1. Introduction

P3(public- private partnership), means a cooperation mode between public sector and private enterprise, is already become an important method of contemporary project management. The key of P3 is the public sector and the private sector taking the risk together through the concession agreement, which in order to realize the best allocation of public resource and the efficient operation of project [1]. This mode have significant advantage: first, it can enhance the efforts of cooperation between the government and the society capital, improve the efficiency of cooperation; secondly, it’s helpful for public sector to relieve the stress of foundation, as well as promote the healthy development of society capital [2]. Chinese scholar Jin Yan point out further that P3 project can realize a feedback of local economy and promote the improvement of regional economy [3]. However, P3 also faces a lot of challenges. P3 project is easy to be affect by multiple factors, like market fluctuations and policy change [4], since it possess the features of large-scale invest, low short-term returns and long-term project cycle, which can increase the risk of project failure. Therefore, to make sure the smooth progress and successful implementation of projects, it’s essential to evaluate the potential risk ample and make the efficient risk management and corresponding tactics.

2. Case introduction

2.1. The “ghost city”

The "ghost city" in Ordos refers to Kangbashi New District, which was initiated for construction in 2004. This urban development project was spearheaded by the Ordos Municipal Government. The initial design capacity for the permanent residents of Kangbashi New District was 300,000 people. The planned area was approximately 352 square kilometers, and the initial planned total investment was about 5 billion RMB. However, due to large-scale infrastructure construction and real estate development, the total investment exceeded 50 billion RMB by 2015.

The project was directly planned and promoted by the government of Ordos City, with real estate enterprises such as Ordos Group handling development, while state-owned banks and local city commercial banks provided loans. During the initial stage of the project, financing relied on government fiscal grants, land transfer income and bank loans. Around 2010, the real estate bubble emerged, giving rise to high-interest private financing with interest rates as high as 30%-40%. In 2011, the price of coal dropped, which further led to a significant shrinkage of fiscal revenue in Ordos City, which heavily relies on the coal industry for its economy. This resulted in the disruption of the project’s capital chain and the abandonment of numerous projects.

After 2015, the government of Ordos City decided to suspend the construction of large-scale real estate projects and started to deal with the existing ones. It introduced technology industries such as Huawei Data Centers and launched tourism industries like Kangzhen Scenic Area. Through issuing local government bonds to replace the existing debts, it ultimately led to an increase in the permanent resident population of Kangbashi District, promoted economic recovery, and achieved the upgrading of the city's positioning.

2.2. California State Route 91

California State Route 91 in the south of California, is an important corridor between orange county and riverside county, where four demonstration projects were allowed to adopt P3 mode after the Assembly Bill No.680 that sign in 1900. Caltrans published a Request for Qualifications (RFQ), which attracted 13 firms. Eventually, the California Private Transportation Company (CPTC) was selected to develop the project. The project included building up four express toll lanes in the middle of SR-91 that already signed a BOT contract that include unconventional award.

Project financing is composed of 20million dollars’ equity, a 7million dollar’s subprime loan from Orange County Transportation Authority (OCTA) and 100million dollars’ loan from the bank.

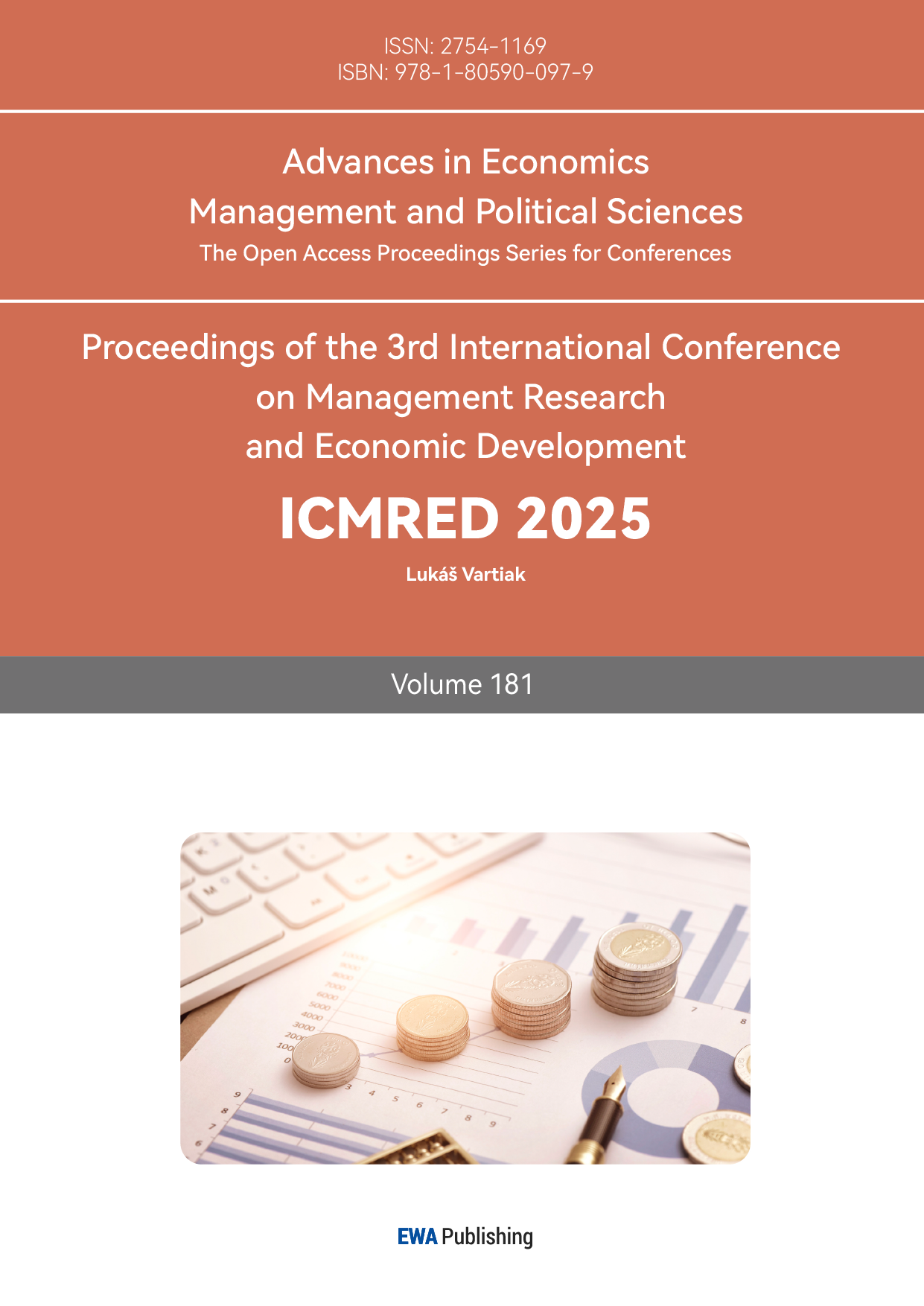

However, the surpass expectations of local economy growth lead the surge of traffic demand, and the unconventional award in the contract limited the power of OCTA to add “competitiveness” or "complementarity" road capacity. In response, OCTA overcame the limitations of the unconventional award by purchasing the lanes and converting them into High Occupancy Vehicle (HOV) toll roads. The project was subsequently extended by 12.9 km to Corona. In Kangbashi, the over-dependence on land financing and real estate development, as well as the ignoring of the law of synergy between population and industry in the initial planning of the project, led to an overestimation of local economic growth. This resulted in supply exceeding demand. The unbalance relationship between supply and demand lead the follow-up economic income cannot cover the investment before. In addition, the slumpering price of coal in 2011 made the economic income of government shrank, which lead the financial burden of government even worse. These combined factors ultimately led to the failure of the project. The model of the failure reason of “Ghost city” is shown as Figure 1:

Figure 1: The failure reason model of “ghost city”

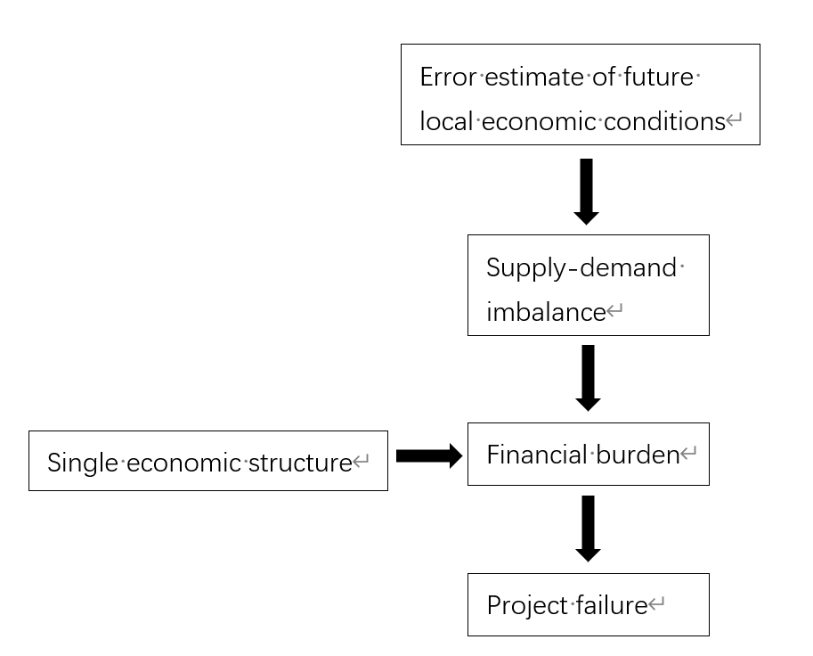

Infer from the consequence of SR-91 that OCTA repurchased the road and extended it means the four express toll lanes of the project cannot meet demand, which means that the supply and demand are imbalance. However, the unconventional award in the contract prevented the problem from being addressed in a timely manner.

Therefore, the cause of SR-91’s failure was the establishing of the unconventional award, which ledthe local government to think the extra traffic demand of local economy could be satisfied by those newly-built express toll lanes. The core issue, therefore, lies in the erroneous estimation of local economic development.

The model of failure reason of SR-91 is shown as Figure 2:

Figure 2: The failure reason model of SR-91

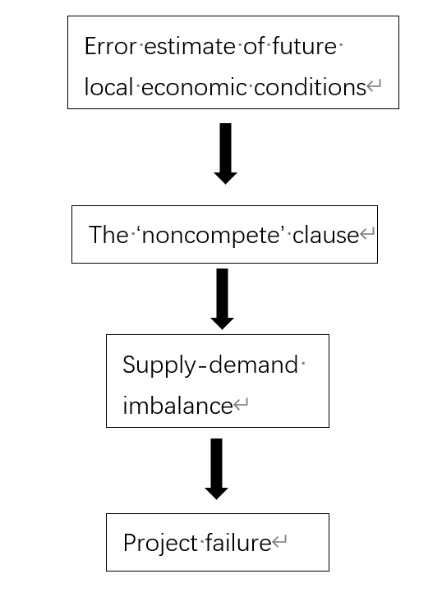

Ultimately, by integrating the Figure 1 and Figure 2, a common problem model for both sides can be distilled which is shown as Figure 3:

Figure 3: The common problem model

3. Solutions

Those three figures underscore the importance of understanding and analyzing the operational rules, influencing factors, and developmental trends of local economic changes [5].

Given the long period, huge investment and low short-tern gain, local macroeconomic fluctuation and government’s financial condition can make an impact of P3 project.

Therefore, P3 projects require the project team to possess comprehensive evaluation capacity of external environment to make sure every types of potential risks that can impact the cost and execute of project [6].

3.1. Multidimensional dynamic analysis

Local government can introduce new technology, such as Artificial Intelligence, cloud computing technology and big data analysis, to form a comprehensive and three-dimensional data collection and analysis system which is used to detect the population flow, enterprise occupancy rate and tax increase as well as summarize the demographic change, industry segmentation market dynamics and consumer behavior depth. Through those information, enterprises investment trends, change in consumption habits can be find out. Therefore, with the help of data computing mold, the changes of various economic conditions under different policy environment. This approach will provide a more scientific basis for decision-making.3.2 professional assessment

The third-party independent team, composed by economist, industry expert, financial analyst and more other experts form many fields, should be established to make sure the comprehensiveness and accuracy of the evaluation of the future economy development condition in the project implementation location during the project initiation consultation stage. Additionally, long-term tracing mechanism should be set up, carrying out evaluations and adjustments of the project regularly to make sure the project can keep up with local economy development.

3.2. Improve transparency

As P3 projects are typically used to contrast the infrastructure, public participation plays an important role in the project. Transparency, which highly correlated with public participation, should be valued. Cloud platform can improve the transparency of project by making the information of project public. Furthermore, streamline the process by which the public submits project proposals. As more information can be convey and public suggestions can be obtained, the public acceptance of the project can be improved, ultimately contributing to the project’s success.

4. Conclusion

Through comparing and analysing the “Ghost city” in Ordos, China and SR-91 California, US. the result shows the reason that lead the P3 project failure and the corresponding strategy to address these issues.

Research shows that the future local economic development condition is the key of a successful P3 project. Based on research findings, this paper proposes with the following strategies:

First, making sure the fully understanding are equipped through the multidimensional dynamic analysis, which can help to make a better estimate in the following process.

Second, in order to improve the accuracy of future local economic development condition and making sure the project will not lagging behind the economic development, predicting evaluation of local economic development condition by entrusting to professionals and making the follow-up actions for project evaluation.

Third, setting up cloud platform to increase the transparency of project, which can not only convey more information, but also collect more suggestion, to improve the public acceptance of the project.

Future research could expand by analyzing failed P3 projects in other countries, conducting a deeper study of the common issues that lead to P3 project failures, and promoting the successful development of future P3 projects.

References

[1]. Peidong Sang & Shuangshuang Xin. (2024). SWOT PEST Analysis of Project cost consulting industry's participation in PPP projects. Engineering cost management (04), 40-44. doi:10.19730/j.cnki.1008-2166.2024-04-040.

[2]. Jin Yan. (2024). Analysis on the development status and optimization countermeasures of public-Private Partnership model (PPP model). Market outlook (19), 19-21.

[3]. Liang, Y., & Ashuri, B. (2022).Challenges and enabling features of small and medium infrastructure public-private partnerships (P3s): A case study of the US P3 infrastructure market.*Engineering, Construction and Architectural Management, 29* (1), 49-71. https://doi.org/10.1108/ECAM-09-2020-0720

[4]. Jonathan L. Gifford, Lisardo A. Bolaños, Nobuhiko Daito & Carter B. Casady. (2024) What triggers public-private partnership (PPP) renegotiations in the United States' Public Management Review, 26:6, 1583-1609, DOI: 10.1080/14719037.2023.220040. https://doi.org/10.1080/14719037.2023.2200404

[5]. Chengcheng Zhang.(2024). Regional Economic Development Forecasting Model and Application based on PLS-IGWO-SVR (Master's Thesis, Northwest Normal University). master https://link.cnki.net/doi/10.27410/d.cnki.gxbfu.2024.002414doi:10.27410/d.cnki.gxbfu.2024.002414.

[6]. Yanxiang Zhang & Jing Li.(2024). Research on cost audit of government investment projects. Engineering cost management. (06), 59-62. doi:10.19730/j.cnki.1008-2166.2024-06-059.

Cite this article

Wang,J. (2025). Study on the Multidimensional Analysis of PPP Project Failure Causes and Risk Management Optimization: Case Studies from China and the United States. Advances in Economics, Management and Political Sciences,181,47-51.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Peidong Sang & Shuangshuang Xin. (2024). SWOT PEST Analysis of Project cost consulting industry's participation in PPP projects. Engineering cost management (04), 40-44. doi:10.19730/j.cnki.1008-2166.2024-04-040.

[2]. Jin Yan. (2024). Analysis on the development status and optimization countermeasures of public-Private Partnership model (PPP model). Market outlook (19), 19-21.

[3]. Liang, Y., & Ashuri, B. (2022).Challenges and enabling features of small and medium infrastructure public-private partnerships (P3s): A case study of the US P3 infrastructure market.*Engineering, Construction and Architectural Management, 29* (1), 49-71. https://doi.org/10.1108/ECAM-09-2020-0720

[4]. Jonathan L. Gifford, Lisardo A. Bolaños, Nobuhiko Daito & Carter B. Casady. (2024) What triggers public-private partnership (PPP) renegotiations in the United States' Public Management Review, 26:6, 1583-1609, DOI: 10.1080/14719037.2023.220040. https://doi.org/10.1080/14719037.2023.2200404

[5]. Chengcheng Zhang.(2024). Regional Economic Development Forecasting Model and Application based on PLS-IGWO-SVR (Master's Thesis, Northwest Normal University). master https://link.cnki.net/doi/10.27410/d.cnki.gxbfu.2024.002414doi:10.27410/d.cnki.gxbfu.2024.002414.

[6]. Yanxiang Zhang & Jing Li.(2024). Research on cost audit of government investment projects. Engineering cost management. (06), 59-62. doi:10.19730/j.cnki.1008-2166.2024-06-059.