1. Introduction

Corporate innovation capability is not only a crucial manifestation of a company’s competitiveness but also a key driver of economic growth and social progress. In the face of the complex market environment brought about by accelerated globalization and technological change, innovation has become an inevitable choice for companies striving to achieve high-quality development. The report of the 20th National Congress of the Communist Party of China states, “High-quality development is the primary task in building a socialist modernized country,” and “We must uphold innovation as the core position in the modernization of our country,” further emphasizing the importance of innovation in driving China’s economic development.

However, with the increasing global economic uncertainty and the rise of trade protectionism, entrepreneurial decision-making faces greater challenges, directly affecting corporate confidence and behavior. Entrepreneurial confidence, as a critical factor in responding to changes in the external environment, has a profound impact on a company’s investment, business decisions, and innovation activities. When confidence is high, companies are more inclined to increase R&D investment and expand into international markets; when confidence is low, conservative innovation and internationalization strategies may result.

In an environment of frequent changes in trade policy, many companies slow down their innovation investments due to the uncertainty of market prospects. However, Beifa Group, as a leader in the stationery industry, has maintained stable innovation development amid high trade policy uncertainty through a series of innovative strategies and management measures, providing an example for boosting entrepreneurial confidence and advancing corporate innovation.

This paper will take Beifa Group as a case study to explore how to boost entrepreneurial confidence under policy uncertainty and thereby promote corporate innovation. Through case analysis, this paper not only provides practical insights for companies to achieve innovation in an uncertain policy environment but also aims to make a theoretical contribution to the research on trade policy uncertainty, entrepreneurial confidence, and corporate innovation.

The structure of this paper is as follows: Chapter 2 reviews academic research on trade policy uncertainty, entrepreneurial confidence, and corporate innovation; Chapter 3 analyzes recent policy uncertainty events using the China-US trade friction as an example; Chapter 4 explores how Beifa Group has strengthened investment confidence and promoted innovation in this environment; Chapter 5 summarizes the findings and offers recommendations.

2. Literature Review

2.1. Literature Review on Trade Policy Uncertainty

Trade policy uncertainty refers to the situation where there is a lack of clarity or predictability regarding the future development of trade relations or policies between countries. Trade policy has significant impacts on both micro and macroeconomics. Since 2018, there has been a notable increase in research on the effects of trade policy uncertainty on businesses.

At the micro level, Chen Gang considered the significant negative effect of trade policy on the technological complexity of corporate exports, noting that the export threshold for businesses rises, which in turn reduces the enthusiasm for R&D innovation [1]. Xing Xiaobing collected data from 79 countries and found that an increase in trade policy uncertainty leads companies to reduce R&D investment in order to mitigate risks, thereby suppressing the improvement of technological innovation levels [2].

At the macro level, Albagli et al. found that uncertainty shocks caused by trade friction could weaken domestic demand, thereby triggering pessimistic expectations among entrepreneurs and lowering entrepreneurial confidence [3]. Xu Zhiwei et al.’s study revealed that economic policy uncertainty significantly impacts China’s economy, causing declines in output, prices, consumption, and investment [4]. Li Yujia et al. found that trade policy uncertainty shocks lead to varying degrees of declines in investment, consumption, and output. However, compared to tariff expectations, trade policy uncertainty has a relatively smaller but more persistent negative effect on macroeconomic downturns [5].

2.2. Literature Review on Entrepreneurial Confidence

The entrepreneurial confidence index is an important indicator that measures entrepreneurs’ expectations regarding economic prospects and the potential for business development. It encompasses a comprehensive assessment of market trends, policy environments, business climates, and the ease of obtaining financing. The level of this index directly correlates with entrepreneurs’ decision-making tendencies in innovation investment, capital expansion, and other areas. When the confidence index is high, entrepreneurs are more likely to show a preference for long-term investments, including business expansion and technological innovation. Conversely, when the index is low, entrepreneurs may adopt more cautious financial strategies, reducing future investments.

Existing research mainly focuses on the impact of entrepreneurial confidence on macroeconomic variables and corporate investment behavior. He Anni and Tang Wenlin examined the relationship between China’s entrepreneurial confidence index and GDP growth over 40 quarters from 2004 to 2013, and their study indicated that the entrepreneurial confidence index positively and significantly promotes economic growth [6]. Ilut et al. found that higher uncertainty has a stronger inhibitory effect on entrepreneurial confidence, which in turn affects macroeconomic activities [7]. Deng Yongliang et al.’s research suggested that enhanced entrepreneurial confidence increases innovation investment through long-term borrowing and equity financing channels, especially for private and high-tech enterprises [8]. Liu Xiaojun et al. pointed out that entrepreneurial confidence directly affects the macroeconomy and improves consumption and investment through better future expectations, thus driving economic growth [9]. In summary, entrepreneurial confidence can impact macroeconomic conditions from a macro perspective, and also influence corporate investment and innovation from a micro perspective.

2.3. Literature Review on Corporate Innovation

The concept of “innovation” was first introduced by economist Joseph Schumpeter in the 1930s, emphasizing that innovation is the core driving force behind technological, economic, and social development. Building on Schumpeter’s concept, Aghion and Howitt proposed that innovation leads to the obsolescence of old technologies or businesses, thereby triggering creative destruction, which is an important mechanism driving long-term economic growth [10]. Over time, the innovation-driven theory has been further refined, and there is now general consensus in academia that technological change is considered an endogenous variable in economic development, and technological change plays a key role in driving economic development.

Among external factors, Angus C. Chu et al. pointed out that companies enhance their innovation capabilities by acquiring knowledge spillover effects through imports [11]. Ni Qin et al. analyzed the impact of trade liberalization after China joined the WTO on entrepreneurial activities, and found that trade liberalization significantly promoted entrepreneurship and innovation activities [12]. This shows that import and export activities can influence the innovation capabilities of enterprises.

Market demand is the intrinsic source of innovation activities. Jacob Schmookler’s demand-pull hypothesis states that innovation is a function of market demand. Zhang Yong’an and Guan Yongjuan, based on the demand-driven approach, verified the positive impact of market demand on corporate innovation performance and proved the positive correlation between market demand and innovation performance for companies in the growth and maturity stages [13].

Internally, the ownership structure of listed companies is an important component of corporate governance. From the perspective of the internal mechanisms through which ownership structure affects corporate innovation, Zhong Teng et al. argued that due to the existence of the second type of agency problem, large shareholders tend to exploit the interests of small and medium shareholders through tunneling effects rather than seeking long-term benefits through innovation and R&D, which reduces the motivation for innovation [14].

Thus, corporate innovation activities are influenced by both external environmental factors and internal company conditions.

2.4. Impact of Trade Policy Uncertainty on Corporate Innovation

Research on this topic is gradually improving. On the one hand, as early as 2015, Tong Jiadong et al. studied data from Chinese industrial enterprises from a micro-product perspective and found that since China’s accession to the WTO, the reduction in trade policy uncertainty has significantly improved the product innovation capabilities of Chinese companies [15]. With the rise of trade protectionism in recent years, Chinese companies have faced increased trade policy uncertainty. Deng Xiaofei et al.’s research found that increased external trade policy uncertainty causes companies to reduce innovation activities in order to avoid internal risks, indicating that trade policy uncertainty has a suppressive effect on corporate innovation [16].

On the other hand, in specific industries, trade uncertainty may produce a counteracting effect on innovation from the perspectives of “internal driving” and “external pressure” [17]. Peng Xin-Yu et al. found a significant positive correlation between economic policy uncertainty and green innovation [18]. Huayu Shen et al.’s study on China’s new energy vehicle industry found that trade policy uncertainty promotes R&D investment by enterprises [19]. Muhammad Nadir Shabbir et al. found that in the field of medical innovation, trade uncertainty brought about by the pandemic promoted medical R&D investment and fostered the development of the healthcare sector [20].

In summary, existing research has laid the foundation for exploring the relationship between trade policy uncertainty, entrepreneurial confidence, and corporate innovation. However, the specific transmission mechanisms between these three factors remain unclear. Although the existing literature reveals the pathways through which uncertainty affects entrepreneurial confidence and innovation, systematically sorting out their specific mechanisms remains a challenge for future research. This study will explore through case analysis how entrepreneurial confidence influences innovation activities under the impact of policy uncertainty, with the aim of providing practical strategies and insights for businesses facing increasing trade policy uncertainty.

3. Events Impacting Trade Policy Uncertainty

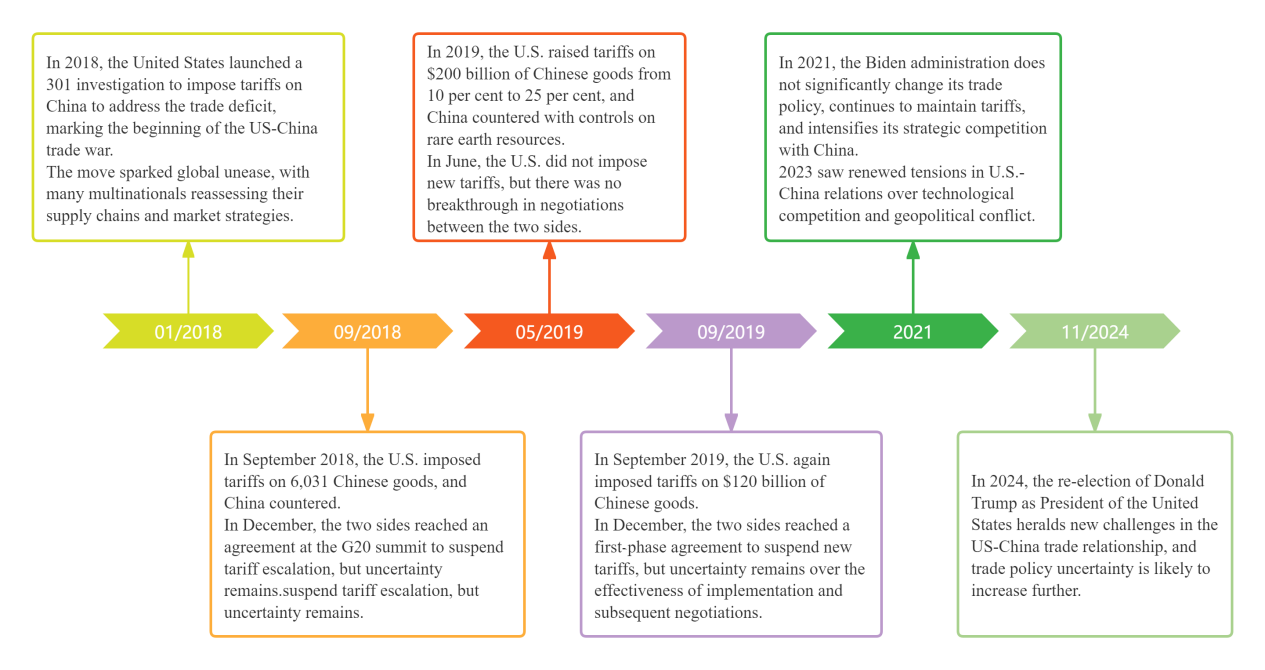

This paper primarily focuses on the Sino-US trade war, outlining the events in recent years that have influenced trade policy uncertainty. The following chart shows the key stages of Sino-US trade relations.

Figure 1: Events Impacting Trade Policy Uncertainty.

Phase 1: The Outbreak of the Trade War

In early 2018, the United States launched a trade investigation against China (referred to as the “301 Investigation”).

The issue of the Sino-US trade deficit has always been a direct factor in Sino-US trade relations and the main excuse for the United States to target China. In an effort to protect its own industries and suppress China’s rise, the Trump administration announced a Section 301 investigation, accusing China of unfair practices in intellectual property protection and technology transfer. This investigation led to punitive tariffs on Chinese goods, marking the official start of the Sino-US trade war. The move caused global market anxiety, raising concerns about the long-term direction of Sino-US trade relations.

In March 2018, the US began imposing tariffs on Chinese imports of steel and aluminum.

In July 2018, the US began imposing a 25% tariff on high-tech imported products worth $34 billion, including aerospace, information technology, and auto parts. China immediately retaliated with similar tariffs on 659 items of US goods valued at approximately $50 billion. The official tariff battle increased uncertainty about future tariff changes, forcing many multinational companies to reassess their supply chain layouts and market strategies. In August, the US Department of Commerce announced that 44 Chinese companies (mainly Chinese military and research institutions) would be placed on an export control list, implementing a technology blockade.

Phase 2: Second Round of Tariffs

On September 18, 2018, the US imposed tariffs on 6,031 goods, including food, textiles, chemicals, heavy metals manufacturing, and light industries. On September 24, China responded with a 10% tariff on nearly $60 billion worth of goods.

In December 2018, during the G20 summit, both China and the US reached an agreement to suspend tariff escalation. The two heads of state discussed Sino-US economic and trade issues and reached a consensus. They announced a suspension of new trade measures and set a three-month negotiation period. Although the suspension of escalation eased market sentiment to some extent, the uncertainty about whether the two sides would reach an agreement in the short term remained, especially regarding how to resolve structural issues, leading to diverging market expectations.

Phase 3: Third Round of Tariffs

On May 11, 2019, the US announced an increase in tariffs on $200 billion worth of Chinese goods from 10% to 25%. On June 1, China announced an increase in tariffs on $60 billion worth of US goods. On June 5, China’s National Development and Reform Commission held a meeting with rare earth industry enterprises, stating that strict controls would be imposed on the export of rare earth resources to protect these valuable resources.

On June 29, during the 2019 G20 summit in Osaka, Japan, both China and the US held talks. After consultations, the US agreed not to impose new tariffs on Chinese products.

On July 10, the US announced the exemption of 110 Chinese products, including medical devices and capacitors, from additional tariffs, while China responded by purchasing over 50,000 tons of US sorghum.

Phase 4: Fourth Round of Tariffs

On September 1, 2019, the US imposed a 10% tariff on $120 billion worth of Chinese imports.

In December 2019, China and the US reached a Phase 1 Agreement.

After prolonged negotiations, China and the US reached a Phase 1 trade agreement in December 2019. The two countries signed the “Economic and Trade Agreement between the People’s Republic of China and the United States” in January 2020, under which China promised to significantly increase purchases of US agricultural products, while the US agreed to suspend further tariff increases. The signing of the Phase 1 Agreement alleviated some of the trade tensions, but the effectiveness of the agreement and the prospects for Phase 2 negotiations remained uncertain.

In early 2020, the outbreak of the novel coronavirus shifted the focus of the trade war but further deepened the vulnerability of global supply chains, exacerbating the ongoing uncertainty in global trade policies.

Phase 5: Stability in Sino-US Relations After Biden Took Office

After the Biden administration took office in 2021, although there was no major reversal of trade policies, the Biden administration adopted a more multilateral and alliance-based approach to dealing with China while maintaining some tariff policies. The Biden administration’s policies meant that businesses continued to face significant uncertainty, as tariff issues remained unresolved and trade negotiations showed no clear breakthrough.

In the National Security Strategy report released in October 2022, China was directly positioned as “the only competitor with the intent and growing economic, diplomatic, military, and technological capabilities to reshape international order.” The US policy emphasized the need to “out-compete” China and initiated a long-term strategic competition with China, further increasing uncertainty in Sino-US trade policies.

In 2023, with the intensification of geopolitical conflicts and technological competition, Sino-US relations became more tense, particularly in high-tech fields like chips and semiconductors, where export restrictions and technology blockade policies were implemented. These measures shifted the trade war from traditional tariff disputes to high-tech competition, increasing risks and uncertainties for global high-tech companies.

In 2024, the Biden administration raised tariffs on imported Chinese electric vehicles from 25% to 100%, increased tariffs on Chinese solar panel imports from 25% to 50%, and raised tariffs on some Chinese steel and aluminum imports from 7.5% to 25%.

Looking back at the four years of the Biden administration, on one hand, Biden and his Democratic Party have stabilized Sino-US relations and prevented further deterioration, while continuing strategic competition with China. They maintained high-level dialogues and communications in various fields, preventing further escalation of trade policies. On the other hand, by strengthening the “decoupling” from China in high-tech sectors and exacerbating regional security tensions, the Democratic Party has also laid the groundwork for long-term and systemic strategic competition with China.

In essence, the Biden administration is constructing a strategic “range” in its competition with China: the upper limit is preventing China from surpassing the US in key fields related to national core competitiveness, and the lower limit is avoiding high-intensity conflicts that the US does not wish to become involved in. Overall, Biden and his party have maintained some aspects of tariff policy and trade competition, making such competition a norm and prolonging it, which has created a delicate stability in Sino-US relations, offering certain opportunities for innovation and development in some of China’s high-tech industries.

Phase 6: Trump’s Re-election and New Stage of Sino-US Trade

On November 6, 2024, Donald Trump won the US presidential election, becoming the 47th President of the United States. His stance on fully containing China’s development and Sino-US trade is unlikely to change significantly. Furthermore, based on an analysis of Trump’s personality traits and previous decisions, [21] his competitive, self-centered, profit-driven, changeable, and results-oriented character traits make him prone to making extreme and erratic decisions in international affairs. As a result, Sino-US relations are likely to face new challenges, and trade policy uncertainty may intensify further.

4. Case Analysis of Beifa Group

Founded in 1994, Beifa Group is a comprehensive enterprise integrating R&D and design, production and sales, as well as supply chain integration, committed to building an internet ecosystem platform for niche industries. Beifa currently occupies approximately 16.5% of China’s pen export market. From January to May 2024, its sales revenue grew by 40%, while profits increased by 100%. Under the strategy of “One Pen, One Chain, One Platform,” Beifa files an average of one new patent every three days, with a cumulative total exceeding 3,300, securing its industry leadership. By focusing on its core business, developing digital channels, and building a branded supply chain, Beifa has achieved a leading position in the global stationery market, offering a practical model for promoting high-quality development amidst uncertainty.

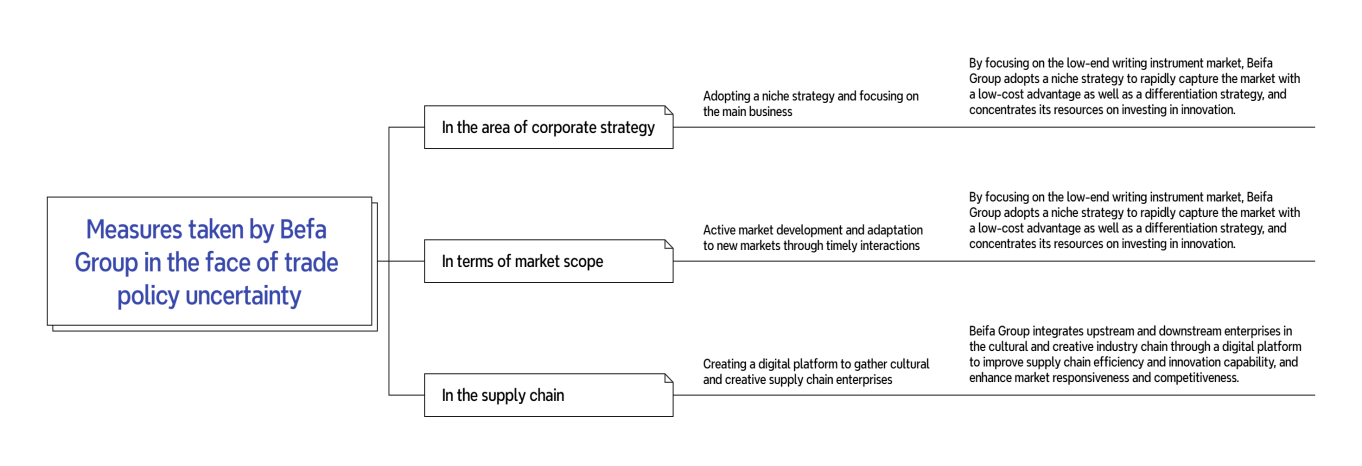

4.1. Strategic Level: Adopting a Niche Strategy and Focusing on Core Business

A niche strategy refers to starting with a narrow business scope, concentrating resources to expand market coverage, and ultimately achieving a leading position in a dominant market. By leveraging this strategy, companies can gain competitive advantages, secure funding for technological innovation, and enhance brand reputation, thereby expanding market reach accordingly [22]. Beifa Group primarily focuses on simple writing tools (such as low-cost fountain pens and ballpoint pens) and the international low-end stationery market, which has relatively weak competition. Addressing the imperfections in international markets and weak points in the simple pen industry, Beifa employs a comprehensive penetration approach and flexible business mechanisms to capitalize on its cost advantages. This allows the company to achieve maximum benefits with minimal costs, quickly filling industry gaps. Enterprises adopting a niche strategy can often avoid direct confrontation with strong competitors by targeting markets overlooked by larger companies. Beifa has entered the market with the simplest products—basic writing tools—and has steadfastly focused on this area for over a decade, consistently establishing itself as a professional stationery supplier both domestically and internationally. By employing this niche strategy, Beifa has become the largest manufacturer in its category, serving as a valuable reference for other enterprises.

4.2. Market Scope: Developing Markets and Achieving Positive Innovation Interactions

Market expansion promotes innovation through two main pathways: (1) Competition Effect – A larger market attracts more competitors, compelling companies to improve production efficiency and technological innovation capabilities. (2) Market Demand Effect – An expanded market generates greater demand, motivating companies to invest in technology and innovation [23]. Additionally, market feedback on innovation outcomes can help refine and calibrate such efforts. In recent years, Beifa has courageously expanded into overseas markets amidst trade policy uncertainties. It has frequently secured overseas orders at import and export trade fairs and established factories and complete supply chain systems in regions such as Southeast Asia and the Middle East. Currently, Beifa has a global customer base of 1.5 billion users, over 100,000 retail terminals, more than 1,000 key clients and distributors, and a presence across over 100 online and offline channels. Its products are exported to more than 200 countries and regions, including North America and Europe. Beifa’s success lies in the virtuous cycle between technological innovation and market expansion: innovation enables entry into new markets, while market expansion, in turn, provides resources and motivation for further innovation. This cycle allows the company to continually build its competitive edge.

4.3. Supply Chain: Building a Digital Platform to Aggregate Cultural and Creative Supply Chain Enterprises

In recent years, Beifa has faced the need for a comprehensive transformation and upgrade of the manufacturing sector, particularly in the cultural and creative industries. With changing trade policies, rapid shifts in market demand, and shortened product life cycles, traditional management models and supply chain systems can no longer meet the market’s demand for flexibility and innovation. To maintain competitiveness and enhance its platform integration capabilities, Beifa began constructing a more open and collaborative cultural and creative supply chain platform in 2020 by integrating upstream and downstream enterprises into its digital platform [24]. This platform attracts design companies, raw material suppliers, logistics enterprises, and other partners to collaborate, forming a more efficient supply chain ecosystem. Through platform integration, all participants can share real-time data, reduce information asymmetry, and improve collaboration efficiency. The platform also enables real-time monitoring of the supply chain, from raw material procurement to production and distribution, allowing for full digital tracking and management. It provides more accurate demand forecasts, enabling Beifa to respond quickly during production, avoid excessive inventory accumulation, and improve response speed to customer demands.

Figure 2: Measures Adopted by Beifa Group in Response to High Trade Policy Uncertainty.

Note:

Measures Taken by Beifa Group in Response to the Uncertainty of U.S. Trade Policies

Strategic Level

Beifa adopts a clear strategy, focusing on key industries. It avoids direct competition in the U.S. market for mid-to-low-end tools and products, opting instead for basic components and integrating platforms. Additionally, Beifa emphasizes technological innovation in niche markets.

Market Scope

Actively expanding into emerging markets and strengthening interaction with dynamic markets. Through deeper interaction with markets with high growth potential, Beifa continuously identifies market needs and enhances its competitive advantages in market positioning.

Supply Chain Level

Establishing a digital platform and clustering innovative upstream and downstream enterprises. By integrating its digital capabilities and fostering collaboration along the industrial chain, Beifa strengthens its resilience in response to market uncertainty.

5. Conclusion

This paper combines theoretical research with a case study of Beifa Group to explore the role of entrepreneurial confidence in driving corporate innovation under the context of trade policy uncertainty, as well as feasible strategies for maintaining such confidence. The study reveals that trade policy uncertainty significantly impacts corporate innovation activities, while entrepreneurial confidence plays a crucial role in mitigating these effects. Specifically, entrepreneurial confidence can motivate firms to increase R&D investment and expand into international markets, thereby fostering innovation. However, policy uncertainty often causes fluctuations in entrepreneurial confidence. When faced with global economic pressures and rising trade protectionism, entrepreneurs may adopt more conservative decision-making, thereby hindering the advancement of innovation.

Using Beifa Group as an example, this paper analyzes its response strategies to events such as the China-U.S. trade war. By adopting a niche strategy, expanding markets, and building a digital supply chain, Beifa effectively navigated policy changes while maintaining its innovation and competitiveness. Its experience demonstrates that in uncertain environments, companies should adopt flexible strategies and manage confidence to sustain innovative vitality.

This study offers valuable insights into how companies can maintain innovative vitality amid uncertain trade policy environments. In the face of global trade uncertainties, businesses should focus on enhancing entrepreneurial confidence, adopting flexible strategies to adapt to policy changes, and optimizing the allocation of innovation resources to strengthen their ability to cope with complex market conditions. Future research could further investigate strategies adopted by different industries and regions under varying degrees of trade policy uncertainty, as well as the long-term mechanisms through which entrepreneurial confidence influences innovation.

References

[1]. Chen, G. (2023). Trade policy uncertainty and the complexity of export technology: Theoretical mechanism and empirical test. Technology Economics and Management Research, (08), 15–20.

[2]. Xing, X.-B., & Gao, J.-W. (2024). Trade policy uncertainty and technological innovation: The moderating effect of trade networks. Journal of Hefei University of Technology (Social Sciences), 38(02), 43–53, 112.

[3]. Albaglie, Fornero, J., Fuentes, M., et al. (2019). On the effects of confidence and uncertainty on aggregate demand: Evidence from Chile. Journal Economía Chilena, 22(3), 8–33.

[4]. Xu, Z.-W., & Wang, W.-F. (2019). The impact of economic policy uncertainty on the macroeconomy: A dynamic analysis based on empirical and theoretical perspectives. China Economic Quarterly, 18(01), 23–50. https://doi.org/10.13821/j.cnki.ceq.2018.02.02

[5]. Li, Y.-J., Che, M., & Zhu, Z.-X. (2023). The macroeconomic effects of trade policy uncertainty. China Economic Issues, (02), 117–132. https://doi.org/10.19365/j.issn1000-4181.2023.02.09

[6]. He, A.-N., & Tang, W.-L. (2016). A study on the correlation between entrepreneurial confidence and economic growth. Academic Forum, (1).

[7]. Ilut, C. L., & Saijo, H. (2016). Learning, confidence, and business cycles (NBER Working Paper No. w22958). National Bureau of Economic Research.

[8]. Deng, Y.-L., & Zhang, H. (2024). Entrepreneurial confidence and corporate innovation investment [J/OL]. North China Finance, (06), 83–93 [2024-09-21]. Retrieved from http://kns.cnki.net/kcms/detail/12.1309.F.20240626.1627.014.html

[9]. Liu, X.-J., Jiang, W., & Hu, J.-S. (2019). A study of confidence, monetary policy, and China’s economic fluctuations based on the TVP-VAR model. Chinese Management Science, 27(08), 37–46. https://doi.org/10.16381/j.cnki.issn1003-207x.2019.08.004

[10]. Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351.

[11]. Chu, A. C., Fan, H., Shen, G., & Zhang, X. (2018). Effects of international trade and intellectual property rights on innovation in China. Journal of Macroeconomics, 57, 110–121. https://doi.org/10.1016/j.jmacro.2018.05.003

[12]. Cai, M., Cui, R., & Li, D. (2023). Trade with innovation benefits: A re-appraisal using micro data from China. Journal of Asian Economics, 89, 101664. https://doi.org/10.1016/j.asieco.2023.101664

[13]. Zhang, Y.-A., & Guan, Y.-J. (2021). The impact of government subsidies on corporate innovation performance. Industrial Technology Economics, 40(02), 18–25.

[14]. Zhong, T., Wang, C.-Y., & Li, Z.-L. (2020). Ownership structure, tunneling effects, and innovation output: Evidence from listed manufacturing companies. Journal of Xiamen University (Philosophy and Social Sciences), (06), 119–130.

[15]. Tong, J.-D., & Li, S.-Q. (2015). The impact of trade policy uncertainty on export enterprises’ product innovation. International Trade Issues, (06), 25–32. https://doi.org/10.13510/j.cnki.jit.2015.06.002

[16]. Deng, X.-F., & Ren, T. (2020). Trade policy uncertainty and corporate innovation. Technology Economics and Management Research, (12), 28–33.

[17]. Song, H.-S., & Cao, T.-T. (2023). Trade policy uncertainty and corporate innovation: Perspectives of “internal drive” and “external pressure”. International Trade Issues, (06), 86–102. https://doi.org/10.13510/j.cnki.jit.2023.06.009

[18]. Peng, X.-Y., Zou, X.-Y., Zhao, X.-X., & Chang, C.-P. (2023). How does economic policy uncertainty affect green innovation? Technological and Economic Development of Economy, 29(1), 114–140. https://doi.org/10.3846/tede.2022.17760

[19]. Shen, H., & Hou, F. (2021). Trade policy uncertainty and corporate innovation: Evidence from Chinese listed firms in the new energy vehicle industry. Energy Economics, 97, 105217.

[20]. Shabbir, M. N., Arshad, M. U., Alvi, M. A., et al. (2022). Impact of trade policy uncertainty and sustainable development on medical innovation for developed countries: An application of the DID approach. Sustainability, 15(1), 49.

[21]. Yin, J.-W., Zheng, J.-J., & Li, H.-Z. (2017). An analysis of Trump’s political personality traits and policy preferences. Modern International Relations, (02), 15–22, 66.

[22]. Echols, A., & Tsai, W. (2005). Niche and performance: The moderating role of network embeddedness. Strategic Management Journal, 26(3), 219–238.

[23]. Chen, Y. (2023). Export market size, initial productivity, and technological innovation of Chinese industrial enterprises. Contemporary Finance & Economics, (02), 106–119. https://doi.org/10.13676/j.cnki.cn36-1030/f.2023.02.007

[24]. Li, X.-L., Fan, M.-X., & Zhang, X. (2024). The impact of digital platform capabilities on the digital transformation of small and medium-sized manufacturing enterprises. Management Journal, 21(10), 1445–1455.

Cite this article

Chen,J. (2025). Trade Policy Uncertainty, Entrepreneurial Confidence, and Corporate Innovation. Advances in Economics, Management and Political Sciences,156,1-10.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, G. (2023). Trade policy uncertainty and the complexity of export technology: Theoretical mechanism and empirical test. Technology Economics and Management Research, (08), 15–20.

[2]. Xing, X.-B., & Gao, J.-W. (2024). Trade policy uncertainty and technological innovation: The moderating effect of trade networks. Journal of Hefei University of Technology (Social Sciences), 38(02), 43–53, 112.

[3]. Albaglie, Fornero, J., Fuentes, M., et al. (2019). On the effects of confidence and uncertainty on aggregate demand: Evidence from Chile. Journal Economía Chilena, 22(3), 8–33.

[4]. Xu, Z.-W., & Wang, W.-F. (2019). The impact of economic policy uncertainty on the macroeconomy: A dynamic analysis based on empirical and theoretical perspectives. China Economic Quarterly, 18(01), 23–50. https://doi.org/10.13821/j.cnki.ceq.2018.02.02

[5]. Li, Y.-J., Che, M., & Zhu, Z.-X. (2023). The macroeconomic effects of trade policy uncertainty. China Economic Issues, (02), 117–132. https://doi.org/10.19365/j.issn1000-4181.2023.02.09

[6]. He, A.-N., & Tang, W.-L. (2016). A study on the correlation between entrepreneurial confidence and economic growth. Academic Forum, (1).

[7]. Ilut, C. L., & Saijo, H. (2016). Learning, confidence, and business cycles (NBER Working Paper No. w22958). National Bureau of Economic Research.

[8]. Deng, Y.-L., & Zhang, H. (2024). Entrepreneurial confidence and corporate innovation investment [J/OL]. North China Finance, (06), 83–93 [2024-09-21]. Retrieved from http://kns.cnki.net/kcms/detail/12.1309.F.20240626.1627.014.html

[9]. Liu, X.-J., Jiang, W., & Hu, J.-S. (2019). A study of confidence, monetary policy, and China’s economic fluctuations based on the TVP-VAR model. Chinese Management Science, 27(08), 37–46. https://doi.org/10.16381/j.cnki.issn1003-207x.2019.08.004

[10]. Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351.

[11]. Chu, A. C., Fan, H., Shen, G., & Zhang, X. (2018). Effects of international trade and intellectual property rights on innovation in China. Journal of Macroeconomics, 57, 110–121. https://doi.org/10.1016/j.jmacro.2018.05.003

[12]. Cai, M., Cui, R., & Li, D. (2023). Trade with innovation benefits: A re-appraisal using micro data from China. Journal of Asian Economics, 89, 101664. https://doi.org/10.1016/j.asieco.2023.101664

[13]. Zhang, Y.-A., & Guan, Y.-J. (2021). The impact of government subsidies on corporate innovation performance. Industrial Technology Economics, 40(02), 18–25.

[14]. Zhong, T., Wang, C.-Y., & Li, Z.-L. (2020). Ownership structure, tunneling effects, and innovation output: Evidence from listed manufacturing companies. Journal of Xiamen University (Philosophy and Social Sciences), (06), 119–130.

[15]. Tong, J.-D., & Li, S.-Q. (2015). The impact of trade policy uncertainty on export enterprises’ product innovation. International Trade Issues, (06), 25–32. https://doi.org/10.13510/j.cnki.jit.2015.06.002

[16]. Deng, X.-F., & Ren, T. (2020). Trade policy uncertainty and corporate innovation. Technology Economics and Management Research, (12), 28–33.

[17]. Song, H.-S., & Cao, T.-T. (2023). Trade policy uncertainty and corporate innovation: Perspectives of “internal drive” and “external pressure”. International Trade Issues, (06), 86–102. https://doi.org/10.13510/j.cnki.jit.2023.06.009

[18]. Peng, X.-Y., Zou, X.-Y., Zhao, X.-X., & Chang, C.-P. (2023). How does economic policy uncertainty affect green innovation? Technological and Economic Development of Economy, 29(1), 114–140. https://doi.org/10.3846/tede.2022.17760

[19]. Shen, H., & Hou, F. (2021). Trade policy uncertainty and corporate innovation: Evidence from Chinese listed firms in the new energy vehicle industry. Energy Economics, 97, 105217.

[20]. Shabbir, M. N., Arshad, M. U., Alvi, M. A., et al. (2022). Impact of trade policy uncertainty and sustainable development on medical innovation for developed countries: An application of the DID approach. Sustainability, 15(1), 49.

[21]. Yin, J.-W., Zheng, J.-J., & Li, H.-Z. (2017). An analysis of Trump’s political personality traits and policy preferences. Modern International Relations, (02), 15–22, 66.

[22]. Echols, A., & Tsai, W. (2005). Niche and performance: The moderating role of network embeddedness. Strategic Management Journal, 26(3), 219–238.

[23]. Chen, Y. (2023). Export market size, initial productivity, and technological innovation of Chinese industrial enterprises. Contemporary Finance & Economics, (02), 106–119. https://doi.org/10.13676/j.cnki.cn36-1030/f.2023.02.007

[24]. Li, X.-L., Fan, M.-X., & Zhang, X. (2024). The impact of digital platform capabilities on the digital transformation of small and medium-sized manufacturing enterprises. Management Journal, 21(10), 1445–1455.