1. Introduction

Fluctuations in global energy markets have long been a critical factor influencing international economic activities. In the context of accelerating energy transitions and the push toward low-carbon development, the impact of crude oil price volatility on the global economic system has become increasingly significant. As a cornerstone of the global economy, crude oil price changes not only shape the economic structures of oil-exporting and oil-importing nations but also affect global financial systems, commodity markets, and supply chains.

Crude oil price fluctuations are driven by a multitude of interrelated factors, including the global economic cycle, financial market dynamics, exchange rate shifts, monetary policy adjustments, international trade relationships, and geopolitical events. Since the start of the 21st century, international crude oil prices have experienced dramatic swings, such as the sharp decline triggered by the 2008 global financial crisis.

At the same time, the global energy sector is undergoing a transformative shift as low-carbon development gains momentum. The rapid adoption of renewable energy sources and improvements in energy efficiency are gradually diminishing reliance on fossil fuels, thereby impacting traditional energy markets and reducing crude oil demand. Under the Paris Agreement framework, many nations have committed to carbon neutrality, fostering increased investments in clean energy technologies. These developments have introduced considerable uncertainty into the fossil fuel markets, further intensifying crude oil price volatility.

Given this backdrop, accurately forecasting crude oil prices has become a pressing issue for policymakers and market participants. Traditional forecasting models often rely on macroeconomic indicators and supply-demand fundamentals. However, as data becomes more abundant and market conditions more intricate, the limitations of conventional methods have become evident.

This paper focuses on utilizing a deep learning approach, specifically the Long Short-Term Memory (LSTM) model, to forecast Brent crude oil prices. By analyzing historical data and evaluating the model's predictive capabilities, this study not only explores the effectiveness of LSTM in energy market forecasting but also provides valuable insights and methodological advancements for addressing the complexities of crude oil markets in the era of low-carbon development.

2. Literature Review

The research of crude oil price forecast has always been a hot topic in economics, finance and energy market research. Many scholars have conducted in-depth research from different angles and methods. In this regard, deep learning models such as LSTM have been widely used in crude oil price forecasting. Jiang Feng et al. put forward a crude oil futures price forecasting model based on multi-source and multi-task automatic encoder, which improved the accuracy of forecasting by effectively using multi-source data and multi-task learning mechanism [1]. Pan Shaowei et al. and Yu Wenmei et al. also used LSTM to forecast crude oil prices, and achieved good forecasting results [2].

At the same time, some researchers try to combine LSTM with other forecasting models to further improve the accuracy of forecasting. Liao Jingwen proposed an international crude oil price forecasting model based on VMD-LSTM-ELMAN [3]. By introducing variational modal decomposition (VMD) and ELMAN neural network, the forecasting accuracy was significantly improved. Li Yang et al. put forward a study on crude oil production time series prediction based on ARIMA-LSTM [4]. This model combines ARIMA model and LSTM model, and the prediction effect is remarkable.

In addition to the deep learning model, researchers also explore the prediction of crude oil prices from different perspectives. Liu Wenjing et al. carried out the forecast and analysis of crude oil price according to the influence of multiple factors [5]. Lin Yu et al. proposed a crude oil futures price forecasting model based on error correction and deep reinforcement learning, which made up for the shortcomings of the traditional forecasting model [6]. Lv Chengshuang et al. put forward a research on international crude oil price prediction based on CATTSTS model, and improved the prediction accuracy by introducing the periodic trend prediction method [7].

In addition, some researchers try to combine the deep learning model with other methods and put forward a new prediction model. For example, Zhao Goya et al. proposed a crude oil futures next-day price forecasting model based on TN-LP-LSTM-SVM hybrid model, which effectively improved the accuracy of forecasting [8].

Numerous studies have shown that deep learning models, especially LSTM, can not only be used for crude oil price forecasting alone, but also be effectively combined with other models to improve the accuracy of forecasting [9-11]. At the same time, multi-factor analysis and new forecasting methods also provide a new perspective for crude oil price forecasting. These studies provide valuable reference for understanding and forecasting the price of crude oil in this paper.

3. Data and Analysis

3.1. Data Introduction

The trend of crude oil price is complex and changeable, which is influenced by multiple factors, such as macroeconomic factors, geopolitical events, supply-demand relationship and market expectations. In order to effectively predict the price fluctuation caused by these complex factors, this paper selects the spot price data of European Brent crude oil provided by us energy information administration (EIA) as the research object. Brent crude oil price is widely regarded as the benchmark of international crude oil price because of its importance in the global oil market. Its price data not only reflects the global supply and demand dynamics, but also includes the market's expectation of future prices and the influence of various economic and political factors.

The data set used in this paper covers the daily spot price of Brent crude oil from January 1, 2018 to September 30, 2019, and the unit is USD/barrel. In order to improve the prediction performance of the model, the original data is transformed logarithmically, which makes the price data more stable in the time series and helps to reduce the errors in model training.

3.2. Model Introduction

This study employs the Long Short-Term Memory (LSTM) model to forecast crude oil price time series. LSTM, a variant of Recurrent Neural Networks (RNN), is specifically designed to capture long-term dependencies in sequential data by incorporating a unique internal structure known as the Memory Cell. Traditional RNNs often encounter challenges such as vanishing or exploding gradients when handling long-sequence data, which limits their ability to retain information from earlier time steps. LSTM effectively overcomes these issues through its internal mechanisms—namely, the "forget gate," "input gate," and "output gate"—which allow the model to selectively retain or discard information as needed, making it highly suitable for processing complex and long-term dependent data.

Using the trained LSTM model, this study forecasts Brent crude oil prices over a short-term horizon. The predictive performance of the model is rigorously evaluated by comparing its outputs with actual market data. The analysis highlights the LSTM model’s ability to capture overall price trends, while also discussing its strengths and limitations, particularly in scenarios of sharp price fluctuations.

Furthermore, the forecasting results not only validate the applicability of the LSTM model in the energy sector but also provide actionable insights for stakeholders, such as policymakers and investors, navigating the uncertainties of the crude oil market. These findings offer valuable reference points for understanding future price dynamics and making informed decisions in the context of an increasingly volatile and complex energy market.

3.3. Data description analysis

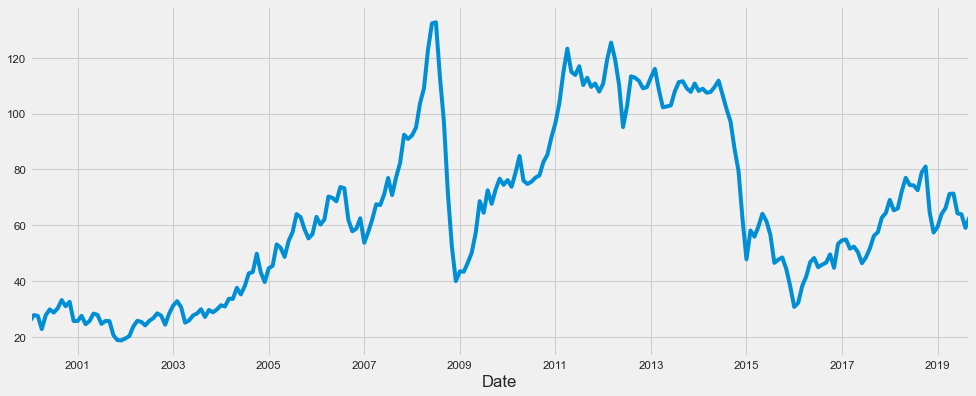

This paper extracts the data from 2000 to 2019, resamples the price data on a monthly basis, and generates a time series of monthly average prices. Furthermore, Figure 1 of this time series is drawn to show the long-term trend and fluctuation of Brent crude oil price during this time period.

Figure 1: Brent crude oil price time series figure

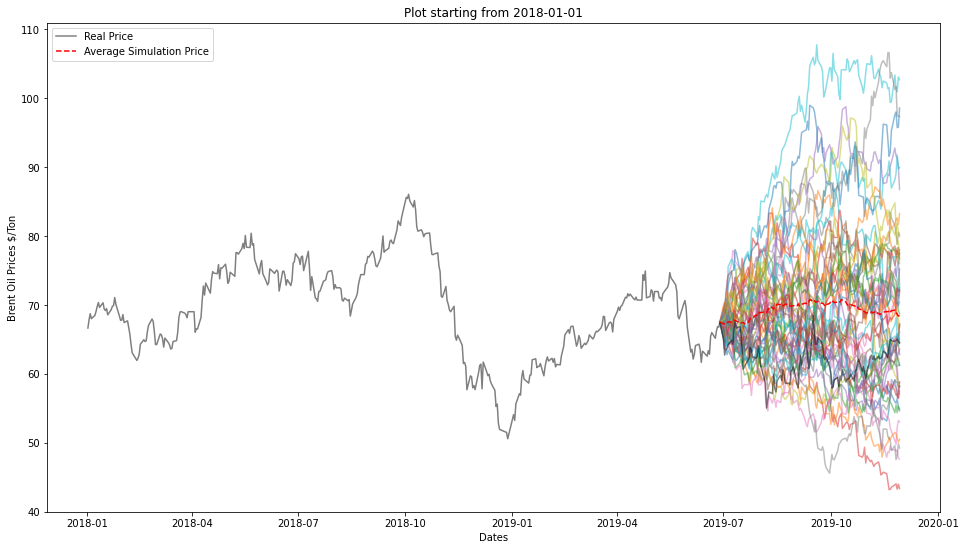

The geometric Brownian motion model is used to simulate the future price of Brent crude oil, and 50 potential price paths are generated, and the average values of these paths are calculated to predict the future price trend. Figure 2 shows the historical price from January 1, 2018, as well as the simulated potential price paths and their average predicted prices, so as to show the potential fluctuation range and possible average trend of future prices.

Figure 2: Simulation figure of geometric Brownian motion model

4. LSTM model analysis

In order to ensure that the training process of the model is more stable and effective, the data set is normalized to between 0 and 1. Then, the data set is divided into 70% training set and 30% testing set to ensure that the model can be tested on new data. Next, the sliding window method is used, and each input sample is set to contain historical data of 90 time steps, so that the LSTM model can predict future values based on past data.

When constructing the LSTM model, this paper designs three layers of LSTM elements, each layer contains 60 elements, and adds a Dropout layer after each layer to reduce the risk of over-fitting. Adam optimizer is used in the model training process, and the verification loss is optimized by reducing the learning rate. After the training, the prediction results of the model on the training set and the test set are denormalized, and the mean absolute error (MAE) and root mean square error (RMSE) are calculated to evaluate the accuracy of the model.

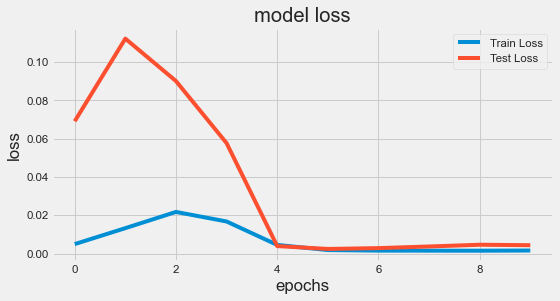

Figure 3: LSTM Model loss curve

Figure 3 shows the loss changes of the model during training. Figure 3 shows that the training loss decreases steadily and tends to be stable after the fifth epoch, while the test loss rises sharply at the beginning, decreases rapidly after reaching the peak, and finally is almost consistent with the training loss. This shows that the model may be over-fitted in the initial stage, but after further training, the model is more stable and has better generalization ability.

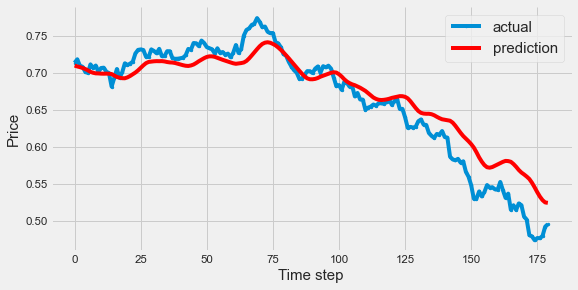

Figure 4: LSTM prediction curve

Figure 4 shows the difference between the predicted results of the LSTM model and the actual data. In the chart, the horizontal axis represents time step, the vertical axis represents price, the blue line represents actual price, and the red line represents the predicted price of the model. By comparing the trends of these two lines, the prediction accuracy of the model can be evaluated intuitively. The chart shows the prediction performance of the model in the first 180 time steps, which is helpful to understand the fitting degree of the model to time series data.

Figure 4 shows that although the overall trend of the predicted value (red line) of the model is close to the actual value (blue line), there are still some deviations, especially in the areas where prices fluctuate. On the whole, the model can capture the downward trend of prices, but it can't accurately track the actual price changes in some time periods.

5. Conclusion

In this paper, the LSTM model is used to predict the price of Brent crude oil, which shows the potential of deep learning in capturing the long-term dependence of crude oil market and its price trend. The results show that the LSTM model can effectively predict the trend of crude oil price in most cases, especially in the period of relatively stable market, although the prediction accuracy decreases during the period of large price fluctuation. This discovery provides a new tool and perspective for policy makers and investors in the face of market uncertainty.

However, considering the acceleration of global low-carbon transformation and the constant change of crude oil market, traditional forecasting methods are facing challenges. The introduction of LSTM model not only improves the adaptability to complex market environment, but also provides a foundation for further research. Future work can explore the combination of LSTM and other forecasting technologies to enhance the performance of the model in extreme market conditions, and at the same time, we can consider introducing more factors that affect the price of crude oil to build a more comprehensive and accurate forecasting model.

References

[1]. Jiang Feng, Hu Chengyu, Wang Hui. Crude oil futures price prediction based on multi-source and multi-task automatic encoder [J/OL]. Systems Engineering Theory and Practice, 1-17[2024-08-22].

[2]. Pan Shaowei, AARON Li, Wang Yaling, et al. LSTM neural network crude oil price forecast [J]. Computer Technology and Development, 2021,31(05):180-185.

[3]. Liao Jingwen. Research on artificial intelligence prediction of international crude oil price based on VMD-LSTM-ELMAN model [J]. Journal of Chengdu University of Technology (Natural Science Edition), 2024,51(01):164-180.

[4]. Li Yang, Du Ruishan, Cheng Yongchang. Study on crude oil production time series prediction based on ARIMA-LSTM combined model [J]. Practice and understanding of mathematics, 2022,52(06):40-48.

[5]. Liu Wenjing, Yang Xiaobu, Wang Zhiguo. Influencing factors and forecast analysis of transaction price based on multiple factors [J]. Statistics and Consulting, 2023,(02):19-23.

[6]. Lin Yu, Yu Yuanyuan, Zhang Xi, et al. Research on crude oil futures price prediction based on error correction and deep reinforcement learning [J]. Systems Engineering Theory and Practice, 2023,43(01):206-221.

[7]. Lv Chengshuang, wangtong. Research on international crude oil price forecast based on CATTSTS model [J]. Price Monthly, 2022,(05):8-13.

[8]. Zhao Geya, Xue Minggao. Prediction of the next-day price change direction and volatility of crude oil futures based on TN-LP-LSTM-SVM mixed model [J]. Control and Decision, 2022,37(10):2627-2636.

[9]. Niu Dongxiao, Cui Xiwen. Crude oil price forecast based on mixed deep learning [J]. Journal of North China Electric Power University (Social Science Edition), 2023,(06):30-42.

[10]. Gao Haixiang, Hu Yu, Yu Lean. Oil price prediction based on decomposition and integration of LSTM neural network model [J]. computer applications and software, 2021,38(10):78-83.

[11]. Yu Wenmei, Fang Fuxing. Research on China crude oil futures index prediction based on LSTM neural network [J]. natural science journal of harbin normal university, 2020,36(02):32-37.

Cite this article

Zhao,Y.;Hu,B.;Wang,S. (2024). Application of LSTM Models in Forecasting Brent Crude Oil Prices During the Green Energy Transition. Advances in Economics, Management and Political Sciences,132,177-182.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jiang Feng, Hu Chengyu, Wang Hui. Crude oil futures price prediction based on multi-source and multi-task automatic encoder [J/OL]. Systems Engineering Theory and Practice, 1-17[2024-08-22].

[2]. Pan Shaowei, AARON Li, Wang Yaling, et al. LSTM neural network crude oil price forecast [J]. Computer Technology and Development, 2021,31(05):180-185.

[3]. Liao Jingwen. Research on artificial intelligence prediction of international crude oil price based on VMD-LSTM-ELMAN model [J]. Journal of Chengdu University of Technology (Natural Science Edition), 2024,51(01):164-180.

[4]. Li Yang, Du Ruishan, Cheng Yongchang. Study on crude oil production time series prediction based on ARIMA-LSTM combined model [J]. Practice and understanding of mathematics, 2022,52(06):40-48.

[5]. Liu Wenjing, Yang Xiaobu, Wang Zhiguo. Influencing factors and forecast analysis of transaction price based on multiple factors [J]. Statistics and Consulting, 2023,(02):19-23.

[6]. Lin Yu, Yu Yuanyuan, Zhang Xi, et al. Research on crude oil futures price prediction based on error correction and deep reinforcement learning [J]. Systems Engineering Theory and Practice, 2023,43(01):206-221.

[7]. Lv Chengshuang, wangtong. Research on international crude oil price forecast based on CATTSTS model [J]. Price Monthly, 2022,(05):8-13.

[8]. Zhao Geya, Xue Minggao. Prediction of the next-day price change direction and volatility of crude oil futures based on TN-LP-LSTM-SVM mixed model [J]. Control and Decision, 2022,37(10):2627-2636.

[9]. Niu Dongxiao, Cui Xiwen. Crude oil price forecast based on mixed deep learning [J]. Journal of North China Electric Power University (Social Science Edition), 2023,(06):30-42.

[10]. Gao Haixiang, Hu Yu, Yu Lean. Oil price prediction based on decomposition and integration of LSTM neural network model [J]. computer applications and software, 2021,38(10):78-83.

[11]. Yu Wenmei, Fang Fuxing. Research on China crude oil futures index prediction based on LSTM neural network [J]. natural science journal of harbin normal university, 2020,36(02):32-37.