1. Introduction

Coffee is one of the most widely used beverages in the world and its production is of vital economic relevance to many countries, as it encompasses both the exploitation of coffee beans and the reuse of coffee after harvesting [1]. Brazil is a major coffee-producing nation in the world and its coffee economy extends from the domestic to the international market [2]. However, while global demand for coffee has been in a state of increase, Brazil's coffee sector is confronted with the negative impacts of climate change and supply chain disruptions. These impacts ultimately led to a significant increase in the price of Brazilian coffees of the Robusta and Arabica varieties in 2024. In addition, extreme weather disasters pose a real threat to the coffee production supply chain. These impacts have dramatically affected Brazil's economic and trade scenarios, thus this paper analyzes the impacts of climate dislocations and supply chain disruptions on Brazil's coffee production, export performance, and pricing, as well as summarizing and outlining the risks and opportunities that Brazilian coffee growers currently face.

This paper aims to analyze the Brazilian coffee industry to understand the interrelationships between the market flows, environmental factors and the governmental policies that influence the development of the industry.

2. Price trends for coffee

2.1. The Brazilian coffee Price change

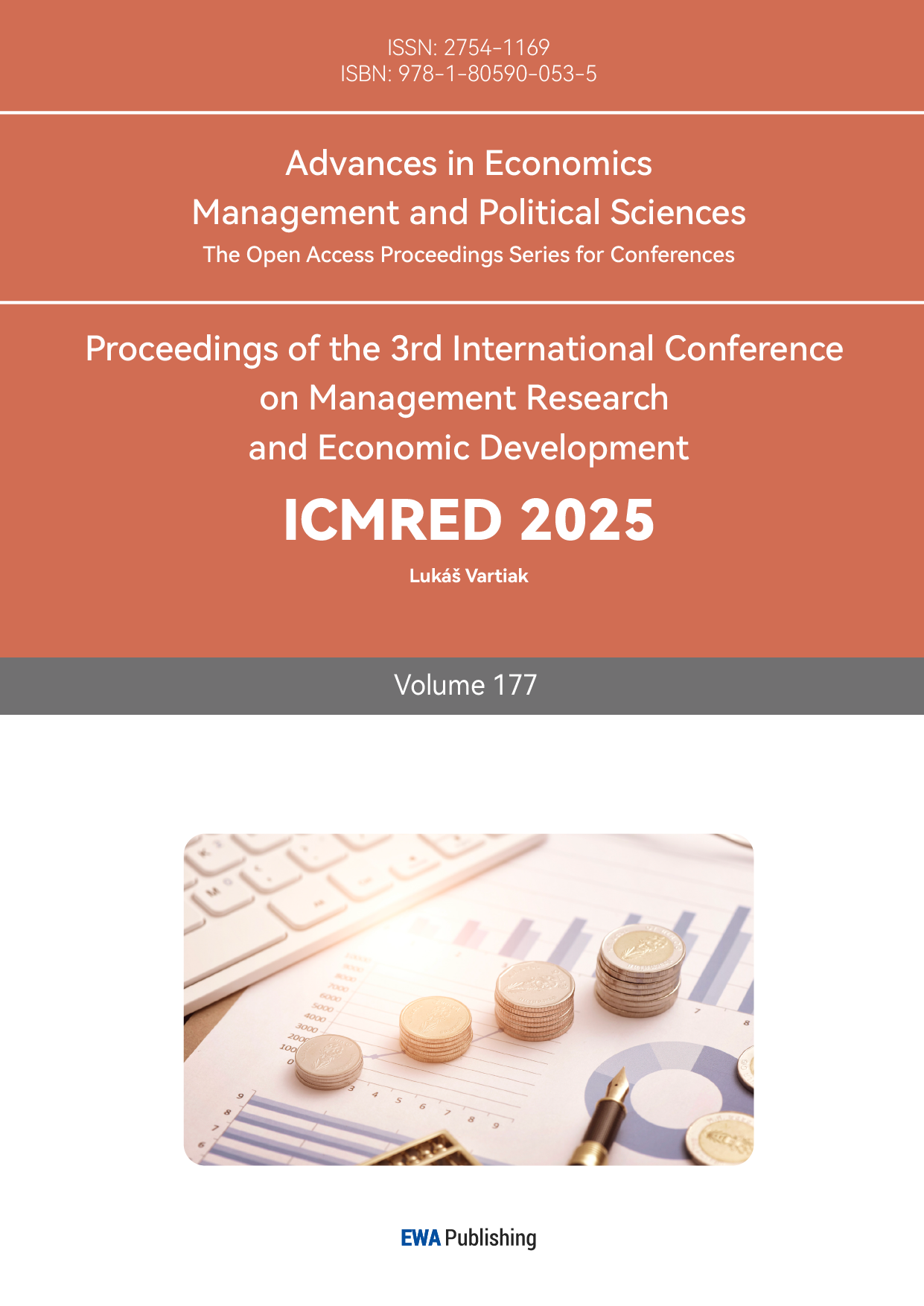

The Brazilian coffee prices rose sharply in 2024, with Robusta coffee in particular reaching record highs on the world market since 2022 [3]. Although Arabica and Robusta coffee prices normally increase from January to October 2024, from January to October 2024 the prices have reached their historic highs. The price of Arabica coffee reached R$1,490.14 reals per bag (approximately $264.88 dollars per bag) in October 2024, an increase of about 80% year-on-year. Robusta coffee prices reached R$1,416.72 reals per bag (approximately $251.88 dollars per bag), with a more significant year-on-year increase of 120% (Figure 1).

Figure 1: Brazilian Arabica and Robusta Prices (Reais) (per 60 kg bag)

2.2. The impact of rising Brazilian coffee prices

The main factors which affect the price of Brazilian coffee are declining supply, growing global demand for coffee, climate change and yield fluctuations, rising production costs, and the global economic situation and exchange rate fluctuations.

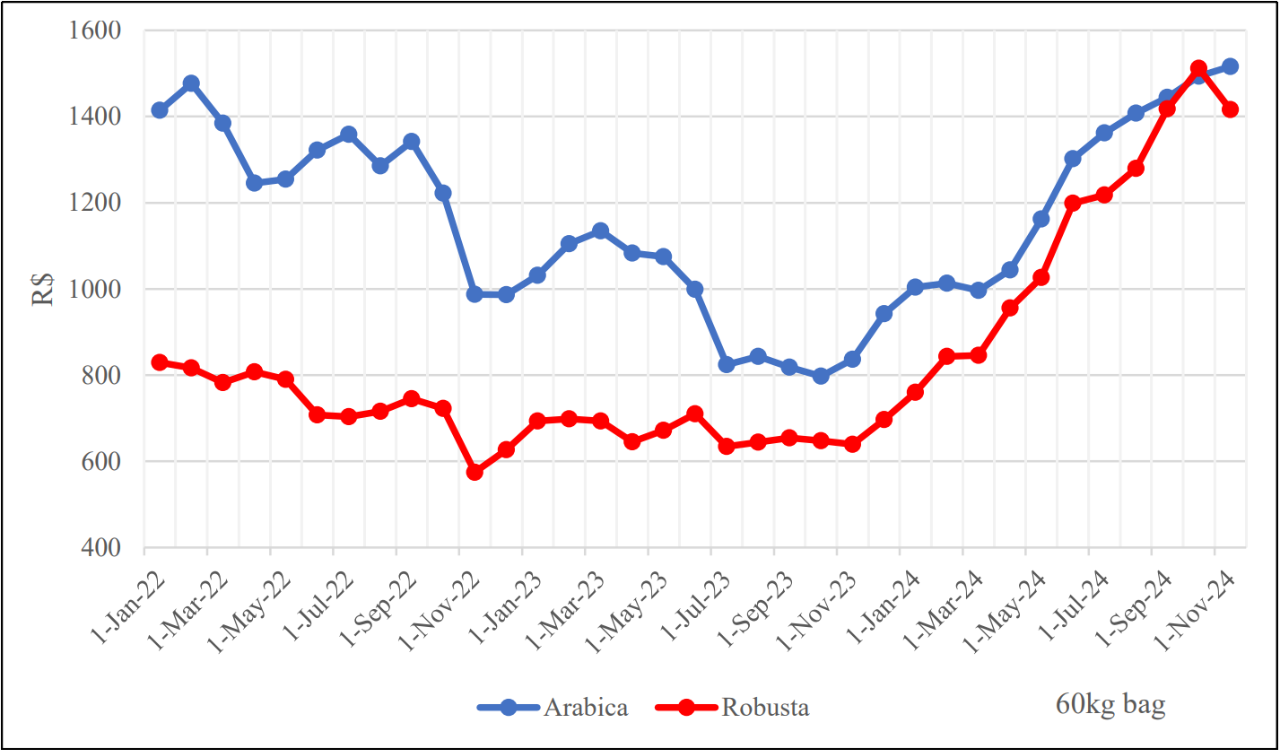

Rising coffee prices in Brazil have had a positive impact on coffee producers, and an exponential increase in retail coffee prices in 21-24 would directly increase the incomes of coffee producers (Figure 2). While higher prices also provide higher incomes for Brazilian coffee growers, which in turn increases capital for production inputs, such as purchasing fertilizers and investing in agricultural technology improvements, which further stabilizes the supply of Brazilian coffee beans and improves the quality of Brazilian coffee beans. Despite fierce competition in the export market, Brazil still holds an important position in the international market with its stable supply and high-quality coffee beans [4].

Figure 2: Average Retail Price of Roasted and Ground Coffee in Brazil (Real/Kilogram)

However, the cost of coffee production has been gradually rising due to the impact of extreme weather events on yield and quality, as well as increasing production uncertainty. And the uncertainty of production affects the changes in coffee price forecasts, thus posing a higher risk to the coffee industry. Increasing coffee prices may prompt some coffee enthusiasts to reduce their daily coffee consumption or to switch to lower-priced alternatives, which could negatively affect sales volumes and revenues of coffee retailers, and thus growers and the international coffee market. International coffee importers would need to face pressure from higher prices, which could affect the stability of the global coffee supply chain.

3. Export

3.1. Basic export conditions

Brazil is one of the largest coffee-producing countries in the world, and its coffee industry not only meets domestic demand but also holds an important position in the global market [3].

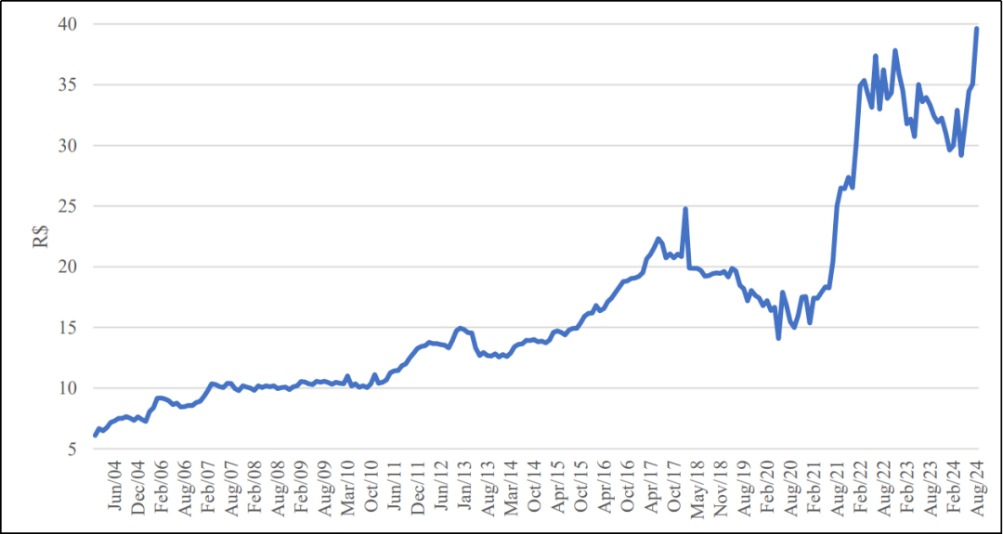

Figure 3: Production of coffee – top 10 countries, ’000 60-kg bags [3]

Against the backdrop of the global coffee demand increasing year by year, Brazil's coffee products not only meet the needs of a large number of consumer markets but also have driven the development of the global coffee industry supply chain. Brazil’s premium coffee products have been gradually favoured in the international market. Because speciality coffee and organic coffee products have come into particular focus for Brazil’s exports.

Global coffee consumption increases to 168.1 million bags in 2024, accounting for about 40% of the global coffee export volume, driven by increased demand for coffee in the EU, US and China in particular. Brazilian coffee exports showed strong growth in 2024, particularly for Robusta. 50.44 million bags of coffee (60 kilograms per bag) were exported from Brazil in 2024, a 28.5 percent increase compared to the 39.247 million bags exported in 2023. Arabica raw beans and Robusta raw beans are the main export types, accounting for 73.2 % and 18.6 % of total exports, respectively. Exports of Arabica Raw Beans amounted to 36,946,011 bags, up 19.8 % year-on-year, while exports of Robusta Raw Beans amounted to 9,355,618 bags, up 97.9 % year-on-year. Brazil remains one of the world's largest coffee exporters in 2024, with major export markets including the United States (7,589,662 bags, up 51.29 percent year-over-year), Germany (4,347,838 bags, up 96.43 percent year-over-year), Italy (3,913,706 bags, up 24.96 percent year-over-year), Japan (2,211,487 bags, down 6.27%) and Spain (1,613,014 bags, up 67.12%). It also exported Robusta coffee to India for the first time, expanding the scope of coffee exports [5].

Global coffee consumption continued to grow, albeit modestly, with increased consumption in emerging markets such as China and India driving demand for coffee in the global market [6]. In addition, demand for coffee in traditional coffee-consuming markets, such as the U.S. and the European Union, remained steady, and demand for high-quality coffee and high-quality roasted beans, including Arabica and Robusta, persisted. Brazilian coffee, with its distinctive flavor and quality, has gained an important position in these markets and is gradually becoming more competitive.

3.2. Main Export Markets

Brazil exported over 30 % of its coffee to the United States, which is its largest export market for coffee. The American market has a great demand for different kinds of coffee, particularly for speciality and high-priced single-origin coffee. The production is on a large scale; many thousand sacks are exported; the quality is high, and prices are low. Hence, it is very popular thus in the U.S. market [7].

Brazilian coffee's second largest export market is Europe, specifically Germany, Italy and France are the main importing countries. Since the Brazilian coffee industry is in line with the trend of speciality and high-end coffees existing in the European market, it has a strong demand for them. Brazilian Arabica coffee with its soft taste and rich aroma is the typical German coffee, mainly imported from Brazil. Also, Italy, one of the birthplaces of coffee culture, demand much of Brazilian Arabica beans. The specialist single-origin coffee or Brazilian high-quality single-origin coffee is known in the French market.

The Asian market is a new growth point for Brazilian coffee exports and coffee consumption is growing rapidly in China, Japan and South Korea. It is worth singling out the Chinese market as it is interesting that the rise of coffee culture and the growth of the middle class have brought Brazilian coffee [8]. Increasing sales of Brazilian coffee have also been due to the development of coffee culture in Japan and South Korea.

Brazil actively expands speciality coffee exports and the demand for speciality coffee continues to grow all around the world. This is due to the growing focus from consumers on sustainability and the environment and the demand for organic, sustainable and fair-trade coffees. Growth of the Asian market of coffee consumption (including China) and Brazilian coffee is advancing large market share capture [9].

4. Weather Changes and Production Challenges

The Brazilian coffee industry faced a series of challenges from weather changes. Extreme weather events became significant factors affecting coffee production [10]. In 2024, rainfall in Brazilian coffee-growing areas was unstable, especially in the main production areas of Arabica coffee, where drought led to delays in the coffee growth cycle and a decline in crop quality [11]. At the same time, 2024 also witnessed crop losses in some parts of Brazil due to extreme weather, particularly in the states of Espírito Santo and Minas Gerais, where coffee crops suffered from significant high temperatures and extreme droughts, resulting in reduced coffee yields in some areas. This not only affected local production capacity but also put some pressure on the supply chain of the entire Brazilian coffee industry. To cope with the challenges of climate change, Brazilian coffee growers adopted various measures, including improving irrigation efficiency and using drought-resistant varieties. At the same time, the continuous progress of Brazilian agricultural technology also alleviated the negative impacts of climate change to some extent.

The production of the Brazilian coffee industry has a direct impact on the stability and price volatility of the global coffee market. Under the influence of a variety of factors, Brazilian coffee production in 2024 was also then subject to a certain degree of uncertainty. Therefore, production forecasts need to take into account factors such as climatic conditions, agricultural technology and market demand. The production forecasts and the international economic environment, policy changes and other conditions affect the price movements in the coffee market.

5. Key Influencing Factors in the Brazilian Coffee Market

However, as agricultural technology advances, so too does Brazil's coffee industry in terms of yield and quality. In recent years, Brazilian growers of coffee have adopted precision irrigation systems, soil improvement technologies and advanced measures of pest and disease control. These technologies have helped farmers increase coffee production and quality in the face of climate change and natural disasters. Especially for Arabica coffee, modern cultivation techniques and varietal improvements have made the growth cycle of coffee trees more stable and increased disease resistance, effectively improving coffee productivity [12]. In addition, Brazil is actively developing organic coffee and sustainable agricultural models, which not only improve coffee quality but also broaden the demand for high-end markets. For Robusta coffee, due to its harsher growing environment, climate conditions and soil quality have a greater impact on its yield, so improving the agricultural technology and production conditions is also a direction that the Brazilian coffee industry needs to focus on in the future.

Changes in labour costs and the availability of labour also affect the production of the Brazilian coffee industry. In recent years, labour costs in Brazil have risen, and farmers in some areas face a shortage of labour [13], especially during the harvest season, where manual picking efficiency decreases, potentially leading to some coffee not being harvested in time, affecting production. At the same time, changes in coffee cultivation in Brazil directly affect the overall changes in production. Because of rising land prices and fluctuations in the profitability of coffee cultivation, some Brazilian coffee growers have gradually reduced their coffee cultivation areas and turned to growing other crops. In addition, the replacement of some ageing coffee trees has also caused short-term fluctuations in production.

The production of Brazilian coffee is closely related to the demand of the international market. Against the backdrop of growing global coffee consumption, the demand for Brazilian coffee exports has increased, providing a guarantee for production. However, changes in coffee prices can induce changes in the production willingness and cultivation area of Brazilian coffee growers as a result of the price being highly volatile. The rise of global coffee prices in 2024 called the buzz of the Brazilian coffee growers, especially in high-quality Arabica coffee cultivation, to which the Brazilian farmers have much production motivation.

Policies of government support for the coffee industry in Brazil have also had some influence on production [14]. In the last decades, the Brazilian government has enacted several policies aimed at supporting agriculture, which include agricultural subsidies, financial loans and technical training. The financial support and technical assurance offered under these policies assist the coffee growers to increase production efficiency and overcome the challenges of climate change. As the Brazilian government also dedicated efforts to promoting and developing policies that are conducive to sustainable agriculture and environmental protection, it has also served as a favourable environment for the long-term development of the coffee industry. These new environmental regulations in addition to the strengthening of certification systems that in turn promote the production of high-quality and organic coffee have cashed in the coffee industry.

6. Conclusion

Overall, Brazil's coffee industry in 2024 faced ups and downs as a result of explosive coffee demand from the globe, supply problems and unusual weather conditions. The increase in the price of both Arabica and Robusta coffees to record highs has positively helped producers on the income side and develop investment capacity. These benefits have been tempered by the rising production costs and the unpredictable climate, which has had an impact on crop yields mainly in the dry and hot areas. These challenges notwithstanding, Brazilian coffee continues to be a powerhouse of the global coffee market, with the exports of its coffee growing, especially of high quality and speciality coffee segments.

Through technological advancements and agricultural techniques, primarily, precision irrigation and drought-resistant variety, the nation has developed ways to compensate for the harm of climate change. On top of that, Brazil is supported by the rise of demand from emerging markets like China and Venezuela as well as the growing consumer demand for sustainable and organic products. However, these remain unsettled by uncertainties in global economic conditions and new costs of labour which will continue to decide between production and export strategies. In the end, the Brazilian coffee industry is not easy, but it has shown it’s not easy to move and it is capable of changing over to the changed environment offering growth in the premium coffee segment.

However, the analysis in this paper is only based on the relevant literature, which suffers from lagging data, a narrow literature and a lack of empirical experiments, which can have an impact on the results. In order to will be based on social research and more information to add to improve the study.

References

[1]. Freitas, V. V., Borges, L. L. R., Vidigal, M. C. T. R., dos Santos, M. H., & Stringheta, P. C. (2024). Coffee: A comprehensive overview of origin, market, and the quality process. Trends in Food Science & Technology, 104411.

[2]. Reichman, D. R. (2018). Big coffee in Brazil: Historical origins and implications for anthropological political economy. The Journal of Latin American and Caribbean Anthropology, 23(2), 241-261.

[3]. International Coffee Organization. (2023). Coffee Development Report 2022-23. http://www.icocoffee.org/documents/cy2024-25/coffee-development-report-2022-23.pdf

[4]. Santos, V. P., Ribeiro, P. C. C., & Rodrigues, L. B. (2023). Sustainability assessment of coffee production in Brazil. Environmental Science and Pollution Research, 29(24), 30(4), 11099-11118.

[5]. United States Department of Agriculture Foreign Agricultural Service. (2024). Coffee: World Markets and Trade. https://apps.fas.usda.gov/psdonline/circulars/coffee.pdf

[6]. Torga, G. N., & Spers, E. E. (2020). Perspectives of global coffee demand. In Coffee consumption and industry strategies in Brazil (pp. 21-49). Woodhead Publishing.

[7]. Pancsira, J. (2022). International Coffee Trade: a literature review. Journal of Agricultural informatics, 13(1).

[8]. Ferreira, J., & Ferreira, C. (2018). Challenges and opportunities of new retail horizons in emerging markets: The case of a rising coffee culture in China. Business Horizons, 61(5), 783-796.

[9]. Franco de Alcântara, P. A., & Perrut, I. M. (2024). Brazil's multiple coffee markets: An ethnographic study of coffee production from family growers to coffee gourmets. Consumption Markets & Culture, 1-13.

[10]. Koh, I., Garrett, R., Janetos, A., & Mueller, N. D. (2020). Climate risks to Brazilian coffee production. Environmental Research Letters, 15(10), 104015.

[11]. Nóia-Júnior, R. D. S., Christo, B. F., & Pezzopane, J. E. M. (2025). Extreme weather events in southern Brazil warn of agricultural collapse. Next Research, 100217.

[12]. Dos Santos, F. K. F., Barcellos-Silva, I. G. C., Leite-Barbosa, O., Ribeiro, R., Cunha-Silva, Y., & Veiga-Junior, V. F. (2024). High Added-Value by-Products from Biomass: A Case Study Unveiling Opportunities for Strengthening the Agroindustry Value Chain. Biomass, 4(2), 217-242.

[13]. Dias, J. (2015). Human capital demand in Brazil: The effects of adjustment cost, economic growth, exports and imports. EconomiA, 16(1), 76-92.

[14]. Caldarelli, C. E., Gilio, L., & Zilberman, D. (2019). The Coffee Market in Brazil: challenges and policy guidelines. Revista de Economia, 39(69), 1-21.

Cite this article

Wang,H. (2025). Analysis of Brazilian Coffee Trade: Production, Prices, and Export Trends. Advances in Economics, Management and Political Sciences,177,50-56.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Freitas, V. V., Borges, L. L. R., Vidigal, M. C. T. R., dos Santos, M. H., & Stringheta, P. C. (2024). Coffee: A comprehensive overview of origin, market, and the quality process. Trends in Food Science & Technology, 104411.

[2]. Reichman, D. R. (2018). Big coffee in Brazil: Historical origins and implications for anthropological political economy. The Journal of Latin American and Caribbean Anthropology, 23(2), 241-261.

[3]. International Coffee Organization. (2023). Coffee Development Report 2022-23. http://www.icocoffee.org/documents/cy2024-25/coffee-development-report-2022-23.pdf

[4]. Santos, V. P., Ribeiro, P. C. C., & Rodrigues, L. B. (2023). Sustainability assessment of coffee production in Brazil. Environmental Science and Pollution Research, 29(24), 30(4), 11099-11118.

[5]. United States Department of Agriculture Foreign Agricultural Service. (2024). Coffee: World Markets and Trade. https://apps.fas.usda.gov/psdonline/circulars/coffee.pdf

[6]. Torga, G. N., & Spers, E. E. (2020). Perspectives of global coffee demand. In Coffee consumption and industry strategies in Brazil (pp. 21-49). Woodhead Publishing.

[7]. Pancsira, J. (2022). International Coffee Trade: a literature review. Journal of Agricultural informatics, 13(1).

[8]. Ferreira, J., & Ferreira, C. (2018). Challenges and opportunities of new retail horizons in emerging markets: The case of a rising coffee culture in China. Business Horizons, 61(5), 783-796.

[9]. Franco de Alcântara, P. A., & Perrut, I. M. (2024). Brazil's multiple coffee markets: An ethnographic study of coffee production from family growers to coffee gourmets. Consumption Markets & Culture, 1-13.

[10]. Koh, I., Garrett, R., Janetos, A., & Mueller, N. D. (2020). Climate risks to Brazilian coffee production. Environmental Research Letters, 15(10), 104015.

[11]. Nóia-Júnior, R. D. S., Christo, B. F., & Pezzopane, J. E. M. (2025). Extreme weather events in southern Brazil warn of agricultural collapse. Next Research, 100217.

[12]. Dos Santos, F. K. F., Barcellos-Silva, I. G. C., Leite-Barbosa, O., Ribeiro, R., Cunha-Silva, Y., & Veiga-Junior, V. F. (2024). High Added-Value by-Products from Biomass: A Case Study Unveiling Opportunities for Strengthening the Agroindustry Value Chain. Biomass, 4(2), 217-242.

[13]. Dias, J. (2015). Human capital demand in Brazil: The effects of adjustment cost, economic growth, exports and imports. EconomiA, 16(1), 76-92.

[14]. Caldarelli, C. E., Gilio, L., & Zilberman, D. (2019). The Coffee Market in Brazil: challenges and policy guidelines. Revista de Economia, 39(69), 1-21.