1. Introduction

Sam's Club Supermarket, as a large warehouse supermarket under Walmart, attracts many families to shop with its large scale, cost-effective, and large package. Sam's Club targets middle-class families living in first and second-tier cities, focuses on high quality and service, and mainly sells all kinds of daily commodities goods and fresh food categories. By providing differentiated products, a unique shopping experience, and member benefits, Samis Club offers its members a quality lifestyle [1]. In this article, I take a step toward theoretically examining Sam's operations in China regions. By analyzing the example of Sam's Club in this article, the key reasons why it has gone viral in the Chinese market in recent years, as well as by going to Sam's Club for a field visit and checking out a large number of feedback from customers on the Internet can get, there are also some concerns about some of the existing problems of Sam's Clubs, and to further open up the market of the Mainland China, it’s necessary to strengthen the strengths and make clear the business strategies. The rest of this paper is organized as follows. The second section looks at the extent of current research into Sam's business model, reading industry insiders' summaries of Sam's current development and forecasts for the future. The third part summarizes the strengths and weaknesses of Sam's business model and the opportunities and threats facing the development environment in China through the SWOT model. It summarizes the current situation of Sam's business model according to the SWOT model.

2. Review

To date, a number of studies have investigated the recent situation and development prospects of the warehouse supermarket industry. What this article can refer to is helpfully based upon these empirical reviews. Previous research, like Lu Dai's article in Frontiers in Business, Economics, and Management, points out that focusing on customer conversion to maintain customer loyalty is a major factor in keeping Sam's Club running in China [2]. The article published by Ming-Ling Chuang James J. Donegan et al. raises the issue of Walmart's emphasis on its well-known standard of operations rather than placing more emphasis on the diversity of consumer behavior and its impact on purchasing [3]. The proposal summarized by Yuqi Chang and Jinmiao Hu in Analysis on the Mode of Multinational Retail Enterprises Entering Chinese Market is that the retail industry, in the process of outward investment and expansion, should be fully aware of the gradual nature of international investment in the retail industry[4]. Jonathan Matusitz and Kristin Leanza, in their analysis of Walmart's entry into the Chinese market, concluded that China is the country where Walmart has the most need for global localization [5]. Zhou Qiping points out that China's warehouse retailing industry shows that Western success cannot be replicated in the Chinese market by imitation [6]. These studies all agree that supermarket companies need to make considerable changes entering the Chinese market.

Meanwhile, Lu Dai and Hailin Cheng1, Yufei Cheng and Yue Xu, published in BCP Business & Management, also pointed out that developing and adhering to a differentiation strategy is an important indicator of a company's competitiveness [7]. George, P. Describes Walmart's plans to continue its cost leadership strategy, as well as the use of differentiation and a lose-lose strategy, whereby cost and quality business strategies are used to introduce more cost-conscious human resource policies and practices [8]. Jacques Roy and Sylvain Landry pointed out that Sam's Clubs, as a Walmart product, has internal advantages from their special supply chain and Satisfying consumers' trust in the brand [9]. Tianyi Zhang also pointed to internal factors, including excellent supply chain management, as the key to the success of warehouse supermarkets in China [10,11].

Much of the previous studies focus on investigating the general industry situation and the trends in the industry or the development of Sam's Club in the wider marketplace. There are few researches in the area of the entrance of Sam’s Club into the Chinese market. This article focuses on the practicality of Sam's Club in China to analyze the development of the road. Sam's Club is currently in the industry to break through the key advantages and disadvantages of the changes in the external environment. As a way to summarize, Sam's Club in the future faced with the road choice can be considered in the decision-making options.

3. Analysis

The following section uses the swot model to position Sam's Club in the current market environment.

3.1. Strengths

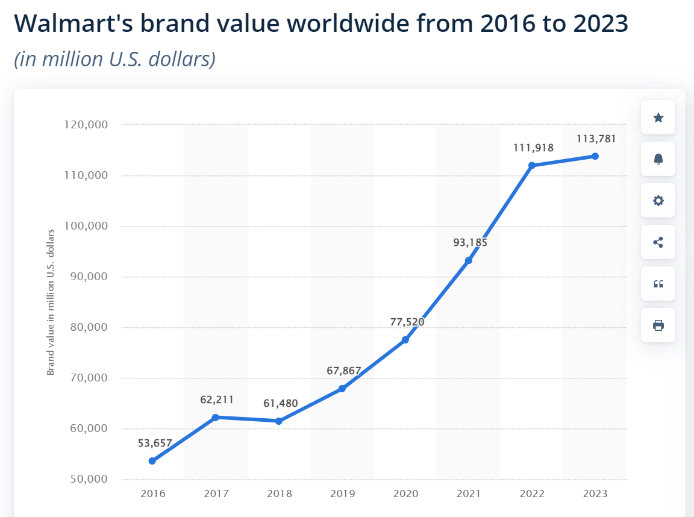

First of all, as a product of Walmart, the market value of a Fortune Global 500 company is shown in Figure 1, which gives Sam's products a certain guarantee of credibility.

Figure 1: Walmart’s brand value worldwide from 2016 to 2023 [12].

3.1.1. Differentiation advantages

Sam's Club's differentiating advantages are mainly reflected in

a. One-stop large-scale warehouse shopping malls

b. Sam's Club special membership system

c. Genuine products selected by big brands

The differentiation advantage provides products and services that are unique in the industry and differentiate the company. This enhances consumer brand loyalty to the enterprise helps the brand to create barriers to entry in the industry competition, and reduces the possibility of substitution. Compared to other competitors. Sam has contracted suppliers strictly selected goods in special channel supplied as shown in Figure 2. It’s hard for the competitors to fully meet the same product supply for consumers, and hard to replicate the business model. Many customers will continue Sam's membership because of the special goods supplied. As the main source of income, the membership system provides customers with high-quality products, which helps Sam’s Club design new marketing strategies for target customers and marks a new consumer model to the general public. The differentiated products lead to customers ' low price sensitivity, their acceptance of Sam's high quality and excellent service also means that they are more willing to pay higher prices for high quality. So, for Sam's Club’s warehouse price and low-cost structure, differentiation advantages reduce the risk that low-cost competition and price wars may bring.

Figure 2: Outer packaging marked with Sam's products.

3.1.2. Total cost lead edge

Sam's Club attracts a wide range of consumers with its cost-effectiveness compared to its competitors. The fundamentals of its business model --- large warehouses, low prices, and family portions. Which reduce packaging costs and commodity management costs. Such a large one-stop warehouse shopping meets the customer's daily necessities of centralized purchasing to reduce time costs.

Sam's Club also has its own supply chain and long-term relationships with suppliers to maintain the amount and cost of goods. In addition, Sam's Club has products with its own specialized channel, which makes it easy to control the purchasing department's price pressure. According to Sam's distribution data, Sam's Clubs are mostly in the suburbs. We can speculate this by contrasting the four first-tier cities shown in Figure 3. It is convenient to transport from the factory to the warehouse and storage. This helps reduce transportation costs and labor costs.

Figure 3: Sam's distribution map in four first-tier cities (The red circle shows the city center).

In Sam's field trip shown in Figure 4 shows the special space optimization measures. All the products are sold and stored in an industrialized minimalist-style warehousing space, it can optimize the spatial structure and save the footprint and decoration superstore costs. And the staff in the loading and replenishment department can record more conveniently and fast, which also save labor cost.

Figure 4: Sam's supermarket decoration style.

3.1.3. Centralization strategy

The products of Sam are less. One is to reflect the advantages of large-scale procurement and to screen out cost-effective products for members. Secondly, the SKU of Sam's Club is maintained at 4000, which makes it easier to guarantee product quality control and price and save economic costs.

3.2. Weakness

3.2.1. Lack of customer flow

The price of a regular membership is 260 RMB, and a Premier membership is 680 RMB. The price is not low compared to others so those who are not willing to buy the membership card still won't buy it. This leads to buying on behalf of others, borrowing cards, etc. This is definitely a disadvantage for Sam's Club, which relies on membership processing fees and renewal rates for its revenue.

3.2.2. Large package size

Sam's Club’s large packages are only suitable for large families or parties. For products with a shelf life of 2-3 days, the portion size is large, so it is easy to expire. And there is a lack of trial packs, especially for food products. Although some food products are available for sampling, for more products, customers are not able to taste them, therefore, they are not willing to try large packages.

3.2.3. Centralization

The centralized strategy will also bring certain disadvantages. While streamlining SKU, Sam's company saves costs to control risks. However, while simplifying the segments, Sam's product tastes are gradually popularized in the trend of massification, and there is a lack of product segmentation options and detailed requirements for customers to compare their preferred tastes and materials.

3.2.4. Geographic location

Most of the locations were set in the suburbs of the first and second-tier cities, although it helps Sam's reduce the cost of transportation, it makes people prefer to choose the neighborhood community supermarkets, rather than long-distance to the suburbs to purchase. And most customers choose to make a one-time purchase during the holiday season rather than on weekdays or multiple times to come, traffic congregation will lower the customer experience, such as sampling services in long lines, checkout queues, shopping carts crowded and other situations may occur.

3.3. Opportunities

First, one of the main factors that make Sam's Clubs explode in popularity is its large portions of family products and its high cost-effectiveness. The recent sweep of COVID-19 has led to a growing awareness of stocking up at home. It led to people's awareness of stocking up at home, Sam's large portions and convenient one-stop shopping for daily necessities are more popular. As one of the countries where the government strictly controls the policy of staying at home, Chinese people pay special attention to hoarding goods and stocking up on food, so Sam's advantages are made good use of. The data given in Figure 5 by Sam's official website illustrates the sales effect of this advantage.

Figure 5: Net sales growth in 3 countries [1].

Secondly, in recent years, the trend of minimalist style and industrial style swept the young groups, such as MUJI, IKEA, and other styles gradually began to be sought after by young groups. Targeted young people who are easy to accept the fresh experience of Sam's products to meet their preferences for minimalist-style product packaging and industrial-style shelves. And the food industry outbreak of all kinds of problems caused people to pay attention to food safety, people prefer high-quality food security and pay for their own health insurance. The fresh market is more popular than traditional supermarket stores, and semi-finished food has also gained a young group of fans. Sam focuses on the taste and eating habits of each region to develop semi-finished food to meet the target group ---- first and second-tier cities of middle and high-income consumers/multiple-population families/busy work/non-hands-on cooking of the young group. Finally, the platform traffic that pushes Sam's marketing to people's vision Under Sam's strong social media influence, Sam can capture the taste characteristics of local people and driving the market trend of pop-up products.

3.4. Threats

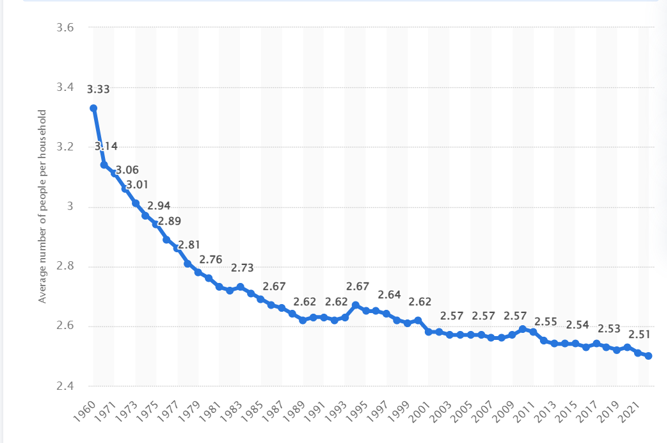

The household population has decreased. According to statistics, the average population of households in China's seventh census is 2.62.2.51 (2021) and 2.4 (2021). The average population per household was 2,62, down 0.84 from 3.10 in the sixth National census in 2010. The data for some Asian countries as South Korea, was 2.21 (2023), and Japan was 2.25 (2021). Figure 6 shows the average household population trend in the United States, the reduction means that Sam's household weight is more easily replaced by small components of goods.

Figure 6: The average number of people per household in the United States from 1960 to 2022 [12].

Although the epidemic policy has given Sam's the opportunity to be popular as a warehouse supermarket, under the pressure of the epidemic as well as the sealing and control policy, unemployed people from all walks of life and the economic recession have made people's consumer behavior change a lot, and the impact of the e-commerce industry has made the group of offline shoppers fewer and fewer. The pressure of competitors, such as Hema Fresh, the discount of competitors with small weight threaten Sam's price advantage. The holiday discounts of Taobao, Jingdong, and other online shopping platforms also threaten Sam's low-price advantage.

3.5. Approach strategies

Based on the previous analysis of Sam's Club's business strategy, it is recommended to choose a WO strategy to avoid internal disadvantages and take advantage of external opportunities. Specifically, the business could choose to offer individual small packages for food products that can be experienced by customers while primarily promoting its own advantages of large packages. The firm can also research more types of instant semi-finished products for its target customers' habits, such as air fryer semi-finished products, to better satisfy its audience's pursuit of convenience and speed. Reasonably strengthen the advantages in the changes of the external environment. According to the changes in the population demand and market structure in the Chinese environment, avoid their own weaknesses and choose the corresponding advantages with significant effects to focus on the strategy.

4. Conclusion

Sam's unique business model and Walmart's global supply chain give Sam a differentiating advantage over other models of supermarkets, which has become an explosive enterprise in China in recent years. The competitive advantages can help Sam's Club to position itself in the new Chinese market and respond to today's economic environment and market development prospects to develop corresponding marketing tools. Through the SWOT analysis to discover] the shortcomings of the enterprise's products and the disadvantages faced in the current regional development, and then adjust and improve the product marketing model to increase market share and industry competitiveness. Observe and predict the risks of competition in the industry, avoid risks, and respond to threats by combining their own strengths and opportunities. Sam's Club, as the leader of warehouse-type membership stores, still sticks to its unique business model in the era of mortar business being impacted by the e-commerce industry and relies on its strength and opportunity to usher in its explosion in China. Of course, on the Sam's Club to the international road, it should respond to the current economic environment and the characteristics of the consumer population to modify the regional business model to adapt to the consumption habits of the population in different regions so that we can achieve better prospects for development!

References

[1]. Samsclub. cn. (2021) https://www.samsclub.cn/

[2]. Dai, L. (2022). Research on the Differentiated Competition Strategy of Membership-based Retail Stores: -- Taking Sam’s Club as An Example. Frontiers in Business, Economics and Management, 5(3), 38–41. https://doi.org/10.54097/fbem.v5i3.1901

[3]. Chuang, M., Donegan, J. J., Ganon, M. W., & Wei, K. (2011). Walmart and Carrefour experiences in China: resolving the structural paradox. Cross Cultural Management: An International Journal, 18(4), 443–463. https://doi.org/10.1108/13527601111179519

[4]. Chang, Y., & Hu, J. (2020). Analysis on the Mode of Multinational Retail Enterprises Entering Chinese Market<br/>—Take Walmart, Carrefour and Metro as Examples. Modern Economy, 11(01), 17–27. https://doi.org/10.4236/me.2020.111003

[5]. Matusitz, J., & Leanza, K. (2009). Wal-Mart: An analysis of the glocalization of the Cathedral of Consumption in China. Globalizations, 6(2), 187–205. https://doi.org/10.1080/14747730902854158

[6]. Zhou, Q. (2022). Warehouse Club in China Retail market development status analysis and improvement. Advances in Economics, Business and Management Research. https://doi.org/10.2991/aebmr.k.220307.291

[7]. Cheng, H., Cheng, Y., & Xu, Y. How Can Large Foreign-Funded Supermarkets Gain a Foothold in China: Take Sam's Club as a Study Case.

[8]. EBSCOHost | 27535450 | Wal-Mart in China -- Crafting strategies to shape their good fortune. (n.d.). https://web.s.ebscohost.com/

[9]. Roy, J. (2014, June 1). Implantation de Flowcasting entre CPGA et Sam’s Club. Document - Gale Academic OneFile.https://go.gale.com/ps/i.do?id=GALE%7CA381284485&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=19112599&p=AONE&sw=w&userGroupName=anon%7E28b6883d&aty=open-web-entry

[10]. Zhang, T. (2022). The contributing factor to success and risk for warehouse club in China. Advances in Economics, Business and Management Research. https://doi.org/10.2991/aebmr.k.220404.004\

[11]. Anderson SP, Coate S (2005) Market provision of broadcasting: A welfare analysis. Review. Economic. Study. 72(4):947–972.

[12]. Walmart: brand value worldwide 2020. (n.d.). Statista. https://www.statista.com/statistics/980007/brand-value-of-walmart-worldwide/

Cite this article

Shi,T. (2024). Situation Analysis of Sam's Club Based on the SWOT Model Based on the Research of Chinese Market Environment. Advances in Economics, Management and Political Sciences,101,60-67.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Samsclub. cn. (2021) https://www.samsclub.cn/

[2]. Dai, L. (2022). Research on the Differentiated Competition Strategy of Membership-based Retail Stores: -- Taking Sam’s Club as An Example. Frontiers in Business, Economics and Management, 5(3), 38–41. https://doi.org/10.54097/fbem.v5i3.1901

[3]. Chuang, M., Donegan, J. J., Ganon, M. W., & Wei, K. (2011). Walmart and Carrefour experiences in China: resolving the structural paradox. Cross Cultural Management: An International Journal, 18(4), 443–463. https://doi.org/10.1108/13527601111179519

[4]. Chang, Y., & Hu, J. (2020). Analysis on the Mode of Multinational Retail Enterprises Entering Chinese Market<br/>—Take Walmart, Carrefour and Metro as Examples. Modern Economy, 11(01), 17–27. https://doi.org/10.4236/me.2020.111003

[5]. Matusitz, J., & Leanza, K. (2009). Wal-Mart: An analysis of the glocalization of the Cathedral of Consumption in China. Globalizations, 6(2), 187–205. https://doi.org/10.1080/14747730902854158

[6]. Zhou, Q. (2022). Warehouse Club in China Retail market development status analysis and improvement. Advances in Economics, Business and Management Research. https://doi.org/10.2991/aebmr.k.220307.291

[7]. Cheng, H., Cheng, Y., & Xu, Y. How Can Large Foreign-Funded Supermarkets Gain a Foothold in China: Take Sam's Club as a Study Case.

[8]. EBSCOHost | 27535450 | Wal-Mart in China -- Crafting strategies to shape their good fortune. (n.d.). https://web.s.ebscohost.com/

[9]. Roy, J. (2014, June 1). Implantation de Flowcasting entre CPGA et Sam’s Club. Document - Gale Academic OneFile.https://go.gale.com/ps/i.do?id=GALE%7CA381284485&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=19112599&p=AONE&sw=w&userGroupName=anon%7E28b6883d&aty=open-web-entry

[10]. Zhang, T. (2022). The contributing factor to success and risk for warehouse club in China. Advances in Economics, Business and Management Research. https://doi.org/10.2991/aebmr.k.220404.004\

[11]. Anderson SP, Coate S (2005) Market provision of broadcasting: A welfare analysis. Review. Economic. Study. 72(4):947–972.

[12]. Walmart: brand value worldwide 2020. (n.d.). Statista. https://www.statista.com/statistics/980007/brand-value-of-walmart-worldwide/