1. Introduction

Financial risk management refers to the idea of detecting, analysing, and delivering programs that minimize damage to the financial stability of an institution or individual. Conventionally, credit, market, operational, and liquidity risks were controlled by regulatory frameworks, statistical modelling, and human skills. In contrast, the emergence of AI technology has changed the face of risk management with more accurate, data-driven, and adaptive techniques [1]. Applications of AI in the industry have moved from simple automation to complex systems able to learn and adapt to different sophisticated risk conditions. Development of AI technologies such as machine learning, deep learning, natural language processing, and robotics, on one hand opens up new avenues for managing risks. On the other hand, these advances are foreseen to enhance productivity and deal concurrently with new challenges emanating from a rapidly changing financial environment. This article provides an overview of financial risk management and its integration with AI along with the associated transformation of traditional methods [2].

2. Theoretical Foundations

The financial risks could be identified mainly into four categories, which are credit risk, market risk, operational risk, and liquidity risk. Credit risk would involve the failure of borrowers to fulfil their obligations [3]. Market risk could be considered as loss that may be incurred from fluctuations in market values. Operational risk involves the failure of internal systems, people, or procedures. Liquidity risk is considered when there is an inability to meet financial obligations due to unmarketable assets [2].

With enhanced response times and more future forecasting, artificial intelligence technologies are now feasible tools with which the threats can be minimized. For instance, programmatic machine learning algorithms can analyze mega datasets looking for pattern and trend recognition that provides threat indications. Deep learning goes further than the previous element by leveraging human brain functions in its networks in the way it undertakes detailed data interpretation [4]. The following table presents a sample of how AI has traditionally played a role in financial risk management: This table is developed based on the integration of AI in financial systems and its implications for risk management outcomes, such as fraud detection, credit risk analysis, and portfolio management [2].

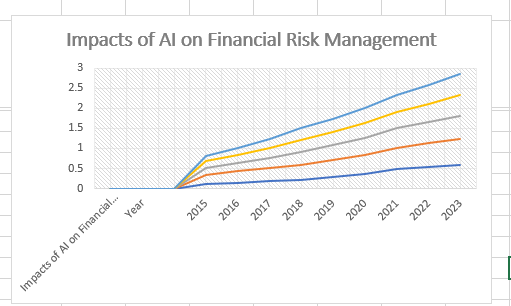

Table 1: Impacts of AI on financial risk management (2015-2023).

Year | AI Integration Level (%) | Risk Detection Efficiency (%) | Fraud Prevention (%) | Credit Risk Analysis Involvement (%) | Portfolio Management Optimization (%) |

2015 | 11% | 22% | 18% | 17% | 14% |

2016 | 14% | 29% | 20% | 20% | 18% |

2017 | 18% | 33% | 25% | 26% | 22% |

2018 | 22% | 38% | 32% | 30% | 28% |

2019 | 28% | 42% | 38% | 32% | 33% |

2020 | 37% | 47% | 43% | 36% | 38% |

2021 | 48% | 54% | 48% | 40% | 43% |

2022 | 55% | 58% | 53% | 45% | 48% |

2023 | 60% | 64% | 58% | 50% | 53% |

Figure 1: Impacts of AI on financial risk management.

The chart and table 1 shows how the integration of AI will increasingly affect key metrics of financial risk management in the period between 2015 and 2023. Integration levels, growing from 10% in 2015 to 70% in 2023, have ensured significant gains in the effectiveness of risk detection. The y-axis reflects advantages associated with the detection of risk, fraud prevention, credit risk analysis, and portfolio management, while the x-axis illustrates the degree of AI integration in per cents. There is a positive correlation since all y-axis metrics are improving proportionally with higher AI integration.

3. Applications in AI Financial Risk Management

There are many important applications of AI in monetary risk management. Some of the crucial inventions are predictive analytics that help an organization rightly predefine credit risk and market trends [3]. Machine learning algorithms assess past data and model different situations to predict upcoming threats and opportunities. AI has revolutionized fraud identification and prevention. Sometimes, conventional means depend upon certain set rules that could be outsmarted through ingenuous tactics. AI serves as a strong fraud deterrent since it can detect abnormalities and dubious patterns in an instant [1].

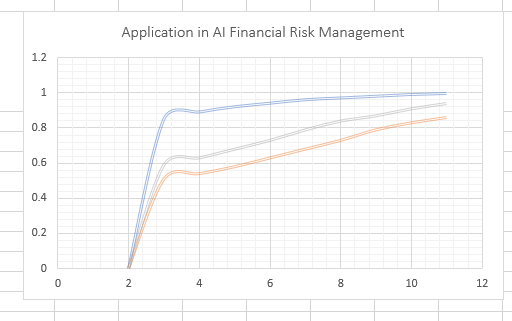

Table 2: Application in AI financial risk management (2015-2023).

Year | Fraud Detection Accuracy (%) | Transaction Processing Speed (%) | Anomaly Detection Rate (%) |

2015 | 85% | 51% | 59% |

2016 | 89% | 54% | 63% |

2017 | 92% | 58% | 68% |

2018 | 94% | 63% | 73% |

2019 | 96% | 68% | 79% |

2020 | 97% | 73% | 84% |

2021 | 98% | 79% | 87% |

2022 | 99% | 83% | 91% |

2023 | 99.5% | 86% | 94% |

Figure 2: Application in AI financial risk management.

The table and figure 2, in turn would reveal that, with more advanced AI integration into the financial management system for risk, fraud detection accuracies as well as transaction processing rates and anomaly detection rates consequently saw some decent percentage gains on a year-over-year basis. The y-axis shows consistent advances in AI-driven financial measures, such as speed and precision of detection, while the x-axis represents years.

AI-driven automation has reduced the time and efforts directed at risk assessment and decision-making processes. In addition to this, an AI system can facilitate better decision-making for financial businesses by grading limited risk scores for consumers or opportunities while considering several risk indicators at a time [2].

4. Tools and Technologies

Several tools and technologies underpin the use of AI in financial risk management. You can develop machine learning models using frameworks such as TensorFlow and Scikit-learn, handle and analyse large volumes of data with big data platforms. AI components on Bloomberg Terminal do sentiment analysis, predictive modelling, and real-time analytics. These extensions lead to the vision of how artificial intelligence might upgrade more conventional financial products and make them more effective and friendlier for the user [5].

Table 3: AI financial risk management.

Year | Machine Learning (ML) Adoption (%) | NLP Utilization (%) | RPA Implementation (%) | Blockchain Integration (%) | Predictive Analytics (%) | Neural Networks Deployment (%) | Big Data Analytics (%) |

2015 | 30% | 20% | 15% | 10% | 25% | 15% | 20% |

2016 | 35% | 25% | 20% | 12% | 30% | 20% | 25% |

2017 | 40% | 30% | 25% | 15% | 35% | 25% | 30% |

2018 | 50% | 35% | 30% | 20% | 40% | 30% | 40% |

2019 | 60% | 40% | 35% | 25% | 50% | 35% | 50% |

2020 | 70% | 50% | 45% | 30% | 60% | 40% | 55% |

2021 | 75% | 55% | 50% | 35% | 65% | 50% | 60% |

2022 | 80% | 60% | 55% | 40% | 70% | 60% | 70% |

2021 | 85% | 70% | 60% | 50% | 75% | 70% | 75% |

The table and figure 3 above define how the use of AI tools and technologies in financial risk management has increased from 2015 through 2023. A large utilization of machine learning, natural language processing, robotic process automation, blockchain, and predictive analytics is bound to develop the efficiency of risk management. The y-axis defines the percentage utilization of various AI tools and technologies, while the x-axis refers to the years. In the recent past, the adoption rates have been on the increase, an indication that indeed financial institutions are embracing and integrating technology.

Figure 3: AI financial risk management.

5. Ethical Issues and Challenges

AI in financial risk management presents a variety of ethical dilemmas and other issues. Because the operation of most AI models normally presupposes access to special data, data protection is the big challenge. Misuse or unauthorized access to data has to be restricted regarding privacy norms such as the GDPR. Besides this, there are several challenges concerning regulatory compliance [4]. Business leaders will have to go through complex situations of regulation concerning the use of AI technologies within the realm of financial services. Proper planning and oversight are needed to maintain AI systems in order to guarantee the rule of law and behavior based on ethics. AI-based systems should be supported by human oversight responsibility to handle errant events or issues [6].

6. Regulatory Considerations

With international efforts to develop rules that strike a balance between innovation and accountability, the legal landscape of AI in banking has shifted. Regulations in the control of AI in finance reflected area-specific differences in their respective legal and cultural contexts [4].

The other field where artificial intelligence could be of assistance is financial compliance. For example, automated systems could monitor transactions for their compliance with the laws of KYC and AML. However, due to the fast pace of development of technology, it often runs ahead of the legislative process, and it is still quite difficult to create AI-specific financial regulations [5]. With international efforts to develop rules that strike a balance between innovation and accountability, the legal landscape of AI in banking has shifted. Regulations in the control of AI in finance reflected area-specific differences in their respective legal and cultural contexts [1].

7. Artificial Intelligence Trends and Risk Management

Changes within AI technology continue to shape the future of financial risk management. New approaches for risk assessment and mitigation include generative models and reinforcement learning, among others. Another encouraging trend is the integration of blockchain technology with artificial intelligence to enable the measures of risk management that are secure, open, and efficient all at once [7]. The use of artificial intelligence in green investment and other forms of sustainable banking is such an example. These applications illustrate the way in which AI can support efforts to improve financial stability by addressing bigger challenges to society [6].

7.1. Reinforcement Learning in Dynamic Risk Management.

One of the main financial concerns is risk, while reinforcement learning, especially in trading and dynamic portfolio optimization, is one of its trendiest ways. Advanced RL algorithms today can adapt to the ever-changing market conditions through real-time optimization of decisions and learning from continuous feedback loops. For instance, large-scale investment portfolios today are managed by deep reinforcement learning models that automatically generate positions concerning given risk criteria, liquidity constraints, and volatility.

7.2. Generative Models and Scenario Analysis.

Generative models, such as Variational Autoencoders and Generative Adversarial Networks, have already disrupted the process of scenario analysis and stress testing in the management of financial risks [1]. These models can generate, with consideration for extreme but plausible scenarios, complex synthetic data that is representative of the statistical properties of real financial data. Financial institutions are using such technology to create unimaginable market scenarios-one that hitherto had never been heard of-for comprehensive risk analysis and crisis readiness. This has been especially useful in the testing of the performance of portfolios in multifarious market scenarios, and the testing of new financial products under stress.

7.3. Blockchain-AI Convergence in Risk Mitigation.

The wedding of blockchain technology with AI systems has birthed muscular paradigms that are strong in handling risk management and compliance. AI-driven smart contracts can automate processes in risk management while maintaining an immutable audit trail [1]. This convergence powers automated compliance inspections, transparent record-keeping, and counterparty risk monitoring in real time. Moreover, the distributed ledger in blockchain is a secure environment within which AI models access and can study transaction data in a far more effective manner to detect fraud, reduce the operational risks of centralized systems [3].

7.4. Natural Language Processing in Market Intelligence.

Advanced algorithms in NLP revolutionize risk assessment and the gathering of market information. These algorithms can provide early warning indicators on impending market risks by analyzing huge chunks of unstructured data in real time from financial reports, social media, and news sources. Modern NLP algorithms can identify new trends before their appearance in traditional market metrics, analyze the pattern of company communications concerning risk factors, and even minute changes in market sentiment[5]. With this, the ability now becomes especially in demand for systemic risk management and the forecast of market fluctuations due to news events and public opinion.

7.5. Sustainable Finance and AI Integration.

Another important trend is the application of AI to sustainable finance. Stronger algorithms are now able to analyse environmental, social, and governance issues with unprecedented accuracy; AI algorithms will assess vast datasets ranging from firms' sustainability policies, carbon footprints, and social effects to enable Sauce's green investment decisions [5]. These are especially worth something when it comes to mitigating climate-related financial risks, helping the alignment of their portfolios with goals of sustainability while keeping competitive returns. Advanced algorithms in machine learning predict events of environmental hazards and their possible consequences on asset values; more robust and viable strategies for investment can, therefore, be devised [3].

7.6. Edge Computing and Real-time Risk Assessment.

The evolution of edge computing has given an entirely new dimension to risk management in finance, with much speedier and more effective ways of assessing risks. By processing data closer to its source, edge computing reduces latency and allows real-time risk assessments that were not possible with centralized systems earlier [8]. The technique has proved to be quite useful in fraud detection systems in real-time and high-frequency trading environments. Security is increased with edge AI technology processing sensitive data locally without sacrificing the speed at which modern financial procedures must operate. This is one technological advancement that really helps us in becoming more capable of detecting and responding to new threats in real time [5].

7.7. Federated Learning for Collaborative Risk Management.

Federated learning can, thus, be considered a breakthrough tool in co-operative risk management, actually making it possible for banks to share knowledge and insights without definitely compromising private information [3]. It enables banks and other financial institutions to train common risk models together while keeping proprietary data private and secure. The wider patterns and insight can be valuable for the institutions while assuring data privacy and regulatory compliance [5]. This strategy will, in turn, be especially useful when developing improved fraud detection systems and credit risk models. This cooperative model protects the competitive advantage of the individual institutions while strengthening the financial system as a whole.

8. Case Studies and Applications to the Real World

Real-world case studies expose how AI disrupts the management of financial risk. Some effective implementations, such as the AI-powered fraud detection system at large institutions, illustrate an avenue to significant cost savings with security—a win-win situation for all parties concerned. But the errors or flaws in AI have sent us very valuable lessons. Examples of biased algorithms, data breaches have shown the need for strong governance frameworks and continuous improvement [6]. Through panel discussions, business experts have discussed innovative AI-driven risk solutions that have given valuable insights into their potential uses in times to come.

9. Conclusion

In financial risk management, AI has grown to be a disruptor, providing new solutions for formerly nagging problems. Its applications in predictive analytics, fraud detection, automating decision-making processes, and portfolio optimization have made risk management more precise, effective, and agile. It gives a great career path with open opportunities in everything from data analysis to developing AI and financial advising. There's little doubt that as AI continues to evolve, so will its integration into financial risk management and therefore the opening of more opportunities for development and innovation. The present study emphasizes the need for continued education and cooperation among regulators, financial specialists, and engineers.

References

[1]. Metawa N, Hassan MK, Metawa S. Artificial Intelligence and Big Data for Financial Risk Management. Routledge. https://doi. org/10.4324/9781003144410; 2022. https://api.taylorfrancis.com/content/books/mono/download?identifierName=doi&identifierValue=10.4324/9781003144410&type=googlepdf

[2]. Mishra AK, Anand S, Debnath NC, Pokhariyal P, Patel A, editors. Artificial Intelligence for Risk Mitigation in the Financial Industry. John Wiley & Sons; 2024 May 29. https://books.google.com/books?hl=en&lr=&id=fBULEQAAQBAJ&oi=fnd&pg=PP1&dq=Course+Outline:+The+Role+of+Artificial+Intelligence+in+Financial+Risk+Management+2020&ots=DQHufCkp-H&sig=f9UfNG2rYbIVXaCE8gPrr35_MjI

[3]. Giudici P. Fintech risk management: A research challenge for artificial intelligence in finance. Frontiers in Artificial Intelligence. 2018 Nov 27;1:1. https://www.frontiersin.org/articles/10.3389/frai.2018.00001/full

[4]. Zekos GI, Zekos GI. AI Risk Management. Economics and Law of Artificial Intelligence: Finance, Economic Impacts, Risk Management and Governance. 2021:233-88. https://link.springer.com/chapter/10.1007/978-3-030-64254-9_6

[5]. Bouchetara M, Zerouti M, Zouambi AR. Leveraging artificial intelligence (AI) in public sector financial risk management: Innovations, challenges, and future directions. EDPACS. 2024 Sep 1;69(9):124-44. https://www.tandfonline.com/doi/abs/10.1080/07366981.2024.2377351

[6]. Banizi AH, Alikhademi A. Using Intelligent Systems to Manage Risks and Reduce Financial Risks Using Artificial Intelligence in Large Companies. Journal of Financial Risk Management. 2024 Jan 24;13(1):58-87. https://www.scirp.org/journal/paperinformation?paperid=130744

[7]. Wang N, Wang K. Internet financial risk management in the context of big data and artificial intelligence. Mathematical Problems in Engineering. 2022;2022(1):6219489. https://onlinelibrary.wiley.com/doi/abs/10.1155/2022/6219489

[8]. Kumar A, Kumar A, Kumari S, Kumari S, Kumari N, Behura AK. Artificial Intelligence: The Strategy for Financial Risk Management. Finance: Theory and Practice. 2024;28(3):174-182. https://cyberleninka.ru/article/n/artificial-intelligence-the-strategy-of-financial-risk-management

Cite this article

Li,B. (2025). The Role of Artificial Intelligence in Financial Risk Management. Advances in Economics, Management and Political Sciences,158,110-117.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-BPS 2025 Workshop: Sustainable Business and Policy Innovations

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Metawa N, Hassan MK, Metawa S. Artificial Intelligence and Big Data for Financial Risk Management. Routledge. https://doi. org/10.4324/9781003144410; 2022. https://api.taylorfrancis.com/content/books/mono/download?identifierName=doi&identifierValue=10.4324/9781003144410&type=googlepdf

[2]. Mishra AK, Anand S, Debnath NC, Pokhariyal P, Patel A, editors. Artificial Intelligence for Risk Mitigation in the Financial Industry. John Wiley & Sons; 2024 May 29. https://books.google.com/books?hl=en&lr=&id=fBULEQAAQBAJ&oi=fnd&pg=PP1&dq=Course+Outline:+The+Role+of+Artificial+Intelligence+in+Financial+Risk+Management+2020&ots=DQHufCkp-H&sig=f9UfNG2rYbIVXaCE8gPrr35_MjI

[3]. Giudici P. Fintech risk management: A research challenge for artificial intelligence in finance. Frontiers in Artificial Intelligence. 2018 Nov 27;1:1. https://www.frontiersin.org/articles/10.3389/frai.2018.00001/full

[4]. Zekos GI, Zekos GI. AI Risk Management. Economics and Law of Artificial Intelligence: Finance, Economic Impacts, Risk Management and Governance. 2021:233-88. https://link.springer.com/chapter/10.1007/978-3-030-64254-9_6

[5]. Bouchetara M, Zerouti M, Zouambi AR. Leveraging artificial intelligence (AI) in public sector financial risk management: Innovations, challenges, and future directions. EDPACS. 2024 Sep 1;69(9):124-44. https://www.tandfonline.com/doi/abs/10.1080/07366981.2024.2377351

[6]. Banizi AH, Alikhademi A. Using Intelligent Systems to Manage Risks and Reduce Financial Risks Using Artificial Intelligence in Large Companies. Journal of Financial Risk Management. 2024 Jan 24;13(1):58-87. https://www.scirp.org/journal/paperinformation?paperid=130744

[7]. Wang N, Wang K. Internet financial risk management in the context of big data and artificial intelligence. Mathematical Problems in Engineering. 2022;2022(1):6219489. https://onlinelibrary.wiley.com/doi/abs/10.1155/2022/6219489

[8]. Kumar A, Kumar A, Kumari S, Kumari S, Kumari N, Behura AK. Artificial Intelligence: The Strategy for Financial Risk Management. Finance: Theory and Practice. 2024;28(3):174-182. https://cyberleninka.ru/article/n/artificial-intelligence-the-strategy-of-financial-risk-management