1. Introduction

Recently, inflation in Japan has attracted widespread research concerning the Japanese Bubble Economy in the 1980s. We reviewed a load of research focusing on the causes, impacts, and policies made by the government and banks of the Japanese Bubble Economy. Although decades have passed, there is still a controversy about the determining factors that caused the bubble economy and surprisingly, we find that when mentioning the Bubble Economy most of people tend to focus on how the Bubble Economy affects real estate and policy making such as specific monetary policies launched by BOJ aiming to revive Japanese economy ignored other valuable content. So, in this paper, we would like to explain the determining policy or accord through an overview. The consequences of a wrong economic policy can be devastating, including a reduction in the average life expectancy of a country, a massive increase in indebtedness, a rise in uncertainty, an increase in inequality, and a decline in supply [1]. At the same time, we would like to suggest how to avoid the next bubble by analyzing the causes of the bubble economy in Japan. Apart from that, it is also worth discussing the economic and social impacts of the Japanese bubble economy, such as how it affected employment rates and asset prices. In addition, we find that there is still room for research on the relationship between the suicide rate and the bubble economy, and we will also analyze this point slightly in this paper. The last point is about how the Japanese government attempted to revive the economy after the collapse of the bubble.

Bubbles are born mainly because of macroeconomic states in which asset values outstrip the real economy and are highly vulnerable to loss of staying power. Lacking the support of the real economy, their assets are as prone to bursting as bubbles. Reviewing those policies made in the 1980s by the Bank of Japan (BOJ) and plenty of burgeoning literature and previous literature related to the Bubble Economy, we believe that the determining cause of the Bubble Economy in the 1980s remains controversial. Although closely related and important, we haven’t reviewed the global situation like the economic problems caused by oil, the end of the Cold War, and many big events that would cause a Bubble Economy indirectly. Overall, our research questions will be set as 4 aspects:

To begin with, we discuss the determining causes, where we take into considering the Plaza Accord and Japan's set economic plans. Secondly, how asset prices and unemployment rates change, accompanied by huge fluctuations in the real estate bubble and unacceptable monetary tightening. Thirdly, discusses how the collapse of the Bubble affected the suicide rate in Japan and how suicide feedback to Japanese economy and society. The last one is to evaluate whether the policies launched by BOJ after Bubble were beneficial or not and wish this paper can become a precaution

This ponder analyzes in detail the arrangement and effect of the Japanese bubble economy and its ensuing policy responses. Through documentary research and comparative study and relapse conditions, and regression equations, we affirm that the Plaza Accord and Japan's economic policies were imperative drivers of the bubble economy. After the collapse of the bubble, the Japanese government embraced an arrangement of approaches to relieve the recession and attempt to recuperate the economy. At the same time, the Japanese government stabilized the financial system and the labor market by expanding infrastructure investment, banking reforms, and other measures, in any case, the impacts of these arrangements were blended. In expansion, the ponder uncovers the effect of the collapse of the bubble economy on the suicide rate. The information appears that there's a critical positive relationship between the increment in the unemployment rate and the increment in the suicide rate after the collapse of the bubble economy.

2. The causes of the bubble economy

There were two main factors that led to Japan's bubble economy, the first was the signing of the Plaza Accord, and the second was Japan's wrong economic policies. We first introduce the background and impact of the signing of the Plaza Accord. In the 1980s, due to the second oil crisis, which led to a substantial increase in the price of energy in the United States, the United States experienced inflation caused by the surge in energy prices. Therefore, the Federal Reserve chose to raise the interest rate three times in order to control inflation, which led to a huge increase in the exchange rate of the US dollar. hence in order to alleviate the fiscal deficit, the United States chose to sign the Plaza Accord with the aim of lowering the exchange rate of the dollar to facilitate increased competitiveness of commodity exports. However, the depreciation of the dollar was fatal to Japan, and the Plaza Accord indirectly led to the Japanese crisis and the lost decade (International Monetary Fund, 2011). Yen appreciated by 60% after the signing of the Plaza Accord in 1985, which made it less economical to engage in labor-intensive activities in Japan and thus reduced the export of these goods. This led Japanese multinational corporations (MNCs) to shift much of this capital to other Asian economies with lower production costs, like Malaysia [2]. Japan's surge in outward investment has been accompanied by a stabilization of FDI and government expenditure, which has indirectly led to difficulties in the survival of Japanese domestic sales [3]. Overall, these changes are indicative that the Plaza Accord did not directly cause Japan's bubble economy; it only affected the value of the yen. Therefore, we will continue to discuss another policy that is generally considered to be the determining factor: the Bank of Japan's incorrectly lowered interest rates drastically and directly triggering the huge appreciation of Japanese real estate and the stock market. In order to show this impact, we model as equation (1) follows.

Where

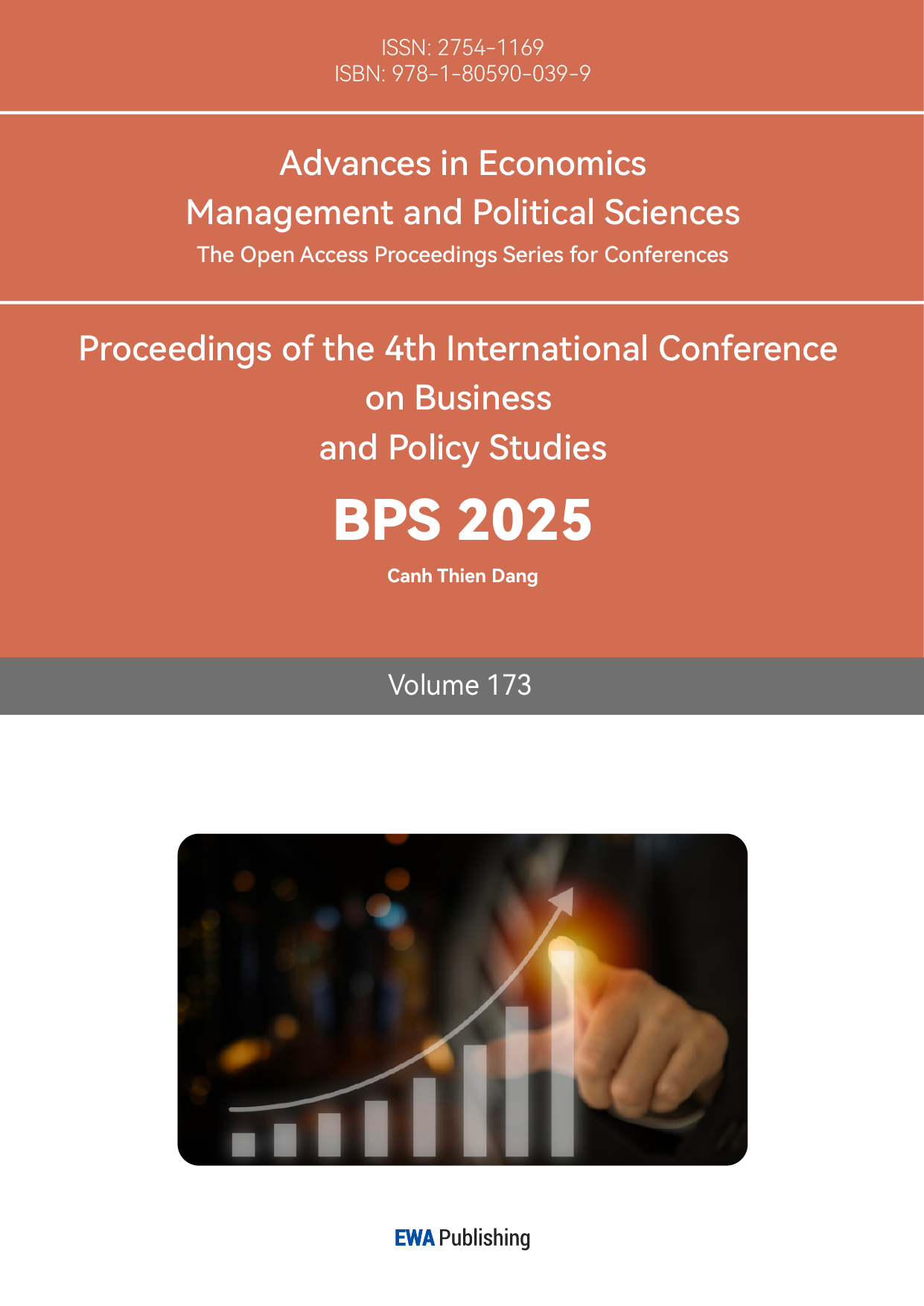

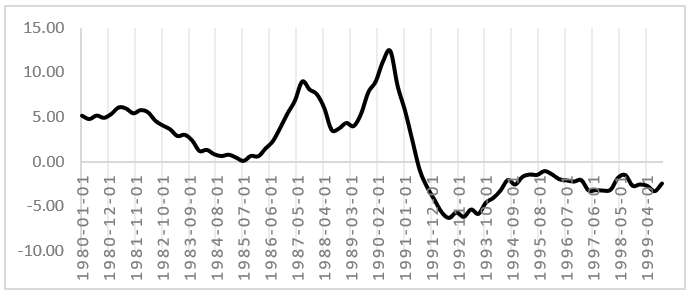

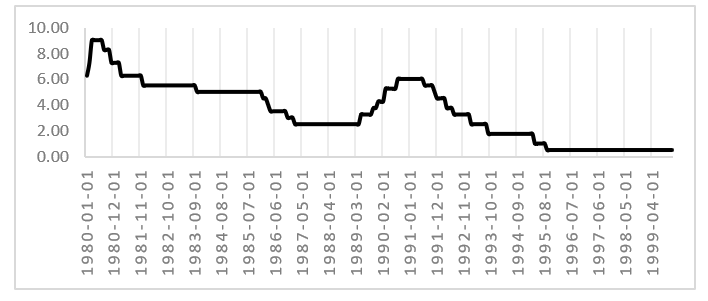

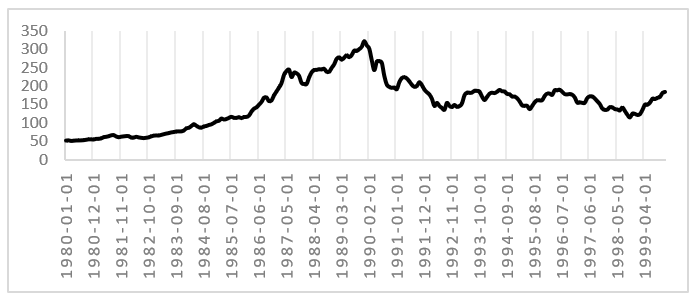

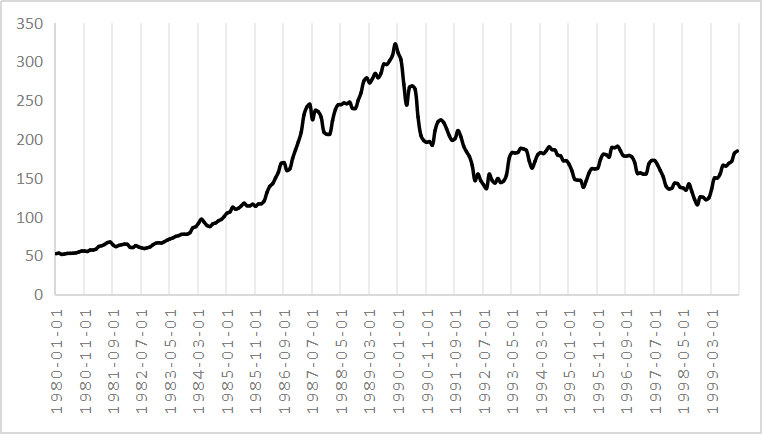

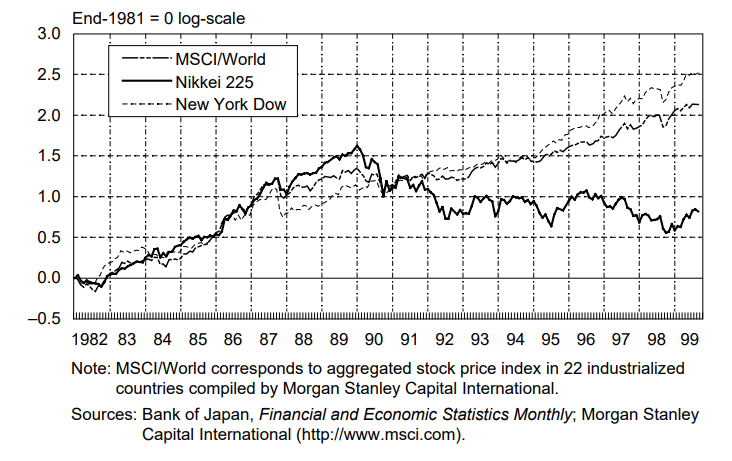

These Figures present price fluctuations in Japanese real estate, Japanese government spending, changes in the exchange rate of the yen to the U.S. dollar, and changes in stock prices from about 1980 to 1999. These Figures do a good job of explaining how Japan's drastic cuts in interest rates led to the bubble economy by comparing the degree of correlation between the images of a few key variables and the image of Y.

Therefore, in the situation of Japan's outward investment surged while FDI stabilized, indirectly leading to a decrease in Japan's domestic sales. So, in order to stimulate domestic sales, the Japanese government chose to cut interest rates (5%~4. 5% interest rate in 86 years 4. 5%~2. 5% in 87 years) to stimulate consumption in the hope that funds would flow from the banks to the market and to reduce the speed of the yen's appreciation, but this drastic reduction of interest rates caused panic among Japanese people who were afraid of devaluing the funds in their hands, so they were in urgent need of converting the easily floating funds into stable assets. Under the influence of such considerations, the Japanese chose to let most of this capital that Japan wanted to flow into the market flow into the purchase of real estate, leading to a surge in Japanese housing prices.

3. Impact on the real estate, the stock market and the unemployment

In the late 1980s, the Japanese economy experienced an unprecedented boom, with the rapid expansion of the real estate and stock markets leading to the well-known phenomenon of the "bubble economy". However, this boom was based on speculative investment and loose monetary policy and lacked solid economic support. With the bursting of the bubble in the early 1990s, Japan was plunged into the "Lost Decade," during which asset prices plummeted, economic growth stagnated, and unemployment rose sharply. By analyzing relevant economic data, this study aims to examine the profound impact of the bursting of the bubble economy on asset prices and the job market in Japan, to verify the long-term impact of this economic event on the socio-economic structure of the society, and to put forward policy recommendations accordingly.

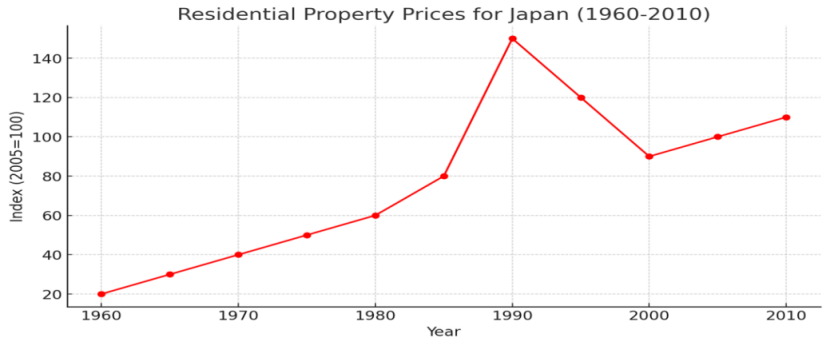

In Japan, the real estate market experienced an unprecedented boom from the mid-1980s to the early 1990s, which was closely related to the monetary policy and financial liberalization at that time. After the signing of the Plaza Accord in 1985, the Japanese yen appreciated sharply, and the Bank of Japan () implemented an easy monetary policy in order to alleviate the pressure on exports. The low-interest rate environment prompted a large amount of capital to flow into the real estate market, and between 1985 and 1987, land and housing prices rose rapidly, making real estate an ideal tool for preserving and increasing value in the eyes of investors.

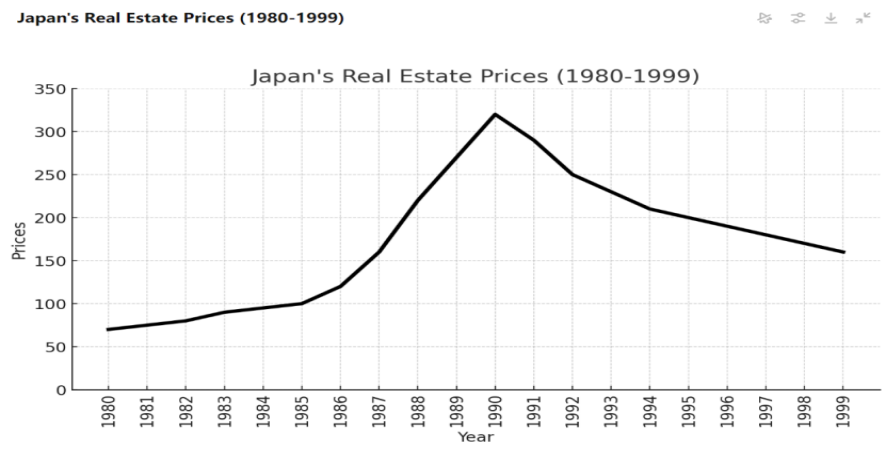

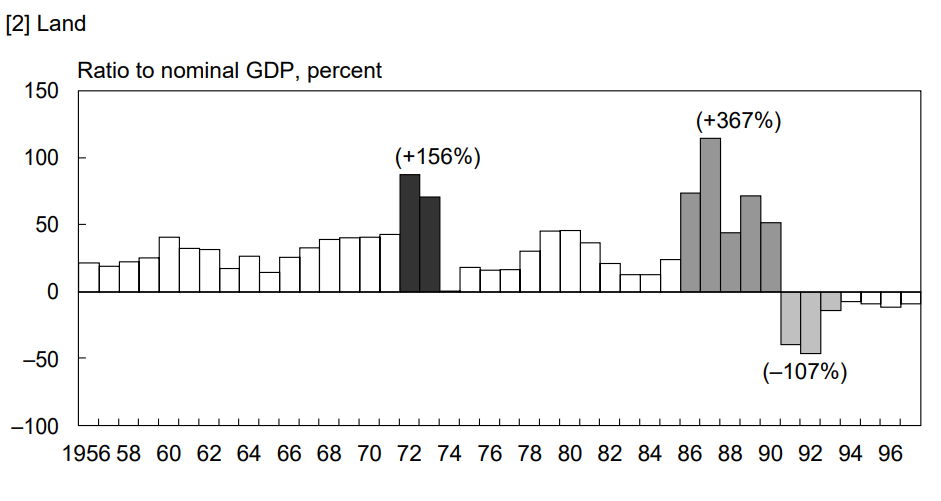

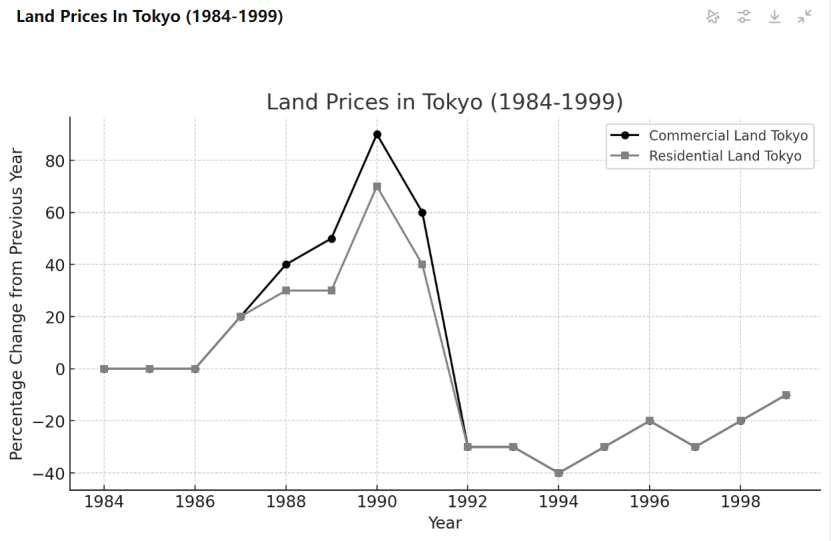

Figure 5(BOJ) shows that from 1985 to 1990, real estate prices in Japan experienced a sharp rise, with capital gains on land prices even reaching 367% of nominal GDP, especially in major cities such as Tokyo, Osaka and Nagoya. The data in Figure 6(BOJ) [4] show that land prices in Tokyo more than tripled during this period, reflecting a frenzied market driven by an investment boom.

However, this rapid rise peaked in 1990, and as the Bank of Japan began to tighten monetary policy in an effort to control inflation and financial stability, the real estate market bubble began to crack. Figure 7(BOJ) [5] illustrates the rapid decline in land prices following the bursting of the bubble, and by 1999, land prices had fallen by about 80% from their 1990 peak. This drastic market correction not only led to the deterioration of corporate and individual balance sheets but also triggered the problem of bad loans at banks, leading to a credit crunch that further dragged down the overall performance of the Japanese economy.

The prolonged downturn in the real estate market and the large number of shelved real estate projects marked the turning point of the Japanese economy from boom to bust. The real estate market during this period was not only one of the core drivers of Japan's bubble economy, but also an important contributor to the recession, with far-reaching social and economic implications.

During Japan's bubble economy, the stock market became another important center of speculative fervor. After the signing of the Plaza Accord in 1985, the sharp appreciation of the yen put tremendous pressure on Japanese exports. In order to stimulate the domestic economy, the Bank of Japan implemented an extremely loose monetary policy. This led to a massive influx of cheap money into the stock market, which drove the stock market to a rapid rise. Figure 8 shows the rapid climb of the Nikkei 225 Index from 1985 to 1989, soaring from 12,598 points in September 1985 to 38,915 points at the end of 1989, an increase of 3.1 times. During this period, the stock market became the main area for investors to chase high returns, and speculation was rampant.

However, as the real estate market bubble began to burst in 1990, the stock market was not immune. Stock prices fell sharply after the bubble burst. Figure 9 [6] shows that the Nikkei 225 Index fell to 14,309 points in August 1992, down more than 60% from its late 1989 peak. Although there was a brief rebound after 1992, the overall trend remained downward. By October 1998, the Nikkei 225 had fallen further to 12,879, a 67% drop from its peak.

This dramatic stock market crash not only led to massive investor losses but also had far-reaching effects on the Japanese financial system. Banks and other financial institutions were hit hard by their large holdings of equity assets, and credit markets tightened further as a result. The prolonged downturn in the stock market intertwined with the downturn in the real estate market to exacerbate Japan's economic decline, leading to a decade-long period of economic stagnation. The stock market turmoil during this period was an important manifestation of the aftermath of the bursting of the Japanese bubble economy and provided a profound lesson for subsequent research in economics [7].

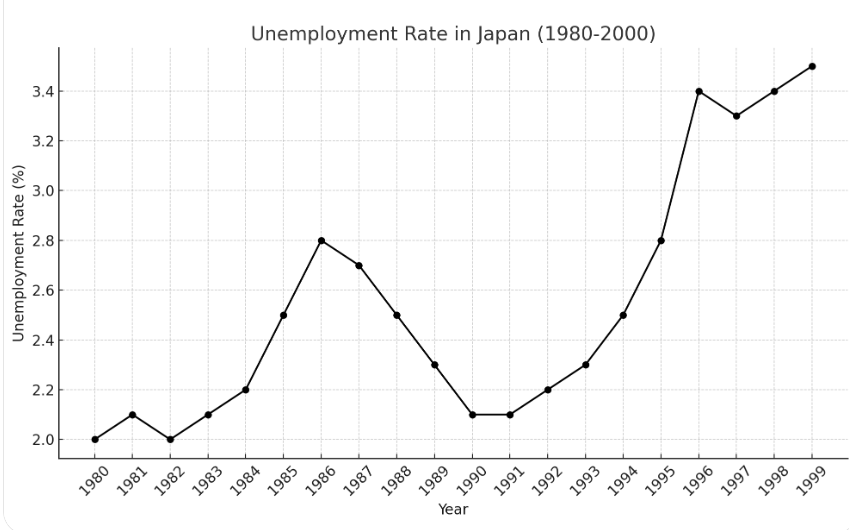

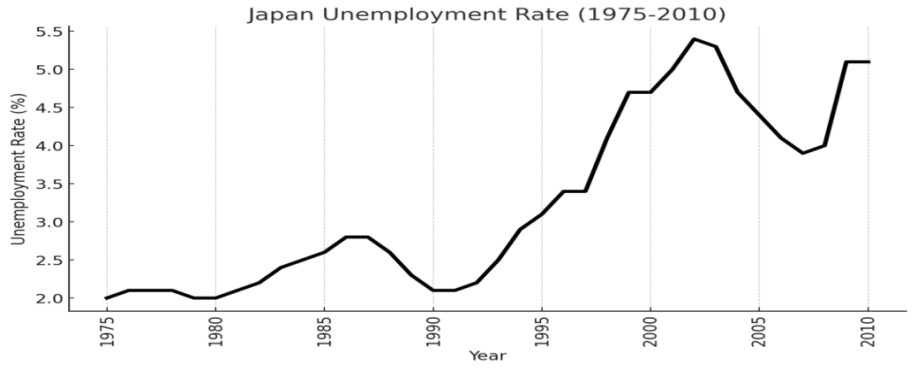

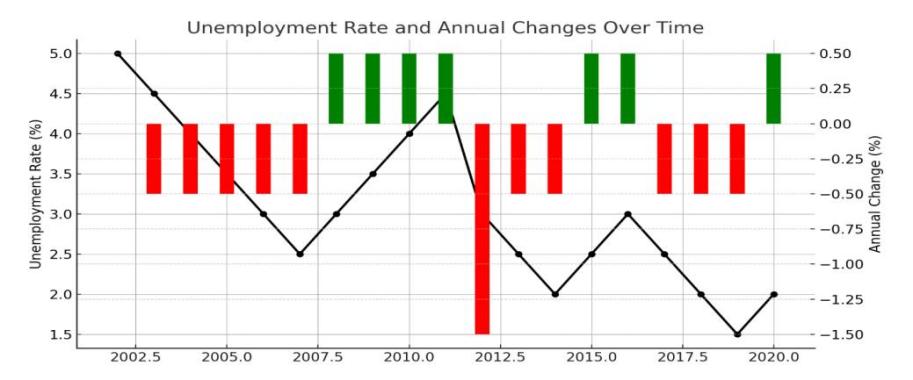

The bursting of the Japanese bubble economy had not only dealt a devastating blow to asset prices and financial markets but also had far-reaching effects on the job market. At the peak of the bubble economy, job opportunities were plentiful, and the unemployment rate remained relatively low due to rapid economic expansion and over-investment by enterprises. However, with the bursting of the bubble in the early 1990s, the Japanese economy rapidly fell into recession, and a significant rise in unemployment ensued [8].

Figure 10 illustrates the trend of the unemployment rate in Japan between 1980 and 2000. It can be clearly seen that at the peak of the bubble economy, the unemployment rate was maintained at a low level, but with the bursting of the bubble in the early 1990s, the unemployment rate began to climb rapidly. By 1999, the unemployment rate had risen from about 2% in the late 1980s to over 3. 4%, marking a great deterioration in the job market.

The recession of this period led to massive layoffs and business closures. As a result of the credit crunch and deteriorating balance sheets, firms were forced to cut costs and reduce their workforce. At the same time, the unemployed faced difficulties in re-employment and long-term unemployment became common. The instability of the job market not only caused economic hardship for individual workers, but also triggered social unrest, such as rising suicide rates and increased psychosocial pressure.

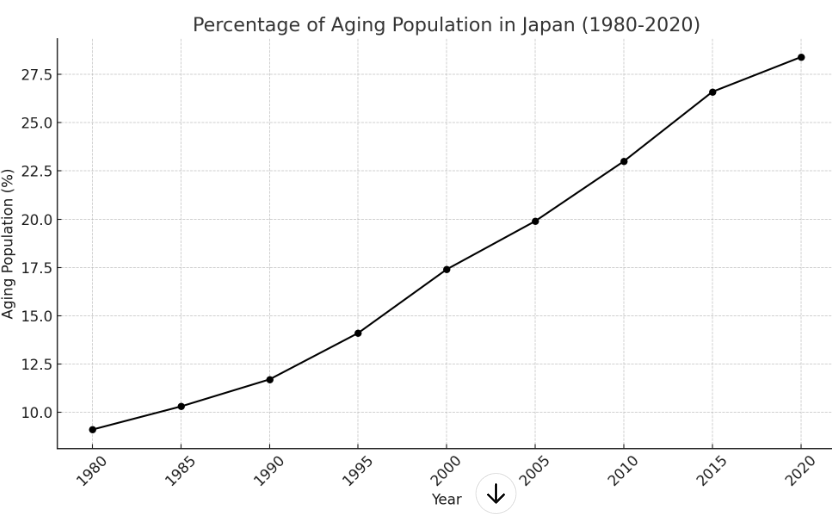

In addition, Figure 11 (Statistics Bureau of Japan) [9] shows the trend of population aging in Japan between 1980 and 2000. During this period, the aging problem gradually intensified, with the proportion of elderly people rising from 9. 1% in 1980 to 17. 4% in 1999. The economic recession and corporate restructuring caused many older employees to retire early, further exacerbating the pressure on the job market. The acceleration of the ageing trend has far-reaching implications for the job market, not only increasing the burden on the social security system but also posing greater challenges for policy makers in confronting employment and retirement issues.

Overall, the bursting of the bubble economy has dealt a severe blow to the Japanese job market, with rising unemployment and declining employment stability becoming important features of the period. This not only had a negative impact on the long-term development of the Japanese economy, but also profoundly changed the structure of Japanese society and the way of life of the public.

To summarize, Japan's bubble economy of the 1980s and its subsequent bursting not only left far-reaching imprints on asset prices, the stock market and the job market, but also marked a turning point in the Japanese economy's shift from rapid growth to prolonged stagnation. The surge and collapse of the real estate market, the sharp fluctuations in the stock market, and the deterioration of the job market together constituted a complex economic situation following the bursting of the bubble. This series of economic turmoil led to an overall deterioration of corporate and individual balance sheets, an intensification of the credit crunch, and an increase in social unrest. Japan's "lost decade" not only reflects the consequences of economic policy failures but also reveals the enormous risks of excessive market speculation and regulatory failures. The impact of this historical period on the Japanese economy and society was far-reaching and long-lasting, and it provided deep lessons for those who came after it, warning of the potential crises behind the economic boom. Future economic policymakers can draw lessons from this period in order to avoid the recurrence of similar economic bubbles and thus ensure stable and sustainable economic development.

4. Impact of employment rate and housing price changes on suicide rates

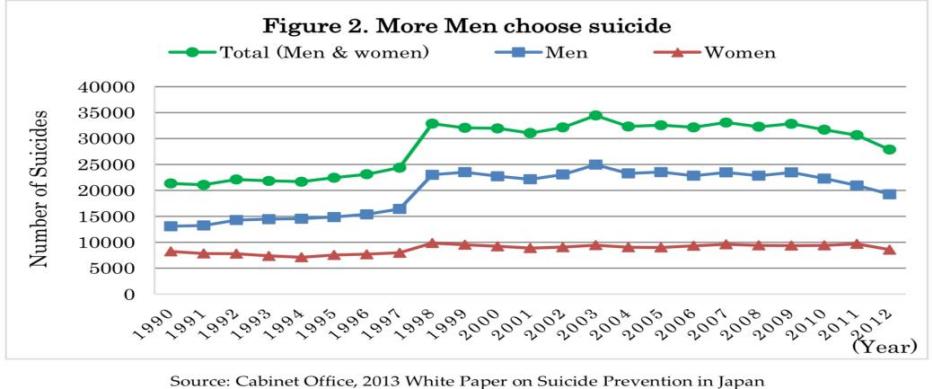

As shown in the figure 12, the suicide rate of the whole country during the foam period of Japan's economy has increased significantly. The purpose of this study is to explore the relationship between economic foam and suicide rate.

Several research surveys have recorded the sharp increase in suicides after the bursting of Japan's foam economy. This surge was particularly evident in the 1990s and early 2000s. Below are some insightful statistical data and key findings to elucidate this phenomenon.

The suicide rate reached its peak in 1998: the number of people choosing to end their lives in Japan increased sharply that year, accounting for every 100000 people. This growth phenomenon is believed to be closely related to the Asian financial crisis, where unemployment and fiscal difficulties were considered key driving factors, as well as the economic recession in Japan at that time.

A thorough study during an economic recession shows that the suicide rate among middle-aged men, especially those between the ages of 40, has significantly increased. This group of people often bear the main economic responsibility and psychological burden of their families in the face of the dual challenges of mortgage pressure and unemployment threat. Of particular note is this phenomenon.

It is a significant phenomenon that regions with severe economic difficulties are particularly prominent in exploring regional differences in suicide rates. In terms of the housing market, cities and regions with a significant increase in suicide rates are most affected.

Observing the above chart, we found that the suicide rate has also shown a clear upward trend, while the unemployment rate has significantly increased during this period. The next step of this study is to explore the possible link between suicide rates and unemployment rates.

From a perspective of the change in employment rate, we aim the analysis its effect on the suicide rates. After the foam burst, Japan's economic downturn and employment were even more difficult. The data during this period clearly shows that the suicide rate increases with the unemployment rate. Unemployment brings not only economic pressure but also psychological burden. Local residents feel despair and despair, which ultimately manifests in the rise of suicide rates. It is worth noting that the unemployment rate itself can also be affected by the suicide rate. The decline in employment quality and the increasing number of people with unstable temporary jobs and low wages have made the situation even worse. The insecurity of work and the uncertainty of income further increase psychological pressure, creating an environment that damages the mental health of workers and ultimately leading to a staggering increase in suicide rates

On the contrary, the suicide rates also could affect the employment rate. The rising suicide rate is not just a personal tragedy but has a negative impact on the entire labor market. A high suicide rate means that it is becoming increasingly difficult for companies with insufficient labor to recruit suitable talents, which will affect their normal operations and future development. Shortage has intensified competition among companies for the best employees, leading to increasing recruitment and training costs for businesses. At the same time, the company had to allocate more resources to the mental health of its employees, thereby increasing operating costs. Therefore, the company had to establish more hygiene plans and psychological support programs to take care of employees and reduce losses. Therefore, the company is facing pressure from labor shortages and improving employee welfare benefits, as employee benefits and expansion capabilities are affected.

Mental health support for employees, which raises operational costs. This necessitates the implementation of comprehensive wellness programs, mental health initiatives, and support systems to ensure employee well-being and retention. Consequently, businesses face the dual burden of managing the direct effects of a constrained labor pool and the indirect costs associated with enhancing mental health support, both of which can hinder their operational efficiency and overall growth potential.

Secondly, we suggest that changes in housing prices could impact on suicide rates.

During periods of economic prosperity, real estate prices often skyrocket, attracting many investors eager to get a piece of the pie. But when these prices drop significantly, many people's financial situations will be affected as a result. The collapse of the real estate market means a sharp drop in property values, leaving many borrowers in a situation of high debt that they cannot repay, and this situation does indeed increase the risk of suicide. Especially those who borrowed a huge amount of money to buy houses during the foam period; Due to the sharp decline in housing prices, they found that there was a lot of pressure on mortgage loans. The pressure of keeping up with mortgage repayments and the psychological pressure of being afraid of losing one's home have increased, which may push people to the brink of despair. As the value of real estate continues to decline and the economic instability and psychological distress caused by mortgage debt gradually spread, many people have become completely desperate.

The rapidly rising suicide rate is actually a signal of a decline in social cohesion in the overall health of the housing market. People's psychological pressure is increasing. The increase in suicide rate represents people starting to feel uneasy and anxious. The uncertainty of the real estate industry's prospects may shake people's confidence in the real estate market, and potential homebuyers may hesitate due to concerns about economic and social instability. Meanwhile, frequent suicide incidents can disrupt the community atmosphere and make residents feel uneasy. This oppressive atmosphere further affects citizens' determination to buy houses and further increases market uncertainty factors. The increase in psychological pressure and the decline in community trust highlight the serious impact of the rising suicide rate on the real estate industry.

According to relevant research (such as the Regional Policy Research Center of Nankai University) [10], after an abnormal death (including suicide) occurs, the value of the housing unit in which it is located will significantly decrease, with an average decrease of about 25%. Because suicide incidents can bring long-term psychological trauma to those who are willing to buy houses, it can directly lead to a decrease in buyers' willingness to purchase houses in the area, resulting in a decrease in demand for home purchases.

During periods of economic prosperity, the rapid increase in asset prices enables many people to quickly accumulate wealth. However, when the foam burst, many people found that their previous wealth was just like a passing cloud. Their wealth shrank sharply, and financial pressure increased, leading to an increase in the suicide rate. The collapse of the foam economy triggered a wave of business closures and layoffs. Many people have lost a stable source of income, and this social situation will only lead them into more severe economic difficulties and drive up suicide rates.

5. Policies of Japan after collapse of the bubble economy

After we analyzed the causes and factors during the Pre-Bubble-Era, potent impact and influence created by the burst of bubble economy. In this part, we wanna introduce all the influential policies implemented by Japanese institutions in order to revive the economy during Post-Bubble-Era, along with their positive and negative impacts. As we analyzed the domestic policies, we tend to emphasize the harm, chaos created by the Bubble Economy, the difficulties, obstacles and fluctuations during the recession era. this paper is expected to contribute to become a precaution for authoritative organizations or official institutions.

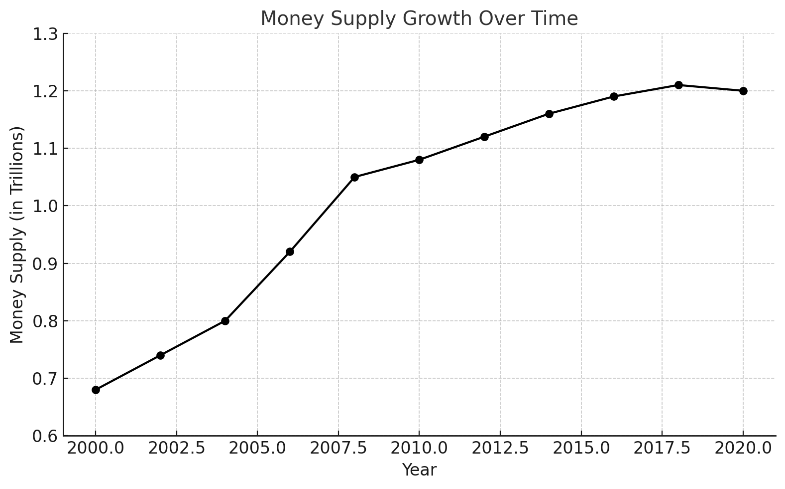

As a basic method to stimulate aggregate demand on investments and purchases, the Bank of Japan (BOJ) [11] implemented Quantitative Easing to increase money supply and encourage lending. In the Figure 15(Data from Bank of Japan) [12], it provides us the data about Japan’s money supply of Yen from 2001 to 2023, we concluded that Quantitative Easing created an enormous amount of money supply and contributed to investments and innovations during the implementation. The quantity is increasing gradually year by year in order to prevent the economy from severe inflation.

Quantitative Easing stabilized the banking system by creating more performing loans and liquidity, it also substantially increases the investments from individuals and corporations, which boosted economy.

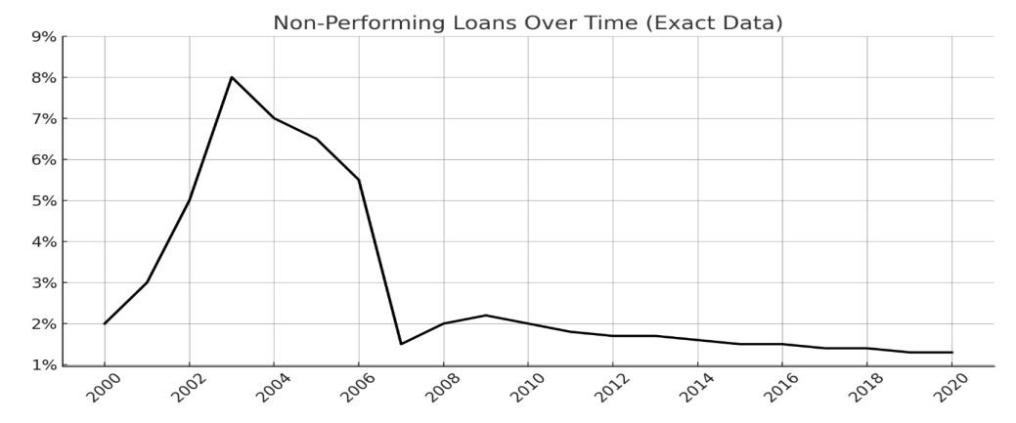

While the Bank of Japan tried to stimulate investment by creating money supply, we find that the government contributed to eliminating the impact of non-performing loans (NPLs) by way of injecting capital into the banks and by setting up disposal and collection companies to manage the bad loans. Known as banking reform, it helped stabilize Japan's financial sector and brought benefits from the recession.

In Figure 16 (data provided by the St. Louis FED), we can see a very significant contribution from Japanese policy. It shows that Japanese banks' non-performing loans as a percentage of total loans have declined significantly since 2003, and banking sector reforms have succeeded in keeping the amount of non-performing loans within a reasonable range of less than 2.5 percent. This policy has provided liquidity and balance to the Japanese currency in a unique way.

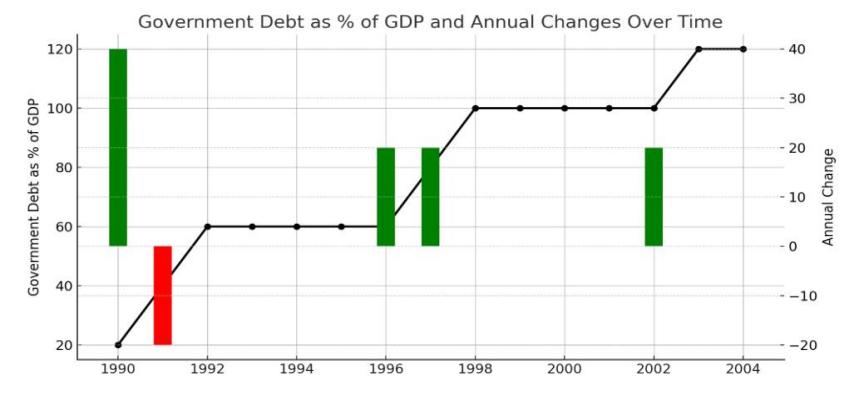

In order to overcome the unemployment crisis caused by the bursting of the bubble, the Japanese Government had a way out and they decided to stabilize the labour market and consumer demand through a policy of increased investment in infrastructure. Although only briefly, these large-scale public works projects did stimulate the economy, thus temporarily boosting economic activity.

However, the approach to infrastructure investment did not always work; it could reduce unemployment in the short term, but by the end of the 2000s, Japan had still accumulated large public debt and government deficits as a result of continued fiscal stimulus and infrastructure spending in the early 2000s. Overall, increased infrastructure investment did help Japan to mitigate the labor market recession, but still posed a potential labor market risk to Japan's unemployment rate.

During 1990s, the Japanese government introduced multiple fiscal stimulus packages to boost economic growth, including tax cuts and increased public spending. As we can see from Figure 17, the percentage of government debt of GDP is increasing and finally triggers the deficit of the government budget. Fiscal stimulus packages eventually led to a significant increase in public debt without achieving sustained economic recovery. The effectiveness of the stimulus was limited by structural issues in the economy.

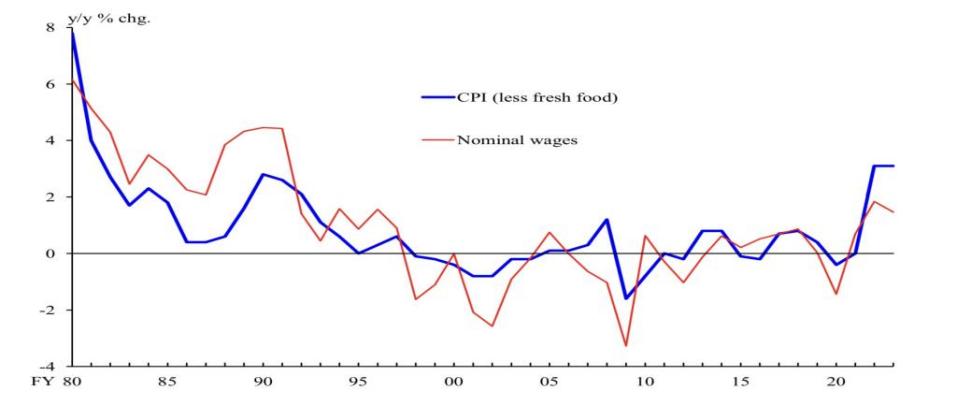

Due to the burst inflationary in the Bubble Era, initially, the BOJ was focused on controlling inflation and was seen as a sensible policy to maintain price stability and life quality. They promoted the Deflationary Monetary Policy to maintain the life quality of residents and the input of production in Japan.

But persistent deflation became a major issue for Japan society, as we can see from the Figure 18, income cannot even meet the products from low price level, then it discouraged Japan’s consumer spending and investment. The BOJ was slow to adopt more aggressive measures to combat deflation, intensified economic stagnation.

Japan's policy responded to the burst of economic bubble were a combo of successes and failures. While some measures helped stabilize the financial system and provided temporary economic revival, other policies were failed to solve the underlying structural problems, leading to a prolonged period of economic stagnation and recession known as the "Lost Decade. " The experience highlights the challenges of reviving an economy and the circumstance of the economy after a series of severe financial crisis and the importance of timely and effective policy interventions. It gave Japan a deep aftermath and offered all the officials and institutions a lesson on implementing policies and controlling the economy. We wish our paper would be a guideline or a handbook for all the people as a reminder and helper.

6. Conclusion

An in-depth ponder of the Japanese bubble economy uncovers the key part of the Plaza Accord and Japanese economic policies in driving the bubble economy. In spite of the fact that the government actualized a number of countermeasures after the collapse of the bubble, counting infrastructure investment and managing an account change, the impacts of these approaches did not completely meet desires. Whereas certain approaches incidentally stabilized the financial system and the labor market, they fizzled generally to anticipate a delayed financial recession and the compounding of social problems.

Of specific note, this consideration uncovers the far-reaching effect of the financial emergency on psychosocial well-being, especially within the solid relationship between rising unemployment and expanded suicide rates. The collapse of the bubble economy not as it were activated financial turmoil, but too had an enduring negative effect on the soundness of Japanese society.

The discoveries remind us that future financial policymaking ought to be more judicious to maintain a strategic distance from rehashing chronicled botches. When confronted with comparative economic challenges, policymakers must consider the long-term impacts of approaches, particularly the potential results in terms of social and mental wellbeing. Japan's lessons provide valuable reference for the world to avoid similar economic and social crises from happening again.

References

[1]. Jason Furman and Lawrence Summers (2010), ” reconsideration of fiscal policy in the era of Low interest rates”

[2]. Soo Y Chua, Selahattin Dibooglu, Subhash CSharma (1999), The lmpact of the US and JapaneseEconomies on Korea and Malaysiaafter the Plaza Accord. Asian Economic Journal 13

[3]. Sanghoon Ahn and Jong-Wha Lee (1999), Integration and Growth in East Asia

[4]. Genna, M. (2012). The impact of financial liberalisation on stock market volatility.

[5]. Nielsen, B. (2022, January 14). The Lost Decade: Lessons From Japan’s Real Estate Crisis. Investopedia.

[6]. Okina, K., Shirakawa, M., & Shiratsuka, S. (2001). The Asset Price Bubble and Monetary Policy: Japan’s Experience in the Late 1980s and the Lessons Background Paper. In MONETARY AND ECONOMIC STUDIES.

[7]. Yoshino, N., & Nishimura, K. (2001). Japan’s Bubble Economy and Financial Crisis.

[8]. Kawai, H. (2005). Suicide Phenomenon and Social Structure in Japan.

[9]. OECD. (Various years). Economic Outlook.

[10]. World Health Organization. (2014). Preventing Suicide: A Global Imperative.

[11]. Koo, J. W., & Cox, H. J. (2008). An economic interpretation of suicide cycles in Japan. Journal of Health Economics, 27(5), 1293-1305.

[12]. Watanabe, N., & Yokoyama, K. (2006). The effect of housing loan burden on suicide: A panel data analysis of Japanese prefectures. Social Science & Medicine, 63(6), 1732-1742.

Cite this article

Fang,Z.;Lai,Q.;Yi,Z.;Xie,H. (2025). The Determining Cause of Bubble Economy and Impact of It. Advances in Economics, Management and Political Sciences,173,150-164.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jason Furman and Lawrence Summers (2010), ” reconsideration of fiscal policy in the era of Low interest rates”

[2]. Soo Y Chua, Selahattin Dibooglu, Subhash CSharma (1999), The lmpact of the US and JapaneseEconomies on Korea and Malaysiaafter the Plaza Accord. Asian Economic Journal 13

[3]. Sanghoon Ahn and Jong-Wha Lee (1999), Integration and Growth in East Asia

[4]. Genna, M. (2012). The impact of financial liberalisation on stock market volatility.

[5]. Nielsen, B. (2022, January 14). The Lost Decade: Lessons From Japan’s Real Estate Crisis. Investopedia.

[6]. Okina, K., Shirakawa, M., & Shiratsuka, S. (2001). The Asset Price Bubble and Monetary Policy: Japan’s Experience in the Late 1980s and the Lessons Background Paper. In MONETARY AND ECONOMIC STUDIES.

[7]. Yoshino, N., & Nishimura, K. (2001). Japan’s Bubble Economy and Financial Crisis.

[8]. Kawai, H. (2005). Suicide Phenomenon and Social Structure in Japan.

[9]. OECD. (Various years). Economic Outlook.

[10]. World Health Organization. (2014). Preventing Suicide: A Global Imperative.

[11]. Koo, J. W., & Cox, H. J. (2008). An economic interpretation of suicide cycles in Japan. Journal of Health Economics, 27(5), 1293-1305.

[12]. Watanabe, N., & Yokoyama, K. (2006). The effect of housing loan burden on suicide: A panel data analysis of Japanese prefectures. Social Science & Medicine, 63(6), 1732-1742.