1. Introduction

Climate change is one of the most detrimental challenges of our time and requires urgent and collective action. As the global community correlates with the environmental impacts of human activity, identifying the problem and understanding the role of finance in promoting sustainable solutions becomes very critical. This essay dives into the world of climate finance and green investment, exploring their importance, challenges and potential for change in shaping a more sustainable future by offering suggestions and ideas. Climate finance is the raising of funds to address climate change challenges. This includes financial instruments and mechanisms used to support processes that will reduce greenhouse gas emissions, increase resilience to climate change and promote sustainable energy [1]. Climate finance has several sources, including public, private and international channels. Public sources are the state funds and international funds, like the Green Climate Fund, which supports climate related projects in several developing countries. Private sources include investments from private owned companies who do sustainable practices, like banks and individual investors. To sum everything up, the aim of this paper is to uncover these opportunities and challenges in detail and uncover the full scale for better understanding and practice.

2. Challenges of climate finance

Climate finance faces numerous issues that impede its ability to address climate problems, with the number one issue being inadequate financing overall. The current available funds are simply not enough to address these issues efficiently. This is most obvious in developing countries, where the funding required to adequately address and adapt to climate variance is high; but financial resources are scarce. Another major problem is the forecasting and therefore planning aspect of trends in climate finance. To create a stable long-term investment climate, climate projects require a similar long-term commitment from their backers. The uncertainty around these backers means that very few projects manage to hang around long enough to truly secure a place for themselves, thus preventing the planning and implementation of projects on a longer timescale that might have an impact in longer periods. Even in the aftermath of this big announcement, the political shaping of climate finance must also be considered. Oftentimes, changes in the political landscape will result in shifts in climate financing, sometimes pulling the rug out from long-standing programs and making it difficult for projects to move forward with consistency behind them. Furthermore, it would be extremely difficult to mass data the emission levels throughout the entire globe, especially if it was down to the sectors and going into minute details, yet it is those factors that will most likely set clear of the problem and allow for a more direct and accurate planning and solution towards regulating or improvising these sectors to lower the levels of emissions. The issue of accessibility and distribution also brings a challenge. Developing countries, which are often the most vulnerable to climate change, encounter difficulties especially in accessing climate finance due to barriers like limited institutional capacity, complex procedures, and a lack of financial structure within its economy. This can result in differences in funding distribution, leaving some regions disproportionately affected by climate change without the appropriate and balanced resources.

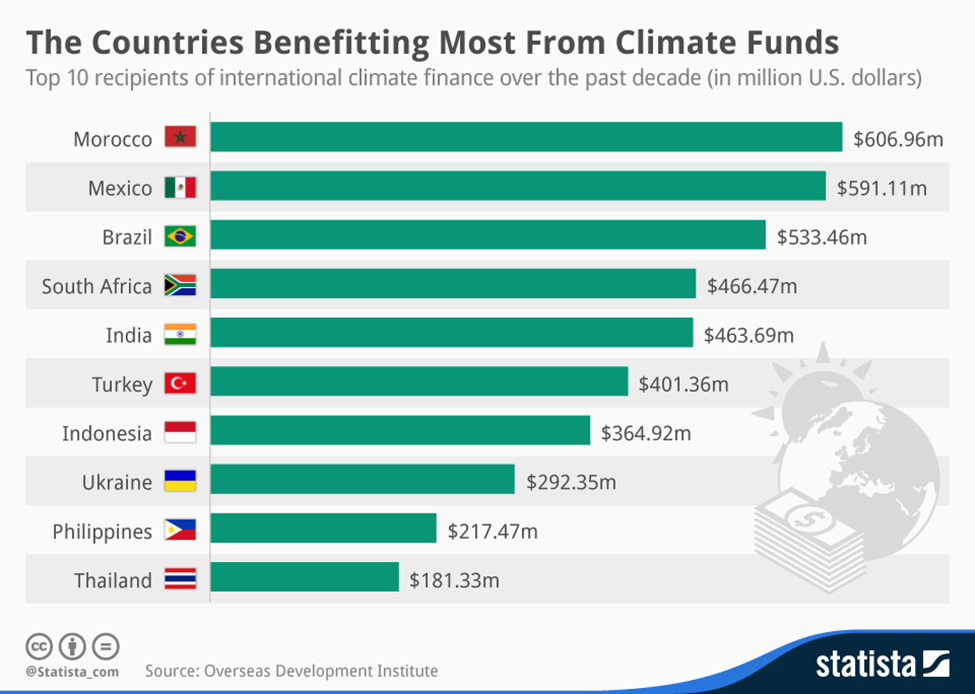

To make use of these challenges and prove its authenticity, statistics will demonstrate just how accurate and legit each problem is. An article from Brookins education published just near the beginning of 2024 suggests that finance for global adaptation has seen a decrease, according to the statistics, from 7% in 2019–2020 to 5% of total climate finance in 2021–2022 in countries like Africa, one of the most impacted countries by climate change and the effects of global warming [2]. Another prime example of the inadequacy displayed of climate fundings amongst countries could be seen in this graph chart[3].

Figure 1: Bar diagram indicating countries finance towards climate sustainability

As shown in the graph, the financing has certainly had an improvement in some countries like Morocco and Mexico but goes drastically downwards when it comes to the bottom few. It is important to note climate change and the unbearable rise in temperature is detrimental especially in south-eastern Asia, countries like the Philippines and Thailand. Already being the up most closest few to the equator, it is without question extremely dangerous if the temperature keeps rising, and in this case, every degree down to the decimals counts. Government collects millions if not billions of dollars across the continent, these findings majority of it goes into the military, infrastructure, healthcare, etc. Although these aspects are just as important as the next, it is crucial to not undertone the severity of climate change and its impact. It is time to act on it, and by putting in more fundings is a great start. To ensure that climate finance meets the priorities and needs of local communities, in some cases, projects may not consider the specific circumstances and needs of the communities they aim to assist. This could lead to negative outcomes and potential social injustices. Furthermore, the alignment of financial incentives with climate goals is critical. Having private sector investments in sustainable initiatives requires the development of specific and clear policies, regulations and more. Overcoming these challenges allows for a coordinated, global effort that involves governments, international organizations, private sectors, and local communities to joint effort and allocate climate finance effectively and efficiently. Addressing these challenges is crucial for ensuring that climate finance acts as a transformative role in building resilience and reducing greenhouse gas emissions worldwide and not just on a smaller scale or designated for those developed countries with more resource and power.

3. Green investment incorporation in business and environment

Moving on to the concept of green investment. Green investment, by definition, is the allocation of financial assets and resources into projects, companies, or individual sectors that are environmentally friendly and socially responsible for the cause of climate change [4]. The center of the investment projects is to generate positive returns while contributing to environmental sustainability and addressing climate change concerns. It is important to note that green investment could be like any other form of investment, just with a cause towards benefiting climate change or any form of effort in improving the state of global warming. The fact is that many different industries that benefit from green investments, including clean technology, sustainable agriculture, renewable energy, and socially conscious companies. Renewable energy projects, like wind farms and solar panels, are a prime example of this investment sector since they produce clean energy that is used by several businesses while lowering the consumption of fossil fuels. Energy efficiency, which are projects that enhance building’s energy performance and reduce waste generation. Socially responsible investing involves moving funds to companies with strong environmental, social, practices. Green bonds being another type of green investment, are issued to fund environmentally friendly projects. These various types of green investments all contribute to addressing climate change.

Green investment's significance should not revolve solely around profit margins. Instead, this investment serves as an important response to the urgent issue of climate change. By businesses channeling funds to projects that decrease gas emissions, securing suitable environment to ensure the safety of the populace, and enhance environmental sustainability, green investment is key part of the worldwide response to Constraints on Public Budgets and Financing of Green Assets and Transitioning Toward Low-Carbon Economies. Green investment meets growing recognition of the environment and social responsibility. Consequently, investors are, and should, increasingly recognize the connections between the flow of their financial resources and its impact on our world and communities. Nowadays, as the world is becoming more and more connected, actions by a business are being watched by the world thanks to the internet. Investing in environmentally sustainable projects is therefore a representation of ethical and responsible financial practices that play a role in ones’ corporate citizenship and contribute to health and well-being of communities. Moreover, green investments are leading a new wave of economic opportunities that are beginning to include innovative technological solutions. As technology has advanced, so too has our capability to radically reimagine our clean energy future, with a variety of alternative noise pollution solutions, further within reach than ever before. Not only do these investments advocate for environmental goals, but they have room to develop across rapidly advancing industries investing in these sectors supports environmental commitment and harnesses economic potential from industries that are already leading the way in global markets. - alongside other benefits. What's more, they may also fortify financial stability in the long run: Our businesses and economies face significant climate risks, and those that have adopted sustainable practices are better positioned to deal with environmental changes. And this is why it is important for investors to create portfolios that possess durable and resilient characteristics to avoid calamities.

Reconciling the information mentioned above on climate finance and green investment in the business field is important in terms of the basic grounded principles. Climate finance and green investment are concepts related to business. That is why it is important to have a basic understanding of how the two can affect you in your business. Companies are also outlining new responsibilities for themselves that the world is tracking with great intent via climate finance, which is the main aspect of it. To be successful in the business world, companies need to recognize the potential damage to their supply chains. Companies are increasingly grappling with these types of questions from a climate change standpoint, necessitating the incorporation of those considerations into operations of the business, towards climate finance. Those that incorporate climate finance in their strategies demonstrate a dedication to environmental conservation, supporting global sustainability initiatives, and increasing shareholder confidence and public approval upon a moral standard as well. This is particularly relevant in an era where consumers are more and more inclined to buy from environmentally friendly businesses, and investors prioritize ESG (Environmental, Social and Governance) as one of the key factors when making their investments [5]. Green investment, instead, is a practical way for enterprises to use their capital in sustainable and profitable projects. For companies in the energy, technology, agriculture or other sectors that are already working on ‘green’ projects, green investments are an attractive way to bring growth and innovation. Any banking system has to ‘label’ its financial products to provide firms with a sufficiently significant incentive to carry out green investments. This partnership between climate finance and business-led green investment is leading to advancements in new technologies, the expansion of environmentally responsible practices, and the development of resilient business models. The concepts of climate finance and green investment not only have a role in the daily business practices, as taught through business studies today, but also demonstrate the importance of business in managing climate-change problems and achieving long-term sustainable development. The understanding of these concepts equips future entrepreneurs with the knowledge and tools needed to run a business large to a global scale that is profitable whilst meeting all the ethical dilemmas regarding environmental protection.

4. Future direction/development

Future directions and recommendations bring a personal proposal relevant to this situation based on researching and relating to the previous ideas and statements. As mentioned above, green investments and renewable energy projects could turn out to be very profitable and generate revenues just like any other business. Assuming this third party is a privately owned business entity, with these findings and assets, the company could reach out to investors introducing this transformational business idea. To buy in deserted lands and plains without much greenery, trees or other habitats, areas that on the first look does not seem to be in the suitable living conditions. By putting the funds in these areas and building these small-sized communities, much like the concept introduced in Dubai where green plants and other natural habitats are built on the inside of a larger structure rather than planted outside. This allows for better and more efficient resource allocations and creates a comfortable yet environmentally friendly living condition. The main source of energy is generated through the same projects as solar panels, water generators and wind generators. The next step is to negotiate with the local governments of those countries devastated by climate change and are unable to provide enough fundings, countries such as the Maldives which face complete disappearance due to the continuous rising of sea levels. Offering immigration opportunities to these countries and providing aid to the people of the land, and helping the citizens move into these small communities. This diminishes the need to farm down trees and destroy natural habitats in the process of building, a much crucial factor leading to global warming. Artificial intelligence (AI) no doubt plays another major role in the development and success in such a field as our society marches towards an AI centered world. Technological innovations are playing a transformative role in shaping the landscape of climate finance and green investment, and artificial intelligence being the thriving field of now and future global development. One significant innovation is the rise of fintech solutions that streamline climate finance transactions. Blockchain technology, for instance, provides a transparent and secure platform for recording and verifying climate related financial transactions [6]. This ensures the credibility of carbon credits, green bonds, waste management, reducing the risk of fraud, illegal dumping and enhancing the overall integrity of climate finance. Artificial Intelligence and data analytics are revolutionizing risk assessment in green investments. These technologies analyze vast datasets within a short amount of time and effort, providing insights into the environmental impact and sustainability performance of companies. Investors can make more informed and accurate decisions, evaluating based on the long-term viability of projects and assessing risks more accurately. Furthermore, digital platforms like mobile applications are easing access to green investments. Retail investors can now participate in crowdfunding campaigns for renewable energy projects or invest in green bonds through simple clicks on the mobile apps, promoting widespread engagement and simplicity. Smart contracts, powered by blockchain, are auto running the execution of climate related agreements, making more complex actions previously simpler and more efficient. The policy and regulatory framework governing climate finance and green investment form an important bedrock for global efforts to combat climate change. At the international level, landmark agreements like the Paris Agreement have set the stage for coordinated action. Instituted in 2015, the Paris Agreement aims to limit global warming to well below 2 degrees Celsius and encourages financial flows toward projects that are low carbon and climate resilient [7]. Nations committed to the agreement are expected to enhance climate finance and report on their progress forming a joint and collective effort towards this globally challenging task.

National governments have been crucial in ensuring that international accords become national policies. Numerous countries have established far-reaching climate regimes which encompass plans to stimulate green investments. There are policy tools that leverage market-based mechanisms, for instance tax incentives, subsidies, energy efficiency, and other environmentally friendly ventures. It is about taking the national economic strategies and aligning them with the climate objectives at the core to make sure it fits the check that needs to be for everyone. In an effort to direct investments and the financial community, green finance standards and taxonomies have emerged. These sets of principles stipulate what sorts of investments will be considered green, providing a clear standard for investment that the global finance industry can live up to. Much like the EU Taxonomy Regulation’s criteria, which includes identifying sustainable economic activities within the European Union, subsequently impact investment decisions [8]. In the above scenario such standards ensure that investments labeled as green are in adherence to a certain set of environmental characteristics thereby engendering confidence and transparency. Climate considerations too have been merging with financial regulations. Regulatory bodies are starting to integrate climate risk assessment and disclosure requirements into financial regulations which will see firms reporting in due course on how they have incorporated the TCFD recommendations, a program that allows for investors to have a more direct disclosure to businesses risk and opportunities [9]. The Task Force on Climate related Financial Disclosures (TCFD) provides recommendations for voluntary climate related financial risk disclosures, encouraging businesses to align their operations with climate goals and disclose relevant information to investors and stakeholders. National development banks for instance, with a mandate for sustainable development, often serve as key players in climate finance. They support projects aligned with national climate goals and those facing challenges in the private market due to perceived risks or extended payback periods. These banks bridge financial gaps and act as catalysts for sustainable development initiatives.

5. Education of climate finance

Lastly, we should talk about education and how it relates to climate financing. Raising knowledge of climate finance and green investment—two critical elements in tackling the world's environmental problems—requires education and awareness. Driving the shift to a low-carbon and sustainable economy requires the active participation of financial experts and an informed public. Target audiences for educational campaigns should include the general public, students, investors, and financial experts, among others. Campaigns for public awareness can help people understand difficult financial concepts pertaining to green investment and climate financing, enabling them to make well-informed decisions. These campaigns may include workshops, webinars, and accessible online resources to promote environmental literacy. In academic settings, integrating sustainability and climate finance topics into curricular, those that enhance student’s understanding of the environmental, social, and economic implications of financial decisions. Presenting case studies and actual instances of profitable green investments might encourage experts and future advancements to include sustainability into their operations, integrating this notion to protect and preserve the environment even during the earliest stage of children’s education. Programs for financial literacy that are specific to green investments and climate finance should also not be disregarded. These initiatives can assist institutional and individual investors in navigating the challenges of sustainable financing. Financial professionals can be equipped with the knowledge and abilities to evaluate environmental risks, integrate ESG criteria, and direct customers toward investment strategies that are environmentally responsible through workshops and training sessions.

6. Conclusion

In summary, green investment and climate finance are important tools for reducing the effects of climate change and offer exciting new directions for environmentally friendly corporate operations. The direction of money flows toward environmentally friendly projects is largely determined by the changing national and international policy and regulatory frameworks. Businesses are paying more attention to and realizing the importance of incorporating climate issues into their plans as the pressure to solve climate change increases. Investment landscapes are changing as a result of the adoption of ESG criteria, taxonomies, and green finance regulations, which are pushing companies to implement sustainable operations. In addition, the harmonization of financial legislation with climate objectives guarantees that corporations precisely evaluate and reveal climate-related risks and prospects. Incorporating clear directional future developments on a global scale, introducing innovative living environments and combining the advancing of artificial intelligence, such a problem would soon be one of the pasts. Climate change isn’t going to end itself; the matter is in our own hands. Humans have brought enough destruction to this very earth given to us, now that the issues reflect and impact directly upon ourselves. It is never too late to change, yet in these desperate times, people need to wake up and do something about it as soon as possible.

References

[1]. Unfccc.int. Accessed July 3, 2024. https://unfccc.int/topics/introduction-to-climate-finance.

[2]. Ede Ijjasz-Vasquez, J. S., Mma Amara Ekeruche, C. H., Paul Muthaura, O. G., Adhanom-Ghebreyesus, T., & Costa, K. (2024, February 28). Finance for climate adaptation in Africa still insufficient and losing ground. Brookings. https://www.brookings.edu/articles/finance-for-climate-adaptation-in-africa-still-insufficient-and-losing-ground/

[3]. McCarthy, N., & Richter, F. (2014b, December 10). Infographic: The countries benefitting most from climate funds. Statista Daily Data. https://www.statista.com/chart/3046/international-climate-finance/

[4]. Inderst, G., Kaminker, C., & Stewart, F. (2012). Defining and measuring green investments..

[5]. Blank, H., Sgambati, G., & Truelson, Z. (2016). Best practices in ESG investing. The Journal of Investing, 25(2), 103-112.

[6]. Sarmah, S. S. (2018). Understanding blockchain technology. Computer Science and Engineering, 8(2), 23-29.https://www.sciencedirect.com/science/article/pii/S2589811620300434

[7]. Savaresi, A. (2016). The Paris Agreement: a new beginning?. Journal of Energy & Natural Resources Law, 34(1), 16-26.

[8]. Schütze, F., Stede, J., Blauert, M., & Erdmann, K. (2020). EU taxonomy increasing transparency of sustainable investments. DIW Weekly Report, 10(51), 485-492.

[9]. Chua, W. F., James, R., King, A., Lee, E., & Soderstrom, N. (2022). Task Force on Climate‐related Financial Disclosures (TCFD) Implementation: An Overview and Insights from the Australian Accounting Standards Board Dialogue Series. Australian Accounting Review, 32(3), 396-40.

Cite this article

Wang,Y. (2024). Climate Finance and Green Investments. Advances in Economics, Management and Political Sciences,129,51-57.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Unfccc.int. Accessed July 3, 2024. https://unfccc.int/topics/introduction-to-climate-finance.

[2]. Ede Ijjasz-Vasquez, J. S., Mma Amara Ekeruche, C. H., Paul Muthaura, O. G., Adhanom-Ghebreyesus, T., & Costa, K. (2024, February 28). Finance for climate adaptation in Africa still insufficient and losing ground. Brookings. https://www.brookings.edu/articles/finance-for-climate-adaptation-in-africa-still-insufficient-and-losing-ground/

[3]. McCarthy, N., & Richter, F. (2014b, December 10). Infographic: The countries benefitting most from climate funds. Statista Daily Data. https://www.statista.com/chart/3046/international-climate-finance/

[4]. Inderst, G., Kaminker, C., & Stewart, F. (2012). Defining and measuring green investments..

[5]. Blank, H., Sgambati, G., & Truelson, Z. (2016). Best practices in ESG investing. The Journal of Investing, 25(2), 103-112.

[6]. Sarmah, S. S. (2018). Understanding blockchain technology. Computer Science and Engineering, 8(2), 23-29.https://www.sciencedirect.com/science/article/pii/S2589811620300434

[7]. Savaresi, A. (2016). The Paris Agreement: a new beginning?. Journal of Energy & Natural Resources Law, 34(1), 16-26.

[8]. Schütze, F., Stede, J., Blauert, M., & Erdmann, K. (2020). EU taxonomy increasing transparency of sustainable investments. DIW Weekly Report, 10(51), 485-492.

[9]. Chua, W. F., James, R., King, A., Lee, E., & Soderstrom, N. (2022). Task Force on Climate‐related Financial Disclosures (TCFD) Implementation: An Overview and Insights from the Australian Accounting Standards Board Dialogue Series. Australian Accounting Review, 32(3), 396-40.