1.Introduction

"China-concept stocks" refer to companies incorporated in mainland China or Hong Kong but listed on overseas exchanges, primarily in the United States. One of the key reasons many Chinese companies choose to list in the U.S. is that NASDAQ has relatively lower listing requirements compared to Chinese exchanges, making it an attractive option for China-concept stocks [1]. These companies attract global investors by leveraging China's vast market while gaining access to international capital. Luckin Coffee was once a prominent example of China-concept stocks. In May 2019, it went public on NASDAQ, marking a significant milestone for Chinese companies going public in the U.S. However, on January 31,2020, Muddy Waters Research, a firm known for shorting China-concept stocks, released an 89-page anonymous report alleging financial fraud at Luckin. This report accused the company of inflating sales and manipulating revenue, leading to a public outcry. By June 2020, following its admission of fraud, Luckin was delisted from NASDAQ.

While financial fraud in publicly listed companies has been widely studied, particularly through theories like the Fraud Triangle, which suggests that pressure, opportunity, and rationalization are the three primary factors contributing to financial fraud, there is limited research on the impact of such fraud on stock prices and corporate reputation rebuilding [2]. This paper aims to fill this gap by using Luckin Coffee as a case study, analyzing the impact of financial fraud on its stock price and providing a detailed illustration of Luckin’s self-rescue efforts. The findings can provide valuable lessons for corporate managers facing reputation crises following incidents of fraud.

2.Overview of Luckin's Financial Fraud

2.1.Market Performance before the Fraud was Exposed

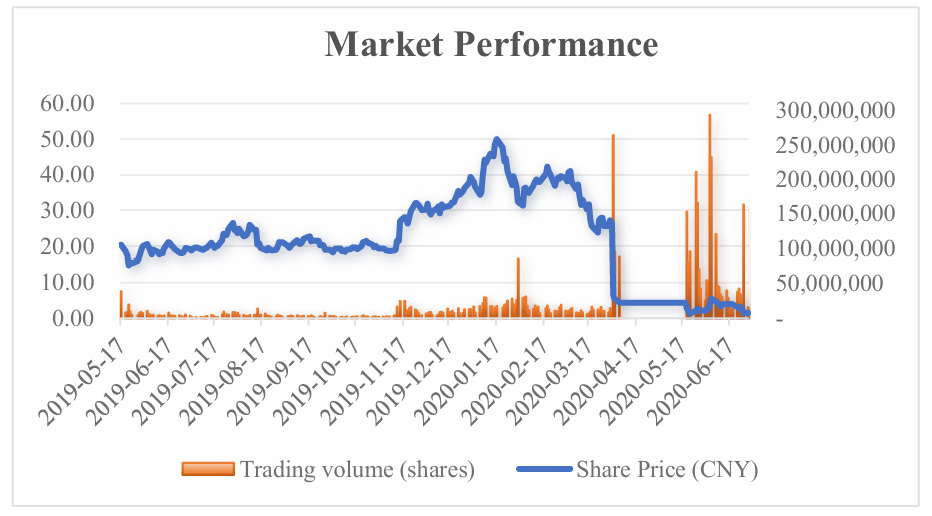

Market performance typically refers to the overall performance of a company or asset in the market [3]. This paper analyzes Luckin Coffee's market performance before the exposure of its financial fraud scandal from three aspects: stock price trends, trading volume, and market capitalization.

As shown in Figure 1, since Luckin Coffee's Initial Public Offering (IPO) on May 17, 2019, its stock price began to rise steadily in the second half of 2019, reaching a peak of 50.02 RMB per share[4]. In terms of trading volume, its fluctuation trend closely aligns with that of the stock price. Starting in the second half of the year, daily trading volume consistently exceeded ten million shares. As a result, the company's market capitalization grew significantly. This indicates that the company's market expansion strategy has been well-received. With the opening of more stores and an increase in market share, the company successfully established a high-growth image, attracting significant investor attention. At the same time, it reflects the market’s recognition of Luckin's rapid expansion and the strong interest and confidence in its growth potential.

However, despite the positive market perception, there were signs that raised concerns. From October 2019 to January 2020, before the financial fraud scandal was exposed, Luckin's stock price increased by approximately 73%. This significant price increase may have been a potential risk signal of financial fraud, especially in light of the financial scandal that emerged afterward. It suggests that the market might have had overly optimistic expectations about the company's financial situation and future prospects, which were likely based on falsified financial data.

Figure 1: Market Performance of Luckin Coffee [4]

2.2.Financial Fraud Methods Employed by the Company

On January 31, 2020, Muddy Waters Research released a lengthy anonymous report accusing Luckin Coffee of financial fraud. On April 2, 2020, a special committee composed of three independent directors at Luckin Coffee publicly admitted that the company had overstated its sales by 2.2 billion yuan, along with inflating related costs and expenses (details can be seen in Table 1). Luckin Coffee's fraudulent practices can be categorized into three main areas, following data is sourced from the Muddy Waters short-selling report:

First, in terms of sales volume and unit price. The company inflated individual store sales volumes by at least 69% in Q3 2019 and 88% in Q4 2019, each store skips an average of 106 orders per day. Also, excluding free products, Luckin exaggerated its net selling price per item by at least 1.23 yuan or 12.3%. The actual selling price was 46% of the product’s marked price, not the 55% claimed by the management.

Second, regarding to costs, Luckin inflated its advertising expenses by over 150% in the third quarter of 2019, particularly with its spending on Focus Media. The overstated advertising expenses (336 million yuan) were later recouped to inflate reported revenue and store-level profits, falsely inflating profits and Return On Investment (ROI) by 3.97 billion yuan.

Third, in terms of other product sales, Luckin exaggerated the revenue contribution of "other products," inflating it from the real 6%-7% to 22%-23%, leading to a 40% overstatement.

Table 1: Estimated Fraud and Revenue Discrepancies by Quarter (2018 Q2 - 2019 Q4) [5]

|

Accounting Period |

2018 Q2 |

2018 Q3 |

2018 Q4 |

2019 Q1 |

2019 Q2 |

2019 Q3 |

2019 Q4 (company forcast) |

|

Revenue (CNY 000) |

121,000 |

241,000 |

466,000 |

479,000 |

909,000 |

1,541,000 |

2,100,000 |

|

No. of stores |

624 |

1,189 |

2,073 |

2,963 |

3,680 |

4,507 |

4507 |

|

store revenue/quarter (CNY 000) |

193.9 |

202.7 |

224.8 |

202.1 |

306.8 |

418.8 |

465.9 |

|

Assume the number of stores is accurate & Estimated Avg. Revenue per Store (3 Quarters): CNY 210,000 |

622,230 |

722,800 |

946,470 |

||||

|

Reported Revenue - Estimated Revenue |

286,770 |

768,200 |

1,153,530 |

||||

|

Estimated Total Amount of Fraud (CNY 000) |

2,208,500 |

||||||

3.The Impact of Luckin's Financial Fraud on the Capital Market

3.1.Significant Drop in Stock Prices

On January 31, 2020, the day the report was released, Luckin's stock price dropped significantly from 36.40 CNY (on January 30) to 32.49 CNY, a decline of approximately 11% in one day. By the time it was delisted in June 2020, Luckin Coffee's stock price dropped by approximately 92.83% (The trend can be seen from Figure 1). It is due to the collapse of investor confidence, which led to a large number of sell-offs and a sharp decline in stock price. Investors hold a pessimistic view of the company's future, believing that its value has been overestimated [6]. Trading volume on January 31, 2020, skyrocketed to 85 million shares, which was much higher than the typical volume in previous days. The surge in trading volume indicates a strong market reaction, with investors rushing to exit or engage in short-term speculative trading, leading to increased market volatility [7]. Such market turbulence typically reflects extreme uncertainty about the company's prospects and governance.

3.2.Regulatory Investigations

After the Luckin Coffee financial fraud scandal was exposed, market regulators swiftly responded. The China Securities Regulatory Commission (CSRC) launched an immediate investigation and imposed administrative penalties on Luckin and its executives, with fines totaling 61 million yuan, while also strengthening disclosure requirements for listed companies. Meanwhile, Luckin reached a $180 million settlement with the U.S. Securities and Exchange Commission (SEC) and signed a $187.5 million settlement agreement with a shareholder class action group to compensate investors for their losses [8]. Following the scandal, Nasdaq suspended trading of Luckin's stock and ultimately delisted the company in June 2020. These penalties had severe consequences for Luckin: the company’s market value plummeted, and its stock price fell by over 90% before being delisted. Furthermore, the company's reputation was severely damaged, investor confidence collapsed, and operations were significantly affected, with financial and legal burdens increasing, forcing the company into large-scale restructuring.

4.Luckin Coffee’s Journey to Restoring Corporate Reputation

4.1.Damage to Brand Image

Brand credibility and consumer price sensitivity influence each other. A brand can impact multiple stages of the consumer decision-making process, thereby affecting various elements of the consumer utility function. When consumers face uncertainty and there is information asymmetry in the market, brand credibility can moderate the effect of price on consumer utility, reducing price sensitivity [9]. Moreover, brand credibility not only helps strengthen long-term customer relationships but also fosters positive word-of-mouth and reduces the likelihood of customers switching to competing brands [10].

Based on the relationship between brand credibility and consumer price sensitivity, the damage to Luckin Coffee's brand image had profound implications for the company. With the loss of brand credibility, a trusted brand has on price sensitivity weakened, consumers became more sensitive to price. This made it more difficult for Luckin to retain customers, as consumers were more likely to turn to competitors offering better prices when faced with uncertainty and distrust. Additionally, the deterioration of brand credibility disrupted the consumer decision-making process, diminishing customer loyalty and reducing the positive word-of-mouth that had previously helped the company grow. This, in turn, increased the likelihood of customers defecting to competing brands, further eroding Luckin's market share and long-term profitability. The loss of brand trust not only impacted immediate revenue but also had long-term consequences, weakening its ability to rebuild customer relationships and maintain market positioning.

4.2.Strategies for Reputation Rebuilding

After the fraud crisis broke out, many believed that Luckin had little chance of a comeback and would have to declare bankruptcy. However, Luckin did not sit idly by; instead, it embarked on an active path of self-recovery.

4.2.1.Reformation of Corporate Governance

After the crisis broke out, there was internal turmoil within Luckin’s management, and key executives linked to the company's major shareholder, the "Lu Zhengyao faction," gradually lost trust. On the evening of May 12, 2020, Luckin Coffee announced in a statement that the company's founder and Chief Executive Officer (CEO), Qian Zhiya, was removed from her position by the board of directors, and was replaced by the company’s co-founder and Senior Vice President, Guo Jinyi. Alongside Qian, the previously suspended Chief Operating Officer (COO), Liu Jian, was also dismissed. In July, during a special shareholders' meeting and board meeting, Luckin appointed Guo Jinyi, the former interim CEO, as Chairman of the Board and CEO.

4.2.2.Corporate Restructuring

During Luckin Coffee’s recovery process, the strong support from Centurium Capital was critical. As an early lead investor in Luckin, Centurium Capital reached an equity acquisition agreement with joint liquidator KPMG on August 14, 2020, with the condition that the deal would be subject to the approval of the British Virgin Islands (BVI) court. Centurium Capital earned trust due to its unwavering support as a long-term shareholder of Luckin. Even after the financial fraud scandal, Centurium Capital remained optimistic about the company’s business and sent a team to work on-site for several months, assisting with large-scale adjustments to store layouts, marketing strategies, product strategies, and digital systems. Additionally, it pushed the board to conduct an independent investigation, cooperate with regulatory authorities, and remove those involved in the fraud. In April 2021, when the capital markets remained closed to Luckin, Centurium Capital injected another $240 million to help with Luckin’s overseas debt restructuring and settlement with the SEC. Ultimately, in January 2022, the BVI court ruled that Lu Zhengyao and Haode Investment’s debt restructuring agreement did not gain the majority approval from creditors, making Centurium Capital the final winner. Centurium Capital, along with IDG Capital and Ares Special Situations Group (Ares SSG), then completed the acquisition of the 383 million shares previously held by Lu Zhengyao and his management team, becoming the controlling shareholder of Luckin Coffee with more than 50% of the voting rights.

4.2.3.Adjusting the Operational Model

In 2020, Luckin Coffee made significant adjustments to its operating model, implementing four key initiatives. First, it slowed the expansion of self-operated stores, closed those with heavy losses, reduced store opening costs, and continued to grow its franchise network. Second, the company significantly cut marketing expenses, shifting to low-cost private domain traffic by distributing sales subsidies through WeChat groups to maintain a high customer repurchase rate, while focusing more on young consumers, primarily students and young professionals. Third, it frequently launched new products to drive "blockbuster marketing", with the coconut latte series, released in June 2021, achieving over 10 million cups sold in one month, setting a new record. In 2023, Luckin Coffee collaborated with multiple brands, enhancing its brand influence and captured the attention of key audiences. (shown in Table 2). Among these collaborations, the most notable success was with Kweichow Moutai. On September 4, 2023, the company collaborated with Moutai to launch the "Sauce Latte," which quickly became a hit.

On September 4, 2023, the company collaborated with Moutai to launch the "Sauce Latte," which quickly became a hit. The collaboration with Moutai had a significant impact on the company’s performance in the capital market. This partnership greatly boosted brand awareness, attracting widespread consumer attention and driving rapid sales growth. The "Luckin × Moutai" Sauce Latte became a blockbuster product, solidifying the company’s market position. As one of China’s most influential high-end brands, Moutai's involvement not only enhanced brand image but also opened doors to high-end consumer markets. This positive response was reflected in the capital market, with the stock price rising after the product launch and investors expressing optimism about future profitability. Overall, this partnership demonstrated the potential for growth through brand collaborations, further strengthening competitiveness.

Table 2: List of Luckin Coffee Co-Branded Products in 2023

|

Date |

Co-Branding Partner |

|

January 9 |

Meilin Han |

|

February 6 |

Line Friends |

|

February 13 |

He Jiong |

|

March 6 |

Landing Human |

|

April 10 |

Doraemon |

|

May 8 |

Five Blind Guys |

|

June 19 |

Movie "No More Bets" |

|

July 10 |

Gulangyu Music Festival |

|

August 7 |

Orange Ocean |

|

August 22 |

Line Friends |

|

August 28 |

Victoria's Secret |

|

September 4 |

Kweichow Moutai |

|

October 9 |

Tom and Jerry |

5.Conclusion

The Luckin Coffee case underscores the severe impact of financial fraud on market value, corporate reputation, and operational stability. After its fraudulent activities were exposed, Luckin's stock plummeted, investor confidence collapsed, and regulatory scrutiny intensified, damaging its reputation. However, the company demonstrated resilience by slowing the expansion of self-operated stores, cutting costs, launching successful new products, and strengthening its market position through strategic partnerships, such as with Moutai.

From a Crisis Management Theory perspective, Luckin’s recovery highlights the importance of swift crisis identification and timely response strategies. Through restructuring and precise marketing, Luckin avoided bankruptcy and restored its market presence. Moreover, in terms of Corporate Social Responsibility (CSR), Luckin's transparency, governance improvements, and efforts to regain stakeholder trust provide a key lesson on recovering from financial fraud.

This paper does not deeply explore the impact of financial fraud on long-term consumer trust or utilize advanced econometric models to assess market reactions.

While Luckin Coffee’s future development remains to be seen, this case serves as a warning to all companies engaging in or contemplating financial fraud. For Chinese concept stocks, the Luckin case is particularly instructive. As representatives of Chinese companies in the international capital markets, maintaining transparency and integrity is not only in the best interest of individual companies but also essential to upholding the image of Chinese enterprises globally. Credit is invaluable, and companies should cherish their reputations rather than relying on luck. It is hoped that, through the collective efforts of all stakeholders, Chinese listed companies can embark on a path of sustainable and healthy development, safeguarding the reputation of Chinese enterprises in the global capital markets.

References

[1]. Hou Yifang. Analysis of the Reasons for Corporate Financial Fraud—A Case Study of Luckin Coffee [J]. Time-Honored Brand Marketing, 2024(1): 156-160.

[2]. Cui Dongying, Hu Mingxia. Case Study of “Yabaite” Financial Fraud: A Perspective Based on the Fraud Triangle Theory [J]. Communication of Finance and Accounting, 2019(4): 6-9.

[3]. Toan Ngoc Bui. Stock Market Performance: Evidence from an Emerging Market[J]. PACIFIC BUSINESS REVIEW INTERNATIONAL, 2019(11): 15-26.

[4]. Yahoo Finance, Luckin Coffee’s Historical Data, 2024, https://finance.yahoo.com/quote/LKNCY/history/

[5]. Data source: Anonymous report by Muddy Waters Research, 2020.

[6]. Robert J. Barro, José F. Ursúa. Stock-market crashes and depressions[J]. RESEARCH IN ECONOMICS, 2017(9):384-398.

[7]. Paul Abbondante. Trading Volume and Stock Indices: A Test of Technical Analysis[J]. American Journal of Economics and Business Administration, 2010(3):287-292.

[8]. Lu Rui, Tang Zizhen, Yang Lei. Insights from the Luckin Coffee Scandal: How Companies Engaged in Financial Fraud Can Redeem Themselves. FRIENDS OF ACCOUNTING. 2022(9):156-160.

[9]. Erdem, T., Swait, J., & Louviere, J. The impact of brand credibility on consumer price sensitivity [J]. International Journal of Research in Marketing, 2002(3):1-19.

[10]. Jill Sweeney. Joffre Swait. The effects of brand credibility on customer loyalty[J]. Journal of retailing and consumer services, 2008(5):179-193.

Cite this article

Zhang,B. (2024). Luckin Coffee: The Impact of Financial Fraud on Company Value -- Research on Capital Market Reactions and Reputation Rebuilding. Advances in Economics, Management and Political Sciences,136,81-87.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hou Yifang. Analysis of the Reasons for Corporate Financial Fraud—A Case Study of Luckin Coffee [J]. Time-Honored Brand Marketing, 2024(1): 156-160.

[2]. Cui Dongying, Hu Mingxia. Case Study of “Yabaite” Financial Fraud: A Perspective Based on the Fraud Triangle Theory [J]. Communication of Finance and Accounting, 2019(4): 6-9.

[3]. Toan Ngoc Bui. Stock Market Performance: Evidence from an Emerging Market[J]. PACIFIC BUSINESS REVIEW INTERNATIONAL, 2019(11): 15-26.

[4]. Yahoo Finance, Luckin Coffee’s Historical Data, 2024, https://finance.yahoo.com/quote/LKNCY/history/

[5]. Data source: Anonymous report by Muddy Waters Research, 2020.

[6]. Robert J. Barro, José F. Ursúa. Stock-market crashes and depressions[J]. RESEARCH IN ECONOMICS, 2017(9):384-398.

[7]. Paul Abbondante. Trading Volume and Stock Indices: A Test of Technical Analysis[J]. American Journal of Economics and Business Administration, 2010(3):287-292.

[8]. Lu Rui, Tang Zizhen, Yang Lei. Insights from the Luckin Coffee Scandal: How Companies Engaged in Financial Fraud Can Redeem Themselves. FRIENDS OF ACCOUNTING. 2022(9):156-160.

[9]. Erdem, T., Swait, J., & Louviere, J. The impact of brand credibility on consumer price sensitivity [J]. International Journal of Research in Marketing, 2002(3):1-19.

[10]. Jill Sweeney. Joffre Swait. The effects of brand credibility on customer loyalty[J]. Journal of retailing and consumer services, 2008(5):179-193.