1. Introduction

Public colleges receive approximately 41% of their total revenue from government funding; this figure is only 9% and 2% for private non-profit and for-profit institutions, respectively. Significantly, about one-fifth of the revenue from public universities comes from students’ tuition fees, and private non-profits and for-profits receive 19 and 93 percent, respectively [1]. Therefore, it is reasonable to infer that the essentiality of student tuition fees reflected in the overall operation of universities leads to potential financial burdens for enrolled students. College costs have risen by more than 135%, or roughly 2.3 times, from 1963 to 2021, across all school categories [2]. As the cost of post-secondary education elevates continuously, student loan applications have become more and more prominent.

The history of student loans can be traced back to medieval Europe from the late 11th century, with the foundation of institutions of higher learning [3]. Educationally, student loans are provided to expand access to higher education since it became a consensus that access to education should not be fettered by poverty [4].

Loans for education are funds borrowed to finance advanced studies, and they are aimed at covering the cost of tuition, textbooks and daily living expenses, relieving pressure for borrowers when pursuing their academic careers. Student loans are mainly divided into two categories: federal student loans and private student loans. Some schools also provide financial assistance to their students in the form of loans. Federal loans are generally the first option for students, covering about 75% of application requests in the US in 2013 [5]. Appliers need to fill out the Free Application for Federal Student Aid (FAFSA) form, and a credit check is not an essential part of the application process. As for private student loans, they require a more standard application process and it is necessary to conduct a credit check. Roughly 43 million Americans have outstanding federal student loan debt and in 2024, student loan borrowers in the United States accumulated to $1.75 trillion in federal and private student loan debt, according to The Motley Fool. Throughout history, the FAFSA has undergone several changes, including simplifying application procedures and formalities. As the application process for FAFSA was always considered lengthy and complicated, some students may fall off track and fail to receive financial subsidies when needed. In some states, policymakers mandated the completion of FAFSA to increase completion rates, and some others set counsellors to navigate students unfamiliar with the system. Simplification on paperwork, such as reduced number of questions on the application form, has been approved as well [6].

This paper evaluates the pros and cons of student loans in the US, thus offering students a more comprehensive understanding of the impact of student loans, and possibly improving their economic conditions, academic performances and even the broader economy by making rational and wise choices.

2. Financial Impacts

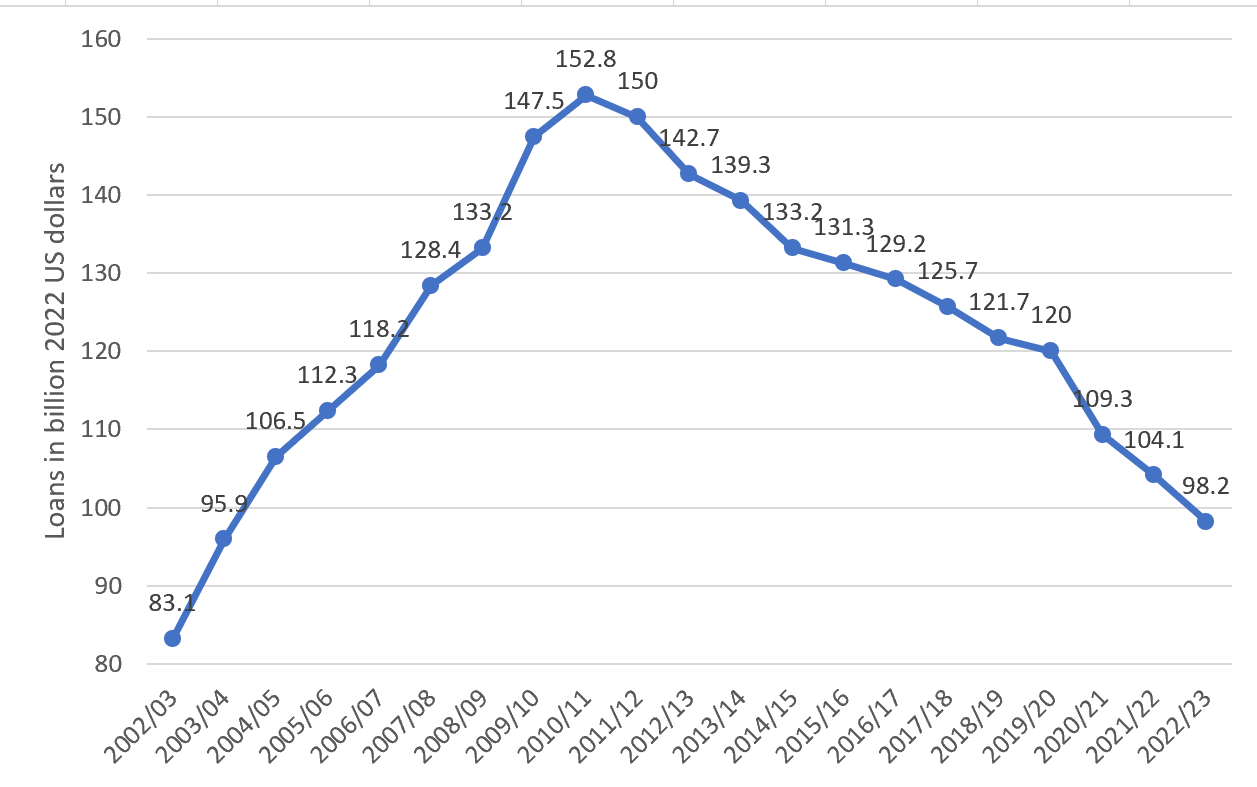

The financial impact of student loans cannot be neglected since this issue directly relates to money. Over the years, it has been widely known that tuition fees have been rising worldwide, especially in the US, based on data from the US Department of Education. Not surprisingly, the overall financial status of college enrollees is not positive. According to the 2018 Healthy Minds Survey, more than half of US college students report their current financial situation as “stressful” and “often stressful”. Likewise, the National College Health Assessment data demonstrates that 75% of US students encountered significant financial distress in the past 12 months. However, according to Figure 1 below, ever since 2010, the total amount of student loans provided by the government started to decline, contrasting with the increasing number of students with student loans.

Figure 1: The fluctuation of the provision of student loans in the US (Data from: Statista).

Research has shown that the default rate is essentially unrelated to the size of loans borrowed. People with approximately less than $10,000 in student debt have the same probability of not repaying their loans as those who have $100,000 in debt. More than 50% of borrowers in default have been making payments for over 3 years, and more than 50% of borrowers in serious delinquency have been making payments for over 4 years [7]. As a result, students must be cautious when applying for student loans because the time cost and possible financial struggle afterwards can be troublesome. People’s incentive to borrow student loans is to invest in higher education with the belief of the commonly cited principle that higher degrees always lead to higher future salaries. However, students in debt may not earn enough to pay their initial loans even after graduation. According to data from Statista, in 2022, the annual earnings of American graduates was about $52,000, while in the academic year of 2021 to 2022, students with loans typically had an average debt of $27,400, meaning that students had to spare half of their income to repay their loans. Nonetheless, it would be too arbitrary to assert that student loans affect students’ financial status negatively depending on various factors, such as the type of institutions they attended and different employment outcomes. It is important to note that education loans are not charities, and they only temporarily push the financial cost of going to universities into the future.

3. Academic Performance and Career Outcome

Student loans also have an impact on academic performance and can possibly affect future career decisions. In fact, based on data from the Federal Reserve’s Survey, most student debt owners are concentrated in upper-income households, accounting for about 60% of outstanding education debt. This should not be surprising, since the premise of applying for student loans is to be enrolled in higher education. Many low-income households consist of adults who have no education beyond high school, and thus, have little education debt. Therefore, it is reasonable to infer that whether the student is on student loans cannot be an accurate criterion for judging a students' academic ability.

According to data released in 2023 by Fortune Institute, 81% of college students worked part-time. Due to the popularity of having part-time jobs, the impact of being employed on students' grades requires discussion. Though part-time jobs are often associated with reduced time for studying or being overwhelmed, it has not found significant differences in Grade Point Average (GPA). However, students not employed do score higher on the American College Test (ACT) than those employed. Participation in extracurricular activities was the sole factor that exhibited a notable variation in college-related engagement. Students working part-time had a lower level of involvement in extracurricular activities [8].

Taking the discussion further, how will part-time jobs affect students’ future career decisions? Working part-time can positively impact students by expanding their social network with corresponding managers, supervisors or colleagues, cultivating practical life skills, and, to some extent covering some college expenditures. These benefits can help students make informed career choices due to exposure to different work environments. On the contrary, overworking could lead to a lack of energy and decreased efficiency, which could narrow students’ career choices since grades are less outstanding [9]. Therefore, the key is to find a balance between employment and coursework, since both the advantages and drawbacks of part-time jobs are evenly matched.

4. Impacts on the Broader Economy

Student debt plays a significant role in the US economy. Students in the United States borrowed a combined $1.67 trillion in federal and private student loan, which is the second largest household debt according to the Federal Reserve’s most recent report. Starting with the government level, the total amount of outstanding student loan in the United States was more than $1.7 trillion as of the fourth quarter of 2023, based on Federal Reserve statistics. If borrowers fail to repay the debt, this forced debt cancellation would lead to financial losses for governments. For example, in 2024, the approval of $1.2 billion in student debt cancellation for nearly 153,000 borrowers currently participating in the Saving on a Valuable Education (SAVE) repayment plan was announced by President Biden [10]. While borrowers’ livelihoods improved greatly due to the cancellation, the financial losses still remain. The government can lose an estimated $1.8 trillion if it cancels all student loans, possibly leading to a decrease in investment into public services. Low-quality public services can cause distrust towards government authorities; the lack of public trust is often attributed to the poor performance of public services, and politicians cite public services as crucial to building trust in governments [11].

From a less financial perspective, offering student loans gives more students with talent but lack economic strength opportunities to receive higher and better education, cultivating more talents and benefiting overall social development. No country can achieve sustainable economic growth without investing in human capital [12]. It is logical to surmise that since more people are educated, they aim for more decent work, and try to avoid ordinary work. Vacancies in basic jobs may contribute to a lack of workforce. For example, in infrastructure construction, nearly 17 million infrastructure workers are projected to permanently leave their jobs, and increasing competition in academic-related jobs could exacerbate the shortage of labour in less-skilled sectors.

From a personal perspective, repaying student loans can limit spending on other products. When significant amounts of people’s purchasing power are undermined, consumer spending may encounter a decline since people may spare a considerable portion of their wealth on repaying their debt instead of keeping disposable and liquid income in their hands. The number of new firms could be reduced with few people having a budget for investing; homeownership rates could be lowered due to the delay created by student loan payments, and students have difficulty moving out of their parents’ houses [13]. Overall, accumulated unpaid loans can negatively impact the overall economy in multiple ways.

5. Conclusion

This paper discusses the impacts of student loans on students’ financial outcomes, academic performances, and the repercussions on the broader economy. While the expanded education access has been acknowledged, the uncertainty of whether student loans can alleviate financial burden has been discussed. In addition, the paper fairly evaluates the pros and cons of the influences of part-time jobs on students’ career experiences. This study analyses the negative consequences of excessive student loans and debt, such as the possible decline in the government budget, inappropriate job allocation in the labour market, and personal predicaments.

Students, as borrowers, need to examine their current and future financial status carefully when applying for loans. If students choose to apply for a loan, then seeking the balance between working to repay the loan and remaining concentrated on coursework is crucial, because the primary goal of having student loans is to receive higher education. Governments should be aware of student loan bubbles. Setting up policies to evaluate the repayment capability of borrowers will be necessary. Regulations for the rational allocation and matching in the labour market should also be established.

The paper is limited in focusing mainly on the situation in the US, and thus cannot resemble the true situation worldwide. Precise data analysis is relatively deficient as it is mainly based on theoretical assumptions. There could be future quantitative studies looking into exactly how much governments should provide the average student loan to maintain a balanced budget, and how much students should borrow based on various economic conditions of each family. Instead of making general suggestions, exact statistical analysis can better offer practical insights.

References

[1]. National Center for Education Statistics. (2022) COE - Postsecondary Institution Revenues. Retrieved from https://nces.ed.gov/programs/coe/indicator/cud/postsecondary-institution-revenue

[2]. National Center for Education Statistics. (2021) Digest of Education Statistics. Retrieved from https://nces.ed.gov/programs/digest/d21/tables/dt21_330.10.asp

[3]. Adams, J. (2016) The history of student loans goes back to the Middle Ages. The Conversation, 23, 1-5.

[4]. Atkinson, G. B. J. (1983) Student Loans. Journal of Further and Higher Education, 7(1), 47–53.

[5]. Edmiston, K. D., Brooks, L. and Shepelwich, S. (2013). Student loans: Overview and issues. Federal Reserve Bank of Kansas City Working Paper, 12-05.

[6]. Siddiqi, J. E. and Mikolowsky, J. (2020) Boosting FAFSA Completion to Increase Student Success. Policy Brief. Equitable Transitions through Pandemic Disruptions. Education Commission of the States, ED607344.

[7]. Hiltonsmith, R. (2017) Small Loans, Big Risks Major Consequences for Student Debtors. Virginia Tech. Retrieved from https://vtechworks.lib.vt.edu/items/f5e592c9-f7ec-4281-b0bd-adca0ea521ea

[8]. Green, G. and Jaquess, S. N. (1987) The Effect of Part-Time Employment on Academic Achievement. The Journal of Educational Research, 80(6), 325–329.

[9]. Tessema, M. and Ready, K. (2014) Tessema, M., Ready, K., & Astanie, M. (2014). Does Part-Time Job Affect College Students’ Satisfaction and Academic Performance (GPA)? The Case of a Mid-sized Public University. International Journal of Business Administration, 5 (2), 1-10.

[10]. The White House. (2024) Fact Sheet: President Biden Cancels Student Debt for more than 150, 000 Student Loan Borrowers Ahead of Schedule. Retrieved from https://www.whitehouse.gov/briefing-room/statements-releases/2024/02/21/fact-sheet-president-biden-cancels-student-debt-for-more-than-150000-student-loan-borrowers-ahead-of-schedule/

[11]. Van de Walle, S. and Bouckaert, G. (2003) Public Service Performance and Trust in Government: The Problem of Causality. International Journal of Public Administration, 26(8-9), 891–913.

[12]. Ozturk, I. (2008) The Role of Education in Economic Development: A Theoretical Perspective. Journal of Rural Development and Administration, 33(1), 39-47.

[13]. Gleeson, M. (2016) Student loan debt and the effects on the broader economy. Master’s thesis. John Hopkins University.

Cite this article

Wu,X. (2024). The Impact of Student Loans on the Enrollees in the US. Advances in Economics, Management and Political Sciences,113,185-189.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. National Center for Education Statistics. (2022) COE - Postsecondary Institution Revenues. Retrieved from https://nces.ed.gov/programs/coe/indicator/cud/postsecondary-institution-revenue

[2]. National Center for Education Statistics. (2021) Digest of Education Statistics. Retrieved from https://nces.ed.gov/programs/digest/d21/tables/dt21_330.10.asp

[3]. Adams, J. (2016) The history of student loans goes back to the Middle Ages. The Conversation, 23, 1-5.

[4]. Atkinson, G. B. J. (1983) Student Loans. Journal of Further and Higher Education, 7(1), 47–53.

[5]. Edmiston, K. D., Brooks, L. and Shepelwich, S. (2013). Student loans: Overview and issues. Federal Reserve Bank of Kansas City Working Paper, 12-05.

[6]. Siddiqi, J. E. and Mikolowsky, J. (2020) Boosting FAFSA Completion to Increase Student Success. Policy Brief. Equitable Transitions through Pandemic Disruptions. Education Commission of the States, ED607344.

[7]. Hiltonsmith, R. (2017) Small Loans, Big Risks Major Consequences for Student Debtors. Virginia Tech. Retrieved from https://vtechworks.lib.vt.edu/items/f5e592c9-f7ec-4281-b0bd-adca0ea521ea

[8]. Green, G. and Jaquess, S. N. (1987) The Effect of Part-Time Employment on Academic Achievement. The Journal of Educational Research, 80(6), 325–329.

[9]. Tessema, M. and Ready, K. (2014) Tessema, M., Ready, K., & Astanie, M. (2014). Does Part-Time Job Affect College Students’ Satisfaction and Academic Performance (GPA)? The Case of a Mid-sized Public University. International Journal of Business Administration, 5 (2), 1-10.

[10]. The White House. (2024) Fact Sheet: President Biden Cancels Student Debt for more than 150, 000 Student Loan Borrowers Ahead of Schedule. Retrieved from https://www.whitehouse.gov/briefing-room/statements-releases/2024/02/21/fact-sheet-president-biden-cancels-student-debt-for-more-than-150000-student-loan-borrowers-ahead-of-schedule/

[11]. Van de Walle, S. and Bouckaert, G. (2003) Public Service Performance and Trust in Government: The Problem of Causality. International Journal of Public Administration, 26(8-9), 891–913.

[12]. Ozturk, I. (2008) The Role of Education in Economic Development: A Theoretical Perspective. Journal of Rural Development and Administration, 33(1), 39-47.

[13]. Gleeson, M. (2016) Student loan debt and the effects on the broader economy. Master’s thesis. John Hopkins University.