1. Introduction

In the twenty-first century, more and more developed countries, as well as developing countries, have entered the era of population ageing. China, though, with its large young working population, has enjoyed the boosting effect of the demographic dividend on economic development since the reform and opening up. However, as the fertility rate declines and life expectancy increases, China's aging population is gradually increasing, and the demographic dividend has gradually faded. According to China's population census bulletin, China's elderly population aged 65 and over continues to rise, and has significantly exceeded the United Nations-defined standard for population aging. China's aging population is a growing problem. At the same time, innovative development is gradually gaining attention as a focal point of today's society and a major aspect of competition among countries. However, will the increase in the ageing population lead to more financial resources being invested in social security and, to a certain extent, have an impact on innovative financial expenditures? Therefore, it is important to conduct an in-depth study on the implications of population aging on innovative national financial expenditures.

In summary, this paper will utilize China's inter-provincial panel data from 2007-2023 to conduct an empirical analysis of the relationship between population aging and innovative fiscal expenditures using one-way linear regression and heterogeneity analysis, providing a Chinese case study and a Chinese strategy for the research related to population aging and innovative fiscal expenditures.

2. Literature Review

The first branch of literature in inconnection with these papers pays attention to research on the relationship between population aging and innovation in various fields. Jen Nelles et al. [1] argue that the new generation of innovation policies related to healthy aging should try to support innovations that help facilitate the elderly by connecting different actors. Weijian Qiu et al. [2] found that population aging has a positive contribution to corporate green innovation. In addition, population aging has a catalytic effect on the regional level of innovation [3]. In terms of geriatric education, Han Zheng [4] believes that a positive view of aging should be used as a guide to form an innovative educational model for geriatric education, so as to help older people continue to participate in the construction of society and reflect their self-worth. In the context of innovation in business and industry, Hafiz Mudassir Rehman et al. [5] argued that in the context of an aging workforce, the development of tailored workforce policies to support an effective Industry 4.0 is necessary. Jingying Huang et al [6] argued that the innovation of business model more effectively meets the health and life needs of the elderly population, and has become a key means to promote the sustainable development of the elderly care industry.

The second category of literature relevant to these papers explores the relationship between population aging and finance. He Li [7] pointed out that the current aging situation in China will lead to a decrease in the growth rate of fiscal revenue and an increase in the growth rate of fiscal expenditure. However, Weiguo Wang et al. [8] found that population aging improved the efficiency of fiscal expenditure and weakened the negative impact of population aging on industrial structure upgrading. In addition, Zhuoyue Wang & Xiaohui Wu [9] argued that excessive population aging will increase the burden on the government, affect the structure of fiscal expenditure, thus putting the government's fiscal policy to the test. Xia Liu [10] also pointed out that as the process of population aging advances, the effect of fiscal expenditure policy is suppressed, which further undermines the flexibility and maneuverability space of fiscal policy. For fiscal expenditures, Shengxin Yan [11] found that the proportion of welfare benefits for the elderly will have an affect on the per capita welfare expenditures and the proportion of consumption-based expenditures of local governments, posing a challenge to fiscal sustainability.

Based on the above literature, there are four possible contributions to this paper. First of all, in terms of survey data, this study adopts the data from the National Bureau of Statistics of China (NBS) for the years 2007-2023, which is comprehensive, relatively new and close to reality, which is conducive to reflecting China's overall problems since the twenty-first century, and helps to draw more precise and more current economic conclusions. Second, in terms of research methodology, this paper conducts a temporal heterogeneity analysis based on the unique characteristics of China's innovative financial expenditures, and also carries out a regional heterogeneity analysis in conjunction with China's geographic characteristics. Third, in terms of subject, few articles concentrates on the impact of China's population aging on innovative fiscal expenditures; this paper takes the old-age dependency ratio as a proxy for population aging, to explore its influence and countermeasures on the proportion of local fiscal expenditure to total expenditure in China, that is, the situation of innovative fiscal expenditure in China. Fourth, in contemporary society, population aging and innovative development have become hot topics, so the conclusions and policy proposals of this paper are of great theoretical significance and practical value, and can provide valuable Chinese cases, Chinese experiences and Chinese solutions for other developing countries in the world.

3. Characterizing Facts on Population Aging and Innovative Fiscal Expenditures in China

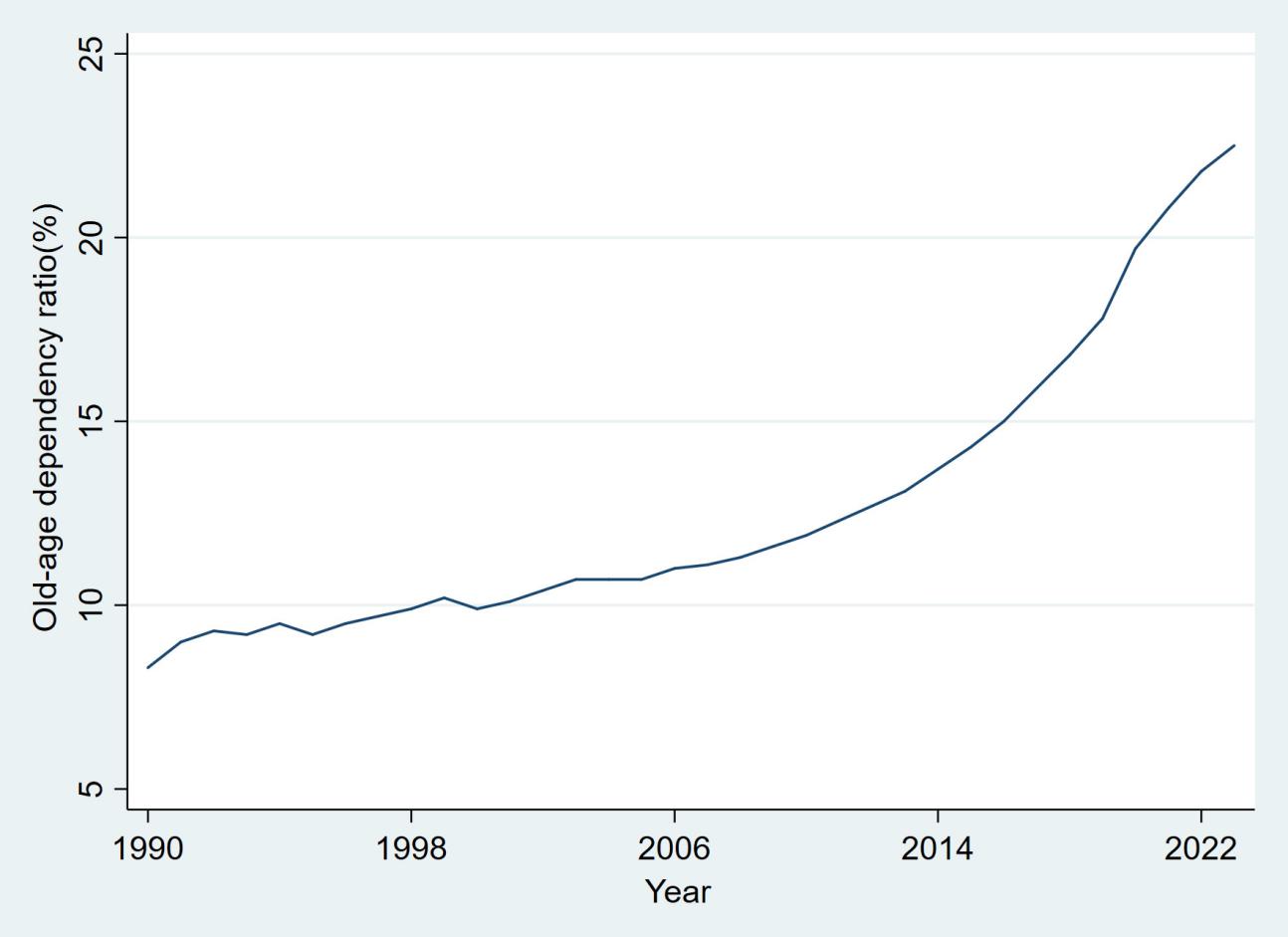

Figure 1 presents the development trend of China's old-age dependency ratio from 1990 to 2023. As can be seen through Figure 1, based on the perspective of development tendency, China's old-age dependency ratio has shown a rising trend year by year, which indicates that the degree of aging in China is worsening. Based on the aspect of development speed, the development of China's old-age dependency ratio before 2000 was relatively flat, with a growth rate of almost zero. Yet after 2000, and especially after 2006, the growth rate of China's old-age dependency ratio accelerated, and has been increasing year by year. It can be seen that the problem of ageing in China has intensified since 2000 and has gradually become a focus of social concern. Furthermore, the growth rate of China's old-age dependency ratio shows a downward trend after 2020, which may be related to the outbreak of the New Crown epidemic at the end of 2019, which negatively affects the phenomenon of aging in China.

Figure 1: Trends in China's old-age dependency ratio

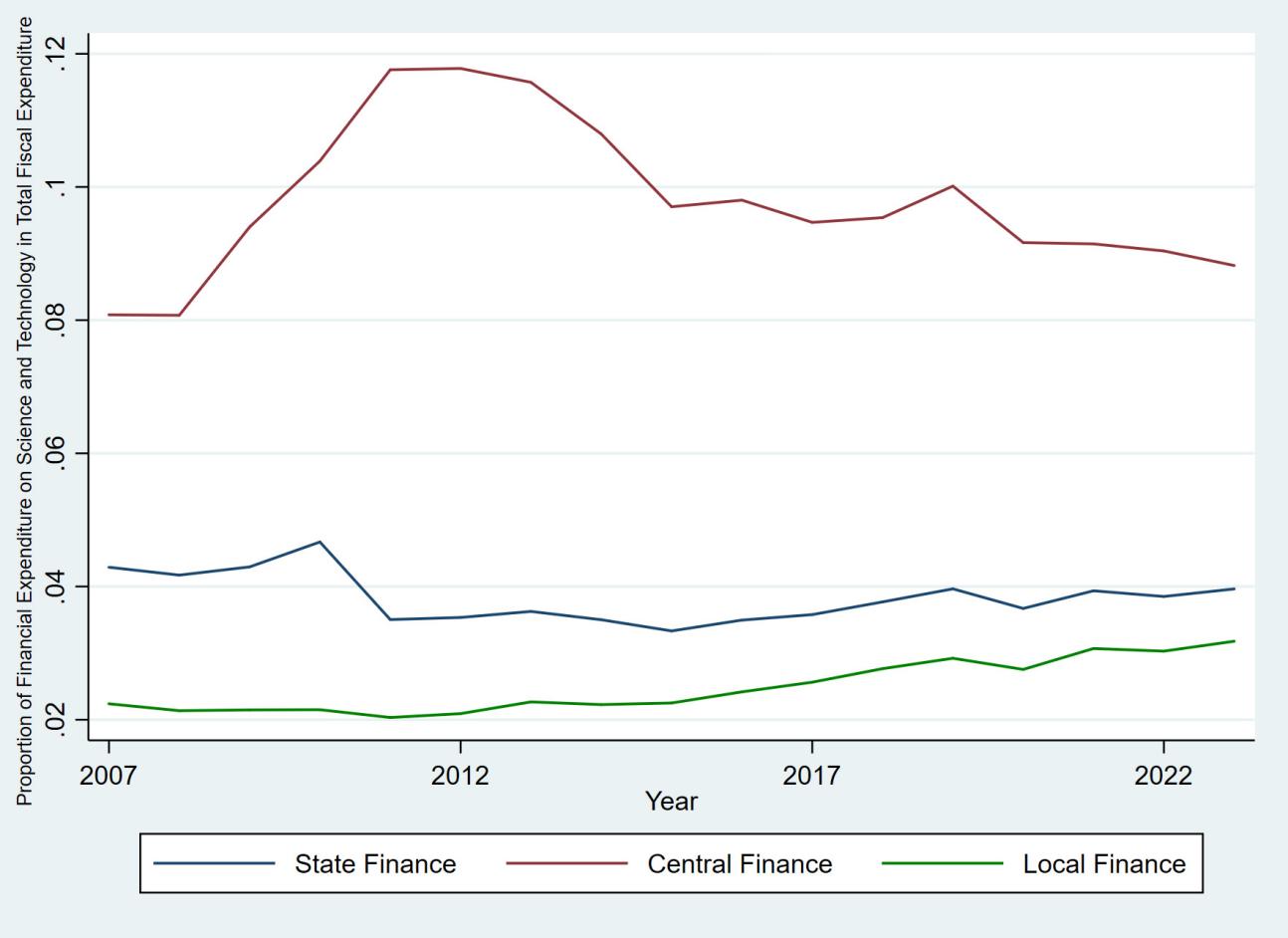

Figure 2 illustrates the proportion of China's national, central and local finances spent on science and technology from 2007 to 2023. Observing the proportion of science and technology expenditures in China's national treasury, it can be found that in terms of development trends, its overall development trend has been flat, and the proportion of expenditures has remained almost unchanged. Moreover, while there was a small increase in the share after 2009, it fell back a year later. As for the proportion of science and technology expenditures in China's local finances, in terms of development trend, there has been a slight upward curve since 2012, however, in terms of development speed, the growth rate has been decreasing year by year. The share of both national and local fiscal spending on science and technology in China suggests that China has not made innovative spending a key area of fiscal expenditure in recent years. For China's central financial science and technology expenditure share, based on the development trend perspective, the share of science and technology expenditure is unstable and fluctuates more compared to the national and local shares. Since 2008, there has been an upward trend, but after 2011, it fluctuates and decreases year by year, and only after 2020 does the proportion stabilize but the overall trend shows a downward trend. Besides, the proportion of science and technology expenditures of China's central government is significantly higher than the proportion of national and local science and technology expenditures. This suggests that China's central government spends more on innovative programs and values them more highly than local governments.

Figure 2: Percentage of China's national, central and local financial expenditures on science and technology

4. Research Design

4.1. Variable Options

The explained variate of this article is innovative fiscal expenditure, and the ratio of local fiscal science and technology expenditure to total fiscal expenditure in China is used as a proxy variable. This paper uses China's old-age dependency ratio as the core explanatory variable to measure population aging in China. This paper will also use the ratio of the number of people aged 65 and above to the total population in China, as well as local financial expenditures on science and technology to conduct robustness tests.

4.2. Data Sources

The empirical part of this paper selects 31 provinces, municipalities or autonomous regions in China as the empirical analysis object, and the observation period is from 2007-2023, and the sample data used are from the National Bureau of Statistics of China. The depictive statistics of this paper are shown in Table 1.

Table 1: Descriptive statistical analysis.

Variable | Obs | Mean | Std.Dev. | Min | Max |

Elderly dependency ratio(%) | 465 | 15.02 | 4.645 | 6.700 | 30.60 |

Local financial expenditure on science and technology (billions of yuan) | 527 | 121.4 | 170.1 | 1.930 | 1169 |

General budget expenditures of local finances (billions of yuan) | 527 | 4611 | 3269 | 241.8 | 18533 |

Elderly population (persons) | 465 | 8999 | 21124 | 125 | 178471 |

Total population (persons) | 465 | 82584 | 199077 | 2556 | 1.700e+06 |

4.3. Model Design.

The research model in this paper is a one-way linear regression as follows:

\( Y=αX+β+ε \) (1)

In this, Y is the explained variable Innovative Fiscal Expenditure, X is the core explanatory variable Population Aging, and \( ε \) is the random error term.

5. Empirical Investigation

5.1. Relevance Analysis

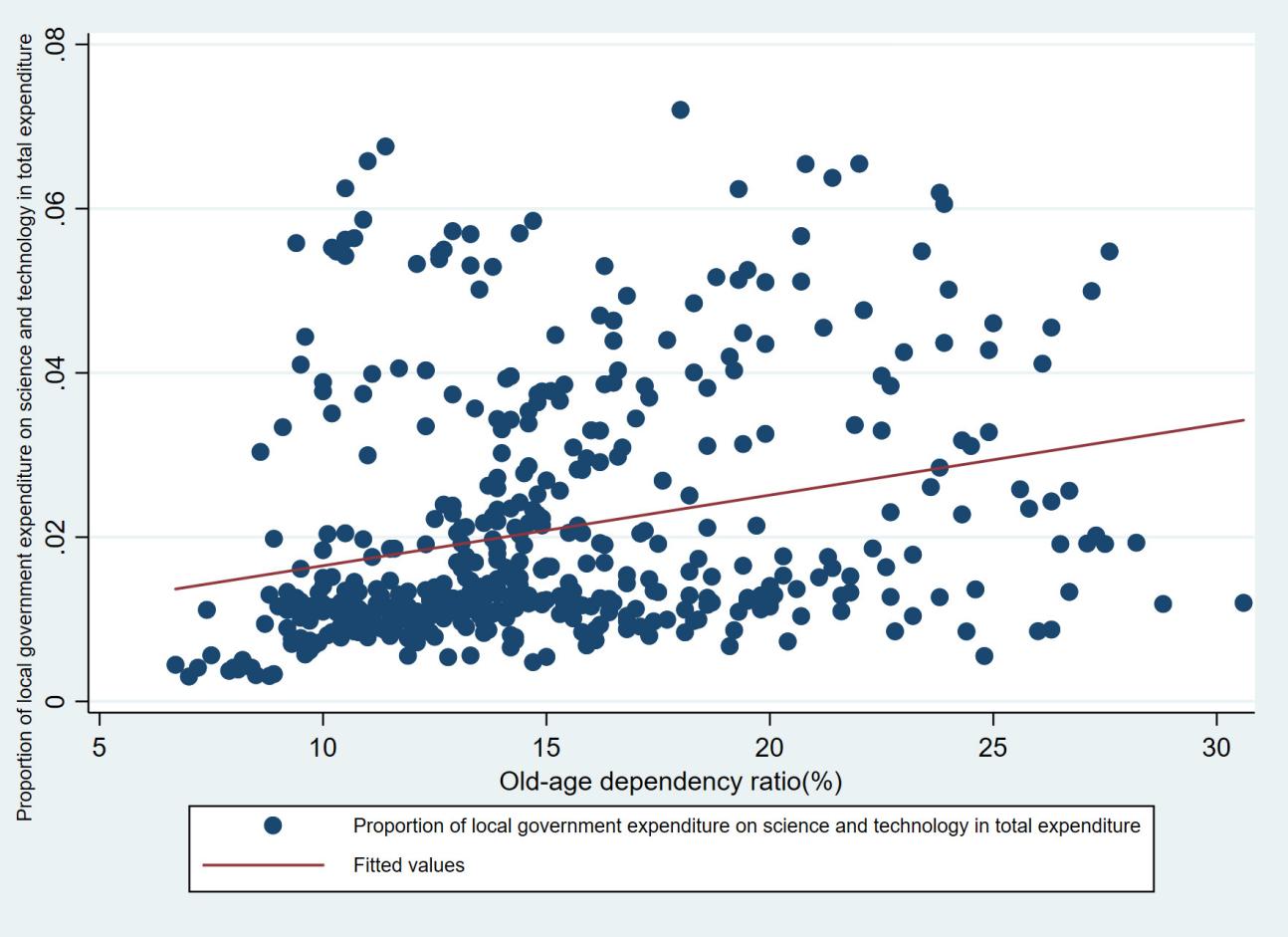

Figure 3 depicts the association between population aging and innovative fiscal expenditures in China. As can be seen from Figure 3, the percentage of science and technology expenditures in total expenditures of local finances increases with the growth of the dependency ratio of the elderly population, indicating a positive correlation between the two. In addition, the distribution of the data is relatively clustered in the sections with low elderly population dependency ratios and low shares of local fiscal expenditures on science and technology, while in the rest of the sections, the distribution of the data is relatively dispersed. That is, most of China is in the state of low aging and low innovative fiscal expenditure in most of the time. Of course, the relationship between population aging and innovative financial expenditures in China needs to be determined by regression analysis in this paper.

Figure 3: Correlation between population aging and innovative fiscal spending in China.

5.2. Benchmark Regression

Table 2 Model (1) reports the major regression consequences of the old-age dependency ratio affecting the share of science and technology expenditures in total expenditures in local finances. In particular, the estimated coefficient on the core explanatory variable of the model is 0.0648, which is significantly positive at the 1% significance level. The regression results preliminarily illustrate that for innovative financial expenditures, the current aging of China's population has a favorable impact on them in general.

Table 2: Benchmark regression and robustness tests.

(1) | (2) | (3) | (4) | |

Y | Y | Y | Y | |

X | 0.0648*** | 0.1017*** | 12.0536*** | 0.0644*** |

(8.5106) | (8.2053) | (16.8911) | (9.1089) | |

_cons | 0.0111*** | 0.0099*** | 4.5602*** | 0.0111*** |

(4.0887) | (3.5937) | (23.2847) | (4.1089) | |

N | 465 | 465 | 465 | 527 |

R2 | 0.1405 | 0.1299 | 0.3890 | 0.1411 |

z statistics in parentheses* p < 0.1, ** p < 0.05, *** p < 0.01

5.3. Robustness Tests

In order to examine the stability and reliability of the baseline regression estimates, this document replaces the measures of population aging and innovative fiscal expenditures. This article uses the number of people aged 65 and over in China as a proportion of the total population as a proxy for the core explanatory variable, old-age dependency ratio, and the results are shown in model (2) of Table 2; and the local financial expenditure on science and technology is used as a substitute for the explanatory variable of the ratio of local financial expenditure on science and technology to the total expenditure, and the results are shown in model (3) of Table 2. Moreover, because China's old-age dependency ratio has missing data in 2010 and 2020, this paper will also use linear interpolation to supplement the missing data and further carry out regression analysis, and the results are shown in Table 2 model (4). The above empirical results show that the impact of population aging on innovative fiscal expenditures in China at the present time is still significantly positive, and the conclusions of the benchmark model are robust.

5.4. Heterogeneity Analysis

5.4.1. Regional Heterogeneity Analysis

In this paper, all provinces in China are divided into four major regions, namely Eastern, Central, Western, and Northeastern China, according to the methodology used by the National Bureau of Statistics of China (NBSC) in 2011 to unveil the regional characteristics of population aging affecting innovative fiscal expenditures. Models (1), (2), (3), and (4) of Table 3 report the regression results of China's old-age dependency ratio affecting the ratio of local fiscal expenditures on science and technology to total expenditures in eastern, central, western, and northeastern China, respectively. The estimated coefficients of the explanatory variables are 0.0519, 0.2186, 0.0473, and -0.0235, respectively. The regression results on the Eastern, Central, and Western regions are significantly positive at the 1% level of significance, but the regression results on the Northeastern region are significantly negative at the 1% level of significance. These suggest that for China, population aging has the greatest impact on the enhancement of innovative financial expenditures in the central region, followed by the eastern region, with a smaller impact on the western region, while showing a negative impact on the northeastern region.

Table 3: Analysis of regional and temporal heterogeneity.

(1) | (2) | (3) | (4) | (5) | (6) | |

Eastern part | Central part | Western part | Northeastern | 2007-2012 | 2013-2023 | |

X | 0.0519*** | 0.2186*** | 0.0473*** | -0.0235** | 0.0123 | 0.0604*** |

(3.7327) | (11.2819) | (7.4656) | (-2.0304) | (0.6017) | (6.9001) | |

_cons | 0.0262*** | -0.0127*** | 0.0046*** | 0.0168*** | 0.0167*** | 0.0123*** |

(4.5860) | (-3.0555) | (3.7883) | (8.3667) | (4.8919) | (4.0492) | |

N | 150 | 90 | 180 | 45 | 155 | 310 |

R2 | 0.0905 | 0.5977 | 0.2293 | 0.5100 | 0.0010 | 0.1422 |

z statistics in parentheses * p < 0.1, ** p < 0.05, *** p < 0.01

5.4.2. Temporal Heterogeneity Analysis

Based on the conclusions of the characteristic facts, this paper finds that the proportion of local financial science and technology expenditures in China's total expenditures was relatively stable before 2012, while the proportion began to increase yearly since 2012. Therefore, this paper will take 2012 as the time point and divide the sample period into two time periods to start the temporal heterogeneity analysis. Models (5), (6) from Table 3 reveal the regression outcomes of the impact of population aging on innovative fiscal expenditures for 2007-2012 and 2013-2023, respectively, with estimated coefficients on the explanatory variables of 0.0123 and 0.0604, in turn. In this case, the regression results for the period 2013-2023 are distinctly positive at the 1% significance level, while the regression results for the period 2007-2012 are not significant. These indicate that population aging contributes positively to innovative fiscal expenditures during the period 2013-2023, while the impact is insignificant during the period 2007-2012.

6. Summary

6.1. Main Conclusions

According to the above empirical results, this study concludes that population aging has a positive relationship with innovative fiscal expenditures; Based on China's four major regional divisions, population aging in China has a positive impact on the eastern, central and western regions, with the greatest impact on the central region, a relatively small impact on the eastern and western regions, and a negative impact on the northeastern region; Based on the angles of different time intervals, China's population aging has a boosting effect on innovative fiscal expenditures in the period of 2013-2023, while the effect is not significant in the period of 2007-2012.

6.2. Policy Recommendations

The policy recommendations of the above conclusions lie in the following three points. First, the government should increase innovative financial expenditures for the senior care industry, promote the development of intelligent senior care services, and foster progress in R&D and application in the elderly care industry, thereby improving the quality of elderly care services. Secondly, the government should promote the optimization and upgrading of industries, encourage the development of various industries in the direction of ageing-friendliness, and cultivate new points of economic growth, hence contributing to the growth of innovative expenditures. Thirdly, a comprehensive old-age security system should be constructed in order to alleviate the burden of old age on families, release more age-appropriate labor to inject new vitality into the innovation of science and technology.

References

[1]. Jen Nelles, Lauren Tuckerman, Nadeen Purna, Judith Phillips & Tim Vorley. (2024). Policy Responses to the Healthy Aging Challenge: Confronting Hybridity with Social Innovation. Journal of aging & social policy11-16.

[2]. Weijian Qiu, Wenxuan Yang & Le Qiu. (2025). Population aging, market competition and enterprise green innovation. Finance Research Letters 106596-106596.

[3]. Wanran Guo & Daojun Zhong. (2025). Population aging and regional innovation levels: Based on the mediating effect of research and development inputs. International Review of Financial Analysis 103799-103799.

[4]. Han Zheng. (2025). Research on the current situation and innovation of geriatric education under the perspective of active aging. PR World (02), 196-198.

[5]. Hafiz Mudassir Rehman, Nadia Adnan & Sandra Moffett. (2024). Innovation bloom: nurturing sustainability in urban manufacturing transformation amidst Industry 4.0 and aging workforce dynamics. Annals of Operations Research (prepublish), 1-39.

[6]. Jingying Huang, Shujia Cheng, Luhong Zhang & Guorong Zhang. (2024). Business Model Innovation in the Healthy Aging Industry. Economic Society and Humanities(7).

[7]. He Li. (2023). Impact of mitigating population aging on China's fiscal sustainability. Macroeconomic Management (08), 85-92. doi:10.19709/j.cnki.11-3199/f.2023.08.010.

[8]. Weiguo Wang, Yijun Zhang. & Dexin Qiu. (2024). (2024). Population Aging, Fiscal Expenditure Efficiency and Industrial Structure Upgrading-Theoretical Mechanisms and Empirical Evidence. Statistical Research (07), 134-147. doi:10.19343/j.cnki.11-1302/c.2024.07.009.

[9]. Zhuoyue Wang & Xiaomei Wu. (2022). Study on the relationship between population aging and fiscal expenditure structure. Bohai Economic Outlook (08), 18-20. doi:10.16457/j.cnki.hbhjjlw.2022.08.008.

[10]. Xia Liu. (2023). A study on the impact of population aging on the economic effects of fiscal expenditure policies. Science and Technology Economic Market (07), 31-34.

[11]. Shengxin Yan. (2024). Population aging and fiscal expenditure analysis. Market Outlook (22), 4-6.

Cite this article

Wei,L. (2025). A Study of the Impact of Population Ageing on Innovative Fiscal Expenditures. Advances in Economics, Management and Political Sciences,170,161-168.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 9th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jen Nelles, Lauren Tuckerman, Nadeen Purna, Judith Phillips & Tim Vorley. (2024). Policy Responses to the Healthy Aging Challenge: Confronting Hybridity with Social Innovation. Journal of aging & social policy11-16.

[2]. Weijian Qiu, Wenxuan Yang & Le Qiu. (2025). Population aging, market competition and enterprise green innovation. Finance Research Letters 106596-106596.

[3]. Wanran Guo & Daojun Zhong. (2025). Population aging and regional innovation levels: Based on the mediating effect of research and development inputs. International Review of Financial Analysis 103799-103799.

[4]. Han Zheng. (2025). Research on the current situation and innovation of geriatric education under the perspective of active aging. PR World (02), 196-198.

[5]. Hafiz Mudassir Rehman, Nadia Adnan & Sandra Moffett. (2024). Innovation bloom: nurturing sustainability in urban manufacturing transformation amidst Industry 4.0 and aging workforce dynamics. Annals of Operations Research (prepublish), 1-39.

[6]. Jingying Huang, Shujia Cheng, Luhong Zhang & Guorong Zhang. (2024). Business Model Innovation in the Healthy Aging Industry. Economic Society and Humanities(7).

[7]. He Li. (2023). Impact of mitigating population aging on China's fiscal sustainability. Macroeconomic Management (08), 85-92. doi:10.19709/j.cnki.11-3199/f.2023.08.010.

[8]. Weiguo Wang, Yijun Zhang. & Dexin Qiu. (2024). (2024). Population Aging, Fiscal Expenditure Efficiency and Industrial Structure Upgrading-Theoretical Mechanisms and Empirical Evidence. Statistical Research (07), 134-147. doi:10.19343/j.cnki.11-1302/c.2024.07.009.

[9]. Zhuoyue Wang & Xiaomei Wu. (2022). Study on the relationship between population aging and fiscal expenditure structure. Bohai Economic Outlook (08), 18-20. doi:10.16457/j.cnki.hbhjjlw.2022.08.008.

[10]. Xia Liu. (2023). A study on the impact of population aging on the economic effects of fiscal expenditure policies. Science and Technology Economic Market (07), 31-34.

[11]. Shengxin Yan. (2024). Population aging and fiscal expenditure analysis. Market Outlook (22), 4-6.