1. Introduction

In today's business landscape where globalization and sustainability are deeply intertwined, environmental, social and corporate governance (ESG) risk management has become a key factor in determining their survival and development, and enterprises are facing unprecedented pressure and opportunities. As a rapidly rising and widely influential enterprise in the global science and technology field, the development of Xiaomi provides rich and valuable materials for the study of enterprise ESG risk management. From smartphones to smart home devices, the nature of the technology industry itself gives Xiaomi a unique ESG risk management situation. Through in-depth analysis of Xiaomi's practice in ESG risk management, this study aims to reveal common opportunities and challenges faced by technology enterprises in this emerging field, provide decision-making reference for enterprise managers, enrich relevant theoretical research for the academic community, and provide industry insights for policy makers. To jointly promote enterprises in the realization of business value while better fulfill social responsibility, to achieve sustainable development goals[1].

2. Theoretical Framework of ESG Risk Management

2.1. Principles and objectives of ESG risk management

The principles of ESG risk management occupy an important place in current corporate and investor concerns. In the last decade, the practice of sustainable investing has undergone a remarkable transformation. The past five years have been one of the most significant periods of change in the field of sustainable development and environmental policy. ESG reporting is moving seamlessly from voluntary to mandatory[2]. Investors prefer to invest in companies with high ESG scores that these companies will withstand the crisis and earn higher returns. After all, ESG risk is not a stand-alone concept, and only when companies look at ESG from a strategic and global perspective can they truly anticipate the risks and opportunities that may arise in the future.

2.2. Concept of ESG risk management

ESG risk differs from traditional risk in that it is macro, multi-dimensional, They are closely linked and can affect the business in a variety of ways, which makes the forecasting and evaluation process of the business more complex and often requires a longer time span. According to the World Economic Forum's Global Risks Report 2020, climate change is having a broad impact across a range of industries, including countries' economies and business activities, and is expected to remain the biggest global threat over the next decade. Climate change continues to affect business performance despite efforts to use a variety of tools to mitigate climate change risks [3].

Risks on the social front refer to the various impacts that an enterprise may have on society, including but not limited to risks to employee rights and interests, supply chain management, product safety, community relations, human rights, labor standards, and the challenges posed by social instability and injustice. For example, Apple is committed to ensuring that its global workforce enjoys fair working conditions and benefits, including protection of wages, hours of work, and labor rights. Governance risks relate to the internal governance structure of the company, the transparency of the management team, the protection of shareholders' rights and interests, and the prevention of corruption, as well as addressing the challenges posed by poor corporate governance and internal corruption.

2.3. International ESG risk management framework and standards

According to the official website of the United Nations Sustainable Stock Exchange (SSE), as of February 17, 2024, the main criteria and percentages of ESG disclosure guidelines cited by stock exchanges around the world are as follows: GRI (96%), SASB (79%), IIRC (76%), CDP (70%), TCFD (63%), and CDSB (36%) [4].

Global Reporting Initiative (GRI): Founded in 1997 and released its first generation of sustainability reporting guidelines in 2000, the organization's global reach extends to South America, North America, Oceania and Europe. Based on the GRI Reporting Guidelines, 50 organizations have published their own sustainability reports.

Sustainability Accounting Standards Board (SASB): The agency was established in 2011, SASB is a not-for-profit organization that has developed a tailored approach to disclosing key ESG details to investors. The Sustainable Industry Classification System (SICS®) was born. SICS categorizes companies into 77 industries (covering 11 sectors).The sustainability themes of the SASB Guidelines are divided into five categories, and SASB identifies 26 relevant sustainability themes within these five sustainability dimensions.

The Task Force on Climate-related Financial Disclosure (TCFD): was co-founded by the Financial Stability Board (FSB) and the Group of Twenty (G20) in December 2015 to increase the focus on the risks and opportunities for organizations transitioning to a low-carbon economy. Its core elements include, among others, governance, strategy, risk management, indicators and targets. The TCFD advocates for businesses to assess and document the potential economic consequences of climate change for themselves, including risks associated with policy and technological change, especially in specific circumstances such as adverse weather conditions.

Different standards can also be used in conjunction with other sustainability reporting frameworks[4]. For example, many companies apply both SASB and GRI standards to meet the needs of interested parties. Companies such as ArcelorMittal and PSA Group use both SASB and GRI for disclosure in the same consolidated report. Nike publishes a gri-based report and SASB summary.

3. Xiaomi's ESG Risk Analysis and Mitigation Strategy Assessment

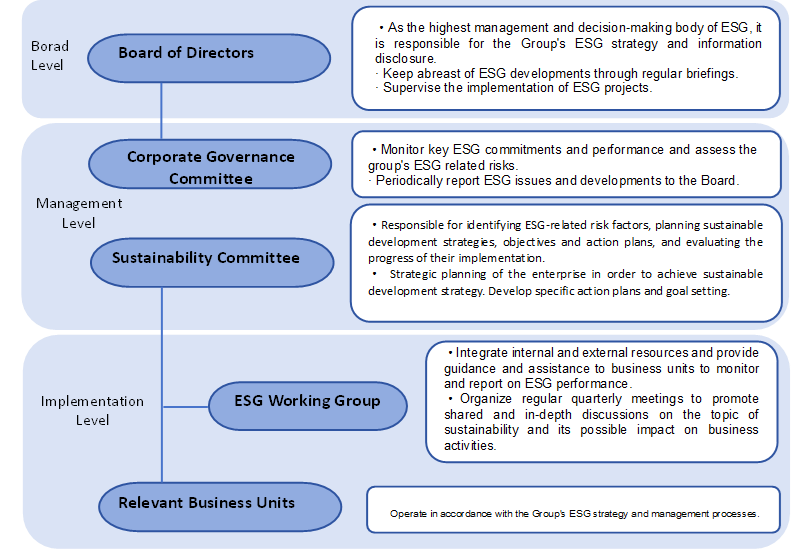

3.1. The current state of risk management in Xiaomi

Focusing on the research field of consumer electronics and artificial intelligence manufacturers, Xiaomi integrates smartphones and smart devices within the IoT framework and boasts of being ranked among the top three smartphone deliveries globally. As of December 31, 2023, Xiaomi has built the world's leading AIoT2 platform, connecting 740 million smart devices, excluding smartphones, laptops and tablets. Xiaomi, the No. 3 company in the global smartphone market and a pioneer of the AloT platform, leverages its broad reach and proficiency to continue to foster a sustainable economic environment that helps users, employees, companies, and the broader human community.

Diligent mining management (environmental) Xiaomi has always acted in accordance with the OECD Due Diligence Guidelines on Responsible Supply Chains for Minerals in Conflict-Affected and High-risk Areas and the ethical Mineral Sourcing guidelines in the RBA Responsible Minerals Initiative (RMI).and avoids ethical mineral sourcing, avoiding the procurement of conflict-related minerals and avoiding the direct or indirect allocation of funds to local armed groups.

Figure 1: Xiaomi Corporation Sustainability Governance Structure[5]

3.2. Xiaomi's ESG Risk Management Analysis

By analyzing the latest 2023 esg report of Xiaomi, it can be seen that as an excellent technology group, Xiaomi has a perfect enterprise management system and enterprise risk management experience. In 5 years of esg practice, more excellent and effective risk management solutions have been summarized. In the 2023 report, Xiaomi has identified and ranked the substantial issues, from which we can see that the risks Xiaomi may face now are.

Quality management and data security handling, the automobile business, as a new business scope of Xiaomi, faces great challenges and risks, in particular, the technology and infrastructure of new energy vehicles may not be fully mature, the production process may involve more automation and high-tech equipment, and the quality control of the production may face challenges, such as manufacturing defects, assembly problems and so on.

3.3. Assessment of Mitigation Strategies of Xiaomi

Table 1: Xiaomi's GHG emissions consist mainly of carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O) and hydrofluorocarbons (HFCs.) Total GHG emissions are reported in CO2 equivalent[6]

Scope (too COe )2 | 2023 | 2022 | 2021 | 2020 |

Direct GHG emissions (Scope 1) | Point 12252 | 7122 .60 | 9096 .95 | 8402 .12 o'clock. |

Indirect GHG emissions (Scope 2) | 104470 .04 points | 78620 .01 points | 73723 .21 | 58079 .17 |

Other indirect GHG emissions from value chains (Scope 3) | To be disclosed in September 2024 | 10075225 points | 12368223 .29 | - |

Through the results of Xiaomi's greenhouse gas emissions inventory, we can see that both direct and indirect greenhouse gas emissions are increasing year by year. Therefore, in the face of this series of environmental risks, Xiaomi has firstly improved and upgraded its products and taken measures such as clean technology frontier exploration, green logistics, green office and energy management. mitigation measures such as waste management and recycling, the most important of which are the following product upgrades and recycling measures.

Ensuring product safety is considered a fundamental aspect within Xiaomi's comprehensive automotive quality management framework. The system covers the entire life cycle of the product, from R&D to every stage of production, adhering to rigorous testing protocols. The system integrates every procedure, management method, quality benchmark, specification and operational directive related to quality and safety in automotive and related group companies.

Table 2: Safeguarding data privacy and security in the automotive industry,Third party audit certification[6]

ISO / IEC 27001 | Certification of information security management system |

ISO / IEC 27018 | Certifying the cloud personal information management system |

ISO / IEC 27701 | Certification of the personal information management system |

SOC 2 Type II certification | Specialized safety audits |

TUV Rheinland Enhances Privacy Protection Testing | MIUI |

Xiaomi has adopted a strict data security incident handling process and emergency response mechanism to ensure that data security risks are handled quickly and synchronously. Xiaomi has established a dedicated individual responsible for the overall supervision of the emergency response to data security incidents, who is responsible for assessing the severity of these incidents and coordinating emergency security measures.

4. Future Opportunities and Outlook for ESG Risk Management

To re-examine risk management structures from a sustainability perspective, we need to integrate environmental, social and governance (ESG) aspects into the risk management process. In this context, this paper, starting from the concept of "risk" and combining with the current international research status of risk assessment and management, puts forward an enterprise risk management system model based on the concept of sustainable development. Reassessing risk management from a sustainability perspective requires expanding traditional risk assessments to include environmental, social and governance (ESG) factors, not just financial and operational measures. Risk management also involves risks, such as transformation risks, technology risks, market risks, etc., but also opportunities, such as resource efficiency opportunities, energy sourcing opportunities, and market opportunities.

ESG risk management will encounter more complex and diversified challenges. When choosing risk management strategies, enterprises should prevent and control potential risks according to their own specific conditions. Sustainable growth strategy is a new concept of value creation. As environmental and social issues continue to grow around the world, businesses are increasingly exposed to risks that require appropriate response strategies. In the ESG risk management process, they will encounter two main challenges: first, the collection of information, and second, the in-depth analysis of the data.

5. Conclusion

ESG (Environmental, Social and Governance) Enterprise Risk Management (ERM) frameworks and standards are constantly developing and evolving, presenting challenges and opportunities in today's business environment. Using Xiaomi as an example, this paper can conclude that although some companies have made some progress in sustainability, they still face many challenges, such as lack of supply chain transparency, environmental impact management, and data privacy issues. In the future, with the continuous development and popularization of ESG standards, ESG enterprise risk management will become one of the key strategies for sustainable development, and companies will need to continuously improve their awareness of ESG risk management in order to achieve long-term sustainable development and contribute more to society and the environment.

References

[1]. Sinha, G. (2021). Corporate Social Responsibility- A Positive Obligation on the Companies to Fulfill their Responsibility towards Country. Journal of Legal Studies & Research, 08(03), 177–197. https://doi.org/10.55662/jlsr.2022.8304

[2]. Zaremba, U. (2023). Strong ESG Risk Management as a Way to Improve Organisational Resilience in Times of Crisis: An Analysis of WIG-ESG Index Constituents. Financial Sciences , 28(1), 17–31. https://doi.org/10.15611/fins.2023.1.02

[3]. Hakan Cavlak, Yasin Cebeci, Necati Güneş & Ömer Faruk Tan, Global Climate Risk Index and Firm Performance: Evidence from Turkish Firms. Ethics and Sustainability in Accounting and Finance, Volume III Chapter, First Online: 05 October 2021 pp 245-279, https://link.springer.com/chapter/10.1007/978-981-33-6636-7_13?

[4]. Lakhani, L., & Herbert, S. (2022). Theoretical frameworks applied in integrated reporting and sustainability reporting research. South African Journal of Economic and Management Sciences, 25(1). https://doi.org/10.4102/sajems.v25i1.4427

[5]. Xiaomi. (2022). ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT . Xiaomi Corporation. https://ir.mi.com/environmental-social-governance

[6]. Xiaomi. (2023). Xiaomi Corporation 2023 Environmental, Social, and Governance (ESG) Report. Xiaomi Corporation. https://www.mi.com/global/about/sustainability

Cite this article

Gao,R. (2024). Opportunities and Challenges of Corporate ESG Risk Management: Evidence from Xiaomi. Advances in Economics, Management and Political Sciences,127,38-43.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sinha, G. (2021). Corporate Social Responsibility- A Positive Obligation on the Companies to Fulfill their Responsibility towards Country. Journal of Legal Studies & Research, 08(03), 177–197. https://doi.org/10.55662/jlsr.2022.8304

[2]. Zaremba, U. (2023). Strong ESG Risk Management as a Way to Improve Organisational Resilience in Times of Crisis: An Analysis of WIG-ESG Index Constituents. Financial Sciences , 28(1), 17–31. https://doi.org/10.15611/fins.2023.1.02

[3]. Hakan Cavlak, Yasin Cebeci, Necati Güneş & Ömer Faruk Tan, Global Climate Risk Index and Firm Performance: Evidence from Turkish Firms. Ethics and Sustainability in Accounting and Finance, Volume III Chapter, First Online: 05 October 2021 pp 245-279, https://link.springer.com/chapter/10.1007/978-981-33-6636-7_13?

[4]. Lakhani, L., & Herbert, S. (2022). Theoretical frameworks applied in integrated reporting and sustainability reporting research. South African Journal of Economic and Management Sciences, 25(1). https://doi.org/10.4102/sajems.v25i1.4427

[5]. Xiaomi. (2022). ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT . Xiaomi Corporation. https://ir.mi.com/environmental-social-governance

[6]. Xiaomi. (2023). Xiaomi Corporation 2023 Environmental, Social, and Governance (ESG) Report. Xiaomi Corporation. https://www.mi.com/global/about/sustainability