1. Introduction

Global central banks have initiated a wave of interest rate cuts, and China's monetary policy takes both internal and external factors into consideration. In March 2018, US President Trump, who was then in office, announced plans to slap tariffs on $60 billion worth of Chinese goods, approved a 25% tariff on steel imports and a 10% tariff on aluminum imports, and imposed trade sanctions on China [1]. Since then, the list has been expanded several times and the tax rate has been increased. China has launched several rounds of counterattacks against the US actions and issued equal countermeasures. The trade friction has gradually escalated and the monetary policies of the two countries have also diverged.

While trade frictions have had an adverse impact on domestic exports, the US interest rate level is at a relatively high level, the US dollar is strong, and the RMB is facing depreciation pressure [2]. In November 2018, the RMB exchange rate against the US dollar depreciated rapidly by 11%, breaking 7 again. After that, as the US and China reached a certain consensus at the G20 summit in December, the exchange rate also fell from 7.0 to 6.7 [3].

During this period, in order to boost the slowing economy and respond to the market sentiment caused by the excessively fast rate hike in 2018, the Federal Reserve cut interest rates three times in 2019, lowering the benchmark interest rate to 1.5%-1.75% [4]. In September, the European Central Bank lowered the deposit facility rate by ten basis points, and nearly 40 developed and emerging market economies including South Korea, Turkey, and Brazil also chose to cut interest rates in 2019 for various reasons [5]. Against the backdrop of global central banks launching a wave of interest rate cuts, China's monetary policy has adhered to a prudent orientation, taking into account domestic and foreign economic conditions and the spillover effects of monetary policy, and taking both internal and external factors into consideration [6]. The economic growth rate and price level are both in a reasonable range.

In February 2020, the stock and commodity markets fluctuated due to the outbreak and spread of the COVID-19 pandemic. In March, the Federal Reserve cut interest rates twice by a total of 150 basis points, while restarting the QE program and a series of emergency loan arrangements to support lending to small and medium-sized enterprises and purchasing corporate bonds [7]. The above unconventional easing path alleviated the short-term crisis, but also led to a rapid expansion of the Fed's assets and liabilities. The amount of the Federal Reserve's balance sheet increased from 4.2 trillion to 7.41 trillion US dollars between February and December 2020.

During the epidemic, China's monetary policy was more flexible, and a variety of tools were used appropriately to release liquidity to the market [8]. In terms of price-based tools, the central bank guided interest rates downward through medium-term lending facilities and open market operations, lowered the interest rate on re-loans to support agriculture and small businesses, and lowered the loan market benchmark rate (LPR) twice. In terms of quantity-based tools, the central bank initiated a 1.8 trillion-yuan re-loan and re-discount program, released 1.75 trillion yuan of long-term funds, and decreased the reserve requirement ratio three times.

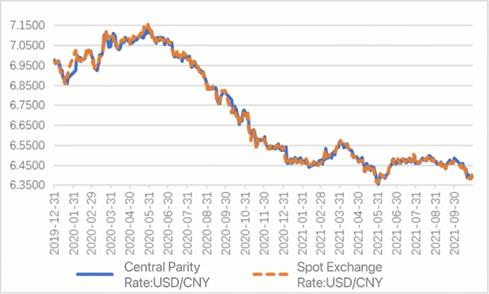

In 2020, the international financial market experienced significant fluctuations, and the RMB exchange rate continued to increase in elasticity, but the overall trend was still relatively stable compared with other major currencies. Throughout the year, it is common to categorize the RMB spot exchange rate against the US dollar into three stages: The first phase took place in the first part of January. Market risk sentiment increased with the US and China signing the first section of their trade agreement. The RMB exchange rate increased from 6.96 at the end of 2019 to 6.84 when combined with the seasonal exchange settlement at the start of the year [9]. The second stage was from the end of January to May. The rapid spread of the new crown epidemic in the world triggered extreme risk aversion in the global financial market and a US dollar liquidity crisis. The US dollar index rose sharply to 103, and the RMB exchange rate followed the pressure of the US dollar index and depreciated to 7.18. The third stage was from June to early December, when the RMB exchange rate against the US dollar continued to fluctuate and rise. Affected by the Federal Reserve and other major international central banks' loose liquidity, the risk emotions in the global market has greatly improved since the first half of the year. US dollar index plummeted dramatically while global stock markets recovered from their lows [10].

As of December 10, the RMB exchange rate against the U.S. dollar closed at 6.5480, up 4,182 points from 6.9662 at the end of 2019, corresponding to an appreciation of 6.0% (see Figure 1).

Figure 1: The exchange rate of RMB against the US dollar (Photo/Picture credit: Original).

After adopting unlimited QE during the epidemic, the US economy has abundant liquidity, but economic growth and recovery remain sluggish. From January to October 2022, the US inflation rate has been fluctuating at a high level above 7.5%. The Federal Reserve will control inflation as the primary goal of monetary policy and raise interest rates five times in a row in 2022, a total of 425 basis points. The global capital flow and re-balancing have been sparked by the Fed's increase in interest rates. On the one hand, money tends to flow toward nations with higher interest rates since Western nations have followed the Fed's pace of rate rises. Therefore, in order to avoid excessive capital outflows, other countries can only raise interest rates simultaneously. On the other hand, the increase in interest rates has further promoted the strengthening of the US dollar and impacted the currencies of other countries.

Unlike the global interest rate hike background, China's monetary policy has continued its prudent tone and emphasized "self-centeredness". In 2022, China's policies did not implement synchronous tightening throughout the year, but based on the current economic situation in China, it cut interest rates and reserve requirements, and always adhered to the implementation of a prudent monetary policy to provide "stable" support for high-quality development. The loan market benchmark rate (LPR) was lowered three times in January, May and August 2022. At the same time, the reserve requirement ratio was lowered three times by the central bank in April and December 2022 and March 2023, respectively.

In 2022, in order to curb inflation, the Federal Reserve launched the fastest interest rate hike process in 40 years. As a result of the aggressive interest rate hike, the US dollar index increased 20% from its starting point of 95.62 to a high of 114.78, and it ended the year up 7.8% overall. The sharp fluctuations in the US dollar index also caused huge fluctuations in the global financial market. The euro, yen, and pound sterling against the US dollar have all hit their lowest levels in more than 20 years or even in history. At the same time, it also increased the two-way fluctuation elasticity of the RMB exchange rate. In 2022, the US dollar rose 9.1% against the RMB throughout the year, from 6.3745 at the beginning of the year to 6.9514 at the end of the year. The CFETS RMB exchange rate index fell 4.2% throughout the year, from 102.98 at the beginning of the year, rising to a high of 106.79, and closing at 98.67 at the end of the year.

2. Hypothesis of Impact Mechanism

2.1. Market Expectation

Figure 2: Changes in 10-year Treasury Bond yields from 2018 Jan. to 2023 Dec.

(Photo/Picture credit: Original).

Through an impact on market expectations, China's and the US's divergent monetary policies influence the trend of the RMB exchange rate. According to the market expectation theory, market sentiment can affect foreign exchange trading behavior. When market players have optimistic expectations for their own currency or foreign currency, they will choose to increase their holdings of the corresponding currency, and vice versa.

As Figure 2 shown, the divergence in monetary policies between the United States and China has resulted in considerable fluctuations in the yields of 10-year bonds in both countries, as well as the strengthening or weakening of the US dollar index. The interest rate gap between China and the US, as well as the US dollar index, have a significant impact on market expectations. They influence the direction of the RMB exchange rate trend and set expectations for the market. Some negative market expectations have also been inflated by the differences in monetary policy between the US and China. For example, since 2022, the Federal Reserve has continued to raise interest rates, while China has adhered to a prudent monetary policy to reduce reserve requirements and interest rates, which has reduced the difference in interest rates between China and the US. In the later period, there was even a period of inversion, and the US dollar index strengthened all the way. During this period, the market expectations for the US dollar were generally and continuously positive. Under the pressure of the strengthening of the US dollar index, the market expectations for the RMB were not ideal. It was manifested in the continuous decline of the RMB exchange rate against the US dollar, which once broke through 7.

Therefore, Hypothesis 1 is proposed. The divergence in monetary policies between China and the United States affects market expectations by changing the interest rate differential between China and the United States and the US dollar index, which in turn affects the trend of the RMB exchange rate. The narrowing and inverted interest rate differential between China and the United States and the strengthening of the US dollar index will lead to better expectations for the US dollar market and worse expectations for the RMB market, thereby causing the RMB exchange rate to fall against the US dollar.

2.2. Foreign Trade (Net Exports)

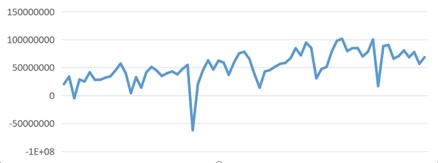

Figure 3: Changes in China's monthly net exports from 2018 Jan. to 2023 Dec.

(Photo/Picture credit: Original).

The US and China's different monetary policies have an impact on the RMB exchange rate's trend by affecting the current account in the balance of payments, especially China's net exports (see Figure 3). Since China is the biggest trading partner of America, the differences in monetary policy between the two countries will have a big effect on both countries' international commerce. Taking the Fed's continuous increase in interest rates in the post-epidemic era as an example, on the one hand, the US interest rate hike indicates that the US economy is recovering and the terminal consumer demand is increasing, which will increase the consumption of Chinese products, thus facilitating the import of Chinese products. On the other hand, the pressure on the RMB's devaluation is increased by the US interest rate hike, which will correspondingly increase the export competitiveness of Chinese products, thereby increasing the export of corporate products. The increase in overall net exports increases the current account balance in my country, raises the need for RMB, and promotes the appreciation of RMB. However, since the trade war between China and the United States, due to many trade barriers and unclear expected policies, there are many uncertainties in China's foreign trade. It is difficult to produce a more obvious trend of change because of the differences in monetary policy between the US and China, the impact of encouraging the RMB's rise could not be readily apparent.

Therefore, Hypothesis 2 is proposed. The RMB exchange rate rises as a result of China's increased net exports due to the differences in monetary policy between the US and China.

2.3. International Capital Flows

The flow of cross-border capital is reflected in the balance of payments' capital and financial accounts, and profit-seeking capital flows will be significantly impacted by the differences in monetary policy between the US and China. The supply and demand of RMB in the foreign currency market are directly impacted by cross-border capital flows, which in turn impacts the direction of the RMB exchange rate. Using the stark differences in monetary policy between the US and China in the wake of the outbreak as an example, the Federal Reserve has been raising interest rates steadily, and the US bank deposit interest rate and the US 10-year bond yield continue to rise, while China's reserve requirement ratio and interest rate cuts have caused China's bank deposits and related bond yields to decline. In contrast, holding US dollars will gain greater returns, resulting in a significant capital flight across borders. The withdrawal of international money will result in a drop in China's foreign exchange reserves and a reduction in demand for the RMB, which will lower the RMB's exchange rate against the US dollar.

Based on this, Hypothesis 3 is proposed. The flow of cross-border capital and, consequently, the trend of the RMB exchange rate will be impacted by the divergence in monetary policies between China and the US, and the RMB would weaken as a result of the capital outflow.

3. Research Design

3.1. Sample Selection and Data Sources

The foreign exchange statistics between China and the United States from January 2018 to September 2023 served as the sample utilized in this article. This period is a period when the monetary policies of the two countries diverge significantly. Among them (see Table 1 and Table 2), exrate comes from China Money Network and is the RMB monthly average exchange rate (direct pricing method) against the US dollar. Margin represents the interest rate difference between China and the United States. That is, the difference between the ten-year bond yields of the two countries. Both bond yields are from the CSMAR database, which is the monthly data averaged from the daily data. Index is from the Yingwei Financial Investing website, which represents the monthly U.S. dollar index. lnnetexport is from the National Bureau of Statistics, which represents the monthly U.S. dollar index. The logarithm of China's monthly net exports. lngdp represents monthly gross domestic product, from the National Bureau of Statistics of China, and is the monthly average GDP calculated by dividing quarterly GDP by three.

3.2. Variable Definitions and Descriptive Statistics

Table 1: Variable definition.

| Variable type | variable name | variable symbol | Calculation method |

| Explained variable | Monthly average exchange rate of RMB against USD | exrate | USD/CNY |

| Explanatory variables | Interest rate spread between China and the United States | margin | China 10-year bond yield minuses US 10-year bond yield |

| dollar index | index | Monthly U.S. Dollar Index | |

| net exports | lnnetexport | China’s monthly net exports take the logarithm | |

| control variables | gross domestic product | lngdp | Logarithm of monthly GDP |

Table 2: Descriptive statistics.

Variables |

N |

mean |

sd |

min |

max |

exrate |

69 |

6.754 |

0.272 |

6.298 |

7.184 |

margin |

69 |

0.766 |

1.098 |

-1.720 |

2.430 |

index |

69 |

97.56 |

5.260 |

89.13 |

112.1 |

lnnetexport |

69 |

16.69 |

5.839 |

-17.94 |

18.43 |

lngdp |

69 |

11.39 |

0.143 |

11.12 |

11.62 |

3.3. Model Design

The following model was created in order to confirm the mechanism by which the difference in monetary policies between the US and China affects the trend of the people's exchange rate.

\( exrate\ =\ \beta_0+\ \beta_1\ast margin+\ \beta_2\ast index+\ \beta_3\ast lnnetexport+\ \beta_4\ast lngdp+\mu \) (1)

If the coefficient before margin \( \beta_1 \) is significantly negative, the coefficient before index \( \beta_2 \) is significantly positive, and the coefficient before lnnetexport \( \beta_3 \) is significantly negative, it basically verifies the conjecture on the mechanism of the impact of the divergence of US-China monetary policies on the trend of the people's exchange rate (Because sufficient bank foreign exchange settlement and sales data cannot be collected to represent cross-border capital flows, the verification of the third impact mechanism is subject to certain limitations).

4. Empirical Results

4.1. Benchmark Regression Results

Table 3: OLS regression results.

Variables |

exrate |

margin |

0.074* |

|

(0.039) |

index |

0.047*** |

|

(0.009) |

lnnetexport |

-0.004 |

|

(0.005) |

lngdp |

-0.339 |

|

(0.218) |

Constant |

6.055** |

|

(2.347) |

Observations |

69 |

R-squared |

0.403 |

F test |

9.60e-07 |

r2_a |

0.365 |

F |

10.78 |

Note: t-statistics in parentheses; *** p<0.01, ** p<0.05, * p<0.1.

From Table 3, it can be concluded that the model passed the overall significance test. The explanatory variables margin and index passed the significance test of the variables, and the constant values were significantly positive. The benchmark OLS regression analysis's findings demonstrate that the strengthening of the US dollar index will affect market expectations, thereby promoting the depreciation of the RMB, and that for every 0.047 unit increase in the US dollar index, the RMB exchange rate (direct quotation method) against the US dollar will rise by one unit. This empirical result is basically consistent with the hypothesized impact mechanism 1. According to the regression results, the widening of the difference in interest rates between the US and China will also promote the depreciation of the RMB, which is contrary to the hypothesized mechanism 1.

4.2. Model Revision

After analyzing the reasons why the empirical results are inconsistent with the hypothesis, it is speculated that there may be strong multicollinearity between the explanatory variables. After testing, it is found that the margin and index have a substantial negative correlation. Therefore, this paper modifies the model in subsequent research as follows.

\( exrate\ =\beta_0+\beta_1\ast margin++\beta_2\ast lnnetexport+\beta_3\ast lngdp+\mu \) (2)

\( exrate\ =\beta_0+\beta_1\ast index+\beta_2\ast lnnetexport+\beta_3\ast lngdp+\mu \) (3)

The influence of the US dollar index and the interest rate gap between the US and China on the evolution of the RMB exchange rate is investigated using two novel models. The results are shown in Table 4 and Table 5.

Table 4: Regression results of modified model 1.

Variables |

exrate |

margin |

-0.084*** |

|

(0.031) |

lnnetexport |

0.000 |

|

(0.006) |

lngdp |

0.075 |

|

(0.245) |

Constant |

5.962** |

|

(2.817) |

Observations |

69 |

R-squared |

0.126 |

F test |

0.0317 |

r2_a |

0.0857 |

F |

3.126 |

Table 5: Regression results of modified model 2.

VARIABLES |

exrate |

index |

0.035*** |

|

(0.006) |

lnnetexport |

-0.003 |

|

(0.005) |

lngdp |

-0.331 |

|

(0.222) |

Constant |

7.179*** |

|

(2.315) |

Observations |

69 |

R-squared |

0.369 |

F test |

1.27e-06 |

r2_a |

0.340 |

F |

12.69 |

The effect mechanism 1 in the hypothesis is essentially confirmed by the above regression findings, which show that the coefficient before margin is considerably negative and the coefficient before index is significantly positive following the revision of the model. However, the coefficients of lnnetexport in the two models' regression findings are not significant. The reason may be that the change of China's net exports is greatly affected by the US-China trade friction. In this context, monetary policy has a very limited effect on changes in net exports. In other words, the divergence of in monetary policy between the US and China has little impact on the increase of China's net exports, and It is challenging to change the RMB exchange rate through this channel.

5. Conclusion

The differences in monetary policy between the US and China seems to have become the norm, and the influence on the RMB exchange rate volatility should be taken seriously. The RMB exchange rate fell all the way to 7, breaking through, and is still falling today due to market expectations influenced by the recent divergence between China and the US, the inverted interest rate gap between the two countries, and the strengthening of the US dollar index. In addition, the US interest rate hike has constrained China's monetary policy, putting my country's monetary policy in a dilemma. On the one hand, China is in a critical period of economic structural transformation and still needs a prudent monetary policy to support economic growth; on the other hand, the Fed's interest rate hike has increased the pressure of capital outflows, aggravated the domestic liquidity tension, and increased the downward pressure on China's economy. Under the trilemma, It is impossible to have a stable exchange rate, free movement of capital, and independent monetary policy at the same time. As a result, the central bank may tighten monetary policy and passively hike interest rates. The central bank may tighten monetary policy and gradually increase interest rates.

Therefore, in the background of the divergence between the two countries, it is imperative to cope with the pressure of US monetary policy, preserve both the RMB exchange rate's stability and China's monetary policy's independence. Therefore, the following suggestions are put forward:

(1) Vigorously promote the development of the foreign exchange market, continuously innovate foreign exchange trading tools, and strengthen the research and development of new foreign exchange products while improving foreign exchange products such as spot, forward, options, and foreign exchange swaps, and make the foreign exchange market truly reflect the supply and demand of the market.

(2) Continuously improve the domestic investment and financing environment, strengthen the construction of relevant laws and regulations, such as the protection of creditor's rights, etc., and through a good policy environment, enhance the ability to attract foreign investment and hedge the risk of large-scale capital outflows caused by the Fed's interest rate hike.

(3) Improve the financial market system and enhance the ability to resist risks. Increase the proportion of the direct financing market, promote the development of the securities market, especially the corporate bond market, broaden corporate financing channels, increase the effectiveness of resource distribution, and provide support for the development of the real economy.

References

[1]. Liu, Y. (2023). The impact of RMB exchange rate changes on my country's current account balance and countermeasures. Overseas Investment and Export Credit, 2023(05), 3-7.

[2]. Tang, Z. (2023). Research on the determinants of RMB equilibrium exchange rate changes and their macroeconomic effects, East China Normal University.

[3]. Liu, X., Mu, X., Zhan, Q., et al. (2023). Analysis of the impact of RMB exchange rate fluctuations on China's export quality. Journal of Shandong Technology and Business University, 37(04), 34-44.

[4]. Jiang, Y. (2023). The impact of the Fed's monetary policy changes on the onshore RMB exchange rate, Shanghai University of Finance and Economics.

[5]. Zuo, X. (2022). RMB cross-border settlement, exchange rate fluctuations and monetary policy effectiveness. Statistics and Decision, 38(19), 145-149.

[6]. Wu, K. (2024). Research on the correlation between RMB exchange rate fluctuations against the US dollar and cross-border short-term capital flows between China and the United States, Shandong University of Finance and Economics.

[7]. Mo, J. (2023). Research on the impact of US quantitative easing monetary policy on Sino-US trade - empirical analysis based on SVAR model. China Market, (26), 54-57.

[8]. He, Z., & Li, W. (2023). China's monetary policy independence, exchange rate system and capital account openness. Shanghai Economic Research, (11), 71-88.

[9]. Yang, X. (2023). A historical study of China's monetary policy autonomy: from the perspective of the Federal Reserve's monetary policy cycle. World Economic Research, (06), 72-81+135.

[10]. Xie, Q. (2024). A study on the impact of the US dollar index on short-term cross-border capital flows, Harbin Normal University.

Cite this article

Ma,S. (2024). An Analysis on the Divergence of Monetary Policies Between China and the United States and Its Impact on the Trend of RMB Exchange Rate. Advances in Economics, Management and Political Sciences,103,42-51.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, Y. (2023). The impact of RMB exchange rate changes on my country's current account balance and countermeasures. Overseas Investment and Export Credit, 2023(05), 3-7.

[2]. Tang, Z. (2023). Research on the determinants of RMB equilibrium exchange rate changes and their macroeconomic effects, East China Normal University.

[3]. Liu, X., Mu, X., Zhan, Q., et al. (2023). Analysis of the impact of RMB exchange rate fluctuations on China's export quality. Journal of Shandong Technology and Business University, 37(04), 34-44.

[4]. Jiang, Y. (2023). The impact of the Fed's monetary policy changes on the onshore RMB exchange rate, Shanghai University of Finance and Economics.

[5]. Zuo, X. (2022). RMB cross-border settlement, exchange rate fluctuations and monetary policy effectiveness. Statistics and Decision, 38(19), 145-149.

[6]. Wu, K. (2024). Research on the correlation between RMB exchange rate fluctuations against the US dollar and cross-border short-term capital flows between China and the United States, Shandong University of Finance and Economics.

[7]. Mo, J. (2023). Research on the impact of US quantitative easing monetary policy on Sino-US trade - empirical analysis based on SVAR model. China Market, (26), 54-57.

[8]. He, Z., & Li, W. (2023). China's monetary policy independence, exchange rate system and capital account openness. Shanghai Economic Research, (11), 71-88.

[9]. Yang, X. (2023). A historical study of China's monetary policy autonomy: from the perspective of the Federal Reserve's monetary policy cycle. World Economic Research, (06), 72-81+135.

[10]. Xie, Q. (2024). A study on the impact of the US dollar index on short-term cross-border capital flows, Harbin Normal University.