1. Introduction

Industrial transfer is a significant manifestation of global economic integration, referring to the relocation of production activities, technology, labor, and other factors from one place to another. As labor costs and environmental pressures rise in developed countries, manufacturing industries have increasingly shifted production processes to developing countries, influencing the economic structure and development patterns of the receiving regions. Since the reform and opening-up, China’s eastern coastal areas, leveraging their low-cost advantage, have received a large number of labor-intensive processing trade industries, driving rapid economic development at both regional and national levels.

The 11th and 12th Five-Year Plans promoted regional coordinated development. Along with rising labor costs in the eastern regions, the central and western regions, endowed with new comparative advantages, have become ideal recipients for processing trade transfer. Since 2007, the Ministry of Commerce and the China Development Bank have successively released lists of cities designated to undertake processing trade in three batches. These policies have accelerated the shift of processing trade towards the central and western regions, promoting economic development in receiving areas, enhancing regional coordination, and supporting economic stability.

Employment is the foundation of people’s livelihoods, and entrepreneurship is the source of employment. Entrepreneurial activity reflects economic vitality and is inevitably influenced by the transfer of processing trade. General Secretary Xi Jinping has emphasized improving the system for entrepreneurship-driven employment and enhancing the quality of entrepreneurship. The policy on processing trade transfer is not only related to economic development but also to people’s livelihoods. Its implementation significantly affects entrepreneurial activity in receiving regions and serves as an important perspective for assessing the well-being of people in central and western China.

Entrepreneurship is fraught with risks and challenges, making a favorable entrepreneurial environment critical. Receiving regions should utilize the capital and technological advantages brought by industrial transfer to optimize the entrepreneurial environment, especially under employment pressure, requiring policy support to boost entrepreneurial vitality. This paper empirically analyzes the impact of the processing trade transfer policy on entrepreneurial activity, explores its underlying mechanisms, and proposes policy recommendations.

The innovations of this study include: first, it is the first to directly link processing trade transfer with entrepreneurial activity, discovering a significant negative effect and filling a research gap; second, it develops a theoretical framework of "multi-dimensional deterrent effects" encompassing market structure, resource allocation, and institutional environment to explain how employment substitution, intensified competition, and industrial restructuring affect entrepreneurship; third, it uses the three batches of processing trade transfers to construct a quasi-natural experiment and employs a multi-period difference-in-differences model to better control endogeneity and enhance the validity of causal inference.

2. Literature review

2.1. Research on processing trade

Processing trade has long been regarded as a key driver of regional economic development, significantly contributing to China's economic growth [1]. Academic research on processing trade mainly focuses on two aspects: first, its relationship with regional economic growth, reflected in the improvement of total factor productivity in manufacturing [2], attraction of foreign investment, and promotion of manufacturing upgrading; second, its role in optimizing industrial structure, developing high-tech industries [3], and increasing industrial value-added [4], while also facilitating technological upgrading [5]. Despite issues such as low value-added and high energy consumption [6], processing trade continues to play a critical role in expanding employment. The eastern coastal region, as the primary host area, has not only enhanced international competitiveness but also increased foreign trade dependence [7]. Some studies have also examined regional disparities [8] and credit constraints, broadening the economic and financial perspectives.

With rising labor costs and industrial upgrading in the eastern region, processing trade has gradually shifted to the central and western regions, promoting coordinated regional development [9]. The orderly transfer of processing trade not only optimizes the industrial structure in the east but also fosters economic growth in the central and western areas [10]. This shift significantly affects the profit rates of enterprises in the receiving regions [11] and labor mobility [12], facilitating the reallocation of labor from the eastern coastal areas to the central and western regions.

2.2. Research on entrepreneurship

Current entrepreneurship research mainly focuses on entrepreneur roles and behaviors, entrepreneurial opportunities, entrepreneurial environment, theoretical frameworks, and corporate entrepreneurship. Some scholars have proposed opportunity recognition and entrepreneurial action theories from the perspective of information processing [12]. Others have interpreted the entrepreneurial environment from social psychology and cultural perspectives [13]. Systematic evaluations of the applicability and limitations of entrepreneurship theories have been conducted [14], along with reviews of entrepreneurial process models [15], and comparisons between entrepreneurial orientation and corporate entrepreneurship [16].

At the urban level, entrepreneurial activity is influenced by multiple factors. Studies have shown that the digital economy significantly enhances entrepreneurial activity, especially in eastern cities [17]; e-commerce has a more pronounced positive effect on entrepreneurship in specific cities [18]. Additionally, population agglomeration has been found to improve entrepreneurial levels by expanding markets and promoting infrastructure development [19], and the development of digital finance also significantly promotes entrepreneurial activity [20].

In terms of policy practice, diversified agglomeration economies have been shown to continuously promote entrepreneurship [21]. Innovative cities generate spillover effects, and national innovation pilots have alleviated financing difficulties, thereby fostering entrepreneurship [22]. Audit supervision has been found to improve the business environment and support entrepreneurship [23], while the construction of pilot free trade zones has driven service-oriented entrepreneurship [24]. Moreover, digital infrastructure significantly enhances entrepreneurial activity by reducing costs and expanding markets [25].

3. Theoretical analysis and research hypotheses

Based on existing literature and theoretical foundations, this paper proposes a theoretical framework of the "multidimensional deterrence effect" to systematically analyze the mechanisms through which the processing trade gradient transfer policy affects entrepreneurial activity in the receiving regions, from the perspectives of market structure, resource allocation, and institutional environment. Building on the foundational deterrents of entrepreneurial culture, market concentration, and technological path dependency, the framework further incorporates employment substitution effects, intensified competition, and industrial structural shifts to elucidate the deeper logic behind the policy’s impact.

From the perspective of market structure, the entry of processing trade enterprises is accompanied by significant economies of scale, which reduce marginal costs through centralized production and integration into global value chains. Their scale advantages enable price leadership, compressing profit margins for local entrepreneurs, particularly in standardized product markets, where a "price ceiling" emerges. Furthermore, based on entry deterrence models, processing trade enterprises may signal low prices by overinvesting in excess capacity, thereby deterring potential entrants and creating barriers to market entry and oligopolistic structures—substantially deterring entrepreneurial activity.

From the perspective of resource allocation, policy bias leads to a concentration of resources in large enterprises, squeezing the survival space of small and medium-sized enterprises (SMEs). Leveraging their scale and policy support, processing trade firms dominate credit resources, intensifying financing constraints for SMEs and hindering entrepreneurial financing. According to institutional change theory, the symbiotic relationship between large enterprises and local governments induces institutional inertia, obstructing entrepreneurship-friendly reforms and constituting a structural deterrent in resource allocation.

From the institutional environment perspective, local governments, in an effort to attract processing trade firms, often grant preferential treatment exceeding that offered to domestic firms, sending negative policy signals and lowering entrepreneurs’ expected returns on investment. Long-term reliance on processing trade also undermines the development of entrepreneurial infrastructure and regional innovation capacity. Institutional signal distortion and interest ossification lead to persistent institutional inertia, which continuously suppresses entrepreneurial dynamism.

Based on the deterrence effects from these three dimensions, this paper proposes the following hypothesis:

Hypothesis 1: The processing trade transfer policy suppresses the level of entrepreneurial activity in the receiving regions.

The suppression of entrepreneurial activity in receiving regions by the processing trade gradient transfer policy essentially stems from the systemic effects of the employment substitution effect and distorted risk preferences under institutional constraints. This theoretical framework integrates insights from behavioral economics and institutional economics, revealing how the policy influences entrepreneurial dynamics through labor market signaling, resulting in structural contraction of entrepreneurial activity.

At the micro level, the stable, low-skilled jobs provided by processing trade firms reshape workers’ opportunity cost thresholds. According to Kahneman and Tversky’s prospect theory, when guaranteed income significantly exceeds expected returns from entrepreneurship, individuals exhibit strong risk-averse tendencies. The anchoring effect of time-based wages intensifies loss aversion in entrepreneurial decision-making. This mechanism is particularly pronounced under skill mismatch conditions: low-skilled workers are locked into processing trade jobs due to the specificity of their human capital, and the generic skills required for entrepreneurship gradually depreciate over time—creating a human capital depreciation trap. At the macro level, the agglomeration of processing trade firms shapes regional risk culture through social learning mechanisms. As stable employment becomes the norm, informational cascades accelerate the social diffusion of risk aversion. More deeply, entrepreneurial cultural capital experiences intergenerational decay. An economy dominated by processing trade fosters a social evaluation system that discourages entrepreneurship, stigmatizes entrepreneurial failure, and generates implicit social exclusion. When entrepreneurial density falls below a critical threshold, entrepreneurship is perceived as "abnormal behavior." Social norms fall into a low-level equilibrium, with the public favoring stable employment over entrepreneurial ventures.

Based on the above analysis, this paper proposes the second hypothesis:

Hypothesis 2: The processing trade transfer policy suppresses entrepreneurial activity in the receiving regions by improving local employment conditions.

The gradient transfer policy affects entrepreneurial activity in recipient regions through three interlinked mechanisms: market structure, technological trajectory, and institutional architecture, all of which reflect the inevitable consequence of intensified market competition driven by policy.

At the market structure level, the policy increases market concentration and strengthens the market power of incumbent firms, thereby intensifying competition. According to entry deterrence theory, processing trade firms use excess capacity to signal low prices, deterring potential entrants, leading to oligopolistic structures and high entry barriers. Economies of scale enable incumbents to suppress the profit margins of new entrants through pricing advantages, while regional industrial agglomeration further consolidates their competitive edge. Although this may enhance productivity, it widens regional economic disparities and indirectly suppresses entrepreneurial vitality.

In terms of technological trajectory, policy-driven technological progress and standard upgrades raise industry entry thresholds. According to technology diffusion theory, new entrants face higher learning costs and resource requirements, while technological lock-in intensifies market competition, discouraging entrepreneurial intent.

Regarding institutional architecture, government support policies tend to favor incumbent firms. Tax incentives and subsidies create institutional barriers, leading to unfair market competition. This weakens the motivation of new firms to enter the market, further constraining entrepreneurial activity.

Based on the above theoretical analysis, the following hypothesis is proposed:

Hypothesis 3: The gradient transfer policy of processing trade intensifies market competition in recipient regions by increasing manufacturing market concentration and technological barriers, thereby suppressing entrepreneurial activity.

The suppression of entrepreneurial activity in recipient regions by the gradient transfer policy is essentially the systemic outcome of the intertwined effects of global value chain (GVC) division and industrial structure transformation.

Technological path lock-in arises from the governance structure of global value chains and the local capability gap. As "captive value chain" participants, processing trade firms face technological upgrading constraints imposed by multinational buyers’ standards and order requirements, resulting in a “technology adaptation trap.” When regional innovation density falls below a critical threshold, the marginal return of technological catch-up diminishes. Entrepreneurs, facing reduced expectations of breaking through value chain ceilings, often shift toward low-end imitation or formal employment, thereby truncating the pathway for high-end entrepreneurship.

Industrial structure transformation is characterized by manufacturing downgrading and lagging service sector development. In the early stages, the industrial clusters formed through processing trade often represent “pseudo-agglomeration,” lacking knowledge spillovers and value chain extensions. According to industrial cluster theory, the processing trade fosters a vicious cycle of "low skills–standardized production–thin profits," suppressing demand for services. The low localization rate leads to weak supporting industries and heightened supply chain disruption risks. As a result, the low value-added nature of manufacturing constrains service sector upgrades, leading to stagnation in the proportion of knowledge-intensive services. This impedes industrial upgrading and undermines the entrepreneurial ecosystem.

Based on the above analysis, the following hypothesis is proposed:

Hypothesis 4: The gradient transfer policy of processing trade delays industrial upgrading in recipient regions, ultimately reducing entrepreneurial activity.

4. Estimation strategy, variable definitions, and data sources

4.1. Baseline multi-period DID regression model

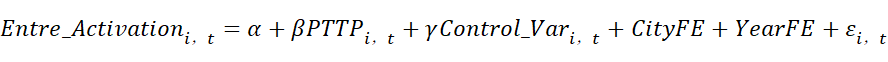

The Gradient Transfer Policy for Processing Trade (PTTP), implemented starting in 2007, constitutes an exogenous policy shock to entrepreneurial activity and can thus be regarded as a quasi-natural experiment. Considering that the PTTP was expanded in batches to include different host cities, this study adopts a multi-period Difference-in-Differences (DID) approach to rigorously assess the impact of the policy on urban entrepreneurial activity. The baseline regression model is constructed as follows:

(1)

(1)

Where Entre_Activation denotes the entrepreneurial activity in city i at time t; PTTP is the treatment variable indicating exposure to the policy; Control_Var is a vector of control variables; CityFE and YearFE represent city and year fixed effects, respectively; and ε is the random error term. The coefficient β is the primary parameter of interest, capturing the average change in entrepreneurial activity in cities before and after the implementation of the PTTP.

4.2. Variable definitions

4.2.1. Dependent variable: entrepreneurial activity (entre_activation)

Entrepreneurial activity serves as a key indicator reflecting the vibrancy of regional entrepreneurial dynamics and is widely used in macro-level entrepreneurship research. Existing literature primarily measures urban entrepreneurial activity using the number of newly established enterprises. To more accurately capture inter-city variations in entrepreneurial activity over the study period, this study draws on the approach used in related research and adopts the “New Firm Entry Score” for prefecture-level cities published in the Regional Innovation and Entrepreneurship Index by the Enterprise Big Data Research Center at Peking University. A higher score indicates a higher level of entrepreneurial activity in a given city. The New Firm Entry Score is derived from the annual count of newly established enterprises in each city as recorded in the enterprise database. Compared to directly using the raw number of new firms, this score offers superior continuity and comparability across regions and over time.

|

variable |

Obs |

Mean |

Std. Dev. |

Min |

Max |

|

Entre_activation |

5292 |

58.2347 |

24.62 |

2.1025 |

99.856 |

|

PTTP |

5292 |

.0986 |

.2982 |

0 |

1 |

|

aconsum |

5292 |

.3587 |

.1137 |

0 |

3.8352 |

|

lnagdp |

5292 |

9.9615 |

.9139 |

4.5951 |

12.4564 |

|

fixed inves |

5292 |

.6973 |

.4515 |

.0099 |

5.6814 |

|

ainternet |

5292 |

2.8453 |

5.2841 |

0 |

100.854 |

|

FDI |

5292 |

1.0179 |

1.7227 |

0 |

30.5202 |

4.2.2. Key explanatory variable

The core explanatory variable is the Processing Trade Gradient Transfer Policy (PTTP), which serves as a quasi-natural experiment. Its effect is captured through the interaction term Treat×Post, where Treat=1 indicates that a city is a designated recipient of transferred processing trade, and Post=1 denotes the period after the policy's implementation. The policy was rolled out in three batches across 2007, 2008, and 2010, so the timing of the policy dummy variable varies accordingly across cities.

4.2.3. Control variables

To accurately estimate the effect of the PTTP on entrepreneurial activity, the model includes several control variables: economic development level (measured by the logarithm of GDP per capita, lnAGDP), market size (per capita retail sales of consumer goods, Aconsum), the ratio of actual foreign direct investment to GDP (FDI/GDP), the ratio of fixed asset investment to GDP (Fixed_Inves/GDP), and internet penetration rate (measured by the number of internet users per million people, Ainternet).

4.3. Data sources

This study employs panel data from 252 prefecture-level and above cities in China for the period 2000 to 2020. To maximize the construction of a balanced panel and minimize the influence of administrative level differences, cities with significant missing data and those newly established as prefecture-level cities after 2011 due to administrative adjustments are excluded. Some missing values are supplemented using local statistical yearbooks or the ARIMA interpolation method. The primary data sources include the Regional Innovation and Entrepreneurship Index, the China City Statistical Yearbook, industrial enterprise databases, and business registration records. Following established methodologies, the study uses 2000–2006 customs enterprise data to calculate each city’s share of national processing trade. Cities in the eastern region with a processing trade share exceeding the national average by more than 0.3% are identified as potential transfer-out locations. A total of 28 such cities—including Beijing, Shanghai, Guangzhou, and Shenzhen—are excluded from the sample to ensure the robustness of the empirical results.

5. Empirical analysis

5.1. Baseline regression

Table 2 reports the regression results for the impact of the PTTP on entrepreneurial activity. Column (1) presents the model without controlling for any covariates or fixed effects, showing no significant results. Column (2) includes city and year fixed effects, while column (3) adds control variables. Column (4) includes both control variables and fixed effects. In the latter three models, the policy effect coefficients are all significantly negative, indicating that the PTTP has a statistically significant dampening effect on entrepreneurial activity in recipient cities. This outcome is likely due to the increase in employment opportunities brought about by the policy, which raises the opportunity cost of entrepreneurship. Additionally, the industrial restructuring induced by the policy intensifies market competition, increasing the difficulty of starting new businesses.

|

(1) |

(2) |

(3) |

(4) |

|

|

variable |

Entre_Activation |

Entre_Activation |

Entre_Activation |

Entre_Activation |

|

PTTP |

19.8286*** |

-2.7709* |

-1.5893*** |

-3.3035** |

|

(17.9949) |

(-1.7087) |

(-2.6719) |

(-2.3594) |

|

|

aconsum |

30.4243*** |

4.7379** |

||

|

(21.0148) |

(2.2992) |

|||

|

lnagdp |

21.1528*** |

9.9095*** |

||

|

(103.0138) |

(6.6621) |

|||

|

fixed_inves |

6.7642*** |

4.9089*** |

||

|

(16.3638) |

(6.7801) |

|||

|

ainternet |

0.0171 |

0.3458*** |

||

|

(0.5454) |

(4.3686) |

|||

|

(1) |

(2) |

(3) |

(4) |

|

|

variable |

Entre_Activation |

Entre_Activation |

Entre_Activation |

Entre_Activation |

|

FDI |

1.0400*** |

0.5715** |

||

|

(10.2187) |

(2.2740) |

|||

|

Control_var |

No |

No |

Yes |

Yes |

|

fixed_inves |

No |

Yes |

No |

Yes |

|

Observations |

5,292 |

5,292 |

5,292 |

5,292 |

|

R-squared |

0.0577 |

0.8758 |

0.7732 |

0.8956 |

Note: t-values based on robust standard errors are reported in parentheses. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively. The same notation applies to all subsequent tables.

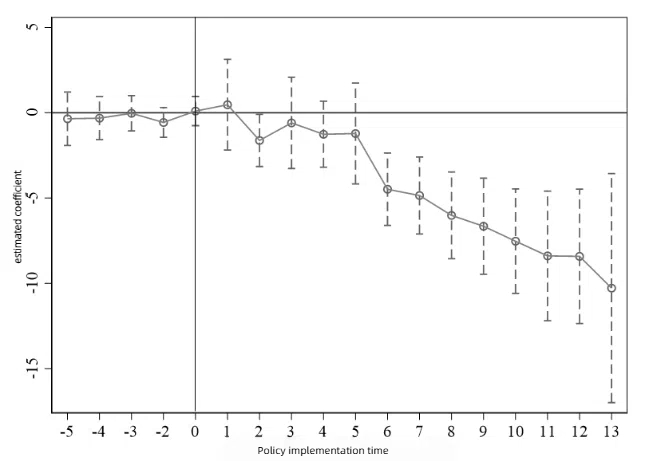

5.2. Parallel trend test

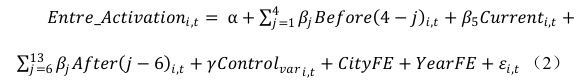

To ensure the reliability of causal inference, the Difference-in-Differences (DID) model must satisfy the parallel trend assumption, meaning that in the absence of policy intervention, the treatment and control groups should follow similar trends. Given the staggered implementation of the Processing Trade Gradient Transfer Policy (PTTP) across different cities, we construct event-study-style dummy variables covering 5 years before the policy, the year of implementation, and up to 13 years after. These are interacted with the treatment indicator, with non-treated cities having corresponding dummy values set to zero. The model is specified as Equation (2):

Here,  denotes the coefficient of each event-time dummy, capturing the difference between treatment and control cities at each relative time point after controlling for other factors. The dummy for year -1 is omitted to avoid multicollinearity. The results show that the coefficients for the four periods before policy implementation are statistically insignificant and stable, indicating no significant pre-trend differences between the treatment and control groups—thus supporting the parallel trend assumption. Post-policy, the negative effect on entrepreneurial activity intensifies over time, becoming significantly stronger six years after implementation. This suggests a delayed and increasing negative impact of the PTTP on entrepreneurship in the receiving cities.

denotes the coefficient of each event-time dummy, capturing the difference between treatment and control cities at each relative time point after controlling for other factors. The dummy for year -1 is omitted to avoid multicollinearity. The results show that the coefficients for the four periods before policy implementation are statistically insignificant and stable, indicating no significant pre-trend differences between the treatment and control groups—thus supporting the parallel trend assumption. Post-policy, the negative effect on entrepreneurial activity intensifies over time, becoming significantly stronger six years after implementation. This suggests a delayed and increasing negative impact of the PTTP on entrepreneurship in the receiving cities.

Figure 1: Parallel trend test

5.3. Heterogeneity analysis

To further investigate whether the negative impact of PTTP on entrepreneurial activity varies across city levels, regions, firm sizes, and industry characteristics, we perform heterogeneity tests. Detailed results are available upon request.

|

division way |

(1) |

(2) |

(3) |

(4) |

(5) |

|

City hierarchy |

Hu's line |

major industry |

medium-sized enterprise |

small enterprise |

|

|

PTTP |

-0.5197 |

-2.7061* |

2.7915* |

3.0906** |

-2.9651* |

|

(-0.3601) |

(-1.9686) |

(1.7926) |

(2.2151) |

(-1.6684) |

|

|

Rank×PTTP |

-12.2868*** |

||||

|

(-6.9431) |

|||||

|

Hu_Line×PTTP |

-12.3655*** |

||||

|

(-8.1969) |

|||||

|

Observations |

5,292 |

5,292 |

5,271 |

5,271 |

5,271 |

|

R-squared |

0.8981 |

0.8962 |

0.7180 |

0.7502 |

0.1721 |

5.3.1. City-level heterogeneity

Cities classified as provincial capitals, sub-provincial cities, or special economic zones are designated as high-level cities (Rank = 1). An interaction term between Rank and PTTP is included. As shown in Column (1) of Table 3, the interaction coefficient is -12.2868 (significant at 1%), indicating that PTTP has a stronger suppressive effect on entrepreneurial activity in high-level cities. These cities often have abundant resources but intense competition, and the policy further increases market pressure, thereby limiting entrepreneurship.

5.3.2. Regional heterogeneity

Using the Hu Huanyong Line as a regional demarcation, cities northwest of the line are coded as 1 and others as 0. The interaction term Hu_Line × PTTP is significantly negative (Table 3, Column 2; 1% level), suggesting that the policy’s suppressive effect on entrepreneurship is more pronounced in northwestern cities, where economic bases are weaker and industrial structures more homogeneous. The policy intensifies competition in these regions, further dampening entrepreneurial activity.

5.3.3. Firm size heterogeneity

Firm size is measured by registered capital. Regression results show that PTTP significantly suppresses entrepreneurial activity among small firms (significant at the 10% level), while medium and large firms experience positive effects (Table 3, Columns 3–5). Larger firms are better positioned to take advantage of the policy due to superior resources and market access, whereas smaller firms, constrained by limited resources, adopt a more cautious entrepreneurial strategy under policy pressure.

5.3.4. Industry heterogeneity

The analysis uses the number of newly registered firms in manufacturing, producer services, and non-producer services as dependent variables. Results indicate that PTTP has a significant negative effect on entrepreneurship in the manufacturing sector (5% level), a significant positive effect on producer services (1% level), and no significant effect on non-producer services. The negative impact in manufacturing stems from intensified competition and transformation pressures. In contrast, producer services benefit from improved investment environments and policy support, while non-producer services are mainly driven by market demand and thus remain unaffected.

5.4. Mechanism test

5.4.1. Employment substitution effect

The PTTP significantly boosts employment levels in receiving cities. Employment is measured by the natural logarithm of the total employed population. Since processing trade in China mainly involves labor-intensive industries, the transfer policy creates abundant job opportunities, particularly easing employment pressure for unskilled labor. As shown in Column (1) of Table 4, PTTP positively affects employment levels (coefficient = 0.1045, significant at the 1% level), confirming the employment-promotion effect of the policy.

However, increased employment suppresses entrepreneurship. First, the influx of stable and relatively well-paying jobs improves living standards, raising the opportunity cost of entrepreneurship. Second, the inherent risks of entrepreneurship (technical, market, and financial) make individuals more likely to choose stable employment over uncertain ventures, reducing entrepreneurial motivation and delaying entry, which ultimately weakens overall entrepreneurial activity.

|

(1) |

(2) |

(3) |

|

|

variable |

employment situation |

the level of competition |

industrial structure |

|

PTTP |

0.1045*** |

-0.0094 |

|

|

(2.6842) |

(-1.4882) |

||

|

L.PTTP |

327.4921* |

||

|

(1.8663) |

|||

|

Constant |

1.6206*** |

1,033.4016*** |

0.7311*** |

|

(3.7137) |

(27.5913) |

(7.7638) |

|

|

Control_vars |

Yes |

Yes |

Yes |

|

fixed effect |

Yes |

Yes |

Yes |

|

Observations |

5,292 |

3,011 |

5,292 |

|

R-squared |

0.3065 |

0.0222 |

0.6546 |

5.4.2. Intensified competition

The policy of processing trade transfer (PTTP) influences entrepreneurial decisions through a dual mechanism: on the one hand, it increases industrial concentration within the manufacturing sector, enhancing incumbents’ economies of scale, raising sunk costs, and intensifying market risks for potential entrants; on the other hand, the transfer of industries promotes technological advancement, wherein both indigenous innovation and technology acquisition facilitate industrial upgrading and optimization. This leads to elevated technical standards and entry barriers, presenting a steeper learning curve for new firms and thus discouraging entrepreneurial enthusiasm.

To verify whether the policy suppresses entrepreneurial activity in host regions by increasing the intensity of competition in the manufacturing sector, this study constructs a Herfindahl-Hirschman Index (HHI) based on the 1998–2015 Industrial Enterprise Database to measure market concentration, and employs the first-order lag of the policy variable to capture its dynamic effects. Regression results in Table 4 indicate that the coefficient of the lagged policy variable on the HHI is 327.492 (p = 0.063), which is significant at the 10% level, suggesting that the policy promotes increased market concentration in the host region’s manufacturing sector and validates the deterrent effect of the PTTP.

The PTTP encourages enterprise agglomeration. Transferred enterprises rapidly dominate the local market by leveraging economies of scale, exacerbating competitive pressure and compressing the survival space for startups. Technological upgrading and equipment investment form barriers in the form of sunk costs, raising entry thresholds for new businesses. While the policy facilitates “creative destruction” by eliminating inefficient firms, it also inhibits new entrants due to heightened competition. This illustrates the tension between dynamic and static efficiency, ultimately increasing entrepreneurial pressure and dampening startup activity. The heterogeneity analysis supports this mechanism: the manufacturing sector, due to its dependence on technology and economies of scale, tends toward monopolistic competition, whereas the service sector benefits from demand expansion driven by policy, further validating Hypothesis 3.

5.4.3. Changes in industrial structure

The transfer of processing trade has a significant impact on the industrial structure of host regions. In this study, the share of tertiary industry value added in GDP is used to measure the level of industrial structure. Processing trade promotes labor migration from the primary sector to the secondary and tertiary sectors, thereby improving labor productivity and the human capital structure, and driving changes in social demand and household consumption patterns. However, given that host regions typically receive transfers from more developed coastal or economically advanced areas, the process of industrial upgrading may be hindered by interregional gradients. Regression results (Table 4, Column 2) show a negative coefficient for the policy variable, suggesting that processing trade transfer exerts a negative impact on the industrial structure of host regions. However, the p-value is 0.138, falling short of conventional significance levels. Possible explanations include: although processing trade stimulates the development of supporting industries, it simultaneously suppresses raw material industries; technological spillovers are limited, and core technologies are tightly controlled. Moreover, the processing trade's industrial chains are short and characterized by weak upstream and downstream linkages, thereby constraining the potential for structural upgrading.

Structural changes resulting from the PTTP also exert a suppressive effect on entrepreneurial activity, reflecting the negative influence of market volatility. It can be inferred that the PTTP introduces fluctuations and a slight decline in the industrial structure of host regions, which in turn curtails entrepreneurial dynamism, thereby partially supporting Hypothesis 4.

6. Conclusion and policy implications

Against the backdrop of profound transformations in the global economic landscape, the effectiveness of policies aimed at enhancing entrepreneurial activity holds significant implications for alleviating employment pressure and promoting high-quality development in China. This study adopts the processing trade gradient transfer policy as a quasi-natural experiment and constructs a multi-period difference-in-differences (DID) model based on panel data from 252 prefecture-level cities in China spanning 2000 to 2020, in order to systematically evaluate the policy's impact on entrepreneurial activity in the receiving regions. The empirical results reveal that the policy significantly suppresses entrepreneurial activity in host regions, a finding that remains robust across multiple specifications. Heterogeneity analysis further indicates that the suppressive effects are more pronounced in higher-tier cities, areas located to the northwest of the Hu Huanyong Line, and among small-sized enterprises. In contrast, medium- and large-sized enterprises as well as producer services sectors exhibit positive responses to the policy. Mechanism analysis suggests that while the policy promotes the expansion of low-skill employment opportunities—improving overall employment levels and quality of life—it also crowds out entrepreneurial intentions. Moreover, a decline in the industrial structure induced by the policy acts as an additional constraint on entrepreneurial activity. Based on the above findings, the following policy recommendations are proposed:

Firstly, optimize the design of the entrepreneurial system, enhance policy evaluation and feedback mechanisms to ensure that the original policy intentions are realized, and promote coordinated regional development. Secondly, refine the targeting and coherence of policy instruments, with special attention to provincial capitals in central and western China as well as small-sized enterprises. Support measures such as preferential financing should be implemented to invigorate the vitality of micro and small businesses. Thirdly, balance the relationship between employment and entrepreneurship, foster a favorable entrepreneurial environment, and encourage the diffusion of technological innovation and managerial experience among enterprises. Fourthly, cultivate drivers for long-term economic growth by promoting industrial upgrading in receiving regions, developing supporting industries, and establishing a virtuous cycle to achieve sustainable growth in entrepreneurship.

References

[1]. Wang, J. (2008). An empirical analysis of processing trade and China's economic growth. Modern Business Trade Industry, 20(12), 3–4.

[2]. Qiu, A. , Hu, Q. , Wang, W. , et al. (2020). The impact of processing trade on total factor productivity of China's manufacturing industry. Journal of Shenyang University of Technology (Social Science Edition), 13(5), 409–416.

[3]. Zhang, D. (2005). The impact of processing trade on China's industrialization (Master’s thesis). Huazhong University of Science and Technology, Hubei.

[4]. Chen, Z. (2008). Prospects of processing trade in China's economic development. China Business and Market, 22(3), 36–39.

[5]. Zhang, J. (2006). The role of processing trade in promoting China's industrial upgrading (Master’s thesis). Hunan University, Hunan.

[6]. Wang, F. (2009). The impact of China's processing trade on the economy and policy suggestions. Business Research, (9), 158–159.

[7]. Liu, X. (2009). Processing trade and China's foreign trade dependence. Industrial Technology & Economy, 28(10), 28–31.

[8]. Wang, H. , & Wang, Z. (2018). Processing trade, income transfer, and urban-rural income gap. Journal of Guizhou University of Finance and Economics, (1), 77–84.

[9]. Liu, C. (2012). Analysis of the characteristics and problems of China's processing trade development. Journal of Ningde Normal University (Philosophy and Social Sciences Edition), (1), 47–55.

[10]. Lin, W. , Hu, Y. , & He, J. (2023). The impact of e-commerce development on urban entrepreneurial vitality. Chinese Journal of Population Science, 37(5), 82–96.

[11]. Lang, L. , & Zhao, H. (2014). Restructuring China’s processing trade layout based on comparative advantage. Study & Exploration, (11), 86–91.

[12]. Song, Y. , & Hu, H. (2024). How processing trade relocation affects export performance in receiving regions. Contemporary Economic Research, 348(8), 97–113.

[13]. Fang, M. , & Sun, M. (2015). The impact of industrial transfer on labor mobility: A case study of Anhui Province. Journal of Anhui Science and Technology University, 29(5), 103–107.

[14]. Zhu, R. , Wang, Y. , Zhou, Q. , et al. (2022). The impact of relational governance in entrepreneurial teams on decision commitment. Chinese Journal of Management, 19(1), 65–73.

[15]. Zhai, Q. , Hu, X. , & Su, J. (2022). Theoretical context and research review of entrepreneurial geography. Areal Research and Development, 41(5), 1–6, 38.

[16]. Shen, R. , Lu, Q. , & Yang, J. (2023). Theoretical framework and research prospect of the interaction between venture capital and entrepreneurial enterprises. R&D Management, 35(1), 89–104.

[17]. Su, Z. , Wei, J. , Zhang, Y. , et al. (2024). Mechanisms of building symbiotic ecosystems by entrepreneurial enterprises. Studies in Science of Science, 42(8), 1685–1694, 1770.

[18]. Zhao, T. , Zhang, Z. , & Liang, S. (2020). Digital economy, entrepreneurial vitality and high-quality development: Empirical evidence from Chinese cities. Management World, 36(10), 65–76.

[19]. Yu, X. , & Xu, Y. (2022). The impact of population agglomeration on entrepreneurial vitality: Effects and pathways considering dynamics. China Population, Resources and Environment, 32(9), 151–163.

[20]. Li, Y. , & Bi, Y. (2023). Urban entrepreneurial vitality: Regional differences, dynamic evolution, and influencing factors. China Soft Science, (5), 99–106.

[21]. Zhang, C. (2018). What makes a city more favorable for entrepreneurship?. Economic Research Journal, 53(4), 151–166.

[22]. Zeng, J. , & Gong, Q. (2017). Talent selection standards in innovation and entrepreneurship contests: Innovation or entrepreneurship?. Studies in Science of Science, 35(10), 1536–1545.

[23]. Luo, C. , Yang, Y. , & Wei, D. (2023). National audit and urban entrepreneurial vitality. Journal of Nanjing Audit University, 20(6), 10–20.

[24]. Ren, F. , Xu, M. , & Zhang, Y. (2022). The impact of free trade zones on urban entrepreneurial vitality: Evidence from firm registration data. China Business and Market, 36(11), 82–91.

[25]. Wang, K. , & Chao, X. (2023). The impact of new digital infrastructure on urban entrepreneurial vitality. Journal of Xi’an University of Finance and Economics, 36(2), 51–63.

Cite this article

Tong,L.;Pu,L.;He,Y.;Lei,W. (2025). The Impact of the Gradient Transfer Policy of Processing Trade on Entrepreneurial Activity in Receiving Regions: An Empirical Analysis. Advances in Economics, Management and Political Sciences,192,213-226.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, J. (2008). An empirical analysis of processing trade and China's economic growth. Modern Business Trade Industry, 20(12), 3–4.

[2]. Qiu, A. , Hu, Q. , Wang, W. , et al. (2020). The impact of processing trade on total factor productivity of China's manufacturing industry. Journal of Shenyang University of Technology (Social Science Edition), 13(5), 409–416.

[3]. Zhang, D. (2005). The impact of processing trade on China's industrialization (Master’s thesis). Huazhong University of Science and Technology, Hubei.

[4]. Chen, Z. (2008). Prospects of processing trade in China's economic development. China Business and Market, 22(3), 36–39.

[5]. Zhang, J. (2006). The role of processing trade in promoting China's industrial upgrading (Master’s thesis). Hunan University, Hunan.

[6]. Wang, F. (2009). The impact of China's processing trade on the economy and policy suggestions. Business Research, (9), 158–159.

[7]. Liu, X. (2009). Processing trade and China's foreign trade dependence. Industrial Technology & Economy, 28(10), 28–31.

[8]. Wang, H. , & Wang, Z. (2018). Processing trade, income transfer, and urban-rural income gap. Journal of Guizhou University of Finance and Economics, (1), 77–84.

[9]. Liu, C. (2012). Analysis of the characteristics and problems of China's processing trade development. Journal of Ningde Normal University (Philosophy and Social Sciences Edition), (1), 47–55.

[10]. Lin, W. , Hu, Y. , & He, J. (2023). The impact of e-commerce development on urban entrepreneurial vitality. Chinese Journal of Population Science, 37(5), 82–96.

[11]. Lang, L. , & Zhao, H. (2014). Restructuring China’s processing trade layout based on comparative advantage. Study & Exploration, (11), 86–91.

[12]. Song, Y. , & Hu, H. (2024). How processing trade relocation affects export performance in receiving regions. Contemporary Economic Research, 348(8), 97–113.

[13]. Fang, M. , & Sun, M. (2015). The impact of industrial transfer on labor mobility: A case study of Anhui Province. Journal of Anhui Science and Technology University, 29(5), 103–107.

[14]. Zhu, R. , Wang, Y. , Zhou, Q. , et al. (2022). The impact of relational governance in entrepreneurial teams on decision commitment. Chinese Journal of Management, 19(1), 65–73.

[15]. Zhai, Q. , Hu, X. , & Su, J. (2022). Theoretical context and research review of entrepreneurial geography. Areal Research and Development, 41(5), 1–6, 38.

[16]. Shen, R. , Lu, Q. , & Yang, J. (2023). Theoretical framework and research prospect of the interaction between venture capital and entrepreneurial enterprises. R&D Management, 35(1), 89–104.

[17]. Su, Z. , Wei, J. , Zhang, Y. , et al. (2024). Mechanisms of building symbiotic ecosystems by entrepreneurial enterprises. Studies in Science of Science, 42(8), 1685–1694, 1770.

[18]. Zhao, T. , Zhang, Z. , & Liang, S. (2020). Digital economy, entrepreneurial vitality and high-quality development: Empirical evidence from Chinese cities. Management World, 36(10), 65–76.

[19]. Yu, X. , & Xu, Y. (2022). The impact of population agglomeration on entrepreneurial vitality: Effects and pathways considering dynamics. China Population, Resources and Environment, 32(9), 151–163.

[20]. Li, Y. , & Bi, Y. (2023). Urban entrepreneurial vitality: Regional differences, dynamic evolution, and influencing factors. China Soft Science, (5), 99–106.

[21]. Zhang, C. (2018). What makes a city more favorable for entrepreneurship?. Economic Research Journal, 53(4), 151–166.

[22]. Zeng, J. , & Gong, Q. (2017). Talent selection standards in innovation and entrepreneurship contests: Innovation or entrepreneurship?. Studies in Science of Science, 35(10), 1536–1545.

[23]. Luo, C. , Yang, Y. , & Wei, D. (2023). National audit and urban entrepreneurial vitality. Journal of Nanjing Audit University, 20(6), 10–20.

[24]. Ren, F. , Xu, M. , & Zhang, Y. (2022). The impact of free trade zones on urban entrepreneurial vitality: Evidence from firm registration data. China Business and Market, 36(11), 82–91.

[25]. Wang, K. , & Chao, X. (2023). The impact of new digital infrastructure on urban entrepreneurial vitality. Journal of Xi’an University of Finance and Economics, 36(2), 51–63.