1. Introduction

With the development of internet technology and the increasing demand for optimized allocation of social resources, the sharing economy has gradually emerged as an economic model. Its core concept is to improve resource utilization and reduce waste by sharing idle resources, thereby achieving a win-win situation for both economic and social benefits. However, the essence of the sharing economy is not traditional "sharing" transactions. Instead, the sharing economy should be referred to as "pseudo-sharing" (practices masquerading as sharing). According to Ernst & Young LLP, "The sharing economy is a socioeconomic ecosystem established around the sharing of human and physical resources. It includes the shared creative activity, production, distribution, trade and use of goods and services by different people and organizations" [1]. Take OFO, for example. As the first bike-sharing company in China, its valuation rapidly soared from zero to 28 billion RMB between 2015 and 2017, an unprecedented growth rate in the industry [2]. However, it is lamentable that this giant, which once secured substantial financing in the sharing economy sector, faced a near 10 billion RMB capital evaporation in just four years. Faced with the dramatic transformation of OFO, people cannot help but ask: Is this the result of internal management failures, or is it an inevitable consequence of changes in the market environment? To thoroughly analyze this issue, this paper will employ the SCP model for a systematic analysis. By studying the failure of OFO, paper aim to reveal the challenges of sustainability in the sharing economy business model, the risks associated with capital operations and financing strategies, the importance of market competition and strategy adjustments, the impact of operational management and user experience, and the crucial role of policy and regulatory environments in business development. This not only provides insights for the bike-sharing industry but also serves as a warning for other industries, helping enterprises avoid similar problems during their development.

2. The Analysis of OFO Bike-sharing Company based on the SCP Model

2.1. Market Structure

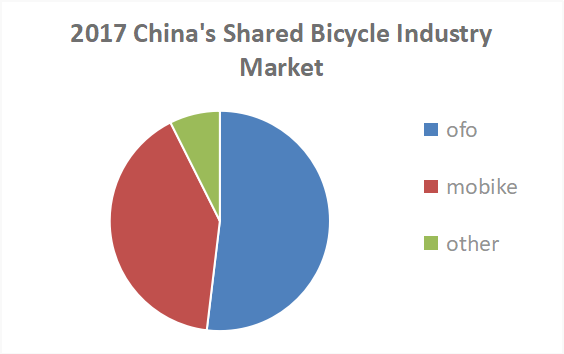

From 2014 to 2015, OFO was in its early development stage. Initially, it was a bike-sharing project within the Peking University campus, mainly serving the faculty, staff, and students [3]. OFO was the first company to propose the concept of bike-sharing and had no competitors at that time. Starting in 2016, OFO officially entered the market and faced its main competitor, Mobike. By 2017, OFO and Mobike had nearly split the market: OFO had the highest city coverage, holding 51.9% of the market share, while Mobike held 40.7%, together capturing 90% of the market (Figure 1) [4]. As market competition intensified, more bike-sharing brands entered the market, including Hellobike and Didi Qingju. By October 2018, OFO began to cease operations in some cities. Subsequently, it faced lawsuits over loans, and its founder was listed as a dishonest debtor [2]. The failure of OFO was imminent.

Figure 1: 2017 China`s Shared Bicycle Industry Market [2]

2.2. Enterprise Conduct

2.2.1. Competitive Conduct

First, there was price competition. OFO successfully attracted a large number of users by implementing a low-price strategy and offering free riding promotions [5]. At the company's inception, users only needed to pay a deposit of 99 RMB to start using its bike-sharing service. In contrast, competitors like Mobike required users to pay a deposit of up to 299 RMB. Additionally, OFO introduced discount policies for specific groups, such as a promotional price of 9.9 RMB per semester for students after certification. The company also regularly issued red envelopes through its official WeChat account, allowing users to use these envelopes to offset rental fees, further reducing the cost of use. Second, there was cooperation and resource integration. OFO established partnerships with well-known internet companies like Alipay [6]. Through these collaborations, OFO was able to leverage its partners' user bases and resources, effectively expanding its own user scale and market coverage.Finally, there was brand promotion. To enhance brand awareness and influence, OFO invested 10 million RMB to hire the popular celebrity Lu Han as its brand ambassador. Additionally, the company heavily advertised in major cities such as Beijing, Shanghai, and Guangzhou at high-traffic subway and bus stations, using these prominent advertising spaces to strengthen its community impact and market recognition.

2.2.2. Outsourcing Conduct

When examining the development of OFO, its outsourcing strategy emerges as a key behavior that cannot be overlooked. At the company's inception, OFO adopted an innovative model by purchasing and refurbishing second-hand bicycles, converting them into the company's shared bike assets. However, as the market significantly expanded in 2016, OFO shifted its focus from the campus market to a broader societal market. During this transition, the company gradually realized that its own resources were insufficient to meet the rapidly growing demand for shared bicycles. To address this challenge, OFO implemented an outsourcing strategy, partnering with well-known Chinese bicycle manufacturers to outsource the mass production of shared bikes. This strategic shift not only enabled the company to respond quickly to market demands but also supported the rapid expansion of its operational network.

Outsourcing brought significant advantages to the company. Firstly, it improved production efficiency; by outsourcing production, OFO was able to rapidly increase its supply of shared bikes, shortening the cycle from production to market and meeting the demand for immediate service. Secondly, it reduced production costs, including time and capital costs. In terms of time costs, the company no longer needed to invest significant time in sourcing and refurbishing second-hand bikes but could instead rely on partners for bulk production. Regarding capital costs, outsourcing minimized the company's need for investment in production facilities and equipment, thus reducing fixed capital expenditures. Lastly, it reduced risks; establishing partnerships with multiple suppliers helped OFO mitigate the risk of relying on a single supplier, avoiding issues such as supply shortages and technological dependence, while also enhancing operational flexibility.

2.3. Enterprise Performance

During 2015 and 2016, OFO was in its early startup stage, facing major challenges in market expansion and building a user base. In 2016, the company successfully completed five rounds of equity financing (including Series A, A+, B, B+, and C rounds). Moving into 2017, on March 1, OFO completed its Series D financing, raising a total of $450 million, equivalent to approximately 3.1 billion RMB [2]. On July 6 of the same year, OFO secured $700 million in Series E1 financing, led by Alibaba, Hony Capital, and CITIC Industrial Fund [7]. Despite its remarkable performance in financing, negative rumors about OFO's financial situation began to surface in the second half of 2017. By January 2018, media reports revealed that OFO was facing a cash flow crisis, with its cash reserves only sufficient to maintain operations for one month. Finally, on February 21, 2023, users reported that the OFO app could no longer receive SMS verification codes, preventing users from logging in. Additionally, users were unable to find the OFO WeChat mini-program and check the status of refunds [8]. This rapid deterioration in financial condition could have been caused by various factors, including but not limited to intense market competition, poor cost control, and lower-than-expected investment returns. The cumulative effect of these issues ultimately led OFO to face a severe liquidity crisis in the short term.

3. Causes of Failure

3.1. Blind Investment

Firstly, there was the excessive spending on promotional expenses. In the field of advertising and marketing, OFO allocated a huge and inefficient budget, with excessive publicity aimed at seizing market share. This led to a distorted competitive model in the shared bicycle sector, where the survival and growth of businesses increasingly depended on continuous capital injections. The company that successfully secured the next round of equity financing could continue to exist and quickly launch more products to capture a larger market share [9]. Secondly, there was the investment in operational costs. Starting from 2017, OFO spent $300 million monthly to purchase approximately 3.5 million bicycles. Lastly, there was the lack of strict investment management measures and approval processes. During its rapid growth, OFO’s senior management did not implement precise management practices, lacking strict investment management measures and approval processes. Examples include renting office space in the Ideal International Building at a monthly rent of $2 million and providing every executive with a Tesla. These meaningless capital expenditures resulted in OFO incurring losses of millions every three months.

3.2. Incorrect Solutions

Facing the tight cash flow situation, the senior management of OFO adopted a highly controversial measure: misappropriating user deposits to alleviate financial pressure. In November 2017, it was also reported that OFO had misappropriated a total of over 6 billion yuan in user deposits to fill the gap, which triggered a frenzy of user withdrawals [10]. The sharp decline in user confidence, the trust crisis among partners, and the doubts of investors collectively led to severe damage to OFO's brand image, inflicting a devastating blow to its business reputation. This incident not only highlighted the company's shortcomings in risk management and internal control but also exposed its deficiencies in crisis public relations and market communication strategies. With the loss of business reputation, OFO's market position and competitiveness were severely affected, bringing long-term negative impacts to the company. It also served as a wake-up call for the entire shared bicycle industry, reminding enterprises that while pursuing development, they must adhere to the principles of honest business operations.

3.3. Impairment of Goodwill

The deposit incident at OFO not only sparked a crisis of trust among its user base but also had profound repercussions on the company's financing activities. The promised investment of $1.8 billion from SoftBank failed to materialize as scheduled due to the exposure of the incident, which not only caused OFO to miss a crucial financing opportunity but also exacerbated its financial predicament. Due to the mismanagement of user deposits, OFO ended up with a huge debt of about 4 billion yuan, which not only put tremendous pressure on the company's cash flow but also further weakened its competitiveness and viability in the market.

4. Conclusion

This paper, based on the SCP analysis model, examines the rise and decline of OFO shared bicycles. Blind investments and competition lead only to short-term prosperity. In the era of the sharing economy, it is essential to distinguish clearly between sharing and renting to use resources more efficiently. However, the sharing of non-idle resources has, to some extent, resulted in ineffective market resource allocation and waste. For instance, the rapid expansion of the bike-sharing industry has led to an excess of vehicles and idle resources. Additionally, Didi’s carpooling service, as a representative of the sharing economy, has shown a trend of shifting from sharing to renting, with many Didi drivers now becoming full-time drivers. This shift somewhat deviates from the original concept of the sharing economy. Therefore, clearly defining the boundaries between sharing and renting is crucial for business positioning and resource optimization. . Furthermore, it is necessary to establish reasonable laws and regulations, oppose monopolies, and guide healthy competition. Although today's bike-sharing services do not require deposits and are freely accessible, the sharing economy must adhere to legal requirements, fair competition, and rule-of-law principles. While pursuing innovation, adherence to ethical practices is also vital. In the future, the development of the bike-sharing industry should not be merely a capital game but should also focus on user comfort, experience, and efficient operations, with strict oversight by government and market regulators to achieve a genuine sharing economy and truly shared bicycles.

The deposit incident at OFO not only sparked a crisis of trust among its user base but also had profound repercussions on the company's financing activities. The promised investment of $1.8 billion from SoftBank failed to materialize as scheduled due to the exposure of the incident, which not only caused OFO to miss a crucial financing opportunity but also exacerbated its financial predicament. Due to the mismanagement of user deposits, OFO ended up with a huge debt of about 4 billion yuan, which not only put tremendous pressure on the company's cash flow but also further weakened its competitiveness and viability in the market.

References

[1]. Chen, J. (2018). Understanding University student's decision to use ofo bike sharing services in Bangkok, Mahidol University, 1-29.

[2]. Liu Qiteng. Observing the Paradox of the Sharing Economy through the Rise and Fall of OFO Bike-sharing, Modern Business (11): 3-5. doi:10.14097/j.cnki.5392/2022.11.005.

[3]. Logistics Engineering and Management: Zheng Han. (2018) An Analysis of the Development of the Bike-sharing Industry from an SCP Perspective (12), 128-130+150.

[4]. Data source: BIA Consulting Data Center, 2017-02-08, http://www.bigdata-research.cn/content/201702/384.html

[5]. Zhang Min. (2017). An Analysis of Bike-sharing Development from an SCP Perspective, China Market (14), 253+255. doi:10.13939/j.cnki.zgsc.2017.14.253.

[6]. Li Yuxin & Ju Yahong. (2019). Exploring Sustainable Business Models in Rapidly Rising and Falling Industries: A Case Study of OFO and Mobike Bike-sharing, China Business Theory, 156-157. doi:10.19699/j.cnki.issn2096-0298.2019.14.156.

[7]. Wang Ya. (2023). Research on the Sustainable Operation Issues of Enterprises under the Sharing Economy Model (Master's thesis, Anhui University of Finance and Economics).https://link.cnki.net/doi/10.26916/d.cnki.gahcc.2023.000148doi:10.26916/d.cnki.gahcc.2023.000148.

[8]. Lu Hanzhi. (2023-12-21). With Coffee Shops Closing Down to Just One, OFO Founder Dai Wei May Face a Second Startup Failure, First Financial Daily, A09. doi:10.28207/n.cnki.ndycj.2023.004983.

[9]. Zhen Nuoyan, Yang Liaofan, & Zhao Naidong. (2024). Analysis of Bike-sharing Business Models and Development Strategies, Industry Innovation Research (05), 82-84.

[10]. Xia Xinzhu. (2018). Research on the Supervision of Users' Deposits in Shared Bicycles [Master's Thesis, China University of Political Science and Law]. Master's degree. https://kns.cnki.net/kcms2/article/abstract?v=4wkQyjAcIEfla3extVwJe71sobifM3Yt2IGO0uHNumDlOYeUrfpSAF7-Qvv7e7FsZHSLYr0NDUWn4tha8mVHjY-4HvuKxyzqIK1ivLaP4HN9o0ndtDuSg8GsRp_VW3VcBIoPZcEuyESyWZ70GTiU_-sIm0tSxk1e_eGv7h4vDbYB6JpqZe8TQmNMSm9PrlXYCj2u8lPHGpc=&uniplatform=NZKPT&language=CHS

Cite this article

Chen,C. (2024). Research on the Development of the Bike-Sharing Industry Based on the SCP Analysis Model: A Case Study of OFO. Advances in Economics, Management and Political Sciences,125,127-131.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, J. (2018). Understanding University student's decision to use ofo bike sharing services in Bangkok, Mahidol University, 1-29.

[2]. Liu Qiteng. Observing the Paradox of the Sharing Economy through the Rise and Fall of OFO Bike-sharing, Modern Business (11): 3-5. doi:10.14097/j.cnki.5392/2022.11.005.

[3]. Logistics Engineering and Management: Zheng Han. (2018) An Analysis of the Development of the Bike-sharing Industry from an SCP Perspective (12), 128-130+150.

[4]. Data source: BIA Consulting Data Center, 2017-02-08, http://www.bigdata-research.cn/content/201702/384.html

[5]. Zhang Min. (2017). An Analysis of Bike-sharing Development from an SCP Perspective, China Market (14), 253+255. doi:10.13939/j.cnki.zgsc.2017.14.253.

[6]. Li Yuxin & Ju Yahong. (2019). Exploring Sustainable Business Models in Rapidly Rising and Falling Industries: A Case Study of OFO and Mobike Bike-sharing, China Business Theory, 156-157. doi:10.19699/j.cnki.issn2096-0298.2019.14.156.

[7]. Wang Ya. (2023). Research on the Sustainable Operation Issues of Enterprises under the Sharing Economy Model (Master's thesis, Anhui University of Finance and Economics).https://link.cnki.net/doi/10.26916/d.cnki.gahcc.2023.000148doi:10.26916/d.cnki.gahcc.2023.000148.

[8]. Lu Hanzhi. (2023-12-21). With Coffee Shops Closing Down to Just One, OFO Founder Dai Wei May Face a Second Startup Failure, First Financial Daily, A09. doi:10.28207/n.cnki.ndycj.2023.004983.

[9]. Zhen Nuoyan, Yang Liaofan, & Zhao Naidong. (2024). Analysis of Bike-sharing Business Models and Development Strategies, Industry Innovation Research (05), 82-84.

[10]. Xia Xinzhu. (2018). Research on the Supervision of Users' Deposits in Shared Bicycles [Master's Thesis, China University of Political Science and Law]. Master's degree. https://kns.cnki.net/kcms2/article/abstract?v=4wkQyjAcIEfla3extVwJe71sobifM3Yt2IGO0uHNumDlOYeUrfpSAF7-Qvv7e7FsZHSLYr0NDUWn4tha8mVHjY-4HvuKxyzqIK1ivLaP4HN9o0ndtDuSg8GsRp_VW3VcBIoPZcEuyESyWZ70GTiU_-sIm0tSxk1e_eGv7h4vDbYB6JpqZe8TQmNMSm9PrlXYCj2u8lPHGpc=&uniplatform=NZKPT&language=CHS