1. Introduction

The global electric vehicle (EV) market is experiencing rapid growth, with China at the forefront. Existing studies often focus on the effects of U.S. monetary policy on capital flows and exchange rates, but there is a significant research gap regarding its impact on the EV supply chain in emerging markets. This study investigates how Federal Reserve rate cuts influence long-term EV supply chain investments in emerging markets through capital flows and asset pricing. Using a qualitative research approach, the paper employs case analysis and industry data comparison to explore this topic. Specifically, it examines BYD’s investments in emerging markets such as India, Southeast Asia, and South America to analyze the practical impact of the Fed’s rate cuts on its long-term investment strategies. This research offers theoretical insights and practical guidance for decision-making in the rapidly expanding EV industry.

2. Literature Review

2.1. Federal Reserve monetary policy and global capital flows

The Federal Reserve's monetary policy adjustments have significant impacts on global capital flows. Zhang Lijuan [1] highlights that Fed interest rate cuts often lead to the depreciation of the US dollar. This is because lower interest rates reduce the yield advantage of US dollar assets, prompting capital to shift toward more attractive markets and resulting in a weaker dollar . Similarly, Zhao Tianshu [2] notes that a wave of interest rate cuts reduces the interest rate differential between developed and emerging markets, thereby easing the pressure of capital outflows from emerging economies. Hou Xintong [3] further explains that expectations of rate cuts encourage foreign capital to return to emerging markets, driving up asset prices in those regions.

2.2. The impact of interest rates on investments

Changes in interest rates influence liquidity and investment behavior in emerging markets. Wang Peng argues that when the Federal Reserve restarts an easing cycle, global asset markets experience significant reshuffling, as investors seek higher yields in alternative markets[4]. Han Yu adds that the triple impact of Fed rate cuts includes easing corporate financing costs, improving investor confidence, and boosting asset prices in emerging economies[5] .

Moreover, Zhang Guangting highlights that US monetary tightening has a pro-cyclical effect on cross-border capital flows in emerging markets[6] . Rising interest rates incentivize global capital to return to the United States, reducing liquidity in emerging markets and increasing financing constraints for corporations. These constraints force companies to scale back investments or adopt more conservative financial strategies.

2.3. Supply chain investment decisions in the new energy vehicle industry

In the context of supply chain investments, interest rate cuts can play a critical role in supporting long-term investment decisions. Jian Yannan discusses how national policies in China have created significant opportunities for the development of new energy vehicle infrastructure, particularly in the market for public charging piles, which is expected to see substantial growth [7]. Jiang Qichen emphasizes the importance of government subsidies in attracting enterprises to the new energy market, facilitating increased local investment and innovation[8] .

Furthermore, Sheng Xiaofeng and Lv Jinxiao point out that lower interest rates help ease financing constraints in the new energy vehicle industry[9] .With improved access to funds, enterprises are more likely to make long-term investments in supply chain optimization and expansion. Wang Qing also stresses that Chinese automakers must carefully pace their global expansion strategies in the context of shifting monetary policies and emerging opportunities in the international market[10] .

3. The Case Study of BYD's investment decisions in emerging markets

3.1. BYD company profile

Founded in 1995, BYD Co., Ltd. (BYD) is a leading new energy vehicle manufacturer in China, with a wide product line in the fields of electric vehicles, batteries and electric public transportation. According to the latest financial report data, BYD's new energy vehicle sales in 2023 will reach 1.85 million units, a year-on-year increase of 80.1%, consolidating its leading position in the global electric vehicle market [12].

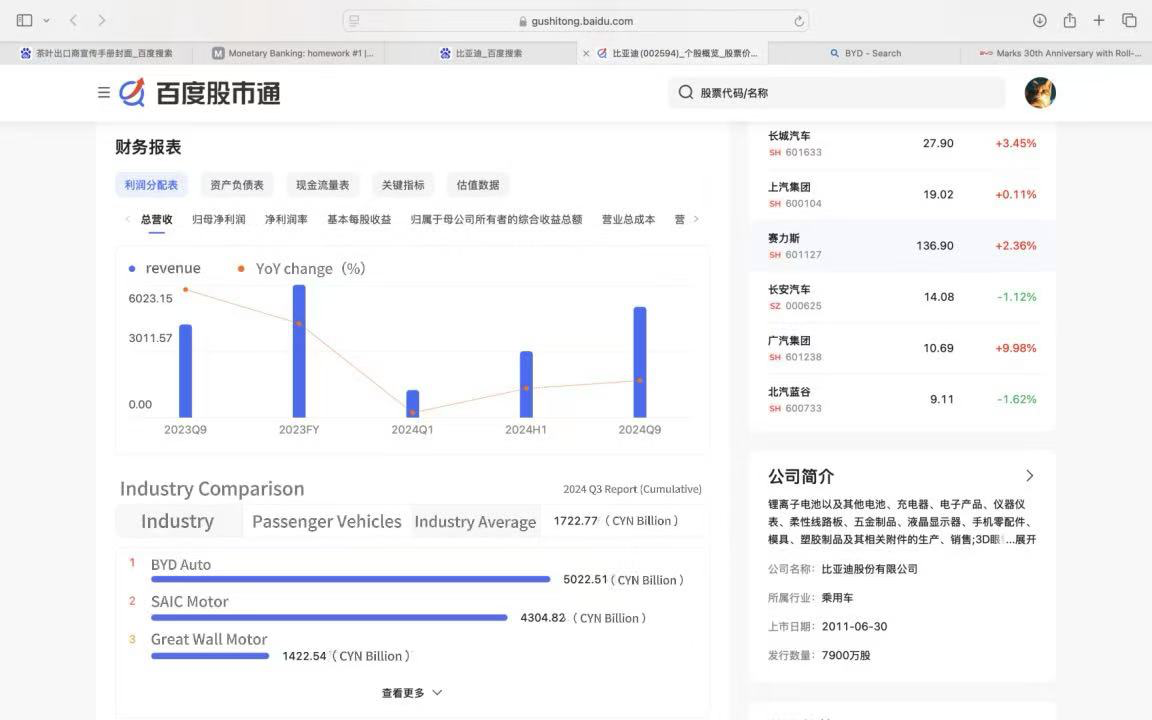

Figure 1: BYD’s Annual Revenue and Industry Comparison[12]

The Federal Reserve’s interest rate cut has significantly impacted BYD by reducing financing costs and increasing liquidity. In 2023, BYD’s average financing cost was approximately 4.5%, but the rate cut in September 2024 lowered this to an estimated 3.5%[12]. This reduction enabled BYD to access cheaper capital, providing greater liquidity for aggressive long-term investments. As shown in the financial report, BYD Auto generated revenue of 5022.51 billion CNY in Q3 2024, far surpassing industry competitors like SAIC Motor (4304.82 billion CNY) and Great Wall Motor (1422.54 billion CNY), while the industry average stood at 1722.77 billion CNY. BYD’s dominant position highlights its effective use of lower borrowing costs to strengthen its financial performance. For instance, in Southeast Asia, where BYD is expanding rapidly, the lower financing costs allowed it to secure favorable loan terms for building local factories and establishing distribution networks. This has further supported BYD's infrastructure development, production facilities, and supply chain integration efforts in emerging markets, enabling it to maintain its leadership in the global electric vehicle sector.

3.2. Market Expansion Strategy

3.2.1. Investment in india

In 2022, BYD made a significant investment of $1 billion to establish an electric vehicle production plant in India, with a planned annual production capacity of 500,000 units. This strategic move aligned with India’s favorable policies promoting electric vehicles, including government subsidies, which created a supportive environment for BYD to enhance its market presence. Furthermore, the Federal Reserve’s rate cut in 2024 reduced BYD’s financing costs, enabling the company to pursue further expansion of its production facilities in India more economically. These combined factors not only allowed BYD to solidify its foothold in the rapidly growing Indian market but also positioned the company to capitalize on the increasing demand for electric vehicles in the region.

3.2.2. Investment in Southeast Asia and Beyond

Uzbekistan Plant: In June 2024, BYD began local production at its Uzbekistan facility, with the Song PLUS DM-i Champion Edition rolling off the assembly line. The first phase of this plant focused on meeting local demand while reducing costs associated with tariffs and logistics[13].

Thailand and Brazil: BYD established new production facilities in these regions to cater to their growing markets. The lower financing costs following the Fed’s rate cut allowed BYD to accelerate these investments while maintaining financial stability.

3.2.3. Globalization Strategy

By the end of October 2024, BYD had established its presence in 96 countries and regions, achieving overseas sales of 329,000 units from January to October—a remarkable year-on-year growth of 86.9%. This expansion was supported by lower financing costs, enabling BYD to advance its “local production and local sales” strategy. By producing vehicles closer to key markets, the company reduced its dependence on exports and minimized risks posed by trade barriers. These efforts are integral to BYD’s globalization strategy, transitioning from a “made in China” model to an integrated global production and sales network. This positions BYD as a leading player in the international electric vehicle industry while enhancing adaptability to regional dynamics.

In 2022, BYD invested USD 1 billion to establish an electric vehicle plant in India, with a planned annual capacity of 500,000 units. Lower financing costs have further improved the financial viability of expanding production in India. Additionally, India’s favorable subsidy policies for electric vehicles have created an optimal environment for BYD, boosting sales growth and market penetration.

Beyond India, BYD accelerated its foreign investment strategy, entering 96 countries and regions globally and establishing production facilities in Uzbekistan, Thailand, Brazil, and Hungary. According to Li Yunfei, General Manager of BYD Group’s Brand and Public Relations Department, the company’s pace of international development is expected to quicken further. BYD’s focus on local production and sales not only addresses trade frictions but also represents a shift toward a globally integrated framework.

BYD’s globalization efforts have yielded remarkable results. From January to October 2024, it achieved overseas sales of 329,000 units, reflecting an 86.9% year-on-year increase. In June 2024, BYD began production at its Uzbekistan plant, with the Song PLUS DM-i Champion Edition rolling off the assembly line. This facility, with an annual capacity of 50,000 units, meets demand in Central Asia. In July 2024, BYD completed its Thailand plant, capable of producing 150,000 units annually, including key processes and parts production. BYD is also expanding into Africa, South America, and other markets, anticipating overseas sales to become a strong source of profit. This strategic approach highlights BYD’s commitment to strengthening its global presence and capitalizing on emerging market opportunities.

3.3. Recommendations

The Fed's interest rate cut has significantly enhanced BYD's ability to make long-term supply chain investments in emerging markets by reducing financing costs. This has allowed BYD to optimize its investment strategy and market layout, leading to improved performance in these markets. With the ongoing expansion of the global new energy vehicle market and further improvements in the financing environment, BYD is expected to continue maintaining its leading position in the global electric vehicle sector. To capitalize on this opportunity, new energy vehicle companies should strengthen their capital-raising capacity by exploring diversified financing methods, such as issuing green bonds, attracting international direct investment, and cooperating with international financial institutions to secure more favorable terms. Additionally, as demand for new energy vehicles grows rapidly in emerging markets, companies should focus on optimizing their supply chain management by strengthening local production and raw material supply. This can be achieved through partnerships with local governments, building production bases, and fostering long-term relationships with local suppliers to enhance efficiency and reduce costs.

The improved capital liquidity resulting from the Fed’s rate cut also supports increased R&D investment, making it crucial for enterprises to prioritize the development of battery technology, charging infrastructure, and intelligent driving systems to enhance product performance and competitiveness. Companies should also remain flexible in adjusting their marketing strategies according to changes in the Fed's monetary policy and global market trends. In particular, emerging markets with high capital acceptance and strong policy support should be prioritized as key areas for expansion. To manage potential risks associated with increased capital flow volatility, enterprises must establish robust risk assessment and management mechanisms, monitor international capital markets and the macroeconomic environment, and adjust investment strategies in response to uncertainties. Finally, companies should take a long-term approach to building a competitive advantage by optimizing supply chain networks, improving production efficiency, and expanding market share, thereby laying the foundation for sustainable long-term supply chain investments.

4. Conclusion

This study finds that the Fed's interest rate cuts do have a significant impact on the NEV industry's long-term supply chain investment decisions in emerging markets. By reducing the cost of financing, companies can be more flexible in making long-term investments and expanding their supply chain footprint in emerging markets. BYD serves as an example of how it has accelerated its expansion and investment in the context of interest rate cuts.

Future research can further explore the investment behavior of other international new energy vehicle companies, such as Tesla, in emerging markets, to verify the supply chain investment strategies of different companies in the face of the Fed's interest rate cuts. In addition, other factors, such as the policy environment in emerging markets and changes in consumer demand, can be combined to more comprehensively assess the diversified influencing factors of long-term investment decisions.

Only one month, September 19, 2024, saw the Federal Reserve cut interest rates, limiting the data source. However, this paper is limited in its consideration of factors such as geopolitics and trade restrictions. Future research can also investigate the role of regional trade agreements and geopolitical stability in shaping supply chain investment decisions in emerging markets. Additionally, examining the long-term impact of interest rate changes over multiple cycles can provide a more comprehensive understanding of investment trends in the NEV industry.

References

[1]. Zhang Lijuan. What is the impact of the Fed's interest rate cut? [J]. ‘China Report’, 2024, (10):70-71.

[2]. Zhao Tianshu. The wave of interest rate cuts triggers changes in global assets [J]. ‘Journal of International Finance’, 2024, 34(2): 45-60.

[3]. Hou Xintong. The return of foreign capital under the expectation of interest rate cuts by the Federal Reserve pushes emerging markets up [J]. ‘Emerging Markets Review’, 2024, 19(3): 42-58. DOI:10.28207/n.cnki.ndycj.2024.003642.

[4]. Wang Peng. The Federal Reserve restarts the easing cycle, global assets or a big reshuffle [J]. ‘Journal of Financial Markets’, 2024, 25(1): 1-15. DOI:10.28719/n.cnki.nshzj.2024.004454.

[5]. Han Yu. The Fed's interest rate cut brings a triple impact [J]. ‘Journal of Economic Dynamics’, 2024, 21(3): 50-65. DOI:10.28096/n.cnki.ncjrb.2024.005053.

[6]. Zhang Guangting. Asymmetric changes in U.S. monetary policy and the pro-cyclicality of cross-border capital flows in emerging markets: theoretical logic and policy response [J]. ‘Journal of World Economy’, 2024, (08): 90-105+137. DOI:10.13516/j.cnki.wes.2024.08.001.

[7]. Jian Yannan. Policy-driven opportunities in China’s new energy vehicle infrastructure market [J]. ‘China Energy Economics’, 2023, 21(11): A12.

[8]. Jiang Qichen. The role of government subsidy policies in promoting new energy vehicle industry investment [J]. ‘Industry Research Journal’, 2023, 18(5): 45-52.

[9]. Sheng Xiaofeng, Lv Jinxiao. Financing models of new energy vehicle enterprises under the context of subsidy decline [J]. ‘Energy Economics Review’, 2024, 27(7): 56-67.

[10]. Wang Qing. The global layout of China’s new energy vehicles should grasp the rhythm [M]. In: ‘Energy and Environmental Policy: Global Perspectives’. Beijing: China Energy Press, 2024: 112-125.

[11]. Obstfeld, M., & Rogoff, K. (1995). The intertemporal approach to the current account. Handbook of International Economics, 3, 1731-1799.

[12]. Wang Qing. The global layout of China’s new energy vehicles should grasp the rhythm [M]. In: ‘Global Market Trends for Electric Vehicles’. Xueqiu, 2024-09-18 [2024-09-24]. Available at: https://xueqiu.com/7237935921/262009142.

[13]. Sheng Xiaofeng, Lv Jinxiao. How can China’s new energy vehicle companies face financing constraints? [C]. In: ‘Proceedings of the 2024 International Conference on Automotive Economics’. PCauto, 2024-09-20. Available at: https://www.pcauto.com.cn/ask/206359.html.

Cite this article

Zheng,M. (2025). The Impact of Fed Rate Cuts on Long-term Investment in Emerging Market Electric Vehicles: A Case Study of BYD. Advances in Economics, Management and Political Sciences,165,1-6.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang Lijuan. What is the impact of the Fed's interest rate cut? [J]. ‘China Report’, 2024, (10):70-71.

[2]. Zhao Tianshu. The wave of interest rate cuts triggers changes in global assets [J]. ‘Journal of International Finance’, 2024, 34(2): 45-60.

[3]. Hou Xintong. The return of foreign capital under the expectation of interest rate cuts by the Federal Reserve pushes emerging markets up [J]. ‘Emerging Markets Review’, 2024, 19(3): 42-58. DOI:10.28207/n.cnki.ndycj.2024.003642.

[4]. Wang Peng. The Federal Reserve restarts the easing cycle, global assets or a big reshuffle [J]. ‘Journal of Financial Markets’, 2024, 25(1): 1-15. DOI:10.28719/n.cnki.nshzj.2024.004454.

[5]. Han Yu. The Fed's interest rate cut brings a triple impact [J]. ‘Journal of Economic Dynamics’, 2024, 21(3): 50-65. DOI:10.28096/n.cnki.ncjrb.2024.005053.

[6]. Zhang Guangting. Asymmetric changes in U.S. monetary policy and the pro-cyclicality of cross-border capital flows in emerging markets: theoretical logic and policy response [J]. ‘Journal of World Economy’, 2024, (08): 90-105+137. DOI:10.13516/j.cnki.wes.2024.08.001.

[7]. Jian Yannan. Policy-driven opportunities in China’s new energy vehicle infrastructure market [J]. ‘China Energy Economics’, 2023, 21(11): A12.

[8]. Jiang Qichen. The role of government subsidy policies in promoting new energy vehicle industry investment [J]. ‘Industry Research Journal’, 2023, 18(5): 45-52.

[9]. Sheng Xiaofeng, Lv Jinxiao. Financing models of new energy vehicle enterprises under the context of subsidy decline [J]. ‘Energy Economics Review’, 2024, 27(7): 56-67.

[10]. Wang Qing. The global layout of China’s new energy vehicles should grasp the rhythm [M]. In: ‘Energy and Environmental Policy: Global Perspectives’. Beijing: China Energy Press, 2024: 112-125.

[11]. Obstfeld, M., & Rogoff, K. (1995). The intertemporal approach to the current account. Handbook of International Economics, 3, 1731-1799.

[12]. Wang Qing. The global layout of China’s new energy vehicles should grasp the rhythm [M]. In: ‘Global Market Trends for Electric Vehicles’. Xueqiu, 2024-09-18 [2024-09-24]. Available at: https://xueqiu.com/7237935921/262009142.

[13]. Sheng Xiaofeng, Lv Jinxiao. How can China’s new energy vehicle companies face financing constraints? [C]. In: ‘Proceedings of the 2024 International Conference on Automotive Economics’. PCauto, 2024-09-20. Available at: https://www.pcauto.com.cn/ask/206359.html.