1. Introduction

1.1. Research Background and Rationales

The scale of China's industrial digitization in 2020 was close to 7.5 trillion yuan, ranking second globally. It is expected that by 2025, the proportion of industrial digitization to GDP will increase from 7.5% in 2020 to 10%, and industrial digitization will enter a stage of rapid development [1]. Which also provided a solid foundation for financial innovation and digital transformation (DT). With the help of DT, manufacturing firms will have a more transparent inventory, reasonable allocation of resources, and better management of innovation activity in different proportions for each segment of the industrial chain.

The close connection between technology, industry, and finance has recently achieved coordinated development. How to integrate the three efficiently and help the economy achieve high-quality and sustainable development has become a problem in the new era. To illustrate, the advent of SCF is of paramount significance for companies like Walmart that operate in an industry chain with substantial cash flow demand disparities upstream and downstream. It considerably assists these industry chain companies in mitigating external shocks akin to that of the COVID-19 pandemic.

At the enterprise level, SCF can help small and micro enterprises (SMEs) alleviate cash flow shortages and improve the financial institution's utilization of funds. SMEs can obtain more sufficient funds from the application of SCF and improve the operational performance and cash turnover rate simultaneously [2]. The emergence of SCF utilizes new technologies to bind SMEs and the core firms in the industry chain using data as a link. Then, financial institutions provide working capital based on inventory, etc., which even enables focal companies to manage working capital collaboratively to achieve outstanding firm performance [3]. At the industrial level, SCF can utilize the funding needs of clients to enhance the data sets within the supply chain. It is achieved by leveraging the functionalities of DT platforms, which make inventory and funding data of upstream and downstream more transparent; therefore, SMEs that use digital technologies have fewer issues with customer relations, increasing competition, access to finance, input costs, regulatory burdens, exogenous shocks, and public crises.

With the concept of sustainable development and responsible investment being increasingly valued and accepted by economies around the world, the ESG investment concept has begun to be widely adopted [4]. In the context of M&A activity, high-ESG acquirers lead to higher post-M&A performance compared to low-ESG acquirers. In the context of secondary market activity, ESG affects enterprise value through channels such as having more loyal employees, more loyal customers/suppliers, and longer-term growth [5]. Several studies also indicate that improving ESG performance can reduce stock price fragility. Additionally, corporate governance factors in ESG performance have a significant positive relationship with firm performance. Higher ESG makes the company more trustworthy in terms of different mechanisms and firm performance, leading to a higher price-to-earnings ratio. Therefore, both ESG and firm performance are adopted in this article as the criteria for evaluating whether SCF and DT have positive effects on enterprises.

1.2. Research Aim, Objectives& Research Questions

This article aims to delve deeper into this issue and integrate these indicators using a web crawler to gather ESG and DT datasets, with Huazhong ESG indicators and company accounting indicators of manufacturing companies listed on A-share from 2009 to 2022 to investigate the mutual interactions among SCF, DT, and firm performance.

Objective 1: Identify the relationships between DT and SCF in the manufacturing industry.

Objective 2: Determine the contribution of SCF to the firm performance in the manufacturing industry.

Objective 3: Determine how DT contributes to the firm performance in the manufacturing industry.

2. Literature Review and Hypothesis Development

2.1. Literature review

2.1.1. Supply Chain Finance

SCF has gained prominence in recent years, offering ways to improve the financial efficiency of supply chains while reducing risk. Numerous studies have focused on SCF [6], who explored SCF concepts, definitions, and potential benefits, providing a comprehensive review of SCF, discussing its evolution and future perspectives.

Despite extensive research, the SCF field still faces several challenges. The integration of SCF systems across companies and the need to understand the risks associated with SCF are some of the major issues. The implementation of SCF is often hindered by the complexity of integrating systems among different stakeholders. They are, moreover, highlighting the need to understand and manage risks associated with SCF.

Current research trends focus on the integration of advanced technologies like blockchain, artificial intelligence, and IoT into SCF. These technologies can potentially enhance SCF’s efficiency and security. Wang discussed the potential of blockchain in enhancing transparency and trust in SCF. Furthermore, Scholer explored ways in which IoT can shape the future of SCF.

The DT is revolutionizing SCF, promising to enhance efficiency, transparency, and security. Several studies have focused on this intersection, facilitating the algorithmic resolution of matching issues to be adopted in the supply chain. Moreover, it highlights how technologies like AI and blockchain can revolutionize SCF; because of the relatively short timeline associated with SCF, there exists an imperative to efficiently match the abundant requirements comprising orders, warehouse receipts, and accounts receivable with the financial supply provided by markets and institutions. The utilization of blockchain technology emerges as a potent solution, capable of effectively addressing these challenges within a condensed timeframe.

2.1.2. Digital Transformation and Corporate ESG Performance

DT refers to the process of using digital technologies to create new or modify existing business processes, culture, and customer experiences [7]. The increasing influence of digital technologies on all aspects of business and society has given rise to an unprecedented rate of change, thus making DT an essential survival mechanism in the modern business world [8].

Current research in DT mainly focuses on the role of digital technologies in reshaping business models and strategies. However, more research is needed to understand how organizations can effectively manage the DT process and the implications of DT for organizational structure and culture, especially in how DT can enhance the efficiency of SCF operations.

Recently, the focus on DT has expanded to include its intersection with ESG factors. Researchers argue that DT can play a pivotal role in enhancing an organization’s ESG performance by promoting sustainability, improving governance, and increasing social responsibility. ESG reflects a growing awareness of the need for sustainable and responsible business practices. The importance of ESG in firm performance and investment decisions has been substantiated in many studies [9] [10]. Several studies have shown a positive relationship between ESG performance and corporate firm performance. Companies exhibiting high ESG standards have been found to have better firm performance, lower cost of capital, and less volatility.

2.2. Hypothesis Development

2.2.1. Supply Chain Finance and firm performance

One key benefit of SCF is its ability to alleviate cash flow constraints in the supply chain. SCF programs enable firms to optimize working capital and reduce the cash conversion cycle. This, in turn, allows for increased liquidity and improved cash flow management, positively impacting the performance of participating firms. Another benefit of SCF is that it helps in enhancing the operational efficiency of the entire supply chain. Research by Ali indicates that SCF can lead to improved supply chain collaboration and synchronization [11]; other previous study shows that SCF results in reduced lead times [12], increased inventory turnover [13], and enhance overall supply chain performance. These improvements positively affect corporate performance and contribute to the sustainable growth of the industry.

Given this knowledge, SCF contributes to the overall stability and sustainability of the supply chain, positively impacting the firm performance in the industry. SCF programs foster closer collaboration and trust among supply chain stakeholders, promoting responsible business practices and improving ESG outcomes and financial performance.

In conclusion, SCF has been identified as an effective solution to address cash flow challenges in the supply chain. It not only helps in improving turnover rates and cash flow management but also reduces risks and enhances corporate stability, which improves ESG performance. The findings emphasize the importance of SCF in achieving these positive outcomes.

Based on the arguments above, the following research hypothesis is proposed.

Hypothesis 1. All other things being equal, SCF has a significantly positive impact on firm performance

2.2.2. Mediating role of Digital Transformation

DT, characterized by investment in cloud data platforms and information technology hardware, has an instrumental role in augmenting the efficiency of SCF, thereby improving corporate performance [8]. The availability of accurate and comprehensive data, facilitated by digitalization, enhances the effective implementation of SCF, which is validated by the association between DT and improved firm performance. Further, digitization allows firms to execute operations seamlessly, improving data accuracy and enhancing decision-making processes, thereby optimizing SCF. Scholars have also emphasized the role of digitalization in enhancing SCF and firm performance.

Investments in digital transformation, although sizable, have been found to increase investment efficiency in firms, warding off haphazard investments. Digitization necessitates a shift of resources but results in more focused and highly productive investments [14]. Recent studies underline the capacity of DT to drive efficiency in capital allocation, thus improving overall corporate performance. Despite the initial financial commitment required for digitalization, the long-term benefits in terms of efficient resource allocation and improved firm performance justify the investments.

Research further excludes that DT not only impacts the internal operations of companies but also changes the way companies interact with their supply chain partners, thereby improving the overall efficiency and effectiveness of the supply chain. Digital tools and technologies such as cloud computing, the Internet of Things, big data analytics, and artificial intelligence are key factors supporting supply chain integration and collaboration. DT also provides more information and data for corporate decision-making, thereby improving the accuracy and efficiency of decisions [15]. Therefore, digitalization can not only bring about operational efficiency but also improve companies' competitiveness and market performance. Thus, the second hypothesis is proposed.

Hypothesis2. All other things being equal, SCF can promote firm performance by improving the digital transformation degree.

3. Research Methods

3.1. Sample and Data collection

In this research, cross-sectional data from A-share-listed manufacturing companies from 2009 to 2022 in China is the target dataset, collecting their financial reports and public announcements from CSMAR and Hua Zheng ESG. Simultaneously, for the continuity of the dataset, the newly listed, delisted, and other companies are excluded, and finally, 18934 samples are obtained.

3.2. Definition of variables

3.2.1. Dependent variables

The return on asset (ROA) is utilized as one of the observed variables for firm performance because it has widespread application in exploring the correlation between SCF and firm performance. In addition to this, this research will also use the return on equity (ROE) and ESG rating from Huazheng ESG from 2009 to 2022 as observed variables to measure the firm performance. The Huazheng ESG rating, being the most comprehensive and data-rich ESG rating in China, ensures the maximum effectiveness of the sample using the ESG scores directly.

3.2.2. Independent variables

One key aspect of this study is the independent variable measure; in this study, the definition of SCF is according to the formula conducted [16]: Supply Chain Finance is equal to Accounts Receivable Turnover Days minus Accounts Payable Turnover Days plus Inventory Turnover Days. However, Considering the varying payment cycles and capital chain efficiency levels among different secondary industries in the manufacturing sector and to ensure the effectiveness of the supply chain finance parameter, this article defines SCF as a latent variable and references different calculation methods used in the CSMAR database to obtain different SCFa, SCFb, SCFc, and SCFttm as the observed variables.

3.2.3. Digital Transformation

Since Digital Transformation (DT) includes a wide range of concepts and business types, establishing if listed firms have implemented it and then identifying the specific type they have utilized is the most challenging task by conducting a search using these DT's key terms. This research employs textual analysis methodologies to formulate the DT index. Initially, utilizing Python software to perform textual analysis on a company's yearly report; after that, to prevent the issue of insufficient data sample size due to the low frequency of DT-related phrases, this study uses the "Jieba" library in Python software to segment the text of DT, incorporating a stop-word dictionary, and converting unstructured text data into word vectors for storage.

Subsequently, in order to accurately differentiate the text of DT, this study will attempt to expand the user dictionary. By applying the lexicon method to categorize text information, it is possible to judge existing text and DT words, thereby helping to improve the accuracy of text analysis. The validity of this approach is further determined, and the user dictionary is expanded through steps such as keyword extraction, random sampling, and manual screening, all translated into academic English. Moreover, For DTa, DTb, and DTc, this study adopts three different measure methods and then uses all of them to be the observed variables of the latent variable DT. It is creating a list of digital transformations, emphasizing five main themes: artificial intelligence (AI), blockchain, cloud computing, big data, and digital technology applications.

3.2.4. Control variables

Various factors highly influence performance within corporations; thus, to mitigate potential influences and review relevant studies, this paper selects variables from both the corporate financial level and firm basic information.

Table 1: SCF and DT variables sources.

Latent variable | Definition | ||

SCF | SCFi,,t | Supply Chain Finance = Accounts Receivable Turnover Days-Accounts Payable Turnover Days + Inventory Turnover Days | (Huang et al., 2021) |

DT | DTi,t | DT-related keywords in a firm’s annual financial report in year t | (Wu et al., 2021) |

Table 2: Variable description table.

Variable type | Variables | Symbols | Variable Definition | Source |

Dependent variable | Firm performance | ESG | Assign ESG ratings from low to high (C, CC, CCC, B, BB, BBB, A, AA, AAA) to values 1–9 respectively | Huazheng ESG rating |

ROA | The ratio of the company’s net income to total assets | CSMAR | ||

ROE | The ratio of the company’s net income to total equity | CSMAR | ||

Independent variable | Supply chain finance | SCFa | Result obtained according to the existing data in the current financial report | Financial report |

SCFb | The beginning and end of the period here are related to the financial report currently used. | |||

SCFc | The beginning and end of the period here are related to the financial report used at the end of the previous year | |||

SCFttm | The beginning and end of the period here are related to the financial report used in the same period of last year | |||

Mediation variables | Digital transformation | DTa | Five dimensions of 76 digitized related word frequencies are counted | (Wu et al., 2021) |

DTb | Four dimensions of 99 digitized related word frequencies are counted | (Zhao et al., 2021) | ||

DTc | 139 digitization-related word frequencies were counted under the categories of technology classification, organizational enablement, and digital applications | (Zhen et al., 2023) | ||

Control variables | Age | Age | Firm age | CSMAR |

Size | Size | Firm size | ||

Leverage | Lev | The ratio of the company’s year-end liabilities to total assets |

3.3. Model construction

The basic model constructed in this study is as follow.

\( Firm performance= α0+a1SCFi,t+ a2DTi,t+βControli,t +∑Year +εi,t \) (1)

4. Empirical result and discussion

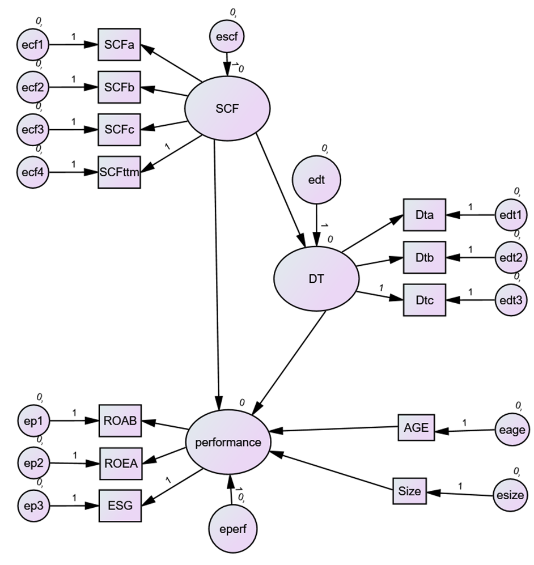

4.1. Path design diagram

SCFa, SCFb, SCFc, SCFttm are taken as the measurable variable of latent variable SCF, and the regression coefficient of SCFttm to latent variable SCF is specified to be 1, DTa DTb and DTc are used as measurable variables of latent variable DT After repeated attempts, it is decided that the coefficient for specifying DTc is 1. After repeated attempts, AGE and size were decided to be used as control variables.

Figure 1: Research model& Configuration model.

It can be seen from Table 4 that, except for the coefficients specified in advance, 10 of the 12 coefficients significantly exceed 0.999, and the significance of the coefficient level is very high. The goodness of fit test: The minimum value of the chi-2 statistic in the maximum likelihood estimation process is 1373355.634 degrees of freedom, and the 39 P value is 0.000. The result is very effective.

Table 3: coefficient estimation results.

Path | Estimate | S.E. | C.R. | P |

DT<---SCF | 0 | 0 | 4.428 | *** |

performance<---DT | 0.003 | 0.001 | 4.492 | *** |

performance<---SCF | 0 | 0 | 0.544 | 0.586 |

performance<---AGE | -0.056 | 0.005 | -11.419 | *** |

performance<---Size | 0.018 | 0.031 | 0.574 | 0.566 |

SCFttm<---SCF | 1 |

|

|

|

SCFc<---SCF | 1 | 0 | 5143284 | *** |

SCFb<---SCF | 0.999 | 0 | 94522.15 | *** |

SCFa<---SCF | 0.998 | 0 | 16562.07 | *** |

Dta<---DT | 0.157 | 0.006 | 27.782 | *** |

Dtb<---DT | 0.4 | 0.014 | 27.855 | *** |

Dtc<---DT | 1 |

|

|

|

ESG<---performance | 1 |

|

|

|

ROAB<---performance | 0.008 | 0.001 | 15.669 | *** |

ROEA<---performance | 0.073 | 0.005 | 15.502 | *** |

4.2. Descriptive statistics analysis

The following are the descriptive statistics and normality test results of the factors involved in this study. According to the description statistics, the average water value of each variable is shown in Table 3. As far as normality test is concerned, we mainly rely on Kline's requirement that the absolute value of skewness coefficient is less than three and the absolute value of kurtosis coefficient is less than 8 to show that the data has approximated normal distribution Specifically, the absolute values of skewness and kurtosis coefficients of most observed variables are within the range, which means that the model coefficients need to be carried out in the subsequent model construction process to make these variables occupy a more important position in the principal components.

Table 4: Descriptive statistics analysis

Average | Std | Skewness | Kurtosis | |

ROE | 0.0423 | 0.89812 | -59.852 | 4247.276 |

ROA | 0.0504 | 0.07752 | -1.085 | 34.062 |

ESG | 73.0520 | 4.80908 | -0.622 | 1.531 |

SCFa | 50.2228 | 17647.19 | -137.356 | 18888.502 |

SCFb | 42.0873 | 17590.67 | -137.351 | 18887.714 |

SCFc | 41.8999 | 17590.65 | -137.352 | 18887.796 |

SCFttm | 41.7396 | 17590.64 | -137.352 | 18887.809 |

Dta | 9.5997 | 24.22640 | 6.508 | 60.786 |

Dtb | 36.4008 | 58.85520 | 5.304 | 46.298 |

Dtc | 22.8306 | 70.65369 | 11.071 | 178.827 |

AGE | 8.4260 | 7.21925 | 0.813 | -0.304 |

Size | 21.9430 | 1.14477 | 0.851 | 0.907 |

4.3. Mediating effects

Because the path coefficient is zero, Sobel and Goodman fail. Instead to make statistics using a 0.05 significance level [17]. The estimated lower limit of mediating effect is 0.17355, and the upper limit is 0.7615. Therefore, the conclusion is obviously that the latent variable DT has a mediating effect.

Table 5: Total effects analysis

Total | SCF | AGE | Size | DT | performance |

DT | 0.047 | 0 | 0 | 0 | 0 |

performance | 0.029 | -0.12 | 0.008 | 0.056 | 0 |

ROEA | 0.008 | -0.034 | 0.002 | 0.016 | 0.286 |

ROAB | 0.011 | -0.044 | 0.003 | 0.02 | 0.365 |

ESG | 0.02 | -0.084 | 0.006 | 0.039 | 0.702 |

Dtc | 0.036 | 0 | 0 | 0.755 | 0 |

Dtb | 0.022 | 0 | 0 | 0.464 | 0 |

Dta | 0.03 | 0 | 0 | 0.639 | 0 |

SCFa | 1 | 0 | 0 | 0 | 0 |

SCFb | 1 | 0 | 0 | 0 | 0 |

SCFc | 1 | 0 | 0 | 0 | 0 |

SCFttm | 1 | 0 | 0 | 0 | 0 |

5. Conclusion

This study selects the financial data of Chinese-listed manufacturing enterprises from 2009 to 2022 and excludes the companies that will be delisted or listed for less than one year. The purpose of this study is to explore the influence of supply chain finance and digital transformation on enterprise performance and try the intermediary role of digital transformation in this influence chain. ESG, ROE, and ROA evaluate the performance of enterprises.

The results show that supply chain finance can alleviate the pressure of the capital chain to a great extent and then improve various performance indicators; although digital transformation has a great demand for investment in the early stage, it can still have a positive effect on enterprise performance. At the same time, supply chain finance further affects enterprise performance through the indicators of digital transformation; that is, digital transformation has an intermediary effect between supply chain finance and firm performance.

From the perspective of research enlightenment, this study has guiding significance for policymakers, enterprise management, and financial institutions. According to the research results, policymakers can consider combining supply chain financial policy with digital transformation policy to provide preferential policies and convenient conditions related to supply chain financial transformation for digital transformation of enterprises to enhance policy effects. For enterprise management, they should realize the necessity and effectiveness of digital transformation investment in the early stage. After the enterprise reaches a certain level, it can appropriately increase the digital transformation to improve the comprehensive performance of the enterprise.

References

[1]. Song & Wang (2022). Complexity economic indexes for the energy market: Evidence during extreme global changes. Energy Economics, 96, 105148. https://doi.org/10.1016/j.eneco.2021.105148

[2]. Pan, Xu, Li & Ling (2020). The impact of supply chain finance on firm cash holdings: Evidence from China. Pacific-Basin Finance Journal, 63, 101402. https://doi.org/10.1016/j.pacfin.2020.101402

[3]. Wetzel& Hofmann (2019). Supply chain finance, financial constraints and corporate performance: An explorative network analysis and future research agenda, International Journal of Production Economics. 216, 364-383. https://doi.org/10.1016/j.ijpe.2019.07.001

[4]. Chen, Song& Gao (2023). Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. Journal of Environmental Management, 345, 118829. https://doi.org/10.1016/j.jenvman.2023.118829

[5]. Chang &Liem (2022). Sustainable Finance: ESG/CSR, Firm Value, and Investment Returns*. Asia-Pacific Journal of Financial Studies, 51(3), 325–371. https://doi.org/10.1111/ajfs.12379

[6]. Hofmann & Kotzab (2010). A SUPPLY CHAIN‐ORIENTED APPROACH OF WORKING CAPITAL MANAGEMENT. Journal of Business Logistics, 31(2), 305–330. https://doi.org/10.1002/j.2158-1592.2010.tb00154.x

[7]. Berman (2012). Digital transformation: Opportunities to create new business models. Strategy & Leadership, 40(2), 16–24. https://doi.org/10.1108/10878571211209314

[8]. Bharadwaj, Sawy (2013). Digital Business Strategy: Toward a Next Generation of Insights. MIS Quarterly, 37(2), 471–482. https://doi.org/10.25300/MISQ/2013/37:2.3

[9]. Eccles & Serafeim (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835–2857. https://doi.org/10.1287/mnsc.2014.1984

[10]. Friede, Busch & Bassen (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. https://doi.org/10.1080/20430795.2015.1118917

[11]. Ali, Gongbing, Mehreen & Ghani (2020). Predicting firm performance through supply chain finance: A moderated and mediated model link. International Journal of Logistics Research and Applications, 23(2), 121–138. https://doi.org/10.1080/13675567.2019.1638894.

[12]. Wuttke, Rosenzweig & Heese (2019). An empirical analysis of supply chain finance adoption. Journal of Operations Management, 65, 242-261. https://doi.org/10.1002/joom.1023

[13]. Guo, Ke & Zhang (2023). Digital transformation along the supply chain. Pacific-Basin Finance Journal, 80, 102088. https://doi.org/10.1016/j.pacfin.2023.102088

[14]. Brynjolfsson, Hitt & Kim (2011). Strength in Numbers: How Does Data-Driven Decision-making Affect Firm Performance? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1819486 https://doi.org/10.1016/j.pursup.2005.10.00

[15]. Chen, Chiang & Storey (2012). Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165. https://doi.org/10.2307/41703503

[16]. Huang, Wang & Yarovaya (2023). Corporate digital transformation and idiosyncratic risk: Based on corporate governance perspective, Emerging Markets Review. 56, 101045. https://doi.org/10.1016/j.ememar.2023.101045

[17]. MacKinnon, Krull & Lockwood (2000). Equivalence of the Mediation, Confounding and Suppression Effect, Prevention science. 1(4), 173-181. https://doi.org/10.1023/a:1026595011371

Cite this article

Diao,S. (2024). Supply Chain Finance, Digital Transformation and Manufacturing Firm Performance: Evidence from China. Advances in Economics, Management and Political Sciences,128,44-53.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Song & Wang (2022). Complexity economic indexes for the energy market: Evidence during extreme global changes. Energy Economics, 96, 105148. https://doi.org/10.1016/j.eneco.2021.105148

[2]. Pan, Xu, Li & Ling (2020). The impact of supply chain finance on firm cash holdings: Evidence from China. Pacific-Basin Finance Journal, 63, 101402. https://doi.org/10.1016/j.pacfin.2020.101402

[3]. Wetzel& Hofmann (2019). Supply chain finance, financial constraints and corporate performance: An explorative network analysis and future research agenda, International Journal of Production Economics. 216, 364-383. https://doi.org/10.1016/j.ijpe.2019.07.001

[4]. Chen, Song& Gao (2023). Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. Journal of Environmental Management, 345, 118829. https://doi.org/10.1016/j.jenvman.2023.118829

[5]. Chang &Liem (2022). Sustainable Finance: ESG/CSR, Firm Value, and Investment Returns*. Asia-Pacific Journal of Financial Studies, 51(3), 325–371. https://doi.org/10.1111/ajfs.12379

[6]. Hofmann & Kotzab (2010). A SUPPLY CHAIN‐ORIENTED APPROACH OF WORKING CAPITAL MANAGEMENT. Journal of Business Logistics, 31(2), 305–330. https://doi.org/10.1002/j.2158-1592.2010.tb00154.x

[7]. Berman (2012). Digital transformation: Opportunities to create new business models. Strategy & Leadership, 40(2), 16–24. https://doi.org/10.1108/10878571211209314

[8]. Bharadwaj, Sawy (2013). Digital Business Strategy: Toward a Next Generation of Insights. MIS Quarterly, 37(2), 471–482. https://doi.org/10.25300/MISQ/2013/37:2.3

[9]. Eccles & Serafeim (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835–2857. https://doi.org/10.1287/mnsc.2014.1984

[10]. Friede, Busch & Bassen (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. https://doi.org/10.1080/20430795.2015.1118917

[11]. Ali, Gongbing, Mehreen & Ghani (2020). Predicting firm performance through supply chain finance: A moderated and mediated model link. International Journal of Logistics Research and Applications, 23(2), 121–138. https://doi.org/10.1080/13675567.2019.1638894.

[12]. Wuttke, Rosenzweig & Heese (2019). An empirical analysis of supply chain finance adoption. Journal of Operations Management, 65, 242-261. https://doi.org/10.1002/joom.1023

[13]. Guo, Ke & Zhang (2023). Digital transformation along the supply chain. Pacific-Basin Finance Journal, 80, 102088. https://doi.org/10.1016/j.pacfin.2023.102088

[14]. Brynjolfsson, Hitt & Kim (2011). Strength in Numbers: How Does Data-Driven Decision-making Affect Firm Performance? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1819486 https://doi.org/10.1016/j.pursup.2005.10.00

[15]. Chen, Chiang & Storey (2012). Business Intelligence and Analytics: From Big Data to Big Impact. MIS Quarterly, 36(4), 1165. https://doi.org/10.2307/41703503

[16]. Huang, Wang & Yarovaya (2023). Corporate digital transformation and idiosyncratic risk: Based on corporate governance perspective, Emerging Markets Review. 56, 101045. https://doi.org/10.1016/j.ememar.2023.101045

[17]. MacKinnon, Krull & Lockwood (2000). Equivalence of the Mediation, Confounding and Suppression Effect, Prevention science. 1(4), 173-181. https://doi.org/10.1023/a:1026595011371