1. Introduction

Global climate change is intensifying, posing a significant threat to human habitats. Reducing greenhouse gas emissions and achieving a low-carbon transition have become global priorities [1]. In this context, green innovation facilitates enterprises in decreasing energy consumption and improving economic benefits by optimizing traditional technologies, while also reducing resource waste and environmental pollution through innovative practices [2]. The traditional financial system struggles to support green innovation, highlighting the growing importance of green finance in promoting sustainable economic growth. This study examines how green finance impacts local green innovation, investigating if advancements in green finance enhance regional green innovation capabilities and exploring their relationship. The findings will provide theoretical support for the development of regional green finance and offer practical recommendations and policy guidance for achieving economic development goals.

Green finance serves as a crucial instrument for advancing regional green innovation, significantly contributing to the green and low-carbon transformation of the economy and the attainment of sustainable development [3]. From a practical standpoint, the green financial system encompasses a range of diversified financial instruments and supporting service frameworks, including green credit, green bonds, green insurance, and green funds [4]. These financial instruments expedite the diffusion and commercialization of green technologies by focusing on areas such as clean energy development, energy conservation, emission reduction technology R&D, and environmental governance innovation. They also significantly lower regional carbon emission intensity and sustain green development momentum. This study establishes a framework to evaluate green finance development using a multi-dimensional index system and panel data from 30 Chinese provinces, employing panel data analysis to systematically assess green finance's impact on regional green innovation. The study examines regional differences in green finance impact on green innovation, offering empirical evidence and theoretical insights for crafting tailored green finance policies.

2. Literature review

2.1. The connotation and development of green finance

Green finance facilitates energy conservation and emission reduction by leveraging financial instruments—including credit mechanisms, insurance products, securities, and industrial funds—to foster the sustainable integration of economic growth, resource efficiency, and environmental protection. From the perspective of theoretical evolution, Salazar [5] first proposed that green finance is a key bridge connecting financial development and environmental protection; Cowan [6] expanded its connotation to "optimizing resource allocation through financial tools to reduce negative externalities in the environment." As the low-carbon economy evolves and ESG concepts gain traction, the theoretical framework of green finance is expanding. Zeng et al. [7] characterizes it as a "financial service system employing traditional financial tools—such as credit, investment, and bond issuance—to channel social capital into green industries like environmental protection, energy conservation, and clean energy." Agrawal et al. [2] further elucidates its core as "integrating environmental factors into investment and financing decisions, directing capital towards sustainable development through systematic financial innovation, and restricting funding for high-energy and high-pollution projects, thereby aligning financial practices with dual economic and environmental objectives."

Research on measuring regional green finance development can be divided into two main approaches: policy evaluation method and impact assessment of specific policies. Notable studies in this category include evaluations of China's green finance reform and innovation pilot zones [8] and green credit policies [9]. This method focuses on policy-driven practices but has limited scope and may not fully capture the overall regional development level. The second approach is the index system method, which directly measures green finance development by constructing a comprehensive multi-dimensional index. For instance, Bakry and W [10] and Xia et al. [11] developed an evaluation framework encompassing four core dimensions: green credit, green bonds, green insurance, and green investment, using the entropy weight method to calculate the green finance index. Some researchers have expanded this framework by including additional dimensions such as environmental protection facility investment [7], green financial infrastructure [4], and government support [12], thereby enhancing the comprehensiveness and scientific rigor of the measurements.

2.2. Drivers of green innovation

Green development prioritizes the simultaneous advancement of economic growth and environmental protection, with green innovation serving as a crucial strategy. By incorporating environmental principles and fostering green technological advancements, enterprises can innovate in products, processes, services, and market models. This approach effectively reduces resource consumption, minimizes ecological harm, enhances resource allocation efficiency, and ultimately facilitates regional green and low-carbon transitions. Existing literature also has identified several key factors affecting this relationship, including environmental regulation, industrial transformation, the degree of openness to external markets, government intervention, and R&D investment. Research [10] indicates that enhancing environmental regulation and facilitating the transformation and upgrading of industrial structures can significantly bolster regional capabilities in green innovation. Rahman [12] found that while green finance positively influences regional innovation, government fiscal intervention exerts a negative impact on it, resulting in an overall detrimental effect when both factors are considered together. Furthermore, various studies have highlighted that R&D investment enhances regional green innovation. For instance, Qamruzzaman [13] argues that enterprise-level technological innovation activities can stimulate the development of new products, enhance market competitiveness, and ultimately improve the overall innovation capacity of the region.

2.3. The mechanism of green finance on green innovation

Research has not conclusively determined the impact of green innovation on regional green finance. One viewpoint suggests that green finance can greatly stimulate technological innovation, benefiting enterprises focused on environmental protection and energy conservation. This can optimize regional industrial structures and overall technological innovation. Green finance is vital at both micro and macro levels, supporting regional green innovation by providing essential financial support for high-tech and clean production technologies through instruments like green equity investments and green bonds. These tools direct limited financial resources towards low-carbon and innovative industries, thereby fostering regional innovation activities. [9] Some argue that green finance may inhibit technological innovation. On a micro level, banks and financial institutions, in adhering to green credit policies, often intensify environmental risk assessments in their credit operations. This can lead to reduced or denied credit for polluting enterprises, limiting their access to funds and stifling green innovation. On a macro level, China's green finance market faces significant challenges, including frequent "greenwashing" and sluggish market activity, revealing substantial developmental flaws. Additionally, excessive government intervention may hinder green finance from achieving its intended positive impact. [11] Qamruzzaman [13] identified significant regional disparities in the coupling coordination among green innovation, green finance, and environmental regulation, with the eastern region exhibiting notably higher coordination than the central and western regions. This study aims to address the lack of consensus on the impact of green finance on green innovation by proposing a unified framework to analyze the transmission mechanisms of regional green innovation's influence on green finance. The research contributes to two key areas: 1) Conducting macro-level analysis utilizing empirical data from 30 Chinese provinces between 2002 and 2022 to assess the impact of green finance on regional green innovation. 2) Performing regional heterogeneity analysis to explore variations in the influence of green finance on green innovation across eastern, central, and western China, providing novel perspectives and policy recommendations to tackle developmental disparities in the nation.

3. Methodology

3.1. Modelling

Referring to reference [14], a double fixed-effects model (1) is constructed to test the impact of green financial development on regional green innovation, and the relevant model is set as follows:

\( {GT_{i,t}}={α_{0}}+{α_{1}}{GFI_{i,t}}+{{α_{2}}GFI_{i,t}^{2}+α_{3}}{C_{i,t}}+{γ_{i}}+{μ_{t}}+{ε_{i,t}} \) (1)

Where i, t represents provinces and years respectively. \( {γ_{i}} \) represents province fixed effect; \( {μ_{t}} \) represents time fixed effect; \( {C_{i,t}} \) represents the control variable ensemble.

3.2. Data sources and description of variables

Panel data from 30 Chinese provinces (excluding Tibet) spanning the years 2002 to 2022 were utilized for the empirical analysis. The data were obtained from reputable sources such as the National Bureau of Statistics, Ministry of Science and Technology, People's Bank of China, and other authoritative institutions, including statistical yearbooks.

• Explanatory variables: Regional green innovation level (GT)

This study utilizes green patent applications to assess regional green innovation capacity, as informed by prior research [8]. Data on green patent from various provinces are gathered from the China National Intellectual Property Administration (CNIPA) and standardized to create a green innovation index. This index serves as a reliable measure of regional green technological innovation output.

• Explanatory variable: regional green finance development level (GFI)

Drawing on the work of Bakry and W [10] and Li et al. [14], this study employs the entropy method to compute the Green Finance Index (GFI) for each province, region, and city. Data from multiple sources such as the Bureau of Statistics, the Ministry of Science and Technology, and the People's Bank of China are used to create the index. Level 1 indicators include green credit, green securities, green investment, green insurance, and carbon finance. A 5-year moving average is applied to address data gaps and minimize the influence of fluctuations.

• Control variables (C)

Regional green innovation is influenced by multiple factors. Drawing on reference [2], this study considers the following control variables: regional economic level, indicating overall economic development; government financial expenditure, reflecting financial support for the green economy; openness to foreign capital and trade, representing the region's integration with global markets; and environmental regulation strength, assessing policy strictness. Data for these variables are sourced from the China Statistical Yearbook (2000-2022). To standardize and enhance model robustness, all data are logarithmized.

Table 1: Description of control variables

Number | Control Variables | Characters | Description |

1 | Regional Economic Level | GDP | Total national economy/billion yuan |

2 | Government Financial Expenditure | GOV | General budget expenditure of local finances/billion yuan |

3 | Openness to Foreign Capital and Trade | OPE | Total foreign investment/billion dollars |

4 | Environmental Regulation Strength | ENV | Sulfur dioxide emissions/ million tons |

4. Results of the empirical analysis

4.1. Descriptive statistics

This study analyzed the descriptive statistics of data from 30 Chinese provinces, as presented in Table 2. The findings reveal notable regional disparities in both green finance development and green innovation on a national scale. The Green Financial Development Index (GFI) varied from 0.05 to 0.63, with a standard deviation of 0.17, underscoring discrepancies within China's green financial framework. Green Technological Innovation (GT) exhibited a standard deviation of 0.84 and a right-skewed distribution, indicating innovation imbalances that predominantly benefit eastern regions. Furthermore, the control variables demonstrate substantial regional variations. These outcomes align with existing literature on China's regional progress, providing a robust empirical foundation for further examination.

Table 2: Descriptive statistics

Variables | Observations | Cross sections | Mean | Median | Minimum | Maximum | Std. Dev. |

GT | 690 | 30 | 3.15 | 3.18 | 0.60 | 4.98 | 0.84 |

GFI | 690 | 30 | 0.28 | 0.27 | 0.05 | 0.63 | 0.12 |

GDP | 690 | 30 | 3.99 | 4.04 | 2.42 | 5.11 | 0.51 |

GOV | 690 | 30 | 3.29 | 3.38 | 1.78 | 4.27 | 0.51 |

OPE | 690 | 30 | 2.66 | 2.65 | 0.76 | 4.75 | 0.72 |

ENV | 690 | 30 | 1.55 | 1.70 | -0.95 | 2.43 | 0.57 |

4.2. Benchmark regression

Table 3 presents regression results derived from panel data from 30 provinces and cities. Column (1) shows outcomes with dual fixed effects, excluding control variables, indicating a nonlinear relationship between green finance and green innovation. An initial increase is followed by a decline. In Column (2), after adding control variables, the regression coefficients for green finance and its quadratic term remain stable. By optimizing fund allocation, green finance incentivizes enterprises to boost investment in green technology R&D, fostering continuous innovation and application, thereby accelerating regional advancements in green innovation. Yet, as the sector develops, its ability to strengthen corporate green innovation gradually weakens and can eventually turn suppressive. The decline could be attributed to resource mismatches, heightened policy constraints, or inadequate marketization within green finance development.

Table 3: Benchmark regression

(1) GT | (2) GT | |

GFI | 2.7970*** | 2.3528*** |

(3.2750) | (3.1613) | |

GFI_SQ | -3.5979*** | -2.3840*** |

(-4.1162) | (-3.0705) | |

_Cons | 1.8150*** | -2.5603*** |

(14.6662) | (-7.8905) | |

C | No | Yes |

Year/Province | Yes | Yes |

N | 690 | 690 |

adj. R2 | 0.967 | 0.975 |

Note: t-statistics in parentheses. * p < 0.1, ** p < 0.05, *** p < 0.01 Same as below.

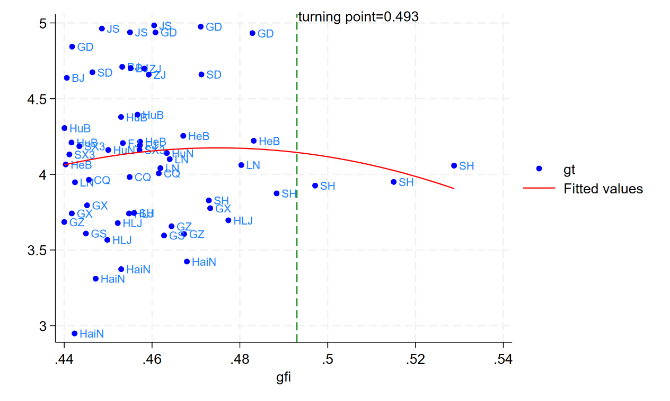

Green financial development's impact on regional green technological innovation displays distinct stage characteristics. Noteworthy turning points were observed in several provinces in 2017. Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang were designated as pilot zones for green financial reform by the State Council in June 2017, signifying the institutionalized progress of green finance in China. This policy has extended to encompass Gansu and Chongqing, establishing a "5+1+1" promotion model. After the pilot zone policy implementation, 18 provinces and municipalities are nearing the threshold value (0.493) for green financial development. In eastern regions like Shanghai, green finance has shifted from increasing to diminishing marginal returns on green tech innovation, indicating its positive yet declining impact as development progresses.

Figure 1: Scatterplot of inflection intervals

4.3. Robustness tests

To ensure the reliability of the findings, this research utilizes Winsorization (Column 1), removal of city samples (Column 2), and exclusion of data from specific years (Column 3). Details of these procedures and outcomes can be found on Table 4. The subsequent analysis indicates no notable alterations in the importance or trends of crucial factors, validating the overall outcomes.

Table 4: Robustness tests

(1) GT | (2) GT | (3) GT | |

GFI | 3.8715* | 4.4544** | 2.5026* |

(1.8968) | (2.5022) | (1.7408) | |

GFI_SQ | -4.3097* | -4.3270* | -2.6574* |

(-1.8050) | (-1.9809) | (-1.7463) | |

_Cons | -2.8172*** | -2.8817*** | -2.4863*** |

(-3.1899) | (-3.1161) | (-2.8917) | |

C | Yes | Yes | Yes |

Year/Province | Yes | Yes | Yes |

N | 644 | 600 | 667 |

adj. R2 | 0.976 | 0.972 | 0.976 |

4.4. Heterogeneity analysis

Table 5 displays regression results for sample groups from three major economic zones in China. The study reveals significant heterogeneity in the influence of green finance on regional green technological innovation.

Table 5: Heterogeneity analysis

(1) East | (2) Central | (3) West | |

GT | GT | GT | |

GFI | 1.5342 | 6.2188** | 2.1398 |

(0.7338) | (2.5602) | (1.0372) | |

GFI_SQ | -0.9551 | -8.0241** | -3.0151 |

(-0.5179) | (-2.7240) | (-1.5365) | |

_Cons | -4.9919*** | -4.7158*** | 0.2732 |

(-3.6857) | (-4.3280) | (0.1829) | |

C | Yes | Yes | Yes |

Year/Province | Yes | Yes | Yes |

N | 276 | 253 | 161 |

adj. R2 | 0.984 | 0.979 | 0.977 |

Green innovation in the central area shows a clear inverted U-shaped response to green finance. However, this relationship is not significant in either eastern or western regions. These results suggest that the central area continues to reap the rewards of green finance's developmental advantages. Leveraging less advanced technology, the region attains significant profits by adopting, integrating, and reimagining innovations. With a focus on manufacturing, it facilitates the transition to green technology, taking advantage of swift expansion and governmental support for environmentally friendly finance. By contrast, green finance's impact on technological innovation is limited in the east due to high clean-tech R&D barriers and costs. In the west, structural constraints, including resource-dependent industries, inadequate financial services, and weak R&D capacity—prevent green finance from significantly driving green innovation. The region's below-average R&D workforce further impedes tech advancement through green financing.

5. Conclusions and discussions

Green finance boosts regional green tech innovation, but its effect weakens with development, following an inverted U-curve. Post-2017, China’s green finance pilot zones narrowed regional disparities, nearing a critical threshold that shifted this dynamic. Impact varies regionally: strongest in central China, moderate in the east, and underdeveloped in the west.

To address these findings, the following policy measures are recommended. First, implement a real-time tracking framework to enhance green finance initiatives by monitoring sustainable lending volumes, bond offerings, and ecological performance. Prioritize monitoring capital efficiency and technological upgrades with a data-driven alert system. Adjust policy instruments and funding priorities based on performance indicators to sustain intervention efficacy. Second, to counter financial overexpansion's impact on innovation, it is crucial to bolster policies supporting eco-friendly technological progress. This involves enhancing environmental transparency regulations and ESG assessment frameworks to guide investments towards sustainable R&D. Additionally, imposing strict penalties for false "green" assertions is essential to combat misinformation. Third, implement region-specific financial strategies to optimize green finance and technological innovation synergy. The eastern region should prioritize product innovation, regulatory improvements, and carbon financial derivatives. The central region requires sustained fiscal incentives, production-financing integration, and a regional green tech trading platform. The western region must enhance financial infrastructure and establish ecological compensation mechanisms for future development.

References

[1]. Ahmed, D., Hua, H. X., & Bhutta, U. S. (2024). Innovation through Green Finance: A thematic review. *Current Opinion in Environmental Sustainability, 66*, 101402. https://doi.org/10.1016/j.cosust.2023.101402

[2]. Agrawal, R., Agrawal, S., Samadhiya, A., Kumar, A., Luthra, S., & Jain, V. (2024). Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. *Geoscience Frontiers, 15*(4), 101669. https://doi.org/10.1016/j.gsf.2023.101669

[3]. Hossain, M. R., Rao, A., Sharma, G. D., Dev, D., & Kharbanda, A. (2024). Empowering energy transition: Green innovation, digital finance, and the path to sustainable prosperity through green finance initiatives. *Energy Economics, 136*, 107736. https://doi.org/10.1016/j.eneco.2024.107736

[4]. Sadiq, M., Le-Dinh, T., Tran, T. K., Chien, F., Phan, T. T. H., & Huy, P. Q. (2023). The role of green finance, eco-innovation, and creativity in the sustainable development goals of ASEAN countries. *Economic Research-Ekonomska Istraživanja, 36*(2), 2175010. https://doi.org/10.1080/1331677X.2023.2175010

[5]. Salazar, J. (1998). Environmental finance: Linking two worlds. *In A Workshop on Financial Innovations for Biodiversity, Bratislava, 1*(2).

[6]. Cowan, N. (1999). An embedded-processes model of working memory. In A. Miyake & P. Shah (Eds.), *Models of working memory: Mechanisms of active maintenance and executive control* (pp. 62–101). Cambridge University Press. https://doi.org/10.1017/CBO9781139174909.006

[7]. Zeng, M., Liu, X., Li, Y., & Peng, L. (2014). Review of renewable energy investment and financing in China: Status, mode, issues and countermeasures. *Renewable and Sustainable Energy Reviews, 31*, 23–37. https://doi.org/10.1016/j.rser.2013.11.026

[8]. Irfan, M., Razzaq, A., Sharif, A., & Yang, X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. *Technological Forecasting and Social Change, 182*, 121882. https://doi.org/10.1016/j.techfore.2022.121882

[9]. Tan, W., Yan, E. H., & Yip, W. S. (2024). Go green: How does Green Credit Policy promote corporate green transformation in China? *Journal of International Financial Management*. https://doi.org/10.1111/jifm.12218

[10]. Bakry, W., Mallik, G., Nghiem, X. H., et al. (2023). Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. *Renewable Energy, 208*, 341–355.

[11]. Xia, Q. (2023). Does green technology advancement and renewable electricity standard impact carbon emissions in China: Role of green finance. *Environmental Science and Pollution Research, 30*(3), 6492–6505.

[12]. Rahman, M. M., & Hossain, M. E. (2025). Synergy of governance, finance, and technology for sustainable natural resource management. *Journal of Open Innovation: Technology, Market, and Complexity, 11*(1), 100468. https://doi.org/10.1016/j.joitmc.2025.100468

[13]. Qamruzzaman, Md. (2025). Green finance, environmental taxation, and green innovation: Unraveling their influence on the growth-quality nexus in China—a provincial perspective. *Environmental Research Communications, 7*(1), 015009. https://doi.org/10.1088/2515-7620/ada1ad

[14]. Li, X., Wang, S., Lu, X., & Guo, F. (2025). Quantity or quality? The effect of green finance on enterprise green technology innovation. *European Journal of Innovation Management, 28*(3), 1114–1140. https://doi.org/10.1108/EJIM-03-2023-0208

Cite this article

Li,X. (2025). The Nonlinear Impact of Green Finance on Green Innovation: Insights from China. Advances in Economics, Management and Political Sciences,180,61-68.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ahmed, D., Hua, H. X., & Bhutta, U. S. (2024). Innovation through Green Finance: A thematic review. *Current Opinion in Environmental Sustainability, 66*, 101402. https://doi.org/10.1016/j.cosust.2023.101402

[2]. Agrawal, R., Agrawal, S., Samadhiya, A., Kumar, A., Luthra, S., & Jain, V. (2024). Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. *Geoscience Frontiers, 15*(4), 101669. https://doi.org/10.1016/j.gsf.2023.101669

[3]. Hossain, M. R., Rao, A., Sharma, G. D., Dev, D., & Kharbanda, A. (2024). Empowering energy transition: Green innovation, digital finance, and the path to sustainable prosperity through green finance initiatives. *Energy Economics, 136*, 107736. https://doi.org/10.1016/j.eneco.2024.107736

[4]. Sadiq, M., Le-Dinh, T., Tran, T. K., Chien, F., Phan, T. T. H., & Huy, P. Q. (2023). The role of green finance, eco-innovation, and creativity in the sustainable development goals of ASEAN countries. *Economic Research-Ekonomska Istraživanja, 36*(2), 2175010. https://doi.org/10.1080/1331677X.2023.2175010

[5]. Salazar, J. (1998). Environmental finance: Linking two worlds. *In A Workshop on Financial Innovations for Biodiversity, Bratislava, 1*(2).

[6]. Cowan, N. (1999). An embedded-processes model of working memory. In A. Miyake & P. Shah (Eds.), *Models of working memory: Mechanisms of active maintenance and executive control* (pp. 62–101). Cambridge University Press. https://doi.org/10.1017/CBO9781139174909.006

[7]. Zeng, M., Liu, X., Li, Y., & Peng, L. (2014). Review of renewable energy investment and financing in China: Status, mode, issues and countermeasures. *Renewable and Sustainable Energy Reviews, 31*, 23–37. https://doi.org/10.1016/j.rser.2013.11.026

[8]. Irfan, M., Razzaq, A., Sharif, A., & Yang, X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. *Technological Forecasting and Social Change, 182*, 121882. https://doi.org/10.1016/j.techfore.2022.121882

[9]. Tan, W., Yan, E. H., & Yip, W. S. (2024). Go green: How does Green Credit Policy promote corporate green transformation in China? *Journal of International Financial Management*. https://doi.org/10.1111/jifm.12218

[10]. Bakry, W., Mallik, G., Nghiem, X. H., et al. (2023). Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. *Renewable Energy, 208*, 341–355.

[11]. Xia, Q. (2023). Does green technology advancement and renewable electricity standard impact carbon emissions in China: Role of green finance. *Environmental Science and Pollution Research, 30*(3), 6492–6505.

[12]. Rahman, M. M., & Hossain, M. E. (2025). Synergy of governance, finance, and technology for sustainable natural resource management. *Journal of Open Innovation: Technology, Market, and Complexity, 11*(1), 100468. https://doi.org/10.1016/j.joitmc.2025.100468

[13]. Qamruzzaman, Md. (2025). Green finance, environmental taxation, and green innovation: Unraveling their influence on the growth-quality nexus in China—a provincial perspective. *Environmental Research Communications, 7*(1), 015009. https://doi.org/10.1088/2515-7620/ada1ad

[14]. Li, X., Wang, S., Lu, X., & Guo, F. (2025). Quantity or quality? The effect of green finance on enterprise green technology innovation. *European Journal of Innovation Management, 28*(3), 1114–1140. https://doi.org/10.1108/EJIM-03-2023-0208