1. Introduction

With increasing global attention to sustainable development and environmental protection, the automotive industry is facing transformation and challenges [1]. Traditional fuel vehicles have gradually lost their market competitiveness due to their high cost and environmental pollution issues. Tesla, as a leading electric vehicle manufacturer, has demonstrated significant advantages in this transformation process [1]. However, Tesla faces a series of challenges in the Chinese market, such as licensing issues and the rise of local competitors. Therefore, under the background of the excess capacity of modern new energy electric vehicles, Tesla electric vehicles need to clearly define their own development direction and establish scientific price positioning plans and schemes in order to establish a foothold in the Chinese market with appropriate pricing strategies [2].

Tesla is an electric vehicle and renewable energy company committed to accelerating the transition to sustainable energy. The company produces high-performance, efficient energy utilization, and innovative design electric vehicles, as well as solar and energy storage products. The founder of Tesla is Elon Musk, whose vision is to reduce dependence on fossil fuels, reduce greenhouse gas emissions, and protect the Earth's environment through electric vehicles and renewable energy technologies.

This article aims to analyze Tesla's pricing strategy in the Chinese market and explore its motivation and impact for price reduction. Tesla’s price strategies have played an important role in promoting the development of the electric vehicle industry. We further explore Tesla's impact on the Chinese automotive economy market. Firstly, we focus on the motivation behind Tesla's price reduction and use SWOT analysis to analyze Tesla's positioning in the Chinese market in depth. Secondly, we analyze Tesla's pricing strategy in the Chinese market and provide a detailed explanation. Thirdly, we explore the impact of the adjustment of the automotive industry structure on the structure of other automotive industry chains and compare it with other Chinese enterprises. These suggestions involve learning value and market expansion, aiming to provide useful references for Tesla.

2. Tesla's SWOT Analysis in the Chinese Market

2.1. Strengths

2.1.1. Leading Technology

Tesla uses a differentiation strategy on products, making the unique performance and design become the core competitiveness that cannot be easily followed by competitors [2].

Tesla has advanced battery technology. Currently, the entire Tesla family uses ternary batteries, which have the greatest advantages of high energy density and good cycling performance. Additionally, Tesla's autonomous vehicles demonstrate their advantages with their excellent safety. Tesla's autonomous driving system uses high-precision sensing devices such as lidar to instantly capture environmental information around the vehicle and respond quickly to road conditions.

2.1.2. Brand Awareness

Tesla is a highly well-known electric vehicle brand in China and even globally. With its high visibility, it has better attracted the attention of more consumers, promoted its products, and promoted their sales in the Chinese market.

2.1.3. First Mover Advantage

Tesla is one of the pioneers in the Chinese electric vehicle market, entering the market early and establishing a certain sales and service network, which enables it to better meet consumer needs and establish brand loyalty.

2.2. Weaknesses

2.2.1. High Price

Tesla's products are relatively expensive compared to traditional fuel vehicles and other electric vehicles, which limits the purchasing power and willingness of some consumers [3]. For example, the latest selling price range of Model S is 698900-828900 yuan, however, the latest selling price range of BYD Song’s price is 69000-149999 yuan. It’s obvious that Tesla’s products are expensive.

2.2.2. Dependence on Imports

At present, Tesla's factories in the United States produce high-quality cars, while its factories in China are still under construction. Therefore, Tesla has chosen to import products into the Chinese market to maintain product consistency and quality. Tesla's sales scale in China is relatively large, and currently, building factories in China is not enough to meet market demand, so it chooses to rely on imports. Therefore, Tesla's products in the Chinese market mainly rely on imports, which results in product prices being affected by factors such as exchange rate fluctuations and tariffs, increasing costs and market risks.

2.3. Opportunities

2.3.1. Government Support

The Chinese government has introduced a series of policies to support the development of electric vehicles, including car purchase subsidies, exemption from purchase taxes, and free use of public charging facilities. These policies provide Tesla with a competitive advantage and market demand in the Chinese market.

2.3.2. Market Potential

As an electric vehicle manufacturer, Tesla has many consumer groups to explore. Here are some potential consumer groups. The consumer group that focuses on environmental protection and sustainable development has a high recognition of electric vehicles. Tesla, as a leading electric vehicle brand, can attract this group of consumers. Moreover, Tesla's prices are relatively high, making it easier for higher income consumer groups to accept and purchase Tesla's products. Finally, Tesla's electric vehicles combine advanced technology and intelligent features, making them attractive to technology enthusiasts and seekers.

2.4. Threats

2.4.1. Market Competition

The competition in China's electric vehicle market is fierce, and Tesla faces competition pressure from local and international competitors. For example, as a local Chinese automaker, BYD has gradually emerged through years of accumulation in hybrid and electric vehicle technology. The continuous growth of sales and market share has made BYD a strong competitor to Tesla.so it needs to constantly innovate and improve product competitiveness.

2.4.2. Technical Risk

Electric vehicle technology is developing rapidly, and market demand and technology are changing rapidly. Tesla needs to constantly follow up and adapt to market changes to avoid the risk of technological lag.

3. Tesla's Pricing Strategy in the Chinese Market

3.1. Price Strategy

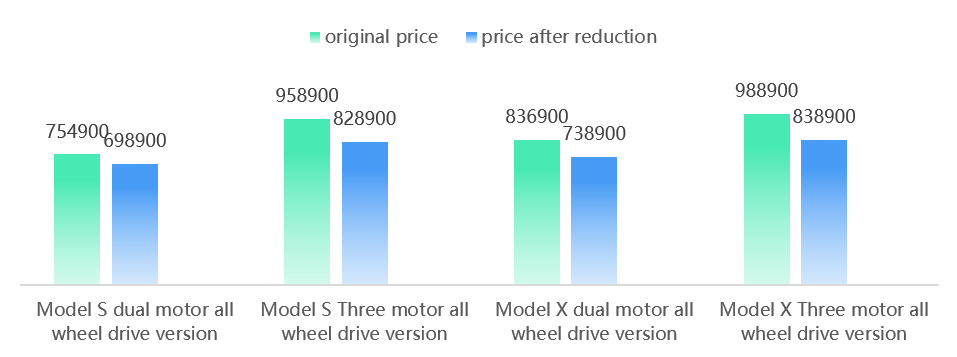

On September 8, 2023, Tesla officially announced that the Tesla Model S and Model X being sold in the Chinese market, undergo price adjustments. The price of Tesla Model S dual motor all wheel drive version has decreased by 7.4%. As figure 1 shows, the price of Tesla Model S Three motor all wheel drive version has decreased by 13.5% . The price of Tesla Model X dual motor all wheel drive version has decreased by 11.7% The price of Tesla Model X Three motor all wheel drive version has decreased by 15.1% .

Figure 1: Tesla Model S and X Price Reduction

3.1.1. Price Reduction Strategy

Tesla increases production scale to reduce costs and improve production efficiency. With the improvement of production capacity, Tesla can achieve higher yields and reduce production costs through economies of scale. Tesla continuously conducts technological research and innovation to improve product performance and quality and reduce production costs. For example, Tesla continuously improves battery technology, increasing the energy density and lifespan of batteries and reducing battery costs. Tesla reduces the procurement costs of raw materials and components by optimizing supply chain management. Tesla establishes long-term partnerships with suppliers to improve the stability and efficiency of the supply chain and reduces costs through procurement strategies. Tesla has also taken measures to reduce production costs, including optimizing production processes, improving production line efficiency, and reducing labor costs. Tesla also uses automation technology to improve production efficiency, reduce manual operations and labor costs.

Overall, Tesla has expanded its production scale, innovated technology, optimized its supply chain, and controlled production costs by

3.1.2. Different Pricing Levels

Tesla provides products at different pricing levels in the Chinese market to meet the needs and budgets of different consumers. Tesla has launched different models and configurations of electric vehicles, with prices ranging from lower entry-level models to more high-end luxury models. This pricing strategy can attract a wider consumer group and increase the market penetration rate of the product.

As Tesla's entry-level model, the Model 3 has launched different configurations and prices in the Chinese market. This model is aimed at a wider consumer group, including young people, family users, and consumers interested in electric vehicles. Pricing starts at a relatively low starting price and varies depending on the configuration.

Model Y is Tesla's compact SUV and a popular model in the Chinese market. It has a larger space and higher seat height, making it suitable for home use and urban driving. The pricing of Model Y is relatively high, targeting higher income consumer groups.

Tesla Model S and Model X are luxury models of Tesla, with higher performance and more luxurious configurations. For example, Tesla hired a team of seasoned automotive engineering and manufacturing specialists to design and develop the Model S. [4]. Tesla Model S and Model X are aimed at high-end consumer groups, consumers who pursue excellent performance and luxurious experiences. The pricing of these two models is relatively high.

3.1.3. Additional Service Pricing

Tesla is continuously expanding the coverage of its charging network in China, providing convenient charging services for car owners. Tesla has built a large number of supercharging stations and destination charging points in China, allowing car owners to easily charge during long-distance travel or parking [5].

Tesla provides customized services for the Chinese market to meet the needs of local consumers. For example, Tesla has launched special edition models for the Chinese market, such as the Tesla Model 3 China Edition, as well as customized configurations and optional packages for Chinese consumers.

Tesla provides comprehensive after-sales service in China, including repairs, maintenance, and component replacement. Tesla has after-sales service centers and stations in China to provide timely repair and maintenance services for car owners.

Tesla collaborates with multiple insurance companies to provide vehicle insurance services for car owners. Tesla's vehicle insurance program covers risks such as vehicle loss, third-party liability, and theft, providing comprehensive protection for car owners

3.1.4. Promotion Activities

Tesla regularly holds promotional activities in the Chinese market, such as price reductions, special discounts, etc., to attract consumers to purchase its products. The pricing strategy of these promotional activities can stimulate consumers' purchasing desire and increase sales.

Tesla may offer some car purchase discounts, such as cash discounts, free value-added services, or extended warranty periods, to attract consumers to purchase its products. These car purchase discounts can increase consumers' purchasing motivation and increase sales. Tesla may launch limited time special offers during specific time periods to encourage consumers to purchase their products as soon as possible. This limited time special offer often takes place during specific holidays or promotional seasons, such as the Double 11 Shopping Festival or the Spring Festival.

4. The Impact of Tesla's Pricing Strategy

4.1. Increasing Market Share

By lowering product prices, Tesla can attract more consumers, drive the sales of electric vehicles, and increase its market share. This helps Tesla expand its brand influence and market share in the Chinese market, further consolidating its leading position

4.2. Improving Product Competitiveness

The Chinese market has emerged with some local competitors who compete with Tesla through continuous innovation and market strategies. Lowering prices can help Tesla become more competitive in terms of pricing and attract more consumers to choose Tesla's products

4.3. Increasing Consumer Willingness To Purchase

The Chinese market has emerged with some local competitors who compete with Tesla through continuous innovation and market strategies. Lowering prices can help Tesla become more competitive in terms of pricing and attract more consumers to choose Tesla's products

5. Conclusion

This paper analyzes Tesla's pricing strategy in the Chinese market and explores the motivation and impact of its price reduction. Tesla's pricing strategy has played an important role in driving the development of the electric vehicle industry. By using the SWOT analysis method, we conduct an in-depth analysis of Tesla's strengths, weaknesses, opportunities, and threats in the Chinese market. At the same time, the article also analyzes the changes in the overall market competition pattern and demonstrates the competitive relationship between Tesla and other local competitors through case studies. In addition, the article also explores the impact of structural adjustment in the automotive industry on the structure of other automotive industry chains and compares it with other Chinese enterprises. Finally, based on research on the future development of the Chinese automotive market, the article proposes some suggestions to help Tesla achieve success in the future development of the Chinese automotive market. These suggestions involve learning value and market expansion, aiming to provide useful references for Tesla.

Acknowledgments

Thank you very much to Professor Shang Yu for his patient guidance and careful review. His guidance on paper writing and structure helped me better organize and express my research findings.

References

[1]. Perkins, G., & Murmann, J. P. (2018). What does the success of Tesla mean for the future dynamics in the global automobile sector. Management and Organization Review,14(3),471-480. DOI: https://doi.org/10.1017/mor.2018.31

[2]. Huang Xuming. Research on the marketing strategy of Tesla Motors in China [D]. Changchun University of Science and Technology, 2016.

[3]. Du, X., & Li, B. (2021, December). Analysis of Tesla’s Marketing Strategy in China. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 1679-1687). Atlantis Press. DOI:10.2991/assehr.k.211209.270

[4]. Teece, D. J. (2018). Tesla and the reshaping of the auto industry. Management and Organization Review,14(3),501-512. DOI: https://doi.org/10.1017/mor.2018.33

[5]. Perkins, G., & Murmann, J. P. (2018). What does the success of Tesla mean for the future dynamics in the global automobile sector? Management and Organization Review, 14(3), 471-480. DOI: https://doi.org/10.1017/mor.2018.31

Cite this article

Hu,J. (2024). Research on Tesla's Pricing Strategy in Chinese Market . Advances in Economics, Management and Political Sciences,106,135-140.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Perkins, G., & Murmann, J. P. (2018). What does the success of Tesla mean for the future dynamics in the global automobile sector. Management and Organization Review,14(3),471-480. DOI: https://doi.org/10.1017/mor.2018.31

[2]. Huang Xuming. Research on the marketing strategy of Tesla Motors in China [D]. Changchun University of Science and Technology, 2016.

[3]. Du, X., & Li, B. (2021, December). Analysis of Tesla’s Marketing Strategy in China. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 1679-1687). Atlantis Press. DOI:10.2991/assehr.k.211209.270

[4]. Teece, D. J. (2018). Tesla and the reshaping of the auto industry. Management and Organization Review,14(3),501-512. DOI: https://doi.org/10.1017/mor.2018.33

[5]. Perkins, G., & Murmann, J. P. (2018). What does the success of Tesla mean for the future dynamics in the global automobile sector? Management and Organization Review, 14(3), 471-480. DOI: https://doi.org/10.1017/mor.2018.31