1.Introduction

In the daily operations of enterprises, information—being objective data used to quantify performance—plays a critical role in linking internal departments with external partners. Ensuring the security and integrity of processes such as recording, storing, updating, and retrieving information accurately and efficiently is a fundamental requirement for establishing an accounting information system and plays a crucial role in influencing senior leadership's decision-making quality in areas like operations, capital investments, loans, talent allocation, and business strategy. Through the analysis on the shortcomings of traditional information management[1], it is evident that conventional methods (e.g. database construction) often exhibit centralized management, where specific individuals or groups possess full control and interpretation rights, while other departments remain secondary and only receive limited access. This structure limits the scope of authority of certain managers, preventing them from accessing complete information and keeping up with the latest updates in a timely manner. As a result, these decentralized managers cannot fully trust the authenticity and reliability of the information they receive. In summary, the issue of mutual trust is a fundamental challenge of traditional information management. Blockchain technology aims to address the challenges stemming from the centralization inherent in traditional information management.

The concept of blockchain was first introduced to the world through the paper Bitcoin: A Peer-to-Peer Electronic Cash System, published on November 1, 2008. This idea is credited to its author, Nakamoto[2]. The paper elaborates on the blockchain system built on a peer-to-peer network model, designed to address the issue of double-spending, and describes several key characteristics. These include immutability (if a majority of the network's computing power is controlled by honest nodes, the possibility of modification is extremely low), privacy protection (nodes are not required to expose or verify identities), and decentralization (no need for intermediaries, as nodes are responsible for verification, transmission, and management). Within the blockchain framework, Bitcoin—a digital currency introduced by Nakamoto—enables trust between unacquainted parties without the need for central institutional support, expanding credibility through consensus and allowing the currency to function effectively in payment transactions.

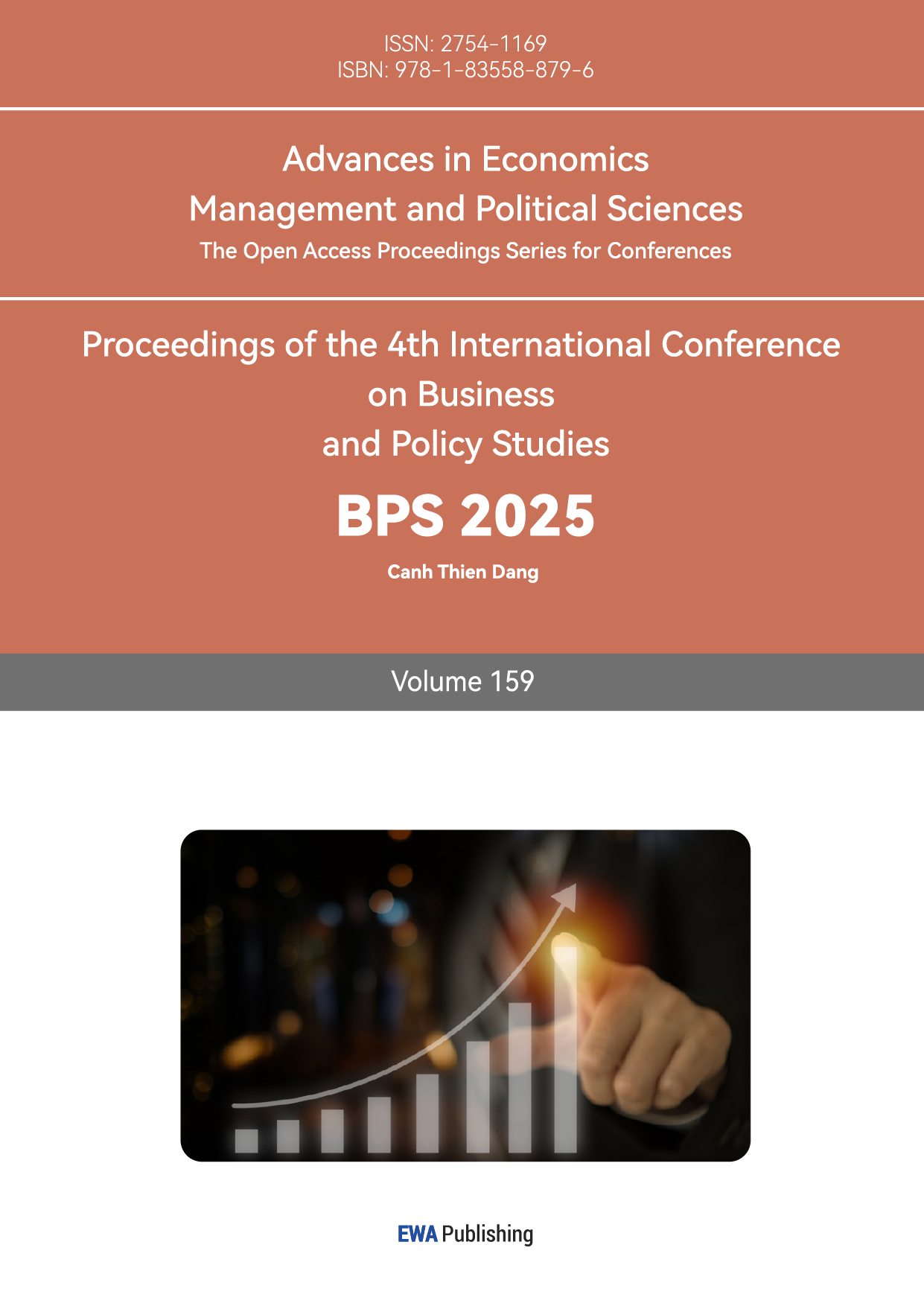

According to the "2023-2024 China Blockchain Annual Development Report" from the communication industry (Figure 1), the number of patent applications for blockchain technology in China increased annually from 2016 to 2020, marking the peak of domestic blockchain innovation. Since 2016, blockchain platforms such as AntChain have steadily penetrated the Chinese market. The number of blockchain patent applications began stabilizing around 2021. Blockchain technology has brought unprecedented innovation to China, with the construction of new trust mechanisms becoming a key driver for the growth of China's digital economy.

Figure 1: China's blockchain patent applications in 2016-2023

What role does blockchain technology play in influencing modern accounting information systems? This paper uses the AntChain platform as a case study to explore its functionality across various sectors and subsequently analyzes the specific impact of blockchain on accounting information systems.

The innovation and purpose of this paper are to build upon previous research, select AntChain as a case study, analyze the feasibility of implementing this technology in financial information systems, and use its data architecture to identify potential limitations and explore avenues for future development. The goal is to provide insights that facilitate the deeper integration of blockchain technology with accounting disciplines.

2.Theory and literature review

2.1.Application principle of blockchain

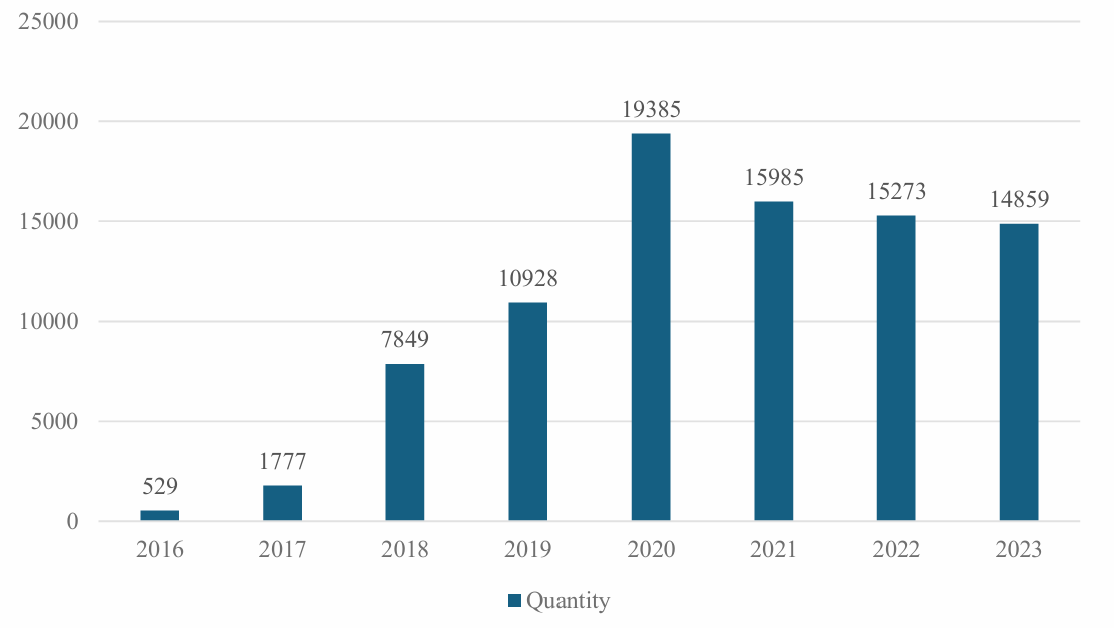

The core features of blockchain are reflected in its chained data organization, automatic execution of smart contracts, distributed architecture principles, data encryption techniques, end-to-end network interconnection, transparency, and customizable consortium chain frameworks. Research on the application of blockchain in transactions[3]demonstrates that, as shown in Figure 2, blockchain employs an innovative transaction mechanism to facilitate new business processes. Participants initiate a transaction and broadcast it to all nodes via the P2P network. Nodes compete for computational power to obtain accounting rights, and the first node to complete the task publishes the results to the network according to the proof of work (PoW) consensus algorithm. Other miner nodes verify the result, and once confirmed, it is irreversibly added to their blockchain ledgers. If an error is detected, the process is recalculated. Information in the blockchain system is linked and structured into a chain of blocks, each containing transactional records. Smart contracts serve as key technical enablers, establishing transaction agreements and automating business processes.

Figure 2: The application principle of blockchain

2.2.Model of accounting information system

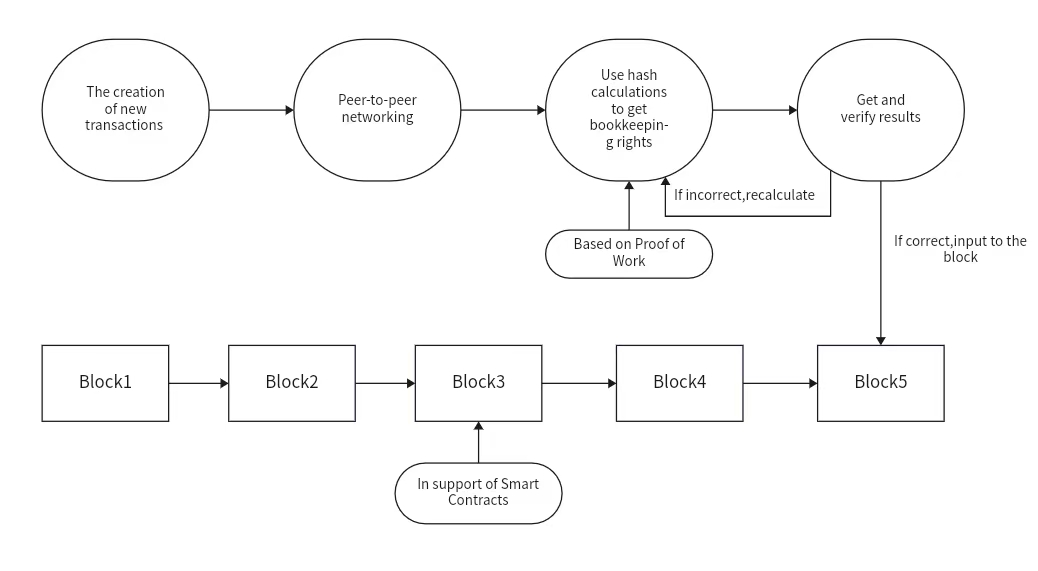

The earliest definition of an accounting information system is a computer-based system designed to process and convert accounting data into useful information. Over time, various models of accounting information systems have emerged. This article uses the modern accounting information system model (Figure 3) based on the principles of ESG, as proposed by Xudong and Rui[4], to illustrate its structure. The modern accounting information system is structured into four levels: the foundational level, responsible for ensuring the system's security, stability, and operational efficiency; the data layer, which focuses on collecting and processing both financial and non-financial data, such as environmental, social responsibility, and corporate governance information. The network layer facilitates communication between the internal accounting department and external entities such as taxation, environmental protection, and other regulatory agencies by linking enterprise business modules, ensuring smooth and effective exchange of environmental data. The application layer manages the enterprise's accounting tasks, including fixed asset tracking, accounting reports, financial disclosures, and audit supervision. This illustrates that the modern accounting information system has moved away from the traditional centralized model, with accounting information now becoming more classified, detailed, and interoperable.

Figure 3: ESG Accounting Information System

3.Research hypothesis

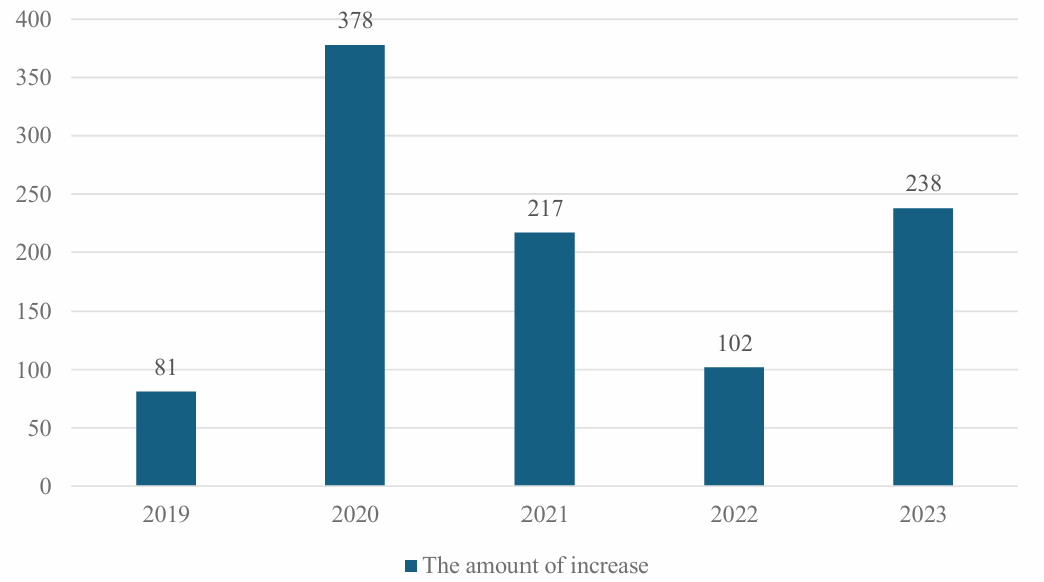

As times have evolved, blockchain technology has experienced rapid development. Since 2004, the total number of blockchain applications in China has reached approximately 80,000, with explosive growth observed after 2017. The number of new blockchain-related enterprises has steadily increased (Figure 4). This growth trend reflects the increasing demand for blockchain solutions across various industries, driven by the technology’s potential to enhance transparency, security, and operational efficiency.

Figure 4: The number of new blockchain chain enterprises in China in 2019-2023 (home)

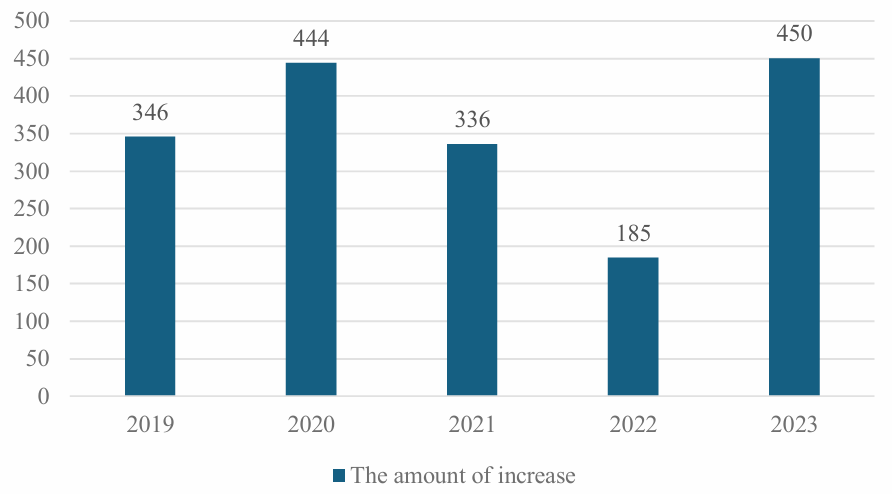

In accounting information systems, the number of blockchain applications has increased annually (see Figure 5). Although growth slowed in 2021, it reached a new peak in 2023. Based on a review of the literature and blockchain business applications, this paper categorizes the applications of blockchain in accounting information systems into two key domains and accordingly proposes two hypotheses.

Figure 5: Application growth of 2019-2023 blockchain in China

3.1.Supply chain finance—enterprise financing optimization

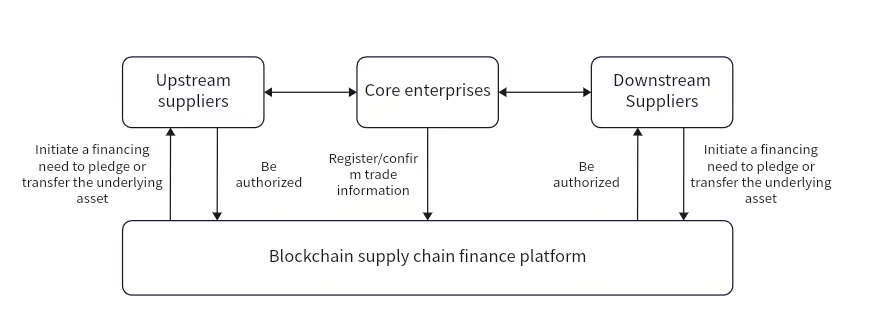

Supply chain finance is a financing model based on actual trade transactions, which connects core enterprises with upstream and downstream entities, providing flexible financial products and services (Figure 6). Based on research, blockchain in supply chain finance has led to optimizations in financing efficiency, risk management and decision-making processes[5]. As a novel financial approach, supply chain finance demonstrates greater stability than traditional enterprises, reducing intermediary financing activities, saving time costs, and improving overall efficiency. By focusing on core enterprises within the supply chain, supply chain finance creates a centralized and integrated investment and financing model that mitigates the impact of certain external factors, thereby reducing financing risks. The financialization of supply chains improves the quality of information processing by managing core enterprises and their upstream and downstream counterparts, allowing for informed decisions regarding whether to provide credit services, along with the manner and scope of such services, thus enabling scientific decision-making in financing. Based on this, this paper proposes Hypothesis 1: Blockchain enhances system financing efficiency.

Figure 6: The business model of 'blockchain + supply chain finance'

3.2.Cross-border trade payment—transaction process optimization

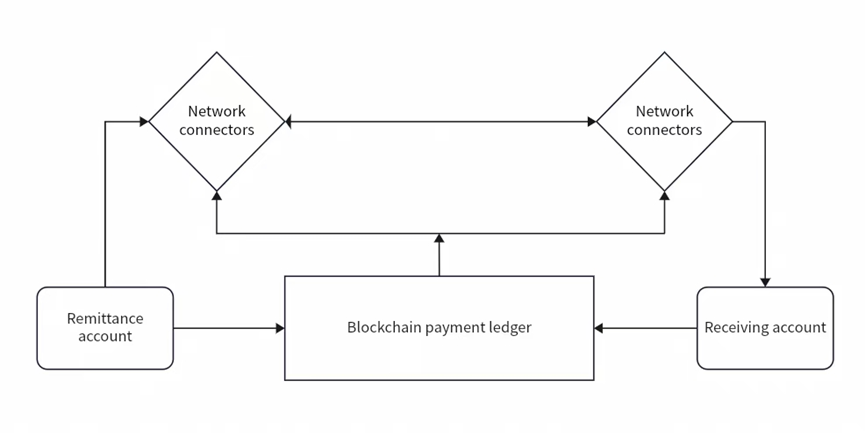

According to theory, blockchain addresses the pain points of cross-border payments within accounting information systems by improving efficiency, reducing costs, and enhancing security[6]. The application of blockchain technology eliminates intermediaries in international capital transfers, enabling direct point-to-point transactions and settlements between the remitter and payee (as shown in Figure 8), which saves time and improves process efficiency. Furthermore, the simplification resulting from blockchain technology significantly reduces the procedural complexity and costs associated with cross-border payments, thereby lowering the financial burden on commercial traders. Additionally, the inherent properties of blockchain provide security for international payments, ensuring transparency, minimizing risks, and guaranteeing the reliability of transactions. Based on this, this paper proposes Hypothesis 2: Blockchain enhances transaction efficiency and security.

Figure 7: Blockchain cross-border payment architecture

3.3.Hypothesis summary

At this stage, the paper outlines its research direction and structure, utilizing the case study method to test Hypothesis 1 and Hypothesis 2, as illustrated by the framework in Figure 8.

Figure 8: Research and analysis framework diagram

4.Research methods and results

4.1.Case selection and data source

The data for this study were obtained from 2015 to 2023, with the time range expanded to better demonstrate the positive impact of modern blockchain on accounting information systems. The data were sourced from the China Knowledge Network Library and Wanfang Data, with each case derived from the official websites of the respective enterprises. To validate the two research hypotheses of this paper, the Ant Chain BaaS platform was chosen as the focus, with its most recent case from 2023 selected to support the hypotheses.

4.2.Ant chain BaaS platform

Ant Group began investing in Ant Chain technology in 2015 and officially launched the Ant Chain BaaS platform in 2018. Since IDC first reported "China's Blockchain BaaS Market Share" in 2021, the Ant Chain BaaS platform has held the largest market share for three consecutive years, establishing itself as the leader in China’s blockchain sector.

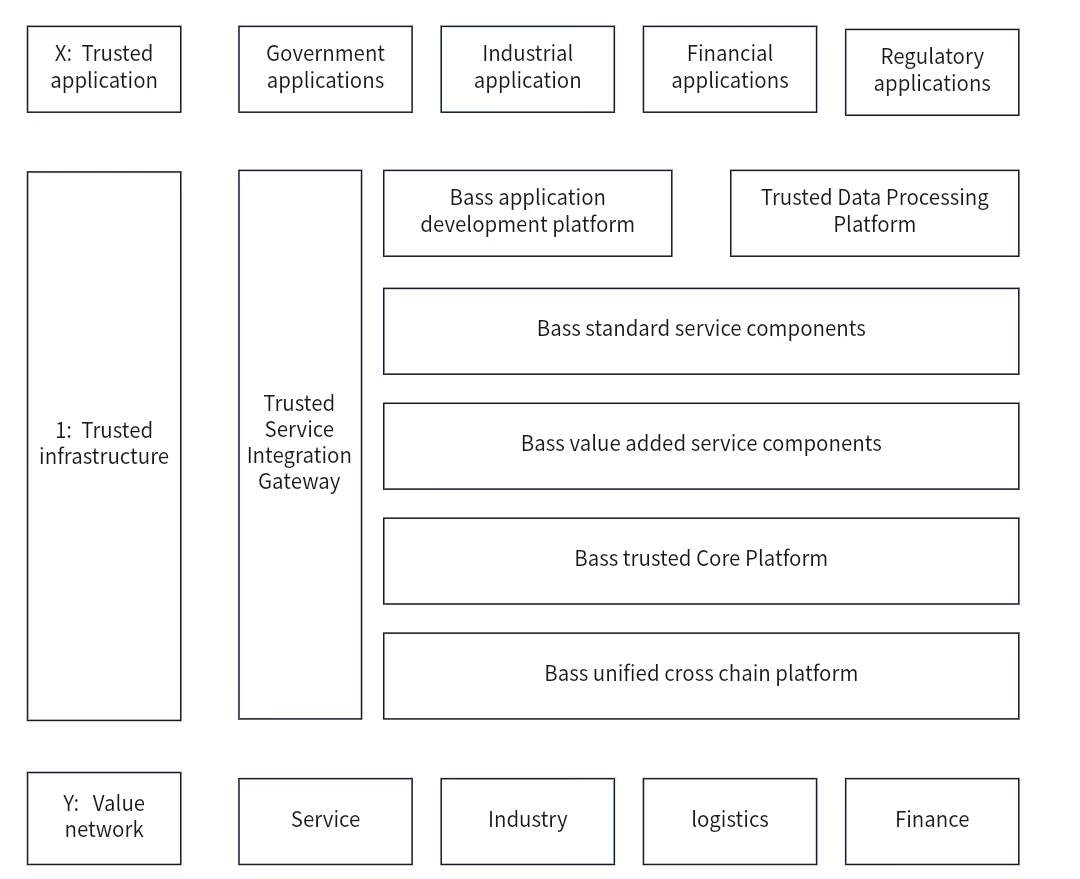

Today, the Ant Chain BaaS platform has been upgraded to version 2.0, featuring a "1 + X + Y" platform architecture (Figure 9), ultra-large-scale networking, TEE chip-level privacy protection, and sensitive application development kits. These three differentiated features continue to drive innovation in areas such as finance, auditing, and education[7-9] . They have reduced risks in the financing module of accounting information systems, enhanced the efficiency of the payment module, and driven ongoing innovations in data management.

Figure 9: The platform architecture of ant chain '1 + X + Y'

4.3.Case study

4.3.1.Ant chain and Luzhou Laojiao cooperation

As a large retail enterprise, the financial support system for dealers and terminal customers in the supply chain is crucial for Luzhou Laojiao. To manage financing for both dealers and terminal customers and foster new cooperation among core enterprises, dealers, and financial institutions, Luzhou Laojiao aims to establish a new financial service platform—Luzhou Laojiao Yi Rong Supermarket. However, the construction of this platform faces challenges such as achieving closed-loop control of funds from terminals to dealers and from dealers to the core enterprise (Problem 1), ensuring that trade data between terminals and dealers is effectively enhanced by the core enterprise platform (Problem 2), and developing a data capitalization architecture to enhance the availability of financing services (Problem 3). To address these challenges, Luzhou Laojiao requires safe, credible, and user-friendly digital technologies as support.

Ant Science uses blockchain as its core technology. First, it establishes a unified online entry system, which includes registration, real-name authentication, signing, querying, and other functions, and can directly connect with the banking system. Through the platform, it can acquire customers in batches nationwide, create connections between dealers, terminals, and core enterprises, and addresses Problem 1. By combining smart contract technology with full-dimensional and process supervision of trade data, integrated with the internal management system, it achieves real-time control, rapid response, credit enhancement, and solves Problem 2. By building a trusted asset chain, Luzhou Laojiao Yi Rong Supermarket links the necessary data for each bank to the data chain. It facilitates real-time data interaction with different banks through smart contracts, confirming the authenticity, effectiveness, and traceability of the data, and solves Problem 3.

So far, the Yi Rong Supermarket platform has developed a financial-grade, real-time interaction platform with unified management and a fully trusted data interaction center. Luzhou Laojiao's business has expanded with the launch of 13 online financial products on the platform. The platform also offers three online multi-currency service products, covering all six state-owned banks, and provides nearly 10 billion RMB in purchase financing support for dealers.

The optimization of Luzhou Laojiao's financing module confirms the validity of Hypothesis 1.

4.3.2.Application of Ant chain in Tmall International

Since 2015, the scale of cross-border e-commerce has consistently increased, with exports surpassing imports. Additionally, transaction models have increasingly leaned toward blockchain-related technologies. Amid this rapid growth, cross-border transactions must prioritize quality upgrades to ensure sustainable development.

Tmall International seeks to build consumer trust and is committed to ensuring the traceability of goods. However, the complexity of cross-border supply chains makes it particularly challenging to ensure the traceability of authentic goods.

On the one hand, internally, the supply chain of cross-border e-commerce comprises several stages such as procurement, logistics, warehousing, and sales, each of which may impact product quality. Traceability data should cover all aspects, but the complete digitization of the entire supply chain is both challenging and costly.

On the other hand, externally, supply chain management standards differ across countries and regions, and gaps in data may occur during cross-border transportation, which can compromise the integrity and transparency of traceability information.

Ant chain traceability technology is built on blockchain technology. Through the identification and verification capabilities of the integration of 'blockchain + AloT' and cloud computing, the traceability system is enhanced to offer consumers safer and more comprehensive traceability services. This is equivalent to providing a unified 'digital identity' for the product. Internally, it can improve the efficiency of warehouse operations; externally, consumers only need to scan the code to effortlessly access product traceability information, enhancing confidence in cross-border shopping. This ensures that the issue of traceability can be permanently resolved.

After upgrading the application of the traceability code label, Tmall International's maternal and child, healthcare, pet, beauty, and other categories are now equipped with a 'Health Code Identity,' encompassing over 100 million products. In addition, the upgrade effectively enhances the label's quality and security, while also increasing the efficiency of code assignment and label verification for warehouse workers.

The application of blockchain in cross-border logistics confirms the validity of Hypothesis 2.

5.Limitations and future development proposals

5.1.Limitations

At present, in optimizing accounting information systems, blockchain still faces several restrictions. According to the research on blockchain limitations by Hongjie and Xinghui [10], the limitations of blockchain are as follows:

5.1.1.Accuracy

The technical level of blockchain is still developing, and the smooth implementation and effectiveness of smart contracts cannot be fully ensured. In addition, blockchain technology still lacks maturity in identifying specific details and delineating the boundaries of related fields.

5.1.2.Citation difficulty

Compared with traditional systems, blockchain introduces significant changes, lacks theoretical guidance, and has stringent requirements for personnel quality. Members of the accounting department must possess not only financial knowledge but also basic technical operation skills. Therefore, the implementation and promotion of blockchain in daily enterprise practice are relatively difficult.

5.1.3.Regulatory process

Regulatory oversight is challenging. Blockchain is a new technology, and accounting requires multiple levels of regulation. New policies and procedures must be established to ensure the new technical mechanism operates legally, appropriately, and efficiently.

5.2.Development proposals

In the future, blockchain technology is expected to advance toward greater intelligence and systematization. The following are the author's own suggestions:

5.2.1.Technology derivation

Aiming at the challenges faced by blockchain in related applications, we can choose to use blockchain-derived technologies to address them. For example, by referencing Ant Chain's Distributed Identity Service (DIS), multi-party authentication can improve regulatory mechanisms and ensure information security. Ant Chain's technology derivatives help resolve issues in regulatory procedures.

5.2.2.Procedure unification and transition phase

For blockchain to be widely adopted, it should have a unified system and style within its primary framework, accompanied by clear theoretical guidance, and there must be a transition stage between blockchain and traditional accounting systems. For example, until blockchain is fully implemented, the centralized system should continue to be used. Once each node is established, central system information is logged into each node, and the central system acts as one node in the transition from centralization to distribution. This approach facilitates employee acceptance and makes enterprise integration more convenient.

5.2.3.Complementing with other technologies

Blockchain can also be integrated with other technologies. For instance, AI can reduce complex operations through intelligent question answering, enhancing blockchain system intelligence. RPA handles low-level transaction processing and information management, minimizing repeated operations and improving blockchain operational efficiency. Together, these technologies reduce learning costs, lower the demand for manual operations, minimize human error, and improve accuracy.

6.Conclusion

Based on the above case analysis of Luzhou Laojiao and Tmall International, the two research hypotheses proposed in this paper are verified. It fully shows that blockchain can not only improve the financing efficiency of accounting information system, but also effectively enhance transaction efficiency and security. Blockchain establishes a dual-chain structure through the integration of the supply chain, reconstructs the conventional accounting information system, streamlines the financing process, enhances the transactions quality, and establishes a point-to-point information transmission model. This study provides an academic foundation for the implementation of blockchain in financial information systems, clearly analyzes its application difficulties and development trends, and actively promotes the deep integration of blockchain technology and accounting discipline.

References

[1]. Songhua, D., & Chenying, L. (2020). Exploring the Adaptability of Blockchain Data Structures in Accounting Information Management: A Focus on Preventing Financial Fraud. Management and Administration(10), 62-66. doi:10.16517/j.cnki.cn12-1034/f.2020.10.015

[2]. Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Satoshi Nakamoto.

[3]. Shuo, L., Zewen, H., & Yuping, L. (2019). Investigation on Models, Technologies of Blockchain and its Typical Applications. Technology Intelligence Engineering, 5(06), 15-36. Retrieved from https://kns.cnki.net/kcms2/article/abstract?v=2arE9-pF_S0r4WT6m2KS_DieZpKXSsDeSdRbK0IrzKRgJvlSr9bNgLmheOqhS2ROHBWTSD3MWKkRtIhuXTHXCTgo0AOrh0v7s702wj79a6PEhMlsZKuI8GvtbAuIvk6RBL8jKbS74j9fHGJcQG0ExZk8ofCj9mNuEz-Tkc_CQypGUGEyWNsVZ2l9POygP49ObVH27Cf3KlY=&uniplatform=NZKPT&language=CHS

[4]. Xudong, Y., & Rui, S. (2024). Research on Environmental Accounting Information System Based on ESG: The JH Automobile as an example. Friends of Accounting(16), 69-74. Retrieved from https://link.cnki.net/urlid/14.1063.F.20240726.1307.022

[5]. Kun, R. (2024). Analysis of the Impact of Supply Chain Finance on Corporate Investment and Financing Efficiency. Modern Business(14), 132-135. doi:10.14097/j.cnki.5392/2024.14.037

[6]. Hongzhen, D. (2023). Research on the Application of Blockchain Technology in the Field of Cross-Border Payment, . China Market(26), 1-8. doi:10.13939/j.cnki.zgsc.2023.26.001

[7]. Cuihua, H., Jiabin, L., Yan, L., & Xiangxi, Y. (2022). Research on the Application of Blockchain Technology in Audit: The Ant Blockchain BaaS Platform as an example. Chinese Agricultural Accounting(04), 75-77. doi:10.13575/j.cnki.319.2022.04.032

[8]. Liang, W., Xiaoming, S., & Ming, H. (2024). Research on the Application of Construction and Management of Traffic Teaching Resource Sharing System in Colleges and Universities Based on Ant Chain. Scienceand Technology&Innovation(04), 194-196. doi:10.15913/j.cnki.kjycx.2024.04.056

[9]. Wenxin, X. (2023). Research on the Innovation of Supply Chain Finance Model Based on Blockchain Technology: The Ant Chain of Ant Group as an example. (Master). Retrieved from https://link.cnki.net/doi/10.27837/d.cnki.ghbjr.2023.000066 Available from Cnki

[10]. Hongjie, Z., & Xinghui, W. (2023). The Optimization of Management Accounting Information System Under the Blockchain. CO-Operative Economy & Science(03), 152-153. doi:10.13665/j.cnki.hzjjykj.2023.03.068

Cite this article

Duan,L. (2025). Research on the Application Technology of Blockchain in Accounting Information System -- Based on Case Study. Advances in Economics, Management and Political Sciences,159,137-147.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Songhua, D., & Chenying, L. (2020). Exploring the Adaptability of Blockchain Data Structures in Accounting Information Management: A Focus on Preventing Financial Fraud. Management and Administration(10), 62-66. doi:10.16517/j.cnki.cn12-1034/f.2020.10.015

[2]. Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Satoshi Nakamoto.

[3]. Shuo, L., Zewen, H., & Yuping, L. (2019). Investigation on Models, Technologies of Blockchain and its Typical Applications. Technology Intelligence Engineering, 5(06), 15-36. Retrieved from https://kns.cnki.net/kcms2/article/abstract?v=2arE9-pF_S0r4WT6m2KS_DieZpKXSsDeSdRbK0IrzKRgJvlSr9bNgLmheOqhS2ROHBWTSD3MWKkRtIhuXTHXCTgo0AOrh0v7s702wj79a6PEhMlsZKuI8GvtbAuIvk6RBL8jKbS74j9fHGJcQG0ExZk8ofCj9mNuEz-Tkc_CQypGUGEyWNsVZ2l9POygP49ObVH27Cf3KlY=&uniplatform=NZKPT&language=CHS

[4]. Xudong, Y., & Rui, S. (2024). Research on Environmental Accounting Information System Based on ESG: The JH Automobile as an example. Friends of Accounting(16), 69-74. Retrieved from https://link.cnki.net/urlid/14.1063.F.20240726.1307.022

[5]. Kun, R. (2024). Analysis of the Impact of Supply Chain Finance on Corporate Investment and Financing Efficiency. Modern Business(14), 132-135. doi:10.14097/j.cnki.5392/2024.14.037

[6]. Hongzhen, D. (2023). Research on the Application of Blockchain Technology in the Field of Cross-Border Payment, . China Market(26), 1-8. doi:10.13939/j.cnki.zgsc.2023.26.001

[7]. Cuihua, H., Jiabin, L., Yan, L., & Xiangxi, Y. (2022). Research on the Application of Blockchain Technology in Audit: The Ant Blockchain BaaS Platform as an example. Chinese Agricultural Accounting(04), 75-77. doi:10.13575/j.cnki.319.2022.04.032

[8]. Liang, W., Xiaoming, S., & Ming, H. (2024). Research on the Application of Construction and Management of Traffic Teaching Resource Sharing System in Colleges and Universities Based on Ant Chain. Scienceand Technology&Innovation(04), 194-196. doi:10.15913/j.cnki.kjycx.2024.04.056

[9]. Wenxin, X. (2023). Research on the Innovation of Supply Chain Finance Model Based on Blockchain Technology: The Ant Chain of Ant Group as an example. (Master). Retrieved from https://link.cnki.net/doi/10.27837/d.cnki.ghbjr.2023.000066 Available from Cnki

[10]. Hongjie, Z., & Xinghui, W. (2023). The Optimization of Management Accounting Information System Under the Blockchain. CO-Operative Economy & Science(03), 152-153. doi:10.13665/j.cnki.hzjjykj.2023.03.068