1. Introduction

With the advancement of digital technology, the media and entertainment industries have undergone a series of evolvement and reforms in the past decade. The rise of the streaming media industry has reshaped the new media landscape and changed television content consumption. Traditional television-viewing mode has been progressively supplanted by streaming media, which will pose a threat to the survival space of traditional television and film companies. The prevalence of streaming media and the decline of the film industry became an impetus for some top film companies to transform into the streaming media industry. Two film giants, Disney and Warner Bros. Discovery, both have similar backgrounds and industry influence, began to embrace this digital shift. They launched their streaming platforms Disney+ and Max, which rapidly became a new force and significant rivals in the industry.

2. Background of streaming media industry and film companies’ streaming media services

2.1. The development of streaming media

Streaming media is a way of multimedia that delivers online videos and audio through the network [1]. Compared to traditional media such as television, streaming media offers more flexible and immediate media services. Streaming media can meet peoples' demands and preferences for viewing. The viewership pattern has been greatly changed by streaming media [2].

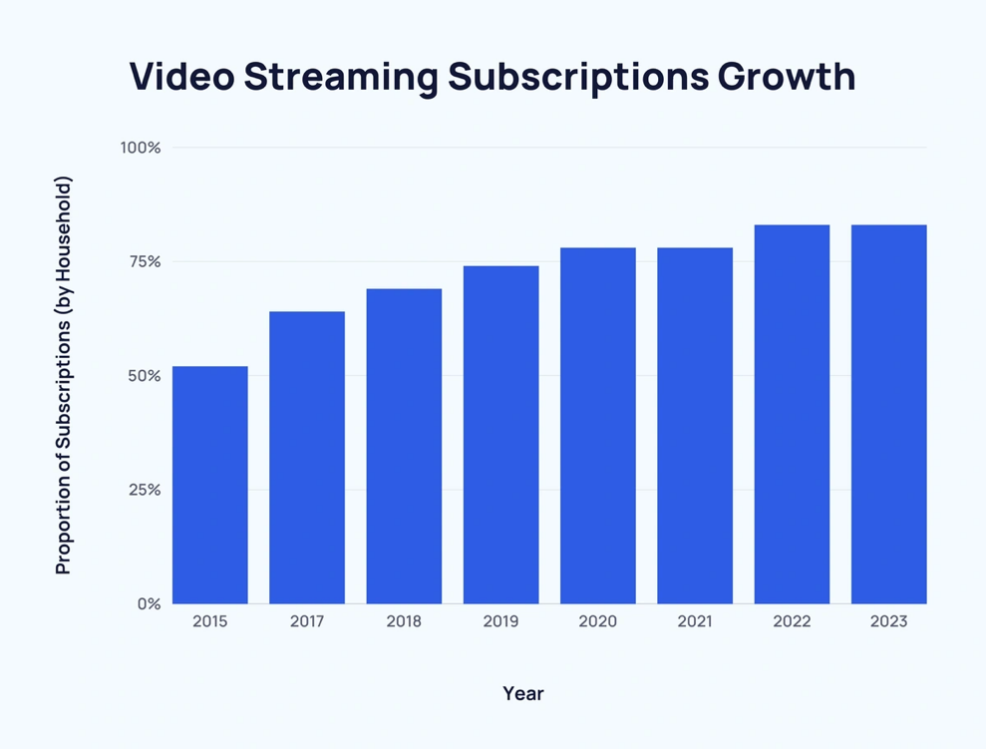

Streaming media has increasingly become popular with the advancement of technology and networks. The usage of streaming media has dramatically increased in recent years. A statistic of streaming media subscription growth in the U.S. (can be seen in Figure 1) indicates that in 2023, 83% of American households subscribed to streaming media services, compared to 52% in 2015 [3].

Figure 1: Video streaming subscriptions growth from 2015 to 2023.

2.2. The inevitability of film companies developing into streaming media companies

The decline of the film industry has become inevitable due to shrinking revenues and output. Movie theatres are undergoing excessive debt, which may lead to business closure and downsizing [4]. The decline of the film industry resulted in a serious trough of the top film companies. Statistics show that from 2010 to 2023, Hollywood's major film studios including Disney and Warner Bros. Discovery have reduced their average amount of films to 83 per year, while from 1995 to 2009, they had an average of 112 films per year [5]. Furthermore, the fading trend of the film industry is reflected in the declining profit of film studios. In 2023, Disney's annual revenue and profit dropped 8% and 3.23% respectively. Warner Bros. Discovery’s yearly revenue and profit have dropped 12% and 19% respectively.

With the rapid development of Internet technology and the widespread adoption of smart devices, audiences are increasingly inclined to watch movies and TV series through streaming platforms anytime, anywhere [6]. This convenient viewing method has attracted a massive user base, resulting in a surge in the number of users on streaming platforms. By collecting user data, streaming platforms can create precise user personas and offer personalised recommendations. This recommendation method enhances users' viewing experience, increases user engagement, and generates potential new revenue streams for companies. Additionally, streaming platforms offer diverse business models such as subscription-based memberships, pay-per-view options, and advertising integrations. These models provide stable revenue streams for film production companies and help reduce their reliance on traditional box office earnings. Therefore, film companies must undergo transformation and reform in the digital age. The emerging influence of streaming platforms and the prevalence of streaming media are forcing film companies to enter to the streaming media industry [7]. Thus, it can be seen that the film industry is facing enormous challenges and difficulties, thereby the need for transformation and reform is necessary in the digital era.

2.3. Comparison between Disney+ and Max

In order to better adapt to the digital age, Disney and Warner Bros. launched Disney+ and HBO MAX in 2019 and 2020, respectively. After several years of development, Disney+ and HBO MAX have achieved remarkable results. According to the statistics of 2024 global top streaming media platforms, Disney+ has a total of 150 million subscribers worldwide, ranking third in the global rankings. In the meanwhile, Max has a total of 95.1 million subscribers, ranking fourth in the global rankings [8]. However, throughout their development journeys, both platforms have their own merits. The following article will conduct a comparative analysis from four aspects: platform content, user experience, pricing, and geographical coverage.

2.3.1. Comparison of video content

There are some key differences in the content offerings between the two platforms. Disney+ provides subscribers with multiple genres to cater to the audience's needs and preferences. In contrast, Max offers fewer types of content. Disney+'s video content is suitable for family audiences and has numerous famous IPs (intellectual properties), such as classic films and TV series like Star Wars and Disney animations. Disney is also constantly innovating in content creation and franchising. Disney has acquired film studios such as Pixar, 21st Century Fox, and Marvel Entertainment. Disney offers popular animated works such as Pixar's "Toy Story" and 21st Century Fox's "The Simpsons" to attract subscription interest from family audiences. Max's contents are primarily adult-oriented and reality-based. Compared to Disney+, Max's video content is more geared towards adult audiences. Max's content is positioned as adult dramas and comedies, with original series such as "Game of Thrones" and "Euphoria" being the core of Max's original series production. In addition, Max offers many choices in reality shows and non-fiction series, which are primarily produced by Discovery+, the former streaming brand of Max. The non-fiction contents aim to be tailored to the viewing interests of adult audiences. In addition, Warner Bros. Discovery has a large number of original IPs such as “Harry Potter” and DC Universe, most of which are blockbuster films and high-budget productions..

2.3.2. Differences in user experience

Disney+ and Max both have excellent device compatibility, and the platform can be used in various electronic devices, including web browsers, mobile devices, and smart TV devices. Disney+ allows seven electronic devices to be used simultaneously, and the platform offers child mode and content restrictions, suitable for family users with children. Max allows one account holder to have five user profiles, each with personalized content recommendation services. In terms of personalized content performance, Disney+ is can recommend video content that users may be interested in or have previously viewed based on recommendation algorithms. Its recommendation algorithm measures user viewing preferences in light of user feedback, such as likes, interactions, and ratings, to improve the accuracy of recommendations. Max has excellent performance in the aspect of searching for content. Due to the wide range of Max's content library, from Hollywood blockbusters to independent films, Max categorizes video content by genre to provide users with a more convenient and efficient way of discovering content.

2.3.3. Pricing

Two platforms offer multiple tiers of pricing plans for their users, which are flexible to satisfy users' needs and preferences. Since ad-free viewing is a distinctive feature of streaming services compared to traditional television, Disney+ and Max both offer ad-free plans for their subscribers. The detail of the pricing strategies of Disney+ and Max indicates the significance and differences (can be seen in Table 1).

Table 1: Pricing analysis between Max and Disney+.

Types of plans | Max | Disney+ |

With ads plan | $9.99/month | $7.99/month |

Ad-free plan | $16.99/month | $13.99/month |

Bundle plan | Max (with ads), Disney+ (with ads) & Hulu (with ads): $16.99/month; Max (ad-free), Disney+ (ad-free) & Hulu (ad-free): $29.99/month | Disney+&Hulu (with ads): $9.99/month; Disney+ (ads), Hulu (ads) & ESPN+: $14.99/month; Disney+ (ad-free) & Hulu (ad-free): $19.99/month; Disney+(ad-free), Hulu (ad-free) & ESPN+: $24.99/month |

In general, the price of Disney+ is more affordable than Max’s. It can be observed that Disney+ provides multiple options of plans from a range of with ads to ad-free, and it has different choices of bundle plans with Disney's other streaming platforms Hulu and ESPN+. Notably, Max's bundle plans with Disney+ and Hulu have been launched in July 2024. Warner Bros. Discovery's new collaborative pricing strategy with Disney aims to reshape the film industry and increase user engagement while reducing churn rates. The cooperation between the two companies is a situation of resource utilization and mutual benefit.

2.3.4. Geographical coverage

Disney+'s rapid development is a result of its aggressive expansion in the international market. Disney+ has launched its service and been available in most countries across Asia, Europe, Oceania, and Africa. Disney+'s expansion in Asia is reflected in content localization and integration with India’s streaming service Hotstar. Disney+ Hotstar was launched in India in 2020 and has since expanded to Southeast Asia, including Singapore, Thailand, and Indonesia. The expansion of Max seems to be slower than Disney+. The launches and availability of Max are relatively limited, and its business development revolves mainly around American and European regions. Max utilised a fragmented strategy in its content availability and its services vary by different markets. For instance, in some areas, the subscribers can access Discovery+'s content on Max, whereas the subscribers from other regions may need to access Max and Discovery+ separately.

3. The factors contributing to the success of Disney+ and MAX

3.1. Clear market positioning

Disney and Warner Bros. Discovery both have clearly defined their market positioning, which is to provide high-quality, family-friendly entertainment content. This positioning has enabled them to stand out among many streaming platforms, attracting a large number of family users and loyal fans. On the one hand, because Max's contents are primarily adult-oriented, the target audience for Max is relatively narrow and primarily consists of adults. In this case, Max’s pricing is generally higher owing to its acclaimed original series and high-budget productions. Its pricing structure is tailored to the audiences who value high-quality content and premium service. On the other hand, Family-friendly is the core of Disney’s market positioning. As Disney has made acquisitions of Pixar, 21st Century Fox ,and Marvel Entertainment, it has produced many successful animations and science fiction films. Therefore, its streaming platform is suitable for audiences of all ages, and bundle plans are highly affordable, meeting the needs of family audiences. Moreover, Disney+ offers affordable price packages for different segments to match users based on their consumption level. A pricing model with price diversity makes Disney competitive in the industry.

3.2. High-quality original content and innovation capabilities

High-quality original content and innovation capabilities are the crucial factors of their success. Disney and Warner Bros. Discovery have created and owned lots of iconic IPs and franchises, which help strengthen their brand identities. Since Disney acquired Marvel Entertainment in 2009, Marvel Entertainment has brought a substantial number of IPs and more production creativity to Disney. For example, Disney continues to produce new Marvel series and expand the Marvel universe, launching exclusive Marvel IP series such as "Loki" and "WandaVision". Disney also focuses on improving the quality of IP production [9]. In 2024, Disney announced its plan of reducing production to improve the quality of films and TV series, with approximately 2 original series and 3 films every year. Warner Bros. Discovery is also devoted to innovating in content creation to adapt to the rapid shift of the streaming industry. Its new original series “The Last of Us” is adapted from an action-adventure game with the same title. The producers use a brand-new perspective and storytelling style and create a group of characters that resonate with the audience. The series reflects the characters' inner emotions and enriches them in ways that cannot be achieved in the game. Moreover, it not only meets the high expectations of game fans but also attracts many audiences who are not familiar with the game through its ingenious plot design.

3.3. Diverse marketing strategies

Both Disney+ and Max have adopted a variety of marketing strategies, including large-scale advertising campaigns, social media promotion, cross-promotion tactics, and more, which have significantly increased their brand awareness and exposure. Max invests heavily in its well-known original TV series "Game of Thrones", which has elevated Max's position in the global streaming media industry. The success of Max is not only because of the attractive series production, but it also relies on its delicate marketing strategies that aim at increasing audience engagement and brand awareness. Max has launched lots of campaigns centred around branding and the themes of the series. In April 2023, Max held a nationwide campaign in the U.S. to promote its new branding. The branding campaign utilized television, broadcasting, social media, and outdoor advertising to largely raise the reputation of the brand and broaden public awareness. In May 2023, the campaign shifted to the second phase which aims at establishing an emotional bond with Max's potential and existing subscribers. It invited many famous actors from Warner Bros. Discovery's films and TV series to enhance the influence of the campaign. It is suggested that Max plans to turn the campaign to the third phase for brand affinity. In terms of the series, Max endeavors to create a sense of community and enthusiasm for its fans. For instance, Warner Bros. Studios produced a reunion trailer for "Friends: The Reunion" premiere on Max in 2021, creating a buzz on the platform and social media.

Creating a sense of nostalgia is the guiding principle of Disney+'s marketing strategy. Disney has a strong brand influence on the public, and its classic animated characters such as Mickey Mouse and The Lion King are memories of several generations of audiences. Thus, Disney enhances consumer loyalty through emotional impressions. For example, Disney has remade its classic film “The Lion King”, which retains the original elements and plots, attracting the attention of audiences of different ages, especially family audiences, as many parents took their children to watch the film they loved at the same age. In addition, the integration of different well-known IPs and contents is conducive to evoking nostalgic emotions in the audience. Disney+ has launched marketing campaigns for “Star Wars” and “The Simpsons”, colliding two animated universes together to celebrate Disney’s Star Wars Day. This type of IP integration establishes an intimate relationship between the fans and the brand. In the meantime, these innovative marketing ideas enhance brand awareness. In terms of digital marketing, Disney has adopted a marketing strategy of cross-promotion with Disney+. Disney+'s new products, such as program trailers, will be promoted on Disney properties. This interrelated marketing tactic effectively retains Disney’s brand consistency through various channel approaches.

4. Conclusion

The success of Disney+ and Max is a model of deep integration across content, branding, marketing, technology, pricing strategies, and a global vision. They not only boast rich and exclusive content libraries, continuously producing high-quality film and television works, but also leverage their formidable brand influence to attract audiences worldwide. Simultaneously, both platforms adopt diversified marketing strategies and incorporate advanced technology to enhance user experience, ensuring seamless viewing and personalized recommendations. Their flexible pricing strategies and membership systems cater to the diverse needs of users, fostering user loyalty. Furthermore, the seamless blend of global strategies with localized operations has enabled them to secure prominent positions in the global market, earning widespread recognition and remarkable achievements. The importance of comparing Disney+ and Warner Bros. Discovery lies in its ability to provide a comprehensive overview of the streaming industry's prospects. Exploring the successes of the two platforms can enable researchers and practitioners to better understand consumer behavior and the growth of media consumption in the streaming sector.

References

[1]. Yang, P., Qiao, J., & Chen, M. (2024). Bit rate selection technology of image processing based on artificial intelligence in MPEG-DASH adaptive streaming media. Journal of Radiation Research and Applied Sciences, 101036.

[2]. Doyle, G. (2016). Digitization and Changing Windowing Strategies in the Television Industry: Negotiating New Windows on the World. Television & New Media, 17(7), 629-645.

[3]. Duarte, F. (2024, June 6). Video Streaming Services Stats (2024). Exploding Topics. Retrieved from: https://explodingtopics.com/blog/video-streaming-stats

[4]. Zhang, X. (2024). Film as a Form of Cultural Medium: Trends of the Film Industry. Transactions on Social Science Education and Humanities Research, 11, 367–373.

[5]. FilmTake (2024, June 5). From Blockbusters to Bust: Why the Film Industry is Fading Fast. FilmTake. Retrieved from:https://www.filmtake.com/distribution/from-blockbusters-to-bust-why-the-film-industry-is-fading-fast/#:~:text=The%20film%20industry%20is%20undergoing

[6]. Jiang, X. (2024). Research on Disney’s Streaming Media Industry Behavior under the Digital Transformation. Advances in Economics, Management and Political Sciences, 80(1), 330–336.

[7]. Burroughs, B. (2018). House of Netflix: Streaming media and digital lore. Popular Communication, 17(1), 1–17.

[8]. Durrani, A. (2024, February 2). Top streaming statistics in 2024. Forbes. Retrieved from: https://www.forbes.com/home-improvement/internet/streaming-stats/

[9]. Yuan, Y. (2024). Turn to Streaming Media: Digital Transformation and Innovation of Disney. Advances in Economics Management and Political Sciences, 59(1), 100–105.

Cite this article

Zhang,Y. (2025). The Transformation of Top Film Companies to Streaming Media: Comparison of Disney and Warner Bros. Discovery. Advances in Economics, Management and Political Sciences,151,178-183.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yang, P., Qiao, J., & Chen, M. (2024). Bit rate selection technology of image processing based on artificial intelligence in MPEG-DASH adaptive streaming media. Journal of Radiation Research and Applied Sciences, 101036.

[2]. Doyle, G. (2016). Digitization and Changing Windowing Strategies in the Television Industry: Negotiating New Windows on the World. Television & New Media, 17(7), 629-645.

[3]. Duarte, F. (2024, June 6). Video Streaming Services Stats (2024). Exploding Topics. Retrieved from: https://explodingtopics.com/blog/video-streaming-stats

[4]. Zhang, X. (2024). Film as a Form of Cultural Medium: Trends of the Film Industry. Transactions on Social Science Education and Humanities Research, 11, 367–373.

[5]. FilmTake (2024, June 5). From Blockbusters to Bust: Why the Film Industry is Fading Fast. FilmTake. Retrieved from:https://www.filmtake.com/distribution/from-blockbusters-to-bust-why-the-film-industry-is-fading-fast/#:~:text=The%20film%20industry%20is%20undergoing

[6]. Jiang, X. (2024). Research on Disney’s Streaming Media Industry Behavior under the Digital Transformation. Advances in Economics, Management and Political Sciences, 80(1), 330–336.

[7]. Burroughs, B. (2018). House of Netflix: Streaming media and digital lore. Popular Communication, 17(1), 1–17.

[8]. Durrani, A. (2024, February 2). Top streaming statistics in 2024. Forbes. Retrieved from: https://www.forbes.com/home-improvement/internet/streaming-stats/

[9]. Yuan, Y. (2024). Turn to Streaming Media: Digital Transformation and Innovation of Disney. Advances in Economics Management and Political Sciences, 59(1), 100–105.