1. Introduction

Cash flow management serves as the basis for the sustained operation and capital control of enterprises. With the advancement of the economy, the industrial chains in various industries have been continuously refined, and an increasing number of enterprises have emerged successively. This process not only stimulates market competition but also promotes the innovation of diverse business models and financial strategies. Owing to the marked discrepancies in aspects such as cash holdings, investment magnitudes, and financing structures across different industries, the cash flow management mechanisms of each industry exhibit distinct variances. For instance, the retail sector typically needs to maintain a relatively high level of cash flow to cope with the rapidly evolving consumer demands, whereas the manufacturing industry might place greater emphasis on long-term investment returns and the capital turnover during the production cycle. Additionally, the large base of enterprises itself further propels the diversification of the current cash flow management models, and enterprises of different scales and at different development stages also demonstrate distinct characteristics in capital operation.

Consequently, the current academic circle mainly conducts rough categorization of industries based on indicators like cash holdings and focuses on conducting empirical research on the characteristics and effects of cash flow management within specific industry domains. Some academic achievements undertake research based on individual enterprises and thereby estimate and predict the cash flow management models of the entire industry. Nevertheless, this approach often neglects the inter-industry connections and influencing factors, and comprehensive deliberations remain relatively scarce. This renders it challenging to compare the differences in cash flow management among different industries from a macroscopic perspective and simultaneously restricts the development of theoretical frameworks.

In addressing this issue, this research will undertake a comparison of the current status of cash flow management in diverse industries. Uncover the commonalities and mechanistic disparities in cash flow management among various industries, thereby offering proposals for future comprehensive studies in this domain. Facilitate the advancement of novel ideas and methods related to cash flow management within the entire industry. This procedure will contribute to the establishment of a more comprehensive and systematic theoretical framework, laying a firm foundation for subsequent empirical research.

In the subsequent research stage, this study shall adopt the method of literature review to undertake a comprehensive analysis of the relevant literature on cash flow management within the retail, manufacturing, and energy sectors. Through a meticulous review and summary of the existing research outcomes in these domains, the common features and distinctive characteristics of cash flow management in each industry shall be identified. Simultaneously, this study will carry out a systematic analysis of the influence of the current natural environment, legal policies, and social demands on the cash flow management models of various industries. This part will primarily explore how enterprises adjust their financial operation strategies in response to the challenges brought about by climate change, as well as how emerging regulations and market trends prompt such adjustments. On this basis, this study will offer corresponding countermeasure suggestions for optimizing and enhancing the research in this field in the future.

2. Cash Management in Retailing Industry

2.1. Industry Traits

The current cash flow management in the retailing industry presents the feature that a high level of cash holdings leads to low profit capacity. This phenomenon is prevalently existent in numerous enterprises, particularly against the backdrop of economic fluctuations and intensified market competition. Although a high level of cash holdings can offer enterprises a certain degree of financial security, the excessive accumulation of cash may cause irrational resource allocation, thus influencing the overall profit capacity. On this basis, this research will undertake a systematic review and analysis from the specific perspectives of comprehensive cash management and working capital.

2.2. Determinants of Cash Holdings in the Retail Sector

From a macro perspective, the current level of cash holdings in the retail sector is relatively high. This phenomenon indicates that when facing uncertainty and market volatility, retail enterprises tend to maintain sufficient liquidity reserves to deal with potential risks. Kim et al. (1998) pointed out that the key factors leading enterprises to increase investment in liquidity assets include rising external financing costs, intensifying fluctuations in future cash flows, and improving expected returns on future investments [1]. Combining this concept with the operational characteristics of retail enterprises can help us understand the underlying mechanisms: in a competitive and rapidly changing environment, small retailers face huge financial pressure and need higher cash reserves to flexibly deal with supply chain issues or unexpected events.

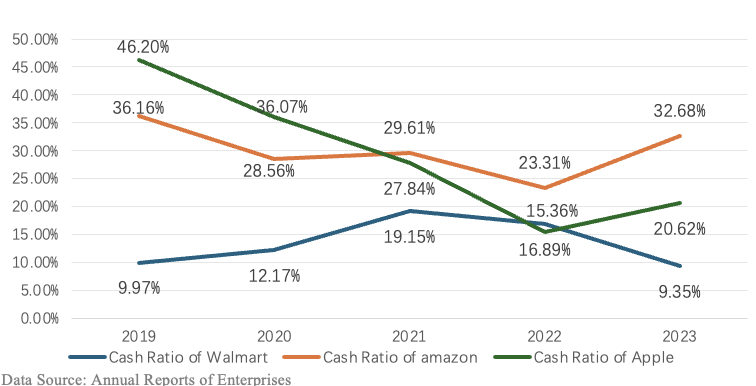

Through an empirical study of cash flow management in the retail sector in Mumbai, Somnath Das (2017) found that small retail enterprises hold a large proportion of their cash reserves due to high external financing costs [2]. Because there may be a large amount of idle funds that cannot be effectively used for production or business expansion, this phenomenon not only affects their daily operational capital turnover efficiency but also limits their long-term development potential. On the contrary, as shown in Figure 1, the cash ratio of large retail enterprises has decreased in recent years, especially Apple, whose cash ratio has decreased significantly. This trend reflects the strategic adjustments in liquidity management made by enterprises in the context of fierce competition and constantly changing consumer demands. As Chireka T et al. (2017) pointed out, enterprises with a large number of alternative liquidity assets and high capital expenditures should maintain lower cash balances [3]. Therefore, large retailers usually allocate idle funds to new technologies, expanding sales channels, or optimizing supply chains to improve operational efficiency.

Figure 1: Cash Ratios of Walmart, Amazon, and Apple.

2.3. Management of Working Capital in the Retail Sector

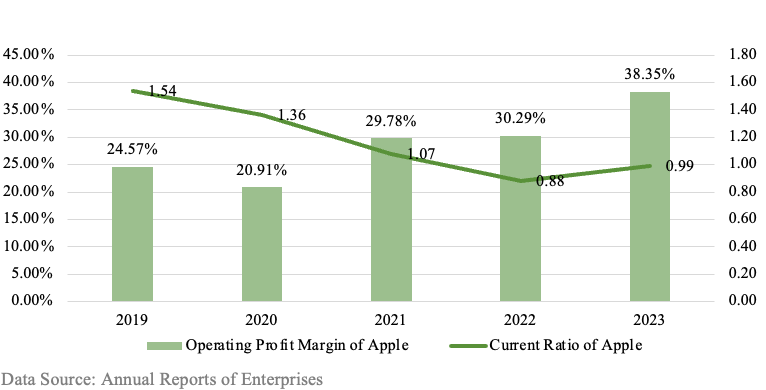

To refine the research direction, this study will concentrate on the field of working capital management in retail enterprises. Currently, it is widely acknowledged in the academic circle that an overly high level of working capital exerts an inhibitory effect on the revenue growth of enterprises. This perspective has been validated in numerous empirical studies. Particularly in a dynamic and changing market environment, overinvestment in current assets might lead to inefficient resource allocation, thereby influencing the overall financial performance [4]. Regarding financial performance, Mandipa & Sibindi (2022) carried out an empirical investigation of the retail industry in the South African region through the fixed-effect model [5]. They analyzed working capital measurement indicators such as the average inventory turnover period (AAI), the average collection period (ACP), the average payment period (APP), and the cash conversion cycle (CCC), and discovered that these factors all have a negative impact on financial performance. Eventually, they indicated that there exists a negative correlation between working capital management practices and the financial performance of enterprises. Hence, when exploring how the retail industry can effectively enhance its profit-making ability, Sathyamoorthi et al. (2018) suggested that the level of current assets should be ensured to be minimized to lower the current ratio, and inventory management techniques should be optimized, for instance, by continuously shortening the delivery time to enhance the efficiency of the supply chain [6]. The empirical analysis results, as depicted in Figure 2, suggest a certain association between the decline in the current ratio and the improvement in the profitability of Apple, particularly during the period from 2020 to 2022.

Figure 2: Profitability and Liquidity ratios of Apple.

2.4. Summary

A comprehensive analysis shows that cash management in the contemporary retail sector is marked by high liquidity and low profitability. Retail enterprises must maintain substantial cash flow to support daily inventory procurement and normal operations. Additionally, an inverse relationship exists between high operating capital and financial performance; when an enterprise overinvests in current assets, its short-term payment capacity may improve, but long-term efficiency of resource allocation decreases, impacting overall profitability. Furthermore, variations in cash management strategies are evident among different types and sizes of retail enterprises. Large chain supermarkets typically have stronger bargaining power and can reduce inventory costs through optimized supply chain management, while small independent stores face greater financial pressure due to a lack of economies of scale. Therefore, all retail enterprises should develop tailored strategies based on their circumstances to achieve effective and sustainable development goals.

3. Cash Management in Manufacturing

3.1. Industry Traits

This study analyzes existing literature and reveals that the contemporary manufacturing sector must maintain relatively high cash holdings due to daily operational requirements and shorter payment periods. Additionally, total cash holdings are influenced by various factors, including the characteristics of the management team and working capital structure. Consequently, this research will explore how these management characteristics, debt equivalents, and other related factors affect cash holdings in the manufacturing industry, providing theoretical support and practical guidance for optimizing cash management within this sector.

3.2. Determinants of Cash Holdings in Manufacturing

Based on the extant research in the domain of cash management within the manufacturing sector and the prevailing financial status of enterprises, this study discerned that the overall cash holding quantity in the manufacturing industry is on an elevated plane. In the empirical research facet, Islam (2012) conducted an analysis of 54 listed manufacturing companies on the Dhaka Stock Exchange, and the outcomes revealed that the cash holding ratio of these companies soared to as high as 11% [7]. This ratio is conspicuously higher than that of numerous other industries and indicates that it might be intimately associated with the distinctive business model inherent in the manufacturing industry.

To further scrutinize the cash holding volume and its influencing factors within the manufacturing sector, a profusion of relevant studies have been initiated in the academic realm. At the enterprise characteristic stratum, Musa (2020) executed a t-test analysis on the listed manufacturing companies on the Indonesia Stock Exchange [8]. The results manifested that the significance level of the company size merely amounted to 0.5798, exerting no discernible influence on the cash holding. This conclusion defies some of the hypotheses within traditional theories, such as the assertion that large enterprises, due to diversified operations, can effectively disperse risks and thus ought to possess higher levels of cash reserves. At the management stratum, Ozordi et al. (2019) undertook an in-depth study on the cash holding decisions of 30 listed manufacturing companies in Nigeria during the period from 2012 to 2017 and pointed out that the cash holding quantity of the companies is primarily significantly impacted by the proportion of individual director's shareholding and the existence or absence of foreign directors [9]. At the debt structure stratum, Umry & Diantimala (2018) discovered through regression curve analysis that an escalation in the proportion of long-term debts would result in a reduction in the enterprise's cash holding [10]. However, Sharma (2014) put forward that there exists a positive correlation between the escalation of the short-term debt ratio and the enterprise's cash holding [11].

3.3. Summary

Based on the preceding research, cash management in manufacturing enterprises is significantly influenced by industry production characteristics. Specifically, these enterprises require substantial working capital for raw material procurement, equipment maintenance, and human resource management to ensure smooth production processes. This includes not only funds for daily operations but also additional liquidity to address unforeseen circumstances or market fluctuations. Furthermore, the manufacturing sector often faces extended production cycles, resulting in a considerable time lag between raw material input and final product sales, which increases overall working capital needs. Additionally, due to a relatively high proportion of short-term liabilities, enterprises may experience greater financial pressure during financing activities, thereby increasing cash holdings. Consequently, many manufacturing firms must maintain adequate cash reserves to meet upcoming debt obligations and other short-term expenses. In this context, effective cash flow management becomes essential for improving operational efficiency. This study recommends that manufacturing enterprises optimize their financial structures according to actual conditions. They should consider investing moderately to enhance unit output while reducing the cash required per product through improved efficiency. Moreover, adopting advanced information technology and data analysis tools can facilitate precise inventory and supply chain management while minimizing unnecessary capital usage and achieving better economic outcomes.

4. Cash Management in Energy Industries

4.1. Industry Traits

Currently, the development of energy sector's is primarily influenced by environmental factors and macroeconomic conditions. As global focus on sustainable development increases and corporate social responsibility strengthens, the operational flexibility of energy enterprises remains low. Additionally, public pressure regarding environmental issues compels companies to exercise greater caution in decision-making. Given these factors, most energy enterprises adopt conservative cash management strategies. Furthermore, some companies are actively exploring diversified financing options, such as issuing green bonds, to optimize their capital structure and enhance financial stability. This research will provide a comprehensive analysis of relevant findings in the energy industry and propose response strategies for enterprises within this sector.

4.2. An Overall Review of Cash Management in the Energy Sector

At the macroeconomic level, according to the 2023 World Energy Statistical Review by KPMG, the global energy transition is relatively slow, with notable disparities in development among different industries. For example, international pipeline natural gas trade volume has continuously declined by 8%, while international coal trade volume reached a new peak in 2023 since 2018, increasing by 8%. This change reflects the varied strategies countries adopt in response to energy structure adjustments and dynamic market demand. Additionally, resource policies of various nations, restrictions on traditional energy consumption, and growing public concern about environmental issues have imposed significant constraints on current operations within the energy industry. Overall, companies tend to adopt conservative cash management policies to mitigate future uncertainties. In this context, Kolegowicz & Sierpińska (2020) studied cash management in Polish energy companies through empirical analysis and found a phenomenon of cash surplus within this sector [12]. This may result from limited short-term financing options and low operational flexibility. From an environmental standpoint, Zimon (2020) noted that tightening carbon emission requirements have significantly increased costs for Polish energy enterprises—particularly due to rising carbon dioxide fees—which further drives these firms to maintain higher cash reserves against potential risks [13]. Furthermore, their study indicates that these companies typically exhibit negative CCC values, suggesting heavy reliance on short-term debt financing. Considering current financial market conditions reveals that under unstable macroeconomic factors as well as social and governmental pressures, a prevalent cash surplus exists within recently energy industry.

4.3. Summary

Overall, the cash management of the current energy industry is profoundly affected by environmental and social factors. Its overall operational turnover capacity is relatively low, and its reliance on short-term financing is relatively high. To be specific, with the continuous escalation of global attention to sustainable development, enterprises have to take environmental regulations and social responsibilities into account in their capital operations, which imposes certain restrictions on their cash liquidity. Furthermore, due to the frequent fluctuations in market demand and the instability of raw material prices, numerous energy enterprises are confronted with greater financial pressure. Under such circumstances, they often have to resort to short-term financing to sustain daily operations and emergency expenditures, thereby leading to a high degree of dependence on short-term capital. In this regard, this study proposes that in order to enhance the overall operational efficiency and mitigate financial risks, managers at all levels within this industry need to apply the government's subsidy policies related to the energy industry flexibly and reduce financial risks.

5. Conclusion

Based on the aforementioned studies, a relatively high cash flow holding situation has prevalently emerged in the retail, manufacturing, and energy sectors at present. Nevertheless, there exists marked heterogeneity in cash management among these industries. The primary cause lies in the disparities in cash flow requirements and financing difficulties arising from the differences in the main business characteristics of various industries. For instance, the retail industry usually confronts rapidly fluctuating market demands and thus needs to retain adequate cash flow to cope with inventory procurement and daily operations. In contrast, the manufacturing industry might necessitate larger investments over a longer period, thereby resulting in a significantly distinct capital operation model from that of the retail industry. Additionally, the energy industry's efficiency of capital utilization can vary due to the influences of policies, regulations, and environmental factors.

On the whole, the existing research encompasses a relatively extensive scope; yet, the research subjects are predominantly concentrated in regions with relatively dense industries such as Nepal and Poland. Although these regions offer certain data support, no comparisons of cash flow management within the same industry across different regions have been carried out. Hence, this study proposes that the research scope should be further expanded to incorporate regional differences as influential factors and conduct comparative analyses of the cash management characteristics of different industries, so as to gain a deeper understanding of the approaches and strategies adopted by each industry when facing the external economic environment. This will contribute to identifying the best practices and provide theoretical basis and empirical support for the development of related fields in the future.

References

[1]. Kim C S, Mauer D C, Sherman A E. The determinants of corporate liquidity: Theory and evidence[J]. Journal of financial and quantitative analysis, 1998, 33(3): 335-359.

[2]. Das, S. (2017). Corporate cash management: A study on retail sector. Accounting , 3(1), 23-40.

[3]. Chireka T, Fakoya M B. The determinants of corporate cash holdings levels: evidence from selected South African retail firms[J]. Investment Management and Financial Innovations, 2017, 14(2): 79-93.

[4]. Knauer, T., Wöhrmann , A. Working capital management and firm profitability[J].Manag Control,2013,24:77-87.

[5]. Mandipa G, Sibindi AB. Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa. Risks.,2022;10(3):63.

[6]. Sathyamoorthi C R, Mapharing M, Selinkie P. The impact of working capital management on profitability: Evidence from the listed retail stores in Botswana[J]. Applied Finance and Accounting, 2018, 4(1): 82-94.

[7]. Islam S. Manufacturing firms' cash holding determinants: Evidence from Bangladesh[J]. International Journal of Business and Management, 2012, 7(6): 172.

[8]. Musa A, Arfan M, Nuraini A. Cash Holding in Manufacturing Companies: A Study of Indonesia[J]. Journal of Accounting Research, Organization and Economics, 2020, 3(3): 292-301.

[9]. Ozordi E, Adetula D T, Eluyela F D, et al. Corporate dynamism and cash holding decision in listed manufacturing firms in Nigeria[J]. Problems and Perspectives in Management,, 2019, 17(4): 1-12.

[10]. Umry M A, Diantimala Y. The Determinants of cash holdings: Evidence from listed manufacturing companies in Indonesia[J]. Journal of Accounting, Finance and Auditing Studies, 2018, 4(4): 173-184.

[11]. Sharma D R. Cash Management in Nepalese Manufacturing Enterprises[J]. Journal of Development and Administrative Studies, 2014, 22(1-2): 1-14.

[12]. Kolegowicz K, Sierpińska M. Cash management in energy companies[J]. Inżynieria Mineralna, 2020.

[13]. Zimon G. Financial liquidity management strategies in Polish energy companies[J]. International Journal of Energy Economics and Policy, 2020, 10(3): 365-368.

Cite this article

Tao,R. (2025). A Literature Study of Cashflow Management Across Industries. Advances in Economics, Management and Political Sciences,145,177-183.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kim C S, Mauer D C, Sherman A E. The determinants of corporate liquidity: Theory and evidence[J]. Journal of financial and quantitative analysis, 1998, 33(3): 335-359.

[2]. Das, S. (2017). Corporate cash management: A study on retail sector. Accounting , 3(1), 23-40.

[3]. Chireka T, Fakoya M B. The determinants of corporate cash holdings levels: evidence from selected South African retail firms[J]. Investment Management and Financial Innovations, 2017, 14(2): 79-93.

[4]. Knauer, T., Wöhrmann , A. Working capital management and firm profitability[J].Manag Control,2013,24:77-87.

[5]. Mandipa G, Sibindi AB. Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa. Risks.,2022;10(3):63.

[6]. Sathyamoorthi C R, Mapharing M, Selinkie P. The impact of working capital management on profitability: Evidence from the listed retail stores in Botswana[J]. Applied Finance and Accounting, 2018, 4(1): 82-94.

[7]. Islam S. Manufacturing firms' cash holding determinants: Evidence from Bangladesh[J]. International Journal of Business and Management, 2012, 7(6): 172.

[8]. Musa A, Arfan M, Nuraini A. Cash Holding in Manufacturing Companies: A Study of Indonesia[J]. Journal of Accounting Research, Organization and Economics, 2020, 3(3): 292-301.

[9]. Ozordi E, Adetula D T, Eluyela F D, et al. Corporate dynamism and cash holding decision in listed manufacturing firms in Nigeria[J]. Problems and Perspectives in Management,, 2019, 17(4): 1-12.

[10]. Umry M A, Diantimala Y. The Determinants of cash holdings: Evidence from listed manufacturing companies in Indonesia[J]. Journal of Accounting, Finance and Auditing Studies, 2018, 4(4): 173-184.

[11]. Sharma D R. Cash Management in Nepalese Manufacturing Enterprises[J]. Journal of Development and Administrative Studies, 2014, 22(1-2): 1-14.

[12]. Kolegowicz K, Sierpińska M. Cash management in energy companies[J]. Inżynieria Mineralna, 2020.

[13]. Zimon G. Financial liquidity management strategies in Polish energy companies[J]. International Journal of Energy Economics and Policy, 2020, 10(3): 365-368.