1. Introduction

In the current globalised economic context, environmental, social and governance (ESG) performance has become an essential indicator for assessing the overall competitiveness and sustainable development of enterprises. Especially in developed countries like the United States, where the transport industry is an essential pillar of the national economy, the impact of its ESG performance on the stock market is particularly significant. However, while the existing literature has studied the relationship between ESG performance and stock returns and volatility, there is little literature that systematically explores the impact of ESG performance on stock idiosyncratic volatility, especially in the specific application to the transport industry. This study aims to fill this research gap by exploring the impact of ESG performance on the stock idiosyncratic volatility of large U.S. transportation firms and its intrinsic mechanisms and providing firms with strategic recommendations for optimising ESG practices.

2. Literature Review

ESG (Environmental, Social and Governance) is a comprehensive assessment framework for measuring corporate performance in environmental protection, social responsibility fulfilment and corporate governance. Since its introduction by the United Nations Global Compact programme in 2004, the concept has become a necessary reference standard for global investment and corporate management.

It consists of three dimensions: Environment, Social Responsibility and Governance, with the Environment dimension focusing on a company's impact on the natural environment, including energy use, waste disposal, greenhouse gas emissions, water management and biodiversity conservation, etc. The Social dimension is concerned with a company's relationship with internal and external stakeholders, such as employee rights and benefits, labour standards, community involvement, consumer protection and supply chain management. The Governance dimension focuses on a company's management structure and operations, including corporate governance practices, board structure, shareholder rights, transparency, and anti-corruption and anti-bribery measures.

ESG performance not only reflects a firm's social responsibility but is also seen as an important indicator of its long-term financial performance and stock market performance.

Early studies focused on the relationship between ESG factors and corporate financial performance. Koundouri [1] believes that across all industries, companies with good ESG performance are significantly better in terms of profitability, this is true for both ROA and ROE.

As the research progressed, scholars began to focus on the impact of ESG factors on the performance of stocks in specific industries. Lee [2] found that ESG performance is positively related to the financial performance of the company through his study on real estate companies.

However, Fu[3] holds a different view and argues that ESG performance is significantly and negatively correlated with stock returns and volatility, implying that good ESG performance may provide investors with more non-financial information, which may affect the judgement of stock value. Liu [4] et al. further confirm that ESG performance significantly reduces stock idiosyncratic volatility through a study of A-share listed companies in China. Liu points out that this may be because ESG investments provide a more transparent information environment for the market, reducing firms' idiosyncratic risk.

A study by Duan[5], on the other hand, In terms of firm value, R&D investment intensity is found to negatively moderate the relationship between ESG performance and manufacturing firm value. Meanwhile, a heterogeneity study suggests that the beneficial effect of ESG performance on firm value is particularly pronounced in Eastern China, among non-state-owned firms, and among heavily polluting industrial firms. This study provides important practical implications for a range of stakeholders, including firms and investors.

In addition, the issue of ESG rating divergence has received academic attention. Brandon et al. [6] shows a positive correlation between ESG rating divergence and stock returns, suggesting that investors may need to demand higher risk premiums for companies with more significant ESG rating divergence.

In terms of investor values, the study by Raut et al. [7] states that investors' environmental concerns (altruistic values) and economic concerns (self-interested values) have a significant impact on attitudes and investment intentions towards ESG stocks. This suggests that investors consider not only financial returns but also a company's environmental and social responsibility performance when evaluating manufacturing stocks.

Collectively, these studies show that the impact of ESG factors on stock performance is a multidimensional issue that involves some aspects, such as firms' financial performance, stock liquidity, rating divergence, and investor values. Although these studies provide preliminary evidence for understanding the role of ESG factors in enhancing firms' market performance, ESG research on the specific area of the transport sector is still insufficient and lacks relevance.

The analysis reveals that Liu [4] et al. provide an important theoretical foundation for this paper as they find that ESG performance affects the stock trait volatility of listed companies by dampening management's incentives for surplus management and increasing analyst attention. This finding suggests that ESG performance may affect stock price volatility by improving disclosure quality and increasing market transparency. Furthermore, Tziovannis and Sarbaev's [8] study explores the potential of the ESG concept as a tool for optimising inventory management based on the case of a car service centre in the Republic of Cyprus, highlighting the application of ESG in the optimisation of transport business processes. This study not only broadens the scope of the application of ESG concepts in different industries but also provides this paper with a precedent for applying ESG concepts to the analysis of stock markets in the transport sector.

3. Methodology

In this study, this research explored the impact of ESG performance on the average return and standard deviation of transport sector stocks. The following steps and techniques were used to ensure the accuracy and reliability of the research methodology:

3.1. Data collection method

1. Selection of Sample Stocks: A random sampling method was used to randomly select seven stocks for the study based on the U.S. transport industry stocks. The selected transport stocks are Southwest Airlines Co, Alaska Air Group, Inc., Hawaiian Holdings, Inc., United Parcel Service, Inc., FedEx Corporation, J.B. Hunt Transport Services, Inc., and Landstar System.

2. data source: mean return, standard deviation, ESG disclosure scores, and performance scores of the selected stocks were collected using publicly available financial databases (e.g., Bloomberg, Thomson Reuters, etc.).

3. time horizon: stocks were selected for analysis from 2013-2023, 10 years of data to ensure data completeness and relevance.

3.2. Data analysis methods

1. Correlation analysis: Calculate the Pearson and Spearman correlation coefficients between ESG disclosure scores, performance scores, and average stock returns and standard deviations to determine the strength and direction of their correlations.

3. Regression analysis: construct multiple linear regression models to analyse the effects of ESG disclosure scores and performance scores on average stock returns and standard deviations, respectively. This research will use Python's `statsmodels` library for regression analysis to obtain regression coefficients and p-values.

Assessment of the choice of research methodology

The reasons for choosing the above research methodology are:

1. comprehensiveness: by combining correlation analysis and regression analysis, this research methodology can comprehensively assess the impact of ESG performance on stock returns and risks.

2. Flexibility: The use of Python for data processing and analysis not only allows for the handling of large amounts of data but also allows for the flexible use of various statistical and machine learning algorithms to improve the precision and efficiency of the study.

3. Transparency: By collecting data through publicly available databases and using open-source analysis tools, this research methodology ensures the transparency of the research process and the verifiability of the results.

The main purpose of adopting this methodology is to accurately identify the relationship between ESG performance and stock market performance, and to provide valuable input to investors and corporate management. By describing the data collection and analysis methodology in detail, this study aims to improve the reliability and applicability of the research, as well as provide a viable methodological framework for future research.

In summary, the methodology of this study ensures a comprehensive, accurate and transparent assessment of the impact of ESG performance on stock returns and risk in the manufacturing sector, providing a solid foundation for academic research and practical application in related fields.

4. Results

The following table is derived by collating the corresponding esg performance scores and disclosure scores, as well as the volatility and average returns for each stock.

Table 1: ESG Performance Score and Disclosure Score

E Score | S Score | G Score | ESG Disclosure | E Disclosure | S Disclosure | G Disclosure | Average Return | StDev | |

0 | 3.21 | 6.91 | 6.77 | 64.80 | 53.94 | 42.84 | 97.50 | 0.0915 | 0.3141 |

1 | 5.87 | 4.94 | 8.18 | 58.66 | 58.23 | 30.14 | 87.48 | 0.1755 | 0.3612 |

2 | 2.81 | 5.88 | 6.92 | 43.65 | 10.72 | 32.59 | 87.48 | 0.2597 | 0.5991 |

3 | 2.83 | 2.52 | 7.31 | 66.41 | 52.55 | 52.84 | 93.74 | 0.0984 | 0.2276 |

4 | 4.41 | 1.94 | 7.30 | 63.42 | 65.42 | 30.99 | 93.74 | 0.1048 | 0.2820 |

5 | 5.52 | 2.65 | 7.07 | 57.36 | 34.61 | 44.29 | 93.05 | 0.2012 | 0.2625 |

6 | 0.00 | 2.77 | 7.20 | 35.10 | 0.33 | 19.80 | 84.98 | 0.1522 | 0.2328 |

Table 2: Volatility and average return per stock

Pearson correlation coefficient (Average Return): | Pearson correlation coefficient (StDev): | |||||||

E Score 0.121169 | E Score 0.079195 | |||||||

s Score 0.219703 | s Score 0.629431 | |||||||

G Score 0.005357 | G Score -0.123624 | |||||||

ESG Disclosure -0.597265 | ESG Disclosure -0.313473 | |||||||

E Disclosure -0.607256 | E Disclosure -0.299413 | |||||||

S Disclosure -0.286862 | S Disclosure -0.195043 | |||||||

G Disclosure -0.612827 | G Disclosure -0.320133 | |||||||

dtype: float64 | dtype: float64 | |||||||

Spearman correlation coefficient (Average Return): | Spearman correlation coefficient (StDev): | |||||||

E Score 0.071429 | E Score 0.250000 | |||||||

S Score 0.107143 | S Score 0.642857 | |||||||

G Score -0.035714 | G Score -0.285714 | |||||||

ESG Disclosure -0.750000 | ESG Disclosure -0.214286 | |||||||

E Disclosure -0.428571 | E Disclosure 0.214286 | |||||||

S Disclosure -0.214286 | S Disclosure -0.285714 | |||||||

G Disclosure -0.709208 | G Disclosure -0.109109 | |||||||

dtype: float64 | dtype: float64 | |||||||

According to the results of Tables 1 and 2, it can be found that:

4.1. Average Return

4.1.1. Pearson's Correlation Coefficient

The correlation coefficients for the E, S, and G scores are very low, indicating that these scores are not significantly related to the average return of the stock. This could mean that ESG scores alone have a relatively limited impact on stock returns or are masked by other, stronger economic factors.

The correlation coefficients for ESG and each of the disclosures are significantly negative, especially for total ESG disclosure (-0.597265), suggesting that higher levels of transparency and disclosure may be perceived as a potential cost or risk in the marketplace, leading to lower average returns.

4.1.2. Spearman correlation coefficient

Similar to the Pearson correlation coefficient, ESG Disclosure has a very negative correlation (-0.750000), emphasising the tendency for the level of disclosure to be negatively correlated with average returns. This may indicate that a high disclosure level draws investors' attention to the potential risks of the firm and affects the valuation of the stock.

4.2. Stock Volatility

4.2.1. Pearson's correlation coefficient

S Score: Shows high positive correlation with volatility (0.629431), indicating that companies with high social responsibility performance may face greater market volatility, which may be related to high expectations and variability associated with social responsibility activities.

G Score: Negative correlation with volatility (-0.123624) may indicate that better governance helps to reduce stock price volatility.

The negative correlation of ESG disclosure and each disclosure with volatility suggests that a higher level of disclosure may reduce investor uncertainty and help stabilise the stock price.

4.2.2. Spearman's correlation coefficient

The same trend is confirmed in the Spearman correlation coefficients, especially the positive correlation between S-score and volatility (0.642857), again emphasising the high volatility association of social factors.

4.3. Comprehensive analysis

These data reveal several key points:

• ESG Scores and Average Returns: Lower correlations may indicate that ESG scores alone have a limited direct impact on stock returns, or that this impact is masked by other, stronger market or economic factors.

• ESG Disclosure and Average Returns: High levels of disclosure are often perceived by the market as potentially costly or risky, leading to lower average returns. This may be because high disclosure standards increase compliance and operational costs for companies, or because investors are reacting to the risks revealed in these disclosures.

• ESG scores and volatility: high volatility in S-scores may reflect the market's sensitivity to socially responsible performance, and good governance can help reduce volatility.

• ESG disclosure and volatility: high levels of disclosure reduce information asymmetry in the market and help reduce stock volatility, suggesting that transparency improves trust and stability in the market.

In summary, these analyses reveal the complex impact of ESG scores and disclosure on stock performance in the current market environment, highlighting the importance of transparency and accountability in investment decisions and how these factors influence investor behaviour and stock market volatility.

4.4. Regression Analysis

Using multiple linear regression models to analyse the impact of ESG disclosure scores and performance scores on average stock returns and standard deviation respectively.

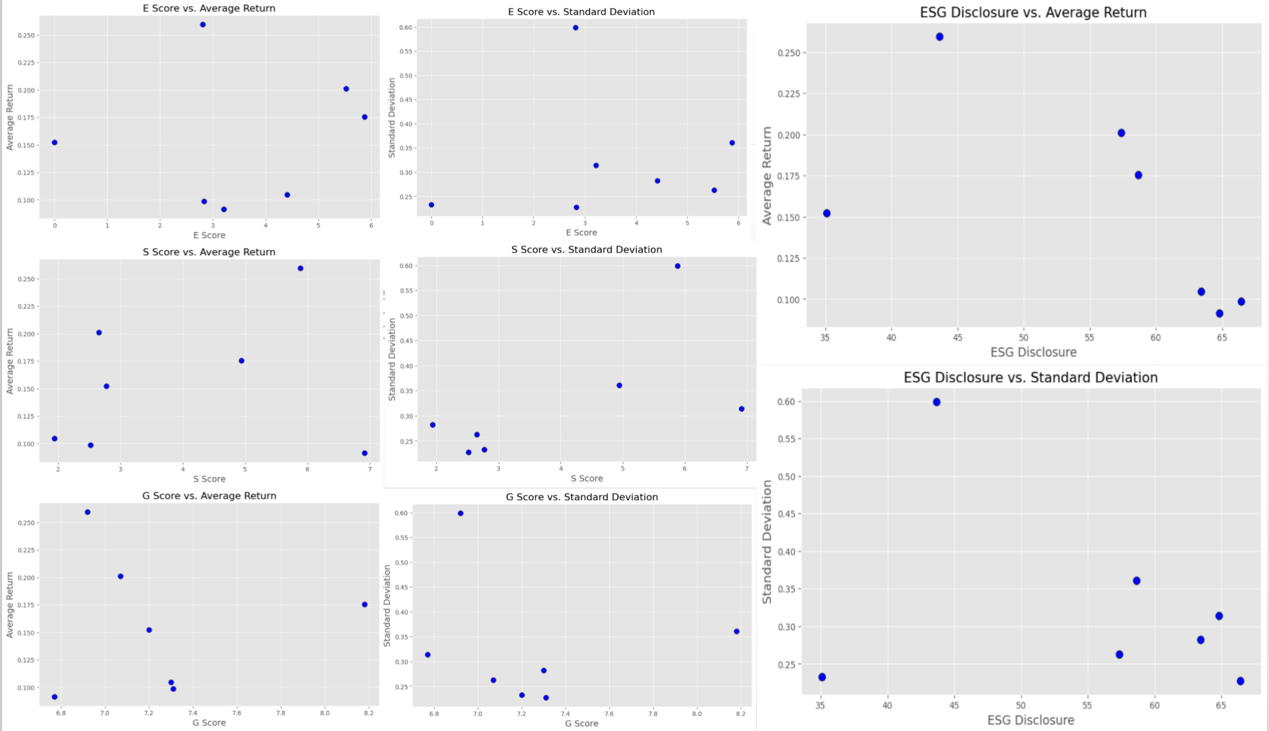

Figure 1: scatterplot: the impact of esg performance and disclosure on stock returns and volatility

Based on the Figure 1 scatterplot results, this research can get the following findings:

• Relationship of E-score to mean return and standard deviation: There seems to be a positive correlation with mean return, which suggests that the higher the E-score, the higher the return. The relationship with standard deviation is less obvious but may indicate that the higher the E-score, the higher the risk.

• Relationship of Social Score to Mean Return and Standard Deviation: The relationship of Social Score to Mean Return is not significant. The relationship between the Social Score and the Standard Deviation is also not significant, suggesting that the Social Score does not have a strong direct relationship with returns or volatility.

• Relationship of Governance Score with Mean Return and Standard Deviation: the relationship of Governance Score with Mean Return and Standard Deviation is more dispersed, and it is difficult to draw a clear conclusion.

• Relationship of ESG disclosure to mean return and standard deviation: It appears that more ESG disclosure is not consistent with higher mean returns. There appears to be a pattern where more disclosure is associated with lower mean returns. More disclosure is associated with a slight decrease in standard deviation, which may imply lower volatility.

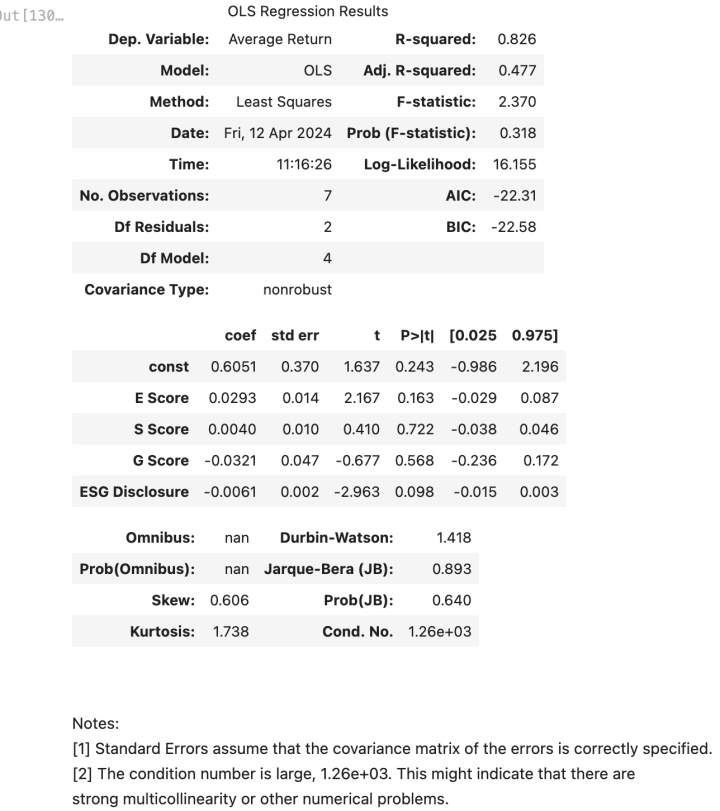

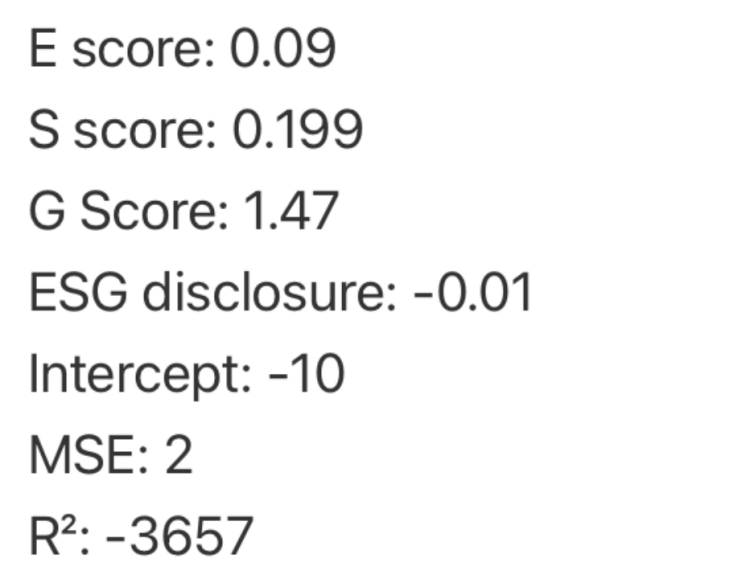

Model 1: ESG Disclosure Score + ESG Performance Score on Average Stock Returns

Figure 2: (Model 1 Average Return OLS Regression Results)

Based on the above regression results this research can get the following analysis (see figure 2):

In the regression coefficient:

• E score has a small positive coefficient (0.0293) indicating that higher environmental performance is associated with a slight increase in returns.

• S score has an even smaller positive coefficient (0.0040) indicating a negligible effect on returns.

• The negative coefficient (-0.0321) for the G score indicates that higher governance scores are associated with lower returns.

The coefficient on ESG disclosure is negative (-0.0061) indicating that higher levels of disclosure may slightly reduce returns.

Significance:

The relatively high p-values associated with these coefficients suggest that the predictions of these variables on average returns may not be statistically significant. However, this could also be due to the small number of observations (only 7) which limits the statistical power of the test.

R-squared: the value of R-squared is 0.826, which means that the model explains 82.6% of the variation in the dependent variable (average return). However, the adjusted R-squared is 0.477 which indicates that the model has weak explanatory power when considering the degrees of freedom.

Model Fit:

The F-statistic was not significant (p > 0.05), indicating that the model fit was not significantly better than the pure intercept model.

The Mean Squared Error of 0.125 is relatively low, indicating that the mean of the residuals (difference between observed and predicted values) is not significant.

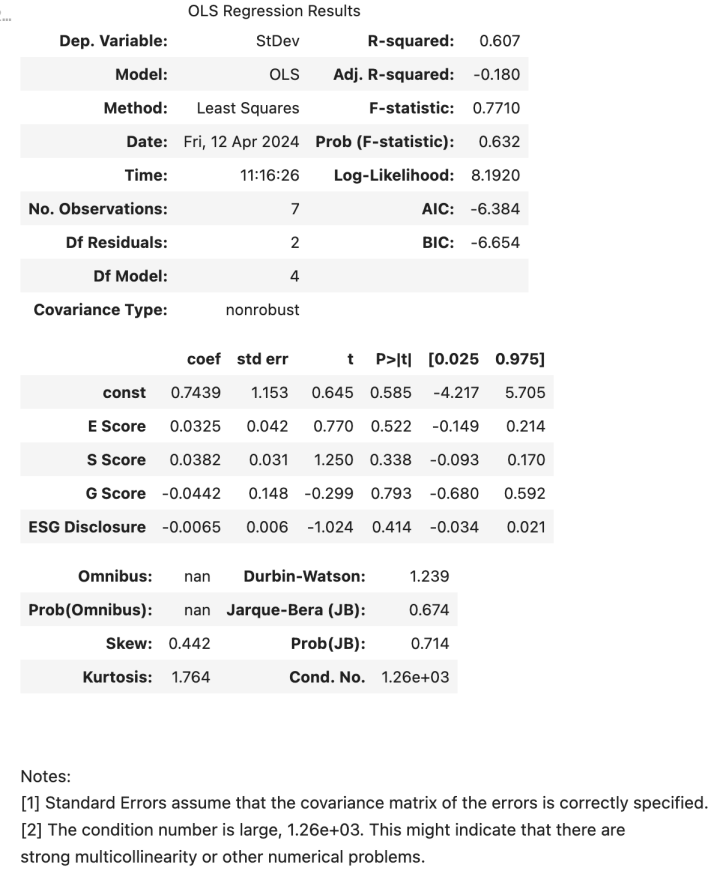

Model 2: ESG Disclosure Score + ESG Performance Score on Stock Standard Deviation

Figure 3: (Model 2 StDev OLS Regression Results)

Based on the figure3 data, this research can find that the regression coefficient for the E score is 0.0325, implying that for every unit increase in the E score, the volatility of the stock changes by 0.0325 units on average, but this result is not statistically significant due to the p-value of 0.522.

The regression coefficient for the S score is 0.0382, indicating that an increase in the S score has a positive correlation with an increase in the volatility of the stock, but again, this correlation is not significant due to the p-value of 0.338.

The regression coefficient for G score is -0.0442 indicating that an increase in G score has a negative correlation with a decrease in stock volatility, however, this correlation is also not significant (p-value of 0.793).

The regression coefficient for ESG disclosure is -0.0065, implying that higher levels of ESG disclosure may slightly reduce stock volatility, consistent with the negative correlation when analysed with mean return. This coefficient is close to being statistically significant (p-value of 0.414).

Intercept is 0.7439, which is the value of stock volatility predicted by the model when all explanatory variables have zero values.

The R-squared value of 0.607 indicates that the model explains 60.7% of the variation in stock volatility. However, the adjusted R-squared is -0.180 which indicates that the model has a weak explanatory power after adjusting for degrees of freedom.

The p-value for the F-statistic is 0.632, indicating that the model did not significantly outperform the baseline model without explanatory variables.

The mean square error (MSE)** of 0.125, which is the average of the squares of the model's prediction errors, is relatively low, indicating that the model's predictions deviate less from the actual values.

Summary

In summary, the complex picture of the impact of ESG (Environmental, Social, Governance) scores and disclosures on average stock returns and volatility in the transport sector is summarised below:

• The impact of ESG scores and average stock returns:

E scores show a slight positive correlation with average returns, but this relationship is not statistically significant.

The S score shows a moderate positive correlation, but also lacks statistical significance.

The G score shows an insignificant and statistically insignificant relationship with the average return.

• The effect of ESG disclosure and average stock return:

ESG disclosure shows a strong negative correlation with average return, implying that too much disclosure may have a negative impact on a firm's average return.

• The effect of ESG score and stock volatility:

The positive correlation between E score and volatility is weak and not statistically significant.

The positive correlation between S score and volatility was more pronounced but also did not reach statistical significance.

The negative correlation between G scores and volatility is again not significant.

• The effect of ESG disclosure and stock volatility:

Regression analyses of ESG disclosure suggest a possible slight reduction in stock volatility, although this finding is also not statistically significant.

Combining the results of the above analysis, companies should do the following to optimise their ESG strategies:

1. Enhance ESG performance and communication: firms should enhance their performance in environmental and social areas and communicate their achievements through moderate disclosure, avoiding the decline in investor confidence that may result from over-disclosure.

2. Prudent consideration of governance improvement: Governance scores show a slight negative correlation, albeit insignificant, with stock volatility, suggesting that enhanced governance may help stabilise market performance. Therefore, firms should consider reasonable improvements to their governance structure.

3. Data analysis and decision-making: Given the low statistical significance in the existing analyses, companies should be cautious and seek more data support when making ESG-based investment decisions.

4. Long-term strategic planning: Companies should not focus solely on the impact of ESG scores and disclosures on stock performance in the short term, but rather on long-term strategic value and reputation management, where the long-term benefits of ESG in terms of risk management and sustainability may be more important than short-term gains.

Finally, it is worth noting that ESG investments and performance are multivariate and dynamic, and companies should regularly assess the effectiveness of their ESG strategies and adjust to changes in the market and regulatory environment.

5. Discussion

This study examines the impact of ESG performance on the average return and volatility of U.S. transportation stocks. The results show that different dimensions of ESG performance have different impacts on stocks, revealing the trade-offs that investors may face when considering ESG information.

The relationship between environmental scores and average returns shows a slight positive correlation, which may indicate that investors are willing to pay a higher premium for environmentally performing companies, which is in line with the global trend of increased emphasis on sustainable practices. However, the relationship between environmental scores and stock volatility is not significant, perhaps reflecting uncertainty in the market about the impact of environmental performance.

The insignificant correlation of the social score with average stock returns and volatility may be because the role of social responsibility in investment decisions is relatively complex and is influenced by a variety of factors, such as a company's industry characteristics, geographic location, and the impact of social events.

The effect of governance scores on average return and volatility is also not significant, possibly because the direct impact of good or bad corporate governance structures and practices on investment returns is more limited, or because this impact is already well reflected in market pricing.

On the other hand, the level of ESG disclosure shows a significant negative correlation with the average returns and volatility, suggesting that highly transparent companies may be penalised for being perceived by the market as taking on more risk. However, such disclosure may also contribute to lower volatility as investors gain a better understanding of a company's operations and risks.

Therefore, based on the complex picture of the impact of the application of ESG performance in the transport sector on stock performance. Investors and company management should recognise that improved ESG scores do not necessarily translate directly into positive stock market returns, especially in the short term. However, good ESG disclosure may help to reduce the information asymmetry and corporate risk premium faced by investors.

For transport companies, recommendations should focus on enhancing environmental and social performance while ensuring that governance structures are in line with best practices. Firms should also disclose ESG-related information in a prudent manner to ensure that the quality and quantity of disclosure balances the needs of investors with the long-term value creation of the firm.

Taken together, the above discussion of the relationship between ESG performance and stock performance suggests that investors and company managers need to consider the role of ESG factors in investment decisions in a more nuanced and comprehensive manner. As for transport companies, the implementation of effective ESG strategies not only helps to improve stock market performance, but also demonstrates their social responsibility and long-term sustainability.

6. Conclusion

This study reveals the relationship between ESG dimensions and average stock returns and volatility through an in-depth examination of the impact of ESG performance in the U.S. transportation stock market. The study finds:

1. Environmental score (E): there is a slight positive correlation with average stock returns, suggesting that the market may positively evaluate companies with high environmental performance, but this effect is not statistically significant and further research is needed to confirm it.

2. Social Score (S): the effect on average return and volatility is not significant, suggesting that the importance of social responsibility in investment decisions may be offset by other factors or not valued by the market.

3. Governance Score (G): the effect is also not significant, which may imply that the market has adequately considered the quality of corporate governance in pricing.

4. Level of ESG disclosure: shows a significant negative correlation with average return, suggesting that excessive disclosure may lead to investor concerns about potential risks of the company, which in turn affects the evaluation and performance of the stock. However, the negative correlation between high levels of ESG disclosure and volatility also points to the fact that better information transparency can help reduce stock uncertainty.

Based on these findings, this research recommends that companies in the transport sector should consider the potential impact on stock performance when advancing ESG practices. While improving environmental and social performance, they should maintain an appropriate level of disclosure to avoid the potential negative impact of too much disclosure. In addition, as the relationship between governance scores and stock performance is insignificant, firms should consider how to effectively improve their corporate governance structure without compromising operational efficiency.

Due to the limited sample size and the confinement of this study to a specific region and time frame, its findings may not apply to other markets or industries. Therefore, it is recommended that future research should include a wider sample that considers the characteristics of different regions and diverse industries to verify the generalisability and robustness of these preliminary findings. Meanwhile, attention should be paid to the long-term impact of ESG performance, especially how it has indirect effects on stock performance through improved risk management and enhanced corporate reputation.

In summary, although this study reveals the impact of ESG performance on stock characteristics in the transport sector, more empirical research is needed to deepen our understanding and provide firms with clearer strategic directions. In this era of increasing focus on sustainability, effective ESG practices have become a key factor for firms to attract investment and remain competitive. This paper provides a more comprehensive framework for understanding the impact of ESG performance on stock idiosyncratic volatility, particularly in the specific area of the transport sector. It not only enriches the theoretical foundation of ESG research, but also provides an empirical basis for corporate practice and policy formulation.

References

[1]. Koundouri, Phoebe, Nikitas Pittis, and Angelos Plataniotis. 2022. "The Impact of ESG Performance on the Financial Performance of European Area Companies: An Empirical Examination" Environmental Sciences Proceedings 15, no. 1: 13. https://doi.org/10.3390/environsciproc2022015013

[2]. Lee, C. L., & Liang, J. (2024). The effect of carbon regulation initiatives on corporate ESG performance in real estate sector: International evidence. Journal of Cleaner Production, 453, 142188. https://doi.org/10.1016/j.jclepro.2024.142188

[3]. Fu, J., et al. (2024). ESG performance and stock returns: An empirical analysis. *Journal Name*, *Volume*(Issue), Page Numbers.

[4]. Liu, D., Gu, K., & Hu, W. (2023). ESG performance and stock idiosyncratic volatility. *Finance Research Letters*, 58, 104393. https://doi.org/10.1016/j.frl.2023.104393

[5]. Duan, Y., Yang, F., & Xiong, L. (2023). Environmental, social, and governance (ESG) performance and firm value: Evidence from chinese manufacturing firms. Sustainability, 15(17), 12858. https://doi.org/10.3390/su151712858

[6]. Gibson Brandon, R., Krueger, P., & Schmidt, P. S. (2021). ESG rating disagreement and stock returns. Financial Analysts Journal, 77(4), 104-127. https://doi.org/10.1080/0015198X.2021.1963186

[7]. Raut, R. K., Shastri, N., Mishra, A. K., & Tiwari, A. K. (2023). Investor’s values and investment decision towards ESG stocks. Review of Accounting & Finance, 22(4), 449-465. https://doi.org/10.1108/RAF-12-2022-0353

[8]. Tzιovannis, S., & Sarbaev, V. (2023). ESG concept as a tool for optimising spare parts stocks in car service centres in the Republic of Cyprus. *E3S Web of Conferences*, 402, 10001. https://doi.org/10.1051/e3sconf/202340210001

Cite this article

Huang,Z. (2024). The Impact of ESG Performance on Equities: The Case of the US Transport . Advances in Economics, Management and Political Sciences,124,170-182.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Koundouri, Phoebe, Nikitas Pittis, and Angelos Plataniotis. 2022. "The Impact of ESG Performance on the Financial Performance of European Area Companies: An Empirical Examination" Environmental Sciences Proceedings 15, no. 1: 13. https://doi.org/10.3390/environsciproc2022015013

[2]. Lee, C. L., & Liang, J. (2024). The effect of carbon regulation initiatives on corporate ESG performance in real estate sector: International evidence. Journal of Cleaner Production, 453, 142188. https://doi.org/10.1016/j.jclepro.2024.142188

[3]. Fu, J., et al. (2024). ESG performance and stock returns: An empirical analysis. *Journal Name*, *Volume*(Issue), Page Numbers.

[4]. Liu, D., Gu, K., & Hu, W. (2023). ESG performance and stock idiosyncratic volatility. *Finance Research Letters*, 58, 104393. https://doi.org/10.1016/j.frl.2023.104393

[5]. Duan, Y., Yang, F., & Xiong, L. (2023). Environmental, social, and governance (ESG) performance and firm value: Evidence from chinese manufacturing firms. Sustainability, 15(17), 12858. https://doi.org/10.3390/su151712858

[6]. Gibson Brandon, R., Krueger, P., & Schmidt, P. S. (2021). ESG rating disagreement and stock returns. Financial Analysts Journal, 77(4), 104-127. https://doi.org/10.1080/0015198X.2021.1963186

[7]. Raut, R. K., Shastri, N., Mishra, A. K., & Tiwari, A. K. (2023). Investor’s values and investment decision towards ESG stocks. Review of Accounting & Finance, 22(4), 449-465. https://doi.org/10.1108/RAF-12-2022-0353

[8]. Tzιovannis, S., & Sarbaev, V. (2023). ESG concept as a tool for optimising spare parts stocks in car service centres in the Republic of Cyprus. *E3S Web of Conferences*, 402, 10001. https://doi.org/10.1051/e3sconf/202340210001