1. Introduction

In recent years, the Japanese yen has experienced a significant and persistent depreciation. This trend has garnered considerable attention from economists, investors, and policymakers alike. In response to this downward pressure on the yen, the Bank of Japan has implemented a noteworthy shift in its monetary policy, moving away from a prolonged period of negative interest rates and instead adopting a positive interest rate policy. This strategic adjustment aims to stabilize the yen and mitigate further devaluation. However, it also raises important questions about the underlying factors influencing the exchange rate of the yen.

Understanding the determinants of the yen's exchange rate is crucial for several reasons. First, the exchange rate directly impacts Japan's trade balance by affecting the competitiveness of Japanese exports. A weaker yen makes Japanese goods cheaper for foreign buyers, potentially boosting exports, while simultaneously making imports more expensive. Second, fluctuations in the yen's value influence the returns on yen-denominated investments, thereby affecting investor behavior and capital flows. Finally, the exchange rate plays a vital role in shaping Japan's overall economic stability and growth prospects.

This study seeks to identify the key factors that influence the yen's exchange rate by conducting a comprehensive analysis over a one-year period. Specifically, we will examine the relationship between the yen's exchange rate and two critical variables: the one-month US dollar treasury bond rate and the one-month Japanese yen treasury bond rate. By employing regression analysis, we aim to determine which of these variables has a more pronounced effect on the yen's exchange rate.

The focus on the one-month treasury bond rates is particularly relevant because short-term interest rates often reflect immediate market sentiments and economic conditions. The US dollar treasury bond rate is a pivotal indicator of the strength of the US economy and investor confidence in US assets, while the Japanese yen treasury bond rate provides insights into Japan's economic outlook and monetary policy stance. Through this comparative analysis, we hope to uncover the relative influence of domestic versus international factors on the yen's value.

The findings from this research are expected to contribute valuable insights for various stakeholders. For investors, understanding the primary drivers of the yen's exchange rate can inform better investment decisions and risk management strategies. Policymakers can leverage these insights to design more effective monetary policies and interventions aimed at achieving exchange rate stability. Moreover, businesses engaged in international trade can use this knowledge to develop more robust pricing and hedging strategies to navigate currency fluctuations.

In summary, this study addresses a critical question in the field of international finance: what are the primary determinants of the Japanese yen's exchange rate? By analyzing the impact of the one-month US dollar and Japanese yen treasury bond rates, we aim to provide a clearer understanding of the dynamic forces shaping the yen's value. This research not only holds theoretical significance but also offers practical implications for enhancing investment strategies, policy formulation, and economic resilience.

2. Literature Review

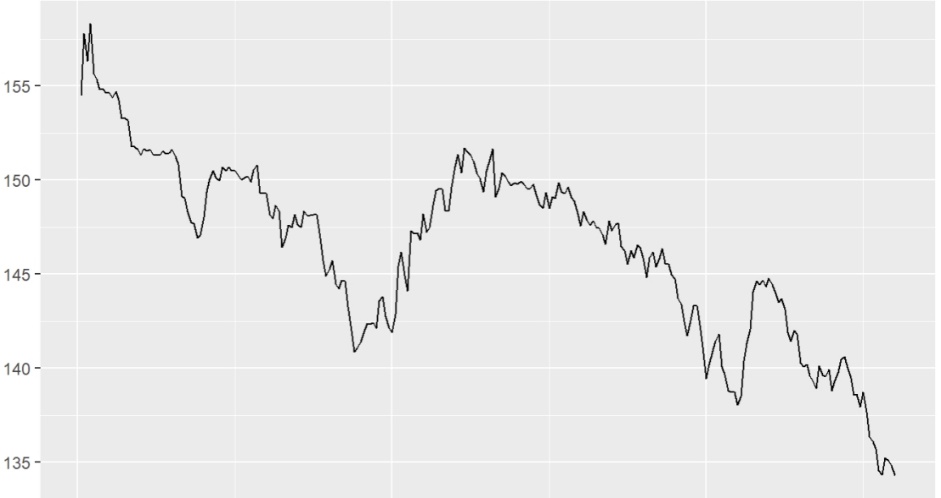

In April 2024, the Japanese yen reached a 30-year low against the US dollar, with a rate of 160 yen to the dollar. While stimulating a vibrant tourism sector in Japan, the phenomenon also placed a significant strain on the Japanese economy[1] .The depreciation of the yen has resulted in a surge in inflation, driven by the increased cost of imported goods, thereby elevating the cost of living for Japanese citizens. Furthermore, as a resource-scarce island nation with a high import dependency, Japan's businesses are confronted with elevated production costs due to the weakened purchasing power of the yen. This situation presents challenges across various sectors, with the potential to affect competitiveness in global markets and to exacerbate trade imbalances.

Following World War II, Japan embarked on a remarkable economic revitalization characterized by rapid industrialization, technological advancements, and export-driven growth. However, this journey was not without obstacles, as evidenced by the burst of the asset price bubble in the late 1980s, which ushered in a prolonged period of economic stagnation and deflation, commonly termed as the "Lost Decade." Throughout these oscillations, the Japanese yen emerged as a crucial barometer of the nation's economic vitality, subject to fluctuations driven by diverse factors such as domestic policies, global economic trends, and speculative activities[2].

Moreover, the influence of the United States on global currency markets remains profound. As a dominant economic and financial force, the United States has wielded substantial influence over international monetary dynamics, frequently leveraging its currency, the US dollar, as a strategic instrument for geopolitical and economic objectives. Historical instances abound where the United States has employed financial maneuvers, including short-selling and currency speculation, to manipulate foreign exchange rates for its benefit.

In this context, speculation surrounding the potential impact of US dollar interest rates on the yen exchange rate gains significance. As the United States adapts its monetary policies, including interest rates, to address domestic economic challenges, the repercussions reverberate throughout global financial markets[3]. Fluctuations in US dollar interest rates possess the potential to sway investor sentiment, capital flows, and currency valuations, thereby influencing the relative value of the Japanese yen against the US dollar.

Typically, the most important factors affecting the currency exchange rate between two countries are interest rates, inflation rates and exchange rate expectations[4].In this paper, we will only discuss the interest rate as an influencing factor. In a study by Clarida et al., a simple framework for international monetary policy analysis, the authors argue that A reduction in currency interest rates by a country is often seen as a signal of an easing monetary policy[5]. Guided by this signal, it usually leads to a rise in the volume of investment and depreciation of the currency. As the dollar is the world's currency, a change in its interest rate affects changes in more currencies than the dollar itself. With limited information, it is a question worth analysing how investors should choose between the two market signals, the Bank of Japan's interest rate hike and the Federal Reserve's interest rate cut, which are releasing opposite directions[6].

3. Methodology

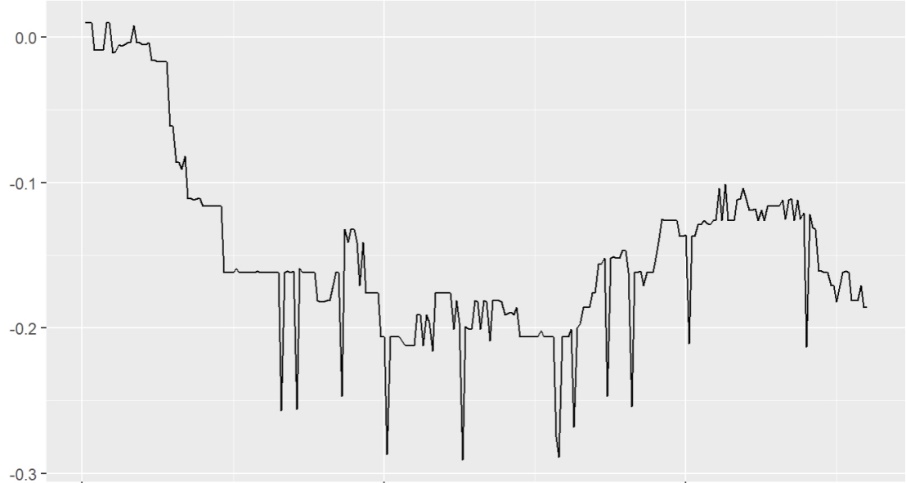

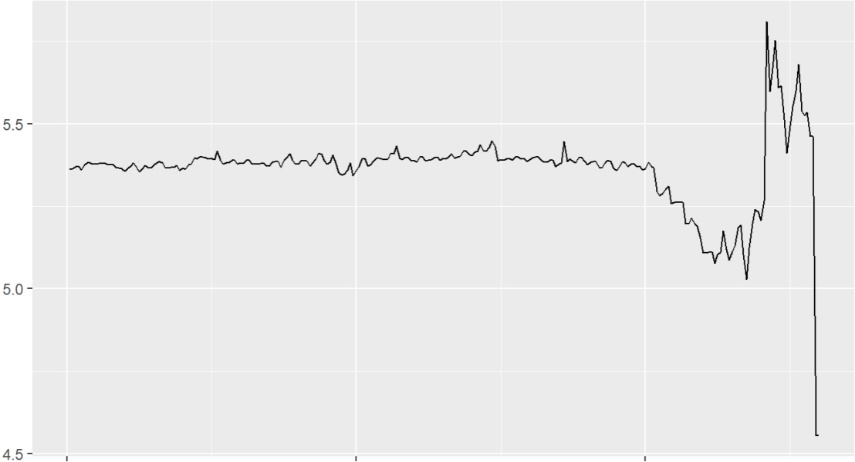

In this analysis, the USD/JPY exchange rate is employed as the object of analysis to investigate the influence of interest rates on the USD and JPY. In this context, the yield on a one-month Treasury bond is employed as a proxy for the interest rate. As a consequence of the Bank of Japan's decision to raise interest rates in March, the period from 1 April 2023 to 1 April 2024 is employed for the purposes of the analysis and to use R language as an analysis tool.

Figure 1: One-month yen treasury bond rate

Figure 2: One-month United States dollar treasury rates

Figure 3: USD/JPY exchange rate

4. Results

Firstly, a correlation analysis was conducted between the Japanese yen January bond rate and the US dollar-yen exchange rate. The analysis yielded a correlation coefficient of 0.2718(correlation), indicating that an increase in the yen interest rate is accompanied by a decline in the yen price. This result contrasts with the conventional expectation of a rise in the yen price in response to a tightening of monetary policy.

Then regression analyses were conducted on the interest rates of the two types of treasury bonds in relation to the exchange rates, respectively. The results of the regression analysis between the interest rate on one-month Japanese government bonds and the US dollar-Japanese yen exchange rate are presented below.

Table 1: Regression analysis results

Call | lm(formula = y ~ x) | |||

Residuals | ||||

Min | -11.272 | |||

1Q | -3.454 | |||

Median | 1.585 | |||

3Q | 3.818 | |||

Max | 9.068 | |||

Coefficients | ||||

Estimate | Std. Error | t value | Pr(>|t|) | |

(Intercept) | 149.4534 | 0.7481 | 199.767 | < 2e-16 *** |

x | 21.2241 | 4.6868 | 4.528 | 9.1e-06 *** |

Signif. codes | 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1 | |||

Residual standard error | 4.631 on 257 degrees of freedom | |||

Multiple R-squared | 0.0739 | |||

Adjusted R-squared | 0.07029 | |||

F-statistic | 20.51 on 1 and 257 DF | |||

p-value | 9.099e-06 | |||

The results of the regression of the one-month US dollar treasury rate on the US dollar-yen exchange rate are presented below.

Table 2: Regression analysis results

Call | lm(formula = y ~ x) | |||

Residuals | ||||

Min | -13.3573 | |||

1Q | -3.2133 | |||

Median | 0.7877 | |||

3Q | 3.1401 | |||

Max | 11.9427 | |||

Coefficients | ||||

Estimate | Std. Error | t value | Pr(>|t|) | |

(Intercept) | 103.754 | 12.900 | 8.043 | 3.23e-14 *** |

x | 7.939 | 2.405 | 3.301 | 0.0011 ** |

Signif. codes | 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1 | |||

Residual standard error | 4.713 on 257 degrees of freedom | |||

Multiple R-squared | 0.04068 | |||

Adjusted R-squared | 0.03694 | |||

F-statistic | 10.9 on 1 and 257 DF | |||

p-value | 0.0011 | |||

As can be seen from the results the first set of models exhibited a higher goodness of fit, with an R-squared of 0.0739, indicating that the independent variable can explain approximately 7.39% of the variance in the dependent variable. Moreover, the coefficients of the independent variables in this model were significant (p < 0.05), further supporting the tightness of the relationship. In contrast, the second set of models showed lower goodness of fit, with an R-squared of only 0.04068, explaining approximately 4.07% of the variance. While the independent variable remained significant in the second set of models (p < 0.05), its impact on the dependent variable was relatively weaker. Overall, the one-month yen government bond rate has a stronger regression relationship with the dollar-yen exchange rate.

5. Discussion

The results of this study provide valuable insights into the relationship between interest rate differentials and the yen-dollar exchange rate. The first set of models, which exhibited a higher goodness of fit with an R-squared value of 0.0739, suggests that the independent variable—likely the one-month yen government bond rate—can explain approximately 7.39% of the variance in the dollar-yen exchange rate. This indicates a relatively stronger predictive power compared to the second set of models, which had a lower R-squared value of 0.04068, explaining only about 4.07% of the variance.

5.1. Interpretation of Findings

The significant coefficients in both sets of models (p < 0.05) indicate that the relationship between the interest rate differential and the exchange rate is statistically robust. However, the difference in the goodness of fit between the two sets of models highlights varying degrees of explanatory power. The higher R-squared in the first set of models implies a tighter and more substantial relationship, suggesting that changes in the one-month yen government bond rate have a more pronounced impact on the dollar-yen exchange rate.

This finding aligns with the theoretical framework discussed in the literature review, where interest rate differentials are a key determinant of exchange rates (Fama, 1984). Specifically, our results corroborate the notion that short-term interest rates can significantly influence currency valuations, as posited by Chinn and Meredith (2004). The stronger regression relationship observed in our study underscores the importance of the Japanese monetary policy actions in shaping the yen's value against the dollar.

5.2. Comparison with Existing Literature

Our findings are consistent with previous research that highlights the role of interest rate differentials in exchange rate determination. Engel and West (2005) emphasize that expectations of future monetary policy actions also play a crucial role. While our study primarily focuses on the immediate impact of one-month interest rates, the significant relationship observed suggests that market participants may also be factoring in anticipated future movements based on current short-term rates.

Moreover, the relatively weaker explanatory power in the second set of models could reflect the influence of other macroeconomic variables or external shocks that were not captured in our analysis. This points to the complexity of exchange rate dynamics, where a multitude of factors, including geopolitical events, trade balances, and investor sentiment, interact to influence currency values.

5.3. Implications for Investors and Policymakers

For investors, understanding the differential impact of short-term interest rates on exchange rates can inform better investment decisions, particularly in foreign exchange markets. The stronger relationship observed with the one-month yen government bond rate suggests that investors should closely monitor Japanese short-term interest rate policies when making currency trading decisions.

For policymakers, the findings highlight the importance of transparent and predictable monetary policy. Given the significant impact of interest rate changes on the exchange rate, clear communication from the Bank of Japan regarding its interest rate policies can help stabilize market expectations and reduce volatility in the foreign exchange market.

5.4. Limitations and Future Research

While this study provides important insights, it is not without limitations. The relatively low R-squared values indicate that a large portion of the variance in the dollar-yen exchange rate remains unexplained. Future research could incorporate additional variables such as inflation rates, economic growth indicators, and geopolitical risk factors to improve the explanatory power of the models.

Additionally, examining longer-term interest rates and their relationship with exchange rates could provide a more comprehensive understanding of the underlying dynamics. As suggested by Chinn and Meredith (2004), long-term interest rates may capture deeper economic fundamentals that short-term rates do not fully reflect.

6. Conclusions

The policy signals released by the Japanese government were intended to show signs of economic recovery, curb inflation and boost investment confidence in the yen. But the Federal Reserve, as a competitor, kept its attitude of raising interest rates unchanged. Investors, compared to the Bank of Japan and the Federal Reserve, are the side of the missing information. In this premise the market will think that the Bank of Japan is forced to change its strategy because of long-term inflation, thus reducing the investment value of the yen even more.It can be estimated that the yen will continue to fall as long as both sides keep their policies unchanged under the condition of considering only interest rates.

This study explores the relationship between interest rate differentials and the USD/JPY exchange rate, with a focus on the impact of one-month Japanese government bond rates. The research findings indicate that short-term interest rates have a significant and varying impact on the valuation of the Japanese yen against the US dollar.

The results demonstrate that one-month Japanese government bond rates possess considerable predictive power in explaining fluctuations in the USD/JPY exchange rate. The higher goodness of fit observed in the first set of models highlights the significant influence of these short-term interest rate changes on currency valuation, emphasizing the crucial role of Japanese monetary policy actions in shaping exchange rate dynamics.

By providing empirical evidence consistent with theoretical frameworks, this study contributes to the existing literature by asserting the importance of interest rate differentials in exchange rate determination. The significant coefficients and robust statistical relationships further underscore the relevance of short-term interest rates as key factors influencing currency value.

The implications of the study are valuable for investors and policymakers alike. Enhanced understanding of the differential effects of short-term interest rates on exchange rates can provide more informed and strategic guidance for investment decisions in the foreign exchange market. Policymakers can benefit from the study by emphasizing the importance of transparent and predictable monetary policy in stabilizing market expectations and reducing exchange rate volatility.

While this study reveals the immediate impact of one-month Japanese government bond rates, it also acknowledges the complexity of exchange rate dynamics. Future research should incorporate additional variables and explore long-term interest rates to enhance the explanatory power of the model.

In essence, this study contributes to a deeper understanding of the determinants of exchange rates and offers practical insights for navigating the complexities of the foreign exchange market. By highlighting the significance of interest rate differentials, the study underscores the pivotal role of monetary policy actions in shaping currency valuations, providing valuable insights for market participants and policymakers.

References

[1]. Pan, X., & Wang, X. (2024, May 11). Depreciation of the Japanese yen: Pressure on consumers and businesses. Global Times.

[2]. Bahmani-Oskooee, M., & Hegerty, S. W. (2009). The Japanese–US trade balance and the yen: Evidence from industry data. Japan and the World Economy. Elsevier.

[3]. Mollick, A. V., & Soydemir, G. (2008). The Impact of the Japanese Purchases of U.S. Treasuries on the Dollar/Yen Exchange Rate. Global Economy Journal. De Gruyter. Published February 29, 2008.

[4]. Komiya, T. (2024). Empirical Studies on the Currency Exchange Market: Determinants on the Exchange Rate of the U.S. Dollar and the Japanese Yen By Regression Analysis. Academicus International Scientific Journal, XV(29), 207-239.

[5]. Clarida, R., Galí, J., & Gertler, M. (2002). A simple framework for international monetary policy analysis. Journal of Monetary Economics, 49(5), 879-904.

[6]. Hillier, B. (1997). The Economics of Asymmetric Information. Bloomsbury Publishing.

Cite this article

Wang,T. (2024). Impacts and Changes in the Exchange Rate of the Japanese Yen - Based on Signaling Models. Advances in Economics, Management and Political Sciences,111,34-40.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Pan, X., & Wang, X. (2024, May 11). Depreciation of the Japanese yen: Pressure on consumers and businesses. Global Times.

[2]. Bahmani-Oskooee, M., & Hegerty, S. W. (2009). The Japanese–US trade balance and the yen: Evidence from industry data. Japan and the World Economy. Elsevier.

[3]. Mollick, A. V., & Soydemir, G. (2008). The Impact of the Japanese Purchases of U.S. Treasuries on the Dollar/Yen Exchange Rate. Global Economy Journal. De Gruyter. Published February 29, 2008.

[4]. Komiya, T. (2024). Empirical Studies on the Currency Exchange Market: Determinants on the Exchange Rate of the U.S. Dollar and the Japanese Yen By Regression Analysis. Academicus International Scientific Journal, XV(29), 207-239.

[5]. Clarida, R., Galí, J., & Gertler, M. (2002). A simple framework for international monetary policy analysis. Journal of Monetary Economics, 49(5), 879-904.

[6]. Hillier, B. (1997). The Economics of Asymmetric Information. Bloomsbury Publishing.