each passenger's identity is bound by the Ethereum public key, and private people cannot see the basic information of passengers. Thus, Didi does not have to spend a lot of money on cameras and identity verification, because the platform can accurately know the identity of the driver through the public key through the way of Ethereum. Even if the driver has a serious traffic accident, the platform can quickly find the specific driver and solve the accident through the policy. Moreover, Ethereum is a key heuristic used to assess trust in blockchain with trust in individual relationships. The results establish users’ cognitive role in embedding privacy and security in blockchain. The Didi platform can use Ethereum to divide the trust and satisfaction level of different drivers by passengers' evaluation of previous drivers’ performance. Passengers can see the trust rates of different drivers before booking a ride on the platform, and then they can book a nearby driver who is more satisfied with the passengers. Therefore, passengers will not distrust the drivers in the car and the platform because the platform allows them to choose a better driver by themselves, and then the passengers’ trust will gradually increase. By illustrating the advantages of Ethereum on the Didi platform above, I believe that Ethereum can solve the traditional sharing economy’s problem: users feel distrust, and it can help the traditional sharing economy to better build trust.

In the case of Danke, both the tenant and the landlord fell victim to the incident, highlighting the issues arising from Danke's role as an artificial middleman in the rental process. The presence of such a middleman introduces significant uncertainty. However, the decentralized nature of Ethereum offers a potential solution to this problem. By leveraging the power of the Ethereum blockchain, users can eliminate the need to place trust in a single intermediary or individual.With Ethereum's decentralized architecture, users have the freedom to draft their own smart contracts during the transaction process. These smart contracts are self-executing and automatically carry out their specified functions under predetermined conditions, removing the need to rely on the honesty and integrity of human intermediaries. This not only empowers participants with greater control but also reduces the inherent risks and costs associated with middlemen like Danke.Furthermore, Ethereum's decentralization ensures that transactions and smart contract executions are immune to censorship by specific governments or institutions. In regions with political volatility or for individuals seeking to maintain privacy, this attribute becomes particularly crucial. Users can engage in transactions and execute smart contracts without worrying about external interference or arbitrary limitations.In conclusion, the Danke incident demonstrates the shortcomings of relying on a centralized middleman in rental transactions. Ethereum's decentralized nature presents a compelling alternative, allowing users to draft and execute smart contracts independently, thus enhancing control, security, and privacy. By adopting Ethereum's decentralized platform, users can effectively mitigate risks, enhance transparency, and ensure fairer and more secure transactions in a variety of scenarios beyond the rental industry.

As mentioned earlier, the shortcomings of the centralized sharing economy platforms not only will increase trading friction and harm the users’ benefits, but they also can cause social damage from unnecessary financial frictions. The decentralized sharing economy business, such as the Ethereum platform, has mechanisms to minimize transaction frictions and therefore encourage real P2P trades among the Ethereum network users. As well known, the Ethereum network is not just a blockchain network that can help people to store and protect data and allow the P2P transactions of cryptos, it also is a platform where the users can create various apps as their tools. Ethereum network, different from the first generation of blockchain like the bitcoin network, has stronger compatibility of coding [20]. Ethereum uses a special coding language called Solidity, by which the coders can create smart contracts on the Ethereum network. The smart contract is an auto-executing program that is powered by the previously edited codes; it relies on the EVM, also known as Ethereum Virtual Machine, which is composed of the thousands of computers that contribute to the Ethereum network, to execute the orders of the programs as long as the preconditions are satisfied [21]. Therefore, the dealers do not need a middleman to help them to make the deal, because both the money and the results can be done on the chain. Besides, the transactions will also be recorded on the blockchain, specifically on the newly generated block of the Ethereum network or some other blocks of some subchains. Thus, all these transactions will be transparent, and no one can fake transactions and all the users can see the real market price. The distribution of profit could also utilize the Sharply method, which ensures every participant obtains what they deserve fairly. Gollapudi et al. (2019) examine Sharply Method in sharing economy and finds that it is more efficient than the commonly used method. Sharply Method ensures social welfare, participation, and fairness. The dealers, on the other hand, only need to pay a very low fee to the miners, who help them to record the transactions in the blocks. Transactions without high intermediary fees can benefit all the participants, and the absence of an untrusted middleman also can lower the damages to the participants and the society from these direct P2P trades, instead, the users only need to pay a low service providers’ fee, who help them to pack up the data and prove the reliability and transparency of the transactions.

Furthermore, some users of the Ethereum network create the DApps by making the more sophisticated Ethereum-based smart contracts work together. DApp is an abbreviation of the Decentralized Apps, which are the decentralized apps on the Ethereum network that do not require an intermediary agent to set the deals and manage people’s assets. DApps have no owners but service providers, or all the users are the owners. Service providers will charge service fees from the users who use their services, and the transparency of the market price and the unwanted fees of information gathering or deals creations that the intermediary agents usually want to charge. An example of decentralized Apps that are based on the Ethereum platform is Goldfinch, which is a decentralized P2P loaning app [20]. Goldfinch aims to use people’s idle money to loan to the ones who need cash. The Goldfinch provides two capital pools, one for primary capitals and the other for secondary capitals. On the one hand, Goldfinch has a complicated, blockchain-based profits distribution system to ensure the loaners' and the borrowers’ benefits, on the other hand, this app also applies a decentralized way of auditing. Goldfinch community has several registered independent auditors, and for every loan, the platform will randomly select a certain number of auditors to audit the loan. After a complex process of auditing, the randomly selected auditing group will pass or deny the transaction, and the auditors will then gain some of Goldfinch’s cryptos as their rewards [22]. In addition, the Goldfinch community will also do KYC for all the loaners and borrowers. The traditional financial institutions that loan money to the public, such as banks, usually have three core services: money storage, customers’ identity authentication, and auditing and risk management. The new, decentralized financial institution Goldfinch breaks down these services, allowing different people to provide, and only charge the users for the service fees rather than the service fees and the middle’s shares. This is an instance of how the decentralized Ethereum platform may be able to change and improve the sharing financial economy. Although now it is still for customers who have high-risk tolerance, as more and more people accept this form of financial service, it will become more and more reliable and reduce social friction, improve social efficiency, and benefit everyone.

5. Conclusion

The conventional Sharing Economic mode mentioned above all rely on a platform to operate, which is often an app. The company builds up the app and servers to store users' and providers’ information and let them deal with each other.The sharing economy middleman needs to gain trust not only from financial institutions to get loans but also need to get credit from individual participants or other businesses as well. Middlemen usually use strategies like advertisements to tell others how professional and reliable they are, but this process usually needs to cost a lot.In addition, centralized asset management and profit distribution can cost risks to consumers and producers. For instance, the case of Danke long-term rental apartments illustrates how risky it is to handle one’s effort in a centralized institution.Such a model benefits all three parties;as the market competes, many rental agencies such as “I Love My Home” compete with Danke for listings. The problem lies in the middleman platform Danke, which puts aside the rent that should be transferred to maintain the flow of funds, which also reduces the social credit of Danke.Furthermore, a middleman may make consumers and service providers pay extra money since as an information provider, the platform needs to gain profits as well. As is well known, P2P trading is a direct transaction mode between individuals, where buyers and sellers engage in transactions directly without the involvement of traditional intermediaries. It can also reduce the cost since without the profit and operating costs of intermediaries, buyers, and sellers can negotiate prices more directly, thereby reducing the cost of products or services. Based on the P2P transaction mode, the Sharing economy has broken the monopoly of some traditional industries, enabling more people to participate in economic activities, promoting market competition, and promoting innovation. Through P2P transactions, the Sharing economy has created more economic opportunities, enabling individuals to realize income by sharing their resources, skills, or time. In recent years, Danke Apartments has utilized the "rent loan" model and rapidly expanded, serving a total of "1 million+" users. Though we addressed several problems in the existing sharing economy, sharing economy is undoubtedly a beneficial business mode. Even if the driver has a serious traffic accident, the platform can quickly find the specific driver and solve the accident through the policy. The Didi platform can use Ethereum to divide the trust and satisfaction level of different drivers by passengers' evaluation of previous drivers’ performance.These smart contracts are self-executing and automatically carry out their specified functions under predetermined conditions, removing the need to rely on the honesty and integrity of human intermediaries. Ethereum's decentralized nature presents a compelling alternative, allowing users to draft and execute smart contracts independently, thus enhancing control, security, and privacy. Ethereum uses a special coding language called Solidity, by which the coders can create smart contracts on the Ethereum network. Thus, all these transactions will be transparent, and no one can fake transactions and all the users can see the real market price.

Acknowledgement

Qiyao Hu, Youran Huang, Yuheng Chen, and Boxiu Zheng contributed equally to this work and should be considered co-first authors.

References

[1]. Coyle, D., & O’Connor, S. Understanding the Sharing Economy (No. ESCoE DP-2019-04). Economic Statistics Centre of Excellence (ESCoE).

[2]. Tetřevová, L., & Kolmašová, P. B2B sharing as part of the sharing economy model. Hradec economic days, Vol. 11 (1).

[3]. Curtis, S. K., & Lehner, M.. Defining the sharing economy for sustainability. Sustainability, 11(3), 567

[4]. Gollapudi, S., Kollias, K., & Panigrahi, D. You get what you share: Incentives for a sharing economy. In Proceedings of the AAAI Conference on Artificial Intelligence (Vol. 33, No. 01, pp.).

[5]. Kim, J., Yoon, Y., & Zo, H. Why people participate in the sharing economy: A social exchange perspective.

[6]. Grondys, K. Implementation of the Sharing Economy in the B2B Sector. Sustainability, 11(14), 3976.

[7]. Chuah, S. H. W., Tseng, M. L., Wu, K. J., & Cheng, C. F. Factors influencing the adoption of sharing economy in B2B context in China: Findings from PLS-SEM and fsQCA. Resources, Conservation and Recycling, 175, 105892.

[8]. Wang, L. Research on the Influencing Factors of Business Mode Innovation in the Context of Sharing Economy Setting Didi Travel as an Example. In 4th International Conference on Contemporary Education, Social Sciences and Humanities (ICCESSH 2019) (pp. 1757-1762). Atlantis Press.

[9]. Zou, Jie. Communication, Identity and Trust: Research on Internet Second-Landlord under the Empowerment of New Media. Journalism and Communications, 10, 174.

[10]. Mei Yan,Wang Si Yang. A comparative analysis of the business models of Uber and Didi Chuxing -- from the perspective of sharing economy. Journal of Hangzhou Dianzi University. Vol.19 Num.2

[11]. Yang, Z., Lei, H., & Qian, W. A hybrid formal verification system in coq for ensuring the reliability and security of ethereum-based service smart contracts. IEEE Access, 8, 21411-21436.

[12]. Dika, A., & Nowostawski, M. (2018, July). Security vulnerabilities in ethereum smart contracts. In 2018 IEEE international conference on Internet of Things (iThings) and IEEE green computing and communications (GreenCom) and IEEE cyber, physical and social computing (CPSCom) and IEEE Smart Data (SmartData) (pp. 955-962). IEEE.

[13]. Kfoury, E. F., & Khoury, D. J. Secure end-to-end VoIP system based on Ethereum Blockchain. Journal of Communications, 450–455. https://doi.org/10.12720/jcm.13.8.450-455

[14]. Shin, D. D. H. Blockchain: The Emerging Technology of Digital Trust. Telematics and Informatics, 45, 101278. https://doi.org/10.1016/j.tele.2019.101278

[15]. Ante, L., & Saggu, A.Time-Varying Bidirectional Causal Relationships between Transaction Fees and Economic Activity of Subsystems Utilizing the Ethereum Blockchain Network. Available at SSRN 4400040.

[16]. Becker, M., & Bodó, B. Trust in blockchain-based systems. Internet Policy Review, 10(2), 1-10.

[17]. Robinson, P.Using ethereum registration authorities to establish trust for ethereum private sidechains. The Journal of the British Blockchain Association, 1(2).

[18]. Yusoff, J., Mohamad, Z., & Anuar, M. A Review: Consensus Algorithms on

[19]. The Decentralized Global Credit Protocol. Goldfinch. (n.d.). https://goldfinch.finance/

[20]. Ethereum: a next generation smart contract and decentralized application platform. Vitalik Buterin. Ethereum.org

[21]. He, S. Impact of Blockchain Applications on Trust in Business. iBusiness, 12(3), 103-112.

[22]. Ethereum Virtual Machine (EVM). ethereum.org. (n.d.). https://ethereum.org/zh/developers/docs/evm/

Cite this article

Hu,Q.;Huang,Y.;Chen,Y.;Zheng,B.;Zhu,Y. (2024). Advantages of the Decentralized Sharing Economy - Take Ethereum Platform as an Example. Advances in Economics, Management and Political Sciences,97,331-342.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Coyle, D., & O’Connor, S. Understanding the Sharing Economy (No. ESCoE DP-2019-04). Economic Statistics Centre of Excellence (ESCoE).

[2]. Tetřevová, L., & Kolmašová, P. B2B sharing as part of the sharing economy model. Hradec economic days, Vol. 11 (1).

[3]. Curtis, S. K., & Lehner, M.. Defining the sharing economy for sustainability. Sustainability, 11(3), 567

[4]. Gollapudi, S., Kollias, K., & Panigrahi, D. You get what you share: Incentives for a sharing economy. In Proceedings of the AAAI Conference on Artificial Intelligence (Vol. 33, No. 01, pp.).

[5]. Kim, J., Yoon, Y., & Zo, H. Why people participate in the sharing economy: A social exchange perspective.

[6]. Grondys, K. Implementation of the Sharing Economy in the B2B Sector. Sustainability, 11(14), 3976.

[7]. Chuah, S. H. W., Tseng, M. L., Wu, K. J., & Cheng, C. F. Factors influencing the adoption of sharing economy in B2B context in China: Findings from PLS-SEM and fsQCA. Resources, Conservation and Recycling, 175, 105892.

[8]. Wang, L. Research on the Influencing Factors of Business Mode Innovation in the Context of Sharing Economy Setting Didi Travel as an Example. In 4th International Conference on Contemporary Education, Social Sciences and Humanities (ICCESSH 2019) (pp. 1757-1762). Atlantis Press.

[9]. Zou, Jie. Communication, Identity and Trust: Research on Internet Second-Landlord under the Empowerment of New Media. Journalism and Communications, 10, 174.

[10]. Mei Yan,Wang Si Yang. A comparative analysis of the business models of Uber and Didi Chuxing -- from the perspective of sharing economy. Journal of Hangzhou Dianzi University. Vol.19 Num.2

[11]. Yang, Z., Lei, H., & Qian, W. A hybrid formal verification system in coq for ensuring the reliability and security of ethereum-based service smart contracts. IEEE Access, 8, 21411-21436.

[12]. Dika, A., & Nowostawski, M. (2018, July). Security vulnerabilities in ethereum smart contracts. In 2018 IEEE international conference on Internet of Things (iThings) and IEEE green computing and communications (GreenCom) and IEEE cyber, physical and social computing (CPSCom) and IEEE Smart Data (SmartData) (pp. 955-962). IEEE.

[13]. Kfoury, E. F., & Khoury, D. J. Secure end-to-end VoIP system based on Ethereum Blockchain. Journal of Communications, 450–455. https://doi.org/10.12720/jcm.13.8.450-455

[14]. Shin, D. D. H. Blockchain: The Emerging Technology of Digital Trust. Telematics and Informatics, 45, 101278. https://doi.org/10.1016/j.tele.2019.101278

[15]. Ante, L., & Saggu, A.Time-Varying Bidirectional Causal Relationships between Transaction Fees and Economic Activity of Subsystems Utilizing the Ethereum Blockchain Network. Available at SSRN 4400040.

[16]. Becker, M., & Bodó, B. Trust in blockchain-based systems. Internet Policy Review, 10(2), 1-10.

[17]. Robinson, P.Using ethereum registration authorities to establish trust for ethereum private sidechains. The Journal of the British Blockchain Association, 1(2).

[18]. Yusoff, J., Mohamad, Z., & Anuar, M. A Review: Consensus Algorithms on

[19]. The Decentralized Global Credit Protocol. Goldfinch. (n.d.). https://goldfinch.finance/

[20]. Ethereum: a next generation smart contract and decentralized application platform. Vitalik Buterin. Ethereum.org

[21]. He, S. Impact of Blockchain Applications on Trust in Business. iBusiness, 12(3), 103-112.

[22]. Ethereum Virtual Machine (EVM). ethereum.org. (n.d.). https://ethereum.org/zh/developers/docs/evm/