1. Introduction

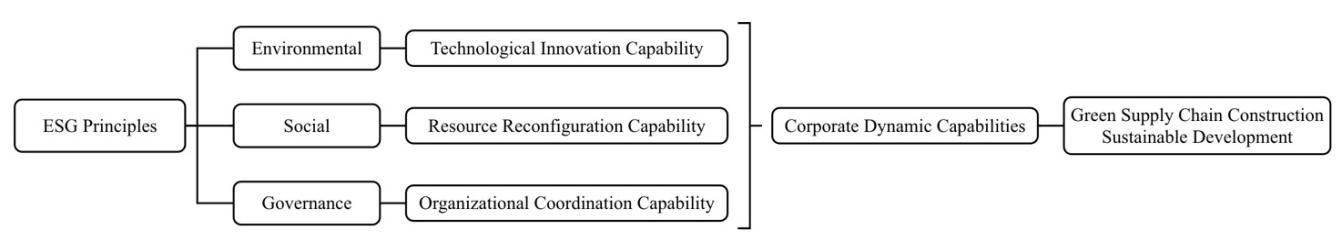

Facing climate change and resource scarcity, 151 countries have set carbon neutrality goals, with 120 enacting them into law, highlighting a global shift towards sustainable development. [1] In this social context, ESG (Environmental, Social and Governance) has been proposed to clarify more details for enterprises in terms of the environmental protection, and has become a crucial approach to businesses that seek to go beyond only maximizing profits [2]. As sustainability becomes the standard, the traditional linear supply chain model, particularly in resource-based enterprises, is no longer adequate to address resource crises, evolving regulations, and changing market demands. For resource-based enterprises, reducing carbon emissions to satisfy regulations and maintaining the economic viability of their supply chains require to enhance dynamic capabilities to adapt to rapid changes in policies and market conditions. The inability of traditional supply chains to balance environmental protection and economic growth compels resource-based enterprises to rethink supply chain management and embed environmental factors across the entire process, thus driving the need for a green supply chain [3]. This paper aims to propose a path for resource-based enterprises to use dynamic capabilities in building a green supply chain within the ESG framework. The ESG concepts align with technological innovation, resource reconfiguration, and organizational coordination capabilities, all of which are key components of corporate dynamic capabilities. By implementing these concepts, enterprises can strengthen these capabilities, thereby laying a solid foundation for building green supply chains and enhancing their green competitiveness.

2. The application of ESG principles and dynamic capability in green supply chain

2.1. The role of ESG in corporate performance

As a corporate sustainability assessment framework, ESG emphasizes that companies should focus on environmental protection, fulfill social responsibilities, and improve governance levels, in order to systematically assess the potential of their long-term value creation. ESG ratings, created by businesses and non-profit organizations, help companies assess risks and opportunities across short, medium, and long-term horizons, providing a more comprehensive and accurate view of how these factors may impact firm performance [4]. Compared to corporate social responsibility (CSR) theory, which focuses on the connection between social responsibilities and business leaders’ obligations to meet human needs within and outside industries, ESG goes further. It reconciles the conflict between business profits and social welfare, and establishes clear, organized, and systematic standards to enhance corporate social performance [5]. In addition, it integrates corporate social responsibilities into strategic decisions, balancing self-interest and social responsibility [6].

2.2. The role of dynamic capabilities in strategic management

Proposed by Teece, Pisano, and Shuen, Dynamic Capability Theory is a foundational framework in strategic management. It emphasizes an organization’s ability to integrate, build, and reconfigure internal and external competencies to adapt to rapidly changing environments [7]. For enterprises, aligning resources with the dynamic environment is essential in order to gain and sustain a competitive edge [8]. The establishment of dynamic capability encompasses the market insights, the scientific and flexible strategic decision, and the efficient resource reconfiguration. It permeates the processes of perception, decision-making, and action, enabling enterprises to swiftly and effectively acquire, allocate, and combine internal and external resources in the face of market opportunities to achieve optimal resource use [9].

2.3. The integration of ESG and dynamic capabilities into green supply chain

The concept of the green supply chain, first put forward by Michigan State University in 1996, incorporates environmental protection and resource conservation into every stage of the supply chain, reducing environmental impact and fostering balanced economic, social, and environmental development. The effort to minimize the environmental influence of business activities is known as green supply chain management [10]. And the regulations enacted by various countries, especially developed ones, have progressed through three distinct phases in their efforts to balance industrial production with environmental protection. The first phase (1970s to mid-1980s) focused on risk management, primarily emphasizing waste and pollution control. The second phase (mid-1980s to early 1990s) shifted towards pollution prevention, aiming to reduce material usage, minimize waste, and enhance efficiency. The third phase (mid-1990s to present) introduced lifecycle management and industrial ecology, further expanding the scope of environmental protection. It is the third phase that marks the start of green supply chain management, which can be traced back to eco-industrial practices in the 1990s. Its development has been further accelerated by the Paris Agreement and the UN Sustainable Development Goals (SDGs). At present, green supply chain management is widely regarded as a crucial strategy for enterprises to achieve sustainability goals.

Based on the concepts and theories, a mutually reinforcing cycle of sustainable development can be created by integrating ESG principles, corporate dynamic capabilities, and the green supply chain. To construct corporate dynamic capabilities, it is crucial to understand how individual and organizational behaviors impact their development and deployment [7]. ESG initiatives can enhance these capabilities, speeding up the adoption of green supply chain practices. By embedding ESG objectives throughout the entire supply chain lifecycle, sustainability considerations are integrated from procurement to delivery. For resource-based enterprises, implementing the green supply chain can not only directly improve ESG performance, but also generate ecological data and experimental insights that feed back into the evolution of dynamic capabilities. This synergistic progression of conceptual understanding, capability development, and practical application allows enterprises to strike a dynamic balance between economic profitability and social responsibility.

3. The construction of green supply chain in resource-based enterprises

3.1. Overview and challenges of resource-based enterprises

Resource-based enterprises are defined as companies whose primary business activities involve the extraction, production, and utilization of natural resources, such as coal, oil, natural gas, metals, and non-metals. These enterprises are crucial for driving economic growth, boosting employment, and ensuring national security. However, they face challenges such as resource depletion, environmental damage, and outdated technology. As a result, they have a more urgent need than other types of companies to reform their supply chain practices to ensure long-term viability and sustainability.

The adoption of green supply chains in these enterprises is driven by both external pressures and internal motivations. Externally, regulatory pressures impose stringent environmental standards and compulsory upgrades. Internally, resource-based enterprises confront mounting sustainability challenges as their reliance on non-renewable resources like minerals and fossil fuels conflicts with accelerating resource depletion and environmental degradation, thereby jeopardizing their long-term viability. For instance, the USGS projects depletion of proven copper reserves in approximately 40 years given current extraction levels [11,12]. Empirical data reveals a persistent underachievement in production outputs at Codelco, Chile’s state-owned copper enterprise. And the 2024 production volume of 1.328 million metric tons represents only a marginal 0.26% year-on-year increase from the 2023 nadir, reflecting continued stagnation that has weakened operational capacity and harmed fiscal performance [13]. The institutional interdependence between extractive industries and their ecological niches creates path-dependent constraints, where cumulative environmental deterioration gradually erodes firms’ ability to adapt in production optimization and strategic renewal. In addition, policies and regulations compel resource-based enterprises to reassess and transform their strategies. With global carbon neutrality goals, countries are pushing businesses to reduce energy consumption and emissions. For example, China’s Carbon Peaking and Neutrality Goals require high-energy industries, like steel and cement, to peak carbon emissions before 2030. In the Carbon Emission Trading System (ETS) in China, enterprises can sell surplus quotas or buy additional ones to comply with regulations, with these policies guiding production and operations. Initially responding to environmental pressures, resource-based enterprises can eventually seize sustainable development opportunities, thus transitioning from survival concerns to market competitiveness and long-term profitability. By internalizing sustainable development, they transform from resource extractors to ecological service providers amidst tightening environmental constraints and evolving market rules. This transformation is supported by enhancing dynamic capabilities, which align with ESG principles. Focusing on technological innovation, resource optimization, and organizational coordination allows resource-based enterprises to enhance adaptive capabilities and create a green supply chain that prioritizes ecological integrity, efficiency, and stakeholder cooperation.

3.2. Environmental (E) and technological innovation capability

Environmental protection has become a key driver of ecological modernization in resource-based supply chains, aligning closely with the Environmental principle. Iterative upgrades in production technology help enterprises integrate resources and enhance product value. At the same time, green technological innovation reduces compliance risks and captures opportunities from new policies, boosting resilience to market fluctuations and environmental challenges. By strengthening dynamic capabilities in resource utilization and risk management, enterprises can drive green transformation, accelerate green supply chain development, and upgrade industrial chains. Besides, the research and development of green technology can target resource utilization and technological advancement.

Enterprises can combine resource identification with artificial intelligence to accurately detect and extract recyclable secondary resources, thus improving recycling rates and optimizing resource allocation. By establishing an intelligent resource flow monitoring system, enterprises can optimize resource allocation across raw material procurement, production consumption, and by-product utilization, thereby effectively reducing waste. Given the networked nature of the supply chain, enterprises can also pay attention to the construction of closed-loop supply chain and reverse logistics by increasing the density of recycling outlets and standardizing disassembly processes. Through network construction, a cycle of extraction, production, recovery, and regeneration can be established to improve resource utilization. To promote technological innovation, enterprises need to increase investment in environmental protection with the special focus on process innovation, emission control, and value extension. The development of clean production technologies, which can minimize pollution and enhance productivity across the supply chain, is key to corporate progress. Post-production emission management should use real-time monitoring systems to track sources and support ongoing reduction efforts. For by-products that cannot be reduced by current clean technologies, enterprises should implement AI-powered value-added processing, extending product lifecycles and maximizing resource utilization. For instance, at the Fengyang Mujishan Mining Area in Anhui, China, an AI-powered dust suppression system controls high-pressure nozzles along transportation routes, significantly reducing airborne particulate matter [14].

3.3. Social (S) and resource configuration capability

The Social principle emphasizes that companies must address the concerns of various stakeholders, including the environment, employees, shareholders, consumers, and the broader socio-economic and cultural impacts. In this sense, enterprises must systematically reconcile diverse demands across supply chain ecosystems, a complex undertaking requiring sophisticated integration and strategic redistribution of both internal and external resources. This operational challenge directly engages with the critical organizational capability of dynamic resource reconfiguration, which refers to the intentional restructuring of enterprise assets, partnerships, and institutional relationships to achieve sustainable value co-creation. In this context, resources are conceptualized in the broadest sense, encompassing tangible assets (like physical infrastructure and financial capital), human capital (like skills and knowledge), and relational capital (like stakeholder trust and community partnerships). The efforts of resource reconfiguration can help transform traditional linear resource allocation into socially-embedded value networks, contributing to a resilient green supply chain that balance commercial viability with systemic social equity.

From internal perspective, enterprises should improve resource management system. Since an enterprise is an integral link within the supply chain, its internal resource management can not only bolster its production and operational capabilities, but radiate benefits throughout the entire chain as well. Internal consolidation involves the integration of various resources, including intellectual capital, digital infrastructure, and operational systems like specialized human assets, organizational learning, data governance frameworks, financial liquidity, and technological patent portfolios. This requires a coordinated approach that aligns knowledge flows, material logistics, and value streams. The alignment of structural and relational capital shifts resource ownership from fragmentation to a holistic development of systemic capabilities via capital reconfiguration. Besides, the integration of external resources can be strategically managed in both upstream and downstream directions along the supply chain. From an upstream perspective, supplier criteria should align with community welfare goals by developing a three-dimensional evaluation model that assesses environmental impact, labor rights, and community effects. The regular publication of supplier capability reports can provide valuable insights for supplier selection. For downstream reform, integrating consumer feedback mechanisms throughout the product lifecycle can help create a participatory governance framework that actively includes consumer input.

3.4. Governance (G) and organizational coordination capability

The idea of Governance stresses enhancing organizational coordination via internal collaboration and external supply chain alignment. The ambition to enhance organizational synergy inherently challenges an enterprise’s internal structure and operational management. Enterprises with superior governance structures usually include employee representatives and consumer protection advocates on their boards. Integrating ESG specialists into directorial roles can formalize oversight of ESG implementation. Besides, this structural reform should be synergized with intelligent governance systems. The realization of intelligent management is inseparable from the support of AI-powered predictive analytics, blockchain-embedded audit trails, and intelligent monitoring systems, which are all essential for achieving refined management of production and operation.

Based on internal reforms, resource-based enterprises can further allocate interests and benefits among the supply chain. For instance, Shanxi Antai Holding Group in China has set up a Carbon Management Committee to align carbon emission targets across its procurement, production, and logistics departments. With its Carbon Management Cloud Platform, it monitors real-time emissions across its entire facility. As a result, it reduced annual CO2 emissions by 59,000 tons via its coke oven tail gas carbon capture project and improved waste heat power generation efficiency by 1.6 times, demonstrating the effectiveness of its environmental decision-making [15]. Also, enterprises can implement an external supplier grading system. By integrating suppliers’ carbon footprints into evaluation criteria through green certification standards, enterprises can better align interests across the entire supply chain. These coordinated efforts foster industry-wide collaborative platforms and symbiotic networks, thus enhancing the comprehensive utilization of solid waste and supporting the development of a sustainable ecological framework.

3.5. Synergistic effects of ESG and corporate dynamic capability

Integrating ESG principles with corporate dynamic capabilities generates synergies that drive green supply chain development. By focusing on technological innovation, resource reconfiguration, and organizational coordination, resource-based enterprises can accelerate their green transformation and boost supply chain collaboration. Technological progress is catalyzed via systematic resource reconfiguration, whereas effective organizational coordination serves as the scaling mechanism that amplifies innovation diffusion and enhances allocation efficiency. The outcomes of technological innovation can be scaled through organizational coordination, which further optimizes resource allocation. These three capabilities mutually reinforce one another, and together propel the green supply chain through a three-stage evolution that involves compliance with ESG principles, value increase brought by green product, and industry-leading green benchmarks. Specifically, resource reconfiguration determines what resources to use, technological innovation defines how to use them, and organizational coordination ensures effective deployment. This synergy enables circular supply chains, thus optimizing eco-economic outcomes. For resource-based enterprises, green supply chain management has become a critical strategy for sustainable growth, aligning global environmental stewardship with competitive adaptation to resource constraints. By optimizing resource flows and minimizing waste, this management supports high-quality international development, strengthening the foundation for sustainable global infrastructure.

4. Conclusion

The ESG principles strengthen dynamic capabilities. For resource-based enterprises, enhancing ESG performance facilitates the integration of internal and external resources, thus advancing green supply chain development. Integrating ESG principles with Dynamic Capability Theory reveals the evolution of corporate green supply chains, hence progressing from policy-driven initiatives to ESG integration and capability iteration. This approach effectively addresses gaps in traditional research by emphasizing the interaction between sustainable policies and corporate capabilities. However, limitations remain. Future researches can further consider the industry-specific heterogeneity within resource-based enterprises. For example, coal industries might prioritize logistics optimization, steel industries could focus on technological innovation, and chemical industries may emphasize material substitution and recycling. Addressing such differences could further advance research on green supply chain development and corporate sustainable development.

References

[1]. China Daily. (2024) Over 150 countries commit to carbon neutrality targets, report says. https://www. chinadaily. com. cn/a/202410/17/WS67110f77a310f1265a1c82e7. html

[2]. Camacho, G. (2022). Anti-corruption in ESG standards. Transparency International.

[3]. Wu, C. , Zhu, Q. and Geng, Y. (2001) The green supply chain management and the enterprises’ sustainable development. China Soft Science, (03), 67-70.

[4]. Witzel, M. and Bhargava, N. (2023) What is ESG? In AI-Related Risk: The Merits of an ESG-Based Approach to Oversight. Centre for International Governance Innovation, 3-4.

[5]. Zhao, Y. , Wu, X. and Wu, Y. (2024). ESG research review and prospects. Commercial Accounting, 73-78.

[6]. Friede, G. , Busch, T. and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

[7]. Teece, D. , Pisano, G. & Shuen, A. (1997) Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533.

[8]. Zhang, C. , Wang, Z. & Xia, C. (2025) C2M e-commerce platform data enabling manufacturing enterprises mass customization: Based on the dynamic capability theory perspective. Journal of Business Economics, 1(01), 5-18.

[9]. Eisenhardt, K. M. , & Martin, J. A. (2000). Dynamic capabilities: Why are they? Strategic Management Journal, 21(10-11), 1105-1121.

[10]. Swami, S. and Shah, J. (2013). Channel coordination in green supply chain management. The Journal of the Operational Research Society, 64(3), 336-351.

[11]. U. S. Geological Survey. (2020). 2020 minerals yearbook: Copper. https://pubs. usgs. gov/myb/vol1/2020/myb1-2020-copper. pdf

[12]. U. S. Geological Survey. (2020) Mineral commodity summaries 2020-Copper. https://pubs. usgs. gov/periodicals/mcs2020/mcs2020-copper. pdf

[13]. Reuters. (2025) Codelco workers fear copper production push hard to maintain. https://www. reuters. com/markets/commodities/codelco-boosts-2024-copper-output-late-push-strains-workers-delays-maintenance-2025-01-16/

[14]. Sina. (2024) Empowering with intelligence to protect the blue skies and clear waters. https://k. sina. com. cn/article_7517400647_1c0126e470590693mq. html?from=tech&kdurlshow=1

[15]. Guangming Daily. (2023) Resource-based enterprises explore green transformation. New Economic Dynamics and Supporting the Development of Private Economy. https://politics. gmw. cn/2023-06/24/content_36648001. htm

Cite this article

Wen,Z. (2025). Construction of Green Supply Chain: Corporate Dynamic Capability under ESG in Resource-Based Enterprises. Advances in Economics, Management and Political Sciences,196,227-233.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: The 4th International Conference on Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China Daily. (2024) Over 150 countries commit to carbon neutrality targets, report says. https://www. chinadaily. com. cn/a/202410/17/WS67110f77a310f1265a1c82e7. html

[2]. Camacho, G. (2022). Anti-corruption in ESG standards. Transparency International.

[3]. Wu, C. , Zhu, Q. and Geng, Y. (2001) The green supply chain management and the enterprises’ sustainable development. China Soft Science, (03), 67-70.

[4]. Witzel, M. and Bhargava, N. (2023) What is ESG? In AI-Related Risk: The Merits of an ESG-Based Approach to Oversight. Centre for International Governance Innovation, 3-4.

[5]. Zhao, Y. , Wu, X. and Wu, Y. (2024). ESG research review and prospects. Commercial Accounting, 73-78.

[6]. Friede, G. , Busch, T. and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

[7]. Teece, D. , Pisano, G. & Shuen, A. (1997) Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533.

[8]. Zhang, C. , Wang, Z. & Xia, C. (2025) C2M e-commerce platform data enabling manufacturing enterprises mass customization: Based on the dynamic capability theory perspective. Journal of Business Economics, 1(01), 5-18.

[9]. Eisenhardt, K. M. , & Martin, J. A. (2000). Dynamic capabilities: Why are they? Strategic Management Journal, 21(10-11), 1105-1121.

[10]. Swami, S. and Shah, J. (2013). Channel coordination in green supply chain management. The Journal of the Operational Research Society, 64(3), 336-351.

[11]. U. S. Geological Survey. (2020). 2020 minerals yearbook: Copper. https://pubs. usgs. gov/myb/vol1/2020/myb1-2020-copper. pdf

[12]. U. S. Geological Survey. (2020) Mineral commodity summaries 2020-Copper. https://pubs. usgs. gov/periodicals/mcs2020/mcs2020-copper. pdf

[13]. Reuters. (2025) Codelco workers fear copper production push hard to maintain. https://www. reuters. com/markets/commodities/codelco-boosts-2024-copper-output-late-push-strains-workers-delays-maintenance-2025-01-16/

[14]. Sina. (2024) Empowering with intelligence to protect the blue skies and clear waters. https://k. sina. com. cn/article_7517400647_1c0126e470590693mq. html?from=tech&kdurlshow=1

[15]. Guangming Daily. (2023) Resource-based enterprises explore green transformation. New Economic Dynamics and Supporting the Development of Private Economy. https://politics. gmw. cn/2023-06/24/content_36648001. htm