1. Introduction

In recent decades, housing prices have become an important part of the economy, and sharp changes in housing prices usually portend a change in the economy and may cause an employment increase. However, if the number of employment changes, it is a question whether the housing price also changes. The number of unemployment can show the economic situation, and if there is really a connection between housing prices and unemployment, it may prove the factors that can influence the economy can also influence each other, then it may prove that economy is a whole composed of quite a lot of factors, is a dynamic balance. More succinctly, the paper wants to research whether housing prices have significant differences between different places and why there are differences. All data come from data.london.gov.uk/ and the research object of the paper is London.

There are many researches about housing prices, and they usually show why housing prices change and what factors influence housing prices. Chen Xiaoliang et al. did study shows monetary policy, demand factors and supply factors are all driving factors of housing prices but not the main driving factor [1]. The housing prices can be influenced by many different factors. This paper also shows some opinions like that, and it wants to research the change in London housing prices in recent years. First of all, the paper will show whether the different parts of London have significant differences by t-test and also show the change in average price in London with a line chart. Then, the paper will research whether there is a relationship between housing prices and the unemployment rate by linear regression. Unemployment can show the economic situation in some way, in fact, the better the economy, the lower the unemployment rate usually is. However, the housing price is not directly influenced by the economic situation. To be more specific, whether the housing price is too low or too high can both be seen as economic problems, but if just use the unemployment rate to study the housing price, it may show a different answer, and make housing prices easier to predict.

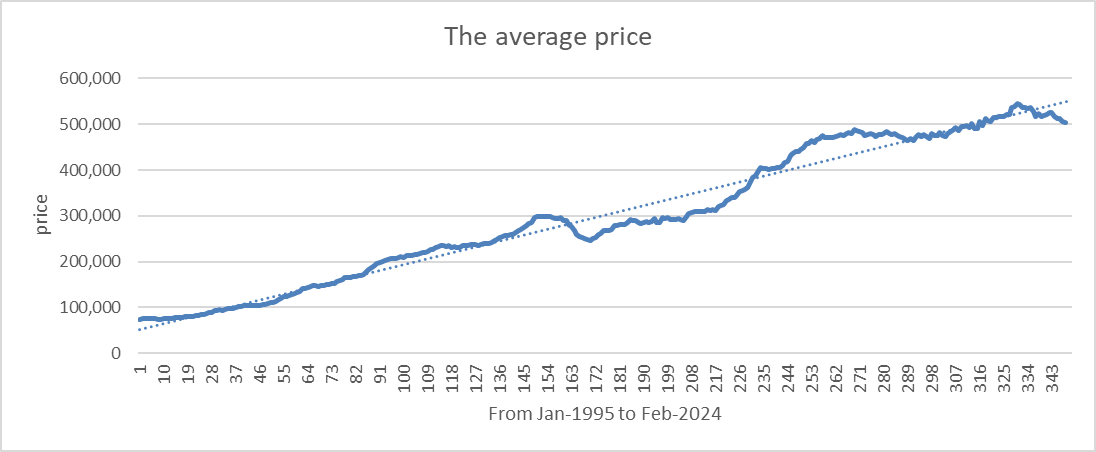

Figure 1: The average price of London price from Jan-1995 to Feb-2024

First of all, this paper uses the data on housing prices from 1995 – 2024 to plot a line chart, which shows that housing prices in London keeps increasing. If we look at a single house, the price may change because of its location, material and design, but if we look at the whole, the average housing price in the area can be influenced by changes in population, new relevant policies and the economic situation like currency inflation or change of interest rate. There are too many factors that can influence housing prices, so that is difficult to correctly predict it, but because having a place to live is an important part of human life, housing prices still can be seen as an important factor in measuring well-being and so on. Under normal conditions, the housing price is higher, the human well-being is lower because people need more money to have a house to live and may cause them to live in a worse place than before. As the trendline in the line chart shows, the housing price increased from January 1995 to February 2024, a total of 350 months. In January 1995, the average housing price in London was just 74436 pounds, but in February 2024, the average housing price has risen to 502690 pounds, almost seven times as many as it was in January 1995. There are multiple reasons to explain this change, mostly economic, and the change can affect the economy and many people’s lives. This paper wants to research, whether housing prices have a connection with the unemployment rate, and if the answer is yes, what thoughts it can show.

2. Unemployment

Unemployment people are people who do not have jobs and do not have income to feed themselves. The number of unemployed people can show the economic situation of the local area and the balance between supply and demand. To research the connection between housing prices and unemployment people, the paper uses analysis of regression, and the result is here:

Table 1: The analysis of regression about housing prices and unemployment people and the analysis and the result of analysis

Analysis of regression | ||||||||||||

Multiple R | 0.936421 | |||||||||||

R Square | 0.876884 | |||||||||||

Adjusted R Square | 0.869988 | |||||||||||

Standard error | 160023.7 | |||||||||||

Observed value | 146 | |||||||||||

Analysis of variance | ||||||||||||

| df | SS | MS | F | Significance F | |||||||

Analysis of regression | 1 | 2.64E+13 | 2.64E+13 | 1032.753 | 1.45E-67 | |||||||

Residual error | 145 | 3.71E+12 | 2.56E+10 | |||||||||

total | 146 | 3.02E+13 |

|

|

| |||||||

| Coefficients | Standard error | t Stat | P-value | Lower 95% | Upper 95% | ||||||

X Variable 1 | 1.44621 | 0.045002 | 32.13648 | 7.88E-68 | 1.357265 | 1.535155 | ||||||

This analysis of regression uses data of unemployment people and housing prices in from January 2012 to February 2024. In these twelve years, the housing price has increase and the number of unemployed people has totally decreased. In January 2012, there were 444360 people employed, almost 10% of the population in London, but finally, in February 2024, there were just almost 217000 unemployed people. It is a great decrease and shows the development of society in London. In the analysis of regression, there is a high R square, which means the model performed very well, and a high F, which means the model is significant on the whole. Overall, the independent variable has a significant influence on the dependent variable, and the coefficient estimates are very reliable. It shows that most of the time, the fewer number of unemployed people, the higher the house prices.

3. The Result

However, as said at the beginning, the change of economics is very complicated, and the housing price can be influenced by many factors, the number of unemployment is just one of them. The result shows they have a high connection may just because they have too many same characteristics, such as both of them would have great change in economic crisis, but then there is a question, if an area has a healthy economy, it of course has very few unemployment people, but whether it has low housing price, or completely opposite, because people have higher purchasing power, the housing price also increase to a higher level. The result above shows the answer is yes, when an area has less unemployment than before, the housing price also increases. It may mean that when the local economy improves, people need more money to keep them in the local area. In some opinion, it is a strange situation, because if people need more money to feed themselves, even if the environment they have become better, their well-being may not increase, so the development of economy may not have some significance, but in some other opinion, this situation is just necessary. The unemployed people become less, and the economy improves, then people have more purchasing power and the demand is changes. As the demand changes, there will be more supply and of course, higher prices, and all of them can make the GDP higher and the economy better. It is a positive cycle, which means prices would rise with economic growth, and higher prices would cause economic growth to rise further. Windsor et al. also think rising housing prices will increase residents’ willingness to develop and enjoy consumption [2], which means the level up of consumption structure. It sounds good, and seem the rising housing prices mean good things. But there are also some different opinions, Muellbauer thought the increase of housing prices would make people save more money to buy houses and lower consumption [3]. On the other side, local people may afford heavier pressure from higher and higher prices during the period, and finally had to move to some more remote places. Monk made a study in 2000 showed the increase in housing prices make the labor force in the south-east of England became shortage [4]. The research from Brakman also shows there is a negative impact of the increasing housing prices on the increase of the labor force [5]. This can be relieved by policy from the government, or the government can just indulge this situation because it can also make remote places have more population. In fact, Yijie Deng in his research shows high housing prices would drive labor to another city because it means the cost of living in the local area would rise [6], and if the government can take appropriate actions, it can make city has coordinated development of regional labor supply and do not cause a problem. The research of Smith & Ohsfeldt shows that the speed of housing price rise is related to the amount of public goods invested by the government [7]. It is one way for the government to control housing prices, as the research of Zhang Linfeng shows, the change in house property tax also can take influences in housing prices [8].

4. The Limitation of the Result

The result loses sight of many details and just look at the whole. This is because there are too many factors that can influence the economy and the paper cannot consider all of them. In fact, even in the different boroughs of London, the average housing price can have significant differences. There is the t-test about Barnet and Barking & Dagenham:

Table 2: the t-test about Barnet and Barking & Dagenham

| Variable 1 | Variable 2 |

Mean | 341794.9 | 182652.1 |

Variance | 2.56E+10 | 8.26E+09 |

Observed value | 350 | 350 |

Assumed mean difference | 0 | |

df | 553 | |

t Stat | 16.16755 | |

P(T<=t) one tail | 9.84E-49 | |

t one tail critical | 1.647614 | |

P(T<=t) two tail | 1.97E-48 | |

t two tail critical | 1.964263 |

|

It shows these two boroughs have significant differences, which means their housing price may need specific analysis and their environment may have great differences. However, the result is still right in the rough. Housing prices in different areas also have different influences on upgrading of consumption structure. As the research of Xu Rui et al. showed, the influence of upgrading of consumption structure from the change of housing prices has regional differences. In Shanxi and Henan it has a promoting effect, but in Anhui, Hubei, Hunan, and Jiangxi it has a restraining effect [9]. The study of Li Xiangjun shows for cities with different population sizes, the effect of housing prices on production efficiency is heterogeneous [10]. Although production efficiency is different from unemployment, it can still prove the influence of housing prices would change because of the population of the city. That mean though housing prices really have a connection with unemployment, the connection would change because of the specific situation. It is not a constant relationship.

5. Conclusion

The conclusion is there is a high and long-run connection between housing price and unemployment by using data of London. The unemployment is lower, and the housing prices are higher, and that led to thoughts about economic development and whether it can give a better life to local people. This would be decided by multiple factors and the government affect the result to some extent by making relevant policies. Although the study not have a detailed explanation about this relationship and it is a one-side and not very accurate result because it ignores many factors that may can have influences in the two variables. It may need a more suitable algorithm to calculate and in the other side, this paper just gives a simple conclusion and it cannot show the relationship between housing prices and unemployment in detail. In fact, there have many people researched in similar subject, and if the paper has more citations of reference literature, it can be more convincing. However, the paper can still take some thoughts about economic development. In the future, the research can focus on other factors that can influence housing prices, and study whether they have different influences on housing prices and why they have different influences.

References

[1]. Chen Xiaoliang, Chen Kan, Wang Zhaorui, Xiao Zhengyan. Identification of Influencing Factors of Housing Price Divergence in Different Cities [J]. Economic Theory and Business Management, 2024,44(2):49-64.

[2]. Windsor C, Jskel J P, Finlay R.Housing wealth effects: Evidence from an Australian panel[J].Economica, 2015, 82(327):552-577.

[3]. Muellbauer J., Housing, Credit and Consumer Expenditure, Symposium Paper, University of Oxford, 2008.

[4]. Monk, S. (2000) The Key Worker’ Problem: The Link between Employment and Housing. In: Monk, S. and Whitehead, C., Eds., Restructuring Housing Systems: From Social to Affordable Housing, York Publishing Services, York 353-355.

[5]. Brakman, S. (2002) New Economic Geography in Germany: Testing the Helpman-Hanson Model. Hwwa Discussion Papers, No. 172, 14-29.

[6]. Deng Yijie. The Influence of Housing Price on Wages in Chinese Cities—Based on the Empirical Analysis of 35 Large and Medium-Sized Cities in China [J]. ISSN:2160-7311,2022,12(5):479-492.

[7]. Smith, B.A. and Ohsfldt, R. (1982) Housing-Price Inflation in Houston, 1970-1976. Policy Studies Journal, 8, 257-276.

[8]. Zhang Linfeng. The Structural Change of House Property Tax on Housing Price [J]. ISSN:2169-2556, 2022,11(2):594-599.

[9]. Xu Rui, Liu Xiaoying. The Impact of Housing Price Fluctuations on the Upgrading of Urban Residents’ Consumption Structure [J]. Productivity Research, 2024(3):44-48.

[10]. Li Xiangjun, Xu Qiao. The Influence Mechanism of Housing Price on Urban Total Factor Productivity: An Empirical Analysis Based on Tobit Model [J].Journal of Technology Economics, 2024,43(1):1-13.

Cite this article

Zhang,S. (2024). The Research about the Connection Between Housing Prices and Unemployment. Advances in Economics, Management and Political Sciences,105,21-25.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen Xiaoliang, Chen Kan, Wang Zhaorui, Xiao Zhengyan. Identification of Influencing Factors of Housing Price Divergence in Different Cities [J]. Economic Theory and Business Management, 2024,44(2):49-64.

[2]. Windsor C, Jskel J P, Finlay R.Housing wealth effects: Evidence from an Australian panel[J].Economica, 2015, 82(327):552-577.

[3]. Muellbauer J., Housing, Credit and Consumer Expenditure, Symposium Paper, University of Oxford, 2008.

[4]. Monk, S. (2000) The Key Worker’ Problem: The Link between Employment and Housing. In: Monk, S. and Whitehead, C., Eds., Restructuring Housing Systems: From Social to Affordable Housing, York Publishing Services, York 353-355.

[5]. Brakman, S. (2002) New Economic Geography in Germany: Testing the Helpman-Hanson Model. Hwwa Discussion Papers, No. 172, 14-29.

[6]. Deng Yijie. The Influence of Housing Price on Wages in Chinese Cities—Based on the Empirical Analysis of 35 Large and Medium-Sized Cities in China [J]. ISSN:2160-7311,2022,12(5):479-492.

[7]. Smith, B.A. and Ohsfldt, R. (1982) Housing-Price Inflation in Houston, 1970-1976. Policy Studies Journal, 8, 257-276.

[8]. Zhang Linfeng. The Structural Change of House Property Tax on Housing Price [J]. ISSN:2169-2556, 2022,11(2):594-599.

[9]. Xu Rui, Liu Xiaoying. The Impact of Housing Price Fluctuations on the Upgrading of Urban Residents’ Consumption Structure [J]. Productivity Research, 2024(3):44-48.

[10]. Li Xiangjun, Xu Qiao. The Influence Mechanism of Housing Price on Urban Total Factor Productivity: An Empirical Analysis Based on Tobit Model [J].Journal of Technology Economics, 2024,43(1):1-13.