1. Introduction

1.1. Background

In early 2024, the Chinese stock market experienced a significant upheaval. Starting from the first trading day of the new year (January 2), the Shanghai Composite Index fluctuated from an opening of 2973 points and fell to 2756 points by January 22. After a brief rebound over four trading days, the Shanghai Composite Index saw a more rapid decline starting from January 29, dropping from 2910 points to a low of 2702 points on February 5.

This sudden stock market crash struck a blow to the middle-class population and the majority of individual investors who represent the primary capital in the Chinese stock market.

Public opinion suggests that the fundamental cause of the stock market crash lies in the excessive emphasis on the financing function within the current Chinese stock market system. Due to relaxed listing qualifications and an imperfect delisting system, the securities market has been used as a platform for company directors to cash out or for poorly performing companies to solve short-term liquidity problems, neglecting the protection of individual investors' rights and the health stock market system. In addition, the question of whether going public can solve the long-term development dilemma for enterprises has become a hot topic.

1.2. Related Research

1.2.1. The motivations for the company's IPO proceed

The original academic theory believed that IPO was a part of the "life cycle" of a company, and going public at a certain stage of life reflected and expanded the company's value. However, going public is not a rule but a choice based on certain motivations [1]. Many well-known large enterprises such as Publix Super Markets, Cargill, and Deloitte have chosen not to go public to maintain a high percentage of ownership by major shareholders or for other reasons.

There are at least five motivations for IPO: Fixed asset investment, Working capital financing, Investment in shares of stock, Debt repayment, and Acquisition [2]. Research suggests that the purpose of an IPO is related to the company's operating conditions; IPOs for different purposes have different impacts on the company's operations [3].

Companies with higher sales growth, greater TPF (total factor productivity), and greater market share have more motivation to allocate IPO proceeds to Fixed asset investment [4]. Companies with relatively poor operating conditions are more likely to use IPO proceeds for Working capital financing and Debt repayment [5]. Other companies allocate IPO proceeds to Investment in shares of stock or Acquisition based on their respective business goals [6].

A study based on IPO data in Indonesia suggests that allocating IPO proceeds to fixed asset investment and stock investment intentions leads to improved operational performance, while other purposes may result in performance decline. Other purposes, such as working capital financing, may be related to uncertainty about future cash flows. Additionally, the advantages of investing in fixed assets and stocks apply only to average and high-performance companies [2].

Other studies suggest that using IPO proceeds to repay debt as a solution may reduce the motivation for businesses to undergo operational contraction and transformation, thereby further deteriorating the company's operating conditions [7].

1.2.2. The motivation for financial fraud in listed companies

There are mainly two theoretical explanations of financial fraud: the Fraud Triangle Theory and the Fraud Diamond Theory. The Fraud Triangle Theory was the earliest theory on fraud risk factors, summarizing fraud characteristics as a "triangle" containing Opportunity, Incentive, and Rationalization. However, this theory does not differentiate between internal and external factors influencing fraud, attributing major factors to the environment. In contrast, the Gone Theory focuses on the decision-making process of individuals in fraudulent behavior, emphasizing individual cognitive dissonance and moral decay while also considering external environmental factors. The Gone Theory identifies the factors of financial fraud as Greed, Opportunity, Need, and Exposure [8].

The fundamental reason for financial fraud in listed companies is the psychology of fraudsters pursuing individual utility maximization, namely "Greed". Whether management engages in fraud depends on the balance of costs and benefits of fraud, a process that is profoundly influenced by the actors' preferences for risk.

The "Opportunity" factor represents the perceived opportunity by the perpetrators to go undetected and evade punishment.

Fraudulent behavior is induced by the "Need". For listed companies, conveying optimistic information through financial statements to external information users is essential to gain market recognition (avoid delisting) and continuous widespread reinvestment (additional issuance, rights issue).

The "Exposure" factor consists of the probability of fraud being discovered and disclosed, as well as the punishment of the fraudsters [9].

An empirical study shows that based on the "Greed" factor, managers' risk preferences, the combination of the chairman and general manager roles, and the percentage of management holding shares are positively correlated with the likelihood of financial reporting fraud. Based on the "Opportunity" factor, the concentration of equity ownership, changes in chairman, related party transaction frequency, degree of related party transactions, and the likelihood of financial reporting fraud are positively correlated, while the number of shareholder meetings and the size of the board of supervisors are negatively correlated with the likelihood of financial reporting fraud. Based on the "Need" factor, a profit margin below 5% for listed companies is positively correlated with the likelihood of financial reporting fraud. Based on the "Exposure" factor, changing accounting firms, offline projects, and the likelihood of financial reporting fraud are positively correlated [10].

1.3. Objective

As mentioned above, previous research has delved deeply into the motivations behind corporate IPOs and financial fraud, but this research has not yet been integrated with institutional design, especially lacking examples from the Chinese stock market. Moreover, as China is an emerging market, its institutional development is still incomplete and requires improvement. Therefore, a listed company—Poten Enviro—has been selected for a comprehensive review of its development history, internal and external challenges, IPO process, financial irregularities, and other related behaviors. The question of whether IPOs should serve as a venue for financing for companies facing internal and external development difficulties and questionable profitability, and how the interests of shareholders can be better protected, will be explored.

2. Introduction of Poten Enviro

Poten Enviro, established in January 1995, is one of the earliest sewage treatment enterprises in the field of environmental protection in China. It was listed on the Shanghai Stock Exchange in February 2017, with the stock code 603603.

Overall, Poten Enviro's business involves the design, construction, operation, and maintenance of sewage treatment facilities, covering the entire industry chain of the sector.

Specifically, the company's main business is divided mainly into sewage environmental solutions, sewage investment and operation, and other business income depending on the product.

The main cooperative partners in the sewage environmental solutions business are mining and industrial private enterprises, and the project mode for industrial wastewater treatment is EPC (Engineering-Procurement-Construction). In this model, the company undertakes the design, procurement, and construction of sewage treatment facilities on behalf of the client company as per the contract, and revenue is determined when ownership of the treatment facility is transferred to the client company. The characteristic of this model is the clear delineation of contractual rights and responsibilities, with a long cost recovery period.

In terms of sewage investment and operation business, the company mainly collaborates with local governments, dealing with municipal sewage. The project mode is BOT (Build-Operate-Transfer). Clients sign a franchise agreement with Poten Enviro, whereby the franchise company is responsible for the investment, construction, operation, and maintenance of sewage treatment facilities. Within the agreed period, the company regularly collects fees from clients to recover project costs and obtain reasonable returns. After the franchise period ends, the client receives ownership of the sewage treatment facility at no cost. The characteristics of this model are significant project investment, a longer cost recovery period, and higher operational risks.

3. The Development Dilemma of Poten Enviro Before the IPO

3.1. The EPC Mode Period (2008-2013): From the Foundation of Rise to the Urgency of Transformation

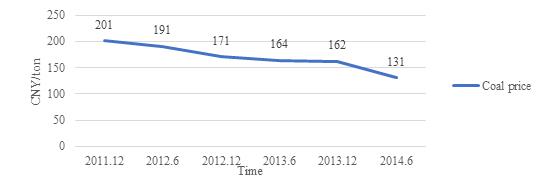

The early 21st century marked a rapid development phase for China's coal chemical industry. During this period, the severe water pollution problems caused by the rise of the coal chemical industry also sparked the emergence of the sewage treatment business. Poten Enviro seized the opportunity of the times and concentrated its business highly on the EPC model, with the coal chemical wastewater treatment business as its core. By concentrating technology and resources, the company's market share continued to rise, securing contracts from numerous large enterprises including Shenhua Group, and at its peak, occupying about seventy percent of the national market, becoming an industry giant (Fig. 1).

However, due to the impact of the transformation of the energy structure, coal prices fell, and the development of the coal chemical industry slowed down. Consequently, the coal chemical wastewater treatment field entered a bottleneck period, and the significant decline in revenue growth brought by Shenhua Group, a key high-end customer of Poten Enviro, urgently prompted Poten Enviro to seek new business growth points.

Figure 1: The fluctuation of coal prices between 2011.12 and 2014.6

Changes in the external environment had a significant impact on the company's operating cash flow. The decreased payment capability of customers in the industrial and energy sectors led to a rapid increase in the proportion of accounts receivable to income. However, at this time, Poten Enviro had already taken on a large number of orders, and there were significant project investment payments yet to be made. Therefore, Poten Enviro had to increase its financing scale, leading to a rise in leverage.

3.2. The BOT Mode Period (2014-2016): Seeking Quick Success and Instant Benefits Only to Make the Situation Worse

Facing the challenge of business contraction, Poten Enviro actively explored incremental markets, positioning growth points in PPP projects primarily focused on municipal sewage treatment. PPP (Public-Private Partnership) emerged in 2014 as a manifestation of the BOT mode. The characteristic of such projects is that the government, through tendering, contracts with social capital possessing investment, construction, operation, and management capabilities to provide public services, for which the government pays compensation to the social capital based on the performance evaluation of public services. However, unlike traditional BOT mode projects, in PPT contracts, the government holds far more bargaining power than traditional clients, and there is a lack of independent third-party supervision in the performance evaluation of social capital enterprises.

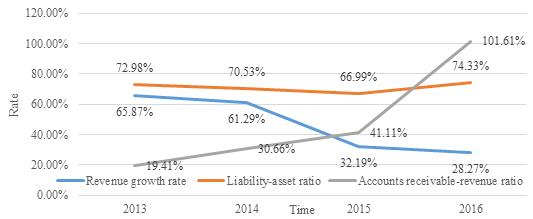

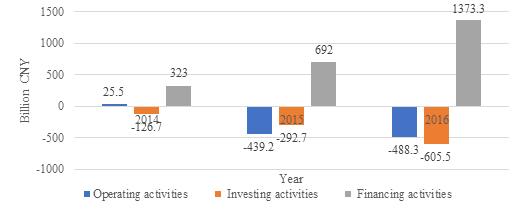

As shown in Fig.2 and Fig. 3, which can be seen that PPP projects, due to their relatively short emergence time, lack maturity and feasibility, and carry significant operational risks, especially given the project's excessively long and unpredictable financial return period, which does not align with Poten Enviro's already tight liquidity situation, it is not a suitable choice.

After the Chinese government announced the "Notice of the Ministry of Finance on Issues Related to Promoting the Application of Government and Social Capital Cooperation Models" in September 2014, Poten Enviro actively engaged in PPT projects, further increasing its leverage.

Figure 2: Highlighted Financial ratios of Poten

Figure 3: Net cash flow of Poten from 2014 to 2016

Also in the same year, Poten Enviro began the IPO process.

According to the theories cited in the preceding literature, the motivation behind Poten Enviro's IPO was debt repayment and working capital financing. Inferred from the information claimed in its official prospectus, the funds raised from the IPO would be utilized to repay the debts accumulated during the EPC mode phase and to increase investments in PPP projects (BOT mode).

However, at the end of 2014, the China Securities Regulatory Commission (CSRC) suspended the review of Poten Enviro's IPO, which dealt a significant blow to Poten Enviro, already deeply embroiled in a financial quagmire. According to the CSRC announcement, the reason for the failed listing was that the company's liability-asset ratio exceeded the "red line" (70%), reaching 72.98%.

4. After the IPO: Deterioration in Operations Leads to Financial Fraud

In February 2017, after another three years of effort, Poten Enviro finally achieved its goal of going public.

However, from 2014 to 2017, the net cash flow generated from operating and investing activities by Poten Enviro was primarily negative and continuously decreasing, indicating a significant funding gap for the company. In 2017, Poten Enviro raised approximately 270 million yuan through its issuance, with a net amount of 239 million yuan after deducting related expenses. The proceeds from this issuance did not fundamentally alleviate the company's funding needs.

On the other hand, as the company aggressively expanded into the PPP project sector after going public, the net cash flow generated from investing activities further declined, exacerbating the funding gap and necessitating continuous increases in financing scale. The company's ability to advance funds is highly demanded, significantly increasing Poten Enviro's risk of debt default.

From 2017 to 2018, the company pursued an extremely aggressive expansion strategy, undertaking numerous projects, particularly focusing on water investment and operation contracts, primarily operated under the BOT mode in PPP projects. This period highlights the company's emphasis on extensive bidding and expanding PPP projects, leading to a substantial increase in its capital requirements. Additionally, due to the nature of PPP projects, which primarily involve urban pollution control and public service provision, the company is unable to receive construction period income reimbursements from the ultimate project owners during the construction phase. Instead, it must advance construction funds, which are recouped through regular operational fee collection during the project operation period (typically 25-30 years) [11].

Poten Enviro's decisions were partly influenced by an incorrect assessment of the external environment. At the time, environmental protection was becoming a hot topic in Chinese society, coupled with government efforts to support the environmental protection industry, leading to particularly optimistic views among the company's leadership. Founder, Chairman, actual controller, and CEO Zhao Lijun expressed optimism during an interview in 2017, stating that Poten might have a market value of 100 billion in 2020 [12]. His prediction was based on the assumption that as social wealth increased, a significant amount of resources would shift from traditional industries such as housing to the environmental industry [13]. The validity of this assumption remains inconclusive, but the development prospects are not as smooth as anticipated.

Starting from 2017, the company's cash flow situation continued to deteriorate. Poor financial data led to a decline in the company's stock price. Financial fraud began from the first year of listing and continued for five years which can be inferred to be meant to hold the stock price.

According to the China Securities Regulatory Commission Beijing Regulatory Bureau's decision on market entry bans and announcements of stock delisting decisions, the annual reports disclosed by the company from 2017 to 2021 contained false records.

Poten Enviro's main methods of inflating operating income and profits include: first, failure to timely account for terminated equipment sales transactions and offsetting the receivables caused by inflated revenue through the signing of fraudulent entrusted payment agreements; second, failure to timely account for completed and settled projects and offsetting the receivables caused by inflated revenue through the signing of fraudulent entrusted payment agreements; third, using commercially insubstantial inspection and valuation certificates to confirm project progress, and concealing the situation of inflated revenue through the signing of fraudulent debt transfer agreements and entrusted payment agreements.

By early 2023, under regulatory pressure from the CSRC, the company disclosed an announcement regarding the correction of prior accounting errors and retrospective adjustments. Retrospective adjustments were made to the consolidated financial statements and the parent company's financial statements for the years 2017 to 2021 (Table 1). These accounting error corrections involved multiple accounting periods and significant amounts.

Table 1: Announced financial fraud of Poten from 2017 to 2021(in millions)

Year |

2017 |

2018 |

2019 |

2020 |

2021 |

Gross profit in financial reports |

166.98 |

224.05 |

-757.03 |

-415.05 |

-1436.03 |

Artificially inflated profit |

118.02 |

501.44 |

-106.06 |

-49.39 |

-249.44 |

Proportion of gross profit |

70.68% |

223.80% |

14.01% |

11.90% |

17.37% |

Seizing the opportunity, the CSRC formally initiated an investigation. After 8 months, the investigation results were released. The Beijing Regulatory Bureau issued a "Pre-notification of Administrative Penalties and Market Entry Bans" to Poten, confirming the long-standing financial fraud issues (Table 2).

Table 2: The analysis of Poten‘s financial fraud by Gone Theory

Greed |

The manager has high risk preferences Combined roles of Chairman and CEO A high proportion of managers stock ownership |

Opportunity |

High concentration of equity ownership The small scale of the supervisory board |

Need |

Unsatisfactory profits |

Exposure |

Change of auditor |

Through the analysis using Gone theory, a perspective on the internal and external environment of Poten’s financial fraud is provided. Poten Enviro can be speculated that, due to its highly unique internal structure with power highly concentrated in Zhao’s hands, was led down the wrong path under his ambition[11]. The lack of external oversight offers him the conditions to manipulate the capital market, even if his intention was indeed to save his company. And the ultimate downfall of the company was the painful price he paid.

5. Conclusion

Looking back at the history of Poten Enviro, adopting erroneous decisions during its developmental challenges ultimately led to financial fraud and downfall. From this case, we can derive three insights:

Proper analysis of external environmental changes: The environmental protection industry is not a conventional necessity-driven industry; its services are only needed in specific circumstances. Although there is a large market potential in the industry, the current expected cash flow heavily relies on policies and economic conditions, especially in emerging markets like China. Poten's incorrect estimation of the external environment led to blindly expanding policies, resulting in a significant decline in profits.

IPO should not be pursued blindly: instead, a company strategy should be formulated rationally: Going public is not a mandatory option for all large-scale enterprises. In pursuit of PPP project market share, Poten hastily initiated an IPO without considering its high leverage ratio and declining profit margins. However, the funds raised from the IPO were used for further project bidding, accelerating the consequences of unwise decisions.

Strengthen supervision of listed companies: A company like Poten Enviro, where the controlling shareholder, chairman, and CEO are the same person, concentrates power heavily in an individual’s hands. Even if it goes public, it is difficult for shareholders and the public to balance the company’s operations. Therefore, it is necessary to improve relevant regulations, strengthen the rights of independent directors and the supervisory board, prevent listed companies from acting against the interests of all shareholders, and create a financial market that better protects investors.

References

[1]. Fan P. A review of IPO motivation[J]. 2018.

[2]. Brau J C, Fawcett S E. Initial public offerings: An analysis of theory and practice[J]. The journal of Finance, 2006, 61(1): 399-436.

[3]. Andriansyah A, Messinis G. Intended use of IPO proceeds and firm performance: A quantile regression approach[J]. Pacific-Basin Finance Journal, 2016, 36: 14-30.

[4]. Chemmanur T J, He S, Nandy D K. The going-public decision and the product market[J]. The Review of Financial Studies, 2010, 23(5): 1855-1908.

[5]. Draho J. The IPO decision: Why and how companies go public[M]. Edward Elgar Publishing, 2004.

[6]. Celikyurt U, Sevilir M, Shivdasani A. Going public to acquire? The acquisition motive in IPOs[J]. Journal of Financial Economics, 2010, 96(3): 345-363.

[7]. Latham S, Braun M R. To IPO or not to IPO: Risks, uncertainty and the decision to go public[J]. British Journal of Management, 2010, 21(3): 666-683.

[8]. Mansor N, Abdullahi R. Fraud triangle theory and fraud diamond theory. Understanding the convergent and divergent for future research[J]. International Journal of Academic Research in Accounting, Finance and Management Science, 2015, 1(4): 38-45.

[9]. Jiangping Qin. Overview and Enlightenment on Foreign Research Related to Accounting Fraud of Listed Companies[J]. Accounting Research,2005,(06):69-74+96. (in Chinese)

[10]. Hong Hong, Huaxia Hu, Chunfei Guo. Research on the Identification of Listed Companies' Financial Reporting Fraud: Based on GONG Theory [J]. Accounting Research, 2012,(08):84-90+97. (in Chinese)

[11]. Xiaotong Yang. Analysis on Causes and Countermeasures ofDebt Default of Environmental Protection Enterprises-A Case Study of*ST Poten[D].Beijing Foreign Studies University,2024.DOI:10.26962/d.cnki.gbjwu.2023.000938. (in Chinese)

[12]. Wenjia Zhao. Lijun Zhao and his 100 biliions prediction of Poten[J].Talents Magazine,2017,(04):60-61. (in Chinese)

[13]. Jun Cao. Interview with Zhao Lijun, Chairman and CEO of Poten Enviro Group: Government support for industries or market support? [J]. Environmental Economy,2015,(01):23. (in Chinese)

Cite this article

Zhang,T. (2024). Relationship Between IPO and Company Development Based on the Case of Poten Enviro. Advances in Economics, Management and Political Sciences,103,100-107.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fan P. A review of IPO motivation[J]. 2018.

[2]. Brau J C, Fawcett S E. Initial public offerings: An analysis of theory and practice[J]. The journal of Finance, 2006, 61(1): 399-436.

[3]. Andriansyah A, Messinis G. Intended use of IPO proceeds and firm performance: A quantile regression approach[J]. Pacific-Basin Finance Journal, 2016, 36: 14-30.

[4]. Chemmanur T J, He S, Nandy D K. The going-public decision and the product market[J]. The Review of Financial Studies, 2010, 23(5): 1855-1908.

[5]. Draho J. The IPO decision: Why and how companies go public[M]. Edward Elgar Publishing, 2004.

[6]. Celikyurt U, Sevilir M, Shivdasani A. Going public to acquire? The acquisition motive in IPOs[J]. Journal of Financial Economics, 2010, 96(3): 345-363.

[7]. Latham S, Braun M R. To IPO or not to IPO: Risks, uncertainty and the decision to go public[J]. British Journal of Management, 2010, 21(3): 666-683.

[8]. Mansor N, Abdullahi R. Fraud triangle theory and fraud diamond theory. Understanding the convergent and divergent for future research[J]. International Journal of Academic Research in Accounting, Finance and Management Science, 2015, 1(4): 38-45.

[9]. Jiangping Qin. Overview and Enlightenment on Foreign Research Related to Accounting Fraud of Listed Companies[J]. Accounting Research,2005,(06):69-74+96. (in Chinese)

[10]. Hong Hong, Huaxia Hu, Chunfei Guo. Research on the Identification of Listed Companies' Financial Reporting Fraud: Based on GONG Theory [J]. Accounting Research, 2012,(08):84-90+97. (in Chinese)

[11]. Xiaotong Yang. Analysis on Causes and Countermeasures ofDebt Default of Environmental Protection Enterprises-A Case Study of*ST Poten[D].Beijing Foreign Studies University,2024.DOI:10.26962/d.cnki.gbjwu.2023.000938. (in Chinese)

[12]. Wenjia Zhao. Lijun Zhao and his 100 biliions prediction of Poten[J].Talents Magazine,2017,(04):60-61. (in Chinese)

[13]. Jun Cao. Interview with Zhao Lijun, Chairman and CEO of Poten Enviro Group: Government support for industries or market support? [J]. Environmental Economy,2015,(01):23. (in Chinese)